Market Overview

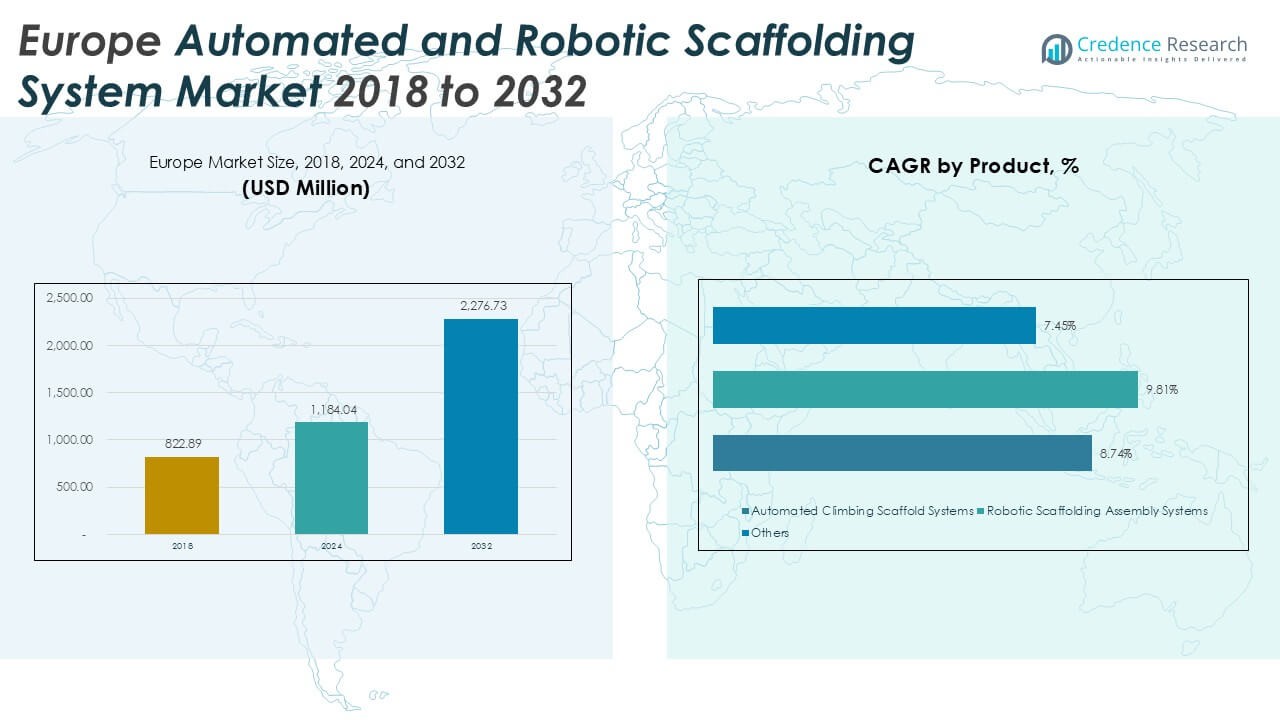

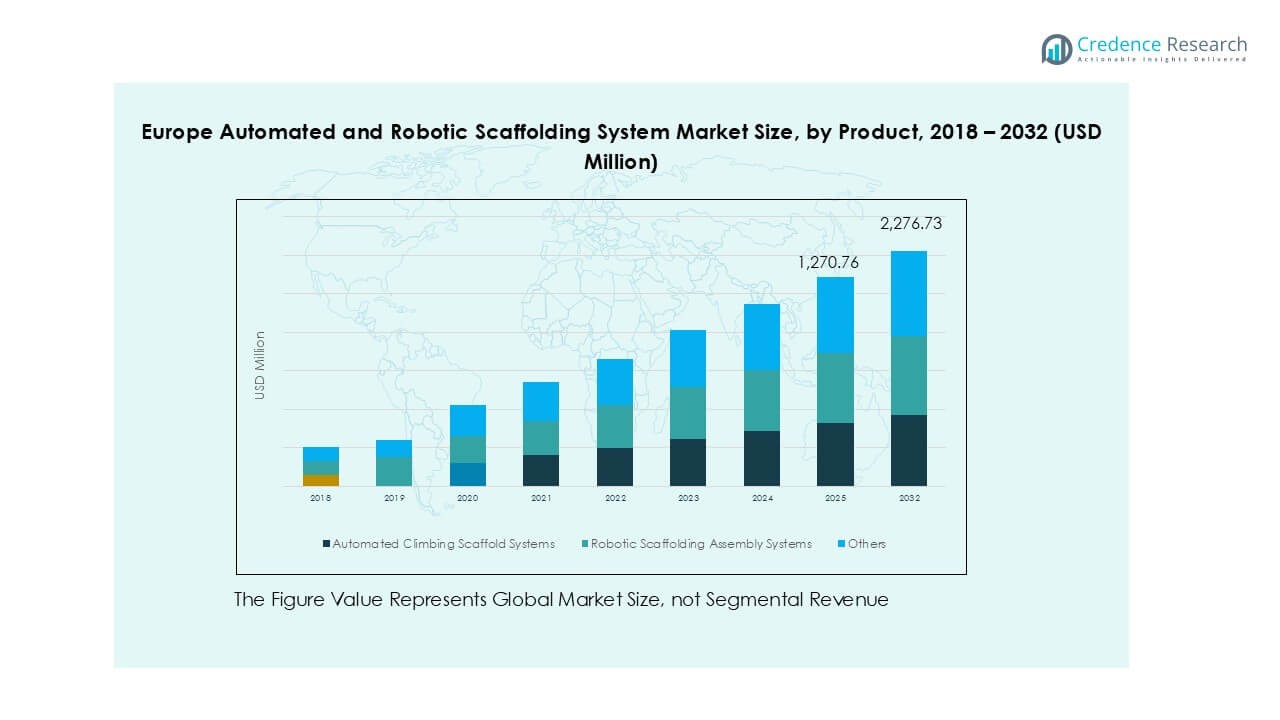

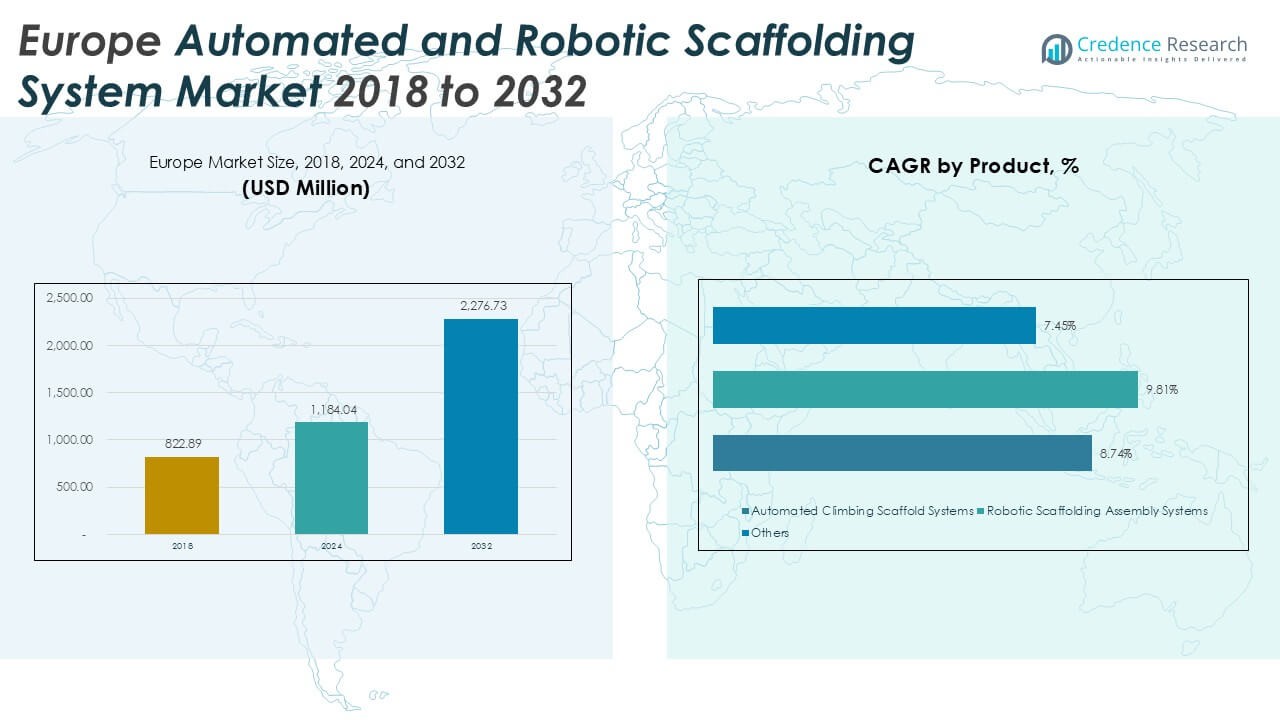

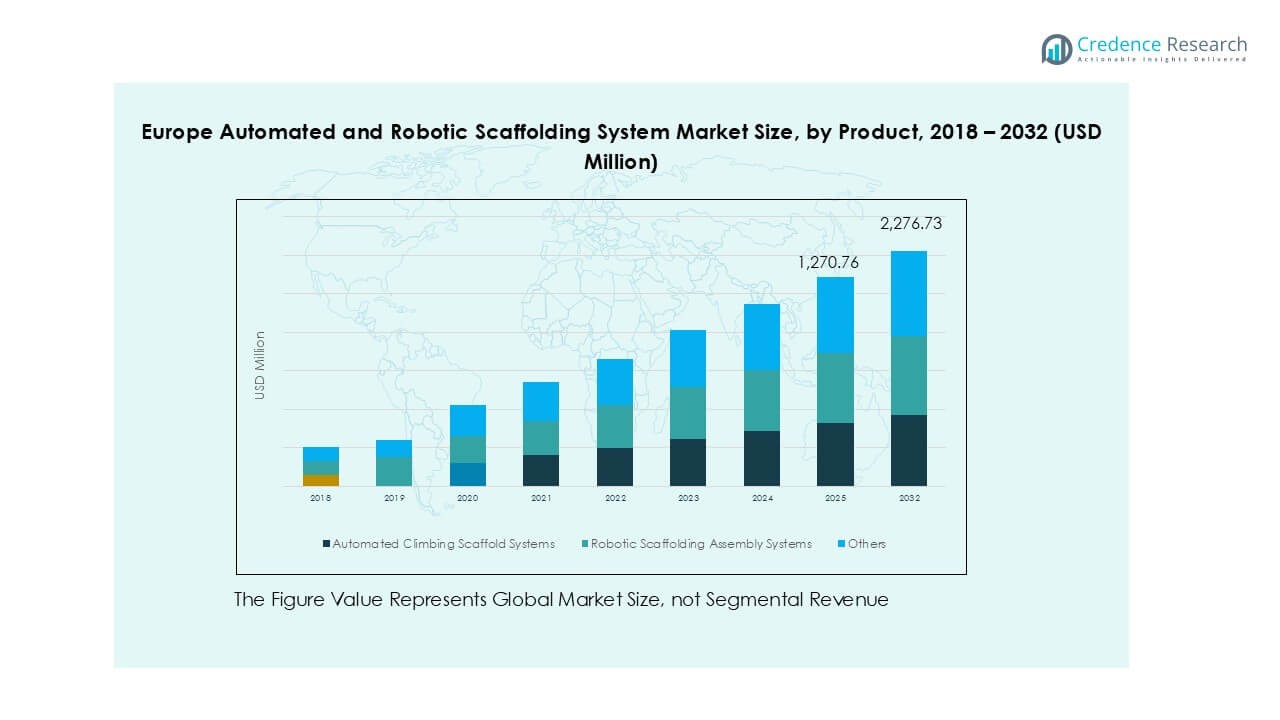

Europe Automated and Robotic Scaffolding System market size was valued at USD 822.89 million in 2018 to USD 1,184.04 million in 2024 and is anticipated to reach USD 2,276.73 million by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Automated and Robotic Scaffolding System market Size 2024 |

USD 1,184.04 Million |

| Europe Automated and Robotic Scaffolding System market, CAGR |

8.7% |

| Europe Automated and Robotic Scaffolding System market Size 2032 |

USD 2,276.73 Million |

The Europe Automated and Robotic Scaffolding System market is led by key players such as Layher, Inc., Kewazo, MEVA, Reo Lift, KITSEN Scaffold & Formwork Technologies, Rohrer Group, and AFIX Group. These companies are at the forefront of innovation, focusing on enhancing automation, operational efficiency, and safety standards in scaffolding systems. Germany emerges as the leading regional market, accounting for approximately 26% of the total European market share in 2024, driven by its strong industrial base, early adoption of construction technologies, and high investment in smart infrastructure. Other key regions include the United Kingdom (22%) and France (17%), where increasing urbanization and strict safety regulations continue to fuel demand for advanced scaffolding systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Automated and Robotic Scaffolding System market was valued at USD 1,184.04 million in 2024 and is projected to reach USD 2,276.73 million by 2032, growing at a CAGR of 8.7% during the forecast period.

- Growth is primarily driven by increasing demand for labor safety, efficiency in high-rise construction, and automation in complex infrastructure projects across major economies.

- Key trends include the integration of robotic scaffolding with BIM systems, rising adoption in renovation and retrofit projects, and increasing deployment of AI-driven predictive maintenance tools.

- The market is moderately fragmented with players like Layher, Inc., Kewazo, and MEVA leading innovation and strategic collaborations; hardware dominates the component segment, while automated climbing scaffold systems lead the product segment.

- Regionally, Germany holds the largest share (26%), followed by the UK (22%) and France (17%), while Installation & Erection Services remain the top application segment across the region.

Market Segmentation Analysis:

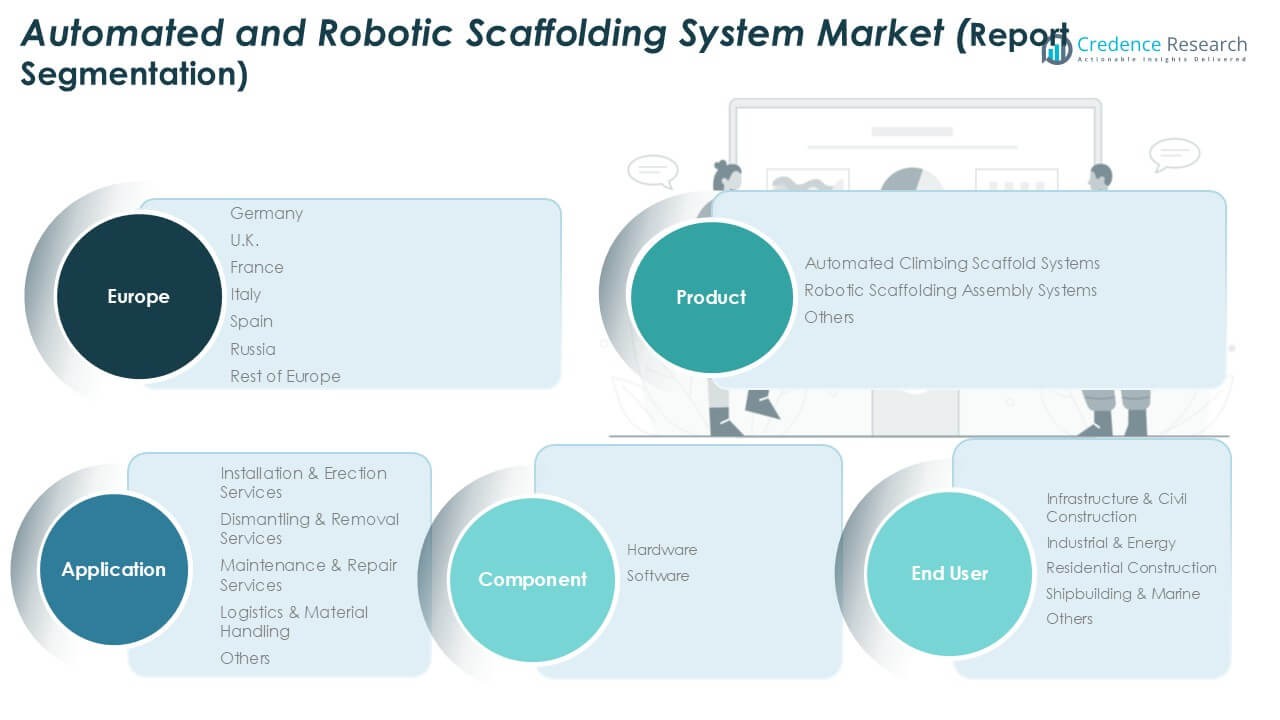

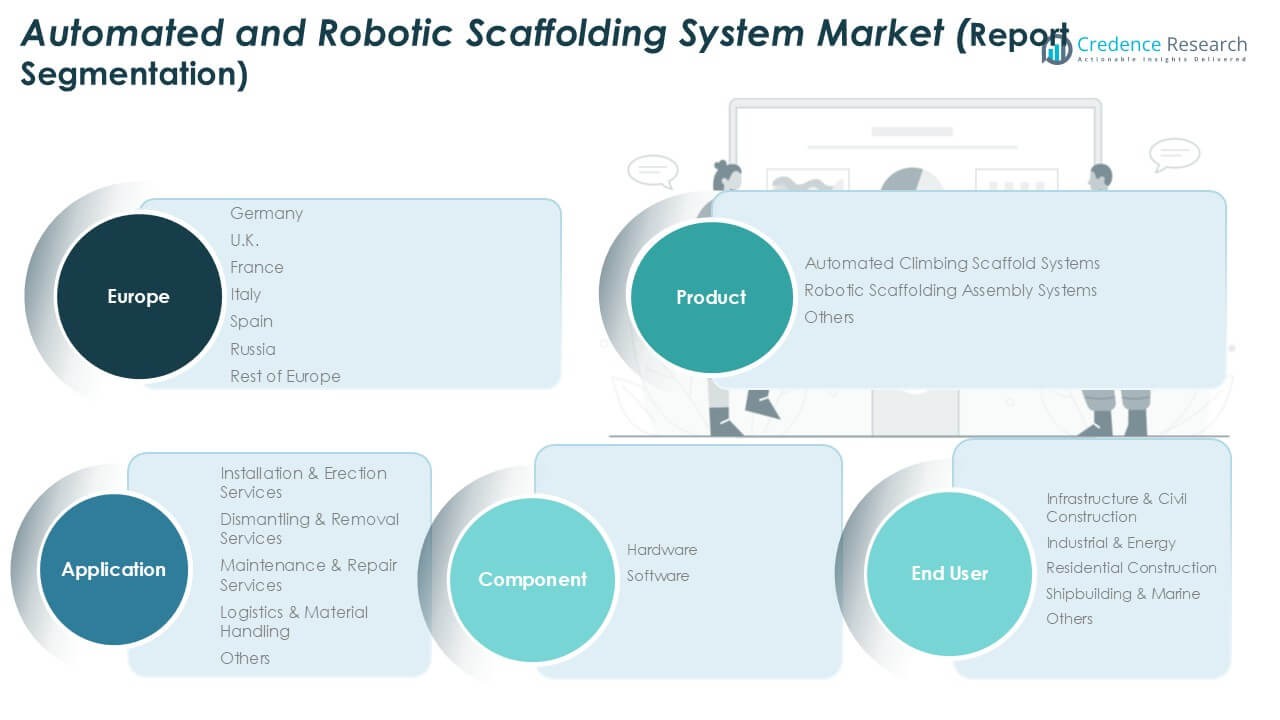

By Product

In the Europe Automated and Robotic Scaffolding System market, Automated Climbing Scaffold Systems dominate the product segment, accounting for the largest market share in 2024. These systems are widely adopted in high-rise construction projects due to their ability to enhance worker safety, reduce labor requirements, and accelerate project timelines. The growing demand for automation in infrastructure and commercial construction is a key driver for this sub-segment. Robotic Scaffolding Assembly Systems are also gaining traction, particularly in complex industrial applications, where precision, consistency, and remote operations are essential. The “Others” category includes hybrid and customizable systems, witnessing gradual adoption.

- For instance, Layher’s Allround Scaffolding system has been deployed in over 80 countries and supports modular assembly with over 2,500 system components, streamlining climbing operations in high-rise construction.

By Application

Among the application segments, Installation & Erection Services hold the dominant market share, driven by increasing demand for faster and safer assembly processes in large-scale infrastructure and high-rise building projects. Automated scaffolding significantly reduces manual labor, minimizes errors, and ensures consistent safety compliance, which is crucial in urban construction zones. Maintenance & Repair Services is an emerging area as facility managers increasingly seek robotic solutions to perform inspections and repairs without disrupting ongoing operations. Meanwhile, segments such as Logistics & Material Handling and Dismantling & Removal Services are experiencing moderate growth due to enhanced efficiency and cost savings brought by automation.

- For instance, KEWAZO’s LIFTBOT robotic system has been used in over 20 industrial projects across Europe, saving up to 44% in labor hours during scaffolding erection tasks.

By Component

In terms of components, Hardware remains the leading sub-segment with the largest revenue share in 2024, attributed to the high costs associated with machinery, sensors, control units, and robotic arms used in scaffolding systems. The increased demand for robust and durable hardware capable of operating under harsh construction environments continues to drive this segment. However, the Software segment is expanding steadily, supported by advancements in automation algorithms, AI-based planning tools, and remote monitoring platforms. The integration of software for predictive maintenance and operational analytics is creating value-added features that attract contractors and developers focused on project efficiency and risk management.

Key Growth Drivers

Rising Demand for Labor Efficiency and Safety

The increasing emphasis on labor safety and efficiency in construction activities across Europe is a major driver for the adoption of automated and robotic scaffolding systems. These systems reduce the dependence on manual labor for high-risk tasks such as erection and dismantling, thereby minimizing workplace accidents and enhancing compliance with safety regulations. As labor shortages persist in several EU countries, automation presents a sustainable alternative to meet project timelines without compromising safety, particularly in high-rise and large-scale infrastructure projects.

- For instance, MEVA’s automated formwork systems are designed to reduce physical strain and have reduced the need for manual handling by up to 60% on urban infrastructure projects in Germany.

Expansion of Urban Infrastructure Projects

Rapid urbanization and the corresponding expansion of infrastructure projects across major European economies are propelling demand for advanced scaffolding systems. With cities undergoing large-scale development in housing, commercial real estate, and transport infrastructure, automated and robotic scaffolding systems offer efficiency, precision, and speed. Government-led investments in smart city initiatives and sustainable urban development further support the adoption of these systems, as they align with the goals of automation, reduced emissions, and resource optimization in construction.

- For instance, KITSEN Scaffold’s automation-enabled systems have been deployed in over 100 urban metro projects, enabling a 35% faster scaffolding process during civil construction in Spain and Italy.

Technological Advancements and Integration

Continuous innovations in robotics, IoT, and AI have significantly enhanced the capabilities of scaffolding systems, making them more adaptive, autonomous, and intelligent. Modern systems equipped with sensors, machine vision, and predictive software enable real-time monitoring, remote operations, and maintenance scheduling. These advancements not only improve operational efficiency but also reduce downtime and long-term costs, encouraging contractors and developers to invest in automated scaffolding solutions as a future-ready infrastructure tool.

Key Trends & Opportunities

Integration with Building Information Modeling (BIM)

One of the notable trends in the market is the integration of automated scaffolding systems with Building Information Modeling (BIM). This synergy allows for better planning, coordination, and visualization of scaffolding operations throughout the project lifecycle. It enables early clash detection, accurate cost estimation, and improved scheduling, thereby enhancing productivity and reducing waste. As BIM adoption becomes more widespread across the European construction industry, vendors offering integrated scaffolding solutions are poised to gain a competitive edge.

- For instance, Rohrer Group has integrated BIM into its robotic scaffolding workflows across 15 major construction sites, enabling time savings of over 20% through real-time design-to-execution alignment.

Growth in Renovation and Retrofit Projects

Europe’s aging building stock and sustainability goals are driving a surge in renovation and retrofit activities, creating new opportunities for robotic scaffolding systems. These projects often involve restricted access, tight spaces, and complex structures, making automated systems ideal for safe and precise operations. The ability of robotic scaffolding to navigate and adapt to different environments with minimal disruption supports its growing demand in retrofit scenarios, particularly in historical building conservation and energy efficiency upgrades.

- For instance, AFIX Group’s automated scaffolding units have supported over 50 restoration projects across Belgium and the Netherlands, improving access efficiency in constrained architectural spaces by 30%.

Key Challenges

High Initial Investment Costs

Despite long-term benefits, the high upfront costs associated with automated and robotic scaffolding systems pose a significant barrier, particularly for small and mid-sized contractors. Hardware procurement, software integration, and workforce training contribute to substantial capital expenditure. These cost challenges are especially critical in low-margin projects, where ROI on automation technologies is difficult to justify without significant volume or operational scale.

Limited Skilled Workforce for System Operation

While the systems reduce manual labor, their operation requires a technically trained workforce proficient in robotics and automation. The current shortage of skilled personnel familiar with operating and maintaining advanced scaffolding systems limits the market’s expansion. This gap in technical know-how, particularly in smaller markets or rural areas, slows adoption and necessitates additional investment in training and education initiatives.

Regulatory and Standardization Issues

The lack of unified regulations and industry standards for robotic scaffolding systems across European countries presents compliance and interoperability challenges. Varying construction codes, safety requirements, and certification processes increase complexity for manufacturers and end-users. This fragmentation can delay product approvals, increase customization costs, and hinder cross-border market scalability, particularly for vendors looking to operate across multiple European markets.

Regional Analysis

United Kingdom

The United Kingdom holds a significant share of the Europe Automated and Robotic Scaffolding System market, accounting for approximately 22% in 2024. The market is driven by strong demand in urban infrastructure and commercial construction, supported by stringent workplace safety regulations and a push toward automation. Major cities like London and Manchester are seeing increased adoption of robotic scaffolding systems, particularly in high-rise and renovation projects. The UK’s advanced construction sector, favorable government policies, and skilled workforce continue to foster innovation, making it a key contributor to market growth in the region.

France

France captures around 17% of the European market share, propelled by government-led infrastructure modernization and sustainability initiatives. The country’s commitment to reducing construction-related carbon emissions and enhancing worker safety has accelerated the adoption of automated scaffolding solutions. Urban redevelopment in cities like Paris and Lyon, along with increased retrofitting activities, fuels demand for robotic scaffolding in both public and private sectors. French construction firms are increasingly investing in automation to meet labor efficiency goals and regulatory standards, which is expected to further boost market penetration over the forecast period.

Germany

Germany holds the largest share in the European market at approximately 26% in 2024, driven by its robust industrial base and early adoption of construction automation technologies. The demand is particularly high in infrastructure, civil engineering, and manufacturing plant construction, where safety and operational efficiency are top priorities. With strong support for Industry 4.0 and smart building initiatives, Germany continues to lead in integrating robotics and AI into construction processes. Moreover, the presence of several domestic technology providers and engineering firms fosters local innovation and increases accessibility to advanced scaffolding systems.

Italy

Italy accounts for roughly 11% of the Europe Automated and Robotic Scaffolding System market, with growing adoption in urban construction and renovation sectors. Cities such as Milan, Rome, and Naples are experiencing increased use of automated scaffolding, particularly in residential and historical building maintenance. The government’s focus on heritage preservation and energy-efficient renovations presents a steady demand for adaptable and non-invasive scaffolding technologies. Despite some budgetary constraints, mid-sized contractors are beginning to adopt robotic systems to address labor shortages and improve operational speed in densely populated urban zones.

Spain

Spain contributes around 9% to the regional market, with growth driven by a resurgence in residential and infrastructure construction. The country is leveraging EU recovery funds to invest in modernization projects, particularly in transport and housing sectors. Robotic scaffolding systems are gaining attention for their ability to streamline large-scale urban development while enhancing worker safety and reducing delays. Although adoption is still in the early stages compared to northern Europe, increasing awareness of automation benefits and government incentives for innovation are expected to strengthen market growth over the coming years.

Russia

Russia holds nearly 8% market share, with increasing demand in industrial construction, energy infrastructure, and commercial development. The market is influenced by large-scale government projects and the need to modernize aging infrastructure. Robotic scaffolding systems are gradually being implemented in energy and manufacturing facilities, where controlled environments and labor shortages make automation a practical solution. However, geopolitical tensions and import restrictions may limit access to advanced technology from Western suppliers, posing challenges to market expansion and technology integration in certain regions.

Rest of Europe

The Rest of Europe, including countries such as the Netherlands, Belgium, Sweden, and Poland, collectively contributes around 7% of the market share. These nations are actively investing in smart construction technologies to address urban development needs, labor constraints, and environmental targets. Particularly in Scandinavia and the Benelux region, there is strong emphasis on sustainable construction and innovation, creating favorable conditions for automated scaffolding adoption. While market maturity varies across countries, increasing collaboration with tech providers and supportive regulatory environments are enabling gradual yet consistent market growth across this cluster.

Market Segmentations:

By Product

- Automated Climbing Scaffold Systems

- Robotic Scaffolding Assembly Systems

- Others

By Application

- Installation & Erection Services

- Dismantling & Removal Services

- Maintenance & Repair Services

- Logistics & Material Handling

- Others

By Component

By End User

- Infrastructure & Civil Construction

- Industrial & Energy

- Residential Construction

- Shipbuilding & Marine

- Others

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Automated and Robotic Scaffolding System market is characterized by a mix of established players and emerging technology-driven companies focused on automation and innovation. Key market participants such as Layher, Inc., Kewazo, MEVA, and KITSEN Scaffold & Formwork Technologies are actively investing in R&D to enhance system efficiency, safety, and adaptability. Companies like Kewazo are pioneering robotic solutions integrated with data analytics and remote monitoring, addressing evolving industry needs. Meanwhile, established firms such as Layher and Rohrer Group leverage extensive distribution networks and strong brand credibility to maintain market share. Strategic partnerships, acquisitions, and expansion into smart construction technologies are prevalent as firms seek to differentiate offerings and capture a broader customer base. The market also sees growing collaboration between scaffolding providers and construction firms to develop tailored automation solutions. Overall, competition remains robust, with innovation, cost-efficiency, and safety performance emerging as key differentiators among players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Layher, Inc.

- Kewazo

- Reo Lift

- MEVA

- KITSEN Scaffold & Formwork Technologies

- Rohrer Group

- AFIX Group

Recent Developments

- In July 2025, Kewazo is continuing its deployment and upgrades of the LIFTBOT robotic scaffolding elevator/lift system. The LIFTBOT autonomously moves materials along scaffolding, enhancing both safety and productivity on construction sites. According to Kewazo, the system’s data analytics platform optimizes processes, leading to potential labor cost savings of up to 44% and improved safety.

- In April 2025, Layher commenced operations at their newest production facility, “Plant 3,” which is a highly automated and energy-efficient production center for their Allround scaffolding.

- In 2025, MEVA USA is actively promoting the MAC (MEVA Automatic Climbing) system in North America. This system is a hydraulically powered, crane-independent solution that allows entire scaffold assemblies to climb as a single unit. It enhances efficiency and safety in high-rise construction by reducing crane usage, minimizing material costs, and accelerating the overall construction timeline.

Market Concentration & Characteristics

The Europe Automated and Robotic Scaffolding System Market demonstrates moderate market concentration, with a mix of established construction technology companies and emerging automation-focused firms. A few key players such as Layher, Kewazo, MEVA, and KITSEN Scaffold & Formwork Technologies hold a significant share, supported by strong product portfolios and regional presence. It features a growing emphasis on automation, safety compliance, and labor efficiency, making it attractive to both large contractors and innovative start-ups. The market shows a strong preference for hardware solutions with embedded intelligence and integration capabilities. Demand remains high in countries with large infrastructure pipelines, strict labor regulations, and technological readiness. It benefits from the rising need for cost control and schedule optimization in high-rise and complex construction projects. Urban centers in Germany, the UK, and France lead adoption due to their dense development environments and government-backed construction modernization initiatives. Pricing pressures, initial capital requirements, and regulatory fragmentation limit entry for new players. The market maintains a forward-looking character with clear momentum toward digital integration and predictive system performance.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Component, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow due to rising demand for automation in construction across major European cities.

- Germany, the UK, and France will remain the key regions driving adoption of robotic scaffolding systems.

- Integration of AI and IoT technologies will enhance system efficiency and real-time decision-making.

- Hardware will retain its dominance, but software adoption will rise due to increasing demand for predictive maintenance tools.

- Robotic scaffolding assembly systems will gain popularity in industrial and retrofit applications.

- Labor shortages and strict safety regulations will accelerate investment in automated solutions.

- Companies will focus on partnerships and R&D to offer scalable, customizable systems.

- Building Information Modeling (BIM) integration will become standard in new scaffolding deployments.

- Small and medium contractors will adopt rental and leasing models to reduce capital expenditure.

- Market competition will intensify as new entrants introduce cost-effective and modular technologies.