Market Overview:

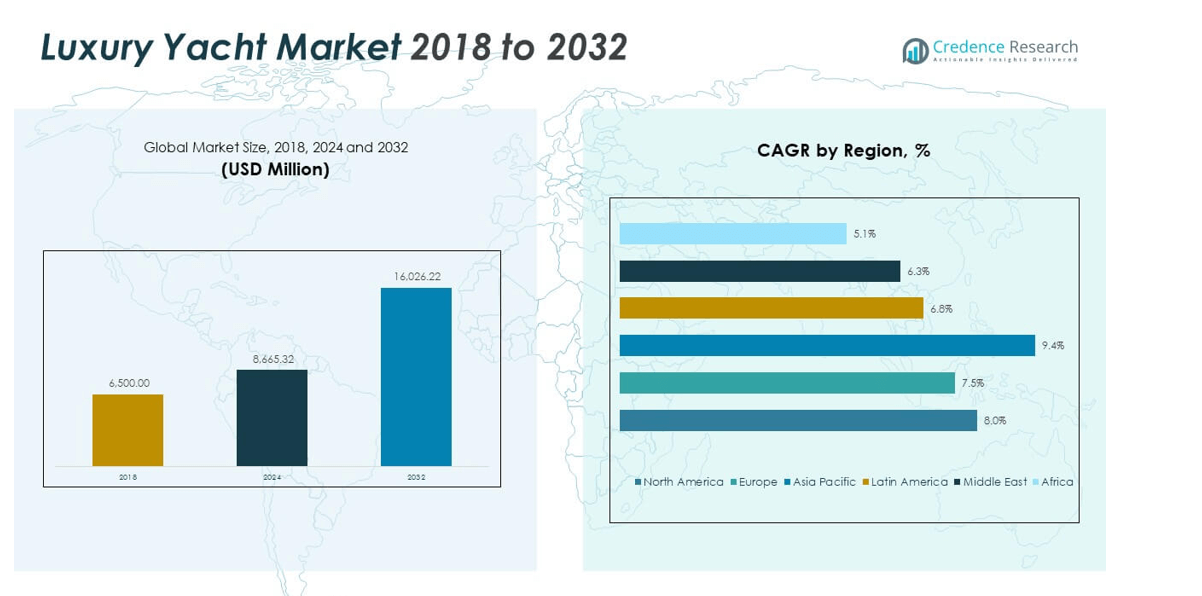

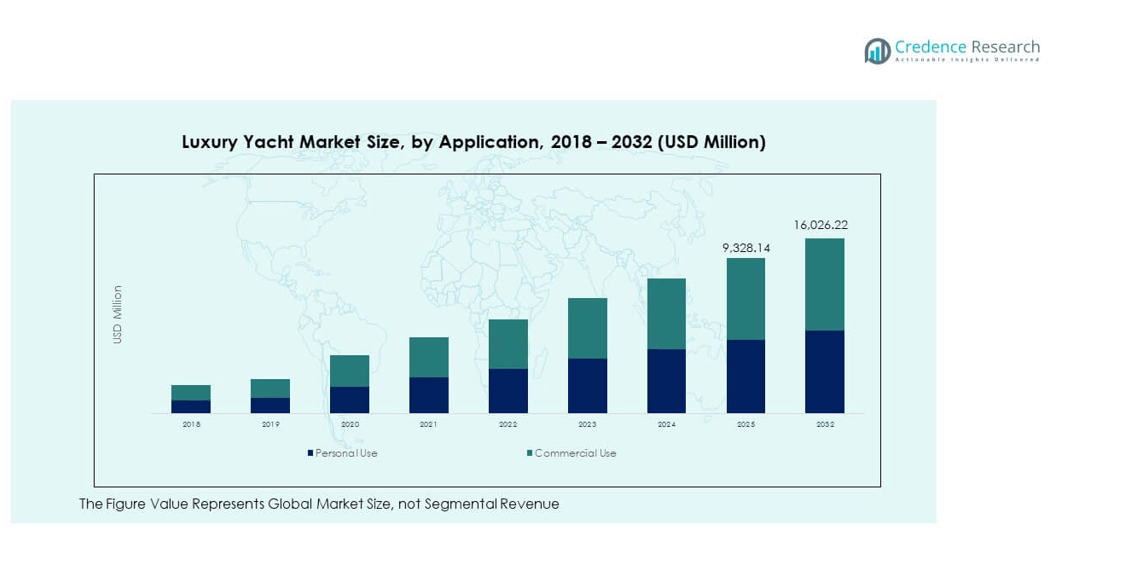

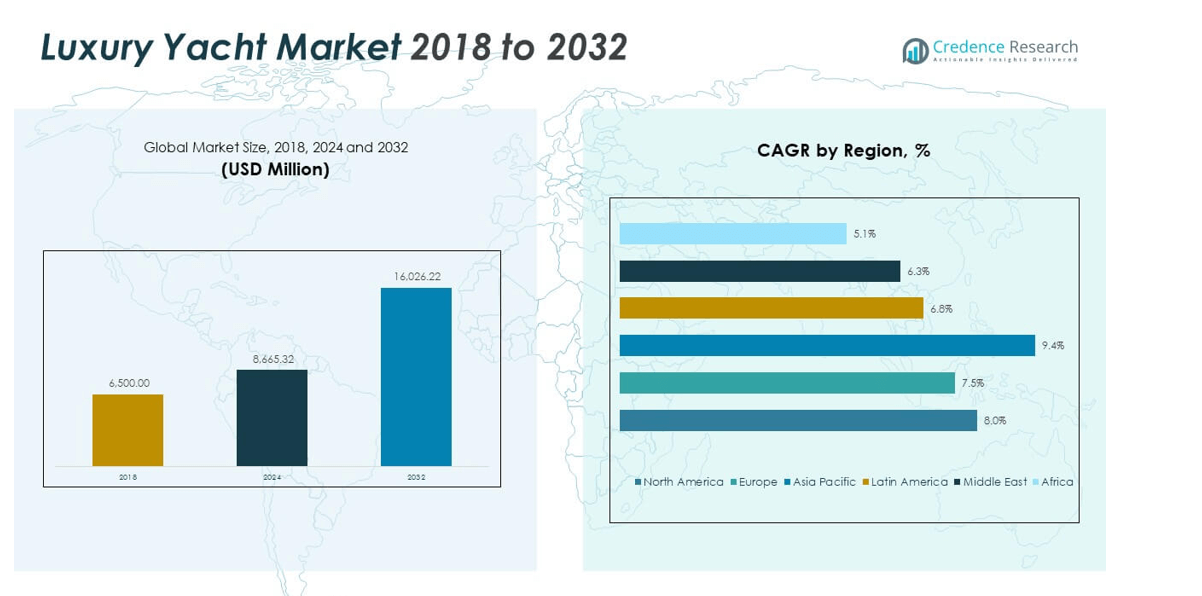

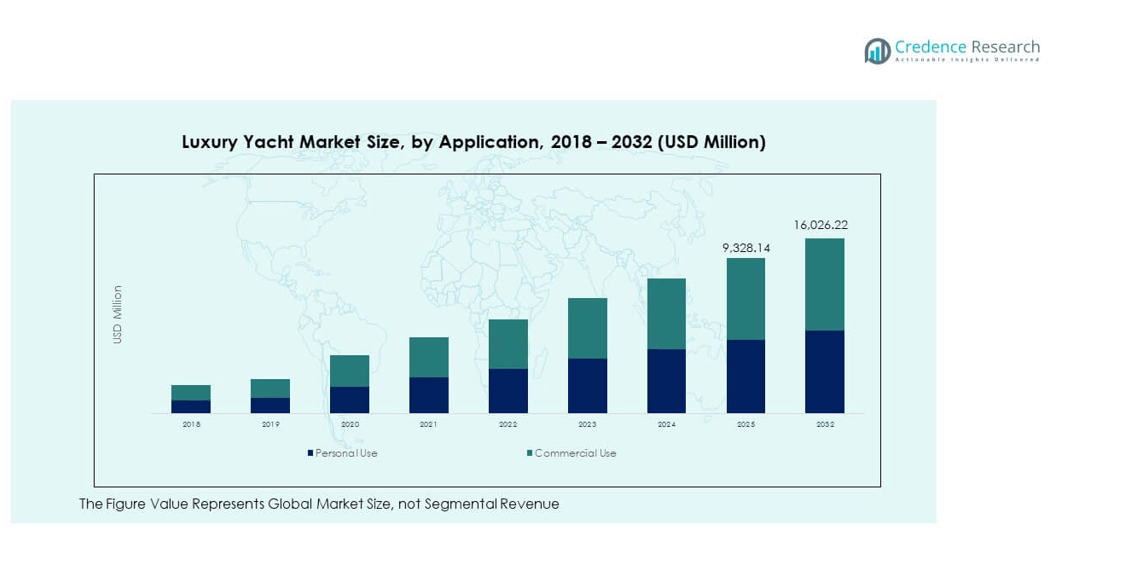

The Global Luxury Yacht Market size was valued at USD 6,500.00 million in 2018 to USD 8,665.32 million in 2024 and is anticipated to reach USD 16,026.22 million by 2032, at a CAGR of 8.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Luxury Yacht Market Size 2024 |

USD 8,665.32 million |

| Luxury Yacht Market , CAGR |

8.04% |

| Luxury Yacht Market Size 2032 |

USD 16,026.22 million |

The market is driven by rising disposable income among high-net-worth individuals, an expanding luxury tourism sector, and the growing appeal of personalized leisure experiences. Advancements in yacht design, hybrid propulsion, and smart automation systems are enhancing comfort, fuel efficiency, and sustainability, attracting both new buyers and charter operators. Additionally, demand for custom-built yachts with modern amenities is strengthening the industry’s growth outlook.

Europe remains the dominant market due to strong yacht-building hubs in Italy, the Netherlands, and Germany. North America follows closely, supported by high leisure spending and coastal tourism. Meanwhile, Asia-Pacific is emerging rapidly, driven by growing wealth in China, Singapore, and Australia, along with rising marina infrastructure and luxury lifestyle adoption.

Market Insights:

- The Global Luxury Yacht Market was valued at USD 6,500.00 million in 2018, reached USD 8,665.32 million in 2024, and is projected to hit USD 16,026.22 million by 2032, expanding at a CAGR of 8.04%.

- Europe (37%), Asia Pacific (29%), and North America (26%) are the top three regions, with Europe leading due to strong yacht manufacturing bases in Italy and the Netherlands, while Asia Pacific’s rapid wealth growth and North America’s robust leisure culture sustain high demand.

- Asia Pacific is the fastest-growing region, supported by expanding marina infrastructure, increasing disposable income, and a rising culture of luxury marine tourism.

- The personal use segment accounts for about 60% of the total market, driven by private ownership and lifestyle-driven purchases among affluent consumers.

- The commercial use segment holds nearly 40% share, supported by the expansion of charter fleets and luxury tourism services across popular yachting destinations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for High-End Recreational Experiences Among Ultra-Wealthy Consumers

The Global Luxury Yacht Market benefits from the strong rise in high-net-worth individuals worldwide. These consumers are prioritizing exclusive recreational experiences that align with their lifestyle preferences. Yachting offers privacy, comfort, and status appeal unmatched by other luxury sectors. Manufacturers are creating vessels with personalized designs, eco-friendly propulsion, and advanced connectivity features. It is gaining attention from buyers seeking both leisure and investment value. Charter services are also expanding, driven by seasonal tourism. The growing preference for customized amenities enhances market visibility.

- For instance, the superyacht Utopia IV, built by Rossinavi in 2018 and measuring 63 meters, is equipped with four MTU diesel engines and waterjets, providing a range of approximately 3,300 to 3,600 nautical miles. It was not launched in 2024, is not a Feadship, does not have autonomous navigation assistance, and does not use hybrid propulsion.

Technological Advancements Enhancing Design, Comfort, and Sustainability

The market is witnessing rapid innovation in yacht construction and onboard systems. Shipbuilders are adopting hybrid propulsion, lightweight composites, and smart energy systems to reduce emissions. These improvements support global sustainability goals and improve operational efficiency. The Global Luxury Yacht Market is evolving toward greater automation and connectivity for safer navigation. Enhanced onboard entertainment, advanced climate control, and ergonomic interiors attract tech-savvy owners. It is also driven by investments in AI-based route planning and maintenance monitoring. The focus on smart solutions is helping brands differentiate in competitive segments.

- For instance, Sunreef’s 100 Sunreef Power Eco, launched in 2025, is equipped with proprietary solar panels integrated into its composite structure, a custom-developed electric propulsion system for near-silent operation, and ultra-light battery packs supporting zero-emission cruising, positioning it as a leader in green technology and energy management.

Expansion of Charter Services and Experiential Luxury Travel

Luxury yacht charters are transforming from niche leisure options to mainstream luxury travel. Tourists are booking yachts for island-hopping, cultural expeditions, and corporate retreats. This trend allows wider market access without ownership burdens. The Global Luxury Yacht Market benefits from high charter fleet utilization and seasonal demand across the Mediterranean and Caribbean. It is further supported by digital booking platforms simplifying rentals. Growing interest among millennials in adventure tourism also fuels this trend. Operators are investing in customized itineraries, wellness experiences, and culinary excellence to retain clientele.

Strong Influence of Lifestyle Marketing and Celebrity Endorsements

Brands are leveraging celebrity ownership and social media campaigns to promote aspirational lifestyles. The visibility of luxury yachts in films, events, and influencer promotions shapes consumer perception. The Global Luxury Yacht Market is gaining momentum through collaborations with luxury fashion and automotive brands. It is also seeing expansion through private exhibitions and elite boat shows. Such marketing strategies strengthen emotional engagement and drive purchase decisions. Manufacturers are tailoring marketing content toward emerging millionaires in Asia and the Middle East. This targeted outreach boosts brand desirability and cross-industry visibility.

Market Trends:

Rising Integration of Eco-Friendly Propulsion and Renewable Technologies

Environmental concerns are leading manufacturers to adopt hybrid, electric, and hydrogen-powered systems. Yacht builders are investing in low-emission engines, solar panels, and battery storage technologies. The Global Luxury Yacht Market is aligning with green innovation to attract eco-conscious buyers. It is also witnessing the use of recyclable materials and energy-efficient interiors. Governments are tightening emission regulations, accelerating green transitions. Buyers now value performance blended with environmental responsibility. Shipyards integrating renewable power sources gain a strong competitive advantage. This sustainable shift redefines luxury as both indulgent and responsible.

- For instance, Lürssen’s Project Cosmos, launched in 2025, is equipped with a methanol-powered fuel cell system enabling up to 1,000 nautical miles of zero-emission cruising at 7 knots and providing hotel services for up to 15 nights emission-free at anchor—a milestone in hydrogen-powered yachting technology.

Increasing Customization and Bespoke Yacht Building Projects

High-end clients are demanding unique designs tailored to personal preferences and lifestyles. Shipyards are offering modular interiors, convertible decks, and adaptive technologies for comfort. The Global Luxury Yacht Market is evolving toward full-scale customization services. It is reshaping the production approach from standard designs to one-off commissions. Builders collaborate with architects, designers, and technology experts for creative innovation. This trend allows seamless integration of luxury amenities such as spas, helipads, and underwater lounges. Buyers prioritize exclusivity over mass appeal, reinforcing the market’s elite positioning. Customization now defines modern yacht luxury.

Digital Connectivity and Smart Yacht Management Systems

Yacht owners seek real-time control over navigation, energy systems, and onboard security. The adoption of IoT and satellite technologies improves performance monitoring and safety. The Global Luxury Yacht Market is advancing toward fully connected yachts with integrated digital dashboards. It is enhancing user experience through automation and mobile-based management. Artificial intelligence supports predictive maintenance, reducing downtime. Connectivity upgrades also enhance guest entertainment and convenience. Shipyards incorporating these systems attract younger, tech-oriented buyers. The digital revolution ensures that yachts operate efficiently and intelligently.

Shift Toward Expedition Yachts and Long-Range Cruising Capabilities

Demand is rising for exploration-class yachts designed for remote destinations. Consumers are seeking immersive experiences beyond traditional cruising routes. The Global Luxury Yacht Market is witnessing growth in vessels built for endurance and autonomy. It is characterized by stronger hulls, larger fuel capacities, and advanced stabilization systems. Owners prefer extended trips to polar regions, tropical islands, and secluded coasts. Expedition yachts combine luxury with rugged performance, expanding the customer base. Builders are adapting designs to support science, diving, and adventure missions. This trend broadens the market’s experiential appeal.

Market Challenges Analysis:

High Ownership Costs and Complex Maintenance Requirements

Owning a yacht involves substantial acquisition, operation, and docking expenses. Maintenance, fuel, crew salaries, and insurance add long-term financial burdens. The Global Luxury Yacht Market faces resistance from potential buyers due to recurring costs. It is also constrained by strict regulations related to maritime safety and environmental standards. Crew shortages, rising labor costs, and spare part availability further complicate ownership. Smaller operators find it difficult to maintain profitability under such conditions. These high costs limit the buyer pool and shift focus toward charters.

Environmental Regulations and Supply Chain Disruptions Impacting Production

Stringent emission standards and material usage restrictions pose challenges to manufacturers. The Global Luxury Yacht Market is adapting to evolving international compliance rules. It is also facing disruptions from global supply chain instability and raw material delays. Rising prices of steel, composites, and electronic components slow production schedules. Builders are investing heavily to align with green manufacturing practices, increasing costs. Logistic constraints and limited shipyard capacity delay deliveries. Such challenges pressure margins and force brands to optimize sourcing and operations.

Market Opportunities:

Emergence of Hybrid and Electric Yacht Segments Driving Future Growth

Eco-friendly propulsion systems are creating new growth prospects for manufacturers. The Global Luxury Yacht Market is witnessing rapid adoption of hybrid and battery-powered models. It is supported by technological progress in marine batteries and energy storage. These innovations attract environmentally conscious consumers and charter operators. The introduction of fast-charging ports across major marinas encourages further expansion. Builders focusing on low-noise, zero-emission yachts can capture premium demand. Sustainability-centered innovation offers long-term competitive differentiation for brands.

Expanding Wealth in Asia-Pacific and Middle Eastern Economies Boosting Demand

Growing affluence and lifestyle transformation in emerging regions create major sales potential. The Global Luxury Yacht Market is gaining momentum in China, India, Singapore, and the UAE. It is fueled by rising leisure spending and investments in marina infrastructure. Governments are promoting coastal tourism and hosting yacht exhibitions. Rising urban elite populations prefer luxury travel experiences over conventional vacations. Localized service networks and brand showrooms strengthen accessibility for buyers. Expanding economic confidence and cultural affinity toward luxury living drive continuous growth.

Market Segmentation Analysis:

By Type

The Global Luxury Yacht Market is segmented into motor yachts and sailing yachts. Motor yachts dominate the segment due to their high speed, advanced propulsion systems, and modern onboard amenities. These yachts attract affluent buyers seeking comfort and performance for long voyages. Sailing yachts hold a smaller share but appeal to traditional enthusiasts who value eco-friendly navigation and the art of sailing. Demand for hybrid propulsion systems is growing, combining fuel efficiency with advanced automation. The rising interest in sustainable travel supports gradual growth for sailing models.

- For instance, the Oyster 885GT, launched in 2024, incorporates a 4.2-meter deep T-keel with a 16-ton lead bulb and a taller carbon rig, increasing righting moment and power for extended bluewater performance while optimizing weight and efficiency—attributes highly favored by sailing yacht owners.

By Size

The market is categorized into yachts up to 50 meters, 50 to 100 meters, and more than 100 meters. Yachts up to 50 meters account for a major share due to manageable operation costs and compact luxury features. The 50 to 100 meters segment is expanding rapidly, driven by demand for extended cruising range and enhanced entertainment areas. Yachts above 100 meters represent the ultra-luxury category, often customized for elite owners with high capital investment and exclusive design requirements.

- For instance, Oceanco’s 127-meter Koru, delivered in April 2023, features a 3,493 GT volume, traditional three-masted schooner design, a pool on the aft deck, nine cabins for 18 guests, and is supported by a 75-meter Damen vessel that carries extra amenities, setting the benchmark for ultra-large, bespoke superyachts.

By Application

Based on application, the market is divided into personal use and commercial use. Personal use dominates the segment, supported by a growing number of private yacht owners and family leisure travelers. The commercial segment includes charter services, event hosting, and corporate hospitality, supported by expanding marine tourism in coastal regions. It benefits from flexible ownership models, creating consistent revenue for operators and shipbuilders worldwide.

Segmentation:

- By Type

- Motor Yachts

- Sailing Yachts

- By Size

- Up to 50 Meters

- 50 to 100 Meters

- More than 100 Meters

- By Application

- Personal Use

- Commercial Use

- By Region

- North America

- Europe

- K.

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Luxury Yacht Market size was valued at USD 1,722.50 million in 2018 to USD 2,258.13 million in 2024 and is anticipated to reach USD 4,168.45 million by 2032, at a CAGR of 8.0% during the forecast period. North America accounts for around 26% of the global market share. The region benefits from a strong base of ultra-high-net-worth individuals, high marine tourism activity, and well-developed coastal infrastructure. The U.S. dominates regional demand, supported by major marinas in Florida and California. It is witnessing growing investments in hybrid yacht models and electric propulsion technology. Rising consumer preference for private leisure and charter experiences strengthens regional sales. Canada and Mexico are also expanding through marina upgrades and tourism initiatives. The presence of key yacht distributors and charter operators further supports long-term growth.

Europe

The Europe Global Luxury Yacht Market size was valued at USD 2,528.50 million in 2018 to USD 3,282.19 million in 2024 and is anticipated to reach USD 5,845.60 million by 2032, at a CAGR of 7.5% during the forecast period. Europe contributes nearly 37% of the total market share, making it the largest regional hub. Italy, the Netherlands, and Germany lead in yacht production due to advanced shipbuilding technologies and established brands. The Mediterranean region drives strong charter demand across France, Spain, and Greece. It is supported by an extensive network of ports and high tourism influx. European manufacturers focus on design innovation, sustainability, and hybrid propulsion systems. Rising wealth in Eastern Europe is boosting private ownership trends. The region’s cultural association with luxury boating continues to sustain market leadership.

Asia Pacific

The Asia Pacific Global Luxury Yacht Market size was valued at USD 1,599.00 million in 2018 to USD 2,225.65 million in 2024 and is anticipated to reach USD 4,540.24 million by 2032, at a CAGR of 9.4% during the forecast period. Asia Pacific holds around 29% of the market share, emerging as the fastest-growing region. China, Japan, and Australia dominate production and demand, supported by expanding marina infrastructure and high disposable income. It is driven by rising interest in luxury marine tourism and private ownership among the regional elite. Singapore is evolving as a yacht charter hub with strong government support. India and Southeast Asia are witnessing increasing demand for leisure yachts. Growing brand awareness and lifestyle transformation enhance regional expansion. The market is poised for rapid diversification over the next decade.

Latin America

The Latin America Global Luxury Yacht Market size was valued at USD 338.00 million in 2018 to USD 445.31 million in 2024 and is anticipated to reach USD 751.15 million by 2032, at a CAGR of 6.8% during the forecast period. Latin America represents roughly 5% of the global market share. The market is expanding through increased tourism activities and coastal investments in Brazil, Mexico, and Argentina. It is supported by improving infrastructure in key ports and marinas. Economic recovery in the region is encouraging luxury spending among high-income consumers. Charter services are gaining popularity along Caribbean routes and South American coastlines. Manufacturers are collaborating with local distributors to strengthen supply networks. Government-led initiatives promoting marine tourism are improving accessibility and regional participation.

Middle East

The Middle East Global Luxury Yacht Market size was valued at USD 201.50 million in 2018 to USD 247.77 million in 2024 and is anticipated to reach USD 402.35 million by 2032, at a CAGR of 6.3% during the forecast period. The region holds nearly 3% of the global market share. The UAE and Saudi Arabia lead demand due to rising interest in private yachts and coastal tourism. Dubai and Abu Dhabi have become prominent yacht event destinations. It is supported by marina infrastructure development and tax-free ownership policies. Regional buyers favor superyachts with bespoke interiors and long-range cruising capabilities. Investments in luxury ports along the Red Sea and Gulf enhance tourism connectivity. Growing expatriate wealth also contributes to expanding ownership.

Africa

The Africa Global Luxury Yacht Market size was valued at USD 110.50 million in 2018 to USD 206.27 million in 2024 and is anticipated to reach USD 318.43 million by 2032, at a CAGR of 5.1% during the forecast period. Africa accounts for nearly 2% of the global market share. The region’s growth is driven by emerging tourism economies such as South Africa, Egypt, and Morocco. It is gaining momentum through luxury coastal resorts and international yacht events. Rising investments in marina development support local demand. South Africa remains a key hub for yacht maintenance and small-scale production. Wealth concentration among high-income individuals is gradually improving market penetration. The region shows long-term promise through tourism diversification and infrastructure modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Azimut Benetti S.p.A. (Italy)

- Sanlorenzo S.p.A. (Italy)

- Ferretti Group (Italy)

- Feadship (Netherlands)

- Princess Yachts (U.K.)

- Sunseeker Yachts (U.K.)

- Lürssen Werft GmbH & Co. KG (Germany)

- ISA Yachts (Italy)

- Ocean Alexander (Taiwan)

- Kingship Marine Limited (China)

Competitive Analysis:

The Global Luxury Yacht Market is highly competitive, featuring prominent manufacturers such as Azimut Benetti, Ferretti Group, Sunseeker Yachts, Sanlorenzo, and Lürssen. These companies compete on product innovation, brand prestige, customization, and technology integration. It is driven by strong demand for personalized designs, sustainable materials, and advanced propulsion systems. European shipbuilders lead the market due to superior craftsmanship and heritage. The industry is witnessing intense rivalry in the 50–100-meter segment, where clients demand performance and luxury balance. Strategic collaborations, aftersales services, and regional expansions define competitive positioning.

Recent Developments:

- In February 2025, Azimut Benetti expanded its partnership with Elite Yachts to cover Saudi Arabia, accompanying the launch of the Azimut Concierge Service to enhance customer experiences in the region. This move follows a 25% year-on-year turnover increase in the Middle East, driven by strategic investments and product innovation. Azimut is also set to globally launch the Grande 25 Metri in the second half of 2025, further boosting its portfolio.

- In August 2024, Sanlorenzo S.p.A. completed the acquisition of Nautor Swan, an iconic high-end sailing yacht brand. This was complemented by the March 2024 acquisition of Simpson Marine, providing Sanlorenzo direct distribution channels across Asia Pacific. In September 2025, Sanlorenzo introduced three new yacht models during the Cannes Yachting Festival, including a flagship flybridge yacht featuring patented asymmetric design and advanced foil technology.

Report Coverage:

The research report offers an in-depth analysis based on type, size, and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable and hybrid yachts will drive future model innovation.

- Growth in ultra-luxury customization will reshape design and interior standards.

- Asia-Pacific will emerge as the fastest-growing market due to rising regional wealth.

- Expansion of marina infrastructure will boost yacht accessibility in developing regions.

- Charter services will expand due to flexible ownership models and luxury tourism.

- Integration of AI-based maintenance and route systems will enhance operational safety.

- Manufacturers will prioritize lightweight composite materials for fuel efficiency.

- Electric and hydrogen propulsion systems will transform long-term sustainability.

- Brand collaborations with technology firms will accelerate smart yacht adoption.

- Rising interest among millennials and next-gen owners will redefine market dynamics.