Market Overview

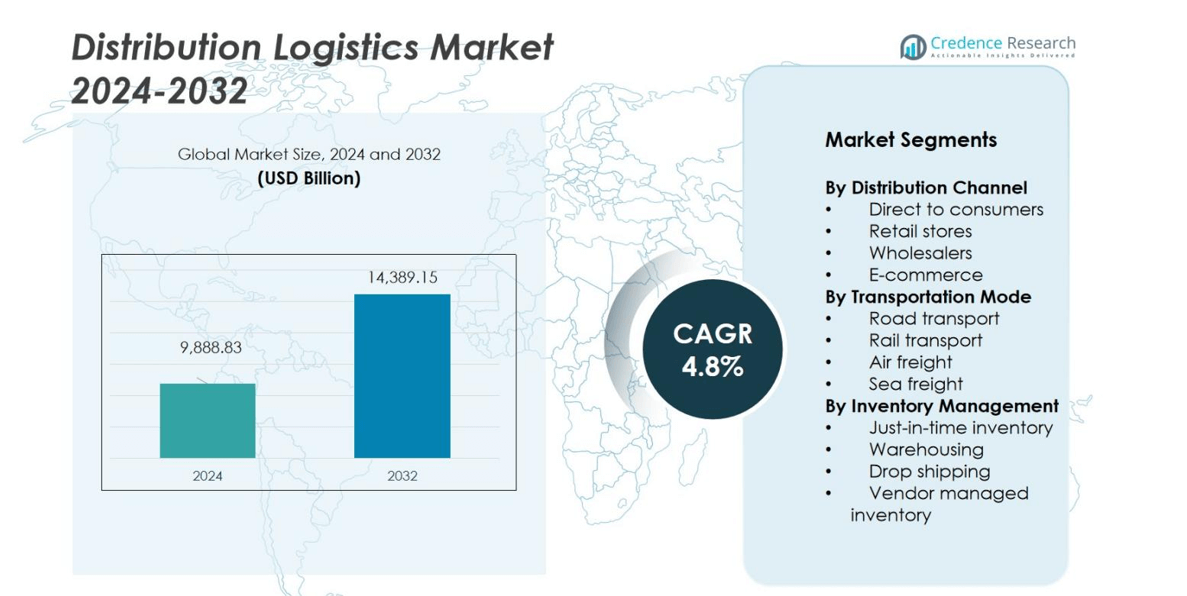

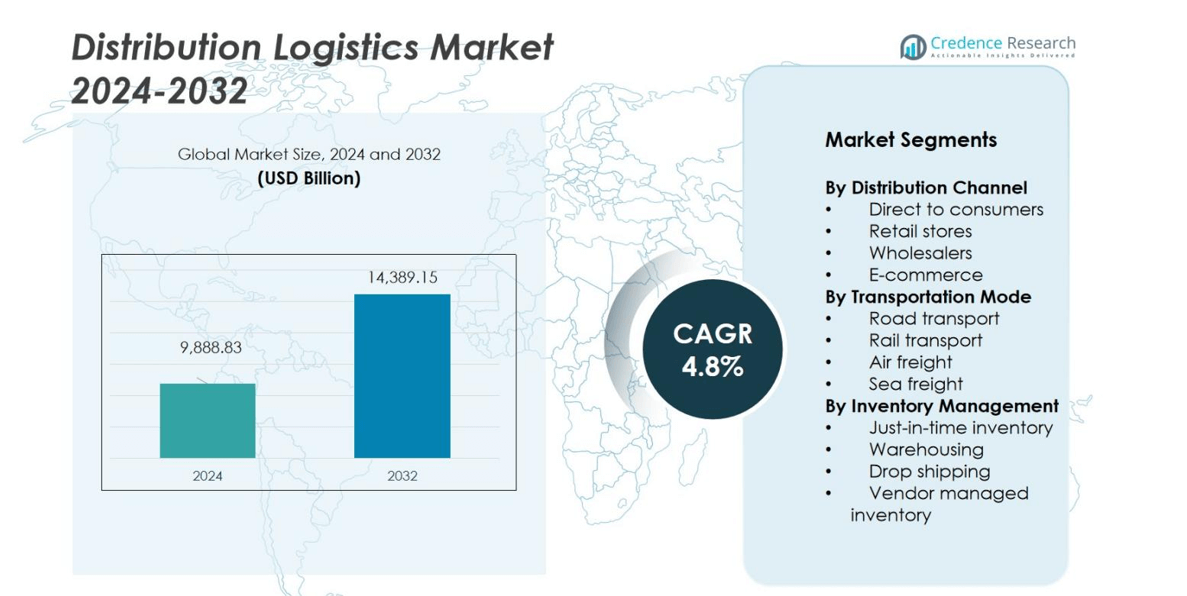

The Distribution Logistics Market size was valued at USD 9,888.83 billion in 2024 and is anticipated to reach USD 14,389.15 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distribution Logistics Market Size 2024 |

USD 9,888.83 billion |

| Distribution Logistics Market, CAGR |

4.8% |

| Distribution Logistics Market Size 2032 |

USD 14,389.15 billion |

The Distribution Logistics Market features top players such as DHL Supply Chain & Global Forwarding, FedEx Corporation, Kuehne + Nagel International AG, DSV A/S, DB Schenker, C.H. Robinson Worldwide Inc. and UPS SCS Inc., all of which leverage extensive global networks and advanced digital platforms. These firms lead by deploying warehousing automation, omnichannel fulfilment solutions and sustainability initiatives to meet evolving customer demands. The Asia‑Pacific region remains the leading geography in this market, accounting for 44.59% of global market share in 2024, driven by rapid e‑commerce growth and infrastructure investment.

Market Insights

- The Distribution Logistics Market was valued at USD 9,888.83 billion in 2024 and is projected to reach USD 14,389.15 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

- Key drivers include the rapid expansion of e‑commerce, increasing demand for faster deliveries, and technological advancements like automation and AI to enhance operational efficiency.

- The market is witnessing trends such as the rise of smart warehousing, the integration of sustainability practices, and the adoption of multimodal transport systems to reduce costs and improve flexibility.

- Competitive pressure remains high as major players like DHL, FedEx, Kuehne + Nagel, and UPS invest in digital solutions, sustainable logistics, and expanding their global networks to maintain leadership.

- Regionally, Asia Pacific holds the largest market share at 44.59% in 2024, followed by North America and Europe, with significant growth driven by infrastructure investments and cross-border trade.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Distribution Channel:

The distribution channel segment in the Distribution Logistics Market includes Direct to Consumers, Retail Stores, Wholesalers, and E-commerce. E-commerce dominates this segment, holding 40% of the market share. The growth of online shopping is driven by the convenience of home delivery, enhanced digital infrastructure, and increasing consumer reliance on e-commerce platforms. As businesses adapt to the demand for quicker and more flexible delivery options, the e-commerce sub-segment is expected to maintain its leading market share throughout the forecast period.

- For instance, ShipBob provides Amazon-like logistics with a strong fulfillment network across the US, Canada, and Europe, helping fast-growing e-commerce brands stay competitive.

By Transportation Mode:

In the transportation mode segment, Road transport leads with the largest market share of 45%. Its dominance is attributed to its flexibility, scalability, and extensive reach, making it essential for domestic and regional logistics. The increasing demand for fast, reliable delivery and improvements in road infrastructure are significant drivers of road transport’s continued market leadership. While rail transport is gaining traction in specific regions, road transport is projected to remain the primary mode of transport, especially for last-mile delivery solutions.

- For instance, Old Dominion Freight Line, a leading motor carrier, offers regional and inter-regional transportation with robust less-than-truckload shipping services, demonstrating the critical role of road transport in delivering a wide range of commodities efficiently.

By Inventory Management:

The inventory management segment consists of Just-in-time inventory, Warehousing, Drop shipping, and Vendor-managed inventory, with Warehousing holding the largest market share at 50%. This dominance is driven by the growing need for efficient storage solutions, improved inventory control, and faster product retrieval. The rise of automation in warehouses and the adoption of real-time tracking technologies are key factors fueling growth in warehousing. As businesses continue to focus on minimizing inventory costs and enhancing operational efficiency, warehousing remains the dominant strategy in logistics.

Key Growth Drivers

Increasing E-commerce Demand

The rapid growth of e-commerce is a major driver in the Distribution Logistics Market. As consumers increasingly turn to online platforms for shopping, the demand for efficient and fast delivery solutions has surged. This has spurred logistics companies to enhance their last-mile delivery systems, expand warehousing capacities, and leverage advanced technologies. The convenience of shopping from home, along with improvements in digital infrastructure and payment systems, continues to drive e-commerce, contributing significantly to the expansion of the logistics market.

- For instance, Locus leverages AI-powered route optimization and predictive delivery insights with tools like DispatchIQ and Control Tower to ensure same-day and next-day delivery accuracy and transparency.

Technological Advancements in Logistics

Technological advancements are reshaping the logistics industry, offering new opportunities for efficiency and cost reduction. Automation, artificial intelligence (AI), the Internet of Things (IoT), and robotics are being widely adopted to optimize inventory management, streamline transportation, and enhance real-time tracking. These technologies enable better forecasting, reduce human errors, and increase supply chain visibility. The ongoing digital transformation across the logistics value chain is expected to drive significant growth by improving operational efficiency and meeting the rising demand for fast and reliable services.

- For instance, Maersk commercially launched its Remote Container Management (RCM) system in 2017, utilizing IoT sensors on its refrigerated containers to provide customers with real-time temperature and location data.

Expansion of Global Trade

The expansion of global trade has significantly impacted the Distribution Logistics Market. As international trade volumes continue to rise, the need for complex logistics networks to handle cross-border transportation, customs clearance, and distribution becomes more crucial. Growth in emerging markets and the establishment of free trade agreements are opening new routes and opportunities for logistics providers. This global trade expansion is driving demand for more robust, scalable, and flexible logistics solutions to manage the movement of goods across regions efficiently.

Key Trends & Opportunities

Sustainability in Logistics

Sustainability is an emerging trend in the logistics industry, driven by increasing environmental awareness and stricter regulations. Companies are adopting green logistics practices, such as using electric vehicles (EVs) for transportation, optimizing routes to reduce fuel consumption, and transitioning to energy-efficient warehouses. The focus on sustainability not only reduces carbon footprints but also improves operational efficiency and appeals to environmentally conscious consumers. The growing demand for sustainable logistics solutions presents a significant opportunity for companies to innovate and gain a competitive edge in the market.

- For instance, Evri powers a significant portion of its first-mile fleet, approximately 40%, with bio-CNG, which cuts CO2 emissions by over 80% (up to 85%) compared to diesel vehicles.

Smart Warehousing and Automation

The rise of smart warehousing and automation is a key opportunity in the Distribution Logistics Market. With the integration of robotics, AI, and machine learning, warehouses are becoming more efficient in managing inventory and order fulfillment. Automation reduces labor costs, minimizes errors, and speeds up processing times, which is vital for meeting consumer expectations for faster deliveries. As companies invest in automated systems and IoT-driven solutions, they can streamline operations and improve scalability, opening up new avenues for growth and competitiveness in the logistics sector.

- For instance, Danfoss Power Solutions deployed OMRON’s LD-90 Autonomous Mobile Robots (AMRs) and an AutoStore automated storage solution, eliminating manual lifting and creating a fully automated logistics flow.

Key Challenges

Rising Operational Costs

One of the significant challenges facing the Distribution Logistics Market is rising operational costs. Fuel price fluctuations, labor shortages, and the high capital expenditure required for infrastructure and technology investments contribute to increasing costs. These factors make it difficult for logistics companies to maintain profitability while meeting the growing demand for faster, more efficient services. Companies must adopt innovative strategies and technologies to manage these costs effectively and remain competitive in an increasingly cost-sensitive market environment.

Supply Chain Disruptions

Supply chain disruptions remain a persistent challenge in the logistics industry. Factors such as geopolitical tensions, natural disasters, and pandemics can lead to delays, product shortages, and fluctuating transportation costs. The COVID-19 pandemic, for instance, highlighted vulnerabilities in global supply chains, causing significant disruptions. Logistics companies must develop more resilient and adaptable supply chains by diversifying suppliers, investing in predictive analytics, and building flexible logistics networks to mitigate the impact of unforeseen disruptions and maintain service continuity.

Regional Analysis

Asia Pacific

The Asia Pacific region accounts for 44.59% of the global distribution logistics market share in 2024. This dominance is driven by rapid industrialization and expanding e‑commerce across China, India, and Southeast Asia. Investments in ports, highways, and rail networks enhance regional connectivity while firms adopt automation to meet fast delivery expectations. Logistics providers scale operations with urban fulfillment centers and cross-border flows, positioning Asia Pacific as the central hub for global distribution networks. This growth is expected to continue with the rise of online shopping and trade infrastructure improvements.

North America

North America holds 23.8% of the global distribution logistics market share in 2024. The region benefits from mature infrastructure, digital supply-chain platforms, and a strong e‑commerce ecosystem in the U.S. and Canada. High consumer demand for fast, flexible delivery and sophisticated last-mile networks underpin growth. In addition, near-shoring trends and trade agreements boost intra-regional flows, reinforcing North America’s role as a critical distribution logistics region. The continued development of logistics technology and sustainable transportation options further strengthens the region’s market position.

Europe

Europe secures 21.3% of the global distribution logistics market share in 2024. Logistics volumes are driven by cross-border trade, stringent sustainability norms, and high-density urban networks. Operators in Germany, the U.K., and France invest in automated warehouses, electric delivery fleets, and multimodal freight corridors. While growth is moderate relative to emerging markets, Europe’s focus on technology integration and green logistics strengthens its regional position. The region’s robust logistics infrastructure and commitment to sustainability are key drivers for continued market growth and innovation.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for 6.5% of the global distribution logistics market share in 2024. The region is experiencing growth due to large-scale infrastructure investments, its strategic location as a trade crossroads, and expanding logistics free zones. Governments in the Gulf region and Africa are upgrading airports, seaports, and road links to capture transit flows. Despite operational challenges like varied regulations and logistics maturity, MEA’s improving connectivity and logistics hubs present significant growth potential, especially as global trade increases.

Latin America

Latin America represents 4.8% of the global distribution logistics market share in 2024, driven by increasing intra-regional trade, expanding retail and e-commerce channels, and upgrades to logistics infrastructure in countries like Brazil and Mexico. While its share is smaller compared to Asia Pacific and North America, the region is experiencing steady growth. Investments in customs modernization, economic reforms, and logistics corridor development are enhancing distribution logistics efficiency. These factors, along with the rise in digital trade, are expected to foster growth in Latin America’s logistics sector.

Market Segmentations:

By Distribution Channel

- Direct to consumers

- Retail stores

- Wholesalers

- E-commerce

By Transportation Mode

- Road transport

- Rail transport

- Air freight

- Sea freight

By Inventory Management

- Just-in-time inventory

- Warehousing

- Drop shipping

- Vendor managed inventory

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Distribution Logistics Market features major players such as DHL Supply Chain & Global Forwarding, FedEx Corporation, Kuehne + Nagel International AG, DSV A/S, DB Schenker, C.H. Robinson Worldwide Inc. and UPS SCS Inc., all of which deploy broad global networks, multimodal capabilities and advanced digital solutions. These firms are investing heavily in warehouse automation, last‑mile delivery optimization and sustainable transport modes to differentiate their services and reduce operational costs. Mergers and acquisitions remain common as companies seek scale and geographic breadth, while smaller regional players focus on niche segments, local market knowledge and tailored service offerings. Competitive pressure remains high as e‑commerce and global trade flows drive demand for flexible, integrated logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2023, Jebel Ali Free Zone, one of the UAE’s largest trading hubs, completed the first phase of the Jebel Ali Logistics Park in partnership with Group Amana. Spanning over 500,000 sq. ft., the facility features temperature-controlled warehouses and modern office spaces to enhance regional logistics capacity.

- In October 2023, GFH Partners Ltd., a subsidiary of Hong Kong-based GFH Financial Group operating from the Dubai International Financial Centre (DIFC), acquired a USD 150 million portfolio of logistics and industrial assets across Saudi Arabia and the UAE to strengthen its presence in the Gulf region.

- In November 2022, A.P. Moller-Maersk launched the Shaheen Express Ocean service connecting India, the UAE, and Saudi Arabia. The route covers key ports such as Mundra, Pipavav, Jebel Ali, and Dammam, providing faster and more reliable regional shipping operations.

Report Coverage

The research report offers an in-depth analysis based on Distribution Channel, Transportation Mode, Inventory Management and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth in e‑commerce and omnichannel retail will continue to drive demand for efficient distribution logistics.

- Technology adoption such as robotics, IoT, and AI will further optimise warehouse operations and transport networks.

- The shift toward sustainable logistics will intensify, with more use of green fleets and energy‑efficient facilities.

- Emerging markets in Asia Pacific and Africa will become major growth zones as infrastructure expands and trade rises.

- Last‑mile delivery solutions will evolve rapidly to meet consumer expectations for faster, more flexible fulfilment.

- Providers will offer more integrated services combining warehousing, transport and inventory management to create value chains.

- Regulatory pressure and supply chain resilience needs will prompt firms to diversify routes and markets.

- Investment in multimodal transport (road, rail, sea, air) will increase to reduce costs and improve efficiency.

- Customer demand for visibility and traceability will lead to expanded use of real‑time dashboards and analytics.

- Capacity constraints and rising costs (labour, fuel, real estate) will force logistics firms to innovate or specialise to stay competitive.