| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| EDA Tools MarketSize 2024 |

USD 18,349.53 million |

| EDA Tools Market, CAGR |

8.83% |

| EDA Tools Market Size 2032 |

USD 37,880.97 million |

Market Overview

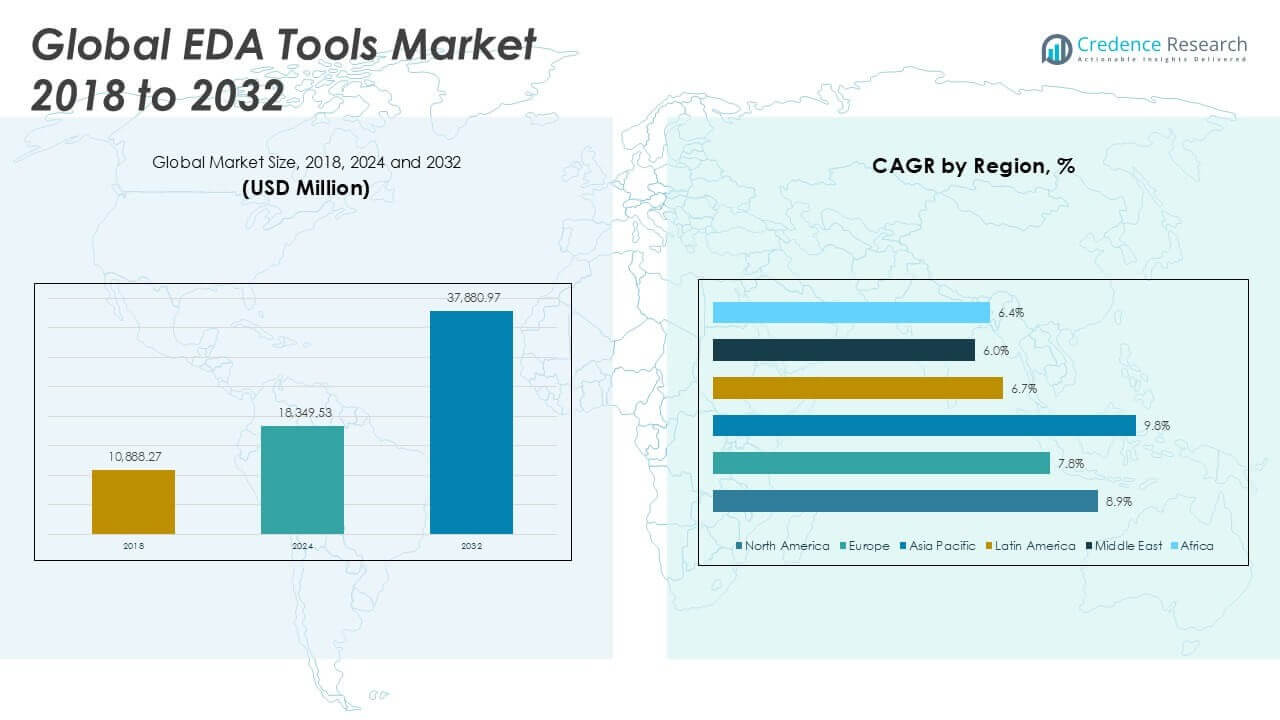

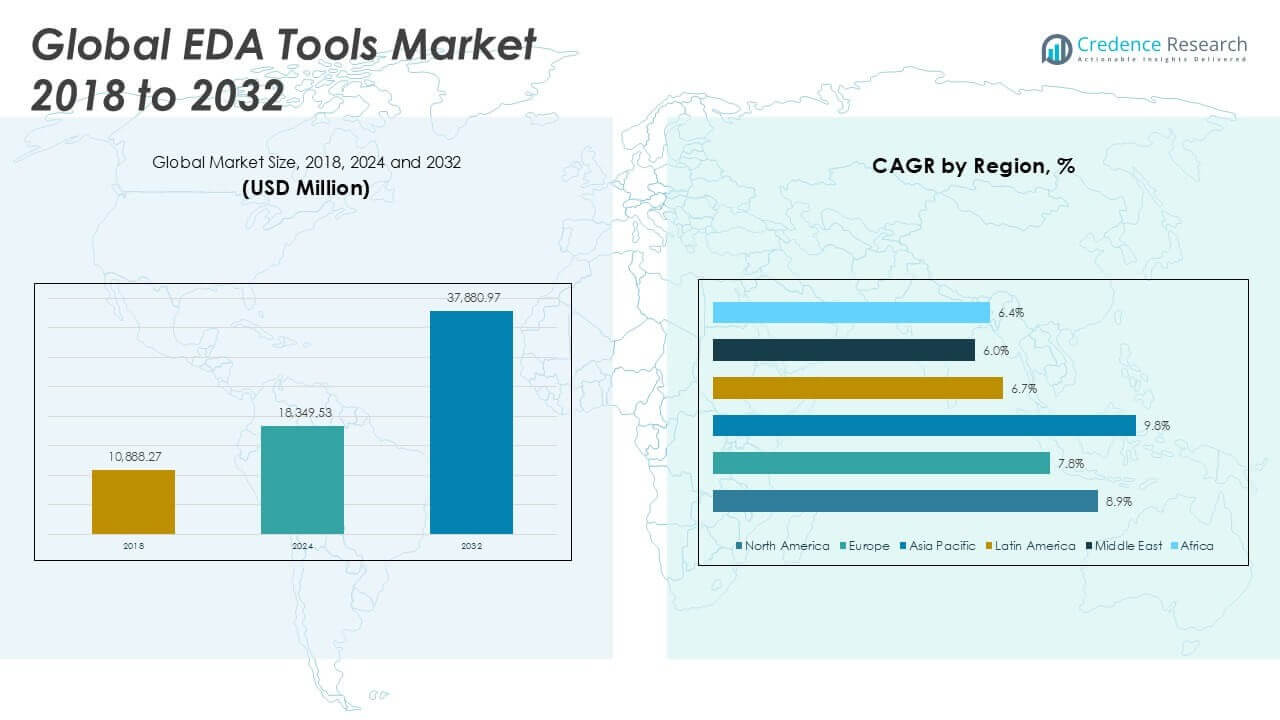

EDA Tools Market size was valued at USD 10,888.27 million in 2018 to USD 18,349.53 million in 2024 and is anticipated to reach USD 37,880.97 million by 2032, at a CAGR of 8.83% during the forecast period.

The EDA Tools market is experiencing robust growth driven by the accelerating complexity of semiconductor designs, rising demand for advanced consumer electronics, and the rapid adoption of technologies such as AI, IoT, and 5G. Organizations increasingly rely on sophisticated EDA solutions to streamline design workflows, reduce time-to-market, and ensure higher chip performance and reliability. The ongoing miniaturization of integrated circuits and the push for energy-efficient devices further amplify the need for innovative design automation tools. Market trends include the integration of cloud-based platforms, enabling scalable collaboration and remote access, as well as the incorporation of machine learning algorithms to enhance simulation accuracy and productivity. Strategic partnerships between EDA vendors and semiconductor foundries, along with continued investment in R&D, are fostering the development of next-generation solutions that address the evolving requirements of the electronics industry, positioning the EDA Tools market for sustained expansion.

The EDA Tools Market demonstrates strong geographical diversity, with significant growth observed across North America, Europe, and Asia Pacific. North America leads innovation through established semiconductor hubs and the presence of leading technology firms, while Europe drives adoption with its advanced automotive and industrial sectors. Asia Pacific stands out for its large-scale electronics manufacturing and rapid adoption of emerging technologies in countries like China, Japan, and South Korea. These regions benefit from government support, robust infrastructure, and the expansion of R&D initiatives. Key players shaping the competitive landscape include Synopsys Inc., known for its comprehensive suite of design automation solutions; Cadence Design Systems Inc., which excels in advanced simulation and verification tools; and Mentor Graphic Corporation (Siemens PLM Software), recognized for its expertise in electronic hardware and embedded software design. These companies invest heavily in innovation, partnerships, and global expansion, ensuring the EDA Tools Market remains dynamic and forward-looking.

Market Insights

- The EDA Tools Market was valued at USD 18,349.53 million in 2024 and is projected to reach USD 37,880.97 million by 2032, with a CAGR of 8.83%.

- The market experiences strong growth due to increasing complexity in semiconductor designs and rising demand for advanced electronics across industries.

- Integration of artificial intelligence and cloud-based platforms is transforming design workflows, enabling smarter automation and enhanced collaboration.

- Key players such as Synopsys Inc., Cadence Design Systems Inc., and Mentor Graphic Corporation (Siemens PLM Software) maintain a competitive edge through continuous R&D investment and strategic global partnerships.

- High software costs, steep learning curves, and the need for specialized engineering talent act as restraints, making adoption challenging for smaller enterprises.

- North America leads innovation with strong R&D infrastructure, while Asia Pacific drives market expansion through large-scale electronics manufacturing and rapid adoption of emerging technologies in China, Japan, and South Korea.

- The market shows robust momentum as companies prioritize digital transformation, expanding applications in consumer electronics, automotive, industrial, and communication sectors.

Market Drivers

Rising Complexity in Semiconductor Design Accelerates the Need for Advanced EDA Solutions

The increasing intricacy of semiconductor design fuels demand for sophisticated EDA Tools. Chip manufacturers require more powerful tools to manage the integration of billions of transistors and intricate architectures on a single chip. The evolution of technologies such as FinFET, 3D ICs, and system-on-chip (SoC) solutions puts significant pressure on design teams to achieve accuracy and reliability. EDA Tools Market addresses these challenges by providing comprehensive simulation, verification, and layout capabilities that support next-generation device development. It plays a crucial role in enabling design teams to optimize workflows and maintain competitive timelines. Design rule complexities and shorter product life cycles further amplify the necessity for effective automation.

- For instance, increasing complexity and miniaturization of ICs are fueling the demand for advanced electronic design automation (EDA) tools, as chip manufacturers strive to meet the demand for high-performance computing and energy-efficient electronics.

Growth in Consumer Electronics and IoT Devices Expands EDA Tool Applications

The proliferation of consumer electronics and the explosive adoption of IoT devices worldwide drive growth for the EDA Tools Market. Consumer demand for smarter, smaller, and more energy-efficient devices has led to a rapid increase in electronic component integration. The market responds to these needs by offering design automation solutions that facilitate innovation across smartphones, wearables, smart home products, and connected vehicles. It ensures designers can meet the expectations of speed, performance, and cost in competitive consumer markets. Enhanced demand for wireless connectivity, sensors, and embedded systems increases the relevance and utility of EDA platforms. The expanding use of electronics in everyday life reinforces the critical role of design automation.

- For instance, the demand for faster and more reliable electronic products necessitates robust circuit design and simulation capabilities, ensuring designers can meet expectations of speed, performance, and cost.

Emergence of Artificial Intelligence and 5G Technologies Strengthens Market Demand

The adoption of AI, machine learning, and 5G technologies accelerates the requirements for advanced design automation tools. Companies in the semiconductor industry face mounting pressure to deliver high-performance, low-latency chips that support AI processing and 5G infrastructure. The EDA Tools Market supports these developments by enabling faster prototyping, more accurate simulation, and robust validation of complex integrated circuits. It fosters collaboration across geographically dispersed teams, ensuring effective design verification and time-to-market advantages. Industry shifts toward autonomous vehicles, smart factories, and edge computing applications intensify the need for reliable and scalable EDA solutions. Investments in R&D keep pace with rapid technological advancement.

Strategic Collaborations and Cloud-Based Solutions Drive Market Evolution

Collaboration between EDA vendors, semiconductor foundries, and IP providers shapes the competitive landscape and technological capabilities within the market. The move toward cloud-based EDA platforms allows design teams to scale resources and improve accessibility, enhancing productivity across organizations. It provides secure environments for global teams to collaborate in real time, reducing development bottlenecks. Integration of artificial intelligence within EDA solutions delivers smarter automation, predictive analysis, and higher efficiency throughout the design process. The industry’s emphasis on partnerships, ecosystem development, and innovation continues to propel growth in the EDA Tools Market. These factors combine to ensure sustained progress and meet the evolving requirements of electronic system designers.

Market Trends

Adoption of Cloud-Based Platforms Reshapes EDA Tools Utilization

Cloud-based deployment stands out as a significant trend in the EDA Tools Market. Organizations seek scalable, secure, and flexible design environments that support global collaboration and remote access. The move to the cloud allows design teams to accelerate project timelines and streamline workflows, providing instant access to computing resources and storage without heavy on-premise investment. It reduces capital expenditure while ensuring continuous software updates and enhanced security features. This shift creates new opportunities for smaller companies to access high-end EDA capabilities and participate in complex semiconductor projects. The industry recognizes cloud-based solutions as a catalyst for innovation and efficiency across electronic design processes.

- For instance, cloud-based EDA adoption rose in 2023, enabling engineers to tap into EDA tools, compute resources, and storage options when needed.

Integration of Artificial Intelligence and Machine Learning Enhances Design Automation

Artificial intelligence and machine learning are transforming traditional EDA workflows by enabling smarter automation and predictive design capabilities. The EDA Tools Market integrates AI algorithms to analyze vast datasets, identify design bottlenecks, and recommend process improvements. It uses machine learning models to enhance simulation accuracy, optimize power consumption, and detect design anomalies early. Design teams can leverage these capabilities to boost productivity, reduce errors, and manage complex multi-dimensional design rules more effectively. The growing demand for faster time-to-market encourages further investment in AI-driven tools. EDA platforms now provide greater support for self-learning and adaptive design automation.

- For instance, AI-driven placement algorithms have achieved notable improvements, reducing wire length by up to 10%.

Expansion of System-Level Design and IP Reuse Gains Momentum

The trend toward system-level design and increased intellectual property (IP) reuse drives efficiency in semiconductor development. Companies in the EDA Tools Market focus on providing solutions that support higher abstraction levels, enabling designers to integrate diverse functions on a single chip more rapidly. It facilitates reuse of pre-verified IP blocks, shortening design cycles and minimizing risks. Growing system complexity pushes organizations to adopt methodologies that ensure interoperability between hardware and software. The emphasis on system-level verification and design streamlines product development for IoT, automotive, and data center applications. IP-centric workflows improve consistency and lower development costs across projects.

Emphasis on Security, Compliance, and Sustainability Shapes Product Roadmaps

Security, regulatory compliance, and environmental sustainability have become central to product development in the EDA Tools Market. Organizations prioritize secure design practices to safeguard intellectual property and protect against cyber threats during collaborative design. It reflects a heightened focus on meeting global standards for electronic safety and data integrity. Compliance requirements across industries drive adoption of tools that support traceability and auditability throughout the design process. The market also witnesses growing demand for sustainable design practices, such as power-aware and resource-efficient development. These evolving priorities are influencing the future direction and competitive dynamics of EDA tool providers.

Market Challenges Analysis

High Costs and Complexity Limit Adoption Across Smaller Enterprises

The cost and complexity of EDA solutions present major barriers for small and medium-sized enterprises. The EDA Tools Market demands significant investment in software licenses, hardware infrastructure, and specialized training. It can be difficult for organizations with limited resources to justify or sustain these expenses, especially given rapid technological change. Complex design flows and steep learning curves often require dedicated engineering talent, which further increases operational costs. Smaller enterprises may struggle to compete with larger players who can afford cutting-edge tools and continuous upgrades. The high barrier to entry slows the democratization of advanced electronic design technologies.

- For instance, high implementation costs and integration challenges are slowing adoption among smaller firms.

Rapid Technological Advancements and Evolving Standards Challenge Market Players

The fast pace of innovation in the semiconductor sector forces companies to update and adapt EDA tools constantly. The EDA Tools Market faces pressure to keep up with new process nodes, emerging device architectures, and evolving industry standards. It places a burden on vendors to invest heavily in research and development, ensuring compatibility with the latest manufacturing processes and technologies. Frequent changes in customer requirements and regulatory frameworks further complicate product development cycles. The need for seamless integration across diverse platforms and ecosystems introduces additional technical challenges. These dynamics make it challenging for market participants to deliver consistent, future-proof solutions.

Market Opportunities

Expansion into Emerging Technologies and New Application Areas Unlocks Growth

The evolution of emerging technologies such as artificial intelligence, 5G, and quantum computing creates significant opportunities for the EDA Tools Market. Organizations require advanced design automation to support complex chip architectures and ensure performance in AI accelerators, high-frequency RF devices, and next-generation processors. The market can extend its reach by offering specialized solutions for verticals such as automotive, healthcare, and industrial automation, where electronics innovation accelerates demand. It benefits from increased investment in sectors like electric vehicles and autonomous systems, where design complexity and reliability standards continue to rise. The integration of EDA tools into these high-growth segments expands revenue streams and enhances the value proposition for solution providers. Companies that tailor offerings to these innovative domains can secure competitive advantages.

Adoption of Cloud-Based and AI-Driven Design Platforms Broadens Accessibility

The shift toward cloud-based EDA platforms opens new avenues for collaboration and scalability across the global design community. The EDA Tools Market can leverage these trends to attract startups and smaller enterprises by reducing the need for heavy upfront investments in infrastructure. It supports remote work, global project management, and faster time-to-market for complex chip designs. The adoption of AI-driven design tools further enables automation, predictive analytics, and smarter verification, which can streamline workflows and improve productivity. Cloud and AI technologies provide a pathway to democratize access to high-performance design environments, fostering innovation across organizations of all sizes. These developments position the market to address evolving customer requirements while driving long-term growth.

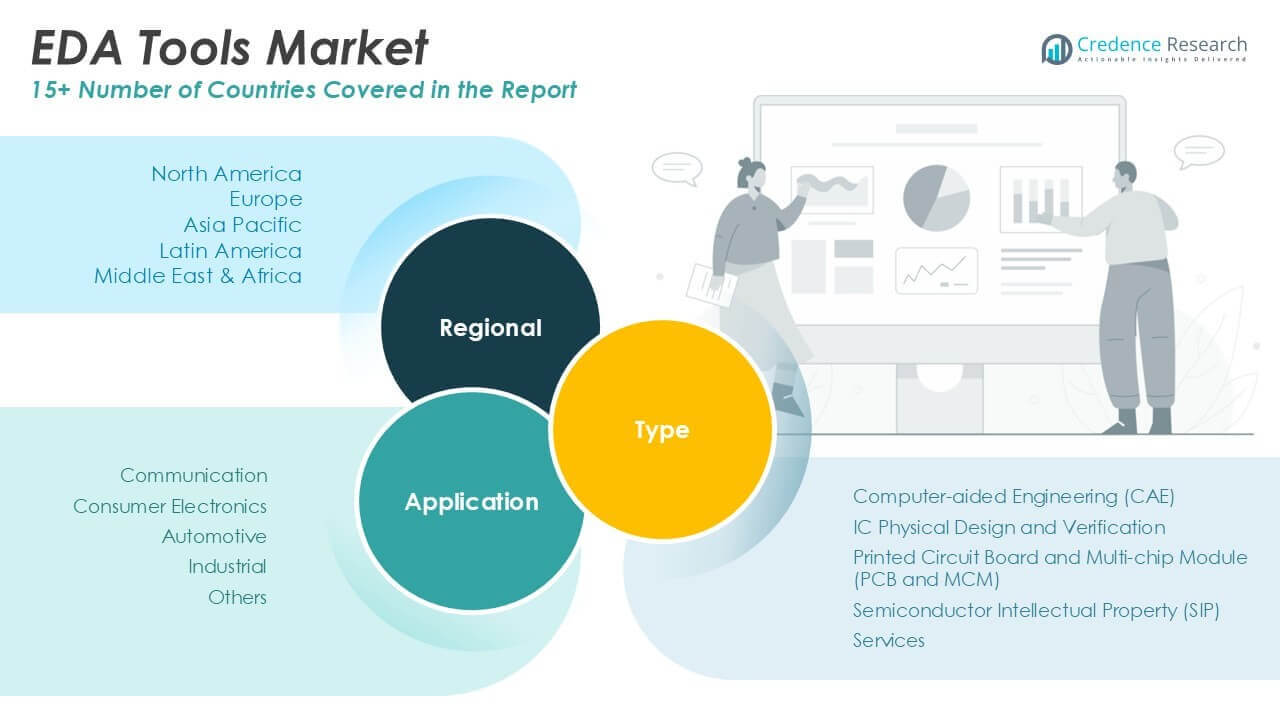

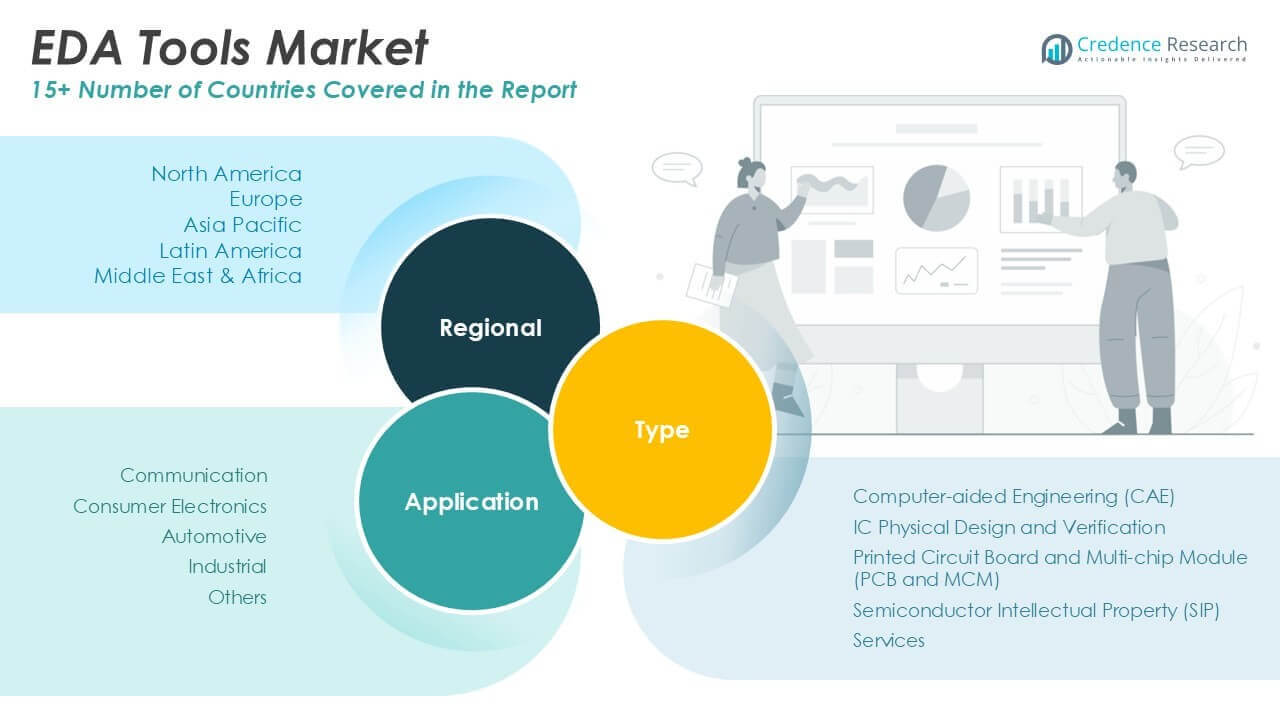

Market Segmentation Analysis:

By Type:

Computer-aided Engineering (CAE) leads adoption due to its critical support for simulation, modeling, and verification throughout product development cycles. Organizations leverage CAE tools to predict performance, optimize designs, and reduce prototyping costs. IC Physical Design and Verification stands out for its importance in translating circuit concepts into manufacturable layouts and ensuring compliance with advanced process technologies. The segment addressing Printed Circuit Board and Multi-chip Module (PCB and MCM) addresses demand for highly reliable interconnects and miniaturized packaging, especially in high-density electronic assemblies. Semiconductor Intellectual Property (SIP) solutions enable efficient design reuse, faster time-to-market, and cost efficiency, which appeal to both established players and innovative startups. Services encompass consulting, technical support, and integration, adding value by helping clients implement, customize, and optimize EDA solutions.

By Application:

The EDA Tools Market finds extensive traction in the communication sector, where the race for faster, smarter, and more reliable connectivity drives demand for sophisticated chip and system design. Consumer electronics form a major growth engine as manufacturers introduce feature-rich smartphones, wearables, and smart home devices that require advanced design automation and verification. Automotive applications gain prominence with the integration of electronics for safety, infotainment, autonomous driving, and electrification. EDA tools enable design teams to meet stringent reliability and safety standards while accelerating development cycles. The industrial segment sees steady uptake as factories, robotics, and infrastructure systems adopt more sensors and intelligent control modules, all relying on robust electronic design automation. Other applications encompass emerging fields such as healthcare devices, aerospace systems, and defense electronics, which depend on the flexibility and scalability of EDA platforms.

Segments:

Based on Type:

- Computer-aided Engineering (CAE)

- IC Physical Design and Verification

- Printed Circuit Board and Multi-chip Module (PCB and MCM)

- Semiconductor Intellectual Property (SIP)

- Services

Based on Application:

- Communication

- Consumer Electronics

- Automotive

- Industrial

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America EDA Tools Market

North America EDA Tools Market grew from USD 3,447.74 million in 2018 to USD 5,727.12 million in 2024 and is projected to reach USD 11,868.58 million by 2032, reflecting a compound annual growth rate (CAGR) of 8.9%. North America is holding a 31% market share. The region benefits from a mature semiconductor industry, strong investment in R&D, and a robust ecosystem of EDA vendors and technology companies. The United States dominates the market, supported by major design centers and a high concentration of leading EDA solution providers. Canada contributes through collaborative innovation initiatives and emerging technology hubs. Regulatory support for technological advancement and growing adoption of AI-driven design solutions sustain North America’s leadership position in the market.

Europe EDA Tools Market

Europe EDA Tools Market grew from USD 2,442.92 million in 2018 to USD 3,929.28 million in 2024 and is expected to reach USD 7,505.54 million by 2032, registering a CAGR of 7.8%. Europe is holding a 20% market share. Germany, France, and the United Kingdom are key contributors, driven by automotive electronics, industrial automation, and the expansion of smart manufacturing initiatives. The market benefits from collaborative R&D, robust regulatory frameworks, and a focus on energy-efficient and safety-critical chip design. Europe’s strong automotive and industrial sectors drive continuous demand for advanced EDA tools and integrated system design.

Asia Pacific EDA Tools Market

Asia Pacific EDA Tools Market grew from USD 4,115.65 million in 2018 to USD 7,232.00 million in 2024 and is anticipated to reach USD 15,976.86 million by 2032, with a CAGR of 9.8%. Asia Pacific is holding a 42% market share. China, Japan, South Korea, and Taiwan lead the region, backed by large-scale electronics manufacturing, a vibrant foundry landscape, and government incentives for semiconductor R&D. The market benefits from rapid adoption of next-generation consumer devices, IoT, and 5G applications. Asia Pacific’s dominance in global chip production ensures ongoing demand for sophisticated design automation tools.

Latin America EDA Tools Market

Latin America EDA Tools Market grew from USD 407.38 million in 2018 to USD 675.77 million in 2024 and is set to reach USD 1,192.02 million by 2032, registering a CAGR of 6.7%. Latin America is holding a 3% market share. Brazil and Mexico drive market growth, leveraging investments in telecommunications, industrial electronics, and automotive sectors. The region focuses on building local design capabilities and encouraging international collaboration with global EDA vendors. Opportunities arise from modernization efforts and the need for enhanced electronic infrastructure.

Middle East EDA Tools Market

Middle East EDA Tools Market grew from USD 261.32 million in 2018 to USD 396.23 million in 2024 and is projected to reach USD 666.46 million by 2032, at a CAGR of 6.0%. The Middle East holds a 2% market share. The United Arab Emirates and Saudi Arabia are at the forefront, driven by investments in smart city development, industrial automation, and digital infrastructure. The market is evolving with strategic partnerships and initiatives to localize electronics design and production capabilities. Emphasis on technology adoption creates incremental demand for advanced EDA tools.

Africa EDA Tools Market

Africa EDA Tools Market grew from USD 213.26 million in 2018 to USD 389.14 million in 2024 and is forecasted to reach USD 671.52 million by 2032, achieving a CAGR of 6.4%. Africa holds a 2% market share. South Africa and Nigeria are key markets, focusing on telecommunications, emerging smart city projects, and industrial modernization. The region’s adoption of EDA solutions grows with expanding ICT infrastructure and increased technology transfer initiatives. Efforts to enhance local technical expertise and collaboration with international vendors support steady market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Altium Limited

- Ansys Inc.

- Cadence Design Systems Inc.

- Keysight Technologies Inc.

- Agnisys Inc.

- Aldec Inc.

- Lauterbach GmbH

- Mentor Graphic Corporation (Siemens PLM Software)

- Synopsys Inc.

- Xilinx Inc.

- Zuken Ltd.

Competitive Analysis

The EDA Tools Market is characterized by intense competition among several prominent players, including Synopsys Inc., Cadence Design Systems Inc., Mentor Graphic Corporation (Siemens PLM Software), Ansys Inc., Keysight Technologies Inc., Altium Limited, Zuken Ltd., Xilinx Inc., Lauterbach GmbH, Aldec Inc., and Agnisys Inc. These companies maintain a leadership position through continuous investment in research and development, enabling them to offer advanced solutions that address the evolving needs of semiconductor design and electronic system development. Leading companies focus on delivering comprehensive solutions that address the increasing complexity of semiconductor and electronic system design. They invest heavily in research and development to enhance tool capabilities, integrating advanced features such as artificial intelligence, cloud-based platforms, and support for emerging process nodes. The ability to provide robust design automation, simulation, and verification tools gives firms a distinct edge in winning large enterprise contracts and supporting mission-critical projects. Global reach, strong technical support, and the formation of strategic partnerships contribute to brand loyalty and recurring revenue streams. Market leaders also emphasize flexibility, offering scalable solutions for both large organizations and smaller design teams, and actively pursue acquisitions and collaborations to accelerate technology adoption and expand their solution portfolios. This dynamic environment ensures that competition remains strong and innovation-driven within the EDA Tools Market.

Recent Developments

- In February 2023, Ansys has expanded the collaboration with Microsoft to increase the availability of the simulation solutions on Microsoft Azure cloud-computing platform. This provides the customers browser-based location independent access. It also deepens the commitment of Ansys to provide cloud-based access to advanced simulation solutions.

- In January 2023, Siemens Digital Industries has launched Questa- a verification IQ software which helps the logic verification team to overcome the challenges in design complexity of ICs. Questa is powered by artificial intelligence and helps to accelerate verification closure, optimize the resources, and streamline traceability.

- In November 2022, eInfochips has partnered with Ambarella, Inc., an edge AI semiconductor company to expand the design and development services for AI camera products.

- In November 2022, Siemens has acquired Avery Design Systems, Inc. which is a simulation-independent verification IP supplier. The company has planned to add Avery to Siemens portfolio as a part of electronic design verification (EDA) integrated circuits verification offerings.

- In June 2022, Keysight Technologies Inc. has launched PathWave Advanced Design System (ADS) 2023, which addresses design complexity and higher frequency in the radio frequency (RF) and microwave industry

Market Concentration & Characteristics

The EDA Tools Market exhibits a high degree of market concentration, with a few established global players holding substantial shares due to their broad product portfolios and significant investments in research and development. It is characterized by continuous innovation, rapid adoption of advanced technologies, and high entry barriers related to technical expertise and capital requirements. The market demands robust solutions that can handle the increasing complexity of semiconductor designs and the integration of new functionalities such as artificial intelligence, IoT, and 5G. It serves a diverse clientele across semiconductor manufacturing, consumer electronics, automotive, and industrial automation. Long-term customer relationships, comprehensive support services, and collaborative development are key characteristics that define the market’s competitive landscape. The EDA Tools Market is dynamic, with frequent technological upgrades, strategic partnerships, and a strong emphasis on intellectual property and regulatory compliance to meet evolving industry needs

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EDA Tools Market will continue to grow as demand rises for complex semiconductor and electronic system designs.

- Adoption of artificial intelligence and machine learning within EDA solutions will accelerate design automation and verification processes.

- Cloud-based EDA platforms will become standard, supporting global collaboration and scalable resource allocation.

- Integration with emerging technologies like 5G, IoT, and quantum computing will expand application areas for EDA tools.

- The market will see increased activity in automotive, healthcare, and industrial automation sectors due to electronic innovation.

- Companies will focus on strengthening cybersecurity and data integrity within EDA platforms to address evolving threats.

- Strategic partnerships and acquisitions will drive portfolio expansion and accelerate innovation across the industry.

- Startups and smaller enterprises will gain greater access to advanced tools through subscription models and cloud delivery.

- Regulatory compliance and sustainability requirements will influence product development and deployment strategies.

- Ongoing investment in R&D will ensure EDA tools keep pace with advances in semiconductor manufacturing technologies.