Market Overview

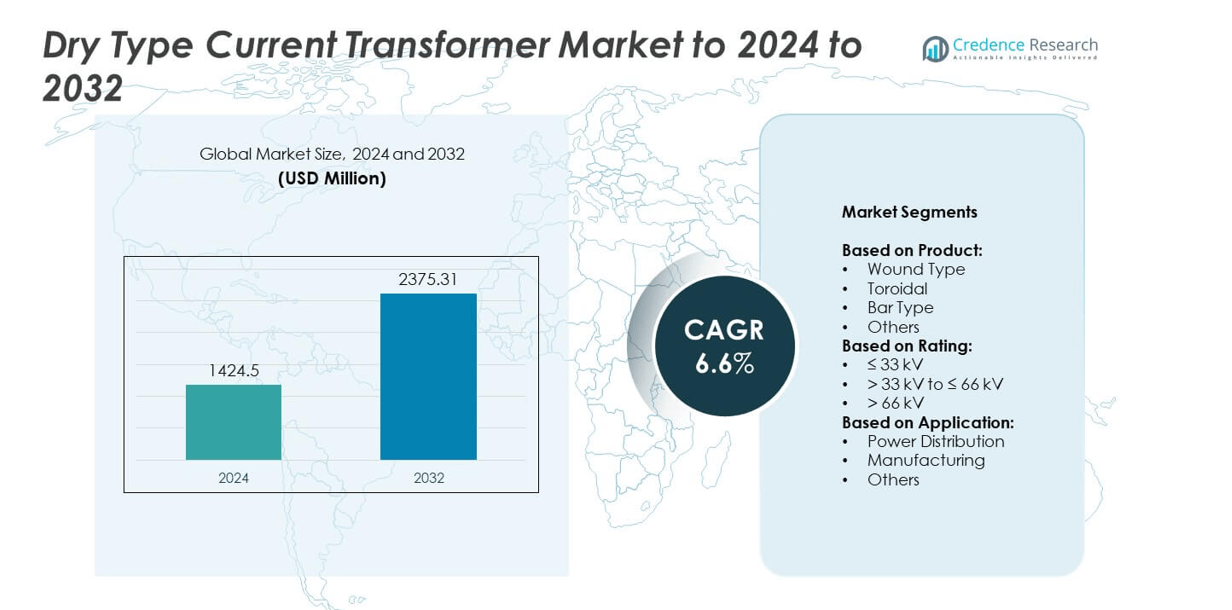

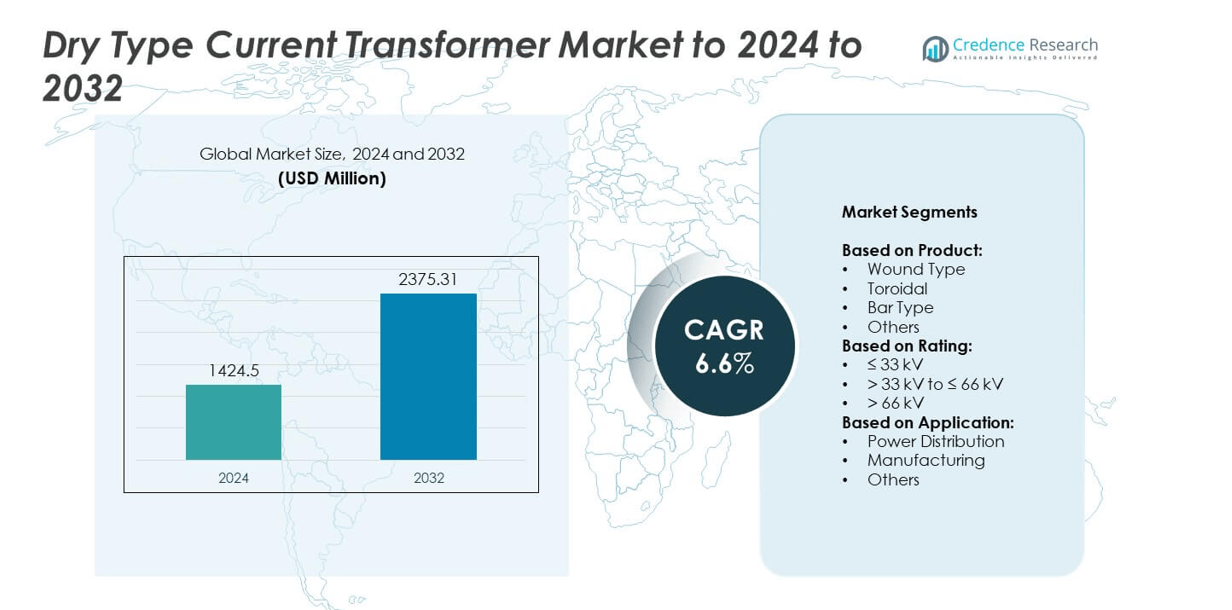

The Dry Type Current Transformer Market size was valued at USD 1,424.5 million in 2024 and is anticipated to reach USD 2,375.31 million by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Type Current Transformer Market Size 2024 |

USD 1,424.5 million |

| Dry Type Current Transformer Market, CAGR |

6.6% |

| Dry Type Current Transformer Market Size 2032 |

USD 2,375.31 million |

The Dry Type Current Transformer Market is led by major players such as Siemens Energy, Hitachi Energy, ABB, General Electric, ARTECHE, CG Power, Automatic Electric, Dalian Huayi Electric Power Electric Appliances, Amran, Guangdong Sihui Instrument Transformer Works, Instrument Transformers, Macroplast, Peak Demand, TWB, and Wenzhou Unisun Electric. These companies focus on innovation in insulation materials, compact designs, and smart monitoring technologies to enhance efficiency and reliability. Strategic initiatives such as capacity expansion, partnerships, and product customization for renewable and smart grid applications strengthen their market presence. North America dominated the global market in 2024 with a 34% share, driven by grid modernization programs, strong renewable energy adoption, and safety regulations. Europe followed with 28%, supported by sustainable energy projects and modernization of power infrastructure, while Asia-Pacific accounted for 25%, reflecting rapid industrialization and expansion of manufacturing and distribution networks.

Market Insights

- The Dry Type Current Transformer Market was valued at USD 1,424.5 million in 2024 and is projected to reach USD 2,375.31 million by 2032, growing at a CAGR of 6.6%.

• Growing demand for smart grid modernization and renewable integration is driving market expansion, supported by eco-friendly and fire-safe transformer designs.

• Integration of IoT-based monitoring systems and compact dry-type designs for urban installations are emerging as key market trends enhancing operational reliability.

• The market is moderately consolidated, with global and regional players focusing on innovation, product customization, and digital monitoring solutions to strengthen competitiveness.

• North America led the market with a 34% share in 2024, followed by Europe with 28% and Asia-Pacific with 25%; by product, the wound-type segment dominated with 42% of total share, driven by its accuracy and reliability in industrial and utility applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The wound-type segment dominated the dry type current transformer market in 2024, accounting for around 42% of the total share. Its dominance stems from widespread adoption in medium-voltage applications due to higher measurement accuracy and insulation reliability. These transformers are preferred for industrial and utility substations where precise current sensing is critical for system protection and monitoring. Meanwhile, toroidal and bar-type transformers are gaining ground in compact installations and smart grid infrastructure, supported by their low maintenance needs and cost efficiency in renewable and distribution applications.

- For instance, RITZ’s GIFS 36-55 CT offers various ratings based on the current ratio. For a ratio of 200:5 A, it is listed with an IEEE metering class of 0.3B-0.9, a relay class of C100, and a rating factor of 3.0.

By Rating

The ≤33 kV segment held the largest market share of about 47% in 2024, driven by strong demand in low- and medium-voltage distribution networks. The rising number of urban grid extensions and commercial installations has boosted the use of ≤33 kV dry type transformers for metering and protection. These systems offer compact design, fire safety, and operational stability. Growth in the >33 kV to ≤66 kV segment is supported by renewable power integration and substation upgrades requiring enhanced insulation performance and reduced dielectric losses.

- For instance, Socomec’s ACCUline CT-O split-core range covers 5–4800 A and offers IEC 61869-2 class 0.2S options.

By Application

The power distribution segment led the dry type current transformer market with a share of nearly 55% in 2024. This dominance is fueled by rapid grid modernization and expansion of smart distribution networks across urban and semi-urban regions. Utilities prefer dry type transformers for their fire-resistant design, minimal maintenance, and suitability for indoor installations. The manufacturing segment also shows steady growth, driven by industrial automation and energy efficiency needs in process industries that rely on accurate current measurement for equipment protection and operational control.

Key Growth Drivers

Rising Demand for Smart Grid Modernization

The growing transition toward smart and digital grids is a major driver for the dry type current transformer market. Utilities are increasingly adopting dry-type units for intelligent monitoring and efficient load management in distribution systems. Their compact design, safety, and compatibility with digital relays make them ideal for smart substations. Government initiatives promoting grid automation and renewable integration in regions like North America and Europe further accelerate adoption, ensuring stable demand for accurate current measurement and fault protection solutions.

- For instance, SEL-787 relays accept 1 A or 5 A CT inputs and support restricted-earth-fault schemes used with modern digital substations.

Increasing Focus on Fire-Safe and Eco-Friendly Equipment

Dry type current transformers are gaining traction due to their non-flammable, oil-free insulation systems that minimize environmental risks. Industries and utilities prefer these transformers for indoor and confined installations where fire safety is critical. The global shift toward eco-friendly electrical equipment, supported by stricter environmental and safety regulations, continues to enhance market growth. Adoption is particularly strong in commercial buildings, renewable energy setups, and smart city projects emphasizing sustainable infrastructure development.

- For instance, Eaton’s medium-voltage dry-type portfolio lists primary voltages from 4.76–46 kV and ratings up to 32,000 kVA, aligning with oil-free designs.

Expansion of Renewable Energy Infrastructure

The rapid deployment of solar and wind energy projects worldwide drives strong demand for dry type current transformers. Their ability to withstand harsh environments and provide accurate current measurement makes them essential in renewable substations and inverter stations. Government investments and grid expansion to integrate distributed energy sources further contribute to market growth. Countries in Asia-Pacific and Europe are leading adoption, using dry-type units to ensure stable grid operations and reduce maintenance costs in renewable networks.

Key Trends & Opportunities

Integration of IoT and Digital Monitoring Systems

The integration of IoT-based monitoring systems within dry type current transformers represents a key market trend. Manufacturers are introducing smart transformers with real-time diagnostics, fault detection, and predictive maintenance capabilities. These features enhance operational reliability and reduce downtime in power networks. As digital substations and smart grids expand, the adoption of intelligent dry-type transformers will increase, offering opportunities for automation-focused suppliers and improving lifecycle efficiency across utilities and industrial sectors.

- For instance, Rugged Monitoring’s CPM601-C performs PD measurements in dual-frequency ranges, with HF channels operating across 10 kHz to 100 MHz and UHF channels operating across 300 MHz to 2000 MHz. It is a multi-channel device designed for continuous analytics.

Rising Adoption in Compact and Urban Installations

Urbanization and infrastructure development are fueling demand for compact and low-maintenance electrical systems. Dry type current transformers are ideal for metro projects, commercial complexes, and renewable plants where space and safety are major concerns. Their ability to operate in confined spaces without oil or cooling fluids presents strong opportunities for adoption. Manufacturers are focusing on modular and high-efficiency designs to cater to growing demand in densely populated and industrialized areas worldwide.

- For instance, MBS AG offers a range of low-voltage CT families, including specialized billing transformers with accuracy classes down to 0.2S and protection transformers with classes such as 10P5. Many of these are available in compact form factors suitable for space-constrained panels.

Key Challenges

High Initial Costs and Design Complexity

One major challenge for the dry type current transformer market is its higher upfront cost compared to oil-immersed alternatives. Advanced insulation materials, epoxy casting, and precise design processes increase production expenses. This cost difference often limits adoption among price-sensitive utilities in developing regions. Manufacturers are addressing this through localized production and modular assembly, yet the cost barrier continues to affect competitiveness in large-scale utility installations and replacement projects.

Thermal Limitations in High-Voltage Applications

Dry type transformers face performance limitations at higher voltage levels due to heat dissipation constraints. Their insulation and cooling systems are less effective under extreme load conditions, restricting deployment in ultra-high-voltage transmission networks. This creates a technological challenge as grid capacities expand globally. Research into advanced resin materials and hybrid insulation systems aims to overcome this issue, but scalability and reliability under continuous high-load operation remain key technical hurdles.

Regional Analysis

North America

North America held the largest share of about 34% in the dry type current transformer market in 2024. The region’s growth is driven by modernization of electrical grids, expansion of renewable energy projects, and rising demand for energy-efficient power equipment. The United States leads adoption due to strong investments in smart grid infrastructure and industrial automation. Increasing safety regulations and replacement of aging oil-immersed transformers also support regional growth. Canada’s focus on sustainable energy distribution and resilient transmission systems further strengthens North America’s position in the global market.

Europe

Europe accounted for around 28% of the dry type current transformer market share in 2024. The region benefits from ongoing renewable integration, especially in wind and solar energy projects. Countries such as Germany, France, and the UK are adopting dry type transformers in smart substations and indoor installations due to their low maintenance and fire-safe design. The European Union’s focus on sustainable electrical infrastructure and decarbonization targets has accelerated market penetration. Industrial automation and refurbishment of medium-voltage networks continue to drive steady demand across major economies.

Asia-Pacific

Asia-Pacific captured nearly 25% of the global dry type current transformer market in 2024. The region’s growth is fueled by rapid industrialization, urban infrastructure development, and large-scale renewable projects across China, India, Japan, and South Korea. Rising investments in grid reliability and expansion of manufacturing facilities contribute to higher transformer adoption. Government programs supporting smart grids and electrification of remote areas are further boosting demand. Strong domestic production capabilities in China and India also enhance regional supply chain resilience, making Asia-Pacific a key growth hub in the global market.

Latin America

Latin America accounted for approximately 8% of the dry type current transformer market in 2024. The region’s demand is supported by expanding power distribution networks and renewable energy integration, particularly in Brazil, Mexico, and Chile. Infrastructure development projects and government initiatives promoting electrical safety and sustainability are enhancing market penetration. While economic fluctuations limit large-scale investments, the shift toward low-maintenance and environmentally safe transformers is gaining traction. Local manufacturers are gradually expanding capacity to meet growing demand for compact and efficient power distribution equipment.

Middle East & Africa

The Middle East & Africa region held around 5% of the global dry type current transformer market share in 2024. Growth is primarily driven by utility expansion, smart grid projects, and renewable power investments in the Gulf countries and South Africa. The rising adoption of dry type transformers in oil and gas plants, urban developments, and industrial facilities supports market growth. However, limited manufacturing infrastructure and high import dependence remain challenges. Ongoing diversification toward non-oil sectors and increasing demand for fire-safe indoor transformers are expected to drive gradual regional expansion.

Market Segmentations:

By Product:

- Wound Type

- Toroidal

- Bar Type

- Others

By Rating:

- ≤ 33 kV

- > 33 kV to ≤ 66 kV

- > 66 kV

By Application:

- Power Distribution

- Manufacturing

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Dry Type Current Transformer market is characterized by strong competition among key players such as Siemens Energy, Hitachi Energy, ABB, General Electric, ARTECHE, CG Power, Automatic Electric, Dalian Huayi Electric Power Electric Appliances, Amran, Guangdong Sihui Instrument Transformer Works, Instrument Transformers, Macroplast, Peak Demand, TWB, and Wenzhou Unisun Electric. Companies are investing in advanced insulation materials, compact design improvements, and digital monitoring features to enhance performance and reliability. Strategic alliances, capacity expansion, and product customization for smart grid and renewable power integration are key focus areas. Firms also emphasize compliance with IEC and ANSI standards to meet utility and industrial safety requirements. Regional manufacturers are strengthening local supply chains and offering cost-efficient solutions to compete with global brands. The market’s consolidation trend reflects a balance between innovation, pricing efficiency, and expanding footprints across high-growth emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- Hitachi Energy

- ABB

- General Electric

- ARTECHE

- CG Power

- Automatic Electric

- Dalian Huayi Electric Power Electric Appliances

- Amran

- Guangdong Sihui Instrument Transformer Works

- Instrument Transformers

- Macroplast

- Peak Demand

- TWB

- Wenzhou Unisun Electric

Recent Developments

- In 2024, ABB partnered with Danish startup Oktogrid to launch the ABB Ability™ Asset Manager for Transformers (TRAFCOM), a digital sensor solution that enables real-time monitoring of transformers

- In 2023, Siemens unveiled the SENTRON PAC dry-type transformer series in November, expanding its power ratings and improving efficiency for industrial applications.

- In 2023, CG Power approved a capacity expansion of power transformers at its Malanpur unit in Madhya Pradesh, increasing capacity from 25,000 MVA to 35,000 MVA with an investment of ₹31 crore.

Report Coverage

The research report offers an in-depth analysis based on Product, Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as utilities modernize power distribution infrastructure worldwide.

- Adoption will rise in renewable energy projects due to safety and low-maintenance needs.

- Smart grid implementation will boost demand for intelligent and IoT-enabled transformer systems.

- Manufacturers will focus on compact, modular, and energy-efficient transformer designs.

- Asia-Pacific will emerge as the fastest-growing region driven by industrialization and urban expansion.

- Fire-safe and eco-friendly insulation materials will gain wider acceptance across industries.

- Digital monitoring and predictive maintenance technologies will become standard features.

- Partnerships between utilities and technology providers will enhance innovation in grid automation.

- Upgrading aging electrical infrastructure in developed economies will sustain steady replacement demand.

- Increased regulatory emphasis on safety and sustainability will further strengthen long-term market growth.