| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Egypt Industrial Fasteners Market Size 2024 |

USD 367.18 Million |

| Egypt Industrial Fasteners Market, CAGR |

2.69% |

| Egypt Industrial Fasteners Market Size 2032 |

USD 454.01 Million |

Market Overview:

The Egypt Industrial Fasteners Market is projected to grow from USD 367.18 million in 2024 to an estimated USD 454.01 million by 2032, with a compound annual growth rate (CAGR) of 2.69% from 2024 to 2032.

Several factors are driving the growth of Egypt’s industrial fasteners market. Foremost among these is the country’s extensive infrastructure development, characterized by large-scale projects such as the New Administrative Capital and the Suez Canal Economic Zone. These initiatives necessitate substantial quantities of fasteners for applications in structural connections, machinery assembly, and equipment installation. Additionally, the automotive sector’s expansion, bolstered by both domestic manufacturing and assembly operations, is contributing to increased demand for high-quality fasteners. The government’s emphasis on industrialization and export-oriented growth further stimulates the market, as manufacturers seek reliable fastening solutions to meet international standards. Moreover, the modernization of Egypt’s ports and logistics infrastructure enhances the efficiency of supply chains, facilitating the import and export of fastener products and raw materials.

Regionally, the demand for industrial fasteners is concentrated in areas experiencing significant industrial and infrastructural development. Cairo and its surrounding regions serve as primary hubs due to their dense industrial zones and ongoing urban projects. The Suez Canal Economic Zone is emerging as a strategic area, attracting investments in manufacturing and logistics, which in turn drives the need for various fastening solutions. Alexandria, with its port facilities and industrial base, also contributes to the market’s growth. Furthermore, Egypt’s strategic location as a nexus between Africa, the Middle East, and Europe positions it as a key player in regional trade, potentially expanding the market for industrial fasteners through increased export opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Egypt Industrial Fasteners Market is anticipated to experience steady growth over the forecast period, supported by expanding industrial and construction activities.

- Government-driven infrastructure projects, including the New Administrative Capital and Suez Canal Economic Zone, continue to drive strong demand for industrial fasteners.

- The automotive sector’s development, supported by increased domestic manufacturing and electric vehicle infrastructure expansion, fuels the need for advanced fastening solutions.

- Ongoing industrialization under Egypt Vision 2030 strengthens demand for certified fasteners across machinery, electronics, and heavy equipment manufacturing sectors.

- Growing investments in renewable energy projects, such as large-scale solar and wind installations, are boosting the requirement for durable and corrosion-resistant fasteners.

- Market challenges include raw material price volatility, slow adoption of modern manufacturing technologies among local players, and reliance on imported specialized fasteners.

- Regionally, Cairo leads in fastener demand, followed by the Suez Canal Economic Zone and Alexandria, benefiting from dense industrial hubs and improved logistics infrastructure.

Market Drivers:

Government Infrastructure Initiatives

The Egyptian government’s substantial investment in infrastructure development is a primary driver of the industrial fasteners market. For example, the New Administrative Capital project, overseen by the Administrative Capital for Urban Development (ACUD), is set to house up to seven million people and includes a business district constructed by China State Contracting Engineering Corporation, with thirty banks committed to relocating their headquarters to the area. These construction activities require durable and high-performance fastening solutions to ensure the structural integrity and safety of large-scale projects. Additionally, the government’s focus on building smart cities and modern industrial parks continues to expand the application base for industrial fasteners, positioning them as essential components across numerous sectors.

Expansion of the Automotive Industry

Egypt’s growing automotive sector significantly contributes to the increasing demand for industrial fasteners. Domestic assembly plants, along with the government’s strategic efforts to promote Egypt as a regional hub for automotive manufacturing, are creating new opportunities for fastener manufacturers. For instance, government’s partnership with Infinity and Hassan Allam Utilities aims to expand the electric vehicle (EV) charging network, deploying both AC and DC chargers at high-traffic filling stations-a move expected to drive further demand for specialized fasteners required in EV infrastructure. As automakers emphasize the production of lightweight vehicles for fuel efficiency and compliance with environmental standards, there is rising demand for specialized fasteners that offer strength without adding excess weight. Moreover, the development of electric vehicle (EV) infrastructure and assembly operations further enhances the need for precision fasteners tailored to evolving automotive engineering requirements.

Industrialization and Manufacturing Growth

The broader push towards industrialization under Egypt Vision 2030 supports the expansion of the manufacturing sector, creating a ripple effect in the fasteners market. As Egypt seeks to diversify its economy and enhance its position as a regional manufacturing hub, industries such as machinery, electronics, and heavy equipment are witnessing steady growth. These industries rely heavily on high-quality fasteners for product assembly, equipment maintenance, and operational safety. The increased focus on export-oriented manufacturing also encourages the adoption of internationally certified fastening products, boosting the overall quality and volume requirements within the domestic market.

Growing Emphasis on Renewable Energy Projects

The rising investment in renewable energy, particularly solar and wind energy projects, is opening new avenues for the industrial fasteners market in Egypt. Projects like the Benban Solar Park and upcoming wind energy farms require advanced fastening solutions capable of withstanding extreme environmental conditions. Renewable energy structures demand corrosion-resistant, high-tensile fasteners that ensure the longevity and efficiency of installations. As Egypt continues to prioritize clean energy initiatives to meet its sustainability goals, the demand for specialized fasteners is expected to grow steadily, further reinforcing the market’s positive trajectory.

Market Trends:

Adoption of Advanced Materials and Lightweight Fasteners

The Egyptian industrial fasteners market is witnessing a shift towards advanced materials, such as stainless steel and lightweight alloys, to meet the evolving demands of various industries. For instance, MKM Fasteners reports the use of premium-grade stainless steel in their products, ensuring excellent durability and corrosion resistance for applications in construction, automotive, and manufacturing sectors. This trend is particularly evident in sectors like automotive and aerospace, where the emphasis on fuel efficiency and performance necessitates the use of lighter yet durable fastening solutions. The adoption of these materials not only enhances the longevity and reliability of fasteners but also aligns with global standards, thereby boosting Egypt’s competitiveness in international markets.

Technological Advancements in Manufacturing Processes

Technological innovation is playing a pivotal role in shaping the fasteners industry in Egypt. The integration of automation and digital technologies in manufacturing processes has led to improved precision, efficiency, and scalability in fastener production. These advancements enable manufacturers to cater to the specific requirements of diverse applications, ranging from construction to electronics, thereby expanding their market reach and fostering growth within the sector.

Expansion of Export Markets and Trade Partnerships

Egypt’s strategic geographical location and its efforts to enhance trade relations have opened new avenues for the export of industrial fasteners. The country has seen a diversification of its export destinations, with significant growth in markets such as Saudi Arabia, which accounted for a substantial share of Egypt’s fastener exports in recent years. This expansion is facilitated by improvements in port infrastructure and logistics, enabling more efficient and cost-effective distribution channels for Egyptian manufacturers.

Emphasis on Sustainable and Eco-Friendly Practices

Environmental considerations are increasingly influencing the industrial fasteners market in Egypt. Manufacturers are adopting sustainable practices, including the use of recyclable materials and energy-efficient production methods, to minimize their ecological footprint. For instance, Suez Steel Company, a major industrial player in Egypt, has implemented a closed-loop water recycling system in its fastener manufacturing unit, reducing water consumption by 35% per ton of product since 2021. This shift not only addresses global environmental concerns but also meets the growing demand from environmentally conscious consumers and businesses, positioning Egypt as a responsible player in the global fasteners industry.

Market Challenges Analysis:

Fluctuating Raw Material Prices

The volatility in the prices of raw materials such as steel, aluminum, and alloys poses a significant restraint to the growth of the Egypt industrial fasteners market. Frequent fluctuations in material costs, driven by global supply-demand imbalances and geopolitical tensions, directly impact the production expenses for fastener manufacturers. These unpredictable costs challenge businesses to maintain stable pricing strategies, affecting their profitability and competitiveness both domestically and in export markets. Additionally, smaller manufacturers often struggle to absorb cost variations, leading to reduced margins and operational constraints.

Limited Technological Advancements among Local Manufacturers

While global trends in the fasteners industry emphasize automation and precision engineering, several local manufacturers in Egypt still rely on traditional manufacturing processes. For example, many Egyptian fastener producers continue to operate with outdated machinery and traditional processes, leading to lower productivity and higher production costs. The limited adoption of advanced production technologies hampers the ability of local companies to produce high-precision, customized, and high-strength fasteners that meet international quality standards. This technological gap restricts their participation in high-growth sectors such as aerospace, renewable energy, and advanced automotive manufacturing, thereby limiting their market potential. Without significant investments in upgrading production capabilities, local players may face difficulties in competing with international brands.

Dependence on Imported Fasteners

The Egypt industrial fasteners market faces a considerable challenge due to its dependence on imported fasteners, especially for specialized applications. Despite efforts to boost local manufacturing, a significant share of high-grade and application-specific fasteners continues to be sourced from foreign suppliers. This reliance exposes the market to external supply chain disruptions, currency fluctuations, and import-related costs. In times of global shipping delays or trade restrictions, the availability of critical fastening components becomes uncertain, affecting project timelines and operational efficiency across industries.

Stringent Quality and Certification Requirements

The growing demand for fasteners that meet international certifications and standards creates another challenge for Egyptian manufacturers. Global industries, particularly automotive, construction, and energy, require compliance with rigorous quality benchmarks. Achieving and maintaining such certifications demands substantial investment in testing facilities, research and development, and skilled labor. Many local manufacturers face resource constraints that limit their ability to consistently meet these requirements, restricting their ability to serve premium market segments and engage in international trade expansion.

Market Opportunities:

The Egypt industrial fasteners market presents substantial growth opportunities driven by the country’s ongoing infrastructure transformation and industrial diversification. Major projects such as the New Administrative Capital, transportation network upgrades, and renewable energy developments are significantly boosting the demand for reliable fastening solutions. The government’s commitment to expanding the construction, manufacturing, and energy sectors under Vision 2030 creates a sustained need for high-quality fasteners. Additionally, increasing foreign direct investment (FDI) into Egypt’s manufacturing sector is generating demand for technologically advanced fasteners that meet international standards, offering local producers opportunities to expand their capabilities and product portfolios.

Another key opportunity lies in Egypt’s strategic geographic positioning, making it a vital link between Africa, the Middle East, and Europe. By enhancing its logistics and port infrastructure, Egypt is poised to become a major export hub for industrial fasteners, particularly to growing markets across Africa and the Gulf Cooperation Council (GCC) countries. Local manufacturers have the potential to tap into rising regional construction and industrial projects by offering competitively priced and certified fastening products. Furthermore, the growing emphasis on lightweight materials, energy-efficient solutions, and sustainable manufacturing practices opens new avenues for companies specializing in innovative and eco-friendly fastening technologies. Businesses that invest in research and development, adopt automation, and align their offerings with global trends are well-positioned to capitalize on the evolving needs of both domestic and international markets.

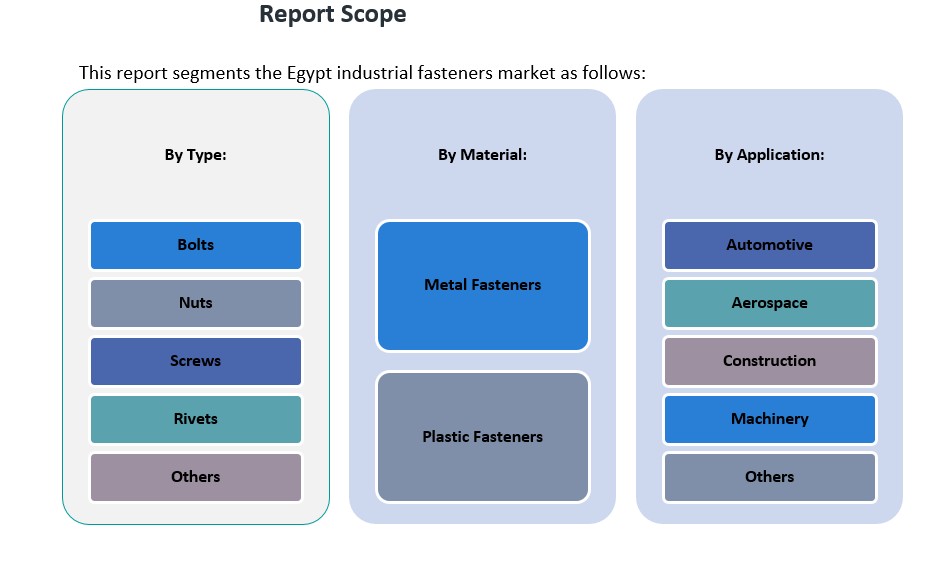

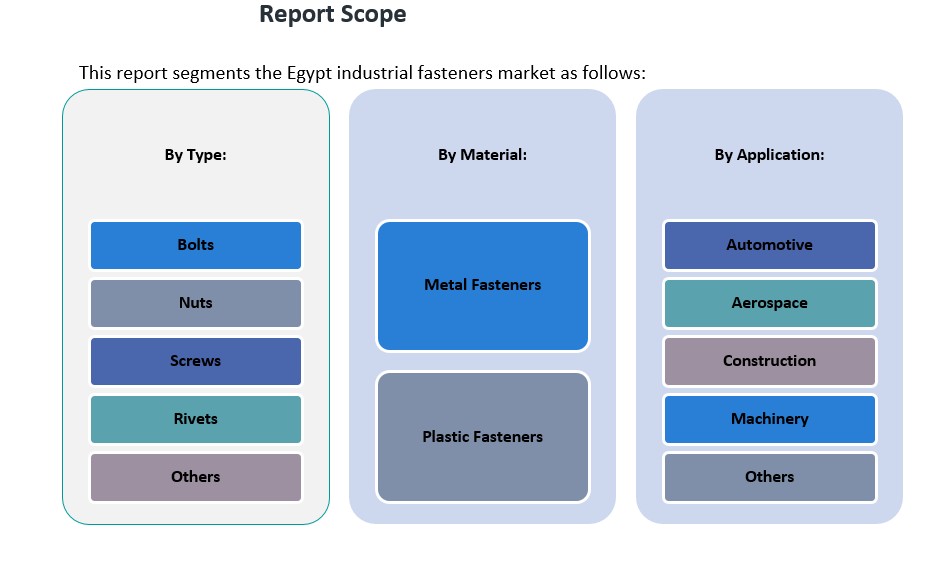

Market Segmentation Analysis:

The Egypt industrial fasteners market is segmented by type, application, and material, each contributing uniquely to the market’s overall growth.

By type, bolts account for a significant share due to their widespread use in construction, automotive, and heavy machinery industries. Nuts and screws also hold substantial market shares, driven by rising demand in assembly operations across multiple sectors. Rivets find increasing usage in aerospace and construction applications, where high strength and vibration resistance are critical. The ‘others’ category, including washers and pins, supports a range of specialized fastening needs in various industries, enhancing market diversity.

By application, the construction segment leads the market, supported by Egypt’s ambitious infrastructure projects and real estate expansion. The automotive sector is another major contributor, fueled by the country’s growing vehicle assembly and component manufacturing activities. Aerospace, though smaller in size, presents high-value opportunities as Egypt aims to develop its aviation and defense sectors. Machinery applications drive steady demand for robust and precision fasteners essential for industrial equipment manufacturing and maintenance. The ‘others’ segment, which includes electrical and electronics industries, is gradually expanding, benefiting from Egypt’s push towards industrial modernization.

By material, metal fasteners dominate the market, favored for their durability, strength, and versatility across applications. However, plastic fasteners are gaining traction, particularly in automotive and electronics industries, where lightweight and corrosion-resistant solutions are increasingly preferred. This material diversification reflects evolving industry requirements and the growing adoption of innovative fastening technologies in Egypt’s fasteners market.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Egypt industrial fasteners market exhibits a regionally diverse landscape, with Cairo and Giza leading in demand due to their extensive industrial zones and infrastructure projects. These areas account for approximately 40% of the national market share, driven by ongoing developments such as the New Administrative Capital and various transportation initiatives. The concentration of manufacturing facilities and construction activities in these regions significantly contributes to the demand for industrial fasteners.

The Suez Canal Economic Zone (SCZone) is emerging as a strategic industrial hub, attracting substantial investments in manufacturing and logistics. This region contributes around 25% to the national market share, bolstered by its strategic location and improved port infrastructure, which facilitate efficient supply chain operations. The SCZone’s focus on export-oriented industries further amplifies the demand for high-quality fasteners compliant with international standards.

Alexandria, with its significant port facilities and industrial base, holds approximately 20% of the market share. The city’s role as a key logistics and manufacturing center supports steady demand for various fastening solutions, particularly in the automotive and construction sectors. The presence of established industries and ongoing urban development projects continue to drive the need for reliable fasteners in this region.

Other regions, including the Nile Delta and Upper Egypt, collectively account for the remaining 15% of the market. These areas are experiencing gradual industrial growth, supported by government initiatives aimed at regional development and investment in infrastructure. As industrial activities expand beyond traditional centers, the demand for industrial fasteners in these regions is expected to rise, contributing to a more balanced regional distribution in the market.

Key Player Analysis:

- EJOT Middle East FZE

- Fischer Fixings Middle East

- Al Jazeera Bolts Industries LLC

- Dubai Bolt and Screw Company LLC

- Bolt Master Middle East

- Fast Trade Est.

- Al Maha Fasteners

- Al-Rajhi Industrial Group

- Petrofast Middle East LLC

- Saudi Fasteners Company

Competitive Analysis:

The Egypt industrial fasteners market features a competitive landscape characterized by a mix of local manufacturers and international suppliers. Leading local players focus on serving the construction, automotive, and general manufacturing sectors by offering a range of standard and customized fastening solutions. International brands maintain a strong presence, particularly in supplying high-performance and specialized fasteners for sectors requiring stringent quality standards such as aerospace and energy. Price competitiveness, product quality, and delivery reliability remain key factors influencing market positioning. Companies are increasingly investing in modernizing production processes, expanding product portfolios, and adopting certifications to align with global benchmarks. Strategic collaborations, technology transfers, and expansion into emerging regional markets are common strategies among key players to enhance their market share. As industrialization accelerates across Egypt, competition is expected to intensify, encouraging innovation, efficiency improvements, and a stronger emphasis on customer-specific requirements.

Recent Developments:

- In January 2023, Sherex Fastening Solutions, a company specializing in engineered fasteners, tooling, and automation, introduced a new product called Optisert. This round body rivet nut is positioned as the best-performing in its category, offering enhanced strength and resistance to spin-out compared to standard round-body rivet nuts. The launch of Optisert follows over five years of engineering design and research, aiming to deliver superior resistance to spin-out and pull-out failures, thus elevating the quality of applications it serves.

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing

Market Concentration & Characteristics:

The Egypt industrial fasteners market is moderately fragmented, with a balanced presence of local manufacturers and international players. No single company dominates the market, allowing medium and small-scale manufacturers to actively compete in various segments. The market is characterized by strong price sensitivity, where bulk purchasing and competitive pricing play crucial roles in influencing buyer decisions. Demand is largely driven by construction, automotive, and industrial manufacturing sectors, which prioritize quality, durability, and compliance with international standards. Local companies primarily focus on standard fasteners, while specialized and high-performance products are often imported. Innovation in lightweight materials, corrosion-resistant coatings, and precision manufacturing is gaining importance as industries modernize and require more specialized fastening solutions. The rising emphasis on sustainability, customization, and value-added services is also shaping the market’s evolving dynamics, offering opportunities for firms that adapt to changing industrial and customer needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of large-scale infrastructure projects will consistently boost fastener demand across Egypt.

- Growth in domestic automotive assembly will drive the need for specialized, lightweight fastening solutions.

- Increased adoption of corrosion-resistant and high-strength fasteners will support the renewable energy sector.

- Rising investment in industrial automation will create opportunities for precision-engineered fasteners.

- Expansion of export opportunities to African and Middle Eastern markets will strengthen local manufacturers’ positions.

- Adoption of eco-friendly materials and sustainable production practices will become a competitive differentiator.

- Technological advancements in manufacturing, including 3D printing, will enable faster prototyping and customization.

- Government initiatives promoting local manufacturing will reduce dependence on imported fasteners.

- Demand for certified, high-performance fasteners will rise in aviation, defense, and energy applications.

- Increasing urbanization and smart city developments will sustain long-term market growth for structural fasteners.