Market Overview

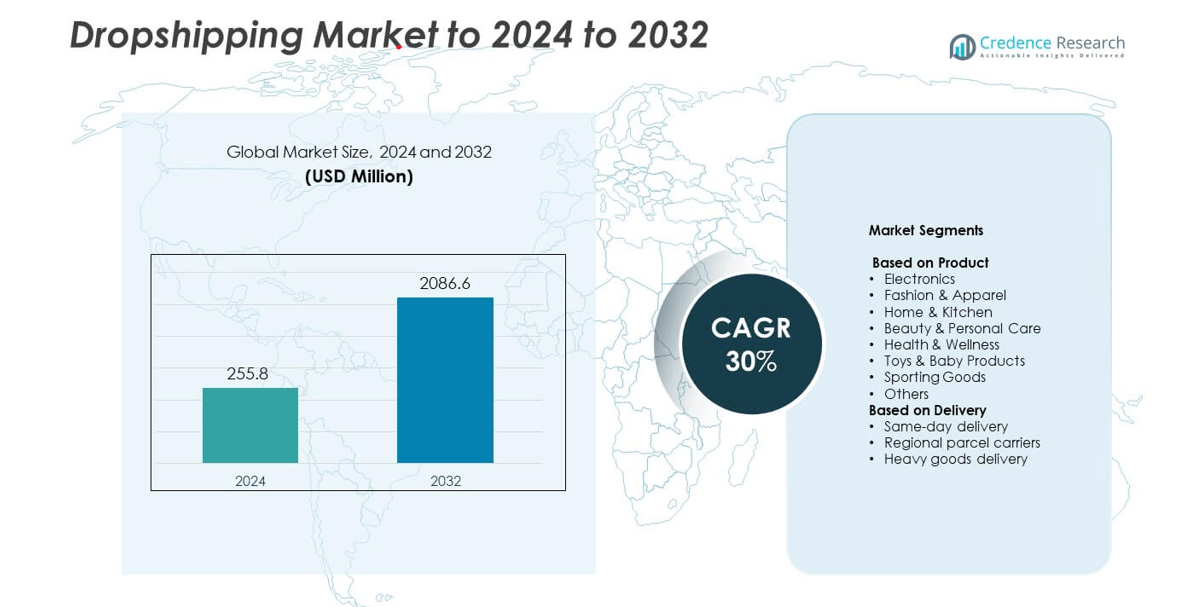

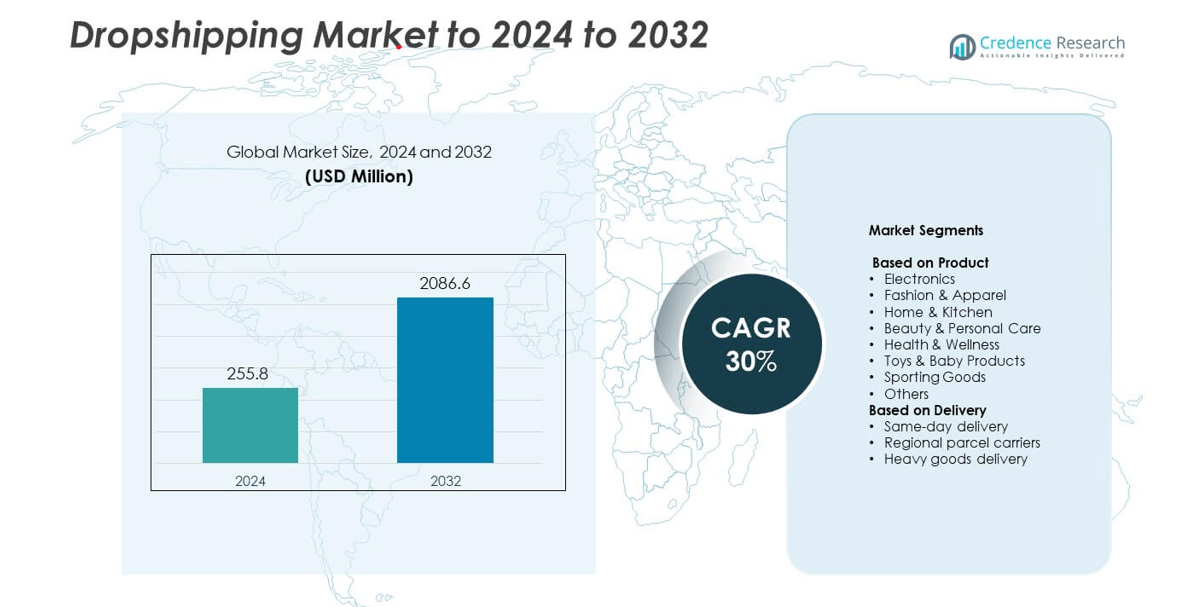

The dropshipping market size was valued at USD 255.8 million in 2024 and is anticipated to reach USD 2,086.6 million by 2032, at a CAGR of 30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dropshipping Market Size 2024 |

USD 255.8 million |

| Dropshipping Market, CAGR |

30% |

| Dropshipping Market Size 2032 |

USD 2,086.6 million |

The dropshipping market is highly competitive, with major players such as Shopify, Doba, Alibaba, Modalyst, Spocket, Salehoo, Wholesale2B, Chinabrands.com, and Printful driving industry growth. These companies focus on expanding product assortments, improving platform integrations, and enhancing supply chain efficiency to meet global e-commerce demand. Technological innovations such as AI-based analytics, automated inventory control, and cross-border logistics optimization strengthen their market presence. Asia-Pacific emerged as the leading region, commanding a 31.8% share in 2024, supported by large-scale manufacturing capacity, cost-efficient sourcing, and rapid adoption of digital commerce platforms across China, India, and Southeast Asia.

Market Insights

- The dropshipping market was valued at USD 255.8 million in 2024 and is projected to reach USD 2,086.6 million by 2032, growing at a CAGR of 30%.

• Growing e-commerce adoption and digital retail expansion are driving demand for flexible, inventory-free business models worldwide.

• Technological advancements such as AI-driven logistics, automation, and cross-border payment integration are shaping key market trends.

• The market is moderately fragmented, with major players focusing on product diversification, supplier partnerships, and faster delivery capabilities.

• Asia-Pacific leads with a 31.8% share, followed by North America at 33.6% and Europe at 27.4%, while electronics remains the dominant product segment with 32.4% of total market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The electronics segment dominated the dropshipping market in 2024, accounting for 32.4% of the total share. High demand for smartphones, accessories, and smart home devices drives this dominance. Dropshippers benefit from consistent product innovation cycles and short replacement periods in the electronics category. The growing popularity of cross-border eCommerce platforms such as AliExpress and Shopify further boosts electronics dropshipping. Rapid adoption of IoT-based devices and competitive supplier pricing enhance profitability for online retailers, sustaining electronics as the leading product segment in global dropshipping operations.

- For instance, Samsung shipped 60.1 million smartphones in Q1 2024. IDC reported global shipments rose to 289.4 million that quarter. Strong smartphone turnover supports electronics demand for online sellers.

By Delivery

Same-day delivery held the dominant 41.8% share of the dropshipping market in 2024, driven by increasing consumer expectations for faster order fulfillment. Integration of AI-driven logistics and micro-fulfillment centers supports efficient same-day operations. Retailers collaborate with local courier networks to minimize delivery times and improve customer satisfaction. Expanding urban warehousing and real-time tracking systems further enhance last-mile efficiency. The segment benefits from growing investments by eCommerce giants in hyperlocal delivery infrastructure, positioning same-day delivery as the preferred fulfillment model in the dropshipping industry.

- For instance, Amazon expanded Same-Day grocery delivery to 1,000+ U.S. cities in 2025 plans announced mid-2025.

Key Growth Drivers

Rising E-commerce Penetration

The surge in global e-commerce adoption continues to fuel dropshipping market growth. Increasing internet access, mobile shopping apps, and digital payment systems have made online retail more accessible. Small businesses and individual sellers leverage dropshipping to reduce inventory costs and entry barriers. The scalability of e-commerce platforms like Shopify and WooCommerce allows rapid business setup. This digital shift has created a favorable environment for dropshipping expansion across emerging and developed economies alike.

- For instance, in its Q3 2024 earnings report, PayPal reported 432 million active accounts. The company’s full fiscal year 2024 total payment volume reached $1.68 trillion, as reported in its Q4 2024 and full-year earnings report.

Expanding Product Diversification

Dropshipping enables retailers to offer vast product catalogs without maintaining physical stock, driving sales flexibility. The growing availability of products across electronics, fashion, and home goods supports diverse consumer demand. Suppliers in Asia-Pacific and Europe now provide faster shipping and broader product customization. Retailers benefit from minimal upfront investment, increasing participation in niche categories. This diversity of offerings has become a vital driver for sustaining competitive advantage in the global dropshipping ecosystem.

- For instance, according to sources in Q2 2025, eBay has approximately 134 million active buyers and around 2.4 billion live listings worldwide, though some reports indicate the number of listings may be closer to 2 billion.

Technological Advancements in Supply Chain Automation

Automation and AI integration are transforming dropshipping operations, improving speed and efficiency. Platforms now use predictive analytics for demand forecasting and inventory optimization. Cloud-based management systems automate supplier coordination and order fulfillment. These technologies reduce delivery errors and enhance customer satisfaction. The resulting operational agility helps retailers adapt to shifting market demands, strengthening the position of dropshipping as a preferred e-commerce model.

Key Trends & Opportunities

Rise of Sustainable and Ethical Sourcing

Consumers are showing growing interest in eco-friendly and ethically sourced products. Dropshipping businesses are adapting by partnering with sustainable suppliers offering recyclable or organic goods. The shift toward green logistics and reduced carbon packaging creates opportunities for differentiation. Brands focusing on transparent supply chains and ethical production standards gain stronger consumer loyalty, aligning profitability with environmental responsibility.

- For instance, H&M collected 17,100 tonnes of textiles for reuse/recycling in 2024. The program has gathered 172,000+ tonnes since 2013. Retailers can align assortments with verified take-back ecosystems.

Growth of Cross-Border E-commerce

Advancements in logistics and global payment systems are accelerating cross-border dropshipping. Retailers can now sell internationally with reduced customs complexity and faster shipping. Asia-Pacific suppliers remain central to this expansion due to low production costs and vast product availability. Regional warehousing partnerships help minimize transit delays. This trend is broadening customer reach and generating new growth avenues for international dropshippers.

- For instance, Alibaba’s International Digital Commerce Group (AIDC) reported that revenue from its international commerce retail business was RMB 31,553 million for the quarter ending December 31, 2024, a year-over-year increase of 36%.

Adoption of AI and Data Analytics

Dropshipping platforms increasingly use AI for customer segmentation, pricing optimization, and personalized marketing. Predictive analytics improves sales forecasting and inventory accuracy. Retailers utilize real-time data insights to identify high-demand products and reduce return rates. The integration of smart tools enhances business intelligence, enabling sellers to make faster, data-driven decisions that improve competitiveness in the global market.

Key Challenges

High Competition and Price Pressure

The ease of market entry in dropshipping has led to intense competition. Thousands of sellers often offer similar products, leading to shrinking profit margins. Dependence on third-party suppliers also limits control over product pricing and quality. To survive, dropshippers must focus on niche differentiation, strong branding, and superior customer experience. Continuous innovation and value-added services are crucial to maintaining profitability in this crowded landscape.

Logistics and Quality Control Issues

Dropshipping heavily relies on external suppliers for production and shipping, leading to variable service quality. Delays, damaged goods, and inconsistent packaging can affect customer trust. Cross-border shipments may also face customs delays or import restrictions. Maintaining consistent product quality without physical oversight remains a challenge. Retailers are increasingly adopting multi-supplier strategies and local fulfillment centers to overcome these logistical risks.

Regional Analysis

North America accounted for 33.6% of the dropshipping market share in 2024, driven by advanced e-commerce infrastructure and widespread adoption of digital retail platforms. The United States leads regional growth with strong consumer preference for online shopping and fast delivery. High smartphone penetration and integration of AI-driven logistics enhance fulfillment efficiency. Major e-commerce players and small-scale entrepreneurs benefit from established supplier networks and advanced payment gateways. Increasing investment in automation and warehouse optimization continues to strengthen North America’s position as a key contributor to global dropshipping revenue.

Europe

Europe held a 27.4% share of the global dropshipping market in 2024, supported by mature e-commerce ecosystems and cross-border trade within the EU. Countries such as Germany, the UK, and France lead adoption due to strong logistics frameworks and rising consumer trust in online purchases. The region benefits from seamless digital payment systems and evolving sustainability standards, attracting eco-conscious shoppers. Growing use of localized suppliers and multilingual storefronts improves accessibility for diverse markets. The expansion of small online retailers and digital startups continues to drive steady regional demand.

Asia-Pacific

Asia-Pacific dominated with a 31.8% share of the dropshipping market in 2024, emerging as the fastest-growing region. China, India, and Southeast Asian countries drive production and supply chain capacity. The availability of low-cost manufacturing and large consumer bases fuels cross-border sales. Rapid smartphone adoption and digital payment integration boost online retail growth. Local platforms like Alibaba and Shopee empower small sellers with global reach. Favorable trade policies and improving logistics infrastructure strengthen Asia-Pacific’s leadership in global dropshipping operations.

Latin America

Latin America captured a 4.6% share of the global dropshipping market in 2024, supported by expanding internet connectivity and a rising middle-class population. Brazil and Mexico dominate regional activity due to the rapid growth of online marketplaces. The adoption of mobile commerce and fintech solutions enhances transaction convenience. Local entrepreneurs are increasingly engaging with international suppliers through global platforms. Despite logistical limitations and payment challenges, improving regional infrastructure and digital literacy are fostering stronger dropshipping penetration across the region.

Middle East & Africa

The Middle East and Africa accounted for 2.6% of the global dropshipping market share in 2024, reflecting growing online retail adoption. The UAE and South Africa lead regional demand, driven by strong smartphone usage and expanding logistics capabilities. Cross-border e-commerce partnerships enable faster product availability and improved delivery reliability. Increasing investment in digital payment solutions and regional fulfillment hubs supports market growth. While infrastructural gaps remain, ongoing government initiatives to promote e-commerce are expected to enhance future opportunities for dropshipping expansion.

Market Segmentations:

By Product

- Electronics

- Fashion & Apparel

- Home & Kitchen

- Beauty & Personal Care

- Health & Wellness

- Toys & Baby Products

- Sporting Goods

- Others

By Delivery

- Same-day delivery

- Regional parcel carriers

- Heavy goods delivery

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The key players in the dropshipping market include Shopify, Doba, Alibaba, Modalyst, Spocket, Salehoo, Wholesale2B, Chinabrands.com, and Printful. The competitive landscape is characterized by platform innovation, supplier integration, and enhanced automation tools aimed at improving operational efficiency. Companies focus on offering diverse product catalogs, seamless API integrations, and faster order processing to attract online retailers. Strategic partnerships with logistics and payment service providers help optimize delivery times and transaction security. Players are also expanding through advanced analytics, AI-enabled product recommendations, and cross-border support features. The market competition continues to intensify as firms invest in technology-driven solutions that strengthen scalability, transparency, and fulfillment reliability, ensuring higher customer retention and platform loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shopify

- Doba

- Alibaba

- Modalyst

- Spocket

- Salehoo

- Wholesale2B

- com

- Printful

Recent Developments

- In 2024, Modalyst Introduced a new feature allowing dropshippers to offer branded invoicing and custom packaging.

- In 2023, Wholesale2B Launched W2B AI, a new tool designed to generate unique product titles and descriptions using artificial intelligence.

- In 2023, Shopify completed the sale of the majority of its Shopify Logistics business to Flexport, a global logistics platform. As part of the deal, Shopify received stock representing a 13% equity interest in Flexport, enhancing its existing stak

Report Coverage

The research report offers an in-depth analysis based on Product, Delivery and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global adoption of e-commerce platforms will continue driving demand for dropshipping services.

- Advancements in AI and automation will streamline inventory management and order fulfillment.

- Integration of real-time analytics will improve demand forecasting and customer personalization.

- Cross-border trade will expand as global logistics networks become more efficient.

- Sustainable and ethical sourcing will become a competitive differentiator among sellers.

- Social media commerce will boost product visibility and influencer-driven sales.

- Cloud-based platforms will enhance scalability for small and medium online retailers.

- Improved payment gateways will simplify international transactions and boost buyer confidence.

- Strategic partnerships with logistics firms will reduce delivery times and costs.

- Continuous technological innovation will strengthen market competitiveness and long-term growth.