Market Overview

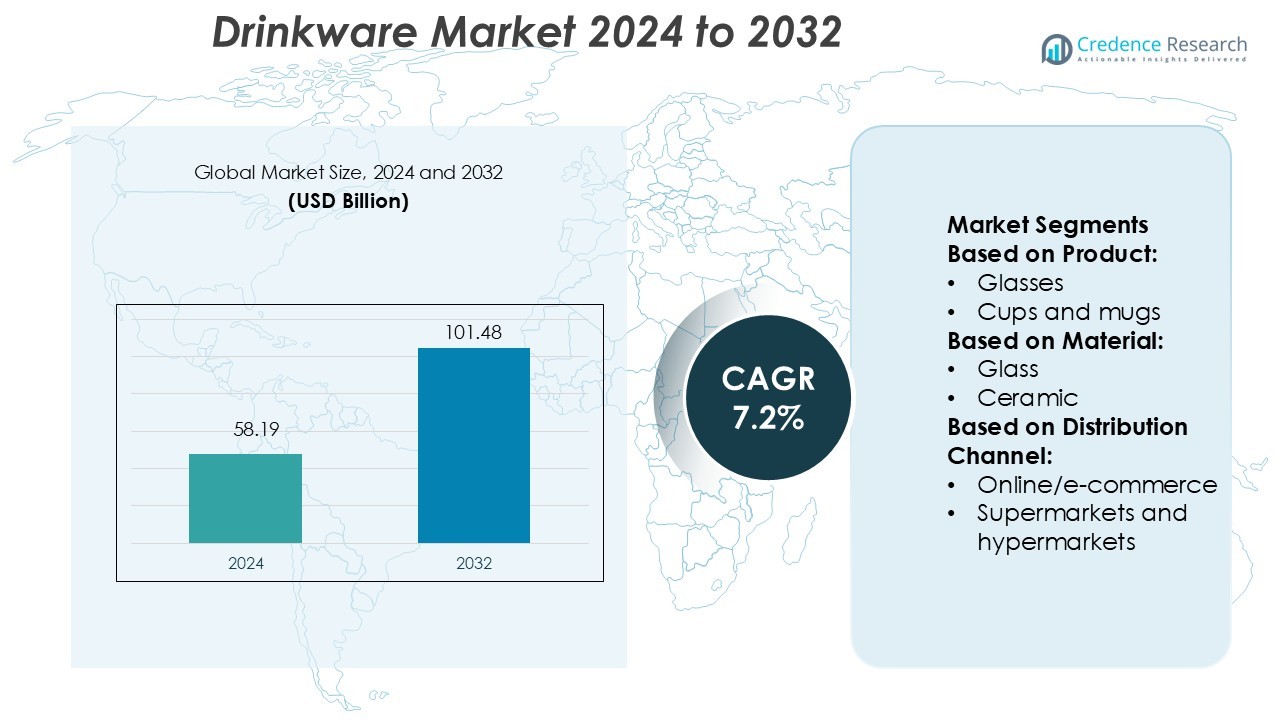

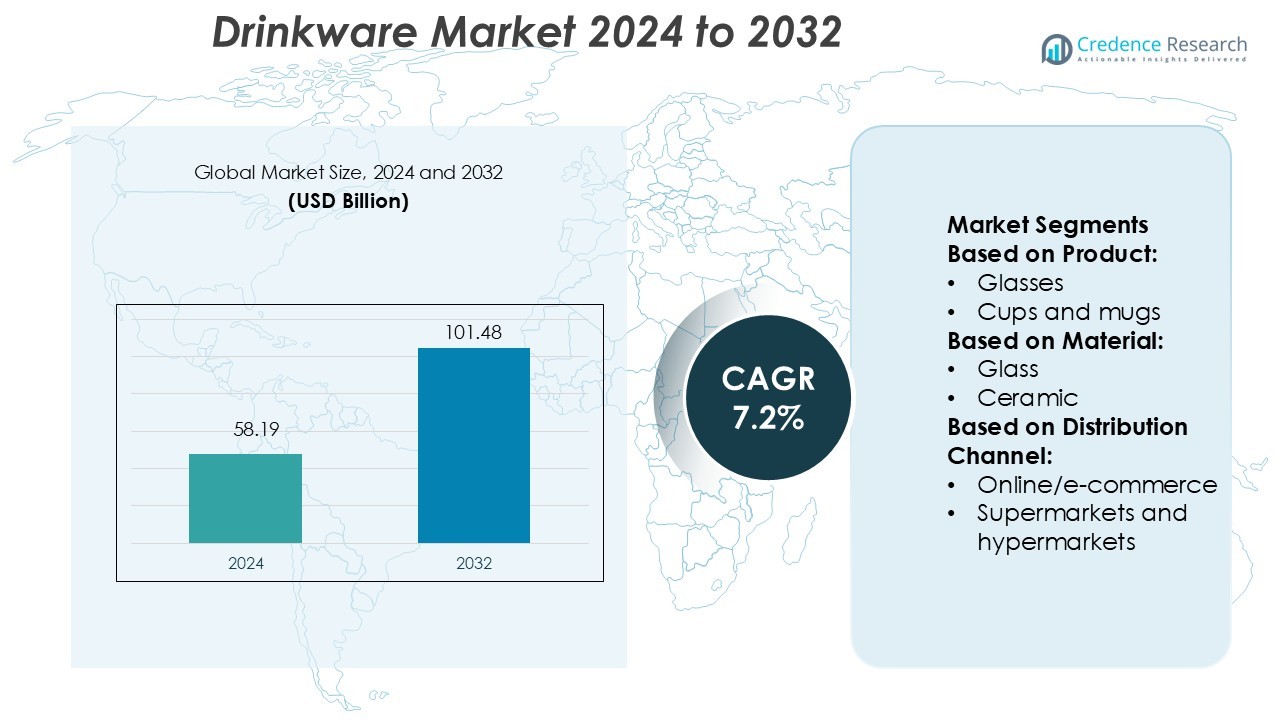

Drinkware Market size was valued USD 58.19 billion in 2024 and is anticipated to reach USD 101.48 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drinkware Market Size 2024 |

USD 58.19 Billion |

| Drinkware Market, CAGR |

7.2% |

| Drinkware Market Size 2032 |

USD 101.48 Billion |

The drinkware market is shaped by major players including Hydro Flask, Anhui Deli Household Glass, Contigo, Bormioli Rocco, Corkcicle, CamelBak Products, Mizu, Dopper, Amcor, and Klean Kanteen. These companies focus on innovation, sustainability, and design to strengthen their competitive position. Many invest in advanced insulation technologies, eco-friendly materials, and personalized product offerings to meet evolving consumer preferences. Strategic partnerships with retailers and strong e-commerce presence enhance their market reach. Asia Pacific leads the global market with a 34% share, driven by rapid urbanization, rising disposable incomes, and expanding foodservice industries. This regional dominance reflects strong consumer adoption of both affordable and premium drinkware.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The drinkware market size was valued at USD 58.19 billion in 2024 and is expected to reach USD 101.48 billion by 2032, growing at a CAGR of 7.2%.

- Demand is driven by rising adoption of reusable and sustainable products, supported by strong growth in hospitality, tourism, and urban lifestyle trends.

- Leading players focus on innovation, eco-friendly materials, insulation technologies, and personalization to build strong brand differentiation and customer loyalty.

- Regulatory pressure on single-use plastics and raw material cost fluctuations remain key restraints impacting pricing and supply chain stability.

- Asia Pacific leads the market with a 34% share, followed by North America and Europe, while glass remains the dominant material segment due to its sustainability and premium appeal.

Market Segmentation Analysis:

By Product

Glasses hold the dominant share in the drinkware market. Their popularity stems from widespread use in households, hotels, and restaurants. Consumers prefer glassware for its elegant appearance, ease of cleaning, and non-reactive properties. The segment benefits from rising demand for premium and customizable designs. Growth in the hospitality and food service industries further drives volume sales. Tumblers and bottles are also gaining traction due to their portability and suitability for on-the-go consumption. Cups and mugs remain stable, supported by daily use for hot beverages like tea and coffee.

- For instance, Hydro Flask offers a 24-oz Standard Mouth bottle that retains cold drinks for 24 hours and hot drinks for 12 hours via its TempShield® double-wall vacuum insulation.

By Material

Glass is the leading material segment in the market. Its clear aesthetic, durability, and recyclability make it a top choice for consumers and businesses. Growing focus on sustainability has increased demand for reusable and eco-friendly glass drinkware. Restaurants and cafes prefer glass for its hygienic and non-toxic properties. Plastic and metal are also key segments, supported by lightweight and durable options for outdoor and travel use. Silicone and ceramic products are gaining niche appeal in premium and specialty markets.

- For instance, Anhui Deli Household Glass Co., Ltd. operates an extensive network of production lines at its Fengyang facility, with a much higher daily melting capacity than previously reported, having expanded to more than 90 production lines and 18 furnaces.

By Distribution Channel

Supermarkets and hypermarkets dominate the distribution segment. They offer wide product availability, competitive pricing, and in-store promotions, driving high consumer footfall. Retail chains provide visibility for both premium and affordable drinkware brands. Online and e-commerce platforms are expanding rapidly, fueled by convenience, product variety, and attractive discounts. Specialty stores cater to consumers seeking designer or eco-friendly drinkware. The growing trend of online shopping and omnichannel strategies is reshaping the sales landscape across all product categories.

Key Growth Drivers

Rising Demand for Sustainable and Reusable Products

The growing consumer preference for eco-friendly products is driving the drinkware market. Shoppers increasingly choose reusable glass, metal, and silicone options over single-use plastics. Governments and brands are also encouraging sustainable consumption through bans, incentives, and awareness campaigns. Hospitality and retail sectors are adopting eco-conscious products to align with green policies. This shift is boosting product innovation and expanding premium reusable lines. Brands offering durable, recyclable drinkware gain a competitive advantage in both developed and emerging markets.

- For instance, Contigo’s stainless steel bottles use the company’s patented AUTOSEAL® lid technology, which locks between sips and is claimed to be 100% leak- and spill-proof in the 16 oz “West Loop 3.0” model.

Expanding Foodservice and Hospitality Industry

Rapid growth in cafes, restaurants, and catering services is a key driver for drinkware sales. Hotels and restaurants rely on high-quality, durable products for daily operations. Rising tourism and urban lifestyle trends are boosting beverage consumption outside the home. This surge in hospitality demand fuels bulk purchases of glasses, mugs, tumblers, and thermoses. Manufacturers are also introducing customizable and branded products for commercial buyers. These developments strengthen market penetration and support consistent volume growth across regions.

- For instance, Corkcicle’s 16 oz Canteen uses triple-walled stainless steel insulation and maintains cold beverages up to 25 hours and hot beverages up to 12 hours.

Increase in Consumer Spending on Premium Products

Consumers are increasingly investing in premium and personalized drinkware products. This shift reflects rising disposable incomes and a growing focus on lifestyle aesthetics. Premium products, such as designer tumblers and glassware, appeal to urban and younger demographics. E-commerce platforms amplify this demand with targeted marketing and customization options. Product differentiation through unique designs, durability, and quality materials supports brand loyalty. This premiumization trend creates higher profit margins and drives innovation in the drinkware industry.

Key Trends & Opportunities

Growth of E-commerce and Omnichannel Retailing

Online shopping platforms are reshaping drinkware distribution. Consumers prefer e-commerce channels for their convenience, wide product variety, and competitive pricing. Brands are adopting omnichannel strategies that integrate online and offline sales to maximize reach. Digital marketing, quick delivery, and easy return policies further attract buyers. E-commerce allows smaller brands to compete with global players, expanding the market’s competitive landscape. This retail shift provides manufacturers with new opportunities to increase visibility and customer engagement.

- For instance, CamelBak’s Crux 1.5 L reservoir offers 20 % more water per sip compared with its prior model, and features an ergonomic fill handle and a one-hand on/off lever at the bite valve to stop leaks.

Customization and Product Innovation

Personalized and multifunctional drinkware products are gaining strong traction. Consumers favor customized colors, prints, and engravings, reflecting their personal style. Brands are responding by launching innovative designs, temperature-retaining features, and ergonomic forms. This focus on personalization strengthens customer loyalty and encourages repeat purchases. It also allows companies to differentiate their offerings in a competitive market. Smart drinkware with added functionality, such as temperature tracking or insulation, represents a major growth opportunity.

- For instance, Mizu offers its custom-print stainless-steel “Tumbler 16” model with a volume of 16 oz / 450 ml, height of 6.2 in / 155 mm, diameter of 3.4 in / 87 mm, and weight 9.3 oz / 264 g.

Shift Toward Smart and Functional Drinkware

Rising demand for convenience is fueling interest in advanced drinkware solutions. Smart tumblers and bottles equipped with temperature indicators or hydration reminders are gaining attention. Fitness-conscious consumers and professionals prefer these products for daily use. Brands are investing in technology integration to enhance product utility. This trend also aligns with the broader adoption of smart lifestyle products. Companies that adopt early technological innovations can secure a competitive edge in this growing niche segment.

Key Challenges

High Competition and Price Pressure

The drinkware market faces intense competition from both established and emerging brands. Low entry barriers and wide product availability increase price sensitivity among consumers. Manufacturers must balance quality and affordability to maintain market share. Discounting strategies often reduce profit margins, especially in mass-market segments. Premium brands face challenges in justifying higher prices to cost-conscious buyers. Sustaining brand differentiation in such a competitive landscape requires strong marketing and innovation investments.

Environmental and Regulatory Constraints

Tighter environmental regulations are challenging manufacturers that rely on plastic products. Bans on single-use plastics and rising compliance costs increase operational pressure. Companies must shift toward sustainable materials, which often come with higher production expenses. Adapting supply chains to meet new standards requires significant investment. Non-compliance can lead to legal penalties and reputational damage. This regulatory shift forces industry players to innovate and adopt eco-friendly solutions to remain competitive.

Regional Analysis

North America

North America holds a 32% share of the global drinkware market, supported by strong consumer spending and a growing preference for sustainable products. The U.S. dominates the region with rising demand for reusable and premium drinkware. Expanding café chains, outdoor activities, and on-the-go consumption drive bottle and tumbler sales. Brands focus on innovative designs and temperature-retaining materials to attract buyers. E-commerce and omnichannel retailing are strengthening distribution networks. Corporate sustainability goals and government regulations also push companies to adopt eco-friendly materials, boosting market expansion.

Europe

Europe accounts for 27% of the global drinkware market, driven by strict environmental regulations and strong consumer awareness. Countries such as Germany, France, and the U.K. lead adoption of sustainable glass and metal drinkware. Demand is supported by rising tourism, café culture, and premium lifestyle products. European consumers prefer reusable and recyclable materials, encouraging manufacturers to innovate. Specialty stores and supermarkets dominate sales, but online retail continues to grow rapidly. Regulatory frameworks limiting single-use plastics further boost eco-friendly product penetration, consolidating Europe’s position as a key market.

Asia Pacific

Asia Pacific leads the global drinkware market with a 34% share, supported by its large population and rising disposable incomes. China, India, and Japan are major contributors, with strong demand across residential and commercial sectors. Expanding foodservice industries and urbanization boost sales of glasses, cups, and tumblers. Affordable pricing and growing middle-class consumption fuel mass-market adoption. E-commerce platforms enable faster market penetration for both global and local brands. Growing environmental awareness is also encouraging the shift from plastic to sustainable materials, strengthening long-term market growth.

Latin America

Latin America holds a 4% share of the global drinkware market. Brazil and Mexico are the primary contributors, driven by expanding hospitality sectors and increasing beverage consumption. Urbanization and tourism support strong demand for glass and metal drinkware in restaurants and hotels. Affordable products dominate, but premium drinkware is gaining attention among middle-income consumers. Online retail platforms are also driving product accessibility across urban centers. Government regulations promoting sustainability are slowly influencing material preferences. Though still a smaller market, its growth potential remains strong with expanding consumer segments.

Middle East & Africa

The Middle East & Africa region represents 3% of the global drinkware market. Demand is driven by growing hospitality industries, rising tourism, and changing consumer lifestyles. The UAE and South Africa lead in premium product adoption, supported by luxury hotel chains and café culture. Metal and glass drinkware products are gaining popularity over plastic due to quality and environmental benefits. Retail expansion and e-commerce platforms are increasing product reach across the region. Although the market is still developing, rising awareness of sustainable consumption presents opportunities for manufacturers.

Market Segmentations:

By Product:

By Material:

By Distribution Channel:

- Online/e-commerce

- Supermarkets and hypermarkets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drinkware market is shaped by key players such as Hydro Flask, Anhui Deli Household Glass, Contigo, Bormioli Rocco, Corkcicle, CamelBak Products, Mizu, Dopper, Amcor, and Klean Kanteen. The drinkware market is characterized by rapid innovation, sustainability initiatives, and strong brand positioning. Companies focus on introducing durable, reusable, and aesthetically appealing products to match changing consumer preferences. Many brands emphasize eco-friendly materials and advanced temperature control technologies to strengthen their product portfolios. E-commerce and omnichannel strategies are critical in enhancing reach and customer engagement. Personalization and premium product lines are gaining traction, especially among urban consumers. Intense competition drives continuous improvements in design, functionality, and pricing strategies. Strategic partnerships and global distribution expansion further support market consolidation and growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, FlasKap expanded its FreePour drinkware line, introducing a tapered cup holder design and stainless steel wells. The new features enhance versatility, allowing users to switch between drinks effortlessly. This innovation targets outdoor enthusiasts and tailgaters, providing a leak-proof, durable solution for hydration and spirits on the go.

- In June 2024, Tupperware Brands Corporation announced their association with Macy’s stores in the U.S. All their products will be available to purchase in the stores and online on Macy.com as well. At selected stores, live demonstrations were conducted for customers for storing and preserving food.

- In January 2024, Starbucks Coffee Company introduced a limited collection of winter-themed products featuring metallic hues and patterns. The lineup encompasses stainless steel and ceramic tumblers, cold cups, water bottles, mugs, and collectible keychains. This merchandise was exclusively offered at designated Starbucks outlets across the U.S.

- In November 2023, Simple Modern extended its collaboration with the Oklahoma City Thunder basketball team, solidifying Simple Modern as the official drinkware partner of the team. In addition to this partnership, both entities joined forces to educate the community about the importance and impact of sustainability.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and reusable drinkware will continue to rise globally.

- Premium and personalized products will gain stronger traction among urban consumers.

- Online and omnichannel retailing will expand market accessibility and reach.

- Smart and functional drinkware with advanced features will become more common.

- Manufacturers will increase investments in eco-friendly materials and production methods.

- Hospitality and foodservice sectors will drive bulk demand for durable drinkware.

- Technological innovation will enhance insulation, durability, and design quality.

- Strategic collaborations and global expansion will strengthen brand competitiveness.

- Regulatory pressure will accelerate the shift away from single-use plastics.

- Emerging markets will offer new growth opportunities for both local and global brands.