Market Overview

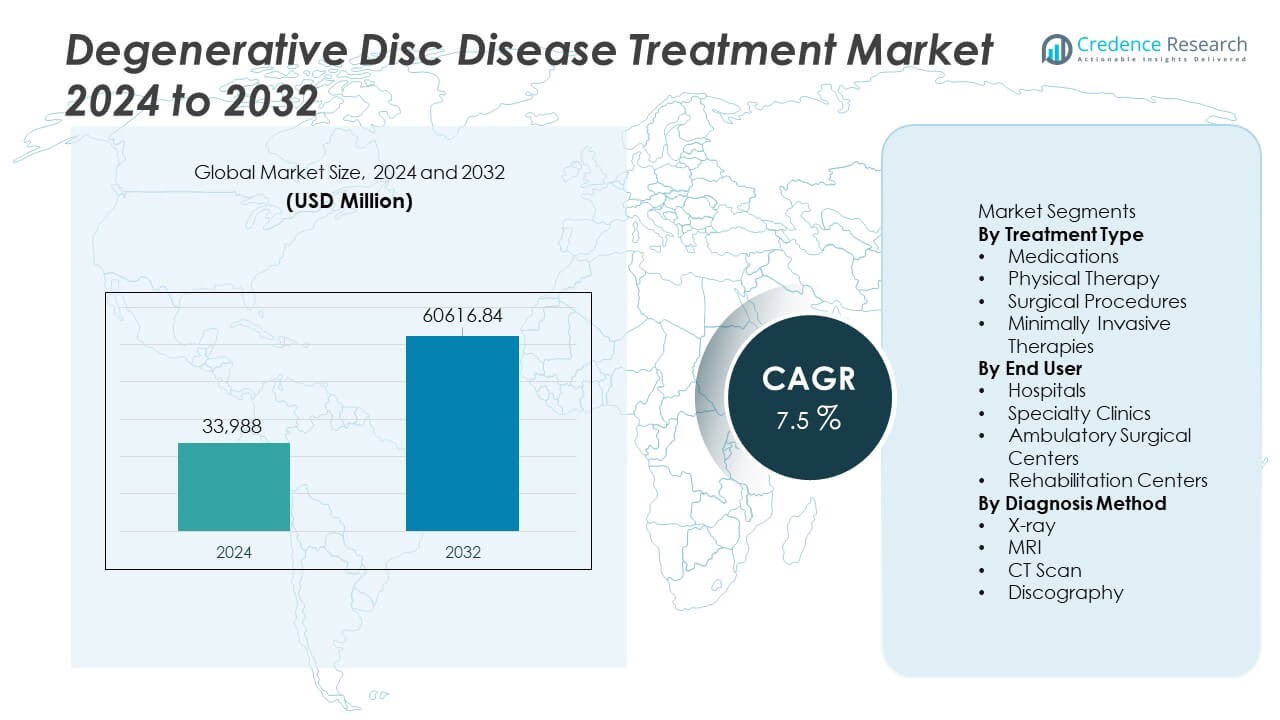

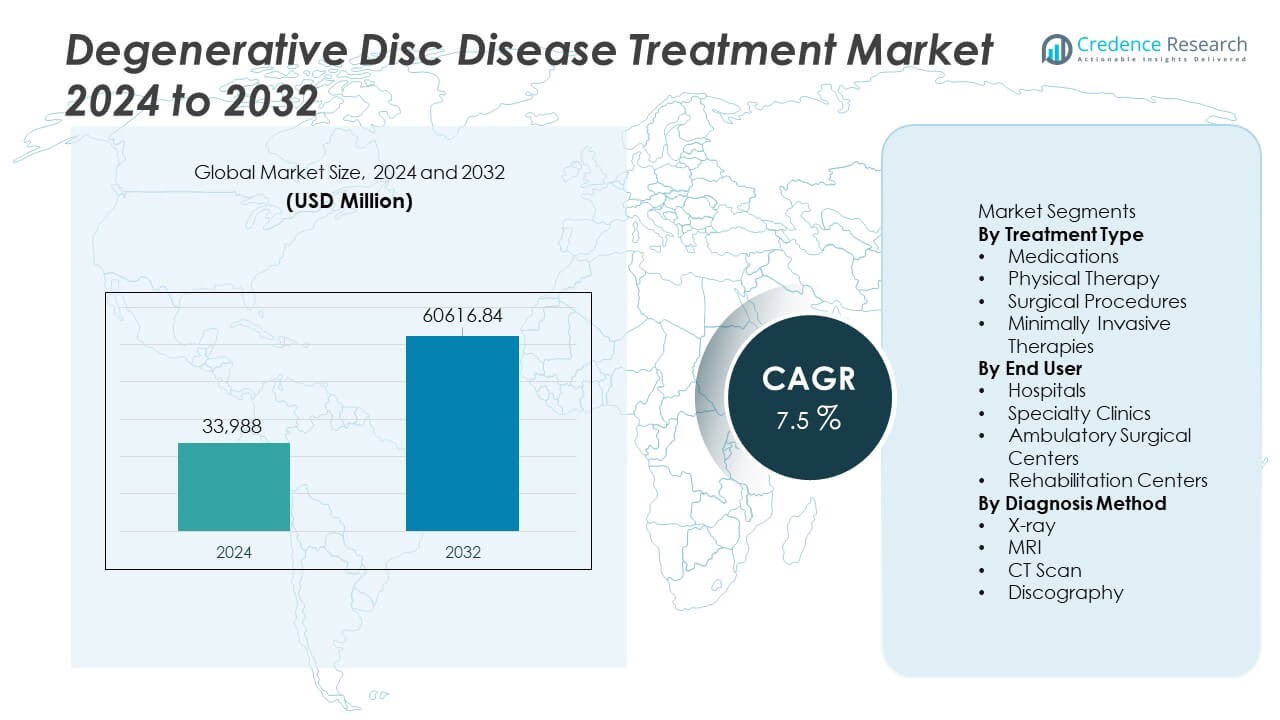

The Degenerative Disc Disease Treatment Market reached USD 33,988 million in 2024 and is projected to grow to USD 60616.84 million by 2032, registering a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Degenerative Disc Disease Treatment Market Size 2024 |

USD 33,988 Million |

| Degenerative Disc Disease Treatment Market, CAGR |

7.5% |

| Degenerative Disc Disease Treatment Market Size 2032 |

USD 60616.84 Million |

The Degenerative Disc Disease Treatment market is shaped by major players such as Medtronic plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, NuVasive Inc., Globus Medical Inc., Orthofix Medical Inc., Boston Scientific Corporation, Braun Melsungen AG, and Centinel Spine LLC. These companies strengthen their positions through advanced spinal implants, minimally invasive procedures, and expanding biologics portfolios. North America leads the global market with a 38% share, supported by strong diagnostic capacity, skilled specialists, and rapid adoption of innovative spine treatments. Europe follows with a 29% share, driven by early diagnosis practices and steady uptake of minimally invasive and regenerative therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 33,988 million in 2024 and will grow at a CAGR of 7.5% through 2032.

- Rising demand for medication-based care drives growth, with medications holding a 41% share, supported by strong adoption across early-stage degenerative disc cases.

- Minimally invasive procedures and digital rehabilitation trends expand treatment options as key players invest in advanced implants, navigation systems, and regenerative technologies.

- Competitive activity intensifies as Medtronic, Stryker, Johnson & Johnson, Zimmer Biomet, and NuVasive focus on innovative spinal solutions while navigating restraints such as high treatment costs and limited reimbursement.

- North America leads with a 38% share, followed by Europe at 29% and Asia Pacific at 25%, reflecting strong diagnostic access and rising demand for early intervention across major economies.

Market Segmentation Analysis:

By Treatment Type

Medications lead this segment with a 41% share, driven by strong demand for pain relief and anti-inflammatory drugs among early-stage patients. Growing use of muscle relaxants and neuropathic agents strengthens the adoption of medication-based care. Physical therapy follows as patients seek non-invasive recovery solutions. Surgical procedures serve severe cases requiring disc replacement or spinal fusion. Minimally invasive therapies gain traction due to lower recovery time and reduced postoperative risks. Rising cases of chronic back pain and earlier diagnosis support medication dominance and reinforce growth across advanced treatment options.

- For instance, Medtronic recorded widespread spine procedure deployments using its M6-C artificial cervical disc globally prior to and following its U.S. FDA approval, which supports significant adoption of surgical disc replacement.

By End User

Hospitals hold the dominant position with a 39% share, due to strong diagnostic capacity, specialist availability, and advanced surgical infrastructure. Hospitals manage both complex and routine degenerative disc cases, which increases patient inflow. Specialty clinics grow steadily as patients seek focused spine care and quicker consultation cycles. Ambulatory surgical centers expand their role with rising demand for minimally invasive procedures. Rehabilitation centers support long-term recovery through targeted therapy plans. Growing preference for coordinated care pathways and access to multidisciplinary teams strengthens hospital leadership across this segment.

- For instance, Stryker reported installation of Mako robotic platforms across major hospitals, enabling high-precision joint replacement procedures, and has recently launched limited use of its Mako Spine application.

By Diagnosis Method

MRI leads this segment with a 46% share, driven by its high accuracy in detecting disc degeneration, nerve compression, and hydration loss. MRI offers detailed soft-tissue visualization, making it the preferred choice for early and advanced diagnosis. X-ray supports initial screening by identifying structural changes in the spine. CT scans provide detailed imaging for surgical planning, especially in complex cases. Discography remains limited but useful for pinpointing pain sources. Rising focus on precise assessment, pre-surgical planning, and early intervention drives MRI dominance and boosts imaging technology adoption across healthcare settings.

Key Growth Driver

Rising Prevalence of Chronic Back Pain

Chronic back pain rises due to aging populations, sedentary work habits, and higher obesity rates. This shift pushes more patients to seek early diagnosis and structured care for degenerative disc conditions. Healthcare systems expand spine programs to manage growing caseloads and improve treatment access. Awareness campaigns encourage early screening and consistent therapy. As the affected population widens across age groups, providers see stronger demand for both non-invasive therapies and advanced surgical options, supporting sustained market expansion.

- For instance, Johnson & Johnson’s DePuy Synthes expanded its spine care access programs by supplying more than 85,000 spinal implants and instruments to partner hospitals in a single year. The company also trained over 4,500 clinicians globally through its spine education network.

Advancements in Minimally Invasive Procedures

Minimally invasive spine procedures gain strong acceptance as patients look for faster recovery and reduced discomfort. Hospitals adopt endoscopic tools, navigation systems, and motion-preserving implants that support safer and more precise interventions. Surgeons increasingly perform microdiscectomy and endoscopic decompression, boosting patient confidence and procedure volume. These techniques lower hospital stays and improve care efficiency. Advancements in device design and surgical precision create new growth avenues for equipment manufacturers and specialized treatment centers.

- For instance, NuVasive reported a substantial number of procedures performed globally using its XLIF lateral access system, demonstrating strong uptake of minimally invasive solutions. The company also reported a significant number of commercial cases utilizing the Pulse surgical platform, which combine navigation, neuromonitoring, and imaging support.

Expanding Access to Diagnostic Imaging

Access to MRI and CT scans improves early identification of disc degeneration, allowing clinicians to plan targeted treatments. High-resolution imaging systems support deeper insights into disc structure, nerve involvement, and spinal alignment. Earlier diagnosis leads to timely intervention and expands the pool of patients eligible for advanced therapies. Hospitals and specialty clinics invest in modern imaging units to enhance diagnostic accuracy. Growing imaging capacity in emerging regions helps reduce care delays and supports broader adoption of treatment solutions.

Key Trend & Opportunity

Growth of Personalized and Regenerative Therapies

Personalized treatment gains momentum as clinicians incorporate patient-specific data and regenerative approaches such as stem cell therapy and biologics. These methods focus on restoring disc function instead of offering short-term relief. Advances in tissue engineering and biomaterials support durable recovery and drive interest in non-surgical options. Biotech firms invest heavily in clinical research to validate long-term outcomes. As evidence for regenerative solutions grows, demand increases among patients seeking targeted, sustainable care for degenerative disc conditions.

- For instance, Mesoblast completed Phase III evaluation of its MPC-06-ID cell therapy, and is conducting an additional trial to support potential regulatory approval of regenerative disc treatment. The company also secured manufacturing capability for many cell-therapy doses annually through its proprietary culture-expansion system.

Integration of Digital Health and Remote Care Models

Digital platforms expand access to care through virtual consultations, remote physiotherapy, and guided rehabilitation programs. Wearable devices help track posture, mobility, and pain patterns, enabling clinicians to tailor treatment plans. These tools strengthen patient adherence and reduce the need for frequent in-person visits. Telemedicine models help hospitals manage high caseloads more efficiently. The rise of digital and hybrid care solutions creates strong opportunities for technology developers and enhances continuity of care for chronic spine conditions.

- For instance, Hinge Health scaled its digital spine program across a significant user base and recorded many completed virtual therapy sessions. The company deployed sensor-based motion trackers or computer vision technology as part of patient programs, improving treatment accuracy for remote musculoskeletal care.

Key Challenge

High Treatment Costs and Limited Reimbursement

Advanced imaging, surgical procedures, and regenerative therapies involve high costs that limit patient access. Reimbursement remains inconsistent, especially for newer biological or minimally invasive treatments. These financial barriers push patients toward conservative options, even when advanced care is recommended. Hospitals face difficulty balancing technology upgrades with affordability. Without broader reimbursement support, many patients delay treatment, slowing adoption of innovative solutions and affecting overall market growth.

Shortage of Skilled Spine Specialists

The growing need for specialized disc treatment outpaces the availability of trained spine surgeons and interventional specialists. Complex procedures require advanced skill sets that are limited across many regions. This gap leads to longer wait times, uneven care quality, and delays in surgical planning. Healthcare systems struggle to scale spine programs without adequate specialist training. Uneven geographic distribution of expertise further restricts access and slows the adoption of advanced treatment methods.

Regional Analysis

North America

North America holds the leading position in the Degenerative Disc Disease Treatment market with a 38% share, supported by strong access to diagnostic imaging, advanced surgical infrastructure, and high awareness of spine health. Rising cases of chronic back pain among older adults and working professionals drive consistent treatment demand. Hospitals and specialty clinics continue to expand minimally invasive surgery programs, strengthening adoption across the region. Favorable reimbursement policies and strong availability of skilled spine specialists improve treatment outcomes. Growing investment in regenerative therapies and digital rehabilitation tools further enhances the region’s growth outlook.

Europe

Europe accounts for a 29% share, driven by robust healthcare systems, early diagnosis practices, and rising adoption of evidence-based spine treatments. The region benefits from strong regulatory support for minimally invasive devices and regenerative research. Aging demographics increase the number of patients needing long-term disc care, boosting demand for both conservative and surgical treatment options. Hospitals upgrade imaging technologies to improve accuracy in disc degeneration assessment. Growing preference for outpatient spine procedures and structured rehabilitation programs enhances market expansion. Strategic collaborations between medical device firms and research institutions strengthen Europe’s innovation landscape.

Asia Pacific

Asia Pacific holds a 25% share, supported by a rapidly growing patient population, rising healthcare spending, and expanding access to advanced diagnostic tools. Increased urbanization and sedentary work patterns contribute to higher back pain incidence. Hospitals across China, India, Japan, and South Korea invest in modern spine surgery technologies and high-resolution imaging systems. Growing awareness of early treatment encourages more patients to seek medical evaluation. Medical tourism strengthens traction for minimally invasive procedures, while rising investments in rehabilitation infrastructure improve long-term outcomes. The region’s expanding healthcare workforce further supports strong market growth.

Latin America

Latin America captures a 5% share, driven by rising cases of spinal disorders and expanding access to specialized care in major countries. Public and private hospitals adopt improved imaging systems and upgrade surgical units to manage a growing volume of degenerative disc cases. Urban populations show higher treatment adoption due to better healthcare reach. However, inconsistent reimbursement and specialist shortages limit wider penetration. Increasing investment in physiotherapy centers and pain management programs supports conservative care growth. Partnerships between global device makers and local providers help strengthen regional capacity for advanced spine treatments.

Middle East & Africa

The Middle East & Africa region holds a 3% share, influenced by rising healthcare infrastructure development and increasing diagnosis of degenerative disc conditions. Gulf countries lead adoption due to strong investment in advanced imaging and minimally invasive spine procedures. Improved access to orthopedic and neurosurgery specialists accelerates treatment uptake. However, many African countries face challenges such as limited imaging availability, high treatment costs, and uneven specialist distribution. Growing medical tourism in the UAE and Saudi Arabia supports regional expansion. Strengthening rehabilitation services and digital health platforms improves long-term patient management across the region.

Market Segmentations:

By Treatment Type

- Medications

- Physical Therapy

- Surgical Procedures

- Minimally Invasive Therapies

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Rehabilitation Centers

By Diagnosis Method

- X-ray

- MRI

- CT Scan

- Discography

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Degenerative Disc Disease Treatment market features leading players such as Medtronic plc, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, NuVasive Inc., Globus Medical Inc., Orthofix Medical Inc., Boston Scientific Corporation, Braun Melsungen AG, and Centinel Spine LLC. These companies compete through innovation in minimally invasive spinal implants, biologics, regenerative solutions, and advanced surgical navigation systems. Many firms invest in R&D to develop motion-preserving technologies and next-generation disc replacement devices that enhance patient outcomes. Strategic acquisitions and partnerships strengthen product portfolios and expand geographic reach. Companies also focus on training programs for surgeons to support wider adoption of new spinal procedures. Growing interest in AI-driven surgical planning, robotic-assisted systems, and digital rehabilitation tools further intensifies competition. As demand for early diagnosis and personalized treatment increases, key players continue enhancing clinical evidence, manufacturing capabilities, and distribution networks to secure stronger market positioning.

Key Player Analysis

- Medtronic plc

- Zimmer Biomet

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- NuVasive, Inc.

- Globus Medical, Inc.

- Boston Scientific Corporation

- Orthofix Medical Inc.

- Braun Melsungen AG

- Centinel Spine, LLC

Recent Developments

- In August 2024, Globus Medical, Inc. launched the ADIRA™ XLIF™ Plate System. The system is cleared for use in lumbar spine stabilisation, including in cases of degenerative disc disease.

- In April 2024, Medtronic plc received FDA Breakthrough Device designation for its INFUSE™ Bone Graft when used with an intervertebral fusion device and a commercially available metallic screw and rod system in a transforaminal lumbar interbody fusion (TLIF) procedure for lumbar degenerative disc disease.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, End User, Diagnosis Method and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive spine procedures will increase as patients seek faster recovery.

- Adoption of regenerative therapies will grow as clinical evidence strengthens over time.

- Digital rehabilitation platforms will expand and support remote monitoring and guided therapy.

- AI-driven imaging and diagnostic tools will improve early detection and treatment planning.

- Motion-preserving implants will gain traction as alternatives to spinal fusion.

- Hospitals will continue upgrading surgical navigation and robotic systems to enhance precision.

- Collaboration between device makers and research centers will accelerate new product development.

- Emerging markets will invest more in imaging and spine care infrastructure.

- Personalized treatment plans will advance through biomechanics data and patient-specific modeling.

- Training programs for spine specialists will expand to support broader adoption of advanced procedures.