Market Overview:

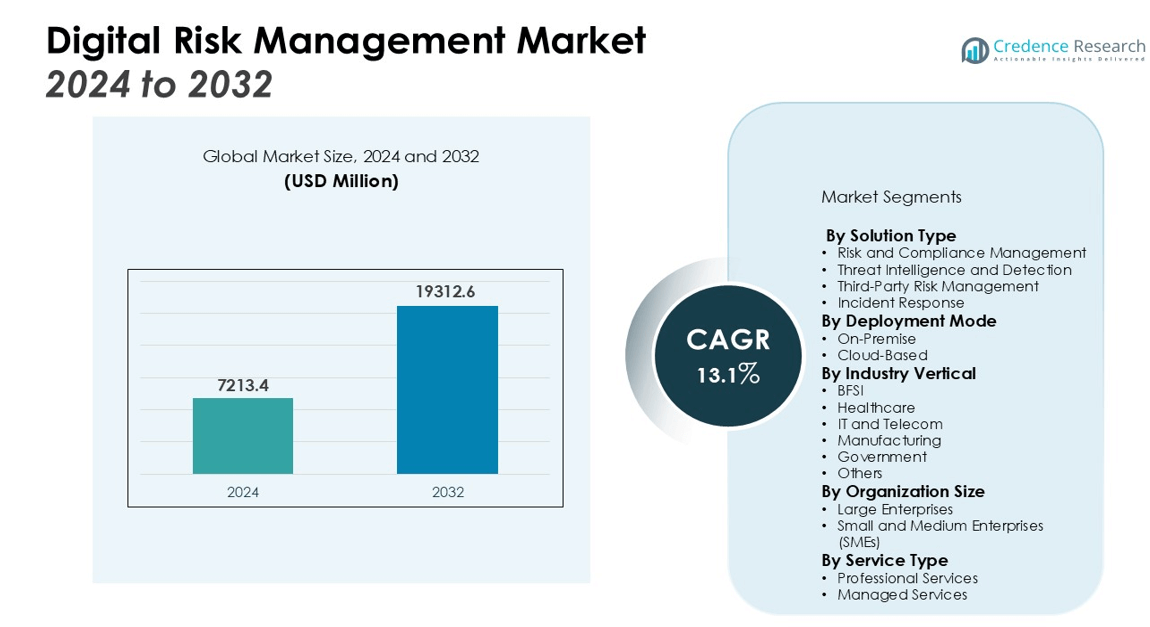

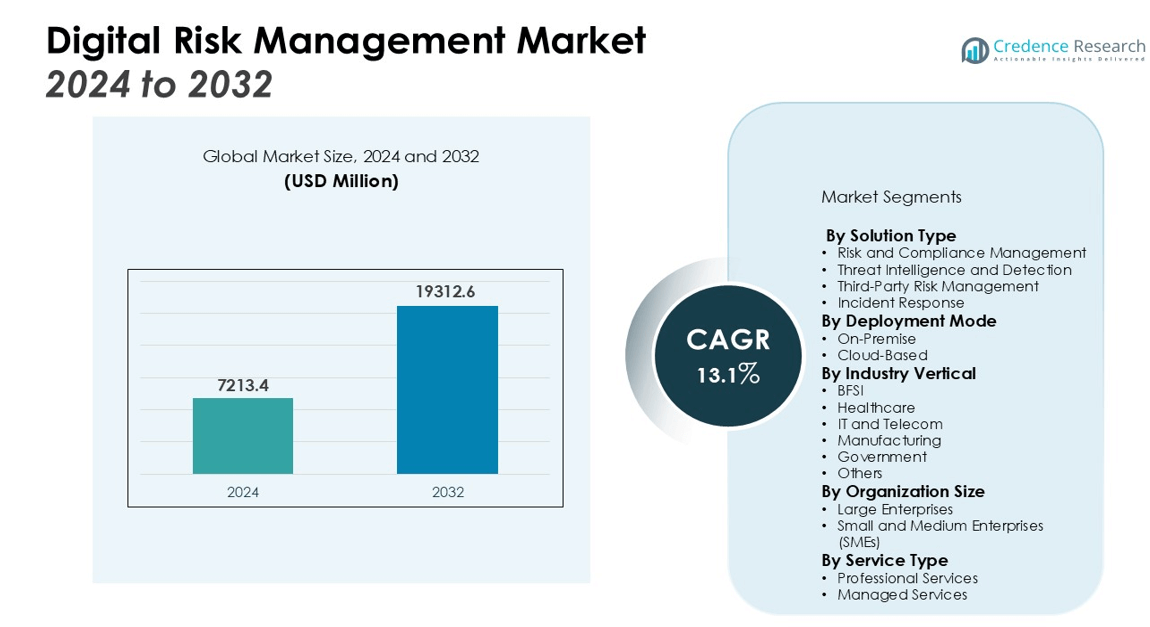

The Digital Risk Management Market size was valued at USD 7213.4 million in 2024 and is anticipated to reach USD 19312.6 million by 2032, at a CAGR of 13.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital Risk Management Market Size 2024 |

USD 7213.4 million |

| Digital Risk Management Market, CAGR |

13.1% |

| Digital Risk Management Market Size 2032 |

USD 19312.6 million |

Market expansion is driven by the surge in cyber-attacks, rapid regulatory changes, and the growing reliance on cloud computing, IoT, and advanced analytics. Enterprises are integrating third-party risk management, AI-powered threat detection, and automated incident response into their frameworks to strengthen resilience. The demand for scalable, cloud-based platforms that offer real-time risk visibility is rising, as companies aim to align their digital risk approaches with overall enterprise risk management strategies. Additionally, the increasing focus on proactive risk intelligence and predictive analytics is enabling organizations to anticipate threats before they escalate.

North America holds the largest share due to its mature cybersecurity infrastructure, advanced technology adoption, and stringent compliance frameworks. Asia-Pacific is the fastest-growing region, supported by rapid digital transformation, booming e-commerce markets, and increasing cybersecurity awareness in economies such as China, India, and Southeast Asian nations. Europe remains a strong contributor, underpinned by strict data protection regulations and widespread digital adoption.

Market Insights:

- The Digital Risk Management Market reached USD 7213.4 million and is projected to achieve USD 19312.6 million by 2032, registering a CAGR of 13.1% during the forecast period.

- Rising cyber-attacks, rapid regulatory changes, and growing reliance on cloud computing, IoT, and analytics are fueling demand for advanced risk management solutions.

- Enterprises are implementing third-party risk management, AI-powered threat detection, and automated incident response to enhance operational resilience.

- High complexity and cost of integration, along with limited skilled professionals, are key challenges impacting broader adoption across industries.

- North America holds 39% share, supported by advanced regulatory frameworks, strong technology adoption, and significant investments in unified risk platforms.

- Asia-Pacific holds 28% share and is the fastest-growing region, driven by digital transformation, e-commerce expansion, and national cybersecurity initiatives.

- Europe holds 23% share, reinforced by GDPR compliance requirements, high awareness of data security, and steady investment in governance solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Cybersecurity Threat Landscape Driving Adoption

The Digital Risk Management Market is witnessing strong growth due to the increasing volume and sophistication of cyber threats targeting organizations across industries. Businesses face heightened risks from ransomware, phishing, data breaches, and state-sponsored cyberattacks. It is essential for enterprises to adopt comprehensive risk management frameworks to safeguard sensitive data and maintain operational continuity. The integration of advanced threat detection, endpoint security, and real-time monitoring tools is becoming a strategic priority. Growing board-level attention to cybersecurity is reinforcing investments in digital risk management solutions.

- For instance, IBM’s advanced threat detection and response capabilities are built on monitoring over 150 billion security events each day.

Evolving Regulatory Frameworks Influencing Market Growth

Tightening global regulations on data privacy, cybersecurity, and financial compliance are accelerating the need for robust digital risk management practices. The market benefits from initiatives such as GDPR in Europe, CCPA in the U.S., and various national cybersecurity mandates in Asia-Pacific. It compels organizations to implement structured compliance monitoring and reporting mechanisms to avoid legal penalties and reputational damage. This regulatory pressure is expanding the adoption of automated risk assessment and governance platforms. Businesses are increasingly aligning their compliance programs with digital risk strategies to meet evolving requirements efficiently.

Expansion of Cloud Computing and Connected Ecosystems

The widespread adoption of cloud computing, IoT devices, and digital platforms is amplifying the complexity of enterprise risk environments. The Digital Risk Management Market is responding with solutions that provide unified visibility across distributed infrastructures. It is crucial for enterprises to manage third-party and supply chain risks arising from interconnected systems. Scalable, cloud-based risk management platforms are enabling organizations to detect vulnerabilities and enforce consistent security policies. The growing dependency on connected technologies is elevating the role of digital risk management in strategic planning.

- For example, to manage third-party vulnerabilities, Bitsight’s risk management solution provides access to a network of over 40,000 vendor security profiles, enabling organizations to continuously monitor their digital supply chain.

Integration of Advanced Technologies to Enhance Risk Intelligence

Artificial intelligence, machine learning, and predictive analytics are transforming how organizations manage digital risks. The market is seeing increased adoption of tools that deliver proactive risk intelligence, automated threat detection, and incident response capabilities. It is enabling businesses to move from reactive measures to preventive strategies. Enhanced data analytics capabilities are providing actionable insights to prioritize critical risks and allocate resources effectively. This technological integration is strengthening the overall value proposition of digital risk management solutions.

Market Trends:

Growing Shift Toward Proactive and Predictive Risk Management Approaches

The Digital Risk Management Market is experiencing a clear transition from reactive defense measures to proactive and predictive risk mitigation strategies. Organizations are deploying advanced analytics and AI-powered models to identify potential threats before they impact operations. It enables enterprises to prioritize risks based on severity and probability, ensuring efficient resource allocation. Predictive capabilities are allowing decision-makers to anticipate vulnerabilities across IT networks, cloud platforms, and third-party environments. The emphasis on continuous monitoring and early warning systems is gaining traction, particularly in highly regulated sectors such as finance, healthcare, and critical infrastructure. This trend is reinforcing the importance of integrated platforms that combine risk assessment, compliance tracking, and incident response in a single ecosystem.

- For instance, CrowdStrike strengthens proactive defense by building its AI Security Services on threat intelligence from tracking more than 265 active adversary groups, which informs its platform’s ability to protect customers.

Increased Emphasis on Integrated and Cloud-Native Risk Platforms

Demand is rising for unified, cloud-native risk management platforms that deliver comprehensive visibility across complex, distributed IT infrastructures. The market is responding with solutions that integrate governance, compliance, and security functions into centralized dashboards. It allows organizations to streamline risk reporting, enforce consistent policies, and reduce operational silos. The shift toward hybrid and multi-cloud architectures is further driving adoption of solutions that provide scalable protection and real-time threat intelligence. Vendors are focusing on user-centric designs and interoperability to support diverse enterprise environments. This development is strengthening the competitive differentiation of providers that can deliver agile, adaptable, and cost-effective digital risk management capabilities.

- For instance, OneTrust’s cloud platform includes compliance automation software that is integrated with more than 50 compliance frameworks, standards, and regulations.

Market Challenges Analysis:

High Complexity and Cost of Implementation Limiting Adoption

The Digital Risk Management Market faces challenges related to the high complexity and cost of deploying comprehensive solutions. Many organizations struggle to integrate digital risk management frameworks with existing IT infrastructures and legacy systems. It requires significant investment in technology, skilled personnel, and continuous updates to address evolving threats. Smaller enterprises often find these costs prohibitive, leading to slower adoption rates. The need for customization across different industries further increases implementation timelines and expenses. This complexity can hinder the ability of businesses to achieve rapid returns on investment.

Shortage of Skilled Professionals and Evolving Threat Landscape

A global shortage of cybersecurity and risk management professionals is impacting the market’s growth potential. The Digital Risk Management Market demands expertise in AI-driven analytics, regulatory compliance, and threat intelligence, yet the talent pool remains limited. It creates reliance on external service providers, which can raise costs and pose data security concerns. The constantly evolving nature of cyber threats requires organizations to adapt strategies quickly, often stretching internal resources. Limited awareness in some regions also slows the adoption of advanced solutions. This talent gap and dynamic threat environment remain critical challenges for sustained market expansion.

Market Opportunities:

Rising Demand for Cloud-Based and AI-Driven Risk Solutions

The Digital Risk Management Market presents strong growth potential through the adoption of cloud-based and AI-powered platforms. Enterprises are seeking scalable solutions that deliver real-time visibility, predictive analytics, and automated response capabilities. It enables organizations to manage risks across hybrid and multi-cloud environments with greater efficiency. The increasing reliance on digital ecosystems and remote operations is driving the need for integrated platforms that consolidate governance, compliance, and security functions. Vendors offering AI-enhanced tools that detect threats earlier and reduce manual intervention are positioned to capture a larger market share. Expanding capabilities in automation and advanced analytics will continue to open new revenue streams.

Expanding Opportunities in Emerging Economies and Regulated Sectors

Rapid digital transformation in emerging economies offers significant opportunities for market expansion. The Digital Risk Management Market can benefit from rising investments in cybersecurity infrastructure across Asia-Pacific, Latin America, and the Middle East. It creates demand for tailored solutions that address local compliance requirements and sector-specific risks. Highly regulated industries such as healthcare, banking, and critical infrastructure are increasingly prioritizing advanced risk management frameworks. Vendors that deliver industry-specific, compliance-ready solutions can gain a competitive edge. Growing awareness of digital risk in previously underserved markets further strengthens the long-term growth outlook.

Market Segmentation Analysis:

By Solution Type

The Digital Risk Management Market is segmented into risk and compliance management, threat intelligence and detection, third-party risk management, and incident response. Risk and compliance management holds a significant share due to increasing regulatory requirements across industries. Threat intelligence and detection is gaining traction as enterprises focus on identifying vulnerabilities before they escalate. Third-party risk management is expanding with the growing complexity of supply chains, while incident response solutions are critical for minimizing the impact of breaches.

- For instance, CrowdStrike’s Falcon platform tracks 257 adversaries, using this intelligence to enhance detection and reduce false positives.

By Deployment Mode

The market is divided into on-premise and cloud-based solutions. Cloud-based deployment is witnessing strong demand due to scalability, cost efficiency, and the ability to provide real-time risk visibility across distributed environments. On-premise solutions maintain relevance in highly regulated sectors that require strict control over data. It is expected that hybrid approaches will see rising adoption as organizations balance security needs with operational flexibility.

- For instance, IBM’s Hybrid Cloud Build Team has already completed over 75 engagements, helping partners create and migrate to open hybrid cloud environments, a process that typically takes between 5 and 20 weeks to develop a working prototype.

By Industry Vertical

The market covers BFSI, healthcare, IT and telecom, manufacturing, government, and others. BFSI leads the segment due to its high exposure to financial crimes and regulatory compliance obligations. Healthcare is increasing adoption to safeguard sensitive patient data and meet privacy mandates. IT and telecom benefit from digital risk solutions to protect extensive networks, while manufacturing focuses on securing connected production systems. Government agencies invest heavily in these solutions to protect national security and public data assets.

Segmentations:

By Solution Type

- Risk and Compliance Management

- Threat Intelligence and Detection

- Third-Party Risk Management

- Incident Response

By Deployment Mode

By Industry Vertical

- BFSI

- Healthcare

- IT and Telecom

- Manufacturing

- Government

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Service Type

- Professional Services

- Managed Services

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America Maintaining Market Leadership Through Advanced Adoption

North America accounted for 39% of the Digital Risk Management Market, supported by its mature cybersecurity infrastructure, strong regulatory enforcement, and high digital adoption rates. The presence of leading technology providers and early integration of AI-driven risk management tools contribute to its dominance. It benefits from a robust ecosystem of service providers, research institutions, and government initiatives aimed at strengthening cybersecurity resilience. Industries such as banking, healthcare, and government are investing heavily in unified risk platforms to address sophisticated threats. Ongoing innovations and substantial R&D investments continue to reinforce the region’s competitive position.

Asia-Pacific Emerging as the Fastest-Growing Region

Asia-Pacific held 28% of the Digital Risk Management Market, driven by large-scale digital transformation, expanding e-commerce markets, and increasing regulatory focus on data protection. The market in this region benefits from rising cybersecurity budgets across enterprises in China, India, Japan, and Southeast Asia. It is witnessing strong demand for cloud-native platforms that can scale with growing digital infrastructures. Government-led initiatives to secure national digital assets are encouraging adoption across both public and private sectors. Rising awareness of third-party and supply chain risks is further propelling the need for comprehensive digital risk strategies.

Europe Strengthening Position with Stringent Data Protection Laws

Europe accounted for 23% of the Digital Risk Management Market, supported by strict compliance requirements such as the General Data Protection Regulation (GDPR). The market in the region is shaped by high awareness of privacy and data security among enterprises and consumers. It benefits from steady investment in advanced governance and compliance solutions across sectors like finance, manufacturing, and healthcare. Regional companies are focusing on integrating digital risk management into enterprise-wide strategies to meet evolving regulatory demands. Strong collaboration between industry bodies and technology vendors is fostering innovation and improving market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SAP

- Oracle Corporation

- IBM Corporation

- SAS Institute Inc.

- NAVEX Global

- ServiceNow

- RSA Security LLC

- Broadcom

- LogicManager

- Metricstream Inc.

Competitive Analysis:

The Digital Risk Management Market features a competitive landscape driven by innovation, strategic partnerships, and expanding service portfolios. Leading players focus on integrating AI, machine learning, and predictive analytics to enhance threat detection and compliance capabilities. It is characterized by a mix of established cybersecurity vendors, specialized risk management providers, and emerging technology firms. Companies are investing in cloud-native platforms, automation, and unified dashboards to meet growing demand for scalable and efficient solutions. Vendors compete on technology differentiation, regulatory expertise, and the ability to deliver tailored industry-specific offerings. The market is also witnessing increased mergers and acquisitions aimed at broadening geographic reach and strengthening product capabilities. Strong emphasis on customer-centric services and continuous product upgrades is enabling leading companies to maintain a competitive edge while attracting new clients in high-growth sectors such as BFSI, healthcare, and government.

Recent Developments:

- In August 2025, IBM partnered with the United States Tennis Association (USTA) to introduce new AI-powered fan experiences for the 2025 US Open, including a ‘Match Chat’ AI assistant.

- In May 2025, IBM launched new enterprise AI technologies, including the IBM LinuxONE 5 platform, and announced advancements to its watsonx platform and Turbonomic application resource management at its Think 2025 conference.

- In July 2025, Oracle announced a cloud services agreement valued at over $30 billion annually, reportedly with OpenAI, to provide substantial cloud infrastructure for the Stargate AI project.

- In May 2025, Broadcom launched its third-generation co-packaged optics (CPO) product line, designed to support the high-radix networks required for large-scale artificial intelligence deployments.

Market Concentration & Characteristics:

The Digital Risk Management Market demonstrates moderate to high concentration, with a limited number of established global vendors holding a significant share alongside a growing base of niche providers. It is characterized by strong technological innovation, frequent product enhancements, and the integration of advanced analytics to address evolving cyber threats and compliance demands. Vendors differentiate through domain expertise, scalable cloud-based solutions, and industry-specific offerings. The market reflects high entry barriers due to the need for advanced technical capabilities, regulatory knowledge, and substantial investment in R&D. Strategic alliances, mergers, and acquisitions are common, aimed at expanding geographic presence and strengthening service portfolios. Demand from sectors such as BFSI, healthcare, and government drives consistent growth, while competition remains intense in delivering real-time risk intelligence and comprehensive governance frameworks.

Report Coverage:

The research report offers an in-depth analysis based on Solution Type, Deployment Mode, Industry Vertical, Organization Size, Service Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of AI-driven risk assessment tools will expand, enabling faster detection and prioritization of emerging threats.

- Cloud-native digital risk management platforms will gain wider acceptance, supporting scalability and integration across hybrid environments.

- Predictive analytics will play a larger role in anticipating vulnerabilities and improving decision-making processes.

- Industry-specific solutions will increase in demand, particularly in regulated sectors such as healthcare, BFSI, and government.

- Partnerships between technology vendors and regulatory bodies will strengthen to align solutions with evolving compliance standards.

- The rise in third-party and supply chain risks will drive greater focus on vendor risk management capabilities.

- Integration of digital risk management with enterprise-wide governance frameworks will become standard practice for large organizations.

- Growth in remote and distributed workforces will accelerate the need for enhanced endpoint and identity risk controls.

- Emerging economies will offer new opportunities as digital transformation and cybersecurity awareness expand.

- Continuous innovation in automation and orchestration will streamline response times and reduce operational costs for enterprises.