Market Overview

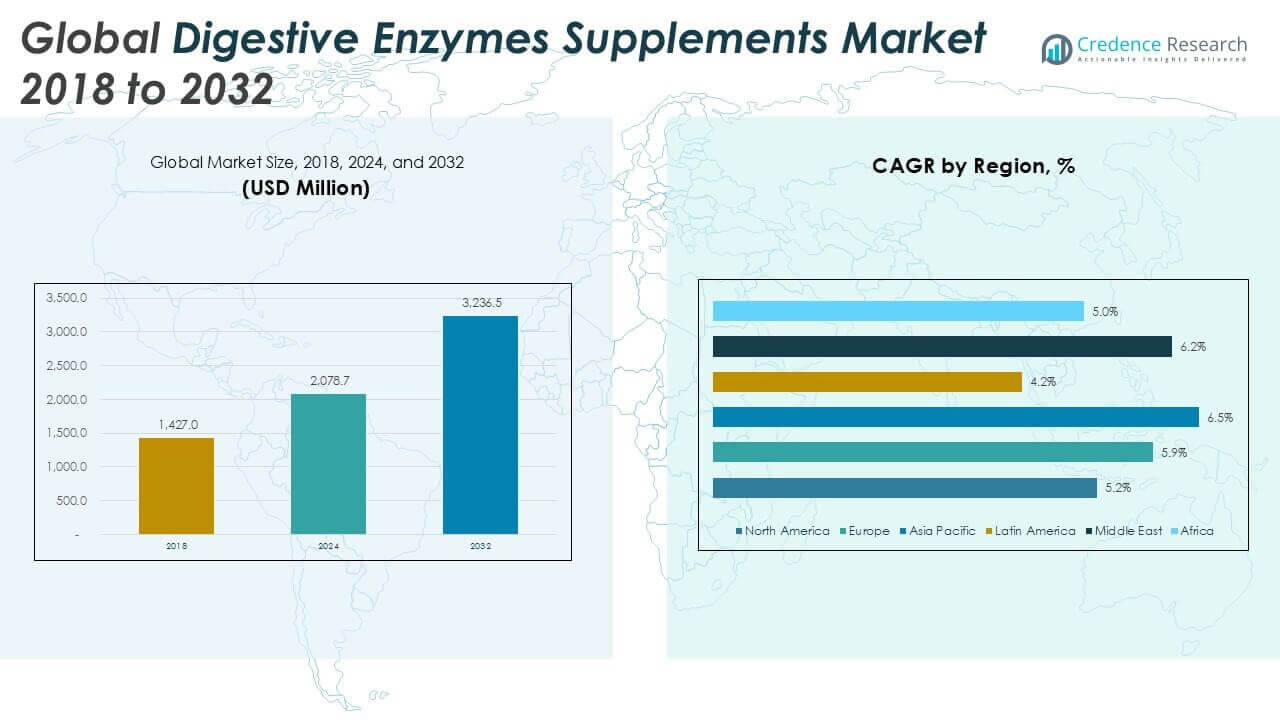

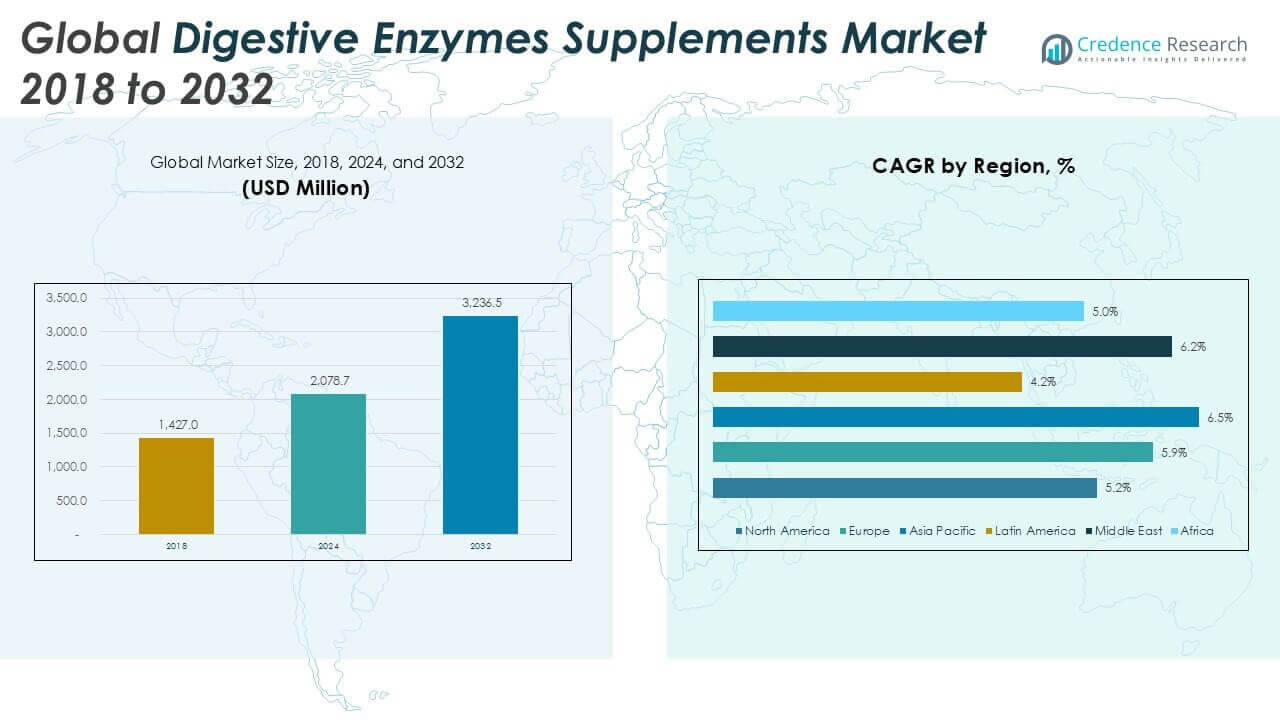

The Global Digestive Enzymes Supplements Market is projected to grow from USD 2,078.7 million in 2024 to an estimated USD 3,236.5 million by 2032, with a compound annual growth rate (CAGR) of 5.66% from 2025 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digestive Enzymes Supplements Market Size 2024 |

USD 2,078.7 Million |

| Digestive Enzymes Supplements Market, CAGR |

5.66% |

| Digestive Enzymes Supplements Market Size 2032 |

USD 3,236.5 Million |

Market drivers include the rising incidence of gastrointestinal diseases like lactose intolerance, irritable bowel syndrome (IBS), and chronic pancreatitis. Consumers are becoming more health-conscious and are proactively incorporating enzyme supplements into their daily routines, particularly as part of specialized diets such as gluten-free or ketogenic plans. Trends indicate a growing demand for plant-based and vegan enzyme supplements, with manufacturers innovating new delivery forms such as capsules, chewable, and powders for enhanced consumer convenience. Additionally, e-commerce platforms are playing a critical role in increasing product accessibility and driving consumer engagement through targeted marketing.

Geographically, North America dominates the market due to high awareness levels, strong healthcare infrastructure, and widespread acceptance of dietary supplements. Asia Pacific is expected to witness the fastest growth during the forecast period, propelled by a rising middle-class population and increasing healthcare expenditures in countries like China and India. Key players in the market include Enzymedica, Garden of Life, Integrative Therapeutics, Country Life LLC, and NOW Foods, who are focused on expanding their product portfolios and strengthening their global distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market is projected to grow from USD 2,078.7 million in 2024 to USD 3,236.5 million by 2032, registering a CAGR of 5.66% from 2025 to 2032.

- Rising awareness of gut health and the increasing prevalence of gastrointestinal disorders are key growth contributors.

- Preventive healthcare adoption and dietary shifts are encouraging consumers to include digestive enzyme supplements in daily routines.

- High product prices and lack of standardized regulatory frameworks remain significant market restraints.

- North America leads the market due to strong healthcare infrastructure and high supplement usage among aging populations.

- Asia Pacific is expected to witness the fastest growth, driven by urbanization, a growing middle class, and rising healthcare spending.

- Clean-label trends, plant-based formulations, and online retail expansion are shaping future product development and distribution strategies.

Market Drivers

Rising Prevalence of Gastrointestinal Disorders Drives Supplement Demand

The Global Digestive Enzymes Supplements Market continues to grow due to the increasing burden of gastrointestinal (GI) disorders such as irritable bowel syndrome, lactose intolerance, acid reflux, and chronic pancreatitis. These conditions disrupt natural digestive processes, prompting consumers to seek external enzyme support. The demand for over-the-counter supplements is increasing among individuals unable to produce sufficient digestive enzymes naturally. Healthcare professionals also recommend enzyme supplements to patients managing chronic digestive conditions. This medical endorsement has helped build trust in the efficacy of such products. The market benefits from a larger patient population actively searching for symptom relief through non-prescription options.

- For instance, the National Institute of Diabetes and Digestive and Kidney Diseases reported that approximately 70,000,000 people in the United States are affected by gastrointestinal disorders each year.

Growing Health Awareness and Shift Toward Preventive Wellness

A global shift toward preventive healthcare and personal well-being supports growth in the Global Digestive Enzymes Supplements Market. Consumers are more informed about the role of gut health in overall wellness and are proactively managing their diets and digestive efficiency. Supplements have become a routine component of lifestyle management, especially among fitness-focused and health-conscious individuals. Rising internet penetration and access to health information enable people to identify digestive issues early and act promptly. The market gains momentum from increasing interest in food optimization and nutrient absorption. It benefits from growing consumer willingness to invest in non-pharmaceutical health products.

- For instance, a 2024 Global Wellness Institute survey found that 45,000,000 consumers worldwide regularly used digestive enzyme supplements as part of their wellness routines.

Increasing Demand for Plant-Based and Allergen-Free Formulations

Consumer preference is moving toward plant-based digestive enzymes derived from sources such as papaya, pineapple, and fungal extracts. This shift aligns with rising adoption of vegan, vegetarian, and gluten-free diets across diverse age groups. The Global Digestive Enzymes Supplements Market is responding with cleaner labels, allergen-free ingredients, and non-GMO certifications to meet evolving consumer expectations. These product enhancements appeal to individuals with food sensitivities and dietary restrictions. Brands focusing on ethical and sustainable sourcing are gaining a competitive edge. Innovation in formulation and delivery methods has helped manufacturers cater to niche health concerns.

Expanding Access Through Digital Retail and Global Distribution Channels

The market has expanded through e-commerce platforms and improved global logistics networks that offer consumers easy access to a variety of supplements. Online availability allows consumers to compare ingredients, read reviews, and receive targeted product recommendations. It enhances market visibility and encourages brand loyalty among tech-savvy users. The Global Digestive Enzymes Supplements Market benefits from the growing popularity of direct-to-consumer models. Manufacturers are partnering with retailers and digital marketplaces to widen their international reach. These developments support faster product adoption in emerging economies and strengthen the market’s global footprint.

Market Trends

Consumer Preference Shifting Toward Natural and Clean-Label Formulations

The Global Digestive Enzymes Supplements Market is witnessing a clear trend toward clean-label, plant-based, and naturally sourced products. Consumers increasingly avoid synthetic additives, artificial colors, and preservatives in favor of enzyme supplements with transparent ingredient profiles. Brands that emphasize non-GMO, vegan, gluten-free, and organic certifications gain a competitive advantage. This trend reflects a broader movement in the health and wellness space toward sustainability and ethical sourcing. Manufacturers are focusing on minimal processing and clear labeling to build consumer trust. It reflects a deeper alignment between product composition and consumer lifestyle values.

- For instance, in 2024, a leading market survey found that more than 1,500 new digestive enzyme supplement products launched globally featured clean-label claims such as “plant-based,” “non-GMO,” or “organic,” with over 600 of these products introduced in the United States alone, according to company product registries and industry databases.

Increased Popularity of Personalized Nutrition and Gut Health Solutions

Personalized healthcare is gaining traction, and the digestive enzyme category is adapting to this shift through targeted formulations. Companies are offering supplements tailored to specific digestive concerns such as lactose intolerance, protein malabsorption, or high-fat diets. The Global Digestive Enzymes Supplements Market is embracing customized enzyme blends that meet individual metabolic profiles and dietary preferences. Consumers are using diagnostic tools and health apps to guide their supplement choices. This trend is accelerating the development of specialized products for different age groups and medical needs. It is positioning enzyme supplements as part of broader personalized nutrition regimes.

- For instance, in 2024, more than 350,000 consumers in North America purchased personalized digestive enzyme supplements through online platforms that used digital health assessments to recommend specific formulations, as reported in a survey by a leading nutrition technology company.

Growth in Functional Foods and Beverage Integration

Digestive enzyme supplements are now extending beyond traditional capsules and tablets into functional foods, gummies, powders, and beverages. The integration of enzymes into everyday consumables enhances convenience and appeals to a wider demographic. It allows consumers to support digestive health without altering daily routines significantly. The Global Digestive Enzymes Supplements Market is exploring on-the-go formulations that align with modern, fast-paced lifestyles. This trend is driving innovation in food science and delivery systems. Companies are using novel encapsulation technologies to maintain enzyme stability in different food formats.

Rising Impact of Digital Platforms and Influencer-Driven Marketing

Digital marketing strategies are transforming how digestive enzyme supplements reach and engage consumers. Social media platforms, health blogs, and influencer partnerships are shaping brand narratives and promoting product education. The Global Digestive Enzymes Supplements Market is using data-driven campaigns to target specific demographics and health-conscious segments. Reviews, testimonials, and educational content help build consumer awareness and credibility. Brands are investing in online visibility through e-commerce partnerships, SEO, and video content. It is helping companies scale faster and penetrate both developed and emerging markets efficiently.

Market Challenges

Lack of Standardization and Scientific Validation Affects Consumer Confidence

The Global Digestive Enzymes Supplements Market faces significant challenges due to the absence of uniform regulatory standards across regions. Varying product quality, inconsistent ingredient potency, and limited clinical backing often create confusion among consumers. Many supplements lack rigorous scientific validation, which raises concerns about efficacy and safety. This uncertainty discourages healthcare professionals from widely recommending enzyme products. The market must address the credibility gap by investing in third-party testing and transparent labeling. It needs to build a stronger foundation of scientific evidence to improve consumer trust and professional endorsement.

- For instance, a ConsumerLab survey in the United States tested 16 leading digestive enzyme supplements and found that 5 of them did not contain the enzyme activity levels listed on their labels, highlighting the need for stricter quality control and third-party verification in the industry

High Product Costs and Limited Insurance Coverage Restrict Accessibility

Digestive enzyme supplements remain unaffordable for a large portion of the global population due to premium pricing. High manufacturing costs, driven by complex extraction processes and quality control, contribute to elevated retail prices. The Global Digestive Enzymes Supplements Market struggles with limited insurance support, making out-of-pocket expenses a barrier to regular usage. Consumers in low- and middle-income countries often prioritize essential healthcare needs over supplements. It limits widespread adoption and slows market penetration in cost-sensitive regions. Brands must explore cost-effective solutions and pricing strategies to expand reach and improve affordability.

Market Opportunities

Emerging Demand in Developing Economies Offers Expansion Potential

The Global Digestive Enzymes Supplements Market holds significant growth potential in emerging markets across Asia Pacific, Latin America, and the Middle East. Rising urbanization, changing dietary habits, and growing awareness of gut health create favorable conditions for product adoption. A younger, health-conscious population is showing interest in preventive healthcare solutions. Local players can capitalize on this shift by introducing region-specific formulations at accessible price points. It opens new revenue streams for global and regional brands looking to diversify beyond saturated markets. Investment in education and outreach programs will help drive long-term consumer engagement.

Innovation in Delivery Formats and Product Personalization Expands Reach

The opportunity to develop novel delivery systems such as enzyme-infused snacks, drink mixes, and dissolvable strips is gaining attention. These innovative formats increase convenience and appeal to younger consumers seeking easy integration into daily routines. The Global Digestive Enzymes Supplements Market can also grow through personalized supplements tailored to individual digestive needs and lifestyles. Advances in nutrigenomics and microbiome research support this trend. Brands that leverage digital health data to offer customized solutions will likely secure greater consumer loyalty. It creates a pathway for differentiation and premium positioning in an increasingly competitive landscape.

Market Segmentation Analysis

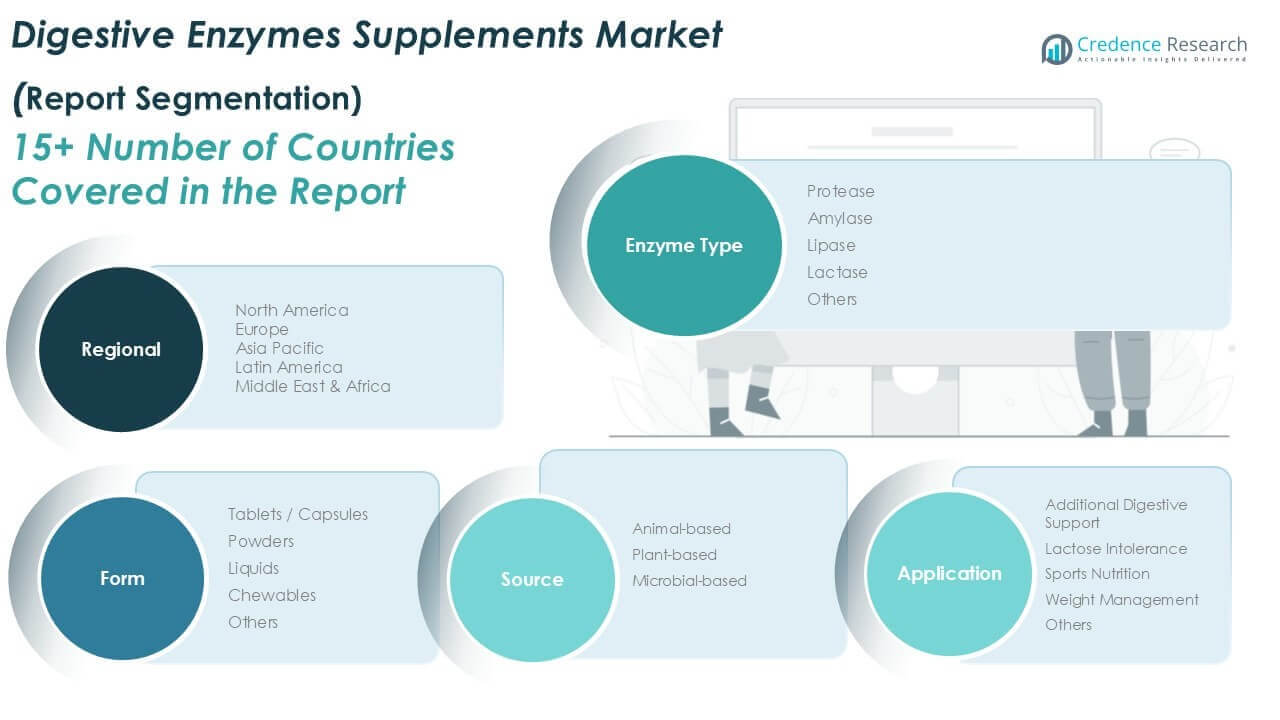

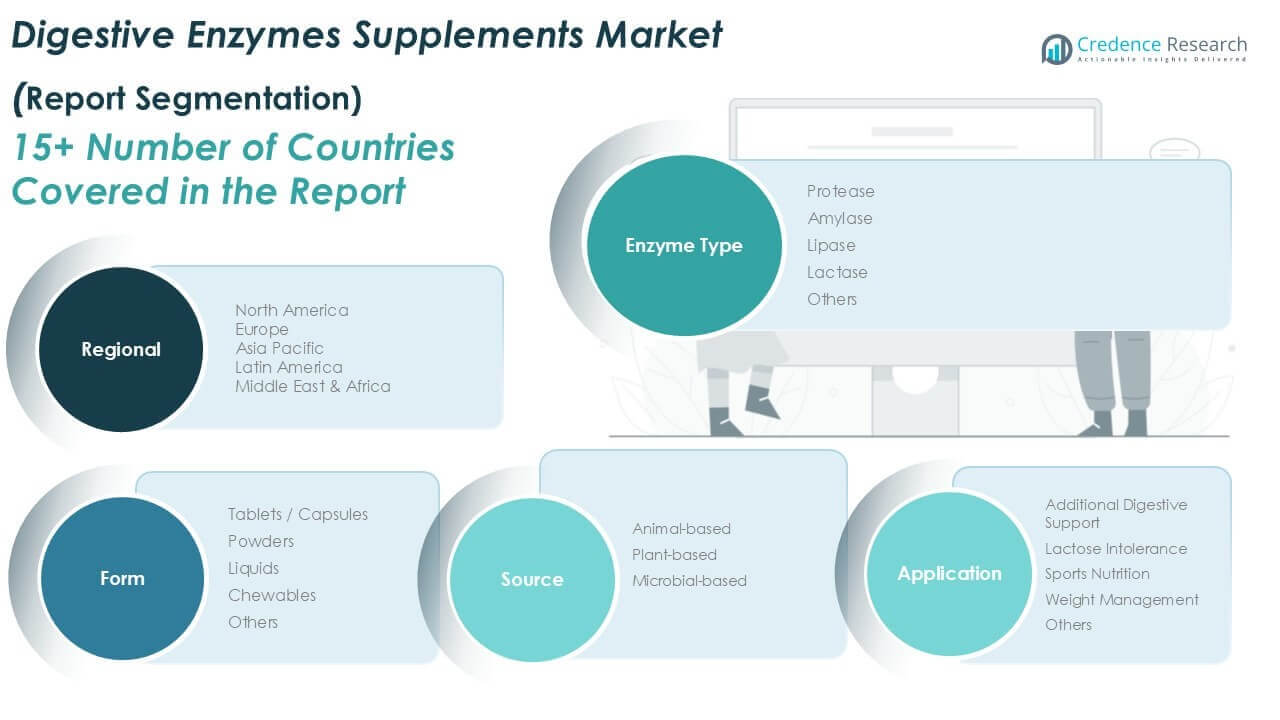

By Enzyme

The Global Digestive Enzymes Supplements Market is segmented by enzyme type into plasma-derived and recombinant coagulation enzymes, protease, amylase, lipase, lactase, and others. Protease dominates the segment due to its widespread use in protein digestion and high demand among individuals with protein intolerance or high-protein diets. Amylase and lipase also hold substantial shares, driven by their role in carbohydrate and fat digestion, respectively. Lactase continues to gain traction among consumers managing lactose intolerance. Plasma-derived and recombinant enzymes are more specialized but show growth potential in clinical and therapeutic settings. It reflects increasing awareness of enzyme-specific digestive support.

- For instance, industry data from 2023 indicate that over 1.2 billion units of protease-based digestive enzyme supplements were sold globally, making it the most widely distributed enzyme type in the market.

By Form

The market is segmented by form into tablets/capsules, powders, liquids, chewables, and others. Tablets and capsules lead this segment due to ease of consumption, precise dosage, and extended shelf life. Powders and liquids follow, appealing to those who require flexible dosing or faster absorption. Chewables are gaining popularity, particularly among pediatric and elderly populations. It enables broader appeal across age groups and improves compliance. Formulation diversity supports personalized health regimens and drives innovation.

- For instance, a 2023 survey of leading supplement manufacturers reported that more than 2.5 billion bottles or packs of digestive enzyme tablets and capsules were distributed globally, compared to approximately 400 million units of powders and liquids.

By Source

Based on source, the market includes animal-based, plant-based, and microbial-based digestive enzymes. Animal-based enzymes hold a strong position due to their high efficacy, especially in clinical applications. However, plant-based and microbial-based enzymes are expanding rapidly due to growing vegan trends and dietary restrictions. The Global Digestive Enzymes Supplements Market benefits from increased demand for non-allergenic, sustainable sources. It reflects a shift in consumer preferences toward cleaner and ethical product alternatives.

By Application Industry

Application-wise, the market is segmented into additional digestive support, lactose intolerance, sports nutrition, weight management, and others. Additional digestive support remains the leading application due to its wide user base and general health focus. Lactose intolerance supplements see rising adoption driven by increased dairy sensitivity awareness. Sports nutrition and weight management applications gain traction among fitness-driven consumers. It shows the expanding role of enzyme supplements in targeted nutritional strategies.

Segments

Based on Enzyme

- Plasma Derived and Recombinant Coagulation

- Protease

- Amylase

- Lipase

- Lactase

- Others

Based on Form

- Tablets / Capsules

- Powders

- Liquids

- Chewables

- Others

Based on Source

- Animal-based

- Plant-based

- Microbial-based

Based on Application Industry

- Additional Digestive Support

- Lactose Intolerance

- Sports Nutrition

- Weight Management

- Others

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Digestive Enzymes Supplements Market

North America held the largest share of the Digestive Enzymes Supplements Market in 2024, accounting for approximately 31.7% of the global market. It was valued at USD 659.48 million in 2024 and is projected to reach USD 989.09 million by 2032, expanding at a CAGR of 5.2%. Strong consumer awareness, a high prevalence of digestive disorders, and widespread adoption of dietary supplements support market growth in the United States and Canada. The region benefits from robust healthcare infrastructure and growing demand for preventive healthcare solutions. It also sees increasing use of enzyme supplements in clinical and sports nutrition applications. Market players continue to introduce advanced formulations and personalized products for mature consumers.

Europe Digestive Enzymes Supplements Market

Europe accounted for 26.4% of the global market in 2024, with a value of USD 550.68 million, and is forecast to reach USD 873.87 million by 2032, growing at a CAGR of 5.9%. The market benefits from high regulatory standards, a rising elderly population, and growing focus on digestive health. Germany, the UK, and France lead the regional demand, supported by increased product availability through pharmacies and online channels. It experiences strong consumer preference for clean-label and vegan enzyme supplements. The region also encourages clinical research, which helps validate product claims and enhance adoption. Strategic partnerships with health retailers further support expansion.

Asia Pacific Digestive Enzymes Supplements Market

Asia Pacific is the fastest-growing region in the Digestive Enzymes Supplements Market, holding 24.3% market share in 2024, with a valuation of USD 506.01 million, expected to reach USD 841.50 million by 2032 at a CAGR of 6.5%. Growth is driven by rising health awareness, dietary transitions, and an expanding middle class in countries like China, India, and Japan. Urbanization and growing interest in natural health supplements support increased demand. It also benefits from the growing e-commerce sector and product accessibility across urban and semi-urban areas. Manufacturers are localizing formulations to align with regional preferences. The market shows strong potential for long-term development.

Latin America Digestive Enzymes Supplements Market

Latin America held a 9.6% share in the global market in 2024, valued at USD 200.39 million, and is projected to reach USD 278.34 million by 2032, registering a CAGR of 4.2%. Brazil and Mexico lead regional demand due to increasing digestive health concerns and dietary changes. It benefits from growing urban populations and wider access to dietary supplements through online retail. Consumer interest in weight management and fitness also supports market penetration. Regulatory improvements are helping streamline product approvals and import procedures. The region presents opportunities for affordable, mid-range formulations tailored to budget-conscious consumers.

Middle East Digestive Enzymes Supplements Market

The Middle East accounted for 4.8% of the global market in 2024, valued at USD 100.01 million, and is forecast to reach USD 161.83 million by 2032, growing at a CAGR of 6.2%. Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia are seeing increased health supplement consumption, driven by lifestyle disorders and rising disposable income. It is influenced by government-led wellness campaigns and higher awareness of digestive disorders. Modern retail formats and health-focused pharmacies aid in product distribution. Consumers increasingly seek plant-based and halal-certified supplements. The market offers significant expansion potential in both clinical and retail segments.

Africa Digestive Enzymes Supplements Market

Africa held the smallest share of the Digestive Enzymes Supplements Market in 2024 at 3.0%, with a market value of USD 62.12 million, projected to reach USD 91.92 million by 2032, growing at a CAGR of 5.0%. Growth remains steady, supported by improvements in healthcare infrastructure and expanding middle-income groups. South Africa leads regional demand, followed by Nigeria and Kenya. Rising interest in nutritional awareness and digestive health education is influencing product adoption. It continues to face affordability barriers and limited distribution networks in rural areas. Local partnerships and low-cost product lines are essential for future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Klaire Labs

- NOW Foods

- Source Naturals

- Douglas Labs

- Integrative Therapeutics

- Lonza Group Ltd.

- National Enzymes Company

- Jarrow Formulas

- Houston Enzymes

- AST Enzymes

- Metagenics

Competitive Analysis

The Global Digestive Enzymes Supplements Market is highly competitive with a strong presence of both established players and emerging brands. Companies like Klaire Labs, NOW Foods, and Metagenics focus on advanced formulations and target-specific enzyme blends. Lonza Group Ltd. and National Enzymes Company leverage manufacturing expertise and global reach to maintain market share. It features a mix of science-backed innovation and consumer-focused product development. Players compete on factors such as product efficacy, ingredient sourcing, clean-label claims, and clinical research support. Strategic partnerships, product diversification, and e-commerce expansion drive growth and intensify competition. Brands that invest in personalization, sustainable sourcing, and transparent labeling hold a competitive advantage in gaining long-term customer trust.

Recent Developments

- In March 2025, Klaire Labs (under its SFI Health division) launched Vital‑Zymes chewable digestive enzymes, featuring a natural cherry flavor and supporting digestion in both adults and children

- In early 2024, NOW Foods expanded its Super Enzymes line to reinforce its broad‑spectrum digestive support, combining bromelain, pancreatin, papain, and ox bile

Market Concentration and Characteristics

The Global Digestive Enzymes Supplements Market is moderately concentrated, with a mix of established nutraceutical companies and emerging health supplement brands. It is characterized by product innovation, strong brand positioning, and growing demand for plant-based and clean-label formulations. Companies compete on efficacy, ingredient transparency, and formulation diversity to meet evolving consumer preferences. The market shows low entry barriers due to limited regulatory constraints in several regions, encouraging new entrants. It is highly responsive to trends in personalized nutrition, online retail expansion, and preventive health awareness. Strategic collaborations and product line extensions remain key growth strategies among leading players.

Report Coverage

The research report offers an in-depth analysis based on Enzyme, Form, Source, Application Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Consumers will increasingly incorporate digestive enzyme supplements into daily routines to manage digestion and improve long-term wellness without relying on pharmaceuticals.

- The market will see a notable shift toward plant-derived enzymes, supported by growing dietary preferences for vegan, gluten-free, and allergen-free supplements.

- Innovations in encapsulation and time-release technologies will improve enzyme stability, making supplements more effective and consumer-friendly.

- Online platforms will play a crucial role in product visibility, enabling global brands to target niche consumer groups and improve customer retention.

- Brands will develop tailored solutions based on individual digestive needs, supported by DNA testing, microbiome analysis, and digital health tools.

- Countries in Asia Pacific, Latin America, and the Middle East will see rising demand due to improved healthcare access and increased awareness of digestive health.

- More clinical studies will validate the efficacy of specific enzyme blends, encouraging wider acceptance among healthcare providers and consumers.

- Partnerships between supplement companies, research institutions, and retailers will drive faster development cycles and broader market penetration.

- Harmonization of regulatory frameworks across key regions will enhance product quality, labeling accuracy, and consumer confidence.

Awareness campaigns, influencer-led promotions, and health literacy initiatives will play a central role in building informed demand and repeat purchase behavior.