Market Overview

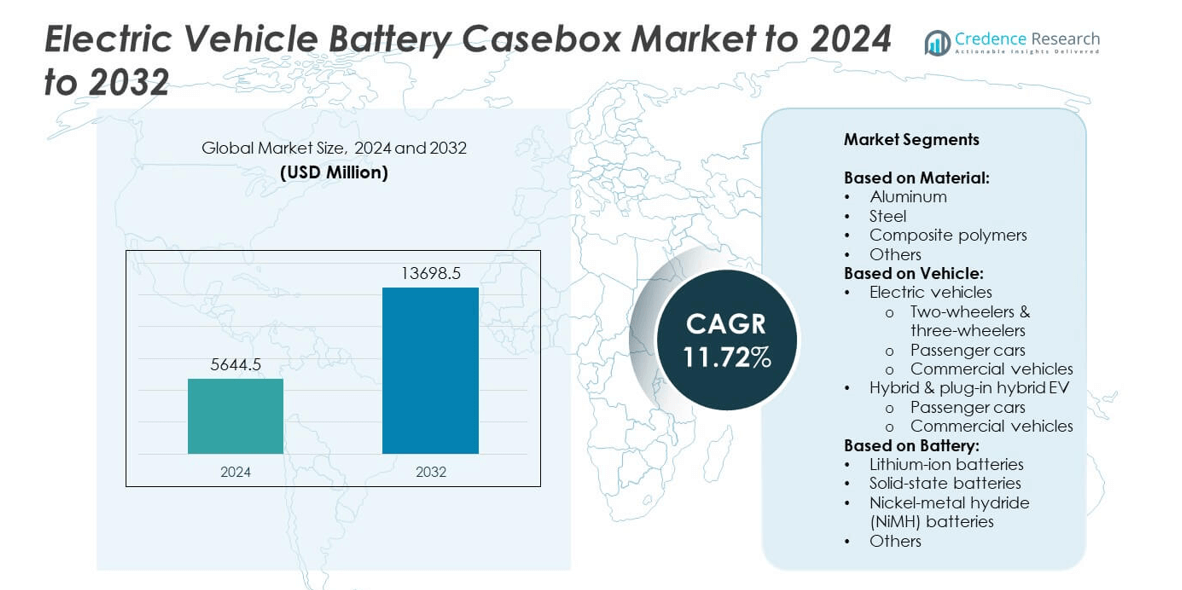

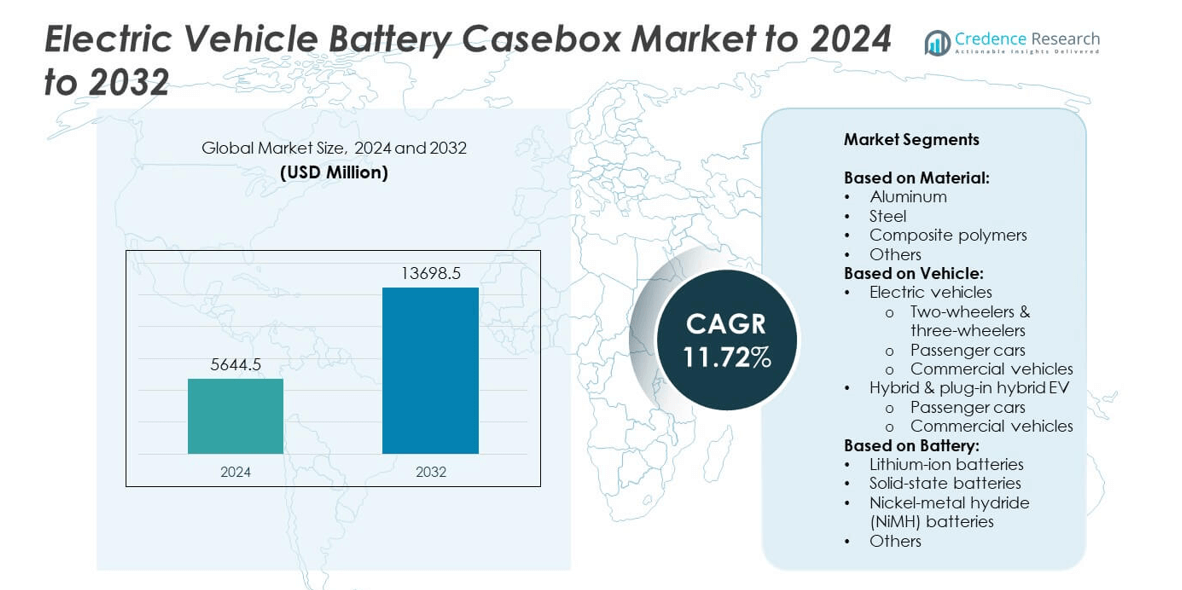

The Electric Vehicle Battery Casebox Market size was valued at USD 5644.5 million in 2024 and is anticipated to reach USD 13698.5 million by 2032, at a CAGR of 11.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Battery Casebox Market Size 2024 |

USD 5644.5 million |

| Electric Vehicle Battery Casebox Market, CAGR |

11.72% |

| Electric Vehicle Battery Casebox Market Size 2032 |

USD 13698.5 million |

The Electric Vehicle Battery Casebox Market is led by prominent companies such as Magna, SGL Carbon, Norsk Hydro ASA, POSCO, Minth, SABIC, Gestamp Automocion, Continental Structural Plastics, UACJ Corporation, ThyssenKrupp AG, Covestro AG, and Constellium SE. These players are focusing on advanced materials, including aluminum alloys and composite polymers, to enhance thermal management, safety, and lightweight performance. Strategic collaborations with major automakers and continuous R&D investments support innovation in recyclable and fire-resistant enclosures. Regionally, Asia-Pacific dominated the global market in 2024 with a 35% share, followed by Europe at 31% and North America at 28%, reflecting strong EV manufacturing and adoption trends.

Market Insights

- The Electric Vehicle Battery Casebox Market was valued at USD 5644.5 million in 2024 and is projected to reach USD 13698.5 million by 2032, growing at a CAGR of 11.72%.

- Rising EV production, sustainability goals, and demand for lightweight battery housings are key drivers enhancing market expansion across passenger and commercial vehicles.

- Market trends highlight growing adoption of aluminum and composite polymers, integration of smart monitoring systems, and rising investments in solid-state battery case designs.

- The market is highly competitive, with leading players focusing on material innovation, cost optimization, and strategic partnerships with automakers to secure long-term contracts.

- Asia-Pacific dominated the market with a 35% share in 2024, followed by Europe at 31% and North America at 28%, while the aluminum material segment accounted for over 48% of the total market share, reinforcing its position as the preferred choice for EV battery enclosures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Aluminum dominated the Electric Vehicle Battery Casebox Market in 2024, accounting for over 48% of the total share. Its leadership is driven by high strength-to-weight ratio, superior corrosion resistance, and excellent thermal conductivity. Aluminum caseboxes enhance battery safety and reduce overall vehicle weight, improving efficiency and range. Steel follows closely, favored for structural rigidity in heavy-duty EVs, while composite polymers are gaining traction in premium models for added design flexibility and weight reduction. Continuous advances in aluminum alloys further support their dominance in large-scale EV manufacturing.

- For instance, Novelis’s Generation II aluminum battery enclosure, which utilizes high-performing Novelis Advanz™ s650 alloy in some of its roll-formed frame sections, is 50% lighter than traditional steel enclosures. In general, the Novelis Advanz 6HS alloy family lists thermal conductivity at \(160190\ \text{W/m\cdotp K}\), supporting efficient heat dissipation. These properties make Advanz 6HS-s650 suitable for structural parts and electric vehicle battery enclosures.

By Vehicle

Passenger cars under the electric vehicle category held the largest share of around 52% in 2024. The surge in global EV adoption, led by major OEMs such as Tesla, BYD, and Volkswagen, has accelerated demand for lightweight and thermally efficient caseboxes. These enclosures protect high-capacity battery modules, ensuring safety and durability during thermal expansion. Commercial vehicles represent the next growth area as fleets transition to electric logistics. Two-wheelers and three-wheelers dominate in Asia-Pacific, driven by affordable EV adoption and battery modularity requirements.

- For instance, Volkswagen Group delivered 744,800 battery-electric vehicles in 2024, led by passenger cars. This volume underscores enclosure demand in mass EV segments.

By Battery

Lithium-ion batteries accounted for nearly 68% of the market share in 2024, making them the leading battery segment for casebox applications. Their high energy density, long cycle life, and compatibility with modular case designs make them ideal for mass-market EVs. Caseboxes for lithium-ion systems require strong structural support and efficient heat management, boosting material innovation in aluminum and composites. Solid-state batteries are emerging rapidly due to improved safety and energy efficiency, prompting new design developments in thermal isolation and flexible enclosures for next-generation electric vehicles.

Key Growth Drivers

Rising EV Production and Battery Demand

The global rise in electric vehicle production is the strongest driver of the battery casebox market. Leading automakers, including Tesla, BYD, and Volkswagen, are scaling EV manufacturing to meet emission targets, increasing the need for safe and efficient battery housings. Battery caseboxes ensure protection, thermal stability, and structural strength for large battery packs in passenger and commercial EVs. Aluminum and composite materials are preferred for their ability to reduce vehicle weight while maintaining crash resistance. With global EV sales surpassing 14 million units in 2024, demand for high-performance caseboxes continues to grow rapidly.

- For instance, Tesla delivered 495,570 vehicles in Q4 2024. While this was a record at the time, it was surpassed by a new quarterly record of 497,099 deliveries in Q3 2025

Advancements in Material and Thermal Management Technologies

Continuous innovation in materials and heat management systems is significantly fueling market growth. Modern aluminum alloys, reinforced steel, and composite polymers are engineered to improve thermal conductivity, durability, and weight balance. Manufacturers are introducing integrated liquid-cooling systems and fire-retardant coatings within the caseboxes to enhance safety under extreme conditions. Companies such as Novelis and SGL Carbon are leading in advanced material supply, focusing on improved recyclability and lightweight designs. These innovations are vital to optimize energy efficiency, extend battery lifespan, and meet global safety standards for next-generation EV platforms.

- For instance, Henkel’s BERGQUIST Gap Filler TGF 7000 is rated at 7.0 W/m·K. Such TIMs help manage pack hotspots in aluminum or composite housings.

Supportive Regulations and Sustainability Goals

Environmental policies and clean energy programs worldwide are driving the adoption of sustainable and recyclable battery enclosures. Governments in Europe, the U.S., and Asia are implementing stricter emission standards and offering incentives for EV manufacturing, indirectly boosting demand for eco-friendly caseboxes. Regulatory frameworks such as the EU’s End-of-Life Vehicle Directive and ISO 26262 encourage the use of lightweight, fire-resistant, and recyclable materials. Automakers are integrating these sustainable materials to meet carbon-neutral goals and improve overall vehicle lifecycle management. This regulatory support ensures steady growth across both passenger and commercial electric vehicle segments.

Key Trends & Opportunities

Adoption of Composite Polymers in Premium EVs

Composite polymers are becoming a defining trend, particularly in high-end and performance electric vehicles. These materials combine high strength with low weight, improving energy efficiency and allowing flexible design for complex battery geometries. Companies like Toray Industries and SABIC are expanding polymer innovations for caseboxes with enhanced thermal insulation and impact resistance. Premium EV models are adopting hybrid structures combining metal and polymer to balance rigidity with weight reduction. This material transition opens strong opportunities for suppliers catering to the luxury and performance EV segment, where efficiency and aesthetics are both critical.

- For instance,Toray’s T1100G carbon fiber lists tensile strength near 7.0 GPa. High strength-to-weight enables hybrid metal-polymer case structures.

Integration of Smart Monitoring Systems

Smart monitoring within battery caseboxes is reshaping safety and maintenance approaches in EV design. Embedded sensors now track real-time parameters such as temperature, vibration, and pressure, ensuring early fault detection and improved reliability. Leading OEMs are incorporating IoT-enabled diagnostic systems to predict battery wear and optimize charging efficiency. This trend aligns with the rise of connected mobility platforms, where data analytics enhance performance and safety. The integration of such smart technologies in caseboxes strengthens predictive maintenance strategies, reduces downtime, and supports the growing ecosystem of intelligent and autonomous electric vehicles.

- For instance, Texas Instruments’ BQ79616-Q1 monitors up to 16 cells and measures voltages in <200 µs. The device supports ASIL-D architectures and stackable daisy-chains.

Expansion in Commercial EV Segment

The electrification of commercial fleets, including delivery vans, buses, and trucks, presents one of the strongest market opportunities. Fleet operators are rapidly transitioning to electric mobility to meet sustainability and cost-efficiency targets. These vehicles demand larger, thermally stable, and impact-resistant caseboxes to house high-capacity batteries operating under long-duty cycles. Manufacturers are developing reinforced aluminum and polymer-composite housings optimized for high load-bearing and thermal dispersion. With governments promoting electric public transport and zero-emission logistics, this segment offers significant growth potential for large-format and modular battery enclosure systems.

Key Challenges

High Manufacturing and Material Costs

The high cost of production remains a major challenge for the Electric Vehicle Battery Casebox Market. Aluminum and composite-based caseboxes require advanced forming, welding, and heat treatment processes that raise overall production expenses. Smaller EV manufacturers face cost constraints when integrating lightweight but durable casebox designs. Volatility in aluminum and carbon fiber prices further affects profitability. Companies are investing in recycling methods and local supply chains to mitigate costs, but achieving large-scale affordability while meeting stringent safety standards remains a persistent challenge in the sector.

Recycling and End-of-Life Management Issues

End-of-life management of battery caseboxes is another pressing concern. The use of mixed materials such as aluminum, steel, and polymer composites complicates recycling and material separation processes. Most regions still lack a standardized infrastructure for reclaiming or reusing these components. This limitation adds to waste generation and undermines circular economy goals. Manufacturers are exploring modular and mono-material designs to simplify disassembly and recycling. Overcoming these sustainability challenges is vital for meeting global environmental regulations and achieving long-term resource efficiency in the EV battery ecosystem.

Regional Analysis

North America

North America held around 28% of the Electric Vehicle Battery Casebox Market in 2024, driven by strong EV adoption across the United States and Canada. Major automakers such as Tesla, General Motors, and Ford are investing in advanced battery housing technologies for improved safety and lightweight design. The region benefits from supportive government policies promoting zero-emission vehicles and local battery production. Expanding gigafactories and growing collaborations with material suppliers are strengthening the supply chain for aluminum and composite caseboxes. Increasing EV sales and infrastructure development continue to accelerate market penetration across North America.

Europe

Europe accounted for nearly 31% of the global market share in 2024, supported by strict emission norms and rapid electrification of transport fleets. Countries like Germany, France, and the UK lead in advanced battery enclosure adoption due to strong automotive manufacturing bases. The European Union’s sustainability directives have driven the use of recyclable materials and lightweight alloys in casebox production. Leading OEMs such as BMW, Volkswagen, and Renault are developing integrated designs to meet safety and efficiency targets. Continuous innovation in composite materials and growing EV charging infrastructure are fueling steady market growth across the region.

Asia-Pacific

Asia-Pacific dominated the Electric Vehicle Battery Casebox Market in 2024 with a 35% share, led by China, Japan, and South Korea. The region’s leadership is attributed to large-scale EV production, government incentives, and rapid technological advancements in battery systems. China remains the largest contributor due to high EV sales and investments in local aluminum and polymer casebox manufacturing. Japan and South Korea are focusing on solid-state battery integration and smart casebox technologies. The region’s strong manufacturing ecosystem, coupled with supportive clean energy policies, ensures continuous expansion of the battery enclosure industry across both passenger and commercial EVs.

Latin America

Latin America captured around 4% of the Electric Vehicle Battery Casebox Market in 2024, primarily driven by emerging EV adoption in Brazil, Mexico, and Chile. Regional governments are promoting electric mobility through import incentives and pilot electrification projects for public transport. Growing interest in battery assembly and local EV component manufacturing is fostering gradual development of the casebox industry. The region faces infrastructure challenges but benefits from increasing private investment in sustainable mobility. Partnerships with global OEMs are expected to strengthen supply networks and accelerate adoption of durable and cost-effective battery enclosure solutions.

Middle East & Africa

The Middle East & Africa region accounted for nearly 2% of the global market share in 2024, showing early but promising growth potential. Countries like the UAE, Saudi Arabia, and South Africa are investing in EV infrastructure and renewable energy integration. Government-led initiatives promoting carbon neutrality and electric mobility are supporting gradual market expansion. Demand for robust and heat-resistant caseboxes is rising due to extreme climate conditions. Although still in a nascent phase, increasing regional manufacturing activities and collaborations with international EV producers are expected to drive steady growth in the coming years.

Market Segmentations:

By Material:

- Aluminum

- Steel

- Composite polymers

- Others

By Vehicle:

- Electric vehicles

- Two-wheelers & three-wheelers

- Passenger cars

- Commercial vehicles

- Hybrid & plug-in hybrid EV

- Passenger cars

- Commercial vehicles

By Battery:

- Lithium-ion batteries

- Solid-state batteries

- Nickel-metal hydride (NiMH) batteries

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

Key players in the Electric Vehicle Battery Casebox Market include Magna, SGL Carbon, Norsk Hydro ASA, POSCO, Minth, SABIC, Gestamp Automocion, Continental Structural Plastics, UACJ Corporation, ThyssenKrupp AG, Covestro AG, and Constellium SE. The market is characterized by intense competition driven by technological innovation, material optimization, and strategic collaborations with automakers. Companies are focusing on developing lightweight, corrosion-resistant, and thermally stable battery housings that enhance vehicle efficiency and safety. Most participants are investing in advanced aluminum alloys, composite polymers, and hybrid material structures to balance strength with cost-effectiveness. Continuous R&D efforts aim to improve fire resistance, recyclability, and integration with evolving battery technologies, including solid-state systems. Partnerships with EV manufacturers are strengthening supply chains and ensuring localized production in key markets such as Asia-Pacific and Europe. Competitive differentiation is increasingly determined by innovation speed, production scalability, and adherence to strict environmental and performance standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Magna

- SGL Carbon

- Norsk Hydro ASA

- POSCO

- Minth

- SABIC

- Gestamp Automocion

- Continental Structural Plastics

- UACJ Corporation

- ThyssenKrupp AG

- Covestro AG

- Constellium SE

Recent Developments

- In 2024, SGL Carbon entered a technology partnership with German manufacturer E-Works Mobility to supply battery cases made from glass fiber-reinforced plastic (GFRP).

- In 2024, Magna began producing battery enclosures for Chevrolet Silverado EV at its expanded St. Clair, Michigan, facility.

- In 2023, Magna announced a $790 million investment to build two supplier facilities at Ford’s BlueOval City in Tennessee. One of the facilities was dedicated to supplying battery enclosures and frames for Ford’s second-generation electric truck.

- In 2022 (with production ramp-up in 2023), Minth Group and Renault Group announced a collaboration to produce battery casings

Report Coverage

The research report offers an in-depth analysis based on Material, Vehicle, Battery and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global EV adoption accelerates across all vehicle categories.

- Advancements in lightweight materials such as aluminum alloys and composites will drive product innovation.

- Solid-state battery integration will create demand for thermally stable and compact casebox designs.

- Automakers will focus on recyclable and sustainable materials to meet carbon neutrality goals.

- The rise of connected EVs will boost adoption of smart caseboxes with embedded monitoring sensors.

- Regional manufacturing expansion will reduce supply chain dependency on imported materials.

- Commercial electric vehicles will emerge as a key application segment for high-capacity enclosures.

- Strategic partnerships between automakers and material suppliers will enhance design efficiency.

- Regulatory standards on safety and recyclability will shape new product development.

- Asia-Pacific will remain the dominant production hub, supported by strong EV manufacturing ecosystems.