Market overview

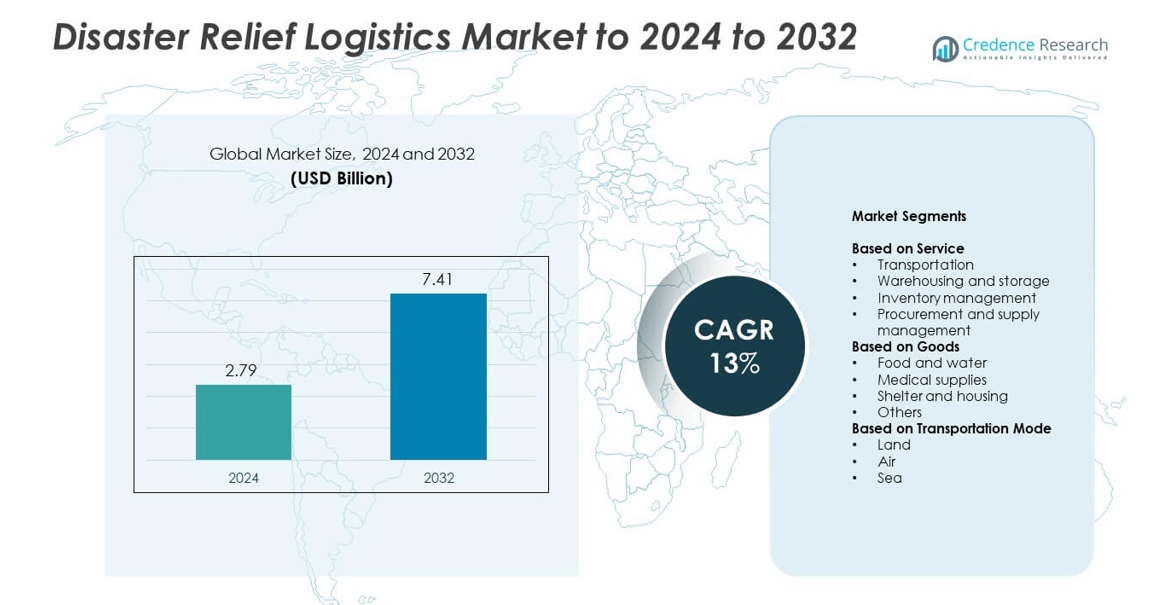

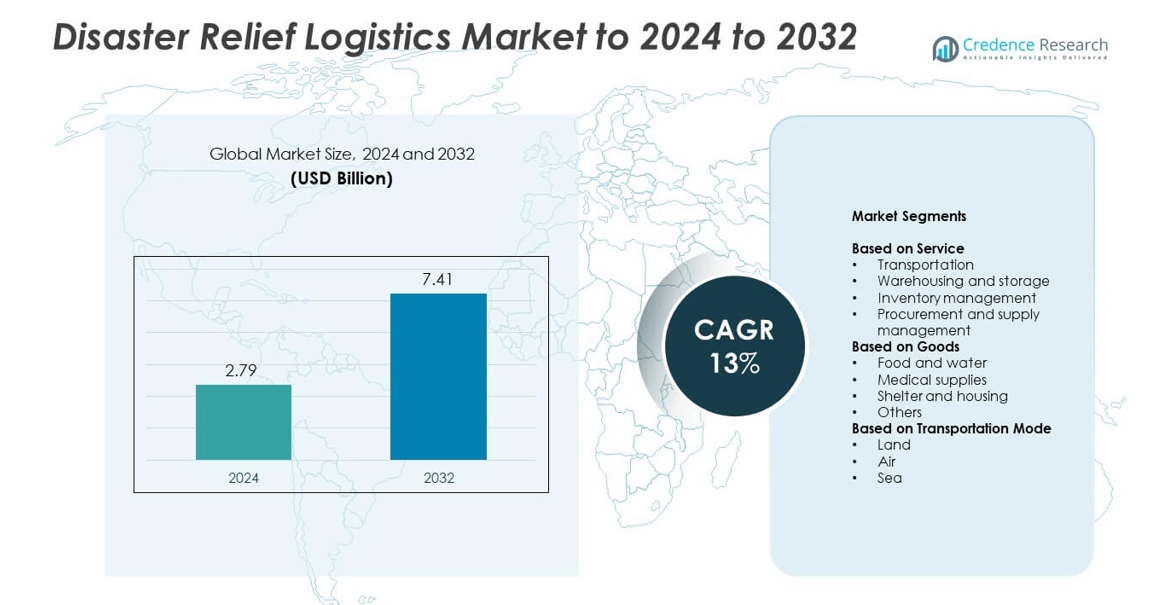

Disaster Relief Logistics Market size was valued at USD 2.79 billion in 2024 and is anticipated to reach USD 7.41 billion by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disaster Relief Logistics Market Size 2024 |

USD 2.79 billion |

| Disaster Relief Logistics Market, CAGR |

13% |

| Disaster Relief Logistics Market Size 2032 |

USD 7.41 billion |

The disaster relief logistics market is led by major players such as DHL Supply Chain, Agility, DB Schenker, C.H. Robinson, FedEx Corporation, Nippon Express, Flexport, United Parcel Service (UPS), Maersk Group, Kuehne + Nagel, and XPO Logistics. These companies dominate through extensive global networks, advanced multimodal transport capabilities, and strategic collaborations with humanitarian organizations. They focus on digital tracking, AI-based supply planning, and sustainable logistics solutions to enhance speed and transparency in crisis response. North America led the market with a 36% share in 2024, driven by strong emergency response infrastructure, while Europe and Asia-Pacific followed with 28% and 24% shares respectively.

Market Insights

- The disaster relief logistics market was valued at USD 2.79 billion in 2024 and is projected to reach USD 7.41 billion by 2032, growing at a CAGR of 13%.

- Rising frequency of natural disasters and growing public–private partnerships are the major drivers accelerating market expansion.

- Integration of AI, IoT, and blockchain technologies is transforming emergency logistics through real-time tracking and predictive response systems.

- The market is moderately competitive, with global logistics companies focusing on digital solutions, sustainability, and rapid response capabilities.

- North America led with a 36% share in 2024, followed by Europe with 28% and Asia-Pacific with 24%, while the transportation segment dominated with a 46% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

The transportation segment dominated the disaster relief logistics market with a 46% share in 2024. Its leadership stems from the need for rapid deployment of aid supplies to affected regions. Ground, air, and sea transport networks ensure timely delivery of food, medicine, and shelter materials during crises. Growing investment in digital tracking and fleet management enhances route optimization and reduces delays in disaster zones. Increasing partnerships between government agencies and logistics firms further strengthen the transportation network’s reliability and response efficiency.

- For instance, DHL’s Disaster Response Teams completed 77 deployments and handled 70,000 tons of relief cargo since launch.

By Goods

Food and water emerged as the leading goods category, capturing a 41% share in 2024. The dominance is driven by their essential role in immediate humanitarian relief operations. Global organizations prioritize pre-positioned stockpiles and cold chain systems to maintain supply consistency during emergencies. The segment benefits from innovations in packaging that extend shelf life and improve handling efficiency. Demand for fortified and ready-to-consume food products has also risen to meet nutritional needs in remote or crisis-hit areas.

- For instance, Tetra Pak delivered 178 billion shelf-stable carton packages worldwide in 2024.

By Transportation Mode

The land transportation mode held the largest market share of 52% in 2024. Its dominance is supported by the availability of extensive road networks and lower operational costs. Trucks and utility vehicles remain critical for last-mile delivery in disaster-prone or remote regions. Governments and NGOs rely heavily on terrestrial logistics due to flexibility in accessing affected areas. Integration of GPS-enabled tracking and real-time communication systems enhances the reliability and coordination of land-based relief logistics operations.

Key Growth Drivers

Rising Frequency of Natural Disasters

The increasing occurrence of floods, earthquakes, wildfires, and hurricanes is driving demand for efficient disaster relief logistics. Governments and humanitarian organizations are investing in stronger supply chains to improve emergency response times. The adoption of pre-positioned relief hubs and predictive analytics ensures quick mobilization of critical goods and personnel. Growing international cooperation through agencies like the UN and Red Cross further enhances coordination and resource utilization across multiple regions during large-scale disaster operations.

- For instance, Munich Re counted natural disasters causing ~11,000 fatalities in 2024.

Advancements in Digital Supply Chain Technologies

The integration of digital tools such as IoT, AI, and blockchain has transformed disaster relief logistics. These technologies enable real-time tracking of shipments, predictive demand forecasting, and transparent coordination between agencies. AI-driven route optimization minimizes delays, while blockchain ensures secure and verified documentation of supplies. The use of drone-based delivery systems and satellite communications further strengthens supply chain visibility and last-mile connectivity in inaccessible or high-risk disaster zones.

- For instance, Zipline surpassed 1,000,000 commercial medical drone deliveries by April 2024.

Expansion of Public–Private Partnerships

Governments and private logistics firms are forming strategic alliances to enhance emergency preparedness. Collaborative frameworks allow efficient pooling of resources, skilled manpower, and transport infrastructure. Private companies contribute advanced logistics technologies and operational flexibility, while public bodies provide policy support and funding. Such partnerships ensure rapid mobilization of relief goods and improve accountability during disaster recovery operations. This collaboration also boosts innovation in supply management and accelerates capacity building across disaster-prone regions.

Key Trends and Opportunities

Growing Adoption of AI and Predictive Analytics

AI and predictive analytics are becoming essential in forecasting disaster impacts and optimizing logistics flows. Data-driven systems improve inventory positioning and identify the fastest delivery routes. Predictive tools enable humanitarian organizations to anticipate shortages and respond before crises escalate. This trend reduces waste, shortens response times, and ensures better allocation of aid resources. The growing integration of machine learning platforms creates opportunities for more resilient and adaptive disaster logistics systems.

- For instance, Google Flood Hub reached 100+ countries and 700 million people by Nov 2024.

Increased Focus on Sustainable Logistics Solutions

Sustainability is emerging as a major opportunity in disaster relief logistics. Organizations are adopting electric vehicles, biofuel-powered fleets, and eco-friendly packaging to minimize environmental impact. Renewable energy systems such as portable solar units support off-grid operations in disaster zones. Green warehousing practices and reduced carbon logistics also align with global climate action goals. The shift toward sustainable operations not only cuts emissions but also enhances long-term resilience in relief supply chains.

- For instance, Maersk–Amazon ECO Delivery cut 44,600 metric tons CO₂e over 2023–2024 shipments.

Key Challenges

Infrastructure Damage and Accessibility Issues

One of the main challenges in disaster relief logistics is infrastructure damage that disrupts transport and communication networks. Destroyed roads, ports, and airports hinder access to affected areas, delaying aid delivery. Relief organizations often struggle with inadequate local storage capacity and limited alternate routes. The dependence on manual coordination in such scenarios increases operational inefficiencies. Developing resilient infrastructure and rapid reconstruction mechanisms remains critical to improving response times and logistics reliability.

Coordination and Data Management Constraints

Coordination among multiple agencies remains a persistent challenge during large-scale disasters. Disconnected information systems and inconsistent data sharing lead to duplication of efforts and resource misallocation. Many humanitarian groups still rely on outdated communication platforms, slowing decision-making. Lack of standardized digital tools further complicates inventory tracking and needs assessment. Strengthening inter-agency data systems and establishing unified logistics platforms are vital to enhancing synchronization and overall relief efficiency.

Regional Analysis

North America

North America held the largest share of 36% in the disaster relief logistics market in 2024. The dominance is driven by advanced emergency response infrastructure, strong public–private partnerships, and high adoption of digital logistics tools. The United States leads with robust FEMA coordination, while Canada focuses on regional disaster preparedness and cross-border cooperation. Investment in drone-based delivery, AI-enabled supply tracking, and pre-positioned relief hubs further enhances operational speed and reliability across disaster-prone areas.

Europe

Europe accounted for 28% of the global market in 2024, supported by well-developed logistics networks and integrated disaster management systems. Countries such as Germany, France, and the United Kingdom have advanced coordination frameworks and resilient supply chains. The European Union’s Civil Protection Mechanism and investments in sustainable relief logistics strengthen overall efficiency. Growing emphasis on climate adaptation, eco-friendly transport, and renewable-powered relief operations continues to shape Europe’s role in global humanitarian response.

Asia-Pacific

Asia-Pacific captured 24% of the disaster relief logistics market in 2024, fueled by frequent natural disasters such as floods, cyclones, and earthquakes. Nations including Japan, India, and China are heavily investing in emergency transport fleets, real-time data systems, and regional relief hubs. Government-led disaster management programs and rising NGO involvement improve coordination and delivery efficiency. Increasing focus on AI-driven forecasting and supply automation further enhances preparedness and rapid deployment in vulnerable coastal and mountainous regions.

Latin America

Latin America represented a 7% share of the market in 2024, driven by rising vulnerability to hurricanes, landslides, and floods. Countries such as Mexico, Brazil, and Chile are modernizing logistics operations through partnerships with international relief agencies. Efforts to improve air and land transport capabilities strengthen accessibility to remote or disaster-hit zones. Expanding investments in warehouse automation and early warning systems enhance regional readiness and reduce response time during emergency relief missions.

Middle East & Africa

The Middle East & Africa region accounted for a 5% market share in 2024. The region faces challenges such as conflict zones and limited logistics infrastructure, yet it is rapidly improving through regional collaboration and technology adoption. Humanitarian agencies and local governments are deploying GPS-enabled fleet systems and modular storage units to ensure supply continuity. Increasing support from global aid organizations and investment in resilient infrastructure are enhancing response capacity and logistical coordination across high-risk areas.

Market Segmentations:

By Service

- Transportation

- Warehousing and storage

- Inventory management

- Procurement and supply management

By Goods

- Food and water

- Medical supplies

- Shelter and housing

- Others

By Transportation Mode

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The disaster relief logistics market features major players such as DHL Supply Chain, Agility, DB Schenker, C.H. Robinson, FedEx Corporation, Nippon Express, Flexport, United Parcel Service (UPS), Maersk Group, Kuehne + Nagel, and XPO Logistics. These companies compete by offering integrated emergency response logistics, advanced warehousing, and multimodal transportation services. The market is characterized by rapid technological integration, where digital tracking, AI-driven planning, and IoT-based monitoring systems enhance transparency and delivery accuracy. Firms are focusing on sustainability through energy-efficient fleets and recyclable packaging solutions. Strategic collaborations with governments, NGOs, and defense agencies strengthen operational readiness in high-risk zones. The competitive environment also emphasizes data analytics, cloud-based logistics platforms, and predictive modeling for real-time resource allocation. Expansion into developing economies and partnerships with local distribution networks are helping global players improve reach, reduce response times, and build resilient supply chains for large-scale disaster relief operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DHL Supply Chain

- Agility

- DB Schenker

- H. Robinson

- FedEx Corporation

- Nippon Express

- Flexport

- United Parcel Service (UPS)

- Maersk Group

- Kuehne + Nagel

- XPO Logistics

Recent Developments

- In 2024, DB Schenker Provided 24/7 manned desks to offer immediate and rapid logistics solutions during emergencies, including expedited services like charter flights and hand-carry shipments.

- In 2023, Agility Logistics As a member of the Logistics Emergency Teams (LET), provided pro bono logistics services to humanitarian partners during large-scale disasters.

- In 2023, Flexport worked in partnership with the International Organization for Migration (IOM) to provide logistical support for Ukrainian refugees and other global emergencies

Report Coverage

The research report offers an in-depth analysis based on Service, Goods, Transportation Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital transformation will strengthen real-time coordination and tracking in disaster logistics operations.

- AI and predictive analytics will enhance disaster forecasting and supply chain responsiveness.

- Governments will increase investment in pre-positioned relief hubs for faster aid delivery.

- Drone and autonomous vehicle adoption will expand for last-mile delivery in remote areas.

- Public–private partnerships will grow to improve efficiency and resource sharing during crises.

- Sustainable logistics practices will gain focus, reducing emissions and improving resilience.

- Blockchain technology will improve transparency and traceability in relief supply management.

- Regional cooperation frameworks will expand to manage cross-border disaster responses.

- Training and skill development programs will strengthen humanitarian logistics capabilities.

- Integration of IoT-enabled sensors will improve asset monitoring and reduce operational delays.