Market Overview

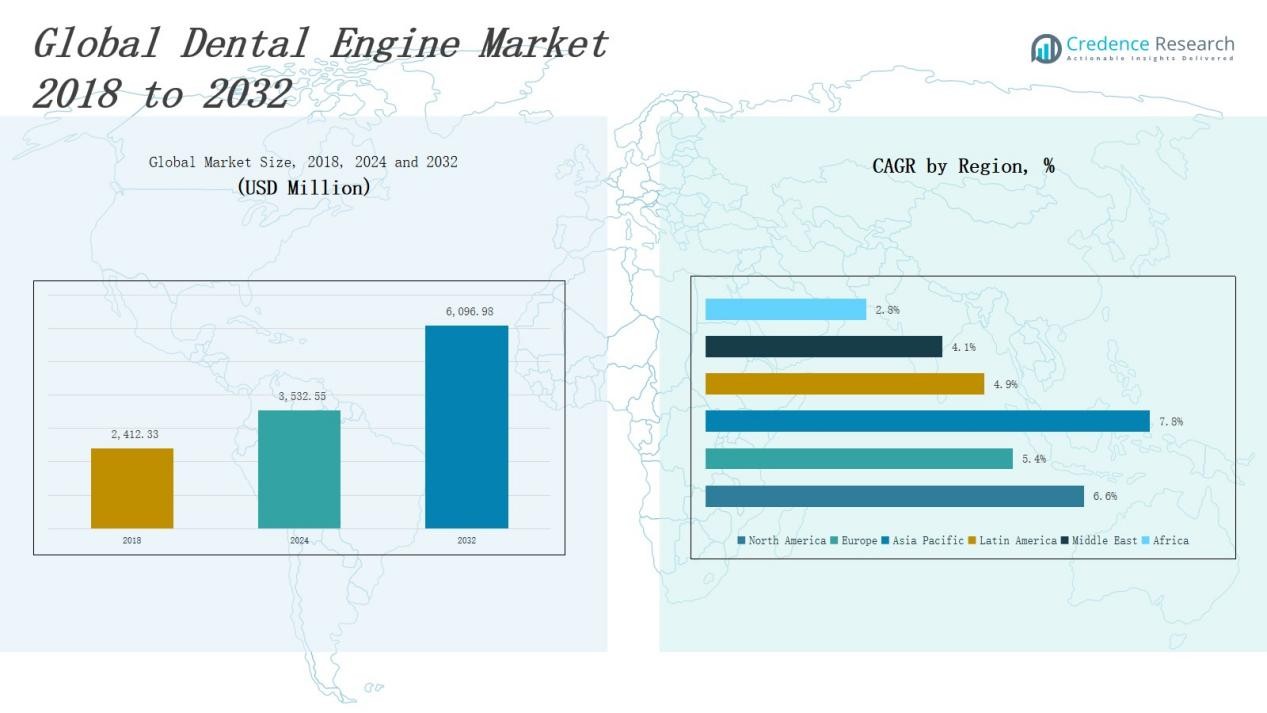

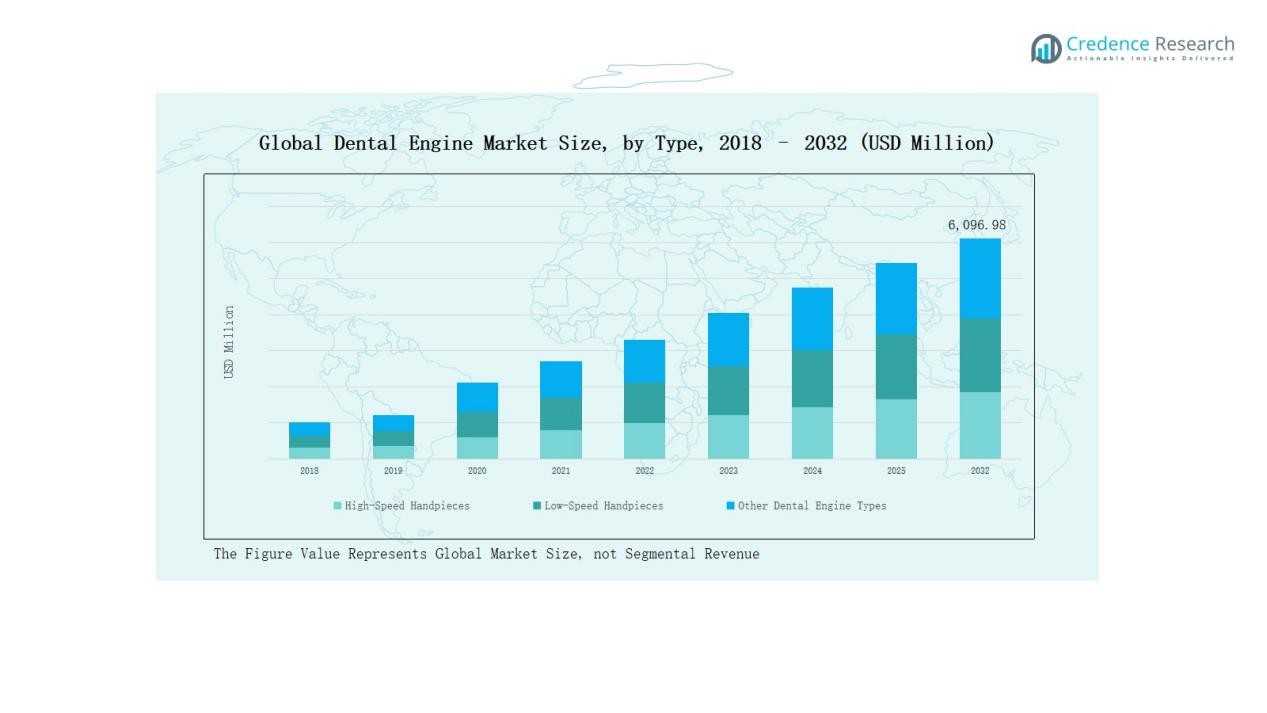

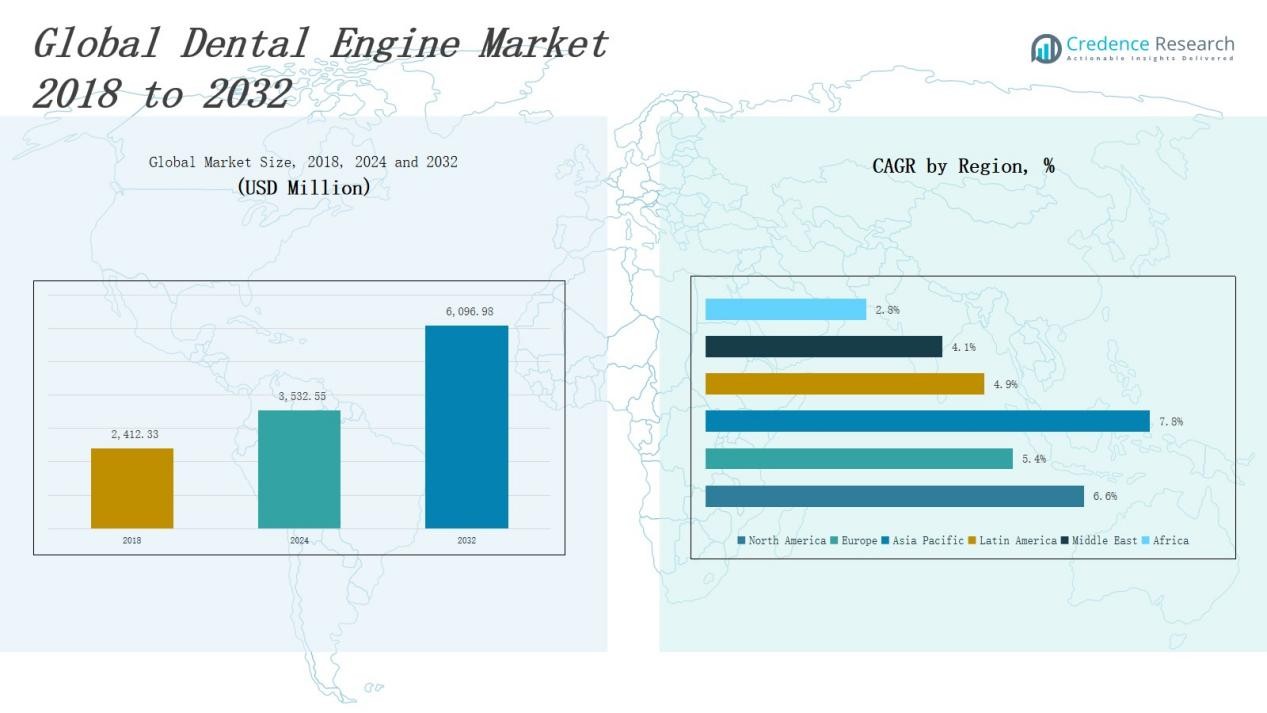

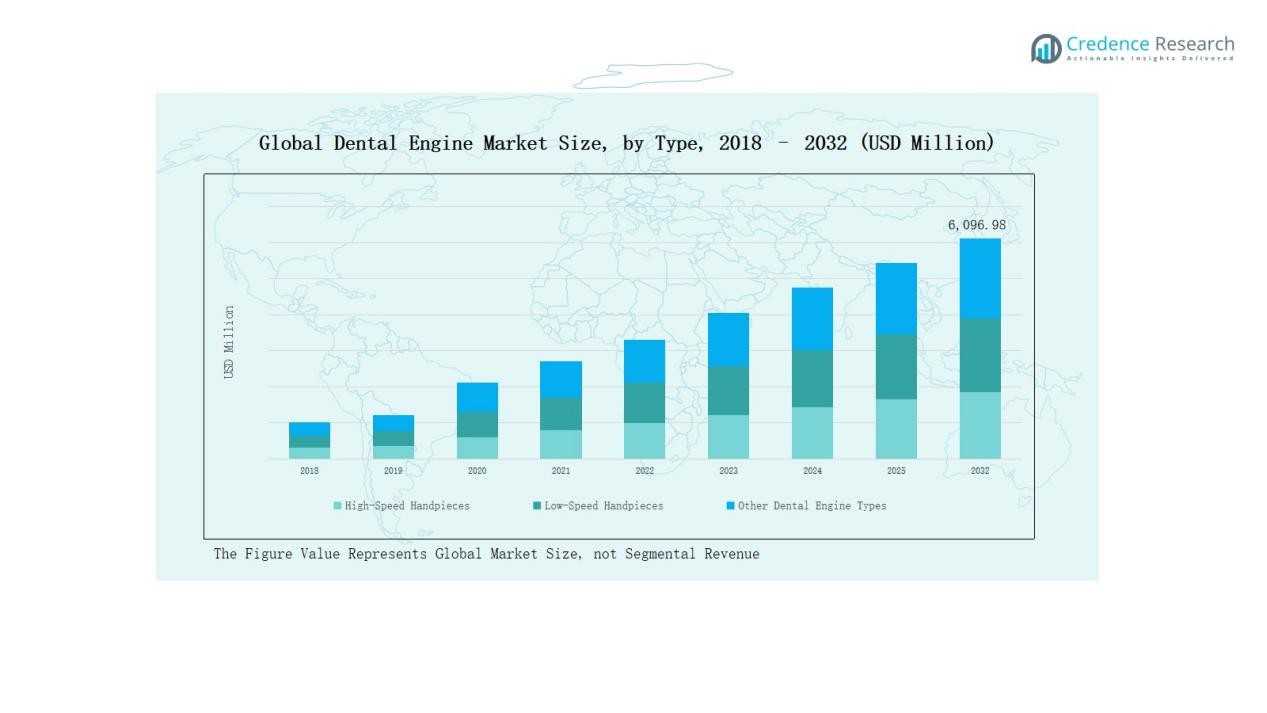

Dental Engine Market size was valued at USD 2,412.33 million in 2018 to USD 3,532.55 million in 2024 and is anticipated to reach USD 6,096.98 million by 2032, at a CAGR of 6.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Engine Market Size 2024 |

USD 3,532.55 Million |

| Dental Engine Market, CAGR |

6.57% |

| Dental Engine Market Size 2032 |

USD 6,096.98 Million |

The Dental Engine Market is shaped by global leaders including 3M Company, Dentsply Sirona, Planmeca Group, Envista Holdings, Align Technology, A-dec Inc., Aseptico, J. Morita Corporation, GC Corporation, and Midmark Corporation. These companies maintain competitive strength through advanced product portfolios, continuous innovation in cordless and AI-enabled engines, and strong distribution networks across developed and emerging markets. Strategic partnerships, mergers, and product upgrades further enhance their market positioning. North America emerged as the leading region in 2024 with a 38% share, supported by robust dental infrastructure, high patient awareness, and rapid adoption of technologically advanced dental engines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dental Engine Market grew from USD 2,412.33 million in 2018 to USD 3,532.55 million in 2024 and is projected to reach USD 6,096.98 million by 2032.

- High-speed handpieces dominated with 52% share in 2024, supported by efficiency in restorative and surgical treatments, while low-speed handpieces and other types accounted for 34% and 14% respectively.

- Corded dental engines led with 61% share in 2024, followed by cordless engines at 27% and AI-enabled engines at 12%, driven by digital dentistry adoption and workflow automation.

- Dental clinics commanded 58% share in 2024, with hospitals holding 26% and specialty clinics 16%, reflecting rising patient visits and expanding adoption of advanced handpiece systems.

- North America led with 38% share in 2024, followed by Asia Pacific at 26% and Europe at 16%, with Asia Pacific emerging as the fastest-growing region through 2032.

Market Segment Insights

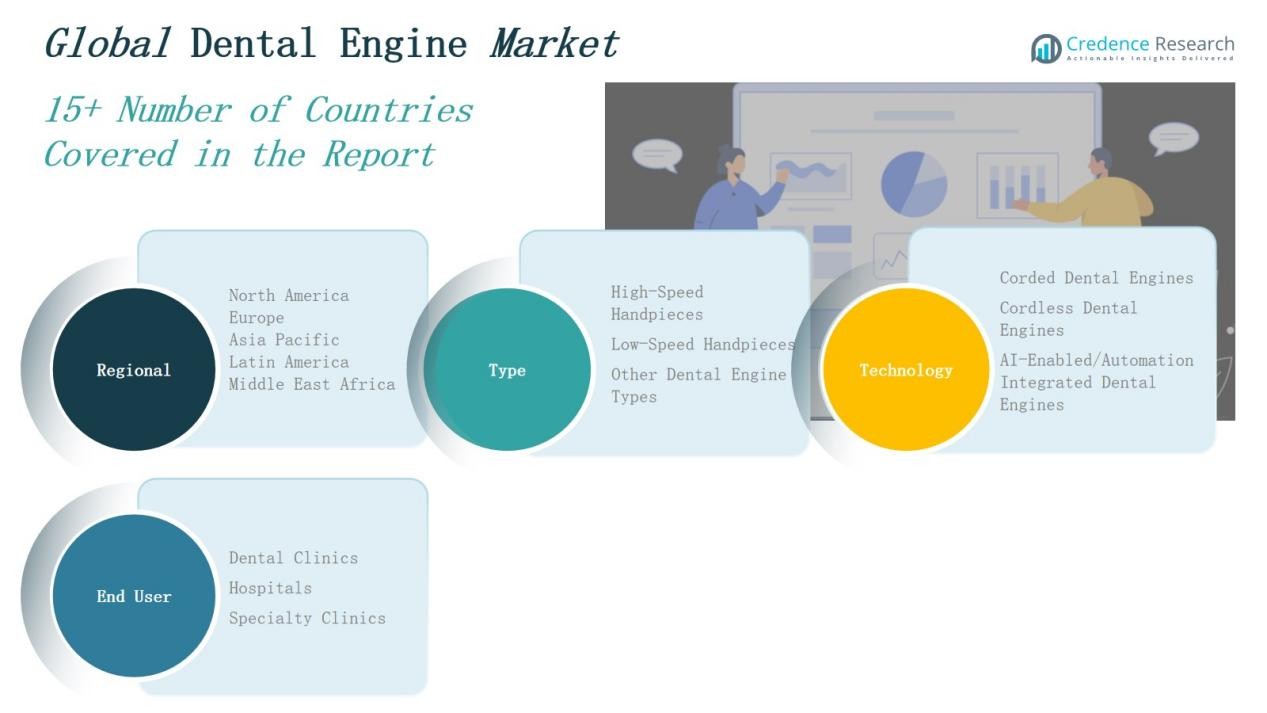

By Type

High-speed handpieces dominated the dental engine market with a 52% share in 2024, driven by their precision, efficiency, and ability to perform restorative and surgical procedures quickly. Their wide adoption in both general dentistry and specialized treatments underscores their role in reducing chair time and improving patient outcomes. Low-speed handpieces held a 34% share, primarily used for polishing, finishing, and endodontic procedures, while other dental engine types accounted for the remaining 14%, serving niche applications and specialized requirements.

- For instance, The NSK Ti-Max Z900L dental handpiece features ceramic ball bearings and a titanium body, which enables a maximum rotation speed of 320,000–400,000 rpm.

By Technology

Corded dental engines led the market with a 61% share in 2024, supported by their reliability, consistent power delivery, and cost-effectiveness in high-volume dental practices. Cordless dental engines represented 27% share, gaining traction due to enhanced mobility, ergonomic benefits, and ease of use in compact clinical setups. AI-enabled and automation-integrated dental engines captured 12% share, driven by growing adoption of digital dentistry, predictive diagnostics, and workflow automation, particularly in advanced dental clinics.

- For instance, NSK’s Surgic Pro+ surgical micromotor engine—widely used in implantology—delivers consistent torque through corded operation, making it a standard in many teaching hospitals.

By End User

Dental clinics were the leading end-user segment with a 58% share in 2024, attributed to the growing number of independent practices, rising patient visits, and demand for advanced handpiece systems to improve efficiency. Hospitals accounted for 26% share, supported by increasing oral surgery procedures and integration of dental engines into surgical departments. Specialty clinics held the remaining 16% share, catering to orthodontics, endodontics, and prosthodontics with demand for precision-focused engines.

Key Growth Drivers

Rising Prevalence of Dental Disorders

The growing incidence of dental caries, periodontal diseases, and oral infections significantly drives demand for dental engines. High-speed and low-speed handpieces are widely used in restorative and preventive procedures, helping dentists deliver faster and more accurate treatments. Rising sugar consumption, poor dietary habits, and tobacco use further contribute to the increasing patient base. This prevalence compels healthcare providers and clinics to invest in advanced dental engines, strengthening the market’s expansion and enhancing access to modern dental care globally.

- For instance, Intego and Intego Pro treatment centers, launched by Dentsply Sirona prior to 2021, feature integrated design elements and advanced water line disinfection systems that improve workflow efficiency and hygiene standards in dental practices.

Technological Advancements in Dental Equipment

Continuous innovation in dental technologies is boosting adoption of advanced dental engines. Integration of cordless handpieces, ergonomic designs, and AI-enabled systems enhances operational efficiency and reduces procedure times. Digital dentistry adoption, including CAD/CAM and automation in diagnosis, complements the demand for high-precision engines. Manufacturers focus on providing solutions that improve patient comfort and clinical outcomes. These innovations are encouraging practices to upgrade traditional devices, thus fueling consistent revenue growth in the market.

- For instance, in 2022 Dentsply Sirona introduced its Primeprint 3D printing system and CEREC CAD/CAM updates, enabling chairside production of restorations with improved precision and speed.

Expansion of Dental Care Infrastructure

Rising investments in dental care infrastructure are supporting market growth. The increasing number of dental clinics, specialty centers, and hospital-based dental departments directly strengthens demand for dental engines. Governments and private players are focusing on improving access to oral healthcare, particularly in emerging economies. Training programs and dental awareness initiatives also drive equipment adoption among professionals. This expansion enables higher patient volumes and accelerates the integration of modern technologies, reinforcing the steady growth of the dental engine market.

Key Trends & Opportunities

Growing Adoption of Cordless and Portable Systems

The shift toward cordless dental engines is gaining momentum, driven by their flexibility, reduced clutter, and ease of use in smaller clinics. Improved battery technology and ergonomic designs enhance productivity while reducing operator fatigue. Portable systems also support mobile dental units, addressing demand in underserved areas. This trend reflects a strong opportunity for manufacturers to expand their cordless product lines, strengthening their market presence and catering to the growing preference for mobility and user convenience.

- For instance, Bien-Air’s Nova contra-angle handpiece system, while not cordless, is an electric handpiece system that integrates optimized weight distribution and reduced vibrations to help minimize wrist strain during lengthy dental procedures.

Integration of AI and Automation in Dentistry

AI-enabled dental engines present a transformative opportunity by enhancing diagnostics, predictive maintenance, and precision in treatment. Automation helps optimize workflows, reduce errors, and improve patient outcomes. Smart systems with integrated sensors provide real-time feedback to practitioners, elevating treatment accuracy. The rising adoption of digital dentistry and data-driven solutions is expanding opportunities for companies investing in AI-integrated engines. This trend is expected to reshape the competitive landscape and support the market’s long-term growth trajectory.

- For instance, Align Technology integrates AI into its iTero intraoral scanners, enabling real-time simulation of orthodontic outcomes, which improves case acceptance and treatment planning.

Key Challenges

High Cost of Advanced Dental Engines

The premium pricing of advanced dental engines poses a major challenge, especially in price-sensitive markets. High acquisition and maintenance costs limit adoption among small and mid-sized clinics. Despite technological benefits, affordability remains a barrier in emerging economies where healthcare budgets are constrained. This challenge often leads to extended replacement cycles and reliance on refurbished equipment, slowing market penetration for new and innovative systems.

Limited Access in Emerging Regions

Access to advanced dental care equipment remains limited in developing regions due to infrastructure gaps and lack of trained professionals. Many rural and semi-urban areas continue to depend on outdated dental tools, restricting the adoption of modern dental engines. Inadequate reimbursement policies and lower awareness about advanced oral treatments also hinder demand. Addressing these disparities is essential for manufacturers and policymakers to expand market reach and ensure broader healthcare coverage.

Stringent Regulatory and Compliance Requirements

Dental engine manufacturers face challenges in navigating strict regulatory standards and compliance frameworks. Certification processes, quality control requirements, and adherence to safety guidelines increase development costs and time-to-market. Smaller companies often struggle to meet these demands, affecting innovation and competitiveness. Regulatory variations across regions further complicate market entry and product approval. These hurdles can delay new product launches, slowing down overall market growth despite rising demand.

Regional Analysis

North America

North America held the largest share of the dental engine market at 38% in 2024, valued at USD 1,542.66 million. The region is projected to reach USD 2,669.86 million by 2032, registering a CAGR of 6.6%. Growth is supported by a strong network of dental clinics, high patient awareness, and favorable reimbursement policies. The U.S. leads with significant adoption of high-speed handpieces and AI-enabled technologies. Increasing investments in advanced oral care infrastructure further strengthen the region’s leadership position, making it a key hub for dental engine innovations.

Europe

Europe accounted for 16% of the global market in 2024, valued at USD 653.55 million. The market is forecast to reach USD 1,030.43 million by 2032, expanding at a CAGR of 5.4%. Rising demand for advanced restorative treatments and a well-established dental industry drive the region’s growth. Countries such as Germany, France, and the UK remain major contributors, supported by strong healthcare funding and adoption of digital dentistry. Preventive oral care campaigns across the EU further enhance demand for dental engines, ensuring steady market expansion.

Asia Pacific

Asia Pacific emerged as the fastest-growing region with 26% share in 2024, valued at USD 1,044.19 million, and is projected to reach USD 1,970.73 million by 2032. The market is expected to grow at a CAGR of 7.8%, driven by rising dental disease prevalence, growing middle-class populations, and rapid urbanization. China, India, and Japan are the key growth engines, supported by government-led oral health programs and increased private investments in dental care infrastructure. The region’s growing preference for cordless and AI-enabled dental engines positions it as a future growth leader.

Latin America

Latin America represented 4% of the market in 2024, valued at USD 157.72 million, and is expected to reach USD 239.53 million by 2032. The region will grow at a CAGR of 4.9%, with Brazil and Mexico leading adoption. Growth is influenced by expanding access to private dental care and rising focus on cosmetic dentistry. However, economic disparities and limited reimbursement coverage continue to restrict broader adoption. Despite these challenges, the market shows steady expansion, particularly in urban centers with high demand for modern dental services.

Middle East

The Middle East captured 2% of the global market in 2024, valued at USD 84.56 million, and is forecast to reach USD 121.56 million by 2032. It will expand at a CAGR of 4.1%. Growth is concentrated in GCC countries, where government investments in healthcare infrastructure are strong. Rising medical tourism, particularly for dental treatments in the UAE, further supports demand. However, adoption of advanced dental engines remains slower in other parts of the region due to affordability barriers and uneven healthcare access.

Africa

Africa accounted for 1% share in 2024, valued at USD 49.87 million, and is projected to reach USD 64.85 million by 2032, growing at a CAGR of 2.8%. The region shows limited adoption due to inadequate infrastructure, low awareness, and affordability issues. South Africa and Egypt lead demand, supported by urban dental clinics and increasing focus on preventive care. Rural regions continue to depend on traditional methods, restricting penetration of advanced dental engines. While growth remains modest, rising public health initiatives present gradual opportunities for expansion.

Market Segmentations:

By Type

- High-Speed Handpieces

- Low-Speed Handpieces

- Other Dental Engine Types

By Technology

- Corded Dental Engines

- Cordless Dental Engines

- AI-Enabled / Automation Integrated Dental Engines

By End User

- Dental Clinics

- Hospitals

- Specialty Clinics

By Region

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The dental engine market is moderately consolidated, with global players dominating through broad product portfolios, strong distribution networks, and continuous innovation. Leading companies such as 3M Company, Dentsply Sirona, Planmeca Group, Envista Holdings, Align Technology, Aseptico, A-dec Inc., J. Morita Corporation, GC Corporation, and Midmark Corporation actively compete by offering technologically advanced handpieces and AI-integrated engines. Their strategies focus on product upgrades, ergonomic designs, cordless solutions, and automation features that enhance treatment efficiency and patient comfort. Mergers, acquisitions, and partnerships strengthen their geographic reach and customer base, particularly in high-growth regions like Asia Pacific. Meanwhile, emerging players emphasize affordability and niche solutions to capture share in cost-sensitive markets. The competitive environment is further shaped by regulatory compliance, R&D investments, and the need to balance innovation with affordability. As demand for advanced and digital dentistry solutions rises, competition is expected to intensify, fostering continuous technological progress across the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- 3M Company

- Dentsply Sirona

- Planmeca Group

- Envista Holdings

- Align Technology

- Aseptico

- A-dec Inc.

- Morita Corporation

- GC Corporation

- Midmark Corporation

Recent Developments

- In mid-August 2025, TrustAI secured $6 million in funding to advance AI applications, while manufacturers launched a cordless handpiece and improved bonding tools for dental practices.

- In August 2025, 3D Systems launched the NextDent Jetted Denture Solution, an FDA‑cleared, one‑piece 3D‑printed denture designed for rapid, high-quality output using the company’s NextDent 300 printer.

- In August 2025, Vasa Denticity acquired a 51% stake in IDS Denmed. This deal aims to establish India’s largest integrated dental supply network, streamlining logistics and expanding product range.

- In may 2025, DCI and NSK launched the DCI Edge Series 5 Plus Delivery System, integrating the NSK NLZ PRO motor system. The promotion includes a free NSK NLZ electric motor, pairing dual motors at no extra cost.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-speed handpieces will continue to dominate due to precision and efficiency.

- Cordless dental engines will gain wider adoption with advancements in battery technology.

- AI-enabled dental engines will reshape treatment accuracy and predictive diagnostics.

- Dental clinics will remain the leading end users, driving consistent equipment demand.

- Hospitals will expand usage of advanced engines for complex surgical procedures.

- Specialty clinics will increasingly adopt precision-focused engines for orthodontic and prosthodontic care.

- Asia Pacific will emerge as the fastest-growing hub for dental engine adoption.

- North America will sustain leadership through strong infrastructure and technological innovation.

- Rising patient awareness will boost investments in preventive and restorative oral care.

- Competitive strategies will emphasize ergonomic design, affordability, and integration with digital dentistry.