Market Overview

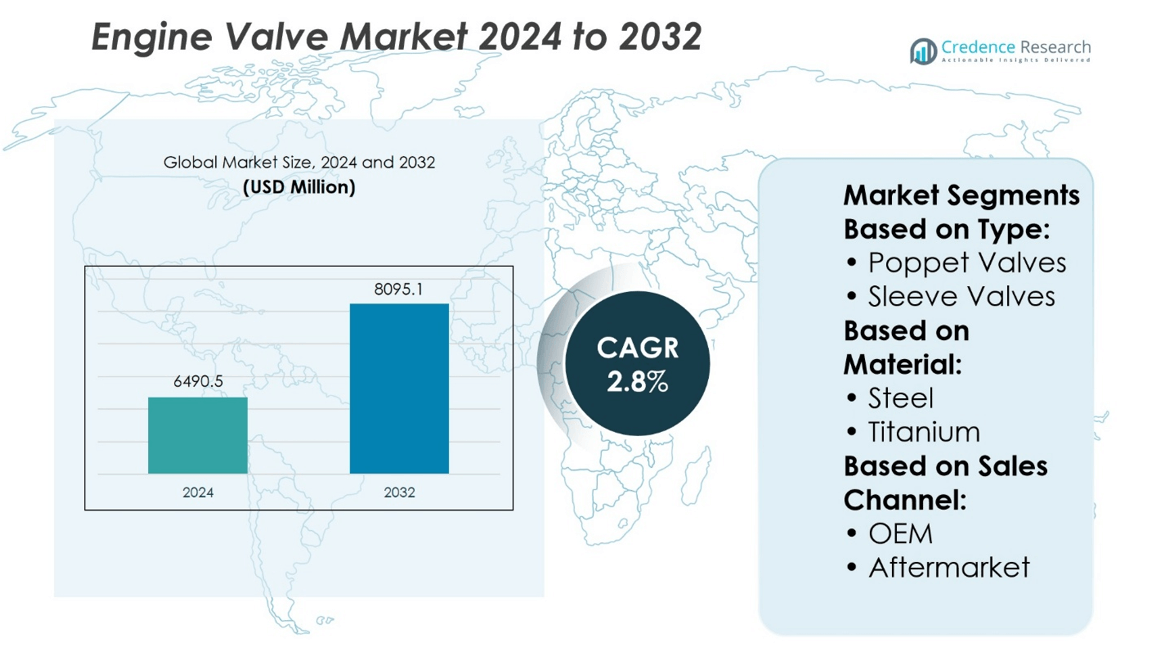

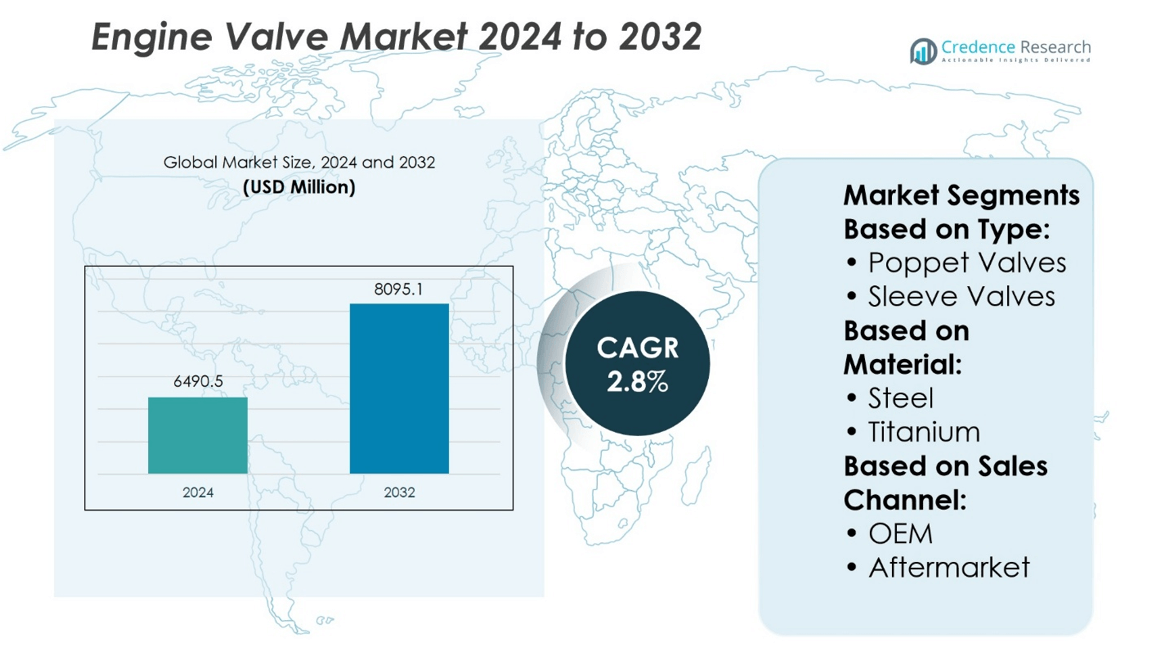

Engine Valve Market size was valued at USD 6490.5 million in 2024 and is anticipated to reach USD 8095.1 million by 2032, at a CAGR of 2.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Engine Valve Market Size 2024 |

USD 6490.5 million |

| Engine Valve Market, CAGR |

2.8% |

| Engine Valve Market Size 2032 |

USD 8095.1 million |

The Engine Valve Market experiences strong growth driven by increasing demand for fuel-efficient and low-emission engines across automotive and industrial sectors. Rising vehicle production in emerging economies and stringent environmental regulations compel manufacturers to develop advanced, lightweight, and durable valve materials. Innovations in variable valve timing and precision manufacturing enhance engine performance and compliance. The market also trends toward integration of smart production technologies and expansion of aftermarket services due to growing vehicle fleets. These factors collectively stimulate continuous innovation and market expansion, positioning the Engine Valve Market for sustained growth in response to evolving industry requirements.

The Engine Valve Market shows strong growth across regions, with Asia-Pacific leading due to rapid industrialization and automotive production, followed by significant shares in North America and Europe driven by stringent regulations and advanced manufacturing. Emerging markets in Latin America and the Middle East offer expanding opportunities. Key players in the market include Bosch, Continental AG, Denso, Eaton Corporation, and Hitachi Ltd, who leverage innovation, quality, and strategic partnerships to maintain leadership and cater to diverse regional demands.

Market Insights

- The Engine Valve Market size was valued at USD 6490.5 million in 2024 and is expected to reach USD 8095.1 million by 2032, growing at a CAGR of 2.8%.

- Increasing demand for fuel-efficient and low-emission engines drives market growth across automotive and industrial sectors.

- Rising vehicle production in emerging economies boosts demand for advanced, lightweight, and durable engine valves.

- Stringent environmental regulations encourage manufacturers to innovate valve materials and designs for better performance.

- Integration of smart manufacturing technologies improves precision and efficiency in valve production.

- Asia-Pacific leads the market due to rapid industrialization and automotive manufacturing, followed by North America and Europe.

- Key players focus on innovation, quality, and strategic partnerships to maintain competitiveness and expand market share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Performance and Fuel-Efficient Engines

The growing emphasis on fuel efficiency and engine performance across automotive and industrial sectors drives the Engine Valve Market significantly. Manufacturers focus on producing valves that enhance combustion efficiency and reduce emissions, meeting stringent regulatory norms. It supports the development of advanced internal combustion engines with improved power output and durability. Increasing consumer preference for vehicles with better mileage fuels demand for durable and high-precision engine valves. It also encourages innovation in valve materials and designs to withstand higher temperatures and pressures. Continuous investments in research and development enable the introduction of lightweight and corrosion-resistant valves, further enhancing engine efficiency.

- For instance, Bosch developed a variable valve timing system that improved engine torque by up to 15 Nm at 2000 RPM, contributing to better fuel efficiency and lower emissions in several passenger car models globally.

Expansion of the Automotive Industry and Vehicle Production Volumes

The Engine Valve Market benefits from the rapid expansion of the automotive industry globally, especially in emerging economies. Growing vehicle production volumes, both passenger and commercial, create substantial demand for engine components, including valves. It directly correlates with the rising number of combustion engine-based vehicles on roads despite the gradual shift towards electric vehicles. Urbanization and rising disposable incomes contribute to increased vehicle sales, boosting engine valve consumption. The trend of vehicle replacement and upgrade cycles also propels market growth. Regional manufacturing hubs play a pivotal role by catering to local and export demands.

- For instance, Denso reported manufacturing over 30 million engine valves annually, supplying to major automakers across Asia and South America, supporting increased vehicle production and meeting diverse engine specifications in these growing markets.

Strict Emission Regulations and Environmental Policies Driving Technological Upgrades

Environmental regulations compel manufacturers to develop engine valves capable of supporting cleaner and more efficient engines. It prompts the adoption of advanced valve technologies such as variable valve timing and lightweight alloys. Meeting emission targets necessitates valves that improve air-fuel mixture control, reducing harmful exhaust gases. Government mandates globally ensure continuous upgrades in engine valve design and production techniques. It encourages collaboration between OEMs and suppliers to innovate solutions compliant with evolving standards. These regulations act as a catalyst for ongoing market evolution and technological refinement.

Growth in Industrial Machinery and Heavy-Duty Equipment Sectors

Demand for engine valves in industrial machinery and heavy-duty equipment contributes significantly to market expansion. It encompasses applications in construction, mining, agriculture, and power generation, where engine reliability is critical. Increasing infrastructure projects worldwide drive the need for durable valves capable of withstanding harsh operating conditions. The diversification of engine applications beyond automotive sectors broadens market opportunities. Manufacturers develop specialized valves to cater to specific industrial requirements, enhancing operational efficiency. Steady growth in these sectors ensures sustained demand for high-quality engine valves.

Market Trends

Advancements in Material Technology Enhancing Valve Performance and Durability

The Engine Valve Market experiences a strong shift toward advanced materials such as titanium alloys, stainless steel, and composite materials. These materials offer enhanced strength-to-weight ratios, corrosion resistance, and thermal stability, improving overall engine efficiency. It allows manufacturers to produce lighter valves that reduce engine inertia and boost fuel economy. Research focuses on surface treatments and coatings that extend valve lifespan under high-temperature conditions. The trend toward material innovation addresses growing demands for performance and durability in modern engines. It supports the adoption of engines that comply with stringent emission standards while maintaining high output.

- For instance, Eaton Corporation developed titanium engine valves weighing approximately 45 grams each, which reduced valve mass by nearly 30 grams compared to traditional steel valves, significantly improving engine response and durability in high-performance applications.

Integration of Smart and Precision Manufacturing Techniques

Manufacturers implement smart manufacturing technologies like automation, robotics, and computer numerical control (CNC) machining to improve the quality and consistency of engine valves. It results in higher precision and reduced production errors, meeting the exacting requirements of modern engines. The integration of Industry 4.0 principles optimizes supply chain management and accelerates production timelines. This trend reflects the broader digital transformation within the automotive and industrial components sectors. It also enables customization and faster adaptation to new engine designs. Continuous improvement in manufacturing capabilities drives competitiveness in the market.

- For instance, Hitachi Ltd. integrated CNC machining centers capable of producing over 500 precision valves per shift, reducing dimensional variance to less than 0.01 millimeters, which significantly enhances engine valve reliability and performance.

Rising Adoption of Variable Valve Timing and Advanced Engine Designs

The Engine Valve Market aligns closely with innovations in engine technologies such as variable valve timing (VVT) and variable valve lift systems. It supports engines that optimize air intake and exhaust flow, improving fuel efficiency and reducing emissions. This trend gains traction in passenger vehicles and commercial engines aiming for enhanced performance and environmental compliance. Valve designs evolve to accommodate these dynamic control systems without compromising reliability. OEMs and suppliers collaborate to develop valves compatible with increasingly complex engine architectures. This shift contributes to greater engine flexibility and operational efficiency.

Expansion into Emerging Markets and Diversification of End-Use Applications

Market growth reflects increasing engine production in emerging economies, driven by expanding automotive and industrial sectors. It opens new opportunities for engine valve manufacturers to cater to diverse applications, including agriculture machinery, construction equipment, and power generation engines. Localization of production and supply chains in these regions reduces costs and improves market responsiveness. The diversification of engine types beyond traditional passenger vehicles broadens demand for specialized valve solutions. Emerging markets also witness rising investments in engine upgrade and replacement programs. This geographic and application-based expansion strengthens the Engine Valve Market’s global footprint.

Market Challenges Analysis

Stringent Regulatory Compliance and Increasing Production Costs Impact Market Growth

The Engine Valve Market faces considerable challenges from tightening emission regulations and environmental standards worldwide. It forces manufacturers to invest heavily in research, development, and production processes to meet these rigorous requirements. Compliance drives up production costs due to the need for advanced materials and sophisticated manufacturing techniques. Small and medium-sized manufacturers often struggle to bear these expenses, impacting market competitiveness. It also demands continuous innovation to maintain product relevance and reliability under stricter norms. High capital investment and extended product development cycles create barriers to entry for new players. These factors collectively slow down rapid market expansion.

Rising Competition from Electric and Alternative Powertrain Technologies Threatens Traditional Demand

The growing adoption of electric vehicles (EVs) and alternative powertrains presents a significant challenge to the Engine Valve Market. It reduces the demand for traditional internal combustion engine components, including engine valves. Shifts in consumer preferences and government incentives accelerate the transition toward cleaner mobility solutions. The market must adapt to fluctuating demand and potential shrinking volumes in key automotive segments. This dynamic creates uncertainty for manufacturers focused on combustion engine technologies. It requires strategic realignment toward diversification or innovation in valve applications beyond conventional engines. Managing this transition while sustaining profitability remains a critical challenge.

Market Opportunities

Emerging Economies Driving Increased Demand for Engine Valves Across Automotive and Industrial Sectors

The Engine Valve Market gains significant opportunities from rapid industrialization and urbanization in emerging economies. It benefits from growing vehicle production and expansion in sectors such as agriculture, construction, and power generation. Rising disposable incomes and infrastructure development boost demand for reliable engine components in these regions. Localization of manufacturing facilities offers cost advantages and faster market responsiveness. It opens avenues for manufacturers to establish strategic partnerships and expand distribution networks. The increasing preference for modern, fuel-efficient engines also stimulates demand for advanced valve technologies. This trend creates a robust platform for sustained market growth.

Technological Innovation and Diversification in Valve Applications Expand Market Potential

Innovation in materials, coatings, and valve designs provides the Engine Valve Market with multiple growth avenues. It allows manufacturers to address evolving engine performance requirements and stringent emission standards effectively. Development of lightweight and high-strength valves supports fuel efficiency and engine longevity. The growing adoption of alternative fuels such as CNG and hydrogen offers new application segments requiring specialized valve solutions. It encourages collaboration between OEMs and suppliers to develop tailored products for diverse engine types. These advancements promote product differentiation and open new revenue streams beyond traditional automotive markets.

Market Segmentation Analysis:

By Type:

The Engine Valve Market primarily consists of poppet valves and sleeve valves. Poppet valves dominate due to their widespread use in internal combustion engines, offering effective sealing and reliable performance under diverse conditions. Sleeve valves cater to niche engine designs that require reduced wear and improved airflow. Innovations continue to improve the efficiency and durability of both valve types to meet evolving engine demands.

- For instance, Federal-Mogul manufactures over 20 million poppet valves annually, providing components for a wide range of passenger cars and commercial vehicles.

By Material:

Steel remains the predominant material for engine valves due to its strength, affordability, and versatility across vehicle types. It supports applications from everyday passenger cars to heavy-duty engines. Titanium increasingly gains adoption for its lightweight nature and superior heat and corrosion resistance, especially in high-performance engines. This material shift reflects the market’s push for improved fuel efficiency and durability.

- For instance, Bosch manufactures titanium valves weighing approximately 40 grams each, which are 35% lighter than comparable steel valves, improving engine responsiveness and reducing wear in high-performance and racing engines.

By Sales Channel:

Original Equipment Manufacturers (OEM) dominate the sales channel segment by supplying valves directly for new vehicle production. It emphasizes strict quality control and close partnerships with engine manufacturers. The aftermarket segment serves replacement and upgrade needs, benefiting from an expanding vehicle fleet and longer maintenance cycles. Aftermarket demand rises as vehicle owners seek to maintain engine performance and extend service life.

Segments:

Based on Type:

- Poppet Valves

- Sleeve Valves

Based on Material:

Based on Sales Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America:

North America holds nearly 25% of the Engine Valve Market, backed by a mature automotive industry and rigorous emission standards. The United States plays a central role, characterized by substantial R&D investments and a well-developed aftermarket sector. Demand for high-performance, fuel-efficient engine valves aligns with stringent regulatory requirements. OEMs and suppliers in the region leverage advanced manufacturing technologies to produce lightweight and durable valves. The commercial vehicle segment also significantly contributes to market size due to strong logistics and construction industries. Continuous innovation and replacement demand sustain steady growth in this market.

Europe:

Europe represents about 20% of the global Engine Valve Market, driven by leading automotive nations such as Germany, France, and Italy. The region focuses heavily on innovation, emission reduction, and adoption of hybrid and advanced combustion engine technologies. Strict environmental regulations encourage the use of high-grade materials like titanium and advanced valve designs. Europe’s large aftermarket for replacement valves supports ongoing market demand, alongside new vehicle production. Commercial vehicles servicing logistics and infrastructure projects also contribute to market expansion. The shift towards cleaner technologies further stimulates valve advancements.

Asia-Pacific:

The Asia-Pacific region commands the largest share of the Engine Valve Market, accounting for approximately 45% of the global volume. This dominance stems from rapid industrialization, expansive automotive manufacturing, and significant infrastructure development in countries such as China, India, Japan, and South Korea. The region benefits from increasing vehicle production across both passenger cars and commercial vehicles. Favorable government policies encouraging automotive growth and urbanization amplify engine valve demand. Rising disposable incomes and expanding middle-class populations support a growing replacement and maintenance market. Manufacturing hubs in Asia-Pacific also attract foreign investments, enabling advanced valve production and technology adoption.

Latin America:

Latin America accounts for a notable portion of the Rest of the World segment in the Engine Valve Market, representing approximately 5% of the global share. The region experiences steady growth fueled by increasing vehicle ownership and production, particularly in countries like Brazil, Mexico, and Argentina. Expanding commercial vehicle fleets support logistics, agriculture, and construction industries, creating consistent demand for durable engine valves. Local manufacturing capabilities improve gradually, supported by regional OEMs and aftermarket suppliers. Economic fluctuations and fluctuating raw material prices pose challenges, but government initiatives promoting automotive industry modernization contribute positively. Rising maintenance and replacement needs in aging vehicle fleets also stimulate aftermarket valve sales.

Middle East:

The Middle East contributes roughly 3-4% of the Engine Valve Market share, with demand primarily driven by infrastructure development, energy, and heavy industry sectors. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar invest heavily in construction, oil & gas, and power generation equipment, where reliable engine valves play a critical role. The growth of commercial vehicles used in mining, transport, and construction fuels demand for high-performance valves that withstand harsh operating conditions. While automotive production remains limited compared to other regions, the industrial engine segment offers significant opportunities. Ongoing diversification efforts in regional economies encourage modernization of manufacturing and supply chains, which supports gradual market growth despite economic and geopolitical uncertainties.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton Corporation

- Bosch

- Fuji Oozx

- Hitachi Ltd

- Federal-Mogul

- Rane

- Continental AG

- Grindtech

- AVR (Vikram) Valves

- Denso

Competitive Analysis

The Engine Valve Market features intense competition among established global players including Bosch, Continental AG, Denso, Eaton Corporation, Federal-Mogul, Hitachi Ltd, Rane, AVR (Vikram) Valves, Fuji Oozx, and Grindtech. The Engine Valve Market remains highly competitive, driven by continuous innovation in materials, design, and manufacturing processes. Companies focus on enhancing valve durability, precision, and performance to meet increasingly stringent emission regulations and fuel efficiency standards. The adoption of advanced materials such as titanium and specialty coatings improves engine efficiency and lifespan, creating differentiation among manufacturers. Automation and digital technologies in production lines enhance product quality and reduce manufacturing costs. Market participants also prioritize expanding their presence in emerging economies to capitalize on growing automotive and industrial demand. Strategic collaborations, technology development, and responsiveness to regulatory changes serve as key factors for gaining and maintaining competitive advantage in this evolving market landscape.

Recent Developments

- In April 2024, the engine component manufacturer Shriram Pistons & Rings Ltd commenced the production of motors and controllers. This was done through the company’s subsidiary, SPR Engenious. Apart from this, the company had planned further growth, targeting the electric powertrain market which has many applications.

- In February 2024, Rane Group announced its merger with Rane Brake Lining and Rane Engine Valve. This action underscores the Rane Group’s preference towards restructuring and enhancing operation efficiency.

- In February 2024, Tenneco has patented a new Monroe Ride Refine SDD valve which is the company’s newest innovation. This addon increases the effectiveness of passive dampers to provide uppermost ease and control during active driving alongside the company’s primary valve technologies.

- In November 2023, Parker Hannifin, one of the leaders in control and motion technologies, announced the expansion of their product line with the introduction of HNV Series needle valves and Hi-Pro Series ball valves featuring O-LOK O-Ring Face Seal (ORFS) interfacing fitting ports at their Instrumentation Products Division, Europe (IPDE).

Market Concentration & Characteristics

The Engine Valve Market exhibits a moderately concentrated structure, dominated by several established global manufacturers that hold significant market shares due to their technological expertise and strong OEM relationships. It operates within a competitive environment where innovation, quality, and cost-efficiency determine market positioning. Leading companies invest substantially in research and development to develop advanced materials and manufacturing processes that enhance valve performance and comply with strict emission standards. The market characteristics include high entry barriers driven by the need for precision engineering, capital-intensive production facilities, and compliance with regulatory requirements. While the market concentration favors large players, numerous regional manufacturers and suppliers participate in the aftermarket segment, catering to replacement and maintenance demands. It maintains a dynamic balance between OEM and aftermarket sales channels, each influencing growth differently. Emerging economies attract investments from global players seeking expansion, encouraging partnerships with local firms. The industry continuously adapts to evolving engine technologies, including the integration of lightweight materials and smart manufacturing techniques. This adaptation drives product differentiation and sustains competitiveness. Overall, the Engine Valve Market combines technological sophistication with regional diversity, requiring companies to maintain innovation leadership and operational excellence to secure long-term growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to increasing demand for fuel-efficient and low-emission engines.

- Manufacturers will focus on developing lightweight and corrosion-resistant valve materials.

- Advancements in variable valve timing and lift technologies will drive valve design innovation.

- The expansion of automotive production in emerging economies will create new growth opportunities.

- Stringent emission regulations will push companies to enhance valve performance and durability.

- Automation and digital manufacturing techniques will improve production precision and reduce costs.

- Aftermarket demand will rise with the growing vehicle fleet and increasing maintenance needs.

- Collaboration between OEMs and suppliers will accelerate the introduction of advanced valve solutions.

- Adoption of alternative fuel engines, including CNG and hydrogen, will require specialized valve designs.

- Regional diversification will increase as manufacturers seek to optimize supply chains and localize production.