Market Overview

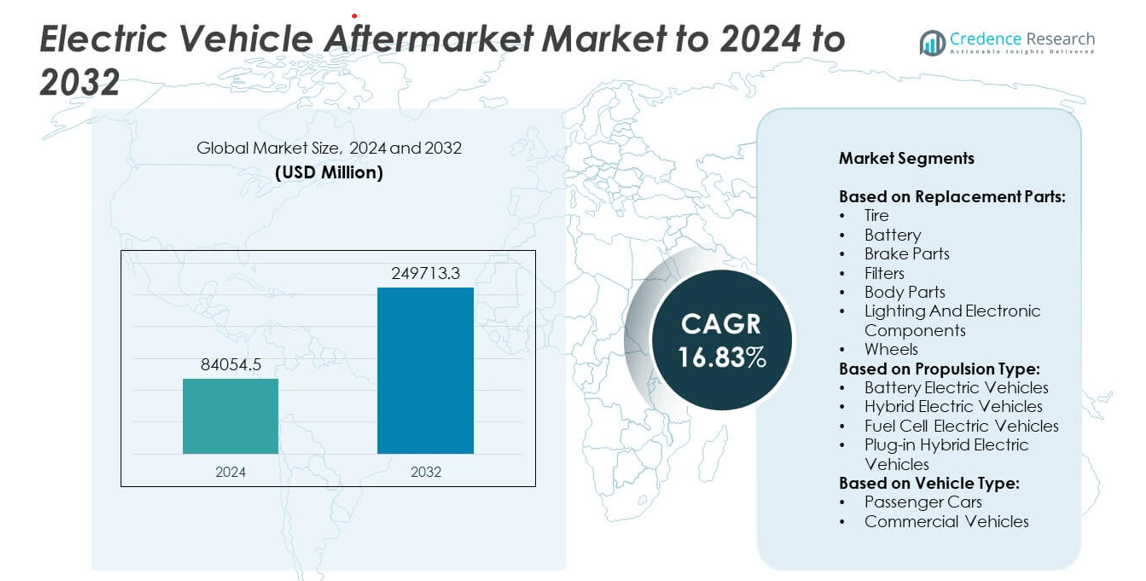

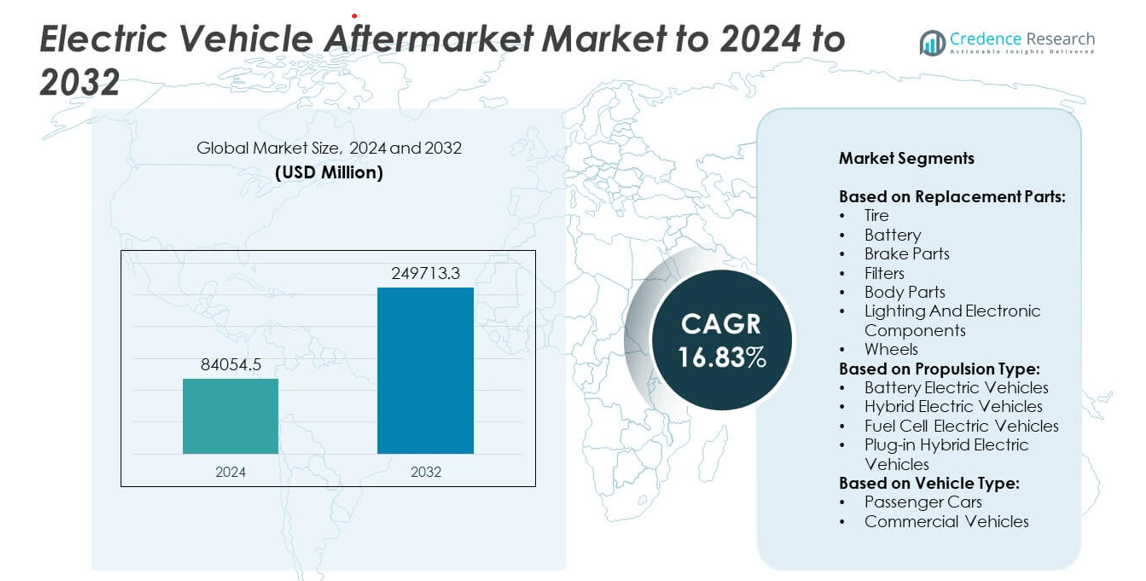

The Electric Vehicle Aftermarket Market size was valued at USD 84,054.5 million in 2024 and is anticipated to reach USD 249,713.3 million by 2032, at a CAGR of 16.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Aftermarket Market Size 2024 |

USD 84,054.5 million |

| Electric Vehicle Aftermarket Market, CAGR |

16.83% |

| Electric Vehicle Aftermarket Market Size 2032 |

USD 249,713.3 million |

The Electric Vehicle Aftermarket Market is shaped by prominent players such as Siemens AG, Continental AG, ChargePoint Inc., Bosch Automotive Service Solutions Inc., ABB Ltd., ZF Aftermarket, and Robert Bosch GmbH. These companies focus on enhancing service efficiency through smart diagnostics, predictive maintenance, and battery recycling initiatives. Strategic investments in digital service platforms and regional service expansion strengthen their competitive positions. North America emerged as the leading region in 2024, commanding around 34% of the total market share, driven by rapid EV adoption, well-established service infrastructure, and strong presence of OEM-authorized aftermarket networks.

Market Insights

- The Electric Vehicle Aftermarket Market was valued at USD 84,054.5 million in 2024 and is projected to reach USD 249,713.3 million by 2032, growing at a CAGR of 16.83%.

- Rising EV adoption, expansion of charging infrastructure, and growing demand for replacement batteries are key factors driving market growth globally.

- The market is witnessing strong trends in digitalized service networks, e-commerce parts distribution, and predictive maintenance technologies powered by AI and IoT.

- Leading players such as Siemens AG, ABB Ltd., and Bosch focus on innovation, recycling, and sustainability to maintain a competitive edge.

- North America led the market with a 34% share in 2024, followed by Europe at 29% and Asia Pacific at 27%, while the battery segment dominated by capturing nearly 40% of the overall market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Replacement Parts

The battery segment dominated the Electric Vehicle Aftermarket in 2024, accounting for nearly 40% of the total share. Battery replacement is crucial due to natural degradation over time and rising demand for higher-capacity cells. The shift toward advanced lithium-ion and emerging solid-state batteries enhances vehicle performance and range, driving aftermarket growth. Manufacturers are focusing on recycling programs and second-life applications to reduce replacement costs. Increasing vehicle lifespan and consumer interest in sustainable power solutions continue to strengthen this segment’s leadership.

- For instance, Brunp Recycling (CATL) operates 240+ collection depots and can process 270,000 tons of waste batteries yearly.

By Propulsion Type

Battery electric vehicles (BEVs) led the market in 2024, holding about 62% of the total share. This dominance results from the global surge in fully electric vehicle sales supported by emission-free policies and battery advancements. BEVs have simpler architectures and fewer mechanical parts, which boosts demand for battery, tire, and electronic component replacements. Continuous improvements in charging infrastructure and extended driving ranges reinforce BEV ownership. Growing adoption by both consumers and fleet operators makes BEVs the key driver in the aftermarket expansion.

- For instance, Tesla delivered 1.81 million battery-electric vehicles in 2023.

By Vehicle Type

Passenger cars captured the largest share of around 58% in the Electric Vehicle Aftermarket in 2024. The segment benefits from increasing urban EV adoption and government incentives for individual buyers. Maintenance of batteries, tires, and electronic components remains frequent due to higher vehicle usage in daily commuting. Automakers like Tesla, BYD, and Hyundai are expanding service networks and spare part accessibility to meet demand. The rising popularity of compact and mid-sized EV models further supports this segment’s continuing market dominance.

Key Growth Drivers

Rising EV Adoption and Aging Fleet

The rapid growth in electric vehicle ownership is driving demand for aftermarket services. As global EV sales rise and early models age, replacement of batteries, tires, and electronics becomes essential. Governments promoting zero-emission vehicles further strengthen this expansion. The aging EV fleet creates recurring demand for maintenance and component upgrades, ensuring sustained aftermarket growth.

- For instance, Nissan has sold nearly 700,000 LEAFs globally since 2010, building a large aging base.

Advancements in Battery Technology

Continuous innovation in lithium-ion and solid-state batteries enhances durability and performance. These advancements increase the need for specialized aftermarket services for diagnostics, replacement, and recycling. Manufacturers investing in battery management and recycling systems drive market expansion. The push for circular economy practices also supports the replacement ecosystem.

- For instance, Panasonic Energy completed preparations for mass production of 4680 cells at its Wakayama factory in September 2024, with mass production planned to begin following client approval.

Expansion of Charging and Service Infrastructure

Growing availability of EV charging networks and service facilities boosts consumer confidence in EV ownership. Automakers and service providers are setting up dedicated maintenance centers for EV-specific components. This expansion improves accessibility to spare parts, diagnostics, and repair solutions, fueling aftermarket demand across both developed and emerging regions.

Key Trends & Opportunities

Digitalization and E-commerce Platforms

Online platforms are transforming the EV aftermarket by offering easy access to spare parts and diagnostics. E-commerce channels enable users to compare prices, access OEM components, and schedule maintenance conveniently. Integration of AI-based recommendation tools enhances part selection and customer experience. This trend is expanding aftermarket reach among individual and fleet owners.

- For instance, LKQ Europe, with its approximately 26,500 employees, supplies parts to around 100,000 workshops in over 18 European countries via a network of more than 900 branches.

Sustainability and Circular Economy Initiatives

Growing focus on recycling and reusing EV batteries and components supports market sustainability. Companies are developing second-life applications and eco-friendly disposal solutions. Adoption of closed-loop supply chains reduces waste and raw material dependency. This shift toward sustainability opens opportunities for specialized recycling service providers in the EV aftermarket.

- For instance, Umicore’s Hoboken plant has an annual recycling capacity of 7,000 tonnes of lithium-ion batteries.

Integration of Predictive Maintenance Technologies

The use of IoT and AI-driven diagnostics allows real-time monitoring of EV health. Predictive maintenance helps identify component wear and optimize replacement schedules, reducing downtime. Automakers are integrating these systems into vehicles to enhance service efficiency. This trend is driving technological transformation within the aftermarket ecosystem.

Key Challenges

High Cost of Replacement Parts

EV-specific components like batteries and electronic systems are expensive compared to traditional vehicle parts. High replacement costs limit aftermarket penetration, especially in price-sensitive markets. Manufacturers are exploring cost-efficient alternatives and localized production to reduce service expenses. Overcoming this cost challenge is vital for broader aftermarket adoption.

Limited Skilled Workforce and Standardization

The shortage of trained technicians and lack of uniform repair standards hinder market growth. EV maintenance requires specialized knowledge in electronics and high-voltage systems. Inconsistent training programs and limited certification frameworks restrict service quality. Expanding workforce training and industry standardization is crucial for sustainable aftermarket development.

Regional Analysis

North America

North America held the largest share of around 34% in the Electric Vehicle Aftermarket Market in 2024. The region’s growth is driven by increasing EV adoption in the U.S. and Canada, along with expanding charging and service networks. Major automakers are investing in battery recycling and aftermarket facilities to support sustainability targets. Strong government incentives and the presence of key players such as Tesla and Rivian further enhance market penetration. The growing demand for replacement batteries, tires, and electronic parts sustains the region’s leading position in the global market.

Europe

Europe accounted for approximately 29% of the market share in 2024, supported by strong emission regulations and advanced EV infrastructure. The region benefits from mature aftermarket networks in Germany, Norway, and the U.K. Replacement of high-performance batteries, sensors, and electronic systems remains in high demand due to increased EV fleet size. Automakers and service providers focus on recycling initiatives and circular economy practices. The European Union’s strict sustainability policies and growing consumer awareness continue to drive consistent aftermarket expansion across the region.

Asia Pacific

Asia Pacific captured nearly 27% of the global market share in 2024, led by rapid EV penetration in China, Japan, and South Korea. Government subsidies and strong local manufacturing ecosystems contribute to fast aftermarket growth. Demand for cost-efficient replacement batteries, tires, and drive components is high among fleet operators. Companies such as BYD and Tata Motors are expanding their regional service and parts supply chains. Growing consumer adoption of affordable EVs and expansion of battery recycling programs position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America accounted for about 6% of the Electric Vehicle Aftermarket Market share in 2024. Countries such as Brazil, Chile, and Mexico are witnessing rising EV sales, supported by urban electrification and import tax benefits. The aftermarket is expanding gradually as service infrastructure develops across key cities. Replacement of basic components like tires, lighting systems, and filters drives the current demand. However, limited local manufacturing and high import dependency present growth challenges. Government-backed sustainability policies are expected to strengthen regional aftermarket activities over the coming years.

Middle East & Africa

The Middle East & Africa region held nearly 4% of the total market share in 2024. Market growth is driven by rising EV investments in the UAE, Saudi Arabia, and South Africa. Governments are introducing clean mobility initiatives and expanding public charging infrastructure. Demand for replacement batteries and electronic parts is growing with increasing EV imports. However, limited technical expertise and higher component costs restrict faster adoption. Partnerships between global OEMs and local distributors are gradually improving service accessibility and aftermarket efficiency in the region.

Market Segmentations:

By Replacement Parts:

- Tire

- Battery

- Brake Parts

- Filters

- Body Parts

- Lighting And Electronic Components

- Wheels

By Propulsion Type:

- Battery Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Electric Vehicles

- Plug-in Hybrid Electric Vehicles

By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of the Electric Vehicle Aftermarket Market includes major players such as Siemens AG, Continental AG, ChargePoint Inc., Bosch Automotive Service Solutions Inc., ZF Aftermarket, Webasto SE, ABB Ltd., Delphi Technologies, EVBox Group, BorgWarner, ClipperCreek Inc., Schneider Electric SE, Denso Corporation, AeroVironment Inc., Robert Bosch GmbH, and 3M. The market is highly dynamic, characterized by continuous technological innovation and strategic partnerships. Companies are investing in advanced diagnostic tools, predictive maintenance systems, and AI-based platforms to enhance service quality. The shift toward digitalized aftermarket operations, including e-commerce distribution and telematics-enabled diagnostics, is redefining service models. Firms are also emphasizing sustainability through component recycling, remanufacturing, and second-life battery initiatives. Competitive differentiation is driven by software integration, efficient supply chain management, and regional service expansion. The ongoing push for standardization, faster part replacement cycles, and improved customer experience continues to shape the global aftermarket landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Continental AG

- ChargePoint Inc.

- Bosch Automotive Service Solutions Inc.

- ZF Aftermarket

- Webasto SE

- ABB Ltd.

- Delphi Technologies

- EVBox Group

- BorgWarner

- ClipperCreek, Inc.

- Schneider Electric SE

- Denso Corporation

- AeroVironment, Inc.

- Robert Bosch GmbH

- 3M

Recent Developments

- In 2024, Bosch launched approximately 30 production projects related to electric vehicle technology globally.

- In 2023, BorgWarner completed the spin-off of its fuel systems and aftermarket segments into a new independent company named Phinia.

- In 2023, ZF Aftermarket showcased its electric, assisted, and sustainable solutions at AAPEX & SEMA 2023.

Report Coverage

The research report offers an in-depth analysis based on Replacement Parts, Propulsion Type, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric vehicle aftermarket will expand rapidly with the growing global EV fleet.

- Demand for replacement batteries and electronic components will remain a primary growth driver.

- Advancements in solid-state and high-density batteries will create new service opportunities.

- Digital platforms will dominate part sales and maintenance scheduling across regions.

- Predictive maintenance powered by AI and IoT will improve aftermarket efficiency.

- Recycling and second-life applications for used EV batteries will gain strong momentum.

- OEMs will strengthen partnerships with third-party service providers to enhance coverage.

- Standardization of EV components will simplify repair processes and reduce service costs.

- Government incentives for EV servicing infrastructure will support aftermarket development.

- Emerging markets in Asia and Latin America will witness the fastest growth in EV maintenance demand.