Market Overview

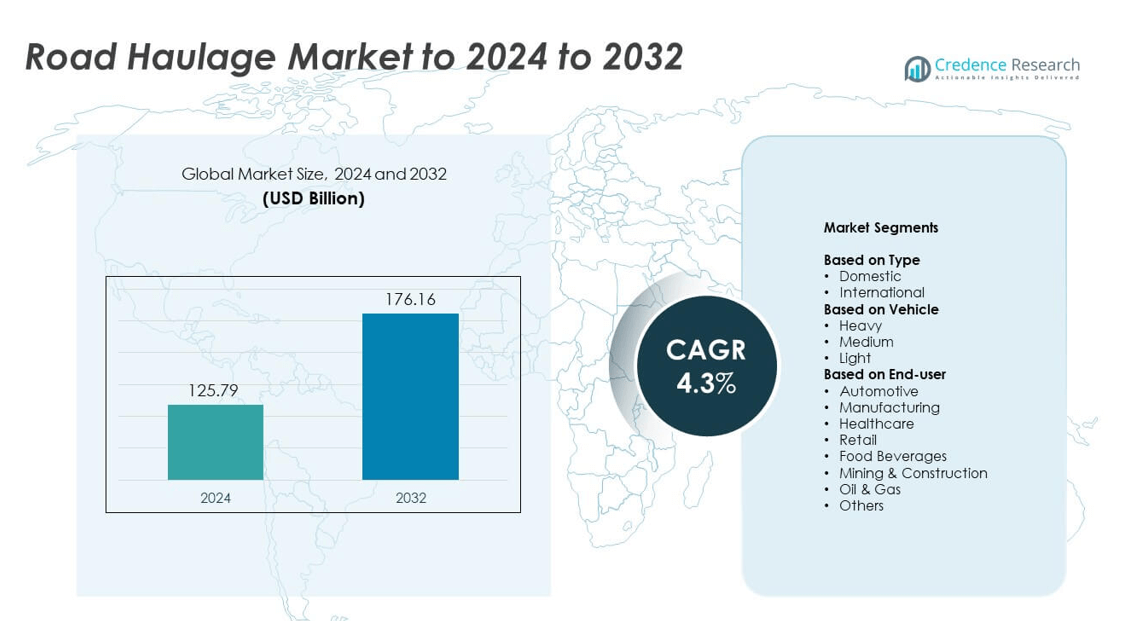

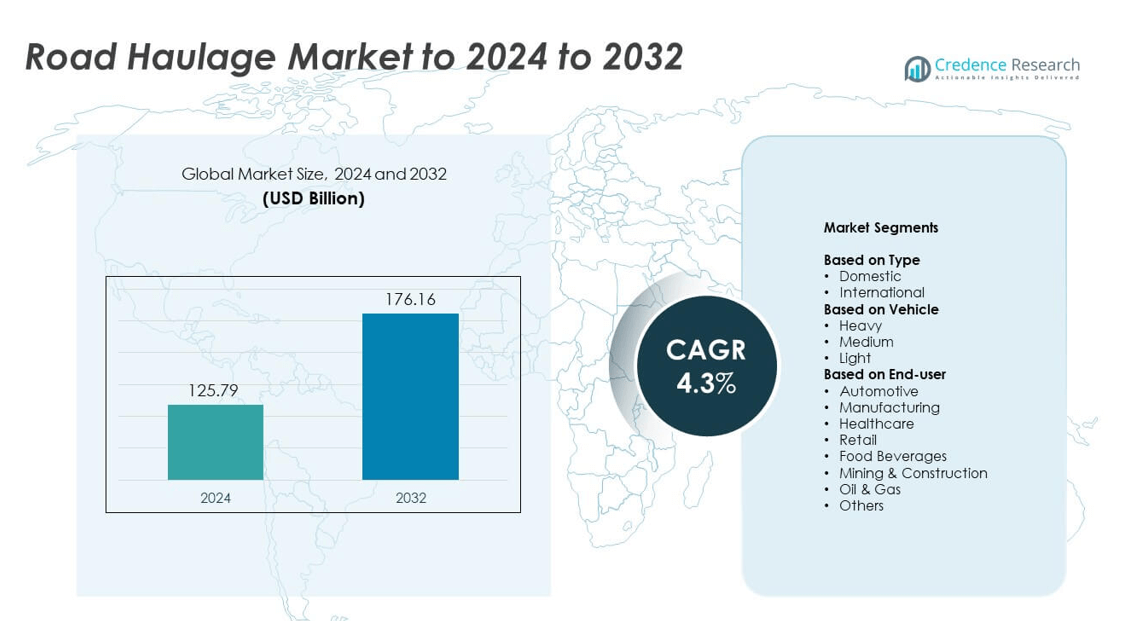

The global road haulage market size was valued at USD 125.79 billion in 2024 and is anticipated to reach USD 176.16 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Road Haulage Market Size 2024 |

USD 125.79 billion |

| Road Haulage Market, CAGR |

4.3% |

| Road Haulage Market Size 2032 |

USD 176.16 billion |

The global road haulage market is led by DHL Freight, C.H. Robinson, Ceva Logistics, XPO Logistics, UPS Freight, DSV, J.B. Hunt Transport Services, FedEx Freight, and Schneider National. These companies lead through extensive logistics networks, advanced digital platforms, and diversified service portfolios spanning domestic and international operations. They focus on efficiency, sustainability, and customer-centric freight solutions by integrating telematics, automation, and real-time tracking technologies. Asia Pacific led the global market with a 33% share in 2024, supported by strong industrial growth, expanding e-commerce logistics, and large-scale infrastructure investments that continue to drive haulage demand across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The road haulage market was valued at USD 125.79 billion in 2024 and is projected to reach USD 176.16 billion by 2032, growing at a CAGR of 4.3%.

- Growing e-commerce activity and manufacturing expansion are key drivers, supported by rising domestic freight demand and improved logistics infrastructure.

- The market is witnessing trends such as adoption of electric trucks, digital freight management, and automation in fleet operations for higher efficiency.

- Leading players are focusing on sustainability, advanced telematics, and strategic partnerships to strengthen global competitiveness and service integration.

- Asia Pacific led the market with a 33% share in 2024, followed by North America at 32% and Europe at 27%, while the domestic type segment held the largest share of 69% due to strong regional transport networks and short-haul logistics demand.

Market Segmentation Analysis:

By Type

The domestic segment dominated the road haulage market with a 69% share in 2024. This dominance is attributed to strong regional trade, last-mile delivery expansion, and increased demand from e-commerce and FMCG sectors. Domestic haulage offers flexible transport solutions for short to medium distances, which is crucial for daily supply chain operations. Growth is further supported by urbanization and government-led infrastructure projects improving national road connectivity. The international segment is expanding steadily, driven by cross-border trade agreements and the adoption of digital freight management systems enhancing operational transparency.

- For instance, Amazon India delivered over 410,000,000 same-/next-day items in 2024, for prime members only.

By Vehicle

The heavy vehicle segment held the largest market share of 54% in 2024, driven by high-capacity freight movement for bulk commodities and industrial goods. These vehicles are preferred for long-distance haulage of construction materials, machinery, and energy products. Technological improvements in fuel efficiency and telematics integration are boosting fleet productivity. The medium vehicle segment benefits from demand in regional logistics, while light commercial vehicles are increasingly used in urban areas for parcel and perishable goods delivery, supported by the rapid rise in e-commerce and small business logistics.

- For instance, Daimler Truck reported 1,000,000+ connected trucks and buses worldwide in 2024.

By End-user

The manufacturing segment led the market with a 28% share in 2024, supported by the large-scale transportation of raw materials and finished goods across industrial hubs. The sector’s growth is fueled by industrial automation and the expansion of industrial corridors connecting production and distribution centers. The retail and food & beverage sectors are also key contributors due to the increasing movement of consumer goods and perishables. Meanwhile, the oil & gas and mining & construction segments rely heavily on heavy-duty haulage for bulk transport of materials and equipment across remote regions.

Key Growth Drivers

Rising E-commerce and Retail Logistics Demand

The rapid expansion of e-commerce and organized retail networks is a primary growth driver for the road haulage market. Increasing online shopping volumes have boosted last-mile delivery requirements and regional freight movement. Logistics companies are scaling fleet capacity and optimizing routes to handle time-sensitive deliveries. The growing preference for same-day and next-day delivery services further amplifies demand for efficient domestic haulage networks, particularly across urban and peri-urban areas where consumer density and purchasing frequency are high.

- For instance, Geotab-connected EVs drove over 1 billion kilometers in 2024, and the number of connected electric vehicles grew by 63%.

Infrastructure Development and Government Investments

Expanding road infrastructure and public investment programs are significantly strengthening the haulage industry. Governments worldwide are modernizing national highways, logistics parks, and freight corridors to support uninterrupted transportation flow. Improved connectivity between industrial zones and ports enhances operational efficiency and reduces turnaround time. These initiatives are particularly strong in developing economies focused on boosting logistics competitiveness. Public-private partnerships in logistics infrastructure are also creating new opportunities for road haulage operators to expand capacity and network reach.

- For instance, according to a press release from the Press Information Bureau (PIB) of India, as of March 31, 2025, the total length of national highways in India was 146,204 km.

Technological Integration in Fleet Operations

The adoption of telematics, GPS tracking, and IoT-enabled fleet management systems is transforming road haulage operations. These technologies improve route optimization, reduce idle time, and enhance cargo monitoring. Predictive maintenance and driver performance analytics help reduce operational costs and downtime. The integration of automation and digital documentation also increases transparency across supply chains. As logistics companies adopt digital freight platforms, the efficiency and reliability of long-distance and short-haul deliveries continue to improve, fostering sustained market expansion.

Key Trends & Opportunities

Shift Toward Green and Sustainable Logistics

The transition toward low-emission vehicles and fuel-efficient transportation solutions is shaping the industry. Operators are increasingly investing in electric and hybrid trucks to comply with emission standards and lower fuel costs. Sustainability initiatives from major logistics companies and government incentives for clean mobility are accelerating adoption. The focus on carbon-neutral logistics is creating opportunities for innovation in fleet electrification, biofuel integration, and energy-efficient vehicle design, aligning the sector with global decarbonization goals.

- For instance, as of May 2025, Volvo Trucks North America had delivered more than 700 battery-electric trucks, which had logged more than 15 million zero-tailpipe-emission miles since commercial orders began in December 2020.

Expansion of Third-Party and Contract Logistics

Outsourced logistics and third-party haulage services are gaining traction among manufacturing, retail, and FMCG industries. Businesses prefer specialized logistics providers to manage transportation efficiency and cost control. This shift allows haulage companies to expand service portfolios with value-added offerings such as warehousing, reverse logistics, and multimodal integration. The trend supports increased market consolidation, as leading operators invest in digital platforms and fleet modernization to deliver end-to-end logistics solutions across domestic and cross-border networks.

- For instance, According to Maersk’s official ‘Year in Review 2023,’ the company’s Logistics & Services arm held more than 470 sites and had over 7.7 million square meters (7,700,000+ sqm) of warehousing capacity globally

Key Challenges

Driver Shortage and Workforce Retention

A persistent shortage of skilled drivers continues to challenge the road haulage sector. High labor turnover, demanding work conditions, and aging driver populations have constrained operational scalability. Logistics companies are investing in training and automation tools, but recruitment gaps remain a bottleneck. The shortage impacts delivery timelines, fleet utilization, and overall service reliability. Addressing this issue requires coordinated industry initiatives and policy support to attract younger workers through better training programs and improved working standards.

Rising Fuel Costs and Regulatory Pressure

Volatile fuel prices and tightening environmental regulations pose significant cost and compliance challenges. Increasing fuel expenses directly affect operational margins for fleet operators. Simultaneously, emission control norms and vehicle maintenance standards raise compliance costs. Operators are under pressure to transition toward cleaner technologies while maintaining competitive pricing. The adoption of electric and LNG-powered vehicles offers partial relief, but high upfront costs and limited charging infrastructure continue to restrict large-scale deployment.

Regional Analysis

North America

North America held a 32% share of the road haulage market in 2024, supported by advanced logistics infrastructure and high freight movement across the United States and Canada. Strong demand from e-commerce, manufacturing, and retail sectors drives consistent road transport volumes. The region benefits from well-developed highway networks and digital fleet management adoption. Growth in cross-border trade with Mexico under the USMCA agreement also enhances haulage activity. Rising investment in electric and autonomous trucks further supports the shift toward sustainable and efficient logistics operations across North America.

Europe

Europe accounted for a 27% share in 2024, driven by robust manufacturing and cross-border freight operations within the EU. Germany, France, and the United Kingdom are leading contributors due to their extensive trade networks and developed logistics systems. The European Green Deal and emission-reduction mandates are accelerating adoption of low-emission vehicles and alternative fuels. The region’s advanced road connectivity and regulatory harmonization support efficient freight flow between industrial zones. Demand from automotive, consumer goods, and industrial sectors remains a key factor sustaining haulage growth across Europe.

Asia Pacific

Asia Pacific dominated the road haulage market with a 33% share in 2024, supported by rapid industrialization and expanding e-commerce activities. China, India, and Japan are major contributors due to high domestic freight volumes and infrastructure investments. Government programs like India’s Bharatmala and China’s Belt and Road Initiative strengthen connectivity and logistics efficiency. Growing adoption of digital logistics platforms and smart fleet management is improving productivity. The expanding retail and manufacturing sectors, along with increasing regional trade flows, continue to boost market growth across Asia Pacific.

Latin America

Latin America held a 5% share of the global road haulage market in 2024, driven by growing regional trade and industrial output. Brazil and Mexico are key markets due to their large transportation networks and agricultural exports. Infrastructure development and private investments in logistics corridors are enhancing supply chain efficiency. Despite challenges related to fuel costs and regulatory complexity, improving cross-border transport agreements and modernization of road fleets support gradual market expansion. The rise in e-commerce and consumer goods distribution further drives demand for haulage services in the region.

Middle East & Africa

The Middle East & Africa accounted for a 3% market share in 2024, supported by expanding construction and energy projects. Gulf Cooperation Council countries are investing in logistics hubs and highway expansions to improve freight connectivity. Growth in oil and gas exploration, coupled with the development of industrial free zones, sustains demand for heavy-duty haulage. In Africa, improving road infrastructure and regional trade under the African Continental Free Trade Area are boosting market potential. Despite infrastructure limitations, rising investments in logistics modernization indicate long-term growth prospects.

Market Segmentations:

By Type

By Vehicle

By End-user

- Automotive

- Manufacturing

- Healthcare

- Retail

- Food Beverages

- Mining & Construction

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

Key players in the road haulage market include DHL Freight, C.H. Robinson, Ceva Logistics, XPO Logistics, UPS Freight, DSV, J.B. Hunt Transport Services, FedEx Freight, and Schneider National. The competitive landscape is characterized by extensive fleet networks, advanced logistics solutions, and technology-driven service models. Companies are investing heavily in digital freight platforms, telematics, and automation to improve operational visibility and delivery efficiency. Strategic mergers and partnerships are expanding service portfolios across domestic and international routes. The focus on sustainability is increasing, with leading operators adopting electric and LNG-powered vehicles to reduce emissions. Enhanced supply chain integration, route optimization, and value-added services such as real-time tracking and temperature-controlled logistics strengthen their market positions. Continuous investment in infrastructure, driver training, and predictive maintenance systems ensures reliability and competitiveness, while expanding e-commerce and industrial activity continue to drive high demand for professional road haulage services globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DHL Freight

- H. Robinson

- Ceva Logistics

- XPO Logistics

- UPS Freight

- DSV

- B. Hunt Transport Services

- FedEx Freight

- Schneider National

Recent Developments

- In 2024, DSV ordered 300 electric trucks from Volvo Trucks, signaling a major commitment to fleet electrification and sustainability efforts.

- In 2023, XPO invested heavily in its proprietary technology to improve the efficiency and visibility of its North American LTL network.

- In 2023, Ceva Logistics India acquired a 96% stake in Stellar Value Chain Solutions, adding over 7.7 million square feet of warehousing space and expanding its presence in India’s booming logistics sector.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The road haulage market will experience sustained growth driven by industrial expansion and global trade recovery.

- Increasing adoption of electric and hydrogen-powered trucks will reduce emissions and fuel dependency.

- Digital freight platforms will enhance operational visibility and route optimization for logistics providers.

- Infrastructure modernization and smart corridor development will improve regional transport efficiency.

- Integration of automation and AI-based fleet management will minimize downtime and improve productivity.

- Cross-border logistics growth and regional trade agreements will expand international haulage operations.

- Demand for temperature-controlled logistics will rise due to growth in pharmaceuticals and food transport.

- Fleet electrification incentives and environmental regulations will accelerate transition to sustainable logistics.

- Partnerships between OEMs and logistics firms will boost innovation in connected vehicle ecosystems.

- Emerging economies in Asia and Africa will drive new investment in haulage networks and fleet expansion.