Market Overview

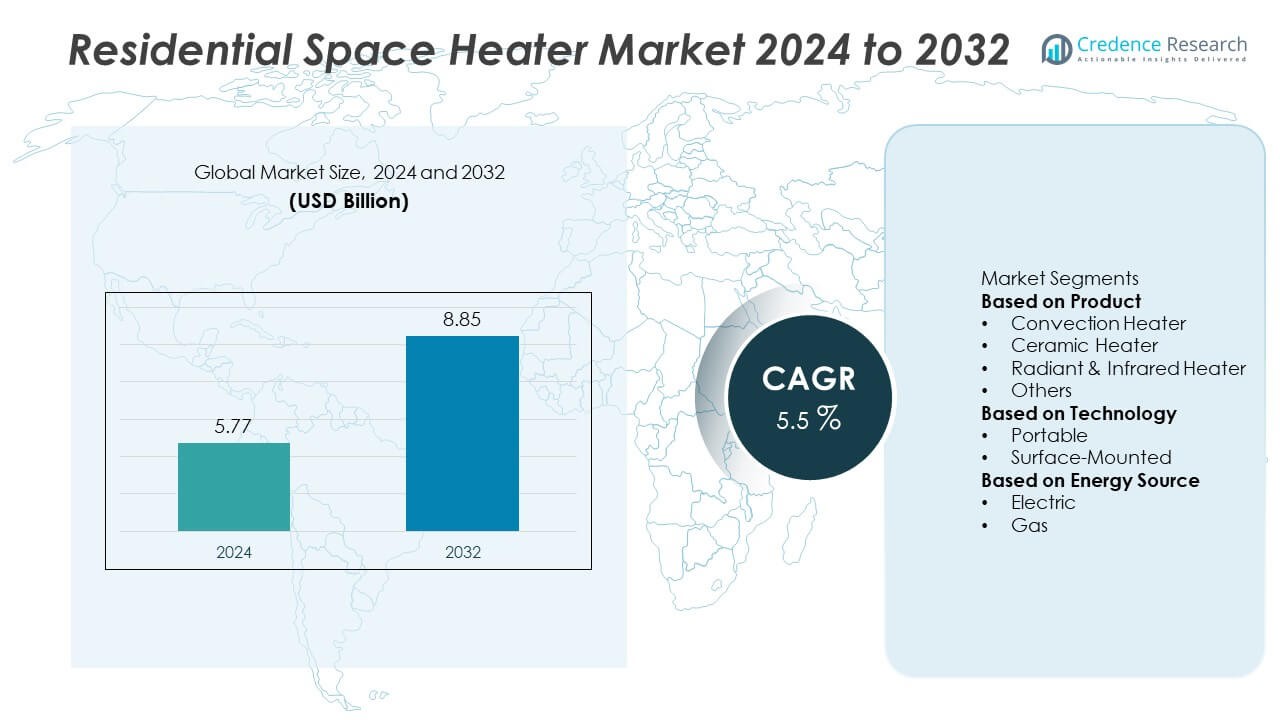

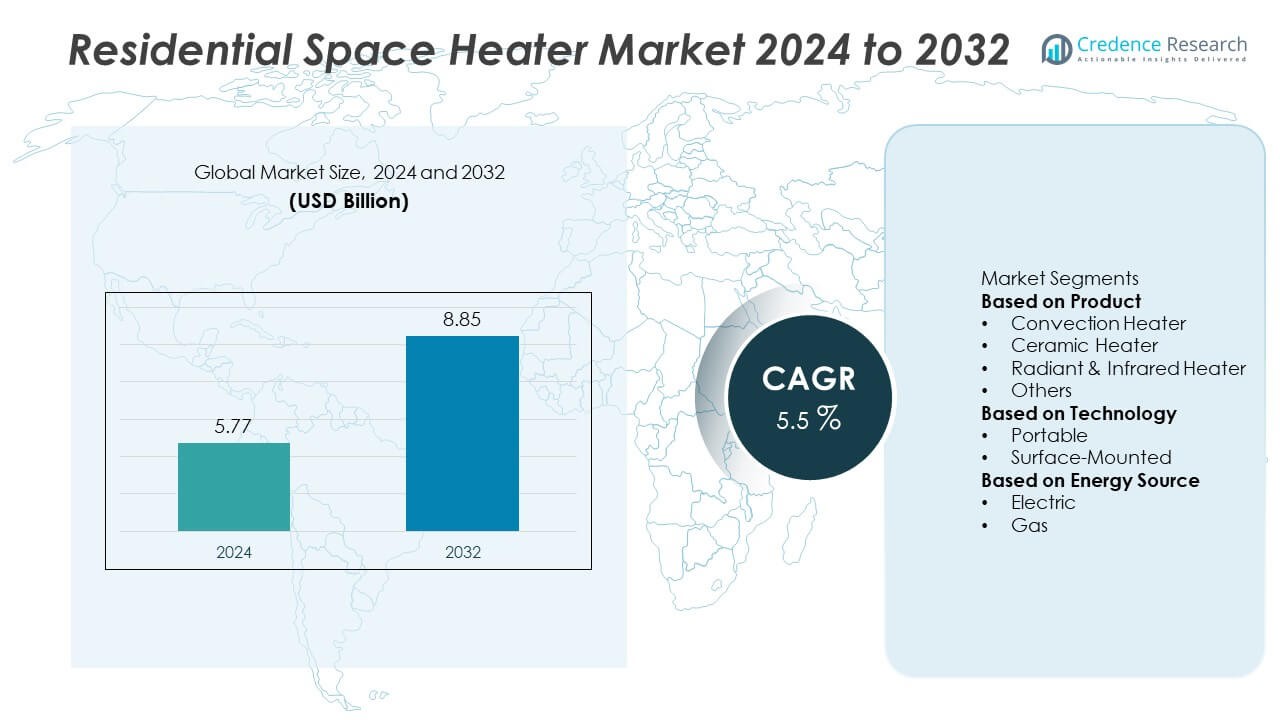

The Residential Space Heater market was valued at USD 5.77 billion in 2024 and is projected to reach USD 8.85 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Space Heater Market Size 2024 |

USD 5.77 Billion |

| Residential Space Heater Market, CAGR |

5.5% |

| Residential Space Heater Market Size 2032 |

USD 8.85 Billion |

The residential space heater market is led by major players such as DeLonghi Appliances Srl, Energy Wise Solutions, Honeywell, Havells India Ltd., Dr. Infrared Heater, Dyson, Domu Brands, Duraflame, Inc., DAIKIN INDUSTRIES, Ltd., and Crane – USA. These companies dominate through strong product innovation, extensive distribution networks, and advanced energy-efficient designs. They focus on integrating smart control systems, compact designs, and safety features to enhance user convenience. North America led the market with a 34% share in 2024, driven by cold climates and high adoption of electric heaters. Europe followed with a 31% share, supported by strict energy-efficiency regulations, while Asia Pacific accounted for a 27% share, emerging as the fastest-growing region due to rapid urbanization, rising disposable incomes, and expanding residential construction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global residential space heater market was valued at USD 5.77 billion in 2024 and is projected to reach USD 8.85 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

- Market growth is driven by rising demand for energy-efficient, compact, and portable heating solutions, supported by increasing residential construction and colder climatic conditions.

- Key trends include the integration of smart and connected technologies, adoption of eco-friendly materials, and growing preference for Wi-Fi-enabled and programmable heaters.

- The market is competitive, with leading players such as DeLonghi Appliances Srl, Honeywell, Dyson, and Havells India Ltd. focusing on innovation, safety features, and energy-efficient designs to enhance user convenience.

- North America led the market with a 34% share, followed by Europe at 31% and Asia Pacific at 27%, while the electric heater segment dominated with a 74% share due to its clean operation and easy installation.

Market Segmentation Analysis:

By Product

The convection heater segment dominated the residential space heater market with a 42% share in 2024, driven by its energy efficiency, affordability, and uniform heat distribution. These heaters are preferred in residential settings for their ability to maintain consistent room temperatures without overheating. The rising adoption of energy-efficient models with adjustable thermostats and programmable timers further boosts demand. Ceramic and radiant heaters are also gaining traction for quick heating and compact design, while infrared heaters appeal to consumers seeking targeted and silent heating solutions for smaller living spaces.

- For instance, DeLonghi Appliances Srl launched its TRD50615E Dragon 4 Pro digital radiator heater rated at 1,500 W, featuring an ECO mode and digital timer. The unit incorporates a “Thermal Slot” design that increases air convection efficiency by 20%, ensuring even heat distribution while maintaining surface temperatures below 60 °C for safety.

By Technology

The portable heater segment held a 67% share in 2024, emerging as the leading category in the residential space heater market. Portability, ease of use, and affordability drive its widespread adoption among homeowners and renters. These heaters are ideal for supplemental heating in bedrooms, garages, and small apartments. Manufacturers are enhancing safety with tip-over protection, auto shut-off, and cool-to-touch designs. Surface-mounted heaters, while holding a smaller share, are increasingly used in modern homes for space-saving and energy-efficient heating applications integrated into walls or baseboards.

- For instance, Dr. Infrared Heater introduced its DR-998WB portable dual-heating system combining 1,500 W PTC ceramic and infrared quartz elements. The model includes tip-over and overheat protection, delivers up to 5,200 BTU output, and features a built-in humidifier capable of dispersing 120 ml/hour to maintain indoor air comfort during extended heating cycles.

By Energy Source

The electric segment accounted for a 74% share in 2024, making it the dominant energy source in the residential space heater market. Its popularity stems from ease of installation, low maintenance, and compatibility with renewable energy systems. Electric heaters are favored in urban households due to their clean operation and adjustable heating controls. Advancements in PTC ceramic and infrared technologies further enhance energy efficiency. The gas segment, although smaller, remains significant in regions with colder climates and stable gas supply, offering powerful heating for large residential areas.

Key Growth Drivers

Increasing Demand for Energy-Efficient Heating Solutions

The growing focus on energy efficiency and sustainability is driving demand for modern residential space heaters. Consumers are replacing outdated systems with models featuring programmable thermostats, ceramic elements, and energy-saving sensors. Governments and utility companies are offering incentives for energy-efficient appliances, further encouraging adoption. Rising awareness of electricity consumption and carbon emissions pushes homeowners to choose eco-friendly options that provide optimal comfort with lower energy costs. This shift supports steady market expansion across both developed and emerging economies.

- For instance, Honeywell introduced its HCE840B HeatGenius ceramic heater rated at 1,575 W with six customized heat settings and a programmable thermostat. The device integrates a HeatPhase™ Timer that gradually reduces heat output over two hours before automatically shutting off.

Rising Urbanization and Growth in Residential Construction

Rapid urbanization and expansion of residential infrastructure globally are boosting space heater demand. Increasing apartment constructions, compact homes, and rental accommodations create a strong need for localized and portable heating solutions. Developers are incorporating energy-efficient and compact heating systems to meet modern living standards. Urban populations in regions such as North America, Europe, and Asia Pacific increasingly rely on electric and ceramic heaters for quick, safe, and convenient heating, strengthening the product’s position in modern residential environments.

- For instance, Havells India Ltd. expanded its Comforter RH2000 series featuring dual 1,000 W PTC heating elements and a built-in thermal cut-off system. The unit delivers rapid heat in rooms up to 200 sq ft and maintains surface temperature below 55 °C for safety, making it suitable for urban apartments and newly built residential units.

Seasonal Demand and Climatic Variations

Colder climates and extended winter seasons continue to be major growth drivers for residential space heaters. The demand peaks during winter months, particularly in North America and Europe, where heating systems are essential for comfort and safety. Unexpected temperature fluctuations and rising occurrences of extreme weather have intensified consumer reliance on supplementary heating appliances. Additionally, product innovation and wider availability across e-commerce platforms have improved accessibility, ensuring year-round sales stability despite seasonal variations.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

Smart and Wi-Fi-enabled space heaters are gaining strong traction as households adopt home automation systems. These advanced devices allow remote temperature control, voice assistance, and energy monitoring through mobile apps. Manufacturers are integrating AI-based adaptive heating and safety features to enhance user convenience and efficiency. The trend toward smart homes and increasing consumer preference for connected appliances present significant growth opportunities, particularly in developed markets with high smart device penetration.

- For instance, Dyson launched the Hot+Cool HP07 smart heater equipped with Wi-Fi connectivity. The unit supports Amazon Alexa and Google Assistant integration and uses sensors to monitor air quality, temperature, and humidity. Its AI-driven thermostat automatically adjusts heating output to maintain user-set conditions, improving energy optimization and comfort.

Shift Toward Eco-Friendly and Low-Emission Models

The growing emphasis on environmental sustainability is driving the adoption of eco-friendly heating systems. Manufacturers are developing models using PTC ceramic elements, low-emission materials, and recyclable components to meet green standards. Electric heaters powered by renewable energy sources are also gaining preference. Consumers are prioritizing clean, odor-free, and safe heating options that align with environmental goals. This shift toward sustainable innovation opens new avenues for manufacturers focusing on energy-efficient and eco-conscious product lines.

- For instance, Duraflame, Inc. offers electric fireplace heaters with a 1,500 W setting that includes an independent flame-effect mode, which can run with or without heat. Some models also feature 750 W and 1,500 W heat settings, but use infrared quartz heating elements rather than ceramic.

Key Challenges

High Electricity Consumption and Operating Costs

Despite efficiency improvements, many electric space heaters still consume significant power, leading to high operational costs for consumers. This factor discourages long-term use, especially in regions with high electricity tariffs. The challenge is more pronounced in large households requiring multiple heaters for consistent warmth. Manufacturers are focusing on technologies that balance comfort with lower energy consumption, but high usage costs remain a key restraint affecting adoption in price-sensitive markets.

Safety Risks and Product Reliability Concerns

Overheating, electrical faults, and fire hazards remain major safety challenges for residential space heaters. Inadequate ventilation or prolonged usage can increase the risk of malfunctions. While leading brands have incorporated safety features like tip-over switches and auto shut-off systems, low-quality and counterfeit products continue to pose hazards. Regulatory compliance and strict safety certifications are essential to maintain consumer confidence. Addressing reliability and safety standards will be critical for market growth and long-term customer trust.

Regional Analysis

North America

America held a 34% share of the residential space heater market in 2024, driven by long winters, advanced heating technologies, and high consumer awareness of energy efficiency. The United States leads the market with strong adoption of electric and ceramic heaters for home and apartment use. Consumers increasingly prefer portable and smart-controlled units for supplemental heating. Government energy-efficiency programs and rebates encourage the replacement of older systems. Continuous innovation by key manufacturers, coupled with a well-developed retail network, supports steady market expansion across both urban and suburban households in the region.

Europe

Europe accounted for a 31% share of the residential space heater market in 2024, supported by stringent energy-efficiency regulations and a strong focus on sustainable home heating. Countries such as Germany, the United Kingdom, and France are leading adopters of electric convection and ceramic heaters. Rising energy costs and the transition away from fossil-fuel-based systems are driving consumers toward eco-friendly models. The region’s cold climate, combined with smart home integration and growing replacement demand, continues to strengthen product adoption. Manufacturers are focusing on low-emission and programmable heaters to align with EU decarbonization targets.

Asia Pacific

Asia Pacific captured a 27% share of the residential space heater market in 2024, emerging as the fastest-growing regional segment. Expanding residential construction, urbanization, and rising disposable incomes in China, Japan, South Korea, and India drive strong product demand. Cold winters in northern China and Japan contribute significantly to heater sales, particularly electric and infrared models. Increasing awareness of safety and energy-efficient technologies supports adoption in modern homes. Rapid growth in e-commerce and local manufacturing enables affordable distribution, positioning Asia Pacific as a key driver of global residential space heating market growth.

Latin America

Latin America held a 5% share of the residential space heater market in 2024, fueled by growing urban populations and rising adoption of affordable portable heating solutions. Countries such as Brazil, Argentina, and Chile are witnessing steady demand due to cold winters and increased housing development in colder regions. The growing popularity of electric and convection heaters is supported by accessible retail channels and online platforms. However, high energy costs and limited consumer awareness restrict large-scale adoption. Continued investments in energy-efficient technologies and expanding middle-class purchasing power are expected to strengthen market growth.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the residential space heater market in 2024, reflecting moderate but growing demand. The market is concentrated in colder regions such as Turkey, Iran, and South Africa, where winter temperatures drive seasonal usage. Urban development and an increasing number of energy-conscious consumers are boosting sales of compact and portable heaters. However, limited cold seasons and higher electricity prices in several areas restrain widespread adoption. Ongoing infrastructure improvements and retail expansion will gradually support stronger market presence in the coming years.

Market Segmentations:

By Product

- Convection Heater

- Ceramic Heater

- Radiant & Infrared Heater

- Others

By Technology

By Energy Source

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The residential space heater market is moderately competitive, featuring key players such as DeLonghi Appliances Srl, Energy Wise Solutions, Honeywell, Havells India Ltd., Dr. Infrared Heater, Dyson, Domu Brands, Duraflame, Inc., DAIKIN INDUSTRIES, Ltd., and Crane – USA. These companies compete through innovation in energy efficiency, product safety, and smart control integration. Leading brands are introducing heaters with programmable thermostats, Wi-Fi connectivity, and eco-friendly materials to meet evolving consumer preferences. Manufacturers focus on expanding their product portfolios across convection, ceramic, and infrared technologies to serve diverse residential applications. Strategic partnerships, digital marketing, and e-commerce expansion enhance market reach and brand visibility. Continuous R&D investments aim to improve heating performance, reduce power consumption, and strengthen regulatory compliance. Regional production facilities and aftersales networks further support competitiveness, positioning these players to capture growing demand for efficient and affordable heating solutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Midea introduced its Cir QHP product line at MCE, claiming it as a complete package for temperature control for households in Europe.

- In January 2024, Daikin’s purchase of Robert Heath Heating expands its suite of residential heating services to include maintenance and advanced heating control features to facilitate energy saving services.

- In September 2023, Lasko integrated its heating collection with the addition of four new models, including a smart oscillating tower and compact units specially created for better performance.

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Energy Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for residential space heaters will increase due to colder climates and rising urban populations.

- Energy-efficient and eco-friendly heater models will dominate future product development.

- Smart and Wi-Fi-enabled heaters will gain traction with growing smart home adoption.

- Manufacturers will focus on advanced safety features such as auto shut-off and tip-over protection.

- Portable and compact designs will continue to attract apartment and small home users.

- Electric heaters will maintain dominance due to low maintenance and clean operation.

- Europe will lead in sustainability-focused innovations and regulatory compliance.

- North America will sustain strong growth driven by replacement demand and seasonal use.

- Asia Pacific will witness the fastest expansion supported by urbanization and residential construction.

- Continuous R&D and digital integration will shape competitive strategies among key global players.