Market Overview:

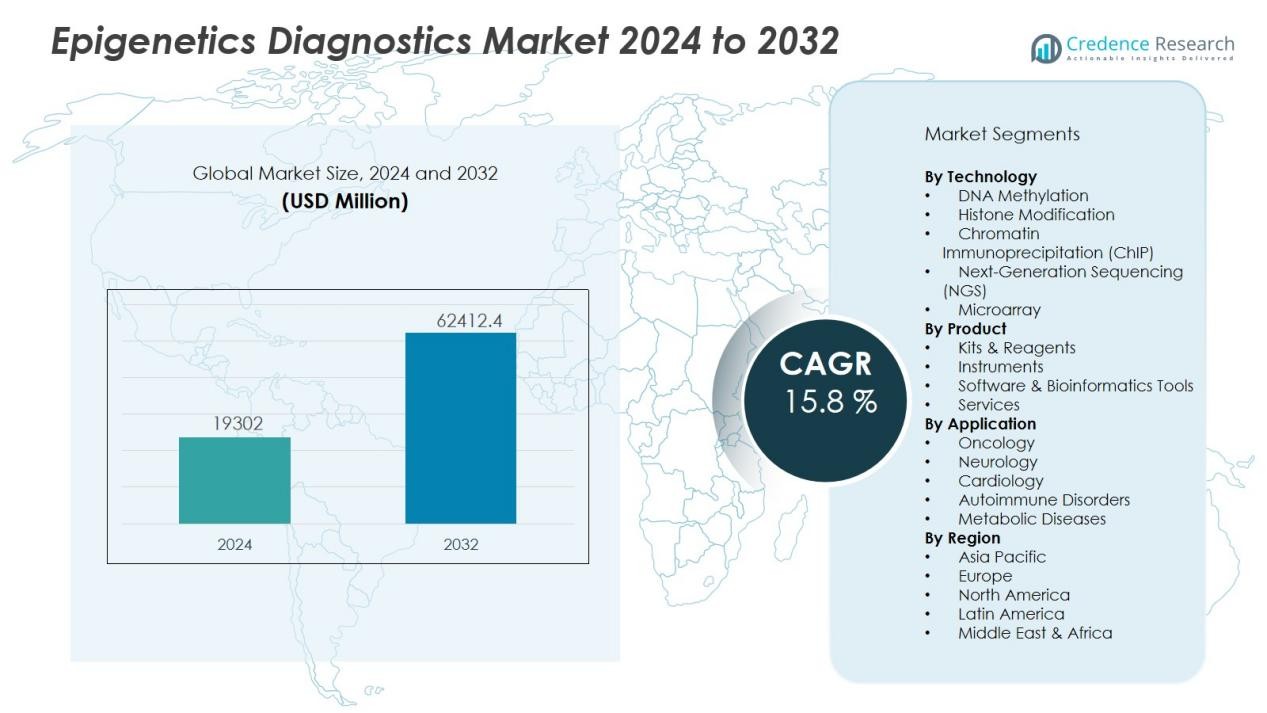

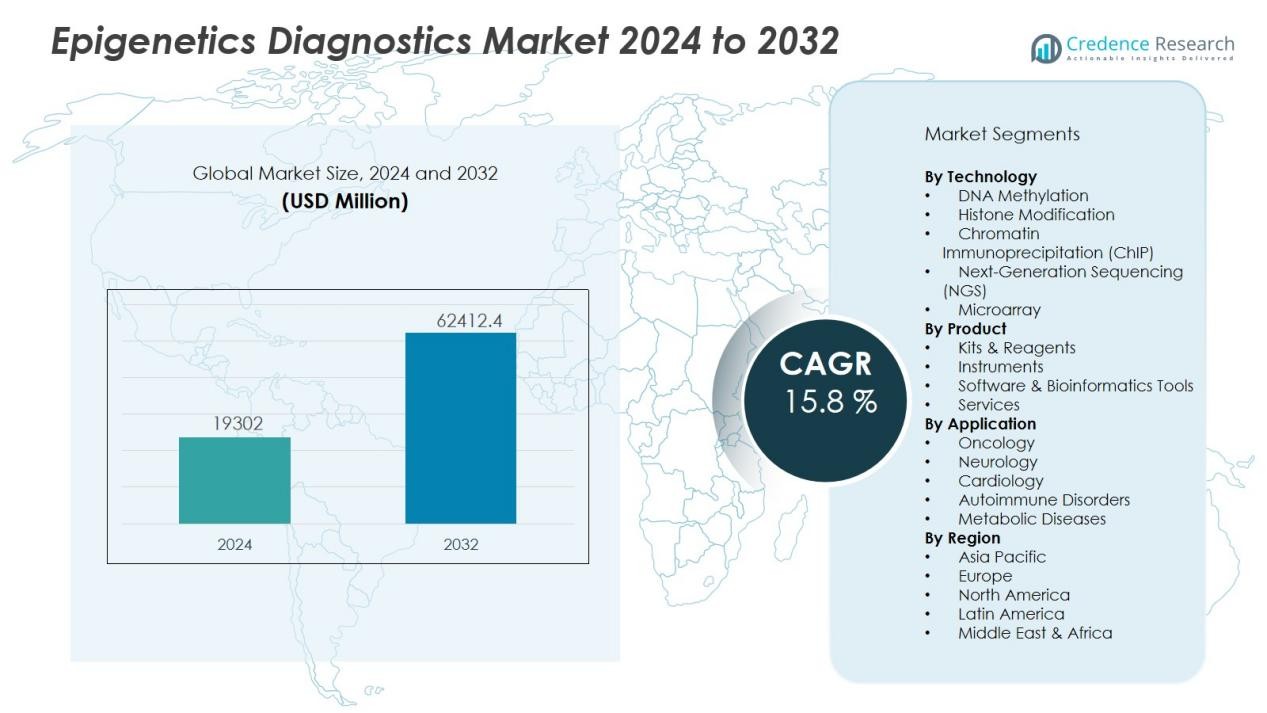

The epigenetics diagnostics market size was valued at USD 19302 million in 2024 and is anticipated to reach USD 62412.4 million by 2032, at a CAGR of 15.8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epigenetics Diagnostics Market Size 2024 |

USD 19302 Million |

| Epigenetics Diagnostics Market, CAGR |

15.8 % |

| Epigenetics Diagnostics Market Size 2032 |

USD 62412.4 Million |

Key drivers of this market include the rising global prevalence of cancer and chronic diseases, where epigenetic modifications serve as critical biomarkers for early diagnosis and treatment monitoring. Increasing demand for non-invasive diagnostic tools, combined with advancements in next-generation sequencing (NGS), DNA methylation assays, and histone modification studies, is fueling rapid adoption. The growth of personalized medicine, supported by ongoing clinical research and collaborations between diagnostic firms and research institutes, further strengthens the market outlook.

Regionally, North America dominates the epigenetics diagnostics market due to strong research infrastructure, high healthcare expenditure, and the presence of leading biotech companies. Europe follows with supportive regulatory frameworks and growing clinical adoption of epigenetic testing in oncology. Asia-Pacific is expected to witness the fastest growth, driven by increasing cancer incidence, expanding healthcare investments in countries like China and India, and rising awareness of early disease detection. Emerging markets in Latin America and the Middle East & Africa are gradually adopting epigenetics diagnostics, supported by improving healthcare infrastructure and international collaborations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The epigenetics diagnostics market was valued at USD 19,302 million in 2024 and is projected to reach USD 62,412.4 million by 2032, reflecting strong growth potential.

- Rising prevalence of cancer and chronic diseases is a primary driver, with epigenetic biomarkers supporting early detection and improved patient outcomes.

- Advancements in next-generation sequencing, chromatin immunoprecipitation, and methylation assays are enhancing diagnostic precision and expanding clinical applications.

- Personalized medicine adoption is increasing, as clinicians and pharmaceutical firms rely on epigenetic data to design targeted therapies and improve treatment effectiveness.

- High costs of advanced testing methods and lack of standardized protocols remain key challenges, limiting accessibility and slowing widespread clinical integration.

- North America leads with 42% market share, supported by robust research infrastructure, favorable reimbursement policies, and strong biotech presence.

- Asia-Pacific is witnessing the fastest growth at 21% market share, driven by rising healthcare investments, cancer screening programs, and adoption of non-invasive diagnostics.

Market Drivers:

Rising Prevalence of Cancer and Chronic Diseases Driving Diagnostic Demand:

The epigenetics diagnostics market benefits from the growing global burden of cancer and chronic diseases, where early and accurate detection plays a critical role in treatment outcomes. Epigenetic biomarkers, such as DNA methylation and histone modifications, provide valuable insights for identifying disease onset at an early stage. It supports the development of targeted therapies and personalized medicine strategies, improving patient survival rates. Increasing healthcare focus on preventive and precision diagnostics continues to strengthen adoption.

- For instance, Volition’s Nu.Q™ assay—an epigenetic blood test—demonstrated 74% sensitivity and 90% specificity for early-stage colorectal cancer detection in a pilot study of 58 asymptomatic patients, supporting improved non-invasive screening protocols.

Advancements in Molecular and Sequencing Technologies Enhancing Applications:

Continuous progress in molecular biology and sequencing platforms significantly contributes to the growth of the epigenetics diagnostics market. Techniques such as next-generation sequencing, chromatin immunoprecipitation, and methylation assays improve the sensitivity and specificity of diagnostics. It enables more comprehensive analysis of epigenetic modifications, expanding their application across oncology, neurology, and autoimmune disorders. Lower costs and faster turnaround times are further encouraging clinical and research use.

- For instance, Illumina’s NovaSeq 6000 sequencer produces up to 20 billion reads per run with over 90% of bases above Q30 quality, substantially increasing throughput and enabling whole genome sequencing in under 44 hours for enhanced clinical research applications.

Growing Adoption of Personalized Medicine and Targeted Therapies:

The rise of personalized medicine is fueling strong demand within the epigenetics diagnostics market. Clinicians rely on epigenetic information to design targeted therapies that match individual patient profiles. It allows healthcare providers to optimize treatment plans, reduce adverse effects, and improve therapeutic effectiveness. Pharmaceutical companies are also integrating epigenetic testing into drug development pipelines to enhance precision in clinical trials.

Supportive Research Investments and Collaborations Accelerating Growth:

Expanding investments in healthcare research and strategic collaborations among biotech firms, diagnostic companies, and academic institutions are accelerating innovation in the epigenetics diagnostics market. Funding initiatives encourage the development of advanced diagnostic platforms and clinical validation of epigenetic biomarkers. It strengthens the transition of research outcomes into commercialized diagnostic solutions. The supportive ecosystem ensures continuous innovation and wider accessibility of cutting-edge diagnostic tools.

Market Trends:

Integration of Epigenetic Biomarkers into Clinical Diagnostics and Precision Medicine:

The epigenetics diagnostics market is witnessing a strong shift toward clinical adoption of epigenetic biomarkers for disease detection and management. Healthcare providers increasingly recognize the role of DNA methylation, histone modifications, and non-coding RNA in identifying cancer, neurological disorders, and rare genetic conditions. It supports the development of companion diagnostics that guide targeted therapy selection and improve treatment outcomes. Pharmaceutical companies are embedding epigenetic testing in clinical trials to stratify patient populations and enhance drug efficacy. The growing acceptance of liquid biopsy-based epigenetic assays is expanding non-invasive diagnostic options, improving patient comfort and compliance. This trend is reinforcing the position of epigenetics as a cornerstone in precision medicine strategies.

- For instance, Illumina’s Infinium MethylationEPIC array enables profiling of over 850,000 CpG sites per sample, offering researchers a high-resolution view of the methylome in a single workflow. This capability has accelerated early-stage cancer detection studies, with over 95% concordance versus whole-genome bisulfite sequencing in multicenter trials.

Technological Innovations and Expansion into Emerging Healthcare Markets:

Rapid advancements in sequencing technologies and bioinformatics tools are shaping the evolution of the epigenetics diagnostics market. Automation, high-throughput platforms, and AI-driven data analysis are enabling faster, more accurate interpretation of epigenetic modifications. It broadens the scope of diagnostic applications beyond oncology into cardiology, immunology, and metabolic diseases. Increasing collaborations between diagnostic firms and research institutions are accelerating the validation of novel biomarkers and commercialization of advanced kits. Emerging markets in Asia-Pacific and Latin America are adopting these solutions at a faster pace due to rising healthcare investments and awareness of early disease detection. This expansion is creating significant opportunities for market players to diversify their offerings and establish a stronger global footprint.

- For instance, in 2023, Qiagen launched the EpiTect Methyl II PCR Array platform, which enables simultaneous analysis of up to 94 methylated DNA regions in a single run, significantly reducing turnaround times for clinical epigenetic diagnostics.

Market Challenges Analysis:

High Costs and Technical Complexity Limiting Widespread Adoption:

The epigenetics diagnostics market faces significant challenges due to the high costs and technical complexity of advanced testing methods. Next-generation sequencing, methylation assays, and bioinformatics tools require substantial investments in infrastructure, skilled personnel, and maintenance. It creates barriers for smaller laboratories and healthcare facilities in resource-limited regions. The cost of tests remains high for patients, reducing accessibility in developing countries. Limited reimbursement policies in many healthcare systems further restrict clinical adoption. These financial and operational constraints slow down the widespread use of epigenetics-based diagnostics in routine practice.

Regulatory Hurdles and Lack of Standardization Affecting Clinical Integration:

Regulatory challenges and the absence of standardized protocols also hinder the growth of the epigenetics diagnostics market. Diagnostic tests must undergo rigorous clinical validation to meet approval standards, delaying commercialization timelines. It increases uncertainty for companies investing in new biomarker discoveries and assay development. Variability in testing methods and interpretation across laboratories reduces reliability and consistency of results. Limited global harmonization of regulatory frameworks complicates market entry for companies targeting multiple regions. The lack of universally accepted guidelines slows clinical integration and limits physician confidence in adopting epigenetic diagnostics for patient care.

Market Opportunities:

Expanding Role of Epigenetic Biomarkers in Early Detection and Personalized Medicine:

The epigenetics diagnostics market presents strong opportunities through the growing demand for early disease detection and personalized treatment strategies. Epigenetic biomarkers enable identification of cancers, neurological disorders, and metabolic conditions at pre-symptomatic stages, offering significant clinical value. It supports the development of companion diagnostics that guide therapy decisions and improve treatment effectiveness. Pharmaceutical and biotechnology companies are increasingly integrating epigenetic testing into drug development pipelines, creating new avenues for collaboration. The rising focus on precision medicine and patient-tailored solutions strengthens the relevance of epigenetic diagnostics in clinical practice. Growing awareness of non-invasive diagnostic methods such as liquid biopsy further enhances adoption potential.

Adoption in Emerging Markets and Advancements in Diagnostic Technologies:

Emerging economies provide substantial growth opportunities for the epigenetics diagnostics market due to rising healthcare investments and improving infrastructure. Governments and private organizations are increasing funding for cancer screening and research programs, creating a supportive environment for adoption. It encourages diagnostic firms to expand their presence in regions such as Asia-Pacific, Latin America, and the Middle East. Advances in sequencing platforms, automation, and AI-driven bioinformatics enhance accuracy and efficiency, making epigenetic tests more accessible. Partnerships between global players and local healthcare providers are accelerating technology transfer and market penetration. The convergence of affordability, innovation, and expanding healthcare access positions epigenetic diagnostics for accelerated global growth.

Market Segmentation Analysis:

By Technology:

The epigenetics diagnostics market is segmented by technology into DNA methylation, histone modification, chromatin immunoprecipitation, and next-generation sequencing (NGS). DNA methylation assays dominate due to their wide application in cancer detection and monitoring. It plays a crucial role in identifying abnormal gene expression and early disease onset. Histone modification analysis is gaining traction for its ability to provide insights into neurodegenerative and autoimmune disorders. NGS platforms are expanding adoption with high accuracy, scalability, and reduced costs. These technologies collectively drive clinical and research applications of epigenetic testing.

- For instance, Illumina’s NovaSeq 6000 platform delivers up to 6Tb output per run, empowering large-scale epigenetic sequencing projects for clinical genomics laboratories.

By Product:

Products in the epigenetics diagnostics market include reagents, kits, instruments, and software solutions. Kits and reagents hold the largest share, driven by their routine use in laboratories and diagnostic centers. Instruments such as sequencers and PCR systems support high-throughput applications and advanced biomarker analysis. It ensures reliability and efficiency in clinical workflows. Software solutions integrated with bioinformatics tools are essential for data interpretation, expanding their importance in diagnostics. Continuous innovation across product categories is improving usability and accessibility.

- For instance, QIAGEN’s CLC Genomics Workbench provides epigenomics analysis workflows capable of processing datasets with more than 500 million sequencing reads, supporting accurate methylation calling and biomarker identification.

By Application:

Applications of the epigenetics diagnostics market span oncology, neurology, cardiology, and autoimmune diseases. Oncology remains the largest application area due to the high burden of cancer and the role of epigenetic biomarkers in early detection and treatment monitoring. Neurology applications are expanding with growing prevalence of Alzheimer’s and Parkinson’s disease. It strengthens demand for early diagnostic solutions. Cardiology and autoimmune disease diagnostics are emerging segments, benefiting from research into gene regulation and immune responses. The expanding clinical scope highlights the market’s potential across diverse medical fields.

Segmentations:

By Technology:

- DNA Methylation

- Histone Modification

- Chromatin Immunoprecipitation (ChIP)

- Next-Generation Sequencing (NGS)

- Microarray

By Product:

- Kits & Reagents

- Instruments

- Software & Bioinformatics Tools

- Services

By Application:

- Oncology

- Neurology

- Cardiology

- Autoimmune Disorders

- Metabolic Diseases

By Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Regional Analysis:

North America :

North America holds 42% market share in the epigenetics diagnostics market, supported by advanced healthcare systems and strong R&D capabilities. The United States leads the region with significant adoption of molecular diagnostics and high cancer screening rates. It benefits from supportive reimbursement frameworks and large-scale government initiatives for precision medicine. The presence of leading biotechnology companies and academic institutions drives innovation and commercialization of novel assays. Clinical trials in oncology and neurology frequently integrate epigenetic biomarkers, strengthening clinical adoption. Canada contributes with increasing investments in genomics and personalized healthcare solutions.

Europe :

Europe accounts for 29% market share in the epigenetics diagnostics market, driven by supportive regulatory frameworks and national genomics initiatives. Countries such as Germany, the United Kingdom, and France are investing heavily in precision medicine programs. It benefits from strong collaboration between healthcare providers, research institutes, and diagnostic firms. The European Medicines Agency plays a critical role in validating biomarkers and accelerating clinical adoption. Rising demand for early cancer detection and neurodegenerative disease testing strengthens adoption of epigenetic assays. Eastern Europe is also witnessing growing adoption due to improving healthcare infrastructure and rising diagnostic awareness.

Asia-Pacific :

Asia-Pacific holds 21% market share in the epigenetics diagnostics market, supported by rapid healthcare expansion and rising disease prevalence. China and India lead the region with increasing government funding in genomics and cancer screening programs. It benefits from cost-effective diagnostic solutions and growing private sector participation. Japan contributes with advanced research in molecular diagnostics and widespread integration of biomarkers in clinical practice. Rising patient awareness and the growing burden of lifestyle diseases support strong demand for early diagnostic tools. Southeast Asia is emerging as a key market with expanding healthcare access and increasing adoption of non-invasive diagnostic technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The epigenetics diagnostics market is highly competitive, with global players driving innovation through advanced technologies and strategic collaborations. Key companies include Hoffmann-La Roche Ltd., Eisai Co. Ltd., Thermo Fisher Scientific, Inc., Novartis AG, Cantata Bio (Dovetail Genomics LLC), Element Biosciences, Inc., and Illumina, Inc. These firms focus on expanding their portfolios with DNA methylation assays, next-generation sequencing platforms, and bioinformatics solutions. It is characterized by continuous R&D investments, partnerships with academic institutions, and acquisitions aimed at strengthening market presence. Established companies leverage strong distribution networks and regulatory expertise to accelerate commercialization, while emerging players focus on niche segments and cost-effective solutions. The market emphasizes precision medicine and non-invasive diagnostics, creating opportunities for differentiation through clinical validation and data-driven platforms. Competition is intensifying as firms aim to capture demand from oncology, neurology, and chronic disease diagnostics, positioning themselves for long-term growth.

Recent Developments:

- In May 2025, Hoffmann-La Roche Ltd. received FDA approval for Susvimo (ranibizumab injection), a new treatment for diabetic retinopathy that allows continuous drug delivery and reduces the frequency of treatment visits.

- In February 2025: Thermo Fisher Scientific, Inc. announced plans to acquire Solventum’s Purification & Filtration unit for $4.1 billion to expand its bioprocessing portfolio, with the deal expected to close by the end of 2025.

- In July 2025, Element Biosciences Inc. announced it surpassed 50 global installations of its AVITI24 5D Multiomic System, the only commercially available fully integrated multiomic platform, marking rapid market adoption since its release in December 2024.

Market Concentration & Characteristics:

The epigenetics diagnostics market is moderately concentrated, with a mix of established biotechnology firms, diagnostic companies, and emerging startups competing for share. Leading players dominate through strong portfolios in DNA methylation assays, next-generation sequencing platforms, and companion diagnostics. It is characterized by continuous innovation, high research intensity, and strategic collaborations between industry and academia. The market emphasizes precision medicine, driving adoption of non-invasive tests and biomarker-based assays. Regional players focus on affordability and accessibility, while global leaders invest in advanced technologies and regulatory approvals. Competition remains dynamic, with differentiation driven by test accuracy, clinical validation, and integration with therapeutic pipelines.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Product, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The epigenetics diagnostics market will expand its role in precision medicine through greater integration of biomarker-driven tests in oncology, neurology, and metabolic disorders.

- It will benefit from increasing adoption of liquid biopsy technologies, offering non-invasive and patient-friendly diagnostic alternatives.

- Growing collaborations between pharmaceutical companies and diagnostic developers will accelerate the development of companion diagnostics to guide targeted therapies.

- Advancements in next-generation sequencing and AI-driven bioinformatics will improve test accuracy, speed, and clinical usability.

- Healthcare systems will invest in early detection programs, strengthening demand for epigenetic assays in cancer screening and chronic disease management.

- Regulatory approvals and standardized testing guidelines will enhance clinical confidence and expand adoption in routine diagnostics.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will drive significant growth due to healthcare investments and rising awareness.

- Academic research will continue to uncover novel epigenetic biomarkers, expanding diagnostic applications beyond oncology into cardiology and autoimmune diseases.

- Cost reduction in sequencing technologies and wider reimbursement coverage will improve patient accessibility and affordability.

- The competitive landscape will remain innovation-driven, with companies focusing on differentiation through advanced platforms, strategic partnerships, and global expansion.