Market Overview

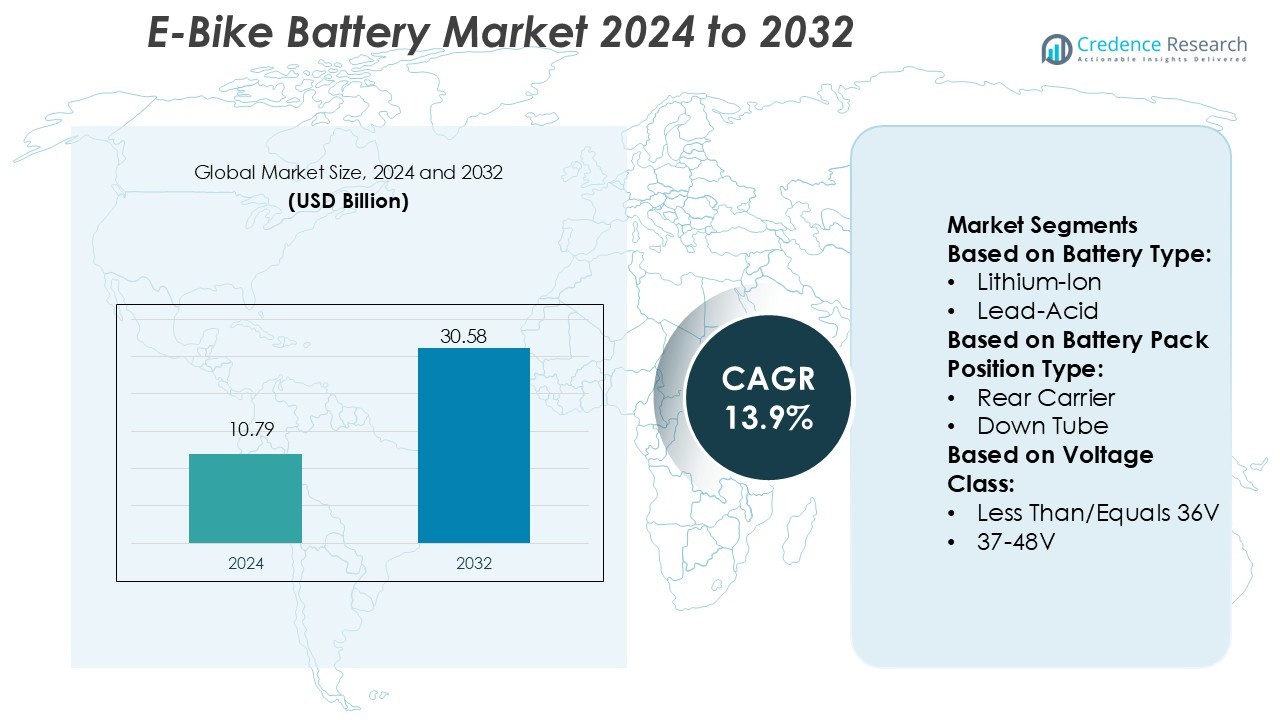

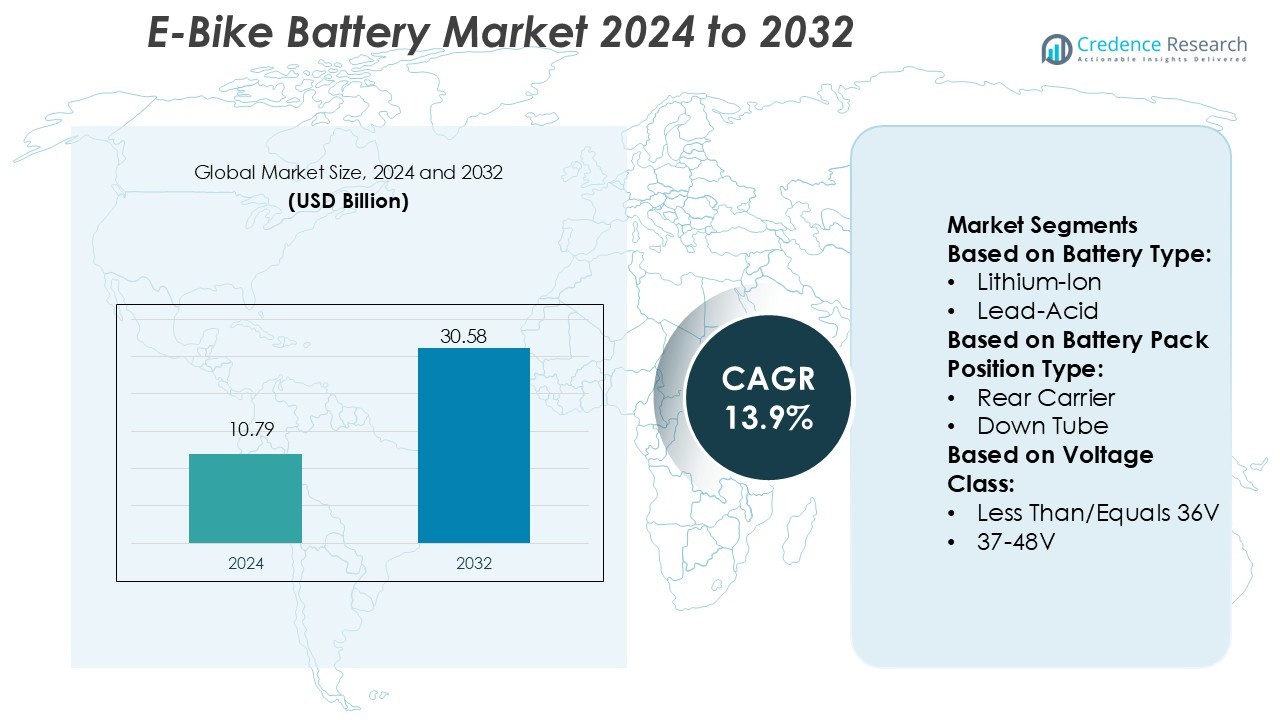

E-Bike Battery Market size was valued USD 10.79 billion in 2024 and is anticipated to reach USD 30.58 billion by 2032, at a CAGR of 13.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-Bike Battery Market Size 2024 |

USD 10.79 Billion |

| E-Bike Battery Market, CAGR |

13.9% |

| E-Bike Battery Market Size 2032 |

USD 30.58 Billion |

The E-Bike Battery Market features strong competition among leading manufacturers focused on innovation, efficiency, and sustainability. Key players such as EXIDE INDUSTRIES LTD., Discover Battery, BYD Co. Ltd, EnerSys, CROWN BATTERY, Clarios, Duracell, East Penn Manufacturing, BSLBATT USA, and A123 Systems emphasize advanced lithium-ion and LFP battery technologies. These companies invest in research to improve battery energy density, lifecycle, and safety performance. Strategic alliances with e-bike OEMs and investments in recycling infrastructure strengthen their market positions. Europe leads the global market with 38% share, driven by strict emission regulations, consumer adoption of e-mobility, and strong government incentives supporting battery innovation and production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The E-Bike Battery Market size was valued at USD 10.79 billion in 2024 and is projected to reach USD 30.58 billion by 2032, growing at a CAGR of 13.9%.

- Rising demand for clean mobility and long-range e-bikes drives the adoption of high-density lithium-ion and LFP batteries.

- Smart and modular battery technologies are emerging as key trends, offering faster charging, enhanced safety, and improved design flexibility.

- The market is competitive, with key players focusing on R&D and strategic partnerships to develop advanced battery management systems and recycling solutions.

- Europe holds the largest regional share of 38%, followed by Asia-Pacific with 30%, while lithium-ion batteries dominate product segmentation with more than 75% market share, supported by strong regulatory support and growing consumer preference for efficient, eco-friendly mobility solutions.

Market Segmentation Analysis:

By Battery Type

Lithium-ion batteries dominate the E-Bike Battery Market with over 78% share in 2024. Their higher energy density, lighter weight, and longer cycle life compared to lead-acid batteries make them the preferred choice for manufacturers and consumers. Improved charging efficiency and reduced maintenance further strengthen adoption across commuter and performance e-bikes. The shift toward sustainable, high-capacity battery chemistries like NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate) also supports lithium-ion’s continued leadership as brands focus on extended range and faster charging capabilities.

- For instance, EXIDE INDUSTRIES LTD.’s Li-Ion range offers a cycle life of more than 2,000 charge cycles, and weighs up to 80 % less than equivalent lead-acid units, enabling faster acceleration and better performance.

By Battery Pack Position Type

The down tube segment leads the market with approximately 62% share, driven by its balanced weight distribution and aerodynamic design advantages. Down tube-mounted batteries enhance stability and center of gravity, improving riding comfort and control. Manufacturers are integrating sleek, removable battery modules within the bike frame to offer aesthetic appeal and security. Rear carrier batteries follow, serving urban and foldable e-bikes, while integrated frame designs are gaining momentum in premium models due to improved protection and compact form factors.

- For instance, Discover Battery’s “Lithium BLUE” LiFePO₄ series features a 12.8 V, 100 Ah unit with real-time Bluetooth monitoring, and supports up to 25% faster 0 %–100 % state-of-charge recharging compared to typical lead-acid analogs.

By Voltage Class

The 37–48V segment holds around 54% share of the E-Bike Battery Market, favored for delivering optimal power-to-weight ratios suited for both commuter and mountain e-bikes. These batteries support higher torque and longer riding ranges without significant weight increase. The growing demand for mid-drive motors and performance-focused bikes fuels this segment’s expansion. Batteries below or equal to 36V remain popular in entry-level and city e-bikes, while high-voltage configurations above 48V are emerging in premium and cargo models to enhance acceleration and load-carrying efficiency.

Key Growth Drivers

- Rising Urbanization and E-Mobility Adoption

Increasing urban congestion and demand for sustainable transportation drive e-bike battery adoption. Cities are encouraging electric mobility through incentives and infrastructure development. Consumers prefer e-bikes for short-distance commuting, reducing dependence on fossil fuels. Battery makers focus on improving range, weight, and durability to meet daily use needs. The growing presence of shared e-bike fleets in Europe and Asia-Pacific further fuels lithium-ion battery demand due to their superior energy density and fast charging capabilities.

- For instance, BYD’s latest thick-blade cell architecture supports more than 3,000 cycles for EV applications and is designed with safety features such as a fire-resistant casing that, in its commercial and industrial energy storage systems, is rated for 2 hours of aerosol suppression.

- Advancements in Battery Technology

Continuous innovation in lithium-ion chemistry and energy management systems drives market expansion. Manufacturers are adopting high-performance cells such as NMC and LFP, providing longer lifespans and enhanced safety. Solid-state battery research promises increased range and reduced charging time. Integration of smart battery management systems (BMS) improves thermal regulation and real-time performance monitoring. These technological improvements make e-bikes more efficient, reliable, and cost-effective, encouraging mass adoption across recreational and commercial segments.

- For instance, EnerSys, Inc. has embedded advanced monitoring technology into its DataSafe® TPPL batteries, enabling real-time tracking of voltage and temperature parameters across 260 individual units deployed at a data centre.

- Government Incentives and Clean Energy Policies

Government-backed subsidies and policies promoting electric mobility significantly boost market growth. Incentive programs for e-bike purchases in countries like Germany, France, and China reduce upfront costs for consumers. Infrastructure investments such as charging stations and renewable energy integration support broader battery adoption. Stricter emission norms push automakers and component suppliers toward greener alternatives. These supportive measures create a favorable ecosystem for battery manufacturers to scale production and expand distribution networks globally.

Key Trends & Opportunities

- Growth of Swappable and Modular Battery Systems

Battery swapping technology is emerging as a key trend, improving user convenience and reducing downtime. Modular battery designs allow users to expand capacity or replace damaged cells easily. Startups and OEMs are collaborating to standardize battery interfaces, enabling cross-brand compatibility. This flexibility attracts delivery and ride-sharing operators that demand quick turnaround times. Modular designs also reduce maintenance costs, enhancing the appeal of e-bikes in densely populated regions with heavy daily usage.

- For instance, Crown Battery CR‑330 Deep‑Cycle Battery features a proprietary Cast-On-Strap (COS) robotic welding process that provides 3,960 fine-control adjustments compared to conventional welding techniques, reducing electrical resistance and enhancing lifecycle durability.

- Integration of Smart and Connected Battery Solutions

The integration of IoT-enabled smart battery systems presents major opportunities. Advanced sensors and AI-driven analytics monitor health, charging cycles, and temperature. These features improve safety and extend battery life. Manufacturers are launching connected apps that offer real-time range estimation and predictive maintenance alerts. This connectivity enhances user experience and aligns with the growing trend toward smart mobility ecosystems, particularly in Europe and North America.

- For instance, Duracell recently introduced a lithium-coin battery range (sizes CR2032, CR2025 and CR2016) featuring a non-toxic bitter coating and child-resistant double-blister packaging. The company guarantees these cells up to 10 years in-storage under conditions of 10 °C to 25 °C.

- Expansion of High-Voltage Batteries for Performance Models

The adoption of high-voltage batteries exceeding 48V is gaining traction in performance e-bikes. These batteries provide greater acceleration and climbing power, appealing to mountain and cargo bike users. Manufacturers are optimizing cell density and cooling systems to support high discharge rates. As demand for premium e-bikes increases, brands are introducing advanced 52V and 60V systems that deliver longer ranges and reduced heat generation, expanding opportunities for high-performance models.

Key Challenges

- High Production and Material Costs

The rising cost of critical raw materials such as lithium, nickel, and cobalt poses challenges for manufacturers. Supply chain disruptions and mining limitations impact price stability. This cost pressure affects profit margins, especially for small-scale producers. Companies are exploring recycling programs and alternative chemistries like sodium-ion to mitigate costs. However, large-scale transition requires time and investment, slowing affordability improvements in the short term.

- Safety and Regulatory Compliance Issues

Thermal runaway risks and battery-related fire incidents have raised safety concerns. Ensuring consistent quality across manufacturers remains a challenge due to varying standards. Governments are enforcing stricter certification and transport regulations for e-bike batteries. Manufacturers must invest in advanced thermal management, fireproof casing, and BMS software upgrades to comply with evolving norms. Maintaining safety without compromising energy density continues to be a critical hurdle in scaling e-bike battery production.

Regional Analysis

North America

North America accounts for nearly 22% of the global e-bike battery market share, driven by rising adoption in the U.S. and Canada. Urban mobility programs, environmental awareness, and growing investments in cycling infrastructure support this growth. Lithium-ion batteries dominate due to their lightweight design and efficiency in commuter e-bikes. Leading manufacturers focus on partnerships with local e-bike brands to meet safety and performance regulations. Expanding government incentives and demand for premium e-bikes with higher voltage systems further enhance regional market penetration and technological development.

Europe

Europe holds the largest share of approximately 38% in the e-bike battery market, led by strong demand in Germany, the Netherlands, and France. The region’s mature cycling culture, coupled with stringent emission norms, accelerates e-bike adoption. European Union initiatives promoting green mobility and subsidies for electric two-wheelers have boosted lithium-ion battery integration. Leading OEMs are investing in solid-state and modular battery technologies to enhance energy efficiency. The presence of established players and supportive regulations positions Europe as the hub for innovation and large-scale e-bike battery production.

Asia-Pacific

Asia-Pacific captures about 30% of the e-bike battery market share, with China, Japan, and India leading consumption. China remains the global leader in e-bike manufacturing and battery exports, supported by robust local supply chains and government incentives. The region’s preference for low-cost and high-performance lithium-ion and lead-acid batteries sustains steady demand. Rapid urbanization, affordable mobility solutions, and advances in battery recycling drive market expansion. Increasing investment from domestic players in next-generation chemistries like LFP and sodium-ion batteries strengthens Asia-Pacific’s long-term dominance in production and innovation.

Latin America

Latin America represents around 6% of the e-bike battery market, with Brazil and Mexico emerging as key growth areas. Economic recovery and growing environmental awareness encourage the shift toward electric mobility. Consumers increasingly adopt e-bikes for urban commuting and delivery services. Lithium-ion batteries dominate due to their better durability in tropical climates and reduced maintenance. Government support through clean transportation policies and rising imports of advanced battery packs from Asian suppliers are likely to boost regional demand over the next few years.

Middle East & Africa

The Middle East & Africa account for nearly 4% of the global e-bike battery market share, driven by growing electrification efforts in South Africa, the UAE, and Israel. The adoption rate remains slower due to limited infrastructure and high battery costs. However, pilot projects and smart city initiatives in the Gulf region are creating new opportunities. Lithium-ion batteries lead deployments due to their adaptability in high-temperature environments. Increasing tourism-based e-mobility and investments in renewable energy integration position the region for gradual but steady growth.

Market Segmentations:

By Battery Type:

By Battery Pack Position Type:

By Voltage Class:

- Less Than/Equals 36V

- 37-48V

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The E-Bike Battery Market is moderately consolidated, with key players including EXIDE INDUSTRIES LTD., Discover Battery, BYD Co. Ltd, EnerSys, Inc., CROWN BATTERY, Clarios, LLC, Duracell Inc., East Penn Manufacturing Co., BSLBATT USA, and A123 Systems, LLC. The E-Bike Battery Market is characterized by strong technological innovation, growing production capacity, and rising strategic collaborations among global manufacturers. Companies are investing heavily in R&D to improve battery energy density, reduce charging time, and enhance thermal stability. The focus has shifted toward lithium-ion and LFP chemistries, given their superior lifecycle and safety features. Automation and digital monitoring are reshaping production lines to ensure efficiency and consistency. Manufacturers are also strengthening supply chains by establishing regional assembly units to mitigate logistics costs. In addition, sustainability initiatives, including battery recycling and second-life usage programs, are becoming central to competitive differentiation in this evolving market.

Key Player Analysis

- EXIDE INDUSTRIES LTD.

- Discover Battery

- BYD Co. Ltd

- EnerSys, Inc.

- CROWN BATTERY

- Clarios, LLC

- Duracell Inc.

- East Penn Manufacturing Co.

- BSLBATT USA

- A123 Systems, LLC

Recent Developments

- In May 2025, Vivo launched the V50 Elite edition with a snapdragon processor, a 6000 mAh battery, and bundled earbuds in India. The brand provides 3 years of OS updates and 4 years of security support.

- In May 2025, NHOA Energy, a global provider of large-scale energy storage systems, started the construction of a 400 megawatt-hour battery energy storage system (BESS) in Kallo, Beveren, Belgium, in partnership with ENGIE.

- In December 2024, LG Energy Solution of South Korea is in talks with India’s JSW Energy to form a joint venture for battery manufacturing, with a projected investment exceeding.The partnership is intended to produce batteries for electric vehicles and renewable energy storage, with plans for a 10-gigawatt-hour (GWh) plant in India.

- In April 2024, Shenzhen Yongxinlong New Energy Technology Co., Ltd. launched new lithium-ion batteries for electric vehicles, which offer high-rate discharge performance. The battery’s capacity is defined as the cell’s discharge capacity, specifically measured using a discharge current of and a cutoff voltage of after a standard charge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Battery Pack Position Type, Voltage Class and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward high-energy-density lithium-ion and solid-state batteries.

- Manufacturers will focus on extending battery life cycles beyond 1,500 charge cycles for greater durability.

- Smart battery management systems will become standard, enhancing performance monitoring and safety.

- Recycling and second-life programs will gain importance to reduce dependency on raw materials.

- Modular and swappable battery designs will expand in shared mobility and delivery fleet applications.

- Integration of AI-based predictive maintenance will optimize charging efficiency and prevent failures.

- Governments will strengthen regulations and incentives supporting electric mobility adoption.

- High-voltage battery systems above 48V will dominate premium and performance e-bike segments.

- Regional manufacturing hubs will rise in Europe and Asia to reduce import dependency.

- Partnerships between battery makers and e-bike OEMs will accelerate innovation and market expansion.