Market Overview:

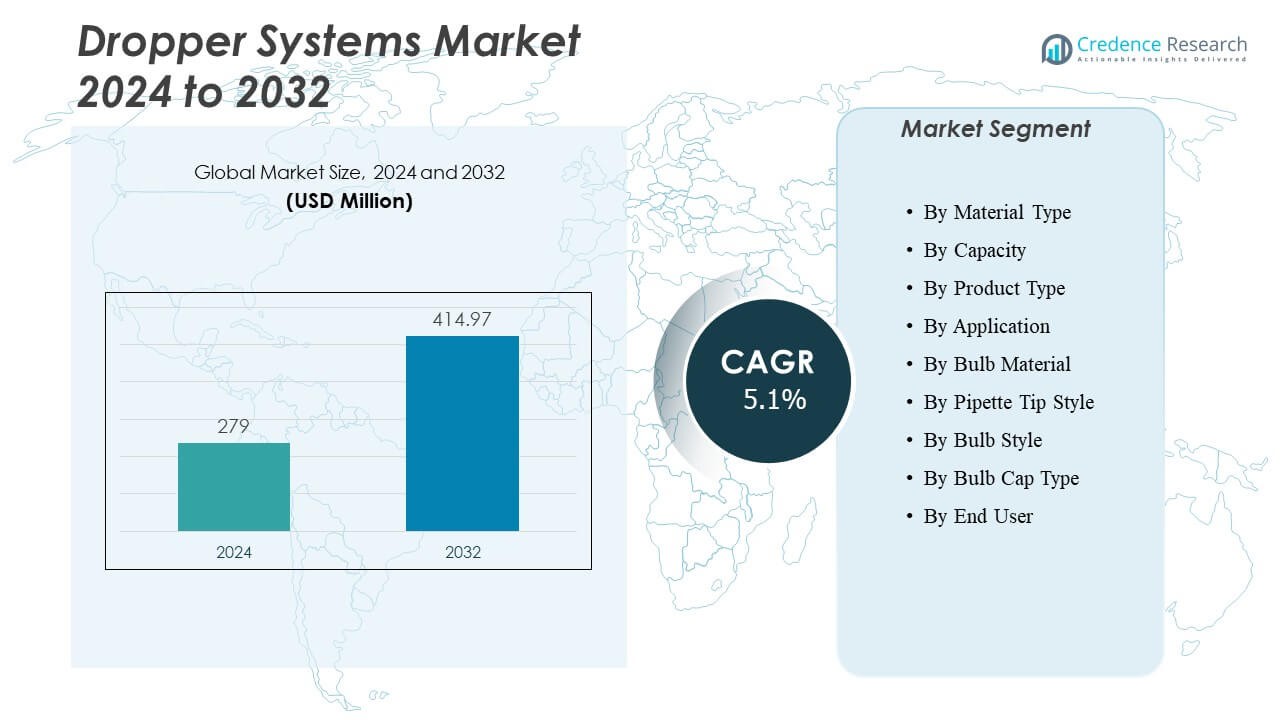

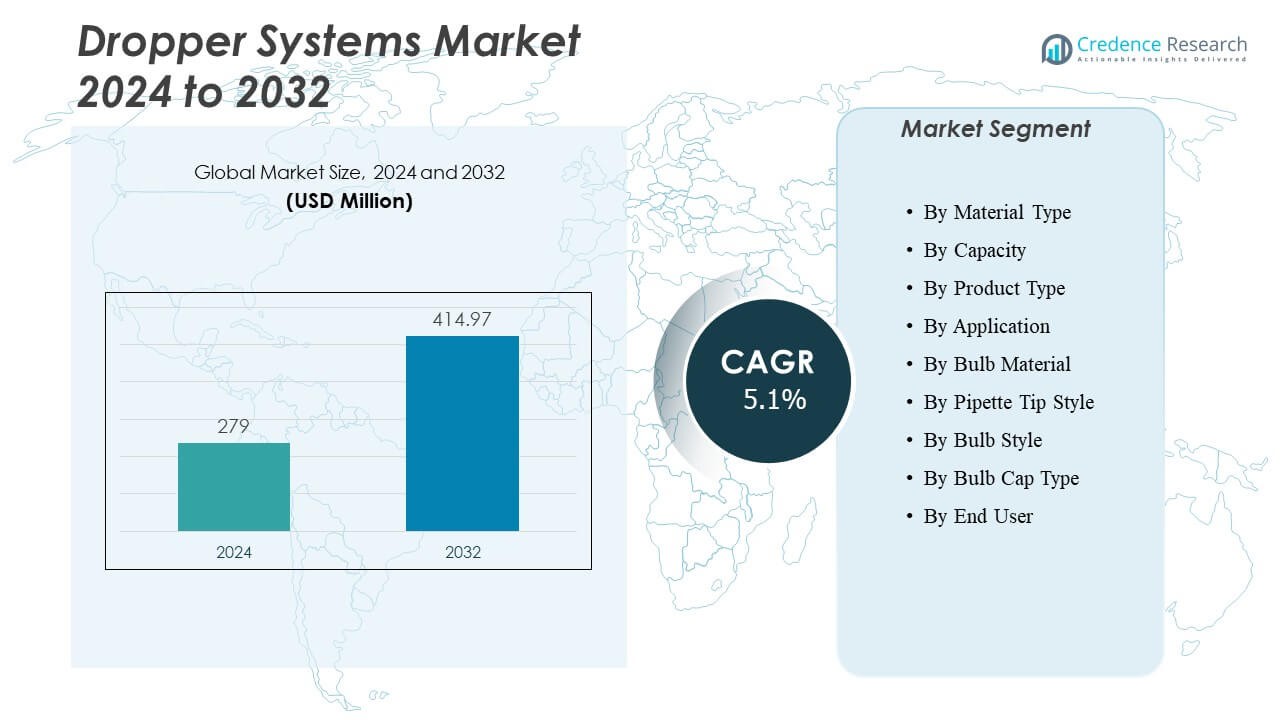

The Dropper Systems Market is projected to grow from USD 279 million in 2024 to an estimated USD 414.97 million by 2032, with a compound annual growth rate (CAGR) of 5.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dropper Systems Market Size 2024 |

USD 279 Million |

| Dropper Systems Market, CAGR |

5.1% |

| Dropper Systems Market Size 2032 |

USD 414.97 Million |

Rising demand for precise liquid dispensing across pharmaceuticals, cosmetics, and nutraceuticals drives market growth. Manufacturers develop user-friendly, contamination-free designs that ensure dosing accuracy and product safety. Increasing adoption of droppers for serums, essential oils, and pediatric medicines supports market expansion. Sustainability trends encourage the use of recyclable glass and biopolymers. Technological innovations in tip, bulb, and cap designs enhance usability and extend product shelf life. It also benefits from growing health-conscious consumer segments globally.

North America leads the Dropper Systems Market due to advanced pharmaceutical production and high cosmetic packaging demand. Europe follows with strong cosmetic innovation and strict regulatory standards for child-resistant and tamper-evident designs. Asia-Pacific is emerging rapidly, supported by growing healthcare infrastructure, increasing disposable income, and rising cosmetic consumption in China, Japan, and India. LAMEA shows potential growth through expanding healthcare access and consumer product adoption. It reflects regional investment trends and evolving consumer behavior driving long-term market development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Dropper Systems Market is projected to grow from USD 279 million in 2024 to USD 414.97 million by 2032, at a CAGR of 5.1%.

- Rising demand for precise liquid dispensing in pharmaceuticals, cosmetics, and nutraceuticals drives market growth.

- Manufacturers focus on contamination-free designs and ergonomic droppers to enhance dosing accuracy and user safety.

- Sustainability trends support adoption of recyclable glass and biopolymer materials in dropper packaging.

- Technological innovations in tip, bulb, and cap designs improve functionality, shelf life, and user convenience.

- North America leads the market due to advanced pharmaceutical and cosmetic production, holding the largest share.

- Asia-Pacific and LAMEA show emerging potential through growing healthcare infrastructure, disposable income, and expanding cosmetic consumption.

Market Drivers

Growing Demand for Precision in Pharmaceutical and Cosmetic Applications

The need for accurate liquid dispensing drives strong adoption across pharmaceutical and cosmetic sectors. The Dropper Systems Market benefits from demand for controlled dosage and hygiene assurance in medication and skincare products. Pharmaceutical companies rely on droppers for pediatric and ophthalmic formulations that need precise delivery. Cosmetic brands use them for serums and essential oils to improve consumer convenience. Rising consumer awareness toward safe and hygienic packaging enhances the system’s usage. Companies introduce advanced droppers with anti-leak and tamper-evident features. It helps strengthen product integrity and user trust.

Shift Toward Sustainable and Eco-Friendly Packaging Materials

Growing preference for sustainable packaging solutions supports market expansion. Consumers and regulatory bodies increasingly promote recyclable glass and bio-based plastic droppers. Manufacturers respond by integrating eco-friendly materials that reduce environmental impact. The Dropper Systems Market sees growing collaboration between packaging firms and cosmetic brands to create biodegradable solutions. Glass droppers with aluminum caps replace single-use plastics in several applications. It supports both brand reputation and compliance with sustainability goals. The adoption of green materials improves supply chain appeal for environmentally conscious buyers.

Technological Advancements in Dropper Design and Dispensing Efficiency

Continuous product innovations improve functionality, durability, and precision. Automated filling lines and advanced sealing systems enhance production efficiency. The Dropper Systems Market benefits from integration of smart dispensing mechanisms ensuring accurate volume release. Manufacturers develop ergonomic designs for easier handling and better user experience. Anti-clog and airless technology help extend product shelf life and prevent contamination. Research and development teams work toward customized solutions suited for viscous or sensitive formulations. It enables brands to differentiate their offerings in a competitive packaging landscape.

- For instance, Berry Global’s Rispharm™ R2 multidose eye dropper features a tamper-evident ring designed to remain attached after opening, ensuring dosage accuracy and enhancing user safety, in compliance with FDA recommendations for eye dropper packaging.

Rising Penetration in Nutraceutical and Aromatherapy Applications

Increased consumption of liquid-based nutraceuticals and essential oils supports product adoption. Droppers provide safe and accurate dosage delivery, essential for wellness formulations. Manufacturers focus on droppers that preserve oil integrity and prevent oxidation. The Dropper Systems Market benefits from expansion of health-conscious consumer segments. Small and mid-sized companies introduce personalized packaging formats to attract premium users. Growth in aromatherapy centers and e-commerce channels widens the product’s accessibility. It allows companies to target multiple customer groups with flexible packaging solutions.

- For instance, Comar’s SecureCap® Child-Resistant/Senior-Friendly dropper tip caps are manufactured in compliance with U.S. Consumer Product Safety Commission (CPSC) Title 16 CFR 1700.2 regulations, as published directly by Comar and referenced in product documentation, guaranteeing strict child safety standards for pharmaceutical and nutraceutical liquids.

Market Trends

Adoption of Smart and Connected Dropper Systems for Advanced Functionality

Smart droppers with digital volume indicators and IoT-enabled monitoring gain popularity. The Dropper Systems Market is evolving toward connected packaging for precise medical dosing. Integration of sensors helps ensure consistency and accuracy in pharmaceutical formulations. Brands use digital droppers to improve patient compliance and monitor usage behavior. The technology also supports clinical research by tracking dispensing data. Compact and lightweight materials make smart droppers suitable for portable use. It increases reliability and customer engagement for healthcare and wellness products.

- For instance, Aptar Beauty’s NeoDropper features improved formula protection and controlled application for high-precision dosing, as announced in their official company news in May 2024

Growing Popularity of Customizable Dropper Designs Across Premium Brands

Luxury cosmetic and skincare companies prefer personalized dropper solutions to align with brand identity. Manufacturers focus on aesthetic appeal through color, finish, and texture customization. The Dropper Systems Market experiences demand for unique shapes and material combinations to enhance shelf visibility. High-end consumers associate customization with exclusivity and trust. Glass and metal droppers dominate this segment for their premium feel and recyclability. Brands collaborate with designers to create ergonomic structures ensuring ease of use. It strengthens product positioning in competitive beauty and personal care markets.

Expansion of E-Commerce and Direct-to-Consumer Sales Channels

Online retail growth reshapes distribution patterns and purchasing behavior. Brands leverage e-commerce platforms to reach global customers quickly. The Dropper Systems Market gains from increasing demand for safe packaging during transit. Companies prioritize leak-proof and compact droppers suited for shipment durability. Direct-to-consumer brands adopt minimalist packaging styles for convenience and branding. Subscription models promote consistent product replenishment and encourage customer loyalty. It enhances market exposure for small manufacturers competing with established brands.

- For instance, The Ordinary reported strong e-commerce growth in 2024, driven by online direct sales of its skincare products, including those using dropper packaging, reflecting increasing consumer preference for convenient and precise liquid formulations.

Rising Use of Refillable and Multi-Use Dropper Packaging

Growing sustainability goals inspire brands to introduce refillable dropper solutions. Consumers prefer reusable containers to reduce waste and cost. The Dropper Systems Market supports refill systems compatible with both skincare and pharmaceutical products. Manufacturers design droppers with reinforced glass and detachable components for easy cleaning. Refillable formats lower production waste and boost customer retention through eco-conscious practices. Major beauty brands integrate refill stations in stores to enhance engagement. It aligns with global sustainability and resource efficiency initiatives.

Market Challenges Analysis

Stringent Regulatory Compliance and Material Safety Standards

Packaging materials must meet strict safety and labeling regulations. The Dropper Systems Market faces complexity in meeting international pharmaceutical and cosmetic packaging standards. Certification processes for chemical compatibility and sterilization increase production costs. Variations in FDA, EMA, and ISO requirements complicate global distribution. Small manufacturers find it difficult to sustain compliance without costly testing facilities. Failure to meet standards risks product recalls and reputational damage. It creates operational pressure and limits market entry for emerging companies.

High Production Costs and Supply Chain Constraints

Rising costs of raw materials such as glass, bioplastics, and metals affect profitability. The Dropper Systems Market experiences challenges from fluctuating energy and transport expenses. Supply chain disruptions delay component sourcing and increase lead times. Manufacturers struggle to maintain affordability while ensuring quality and performance. Limited availability of sustainable material suppliers adds complexity. Automated production setup demands high capital investment. It restricts scalability and delays innovation among small and mid-sized producers.

Market Opportunities

Expansion in Biopharmaceutical and Precision Medicine Applications

Growing investment in precision therapeutics opens new opportunities for advanced dispensing tools. The Dropper Systems Market can support next-generation biologics requiring accurate dosage control. Biopharmaceutical firms explore droppers for liquid vaccines and controlled drug delivery systems. Integration of sterilized and tamper-evident components enhances reliability. Packaging partnerships between pharma companies and design specialists create specialized dropper formats. It supports better patient adherence and simplifies drug administration in clinical environments. Demand for user-centric packaging continues to shape new innovations.

Growing Penetration Across Emerging Healthcare and Cosmetic Markets

Rising disposable incomes and healthcare awareness in Asia-Pacific, Latin America, and the Middle East generate strong prospects. Local manufacturers invest in affordable dropper solutions catering to small-scale pharmaceutical and cosmetic producers. The Dropper Systems Market benefits from expanding infrastructure and retail presence in these regions. Consumers seek functional yet aesthetically appealing packaging. Global brands entering these markets adopt localized strategies to meet cultural preferences. Regulatory reforms supporting import flexibility also encourage new investments. It widens the market’s geographic scope and strengthens long-term growth potential.

Market Segmentation Analysis:

By Material Type

The Dropper Systems Market includes glass and plastic pipettes, each serving specific industry needs. Glass pipettes, including Type I borosilicate and Type III soda lime glass, dominate pharmaceutical and laboratory applications due to chemical resistance and precision. Plastic pipettes such as HDPE, LDPE, PP, PET, and other polymers offer cost-efficiency and flexibility for consumer healthcare and cosmetics. It supports diverse packaging requirements while maintaining durability and product integrity. Manufacturers prioritize material selection based on chemical compatibility, product viscosity, and user convenience.

- For instance, Corning Incorporated’s 2024 annual report states that its Specialty Materials segment achieved USD 2.0 billion in sales, marking an 8% year-over-year increase, driven by growth in premium glass products across multiple industries, including pharmaceuticals.

By Capacity

Dropper systems cater to various capacities, ranging from under 2 ml to above 60 ml. Small-volume droppers up to 2 ml serve pediatric, cosmetic, and essential oil applications. Medium capacities from 2 ml to 30 ml cover hair oils, serums, and liquid medicines, ensuring controlled dosing. Larger volumes between 31 ml and 60 ml and above support industrial and laboratory dispensing. It enables manufacturers to meet precise dosing requirements across multiple sectors while maintaining consistent product performance.

- For instance, Gerresheimer AG offers dropper bottles in multiple sizes made of LDPE, HDPE, and PET, designed for pharmaceutical and laboratory applications, with production adhering to strict quality and hygiene standards as outlined in their official product catalogue.

By Product Type

The market offers Child Resistant Closure (CRC) droppers, non-CRC droppers, tamper-evident caps, and combined CRC/tamper-evident variants. CRC droppers dominate pharmaceuticals and household chemicals due to safety compliance. Tamper-evident solutions gain traction in cosmetics and nutraceuticals. It allows manufacturers to enhance product security, regulatory adherence, and consumer confidence. Non-CRC droppers remain popular in low-risk personal care and home applications.

By Application

Dropper systems serve liquid medicines, essential oils, serums, lotions, hair oils, edible flavors, laboratory auxiliaries, and precision dosing equipment. It ensures accurate delivery, hygiene, and consistency in sensitive formulations. Pharmaceutical and consumer healthcare applications lead demand due to strict dosing requirements. Cosmetic and personal care products adopt droppers for premium packaging and ease of use.

By Bulb Material

Bulb materials include natural rubber, thermoplastic elastomers, thermoset polymers, and others. Natural rubber dominates traditional pharmaceutical droppers due to elasticity and chemical stability. Thermoplastic elastomers and thermoset polymers provide durability, temperature resistance, and compatibility with various liquids. It supports precise control and extends product shelf life across applications.

By Pipette Tip Style

Tip styles include straight, bent, blunt, ball, and bent ball. Straight tips serve general dispensing needs, while bent and ball tips enhance accuracy for specific applications. It allows end-users to select droppers based on formulation viscosity and precision requirements, improving usability and dosing efficiency.

By Bulb Style

Bulb styles consist of skirt, ring, and straight designs. Skirt and ring styles provide ergonomic handling for laboratory and personal care usage. Straight bulbs suit compact packaging and portability needs. It enables manufacturers to address diverse handling preferences and enhance user experience.

By Bulb Cap Type

Cap types include regular, tamper-evident, child-resistant, and combined CRC/tamper-evident designs. Tamper-evident and CRC caps dominate pharmaceutical and high-value cosmetic packaging. It ensures product safety, regulatory compliance, and consumer trust across markets.

By End User

End users include pharmaceuticals, medical, consumer healthcare, cosmetics, home care, food and beverage, and laboratory auxiliaries. Pharmaceuticals and healthcare applications hold a significant share due to high safety and dosing standards. Consumer healthcare and cosmetics drive growth with premium and sustainable packaging preferences. It supports broad adoption across regulated and emerging markets, enhancing overall market penetration.

Segmentation:

By Material Type

- Glass Pipette

- Type I (Borosilicate Glass)

- Type III (Regular Soda Lime Glass)

- Plastic Pipette

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Others

By Capacity

- Up to 2 ml

- 2 ml – 6 ml

- 6 ml – 10 ml

- 11 ml – 15 ml

- 16 ml – 30 ml

- 31 ml – 60 ml

- Above 60 ml

By Product Type

- Child Resistant Closure (CRC) Droppers

- Non-CRC Droppers

- Tamper Evident Cap Droppers

- Child Resistant / Tamper Evident Cap Droppers

By Application

- Liquid Medicines Packaging

- Essential Oil, Serum & Lotions Packaging

- Hair Oil Packaging

- Laboratory Test & Measurement Auxiliaries

- Edible Flavor Packaging

- Precision Dosing Equipment

- Others

By Bulb Material

- Natural Rubber

- Thermoplastic Elastomer (Monoprene, Santoprene)

- Thermoset Polymers (Neoprene, Nitrile, Silicone)

- Others

By Pipette Tip Style

- Straight

- Bent

- Blunt

- Ball

- Bent Ball

By Bulb Style

By Bulb Cap Type

- Regular Cap

- Tamper Evident Cap

- Child Resistant Cap

- Child Resistant / Tamper Evident Cap

By End User

- Pharmaceuticals

- Medical

- Consumer Healthcare

- Cosmetics & Personal Care

- Home Care

- Food & Beverage

- Laboratory Test & Measurement Auxiliaries

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America dominates the Dropper Systems Market with a 37.4% share, driven by strong pharmaceutical and cosmetic manufacturing capabilities. The region’s advanced healthcare infrastructure supports widespread use of droppers for precision liquid dosage. The U.S. remains the leading contributor due to high adoption in drug formulations and personal care products. Cosmetic brands in the U.S. and Canada invest in premium dropper packaging to enhance consumer experience. Regulatory compliance for packaging safety further strengthens demand across both sectors. It continues to benefit from innovation in material science and product design that enhance durability and user convenience.

Europe holds a 31.6% market share, supported by its well-established cosmetic and personal care industry. Countries such as Germany, France, and Italy lead due to strong pharmaceutical production and sustainability-driven packaging regulations. Manufacturers focus on eco-friendly and recyclable materials to align with EU environmental policies. The region also benefits from advanced glass manufacturing capabilities, which improve dropper quality and precision. Rising demand for child-resistant and tamper-evident packaging contributes to market growth. It maintains a robust position due to ongoing innovation and stringent quality standards across key end-use industries.

Asia-Pacific accounts for a 23.8% market share and exhibits the fastest growth potential globally. Expanding pharmaceutical sectors in China and India drive significant adoption of droppers in healthcare packaging. Increasing consumer awareness of personal care and wellness products also fuels demand. Local manufacturers invest in cost-efficient production methods to serve both domestic and export markets. Japan and South Korea contribute with technological advancements in lightweight and sustainable packaging. It gains momentum from strong e-commerce distribution and rising disposable income across developing nations. Latin America, the Middle East, and Africa collectively represent 7.2%, showing emerging opportunities through healthcare expansion and consumer product diversification.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AptarGroup, Inc.

- Comar LLC

- Gerresheimer AG

- Berry Global Group, Inc.

- SGD Pharma

- Virospack SL

- RPC Group PLC

- Amcor plc

- Berk Company

- Adelphi Healthcare Packaging

- Nipro Corporation

- SONE Products Ltd

- HCP Packaging Co. Ltd

- Albéa Group

- Quadpack SA

Competitive Analysis:

The Dropper Systems Market features a moderately consolidated competitive landscape with key players focusing on innovation, material efficiency, and product differentiation. Leading companies such as Gerresheimer AG, Bormioli Pharma, Virospack, DWK Life Sciences, and AptarGroup, Inc. dominate through advanced design and strong global distribution. These players invest heavily in automation, glass processing, and biopolymer technology to enhance manufacturing precision. Smaller firms compete by offering custom designs and sustainable packaging solutions for niche segments. It emphasizes partnerships between pharmaceutical packaging suppliers and cosmetic brands to strengthen long-term market positioning. Continuous mergers and acquisitions enhance production capabilities and geographic reach, ensuring sustained competitiveness across major regional markets.

Recent Developments:

- In July 2025, AptarGroup, Inc. launched the ninth generation of the iconic Double Serum in collaboration with Clarins. This new eco-designed packaging solution features two power-packed hydric and lipidic serums combined into a double-chamber dispensing system, showcasing Aptar’s advanced industrial power and innovation capacity.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Capacity, Product Type, Application, Bulb Material, Pipette Tip Style, Bulb Style, Bulb Cap Type and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing demand for precise liquid dosing will drive adoption across pharmaceuticals and cosmetics.

- Development of eco-friendly and recyclable materials will expand sustainable packaging solutions.

- Smart and connected dropper systems will gain traction for improved accuracy and monitoring.

- Growth in e-commerce and direct-to-consumer channels will enhance market reach globally.

- Expansion in emerging regions will provide opportunities for local and international manufacturers.

- Technological innovations in tip and bulb design will improve user convenience and product reliability.

- Premium and customized droppers will attract high-end cosmetic and personal care brands.

- Integration in nutraceutical and wellness products will boost overall consumption.

- Partnerships between packaging companies and pharmaceutical firms will strengthen market positioning.

- Regulatory compliance for child-resistant and tamper-evident designs will maintain product safety standards.