Market Overview

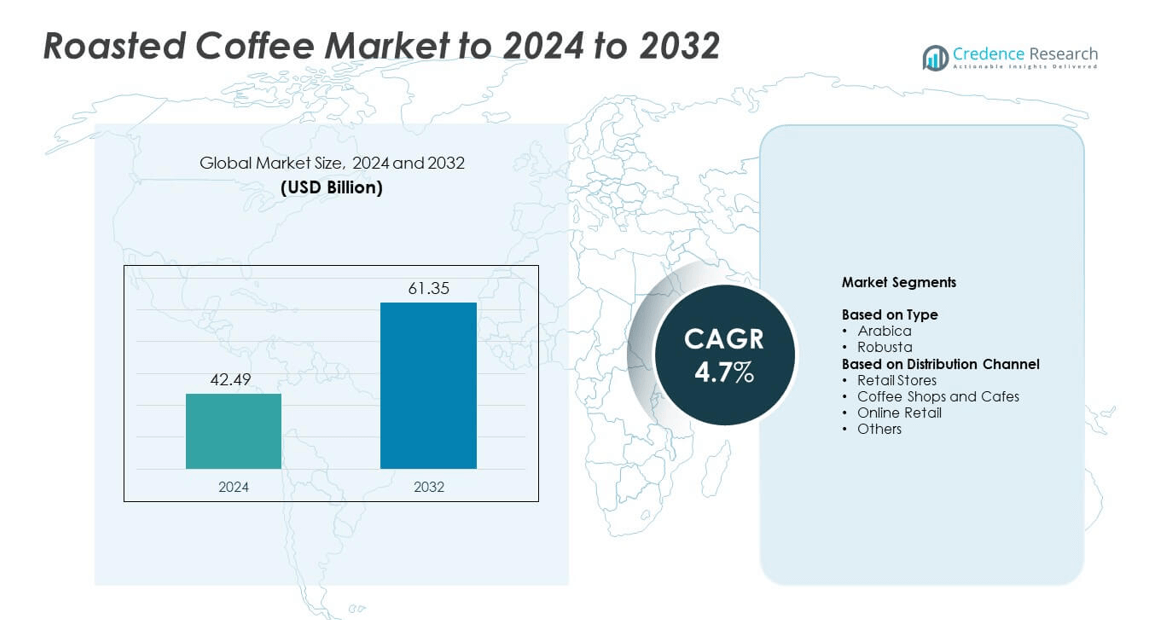

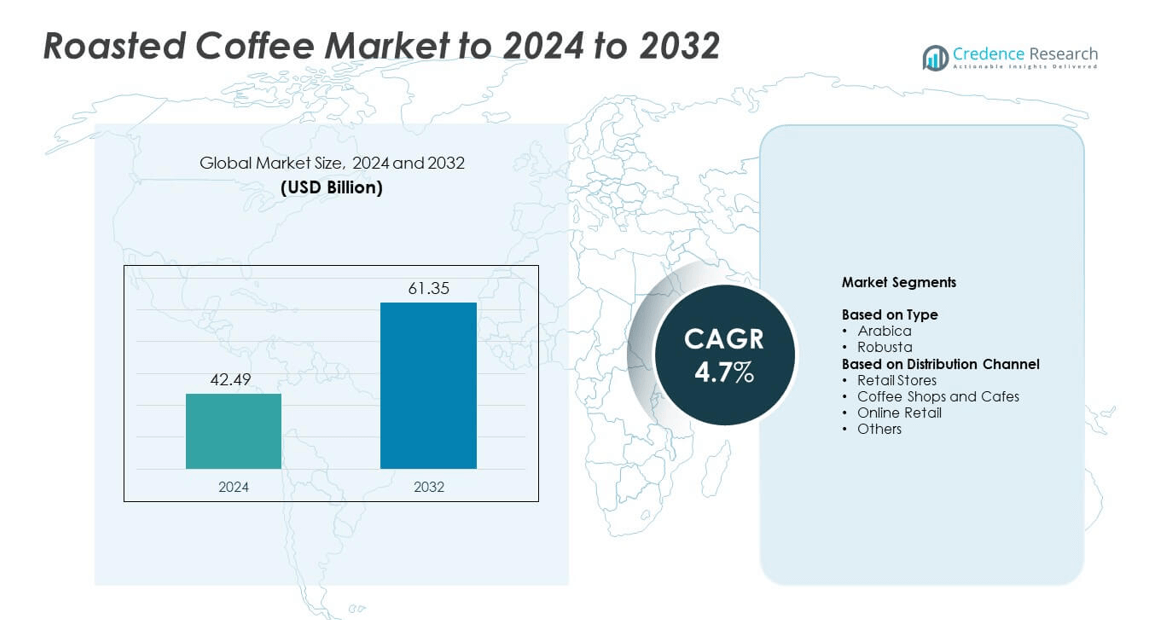

The roasted coffee market size was valued at USD 42.49 billion in 2024 and is anticipated to reach USD 61.35 billion by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roasted Coffee Market Size 2024 |

USD 42.49 billion |

| Roasted Coffee Market, CAGR |

4.7% |

| Roasted Coffee Market Size 2032 |

USD 61.35 billion |

The roasted coffee market is driven by major players such as Starbucks Corporation, Nestlé S.A., JDE Peet’s, Luigi Lavazza S.p.A., and The J.M. Smucker Company. These companies focus on premium product innovation, sustainable sourcing, and expansion across global retail and café networks. Market leaders are investing in specialty blends, digital retail strategies, and eco-friendly packaging to strengthen brand positioning. Europe held the largest regional share of 32.7% in 2024, supported by strong café culture and high per capita consumption, while Asia Pacific emerged as the fastest-growing region driven by rising urbanization and café expansion in developing economies

.Market Insights

- The roasted coffee market was valued at USD 42.49 billion in 2024 and is projected to reach USD 61.35 billion by 2032, growing at a CAGR of 4.7%.

- Rising global coffee consumption, the popularity of specialty blends, and expanding e-commerce channels are major factors fueling market growth.

- Trends such as sustainable sourcing, premiumization, and digital retail transformation are reshaping product offerings and consumer engagement.

- The market is highly competitive, with key players focusing on innovation, eco-friendly packaging, and global expansion to strengthen brand presence.

- Europe led the market with a 32.7% share in 2024, followed by Asia Pacific at 28.5%, while the Arabica segment dominated globally with a 63% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Arabica segment dominated the roasted coffee market in 2024 with a 63% share. Its leadership stems from superior flavor, lower caffeine content, and widespread consumer preference for premium coffee blends. Arabica beans are favored by specialty coffee brands and high-end cafes due to their smooth taste and aroma. Increasing demand for single-origin and organic varieties is further strengthening Arabica’s position in developed regions. Meanwhile, Robusta continues to grow in emerging markets because of its affordability, higher yield, and stronger caffeine content suitable for instant and espresso products.

- For instance, illycaffè confirms a 100% Arabica blend across its core range.

By Distribution Channel

The coffee shops and cafes segment held the largest share of 41% in 2024, driven by rising out-of-home coffee consumption and café culture expansion. Growing preference for freshly brewed, customized beverages supports this channel’s dominance. Global chains and local cafes are investing in experiential settings and specialty brews to attract urban consumers. The retail stores segment follows, benefiting from increased packaged coffee sales and brand visibility. Online retail is growing rapidly as digital platforms and subscription models offer consumers convenient access to premium and specialty roasted coffee products.

- For instance, Starbucks operated 40,199 stores worldwide in 2024, indicating vast café reach.

Key Growth Drivers

Rising Global Coffee Consumption

Increasing coffee consumption across both developed and emerging economies is driving roasted coffee market expansion. Urbanization and evolving lifestyles have boosted demand for convenient, high-quality coffee options. Consumers are shifting toward premium roasted blends and specialty flavors that offer distinctive taste experiences. The growing presence of international coffee chains and independent cafes is also fueling consumption in metropolitan regions, creating consistent demand for roasted beans. This rising global coffee culture continues to position roasted coffee as a daily beverage choice across diverse demographics.

- For instance, Luckin Coffee ended 2024 with 22,340 stores, reflecting strong consumption momentum.

Expansion of Specialty Coffee Culture

The global rise of specialty coffee culture is significantly contributing to roasted coffee demand. Consumers increasingly seek ethically sourced, single-origin, and freshly roasted varieties. Artisanal roasters emphasize traceability and quality, attracting younger consumers and connoisseurs. Premiumization trends have led to greater awareness of bean quality, roasting profiles, and brewing techniques. This focus on craftsmanship and sustainability encourages innovation across supply chains and supports the market’s shift toward value-added roasted coffee offerings.

- For instance, JDE Peet’s serves about 4,400 cups per second across 100+ markets, underscoring specialty uptake.

Growth of E-commerce and Digital Distribution

The expansion of e-commerce platforms has transformed roasted coffee distribution. Online retail channels provide direct access to global brands and independent roasters, enabling product diversification. Subscription-based models, offering home delivery of roasted coffee blends, have gained popularity among urban consumers. Digital marketing and social media engagement also strengthen brand loyalty and consumer awareness. This rapid digital adoption allows coffee producers to reach wider audiences and promote specialty products effectively, enhancing overall market growth potential.

Key Trends & Opportunities

Sustainability and Ethical Sourcing Initiatives

Sustainability has become a central trend shaping the roasted coffee market. Growing consumer preference for eco-friendly products has encouraged brands to adopt ethical sourcing practices and carbon-neutral operations. Companies are investing in certified organic and Fair Trade beans to ensure transparency and environmental responsibility. This sustainability-driven shift is also opening new opportunities for brands that emphasize regenerative agriculture, reduced packaging waste, and community-focused supply chain development.

- For instance, in 2024, the Lavazza Group reported that 63% of its strategic suppliers were assessed through EcoVadis, as part of its progress toward a 75% target by 2027.

Emergence of Ready-to-Drink and Premium Blends

The increasing popularity of ready-to-drink coffee beverages and high-end blends is reshaping the market landscape. Consumers are seeking convenient options without compromising on flavor or quality. Premium roasted coffee variants, such as micro-lot and cold brew blends, are attracting health-conscious and younger demographics. Product innovation in packaging and flavor combinations continues to create new growth avenues, especially within retail and online channels targeting on-the-go consumers.

- For instance, Costa Coffee operates over 4,000 stores and has more than 10,000 away-from-home points across over 30 countries.

Key Challenges

Fluctuating Raw Material Prices

Volatility in coffee bean prices remains a key challenge for roasted coffee producers. Price fluctuations arise from unpredictable weather patterns, supply chain disruptions, and geopolitical instability in coffee-growing regions. These variations directly impact production costs and profit margins for both large and small-scale roasters. Managing procurement risks and ensuring long-term supply stability has become critical for maintaining competitive pricing and sustaining brand profitability.

Rising Competition and Market Saturation

Intensifying competition among established brands and emerging local roasters presents a major challenge in the roasted coffee market. The influx of private-label and specialty products has fragmented market share. Companies face mounting pressure to differentiate through quality, sustainability, or innovation. High marketing and distribution costs further limit margins, especially for smaller players. To sustain growth, firms must focus on product uniqueness, strategic collaborations, and technological advancements in roasting and packaging.

Regional Analysis

North America

North America held a 19.4% share of the global roasted coffee market in 2024. The region benefits from a mature coffee culture and strong consumer preference for premium roasted blends. Growth is supported by the widespread presence of specialty coffee chains and an increase in at-home brewing using premium beans. Rising demand for organic and ethically sourced products further strengthens market expansion. However, market saturation in established segments is leading producers to focus on innovative flavors and sustainable packaging to attract evolving consumer preferences.

Europe

Europe dominated the roasted coffee market with a 32.7% share in 2024. The region’s strong café culture, high per capita coffee consumption, and growing demand for specialty and organic blends drive market performance. Consumers in Western Europe favor sustainable and traceable products, boosting demand for ethically sourced roasted coffee. Increasing adoption of pod-based systems and premium single-origin varieties further enhances growth. However, market maturity in key countries encourages brands to focus on product diversification and expansion into Eastern European markets for additional growth.

Asia Pacific

Asia Pacific accounted for 28.5% of the roasted coffee market in 2024, marking it as the fastest-growing region. Rapid urbanization, rising disposable incomes, and growing café culture in countries like China, Japan, and India are fueling demand. Younger consumers prefer artisanal and ready-to-drink roasted coffee products. The region’s expanding e-commerce platforms and increasing exposure to Western coffee culture are further accelerating market penetration. Local producers are investing in roasting facilities and premium packaging to cater to evolving consumer tastes and enhance regional competitiveness.

Latin America

Latin America captured a 12.1% share of the roasted coffee market in 2024. The region benefits from being a major coffee producer, with Brazil and Colombia leading production and domestic consumption. Increasing adoption of premium roasted coffee products among urban consumers supports steady growth. However, economic fluctuations and pricing volatility in green coffee beans pose challenges. Investments in modern roasting technology and value-added coffee exports are helping local companies strengthen their position. Growth is also driven by expanding retail networks and the popularity of café chains across major cities.

Middle East & Africa

The Middle East & Africa region accounted for 7.3% of the roasted coffee market in 2024. Demand is rising as café culture expands in urban centers such as Dubai, Riyadh, and Johannesburg. Increasing youth population and exposure to global coffee trends are driving preference for roasted and specialty blends. Import reliance remains high, yet local roasting facilities are emerging to reduce costs and cater to regional tastes. The region’s growing tourism and hospitality sectors further contribute to the adoption of premium roasted coffee products across hotels and restaurants.

Market Segmentations:

By Type

By Distribution Channel

- Retail Stores

- Coffee Shops and Cafes

- Online Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The roasted coffee market features prominent players such as Starbucks Corporation, Nestlé S.A., JDE Peet’s, Luigi Lavazza S.p.A., The J.M. Smucker Company, Tchibo, STRAUSS Coffee B.V., Massimo Zanetti Beverage Group, Melitta Group, and Farmer Bros. Co. The competitive landscape is characterized by continuous product innovation, expansion of specialty coffee lines, and strategic investments in sustainable sourcing. Companies are focusing on digital transformation, supply chain optimization, and premium product development to strengthen brand loyalty. Many market leaders are also expanding their global presence through mergers, acquisitions, and retail partnerships. Sustainability initiatives, including the use of recyclable packaging and fair-trade certifications, have become essential for maintaining consumer trust. Moreover, the growing demand for personalized and ready-to-drink coffee products is driving innovation in roasting technology and packaging formats. The competition remains intense as brands aim to balance quality, affordability, and environmental responsibility while catering to evolving consumer preferences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Starbucks Corporation

- Nestlé S.A.

- JDE Peet’s

- Luigi Lavazza S.p.A.

- The J.M. Smucker Company

- Tchibo

- STRAUSS Coffee B.V. (Strauss Group)

- Massimo Zanetti Beverage Group

- Melitta Group

- Farmer Bros. Co.

Recent Developments

- In 2024, Nestlé launched a premium Nescafé Espresso Concentrate product in Australia, New Zealand, and China, with a planned expansion to Europe and North America in 2025.

- In 2024, Starbucks expanded its global coffee innovation network by adding two new farms in Guatemala and Costa Rica, with plans for future investments in Africa and Asia.

- In 2024, Melitta Group acquired a majority stake in Caturra, a coffee roaster and service provider based in Cape Town, South Africa.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The roasted coffee market will continue expanding as global coffee consumption increases steadily.

- Specialty and single-origin roasted coffee will gain popularity among premium consumers.

- E-commerce and subscription-based sales channels will drive strong future growth.

- Sustainability and traceable sourcing will become core factors in brand differentiation.

- Automation and smart roasting technologies will improve efficiency and flavor consistency.

- Asia Pacific will emerge as the fastest-growing regional market driven by urban café culture.

- Ready-to-drink and cold brew roasted coffee formats will attract younger consumers.

- Strategic mergers and acquisitions will strengthen global supply chain integration.

- Innovation in packaging, such as compostable and recyclable materials, will support eco-friendly demand.

- Expanding café chains and rising at-home brewing culture will continue fueling long-term market demand.