Market Overview

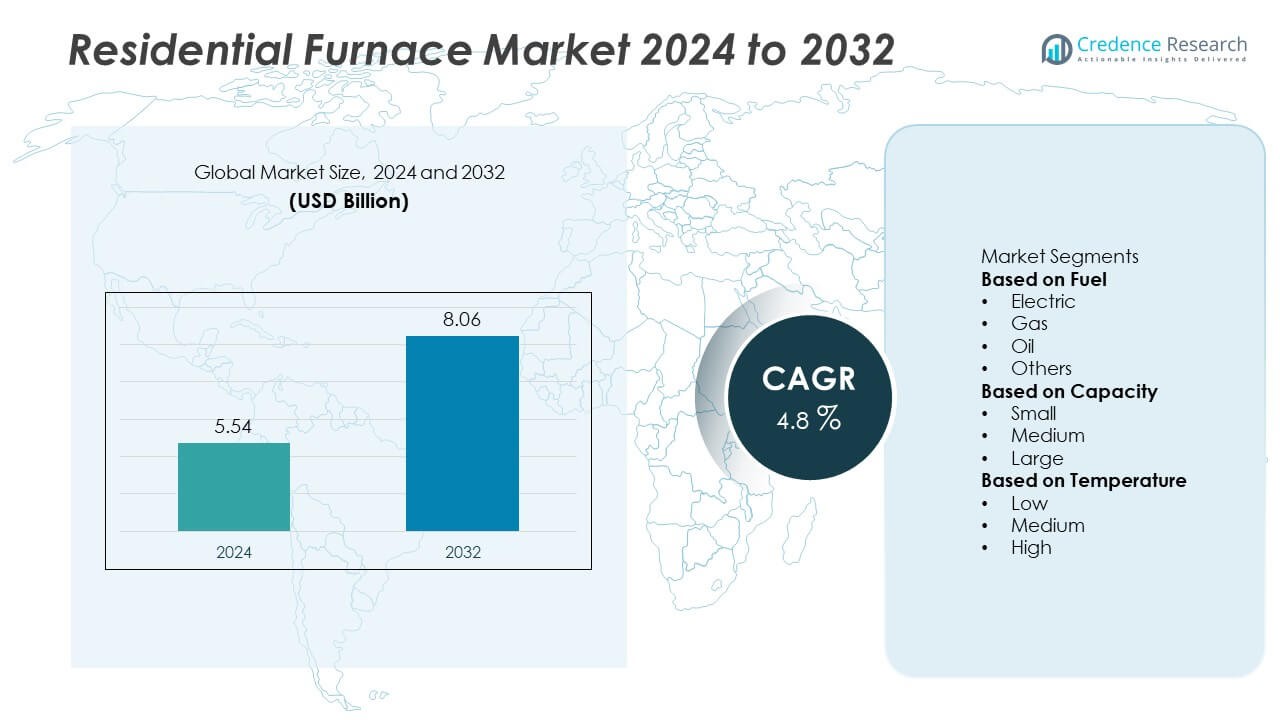

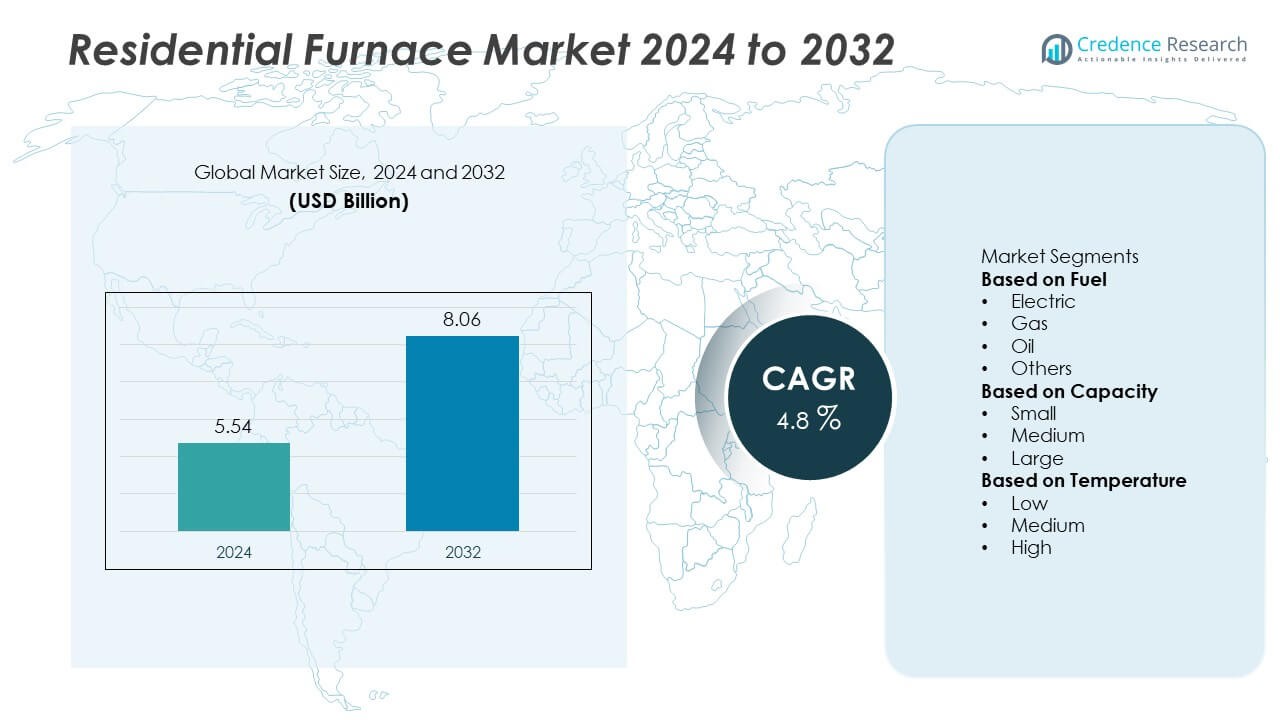

The global residential furnace market was valued at USD 5.54 billion in 2024 and is projected to reach USD 8.06 billion by 2032, registering a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Furnace Market Size 2024 |

USD 5.54 Billion |

| Residential Furnace Market, CAGR |

4.8% |

| Residential Furnace Market Size 2032 |

USD 8.06 Billion |

The residential furnace market is led by major players such as Daikin Industries Ltd., Amana, Heil, Carbolite Gero Ltd., Goodman Manufacturing Company, Emerson Electric Co., Carrier, Inductotherm, Bryant, and American Standard Heating and Air Conditioning. These companies dominate through advanced product portfolios emphasizing energy efficiency, smart controls, and low-emission heating systems. Continuous investments in R&D and digital integration strengthen their competitiveness across developed and emerging markets. Asia Pacific emerged as the leading region with a 31% share in 2024, driven by rapid residential construction and adoption of electric furnaces. North America followed with a 37% share, supported by replacement demand and energy-efficiency upgrades, while Europe accounted for 28%, driven by strict environmental and performance regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global residential furnace market was valued at USD 5.54 billion in 2024 and is projected to reach USD 8.06 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

- Market growth is driven by rising demand for energy-efficient heating solutions, expanding residential construction, and increasing replacement of older systems with advanced, low-emission models.

- Key trends include adoption of smart, connected furnaces, integration of variable-speed technologies, and a growing shift toward electric and hybrid systems for cleaner heating.

- The market is competitive with major players such as Daikin Industries Ltd., Carrier, Emerson Electric Co., and Goodman Manufacturing Company focusing on innovation, eco-efficiency, and product diversification to maintain leadership.

- North America led with a 37% share, followed by Europe at 28% and Asia Pacific at 31%, while the gas furnace segment dominated with a 61% share, supported by widespread residential adoption in colder climates.

Market Segmentation Analysis:

By Fuel

The gas furnace segment dominated the residential furnace market with a 61% share in 2024, driven by its high heating efficiency, cost-effectiveness, and widespread use in colder climates. Gas furnaces offer faster heating and lower operating costs compared to electric and oil models. Government incentives promoting natural gas-based heating systems further strengthen this segment. Electric furnaces hold a growing share due to their clean operation and easy installation, particularly in regions with strong electrification policies, while oil and other fuels continue to serve niche rural and off-grid applications.

- For instance, Goodman Manufacturing Company launched its GM9S96 series, which includes single-stage gas furnace models with a 96% AFUE and heat outputs of up to 120,000 BTU/hr. The series features a durable silicon nitride igniter and utilizes an efficient multi-speed ECM blower motor.

By Capacity

The medium-capacity segment held a 48% share in 2024, making it the leading category in the residential furnace market. This segment caters to standard residential spaces, offering a balance between heating performance, energy efficiency, and affordability. Medium-capacity furnaces are ideal for suburban and multi-family homes, driving high adoption across North America and Europe. Small-capacity units are favored in apartments and compact dwellings, while large-capacity furnaces dominate in luxury or multi-zone residences where heating demand is significantly higher during prolonged winter conditions.

- For instance, Carrier’s Infinity 96 Gas Furnace (model 59TN6) offers capacities up to 120,000 BTUh with a two-stage gas valve. The model integrates a variable-speed ECM blower, and when paired with a compatible Infinity control, it provides enhanced temperature control and summer dehumidification.

By Temperature

The medium-temperature segment accounted for a 54% share in 2024, reflecting its dominance in typical residential heating applications. Medium-temperature furnaces provide steady, energy-efficient warmth suitable for moderate to cold climates without excessive fuel consumption. These systems are commonly installed in single-family homes and are increasingly available with variable-speed motors for optimized airflow control. Low-temperature systems are expanding in milder regions emphasizing energy savings, while high-temperature furnaces remain in demand in extreme cold zones requiring rapid, high-output heating to maintain consistent indoor comfort.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Systems

Growing consumer focus on energy savings and environmental sustainability is driving demand for high-efficiency residential furnaces. Homeowners are replacing outdated models with advanced condensing furnaces that achieve energy ratings above traditional systems. Governments across North America and Europe offer tax credits and rebates for Energy Star-certified units, boosting adoption. The integration of variable-speed blowers and smart thermostats further enhances fuel utilization and temperature control, contributing to significant cost and emission reductions for residential heating applications.

- For instance, the Daikin DM97MC is a modulating gas furnace equipped with a variable-speed ECM blower motor. It features an efficiency rating of up to 98% AFUE and is compatible with Daikin One+ smart thermostat technology.

Expansion of Residential Construction and Renovation Activities

Rising residential construction and renovation projects worldwide are strengthening furnace demand. Population growth, urban housing development, and aging infrastructure upgrades have led to increased installations of modern heating systems. Builders and homeowners prefer furnaces that deliver efficient, consistent heating with minimal maintenance. The shift toward smart and connected homes also drives integration of furnaces with digital control systems, enabling remote operation and real-time energy monitoring, which enhances comfort and operational efficiency across residential properties.

- For instance, Emerson Electric Co. launched its Sensi™ Predict connected monitoring platform, which integrates with residential HVAC systems to track performance, including indicators like furnace cycle rates, air temperature, and airflow.

Stringent Government Regulations on Emissions and Efficiency

Government policies promoting low-emission and high-efficiency heating equipment are a key growth driver. Regulatory frameworks such as the U.S. Department of Energy standards and EU Ecodesign directives mandate higher energy performance levels. These regulations encourage manufacturers to design cleaner, more efficient systems using advanced combustion technologies. Consumers are increasingly replacing older units with compliant models to lower energy bills and meet local emission limits. This policy-driven replacement cycle is expanding market opportunities for manufacturers offering environmentally responsible furnace solutions.

Key Trends & Opportunities

Adoption of Smart and Connected Furnace Systems

Smart residential furnaces integrated with IoT and AI-based control technologies are gaining traction. These systems enable real-time temperature adjustments, predictive maintenance, and remote monitoring through mobile applications. Manufacturers are embedding advanced sensors and connectivity features to optimize fuel consumption and performance. The rise of smart home ecosystems is further promoting integration between furnaces, HVAC systems, and energy management platforms, offering homeowners improved comfort and operational transparency while reducing utility expenses.

- For instance, Bryant Heating & Cooling Systems offers the Wi-Fi® enabled Evolution Connex control as part of its Evolution System, which connects with compatible variable-speed furnaces and smart zoning systems. The system manages up to 8 zones and offers remote access via the Bryant SmartHome App.

Shift Toward Electric and Hybrid Furnace Models

The transition toward electrification in heating solutions presents a major opportunity for market growth. Electric and hybrid furnaces are increasingly favored for their zero-emission operation and compatibility with renewable energy sources. Technological advancements in heat exchangers and insulation materials enhance performance and durability, making them viable alternatives to gas and oil-based systems. Supportive government policies and incentives for electrified heating further accelerate the adoption of these eco-friendly furnace models in both new and retrofitted homes.

- For instance, American Standard Heating and Air Conditioning offers a hybrid heating system that combines a variable-speed electric heat pump, such as the AccuComfort™ Platinum 20, with an auxiliary gas furnace.

Expansion of Aftermarket and Replacement Demand

A growing number of aging furnace installations worldwide is creating strong aftermarket opportunities. Consumers are upgrading to high-efficiency models offering better temperature control, lower energy consumption, and reduced emissions. Manufacturers and service providers are expanding maintenance contracts and retrofit solutions to extend equipment life and optimize performance. The availability of digital diagnostics and predictive maintenance tools enables faster servicing, enhancing customer satisfaction and supporting continuous revenue generation for furnace producers and installers.

Key Challenges

High Initial Installation and Replacement Costs

The cost of purchasing and installing high-efficiency residential furnaces remains a major challenge. Advanced systems with smart controls and premium components require higher upfront investment compared to traditional models. Many homeowners in emerging economies delay upgrades due to limited financial incentives and low awareness of long-term energy savings. Additionally, installation expenses rise with ductwork modifications or conversions from oil to gas systems, limiting the adoption rate of modern furnace technologies among cost-sensitive households.

Fluctuating Raw Material and Energy Prices

Volatility in steel, aluminum, and copper prices significantly impacts furnace manufacturing costs. Rising energy prices also affect production and distribution expenses for manufacturers. These cost fluctuations reduce profit margins and lead to inconsistent retail pricing, which can hinder consumer purchasing decisions. Moreover, disruptions in natural gas supply or changes in energy tariffs directly influence furnace demand patterns, particularly in regions dependent on fossil fuel-based heating systems. Manufacturers must adapt pricing and sourcing strategies to maintain competitiveness.

Regional Analysis

North America

North America held a 37% share of the residential furnace market in 2024, supported by strong replacement demand and harsh winter conditions across the United States and Canada. The widespread adoption of high-efficiency gas and electric furnaces is driven by government incentives promoting energy-saving systems. Rising construction of single-family homes and renovation projects further fuel market expansion. Manufacturers focus on integrating smart control technologies and variable-speed motors to meet evolving consumer preferences. The region’s well-developed distribution networks and emphasis on eco-friendly heating solutions continue to sustain its market leadership.

Europe

Europe accounted for a 28% share of the residential furnace market in 2024, driven by stringent energy-efficiency regulations and growing interest in sustainable heating technologies. Countries such as Germany, the United Kingdom, and France are leading adopters of condensing gas furnaces and hybrid systems. Supportive policies under the EU’s Green Deal encourage the transition from oil-based to electric and gas-powered units. Renovation of older buildings and expansion of district heating systems contribute to steady furnace demand. Manufacturers emphasize noise reduction and emission compliance to align with Europe’s long-term decarbonization goals.

Asia Pacific

Asia Pacific dominated the global residential furnace market with a 31% share in 2024, emerging as the fastest-growing regional segment. Rapid urbanization, rising disposable incomes, and expanding residential construction in China, Japan, and South Korea drive strong product adoption. Consumers prefer energy-efficient electric and gas furnaces to manage temperature control in cold and temperate regions. Government programs promoting clean heating technologies in China and Japan further enhance market penetration. Continuous innovation by regional players and the expansion of smart, IoT-enabled heating systems strengthen the region’s competitive advantage.

Latin America

Latin America captured a 3% share of the residential furnace market in 2024, led by increasing demand in Brazil, Mexico, and Argentina. Growth is supported by the expansion of urban housing projects and the gradual adoption of electric furnaces in colder, high-altitude regions. Rising awareness of energy-efficient home heating solutions encourages consumers to replace outdated systems. Economic recovery and public infrastructure investments contribute to moderate market expansion. However, high installation costs and limited local manufacturing capabilities restrain faster adoption of advanced heating technologies across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 1% share of the residential furnace market in 2024, driven by demand in colder parts of Turkey, Iran, and South Africa. Growth is primarily fueled by increasing adoption of compact electric and gas furnaces in residential and hospitality projects. Expanding urban development and rising income levels are supporting gradual penetration of heating technologies. However, the warmer climate across much of the region limits large-scale adoption. Efforts to diversify building infrastructure and improve indoor comfort standards continue to create niche growth opportunities.

Market Segmentations:

By Fuel

By Capacity

By Temperature

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential furnace market is highly competitive, featuring leading players such as Daikin Industries Ltd., Amana, Heil, Carbolite Gero Ltd., Goodman Manufacturing Company, Emerson Electric Co., Carrier, Inductotherm, Bryant, and American Standard Heating and Air Conditioning. These companies compete through innovation, energy efficiency, and advanced control technologies. Key manufacturers are focusing on smart, connected furnaces that integrate with home automation systems to enhance user convenience and performance monitoring. Investments in high-efficiency gas and electric models with reduced emissions are shaping competitive dynamics. Mergers, acquisitions, and strategic partnerships help companies expand their product portfolios and strengthen global distribution. Leading brands also emphasize variable-speed technologies, noise reduction, and eco-friendly refrigerants to comply with regulatory standards. Continuous R&D and customer-centric service networks remain critical strategies for maintaining market leadership in this evolving, sustainability-driven heating industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daikin Industries Ltd.

- Amana

- Heil

- Carbolite Gero Ltd.

- Goodman Manufacturing Company

- Emerson Electric Co.

- Carrier

- Inductotherm

- Bryant

- American Standard Heating and Air Conditioning

Recent Developments

- In March 2025, Carrier unveiled its first Environmental Product Declaration (EPD) for its residential HVAC systems in North America, covering carbon dioxide performance, energy consumption, and material usage.

- In 2025, Carrier Global Corporation introduced an updated residential heating system series with its Infinity® variable-speed platform achieving a verified operational threshold down to –23 °F and noise levels as low as 55 dB, aimed at cold-climate markets.

- In 2024, Daikin introduced its “Altherma 4 H” residential heat-pump range with R-290 refrigerant, capable of delivering hot-water output up to 75 °C and operating down to -28 °C ambient.

Report Coverage

The research report offers an in-depth analysis based on Fuel, Capacity, Temperature and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for residential furnaces will rise with ongoing urbanization and new housing developments.

- Energy-efficient and low-emission models will gain preference due to stricter environmental regulations.

- Smart and connected furnaces will become standard features in modern homes.

- Electric and hybrid furnaces will see higher adoption as electrification of heating systems expands.

- Manufacturers will invest more in variable-speed and noise-reduction technologies.

- Replacement demand will increase as older systems reach the end of their operational lifespan.

- North America will continue to lead the market due to strong renovation activity and energy-efficiency programs.

- Europe will focus on decarbonization, promoting clean and hybrid furnace technologies.

- Asia Pacific will witness rapid growth driven by rising residential construction and government incentives.

- Partnerships, digital integration, and regional manufacturing expansion will shape future competitive strategies.