Market Overview:

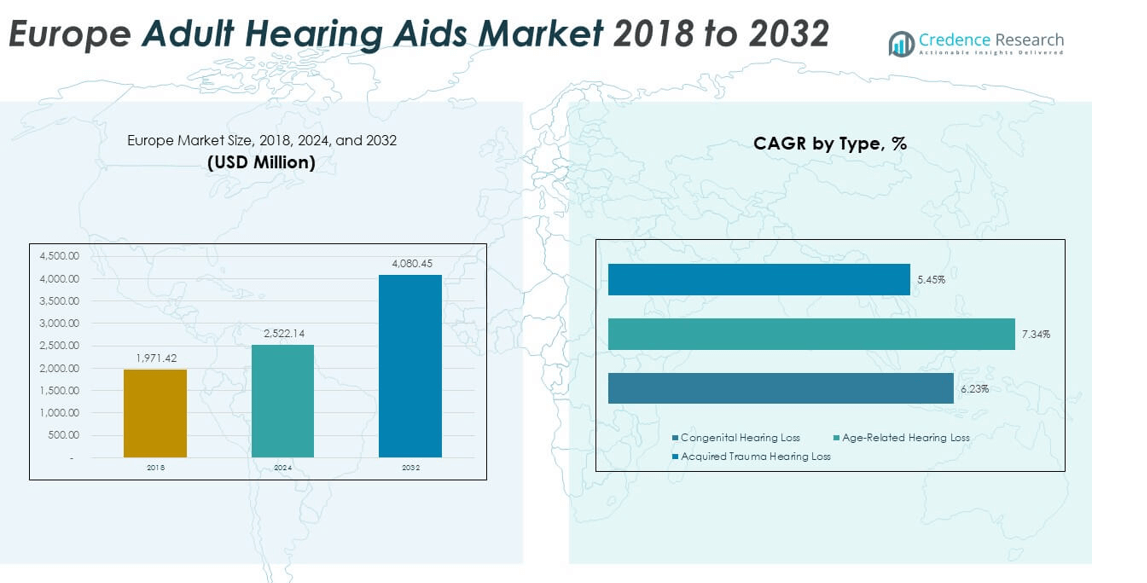

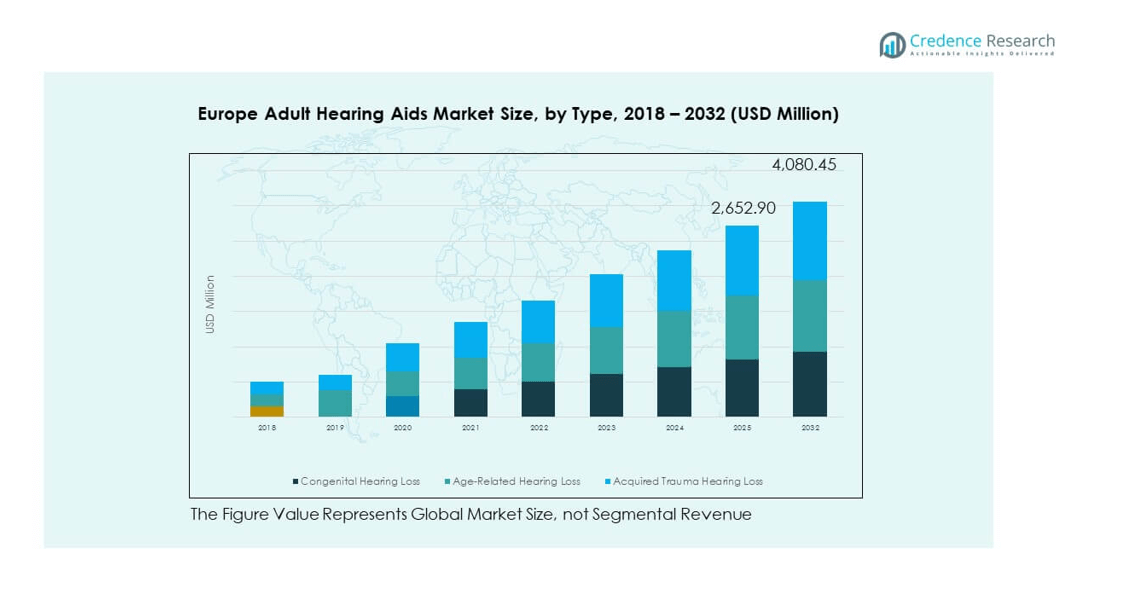

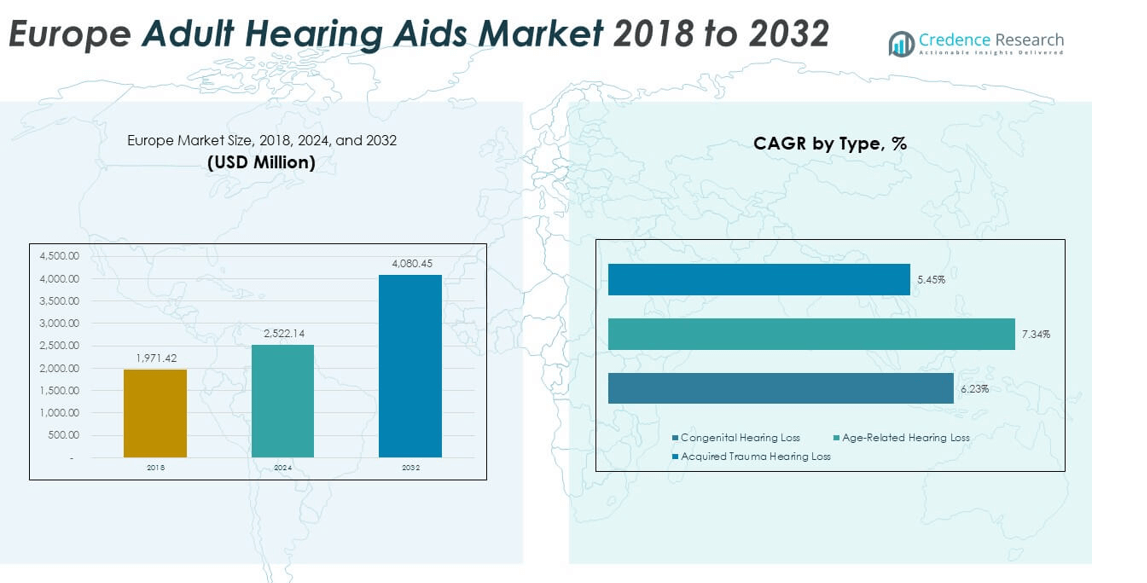

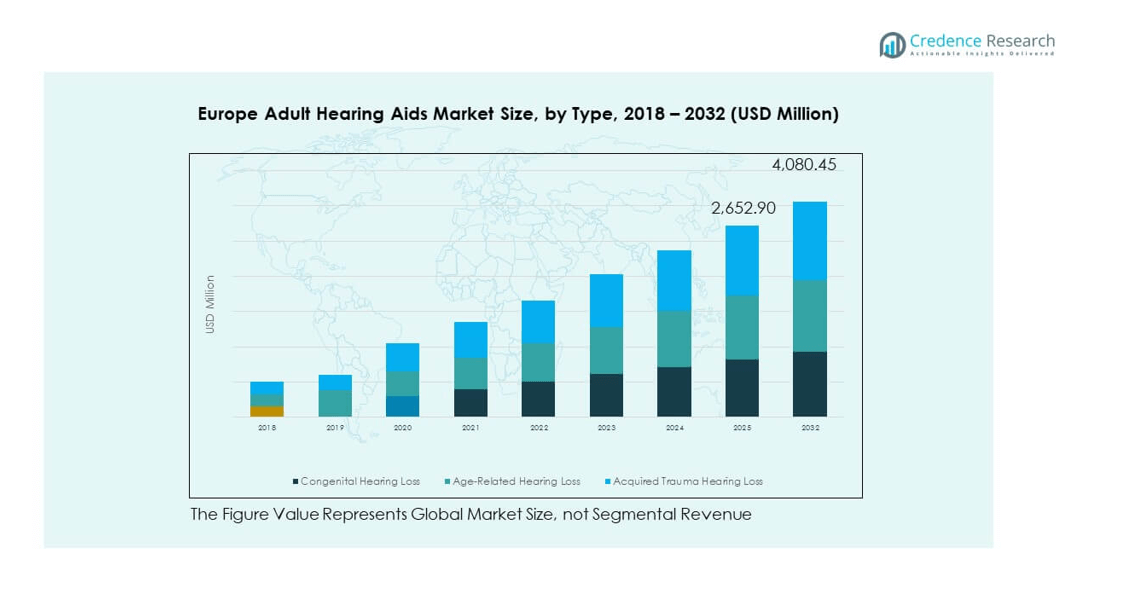

The Europe Adult Hearing Aids Market size was valued at USD 1,971.42 million in 2018 to USD 2,522.14 million in 2024 and is anticipated to reach USD 4,080.45 million by 2032, at a CAGR of 6.34% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Adult Hearing Aids Market Size 2024 |

USD 2,522.14 million |

| Europe Adult Hearing Aids Market, CAGR |

6.34% |

| Europe Adult Hearing Aids Market Size 2032 |

USD 4,080.45 million |

Market growth is being driven by rising cases of age-related hearing loss, growing awareness about early diagnosis, and increasing adoption of digital hearing aids. Advancements in miniaturization, wireless connectivity, and AI-enabled features enhance comfort and sound clarity, boosting user acceptance. Supportive healthcare policies, rising insurance coverage, and improved distribution channels are further supporting the demand for advanced hearing aids across Europe.

Regionally, Western Europe leads the market, supported by strong healthcare infrastructure and higher adoption of advanced devices in countries such as Germany, France, and the UK. Southern and Eastern European countries are emerging markets, benefiting from increasing healthcare investments and greater awareness campaigns. The presence of aging populations across Europe, combined with technological innovation and policy support, continues to position the region as a significant contributor to global hearing aid adoption.

Market Insights:

- The Europe Adult Hearing Aids Market. was valued at USD 1,971.42 million in 2018, reached USD 2,522.14 million in 2024, and is projected to hit USD 4,080.45 million by 2032, growing at a CAGR of 6.34%.

- The Global Adult Hearing Aids Market size was valued at USD 5,874.3 million in 2018 to USD 7,569.5 million in 2024 and is anticipated to reach USD 12,365.0 million by 2032, at a CAGR of 6.47% during the forecast period.

- Western Europe led with 46% share in 2024 due to advanced healthcare systems, strong reimbursement, and early adoption of digital devices; Southern Europe held 22% driven by healthcare reforms and growing elderly populations; Northern Europe captured 14% supported by advanced technology integration and robust public health infrastructure.

- Eastern Europe recorded 18% share and is the fastest-growing region, fueled by rising healthcare investments, expanding access to specialists, and increasing awareness in emerging markets.

- Age-related hearing loss dominated the type segment in 2024 with over 52% share, supported by a large geriatric base and growing preference for advanced digital solutions.

- Congenital hearing loss accounted for 28%, while acquired trauma hearing loss contributed 20%, reflecting steady demand from pediatric-to-adult transitions and noise-induced impairments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Prevalence of Hearing Disorders and Rising Aging Population

The Europe Adult Hearing Aids Market. is experiencing strong momentum due to the rising prevalence of age-related hearing disorders and an aging population. The region has one of the highest shares of elderly citizens globally, driving the demand for effective hearing solutions. Hearing impairment rates among adults continue to rise, pushing healthcare systems to prioritize early interventions. It benefits from public health initiatives encouraging regular hearing assessments and screenings. Rising awareness about the negative effects of untreated hearing loss further accelerates adoption. Manufacturers are tailoring advanced devices to address specific geriatric needs, including ease of use and comfort. The growing elderly population ensures long-term, sustainable demand for hearing aids across European markets.

Rising Technological Innovations and Digitalization of Hearing Aids

Technological innovations are transforming the Europe Adult Hearing Aids Market. with digitalization playing a central role in product development. Modern devices now integrate wireless connectivity, Bluetooth compatibility, and smartphone-based applications. AI-enabled functions are also enhancing speech recognition and background noise reduction. It provides users with personalized sound experiences that improve satisfaction and long-term device usage. Manufacturers are investing heavily in miniaturized designs that are discreet yet powerful. Demand for rechargeable batteries and low-maintenance devices is increasing rapidly. Such advancements are reshaping consumer preferences and setting higher standards in the market. Continuous product innovations create strong differentiation among leading players.

- For instance, Phonak launched the Audéo Paradise in 2020, featuring motion sensors for optimized hearing in noisy environments and seamless connectivity to multiple Bluetooth devices. This reflected a growing market demand for rechargeable and low-maintenance hearing aid technology.

Expansion of Healthcare Coverage and Supportive Policy Frameworks

The Europe Adult Hearing Aids Market. benefits from government-backed initiatives and strong healthcare policies. Many European countries provide reimbursement programs and insurance coverage for hearing aids, making them accessible to wider populations. Public funding in healthcare supports early screening and diagnosis, encouraging higher adoption rates. It creates a favorable ecosystem for both manufacturers and distributors. Governments are also running awareness campaigns about the importance of hearing health. Enhanced availability of clinical facilities for testing and fitting further boosts market penetration. Policymakers are focused on reducing barriers to access and affordability. The supportive policy landscape ensures long-term stability and steady growth.

- For instance, in France, the national health insurance scheme reimbursed at least 70% of the cost for more than 300,000 hearing aid fittings in 2024, significantly reducing out-of-pocket barriers for adults.

Growing Awareness and Lifestyle Shifts Supporting Hearing Aid Acceptance

Awareness campaigns across Europe are strengthening the Europe Adult Hearing Aids Market. by highlighting the benefits of timely treatment. Adults are becoming more conscious of the lifestyle improvements hearing aids can bring. It reduces social isolation, improves workplace performance, and enhances overall quality of life. Younger adults with noise-induced hearing issues are also contributing to demand. Social acceptance of wearable health devices has increased, lowering stigma around hearing aid use. Marketing strategies emphasize design, style, and convenience to attract broader demographics. The cultural shift toward embracing wellness-focused products also supports growth. Stronger awareness translates into faster adoption and sustained demand across segments.

Market Trends:

Rising Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence and machine learning is shaping the Europe Adult Hearing Aids Market. These technologies are enhancing real-time sound processing, adaptive noise cancellation, and voice clarity. It allows devices to automatically adjust to changing sound environments without manual input. Machine learning algorithms continuously improve performance based on user habits. This personalization drives greater satisfaction and adherence to device usage. Manufacturers are incorporating AI in premium devices to build competitive advantages. The adoption of AI creates opportunities for collaboration with tech companies. Growing consumer preference for smart, adaptive solutions strengthens the long-term trend of AI-driven hearing aids.

- For instance, Widex Moment hearing aids feature PureSound technology with a ZeroDelay™ processing pathway that handles sound in under 0.5 milliseconds. This reduces echo and distortion for a more natural listening experience, particularly for users with mild-to-moderate hearing loss.

Expansion of Remote Care and Tele-Audiology Solutions

Tele-audiology is emerging as a significant trend within the Europe Adult Hearing Aids Market. Remote diagnostic tools and virtual consultations improve access to professional care. It is particularly valuable in rural and underserved regions. Online platforms enable follow-ups, fine-tuning, and maintenance without requiring in-person visits. This approach reduces healthcare costs and increases convenience for patients. Audiologists and clinics are increasingly adopting digital platforms for ongoing support. Pandemic-driven shifts have accelerated digital adoption in audiology practices. Integration of telemedicine into hearing care ecosystems is expected to remain a long-term trend. The growing acceptance of remote services reflects consumer demand for convenience and accessibility.

- For instance, tele-audiology is an emerging trend in the European adult hearing aids market, and platforms like Phonak’s Remote Support facilitate virtual consultations. While manufacturers report improved patient convenience and follow-up rates with digital adoption,

Growing Popularity of Discreet and Stylish Hearing Aid Designs

Design innovations are influencing consumer behavior in the Europe Adult Hearing Aids Market. Users now prefer discreet, lightweight, and fashionable models that align with modern lifestyles. It reduces stigma traditionally associated with hearing aids. Manufacturers are emphasizing aesthetics alongside advanced features to attract younger and style-conscious adults. Color customization, compact forms, and nearly invisible models are gaining traction. Lifestyle-focused marketing campaigns highlight how design enhances user confidence. Consumer acceptance improves as hearing aids become more aligned with wearable technology. Growing alignment between functionality and fashion is strengthening brand competitiveness. This trend ensures broader adoption across diverse consumer segments.

Integration with Consumer Electronics and Smart Devices

The convergence of hearing aids with consumer electronics is reshaping the Europe Adult Hearing Aids Market. Hearing aids are now compatible with smartphones, tablets, and even smart home devices. It provides seamless audio streaming and enhanced connectivity. Direct integration with music, calls, and entertainment apps improves daily usability. Tech companies and medical device manufacturers are collaborating to deliver hybrid devices. The growing overlap between hearing aids and consumer electronics is increasing adoption among younger users. This trend positions hearing aids as multifunctional devices rather than medical-only products. Expanding compatibility with mainstream technologies continues to drive innovation and market adoption.

Market Challenges Analysis:

High Cost of Devices and Limited Affordability

The Europe Adult Hearing Aids Market. faces affordability challenges due to the high cost of advanced devices. Premium hearing aids equipped with AI, wireless connectivity, and rechargeable batteries remain expensive for many consumers. It limits access, especially among populations with lower incomes or limited insurance coverage. The reimbursement process in some countries is slow and restrictive, further discouraging adoption. Patients often postpone or avoid purchases due to financial constraints. Price sensitivity also increases competition among low-cost manufacturers. High upfront costs remain a barrier even in countries with developed healthcare systems. This challenge reduces penetration rates and slows down growth momentum.

Social Stigma and Limited Awareness Among Certain Groups

Another significant challenge for the Europe Adult Hearing Aids Market. is social stigma and limited awareness. Some adults avoid using hearing aids due to concerns about appearance or perceived aging. It leads to underdiagnosis and untreated hearing loss across many demographics. In rural regions, awareness about advanced solutions is still limited. Cultural perceptions often discourage adoption even when affordable options exist. Delayed treatment results in declining quality of life and higher long-term healthcare costs. Healthcare professionals and policymakers must work to reduce stigma and expand awareness campaigns. These social and cultural barriers hinder full market potential and slow consumer acceptance.

Market Opportunities:

Advancements in Smart and Connected Hearing Solutions

The Europe Adult Hearing Aids Market. presents opportunities in the development of smart and connected devices. Demand for seamless integration with smartphones, wearable devices, and digital ecosystems is rising. It creates space for manufacturers to innovate and collaborate with technology companies. Enhanced features such as voice assistants, real-time language translation, and app-based controls drive consumer appeal. Growth in digital health adoption supports expansion of smart hearing aids. Personalization through connected apps enhances consumer satisfaction and retention. Technological convergence positions hearing aids as part of broader health and wellness ecosystems. This creates significant opportunities for expansion in both premium and mid-range product categories.

Expansion into Emerging Eastern and Southern European Markets

Expanding into Eastern and Southern Europe offers significant opportunities for the Europe Adult Hearing Aids Market. Rising healthcare investments, improved access to specialists, and growing awareness drive demand in these regions. It creates new avenues for manufacturers seeking to broaden their reach. Urbanization and increasing disposable incomes enhance affordability for modern hearing solutions. Partnerships with local healthcare providers strengthen distribution networks. Awareness campaigns targeting underserved populations encourage adoption. These markets provide growth potential for both entry-level and advanced hearing aid devices. Leveraging regional healthcare reforms and awareness initiatives will unlock long-term opportunities for manufacturers.

Market Segmentation Analysis:

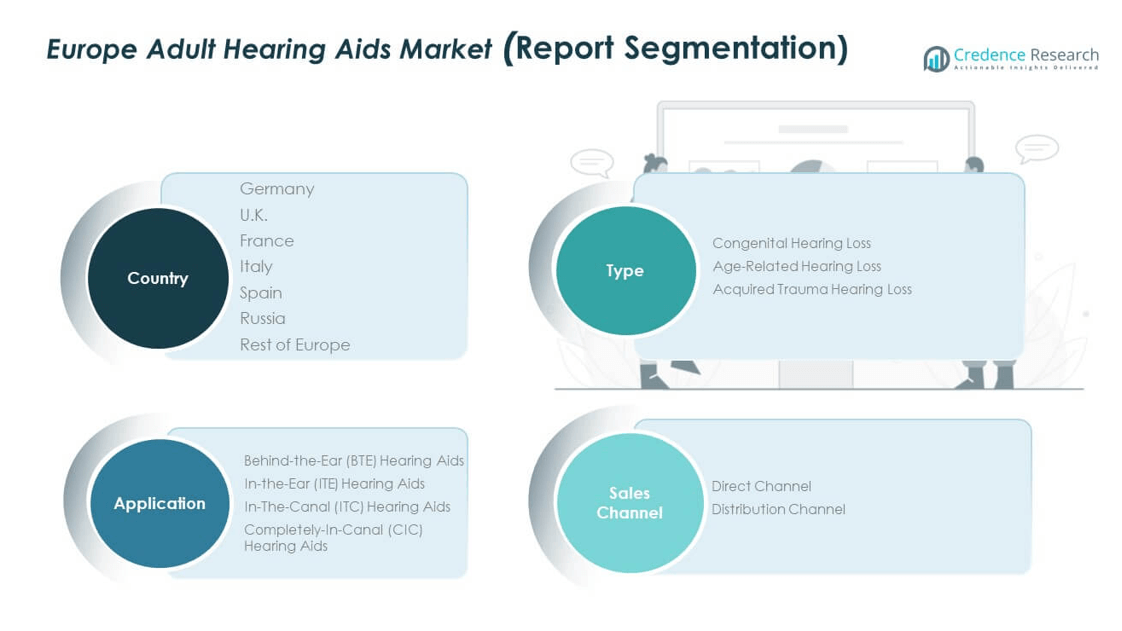

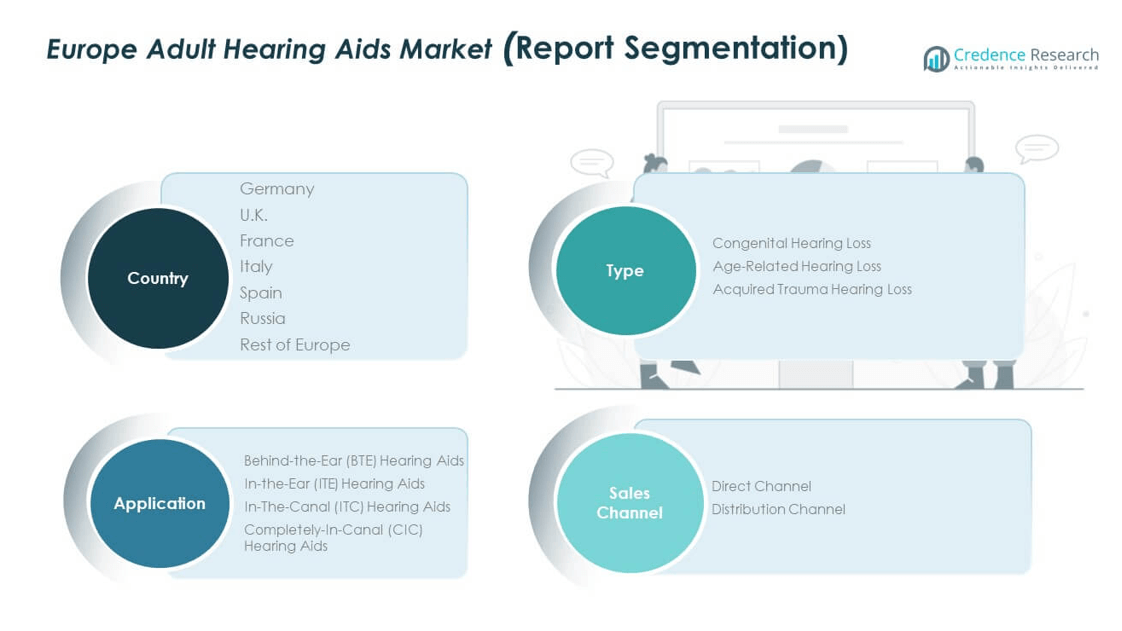

By type, the Europe Adult Hearing Aids Market by type, is shaped by three core categories: congenital hearing loss, age-related hearing loss, and acquired trauma hearing loss. Age-related hearing loss dominates due to the region’s expanding elderly population and rising awareness of early treatment. Congenital hearing loss maintains steady demand supported by better screening programs and pediatric care that extends into adulthood. Acquired trauma hearing loss reflects growing cases from workplace exposure, accidents, and noise pollution, creating consistent adoption across working-age adults. Each type requires tailored product innovation, encouraging manufacturers to develop versatile solutions across the spectrum of patient needs.

- For instance, age-related hearing loss is the dominant form of hearing loss globally. As a result, hearing aid manufacturers like GN Hearing experience a strong sales emphasis on devices targeting adults aged 65 and older in the European market, which aligns with market trends driven by the aging population.

By application, the market includes behind-the-ear (BTE), in-the-ear (ITE), in-the-canal (ITC), and completely-in-canal (CIC) hearing aids. BTE devices hold significant share due to their durability, advanced features, and suitability for severe hearing loss. ITE and ITC segments attract users seeking balance between performance and discretion. CIC hearing aids cater to consumers preferring nearly invisible designs, gaining popularity with younger adults and style-conscious users. The application mix reflects shifting consumer behavior, emphasizing both performance and aesthetics in device selection.

- For instance, WS Audiology’s Signia markets the Styletto X as a slim, rechargeable Receiver-in-Canal (RIC) hearing aid with an award-winning design to attract younger, image-conscious users who value discreet and modern-looking devices

By sales channel, the market is divided into direct and distribution networks. Distribution channels dominate, supported by widespread availability through clinics, audiology centers, and retail outlets. It provides patients with expert consultation, fitting services, and aftercare support, which strengthen customer confidence. Direct channels, including online platforms and company outlets, are growing steadily as digital adoption rises and consumers seek convenience. The balance between traditional distribution and direct digital sales highlights evolving purchasing behavior across the region.

Segmentation:

By Type

- Congenital Hearing Loss

- Age-Related Hearing Loss

- Acquired Trauma Hearing Loss

By Application

- Behind-the-Ear (BTE) Hearing Aids

- In-the-Ear (ITE) Hearing Aids

- In-the-Canal (ITC) Hearing Aids

- Completely-In-Canal (CIC) Hearing Aids

By Sales Channel

- Direct Channel

- Distribution Channel

By Country (Regional Analysis – Europe)

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe dominates the Europe Adult Hearing Aids Market. with a market share of 46%, driven by advanced healthcare infrastructure, widespread insurance coverage, and high awareness levels among aging populations. Countries such as Germany, France, and the UK lead adoption due to robust reimbursement policies and continuous product innovation. It benefits from strong penetration of digital hearing aids, integration of smart technologies, and presence of global manufacturers. Western Europe remains the most lucrative hub for premium devices, supported by early diagnosis programs and strong demand for discreet, stylish models. The maturity of healthcare systems sustains consistent growth across this region.

Southern Europe accounts for 22% of the market, with Italy and Spain emerging as major contributors. Healthcare reforms, growing disposable incomes, and expanding private healthcare facilities strengthen adoption. It benefits from government-led awareness campaigns that promote hearing health and reduce stigma. Rising geriatric populations in Italy and Spain further push demand for advanced devices. The region shows increasing preference for compact and in-the-canal hearing aids, reflecting lifestyle shifts. Growth opportunities remain significant due to rising adoption of digital platforms for consultations and device purchases.

Eastern Europe holds 18% of the market, while Northern Europe contributes 14%, together forming a dynamic growth landscape. Eastern Europe is gaining traction through rising investments in healthcare infrastructure and gradual improvement in diagnosis rates, especially in Russia and Poland. It faces challenges such as affordability gaps but benefits from government initiatives aimed at improving access to assistive devices. Northern Europe, including Scandinavia, demonstrates high adoption of technologically advanced devices supported by digital health integration and strong public healthcare systems. Growing consumer preference for tele-audiology solutions and smart connectivity enhances the role of these regions. Collectively, these areas complement Western and Southern Europe by offering new growth corridors for manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Europe Adult Hearing Aids Market. is shaped by strong competition between global leaders and regional players. Major companies such as Sonova, William Demant, WS Audiology, and GN ReSound dominate through advanced product portfolios, innovation, and extensive distribution. It benefits from AI integration, wireless features, and rechargeable batteries that enhance device performance and adoption. Partnerships with healthcare providers and audiology clinics further strengthen their market position across Europe. Regional firms like Rion, Sebotek Hearing Systems, Audina Hearing Instruments, Microson, and Audicus focus on affordability, catering to price-sensitive consumers and expanding access in emerging markets. It supports growth in regions with limited reimbursement and rising awareness of hearing health. Online platforms and direct-to-consumer sales are boosting visibility and reach for both large and mid-sized players. The market remains competitive with frequent product launches, acquisitions, and expansion strategies. It highlights technology innovation, affordability, and service quality as the key factors driving long-term success in the European landscape.

Recent Developments:

- In June 2025, Demant, headquartered in Denmark, announced its largest acquisition to date: a €700 million deal to acquire KIND Group, one of Germany’s leading hearing aid retailers. The acquisition expands Demant’s distribution network by around 650 clinics, predominantly in Germany and with additional locations in Switzerland, Austria, Luxembourg, and Singapore.

- In May 2025, Sonova announced strong market share gains for its Europe adult hearing aids business, supported by successful new product launches and commercial execution improvements during the financial year.

- In August 2024, Sonova Holding AG introduced two new hearing aid platforms under its main brand, Phonak: Audéo Infinio and Audéo Sphere Infinio. Audéo Sphere Infinio features proprietary dual-chip technology, including a chip that uses real-time artificial intelligence for enhanced sound processing.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Adult Hearing Aids Market. will expand steadily, supported by rising demand from aging populations.

- Increasing awareness of untreated hearing loss will drive adoption of advanced and user-friendly devices.

- Technological improvements such as AI-driven sound processing will enhance personalization and user satisfaction.

- Integration with smartphones and consumer electronics will position hearing aids as multifunctional lifestyle devices.

- Growing acceptance of discreet and stylish designs will attract younger demographics and reduce stigma.

- Expansion of tele-audiology and remote care solutions will improve accessibility across rural and underserved regions.

- Insurance coverage and favorable healthcare policies will strengthen affordability and encourage faster adoption.

- Direct-to-consumer channels and online platforms will reshape purchasing patterns and broaden market reach.

- Strategic mergers, acquisitions, and partnerships will consolidate the market and fuel innovation pipelines.

- Rising investments in emerging Eastern and Southern European countries will unlock new growth opportunities.