| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Automotive Lead Acid Battery Market Size 2024 |

USD 5,615.17 million |

| Europe Automotive Lead Acid Battery Market CAGR |

7.4% |

| Europe Automotive Lead Acid Battery Market Size 2032 |

USD 10,715.78 million |

Market Overview

Europe Automotive Lead Acid Battery market size was valued at USD 5,615.17 million in 2023 and is anticipated to reach USD 10,715.78 million by 2032, at a CAGR of 7.4% during the forecast period (2023-2032).

The Europe Automotive Lead Acid Battery market is driven by several key factors, including the growing demand for electric vehicles (EVs) and the increasing adoption of advanced start-stop systems in conventional vehicles. Lead-acid batteries continue to be a cost-effective and reliable power solution for automotive applications, offering a balance of performance and affordability. Additionally, the expanding use of these batteries in energy storage systems, such as for backup power in electric vehicles and hybrid electric vehicles (HEVs), is contributing to market growth. Technological advancements in lead-acid battery efficiency and recycling processes further enhance their appeal in the automotive sector. Moreover, stricter environmental regulations and the growing focus on sustainability encourage the development of more eco-friendly, high-performance batteries, boosting market demand. These factors combined are expected to propel the market toward steady growth, as automotive manufacturers seek cost-efficient and reliable power solutions for their vehicles.

The Europe Automotive Lead Acid Battery market exhibits significant regional variation, with countries like Germany, the United Kingdom, France, and Italy leading the demand for these batteries due to their strong automotive industries and increasing adoption of hybrid vehicles and start-stop systems. The growing emphasis on fuel efficiency and emission reductions further stimulates the use of lead-acid batteries in both conventional and hybrid vehicles. Other regions, such as Poland and Spain, are also contributing to market growth, with increasing automotive manufacturing activities. Key players in this market include leading battery manufacturers such as Clarios, EnerSys, Exide Industries, and Johnson Controls, all of which dominate the region with their advanced lead-acid battery solutions. These companies continue to innovate, focusing on improving battery performance and sustainability. Additionally, other players like Camel Group, C&D Technologies, and GS Yuasa are expanding their presence in the European automotive battery market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Automotive Lead Acid Battery market was valued at USD 5,615.17 million in 2023 and is expected to reach USD 10,715.78 million by 2032, growing at a CAGR of 7.4% during the forecast period (2023-2032).

- The Global Automotive Lead Acid Battery market was valued at USD 21,181.34 million in 2023 and is expected to reach USD 43,052.54 million by 2032, growing at a CAGR of 8.2% from 2023 to 2032.

- The increasing demand for electric and hybrid vehicles, which use lead-acid batteries for auxiliary power and start-stop systems, is a major market driver.

- Technological advancements in lead-acid battery efficiency and recycling processes are contributing to the market’s growth.

- The growing adoption of start-stop systems in vehicles is a key trend driving the demand for lead-acid batteries.

- Competition from lithium-ion and emerging battery technologies poses a restraint on the growth of the lead-acid battery market.

- Germany, the UK, and France dominate the European market, with growing demand driven by both conventional and hybrid vehicle adoption.

- Key players include Clarios, EnerSys, Exide Industries, and Johnson Controls, which are focusing on enhancing battery performance and sustainability.

Report Scope

This report segments the Europe Automotive Lead Acid Battery Market as follows:

Market Drivers

Growing Demand for Electric and Hybrid Vehicles

The increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) is one of the primary drivers of the Europe Automotive Lead Acid Battery market. Lead-acid batteries, although being relatively older technology, are widely used in EVs and HEVs due to their affordability, reliability, and ability to support the power needs of smaller vehicles. For instance, the European Battery Alliance emphasizes that over 90% of lead-acid batteries are recycled in Europe, reinforcing their sustainability credentials. In HEVs, lead-acid batteries play a critical role in energy regeneration during braking and power management. Additionally, the development of advanced lead-acid battery variants, such as absorbed glass mat (AGM) and enhanced flooded batteries (EFB), provides better performance and greater energy efficiency, contributing to the continued demand for these solutions. As Europe continues to push for higher EV adoption rates to meet environmental goals, the role of lead-acid batteries in this transition remains significant, thus boosting market growth.

Technological Advancements in Battery Performance

Technological advancements in lead-acid battery performance have contributed significantly to the market’s growth. Modern lead-acid batteries, such as AGM and EFB, are designed to offer better cycle life, improved charging efficiency, and greater power density compared to traditional flooded batteries. For instance, the European Battery Regulation introduces sustainability requirements, including minimum recycled content and performance criteria, to enhance battery efficiency. These innovations have made lead-acid batteries more suitable for a range of automotive applications, including both conventional and electric vehicles. Enhanced durability and greater energy efficiency make these batteries a viable option for both vehicle manufacturers and consumers. Additionally, advancements in battery management systems (BMS) help optimize battery performance, further enhancing the overall functionality of lead-acid batteries in automotive applications. These technological upgrades are expected to continue fueling demand for lead-acid batteries across Europe.

Cost-Effectiveness and Affordability

Lead-acid batteries are one of the most cost-effective solutions available in the automotive battery market. For vehicle manufacturers, especially in the budget and entry-level segments, these batteries offer an economical alternative to more expensive lithium-ion batteries. Lead-acid batteries are significantly cheaper to produce and replace, which makes them a preferred choice for conventional internal combustion engine vehicles (ICEVs) with start-stop technology. These vehicles utilize lead-acid batteries to support the start-stop system, which reduces fuel consumption and emissions. As a result, the low upfront and replacement costs of lead-acid batteries continue to make them an attractive option in the automotive sector, particularly for mass-market vehicles in Europe.

Stringent Environmental Regulations and Sustainability Initiatives

As Europe continues to implement stringent environmental regulations and sustainability goals, the demand for eco-friendly automotive solutions has surged. Lead-acid batteries are considered more environmentally sustainable compared to other battery types due to their higher recycling rates and established infrastructure for handling used batteries. The European Union’s focus on reducing carbon emissions and promoting circular economy practices has spurred greater investment in battery recycling technologies. Furthermore, the push for reducing the carbon footprint in the automotive sector has led to an increased focus on improving the efficiency and sustainability of lead-acid batteries. Manufacturers are also exploring ways to enhance the lifecycle of these batteries through improved recycling processes, which, in turn, supports the adoption of lead-acid batteries as a more sustainable option for automotive applications. This regulatory environment is a significant factor driving the growth of the lead-acid battery market in Europe.

Market Trends

Increasing Adoption of Start-Stop Technology

One of the major trends in the European automotive lead-acid battery market is the increasing adoption of start-stop technology in vehicles. This system, which automatically shuts off and restarts the engine to reduce fuel consumption and emissions, relies heavily on lead-acid batteries to ensure smooth and reliable engine starts. For instance, stringent regulations aimed at reducing CO2 emissions and improving fuel efficiency have spurred the adoption of start-stop technology, which automatically shuts off the engine during idling to save fuel and reduce emissions. The demand for start-stop systems is growing as consumers and manufacturers alike become more focused on reducing vehicle fuel consumption and meeting stringent emission standards. As a result, lead-acid batteries, particularly enhanced flooded batteries (EFBs) and absorbed glass mat (AGM) batteries, are being widely used in vehicles with start-stop functionality. This trend is expected to continue, further driving the demand for automotive lead-acid batteries in Europe.

Technological Advancements in Battery Efficiency and Performance

Advancements in lead-acid battery technology are significantly shaping the European automotive market. Modern lead-acid batteries have been optimized for better efficiency, longer cycle life, and improved power density, making them more suitable for a variety of automotive applications. Innovations such as AGM and EFB technology allow for higher performance in vehicles with start-stop systems, ensuring reliability under the repeated charge and discharge cycles common in these systems. For instance, the Clean Energy Technology Observatory highlights ongoing research into improving battery performance and recyclability in Europe. Moreover, developments in battery management systems (BMS) enable better monitoring and control of battery health, improving overall vehicle performance. These technological improvements help lead-acid batteries remain competitive in an increasingly electric vehicle-dominated market, making them a cost-effective and efficient choice for automakers.

Growing Demand for Cost-Effective Automotive Solutions

As electric vehicle (EV) adoption continues to rise, the cost-effectiveness of lead-acid batteries remains a significant trend in the European automotive sector. Lead-acid batteries are much cheaper to produce and replace than alternatives like lithium-ion batteries, making them a preferred choice for conventional internal combustion engine vehicles and lower-cost hybrid electric vehicles (HEVs). Despite the increasing popularity of electric and hybrid vehicles, lead-acid batteries still offer a viable solution for mass-market vehicles, particularly in the budget segment. The relatively low upfront costs of lead-acid batteries make them attractive for automakers seeking to keep vehicle prices competitive while still meeting evolving emissions and fuel efficiency standards. This trend ensures that lead-acid batteries will remain an essential component of the automotive sector in Europe.

Focus on Sustainability and Recycling

Sustainability is becoming an increasingly important focus for the European automotive lead-acid battery market. Lead-acid batteries have one of the highest recycling rates among all types of automotive batteries, making them a more eco-friendly choice compared to alternatives like lithium-ion batteries. As the European Union pushes for a circular economy and stricter environmental regulations, automakers and battery manufacturers are investing in more sustainable production and recycling practices. Innovations in battery recycling technology are enhancing the sustainability of lead-acid batteries, ensuring that more materials are reused and fewer batteries end up in landfills. The combination of regulatory pressure and consumer demand for greener products is likely to continue driving this trend, solidifying the role of lead-acid batteries in a more sustainable automotive ecosystem.

Market Challenges Analysis

Competition from Alternative Battery Technologies

One of the significant challenges faced by the Europe Automotive Lead Acid Battery market is the growing competition from alternative battery technologies, especially lithium-ion (Li-ion) batteries. While lead-acid batteries continue to be a reliable and cost-effective option for automotive applications, lithium-ion batteries offer several advantages, such as higher energy density, longer cycle life, and lighter weight. These benefits make Li-ion batteries particularly attractive for electric vehicles (EVs) and hybrid electric vehicles (HEVs), where efficiency, range, and performance are critical. As the automotive industry increasingly shifts toward electrification, the demand for lithium-ion batteries is expected to continue rising, posing a threat to the lead-acid battery market. Additionally, advancements in solid-state batteries and other emerging technologies could further intensify the competition, making it essential for lead-acid battery manufacturers to innovate and enhance their products to maintain market relevance.

Environmental and Recycling Challenges

While lead-acid batteries are known for their high recycling rates, they still face significant environmental challenges. Lead is a toxic substance, and improper disposal or recycling of lead-acid batteries can lead to severe environmental damage. For instance, close to one-half (46%) of the portable batteries and accumulators sold in the EU were collected for recycling in 2022, highlighting the need for improved recycling infrastructure. Despite the established recycling infrastructure in Europe, the process of handling used batteries remains costly and complicated. Stricter environmental regulations, such as the European Union’s Waste Electrical and Electronic Equipment (WEEE) Directive and Battery Directive, impose stringent requirements on the collection, recycling, and disposal of automotive batteries. These regulations force manufacturers to invest in advanced recycling technologies and ensure compliance with sustainability standards, which can increase operational costs. Additionally, public awareness around the environmental impact of lead remains a challenge for the lead-acid battery market. Consumers and automakers are increasingly prioritizing greener, more sustainable alternatives, placing pressure on the lead-acid battery sector to adapt to the evolving regulatory landscape and public sentiment.

Market Opportunities

The Europe Automotive Lead Acid Battery market presents significant opportunities driven by evolving automotive trends and increasing regulatory demands for sustainability. One key opportunity lies in the growing adoption of start-stop systems in vehicles. These systems, which automatically shut off and restart the engine to reduce fuel consumption and emissions, require efficient and reliable batteries like lead-acid to function optimally. With Europe’s stringent emission standards pushing for greater fuel efficiency, the demand for lead-acid batteries in start-stop vehicles is expected to rise. Additionally, the increasing penetration of hybrid and electric vehicles in the European market presents a further opportunity for lead-acid batteries, particularly in lower-cost hybrid solutions where they complement the primary power source. Technological advancements in lead-acid battery variants, such as enhanced flooded batteries (EFBs) and absorbed glass mat (AGM) batteries, have improved their performance, creating new applications in both conventional and electrified vehicles.

Another growing opportunity stems from the European Union’s focus on sustainability and the circular economy. Lead-acid batteries have one of the highest recycling rates among all battery types, with an established and efficient recycling infrastructure in Europe. This environmental advantage presents a unique opportunity for manufacturers to position lead-acid batteries as a greener alternative to other technologies, such as lithium-ion batteries, which are more challenging to recycle. The increasing pressure on automakers to reduce their carbon footprint and meet sustainability goals aligns well with the eco-friendly attributes of lead-acid batteries. Additionally, advancements in battery recycling technologies are expected to enhance the overall sustainability of lead-acid batteries, further strengthening their position in the market. As a result, manufacturers can capitalize on these opportunities by promoting the environmental benefits and cost-effectiveness of lead-acid batteries while responding to the growing demand for more sustainable automotive solutions.

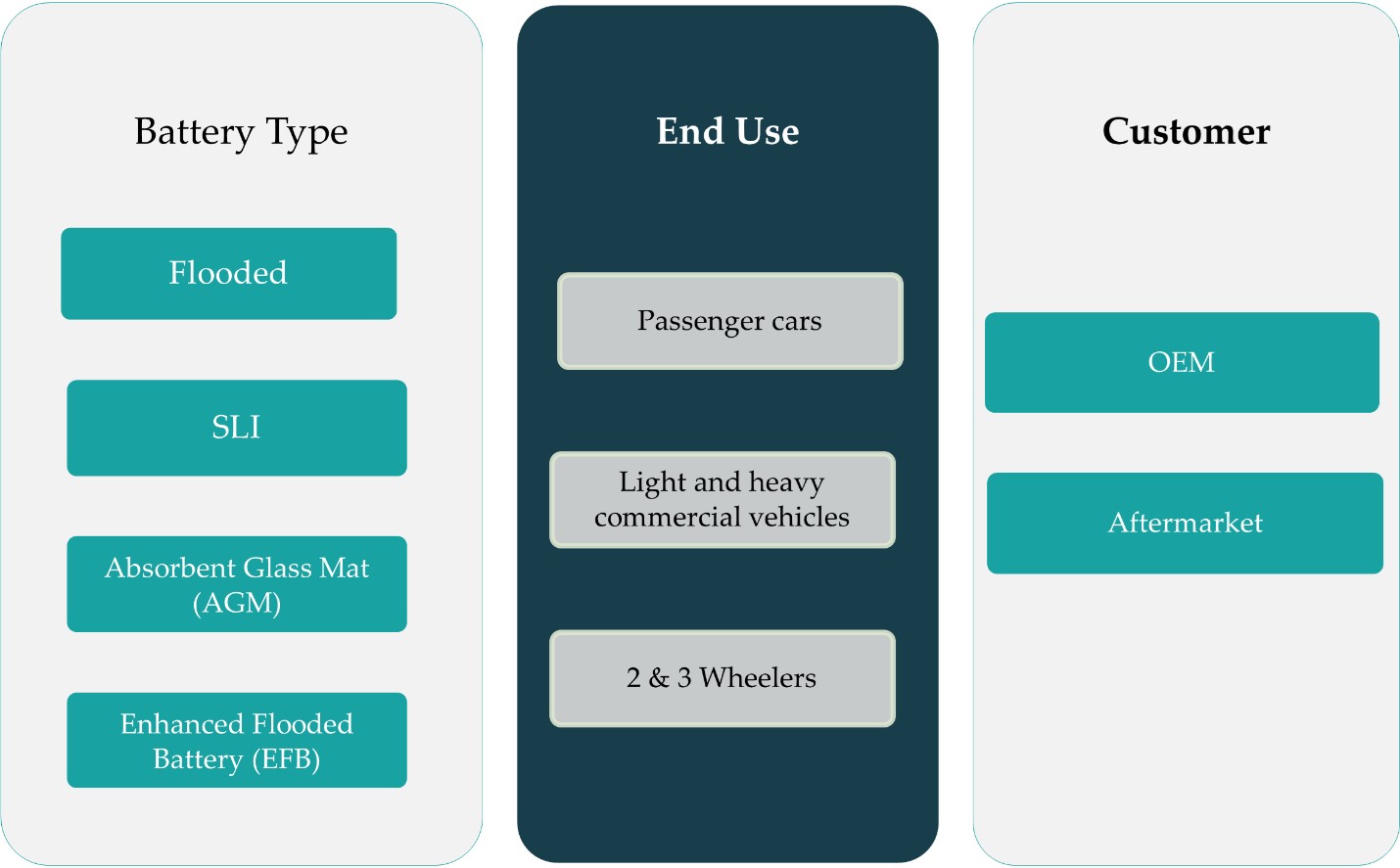

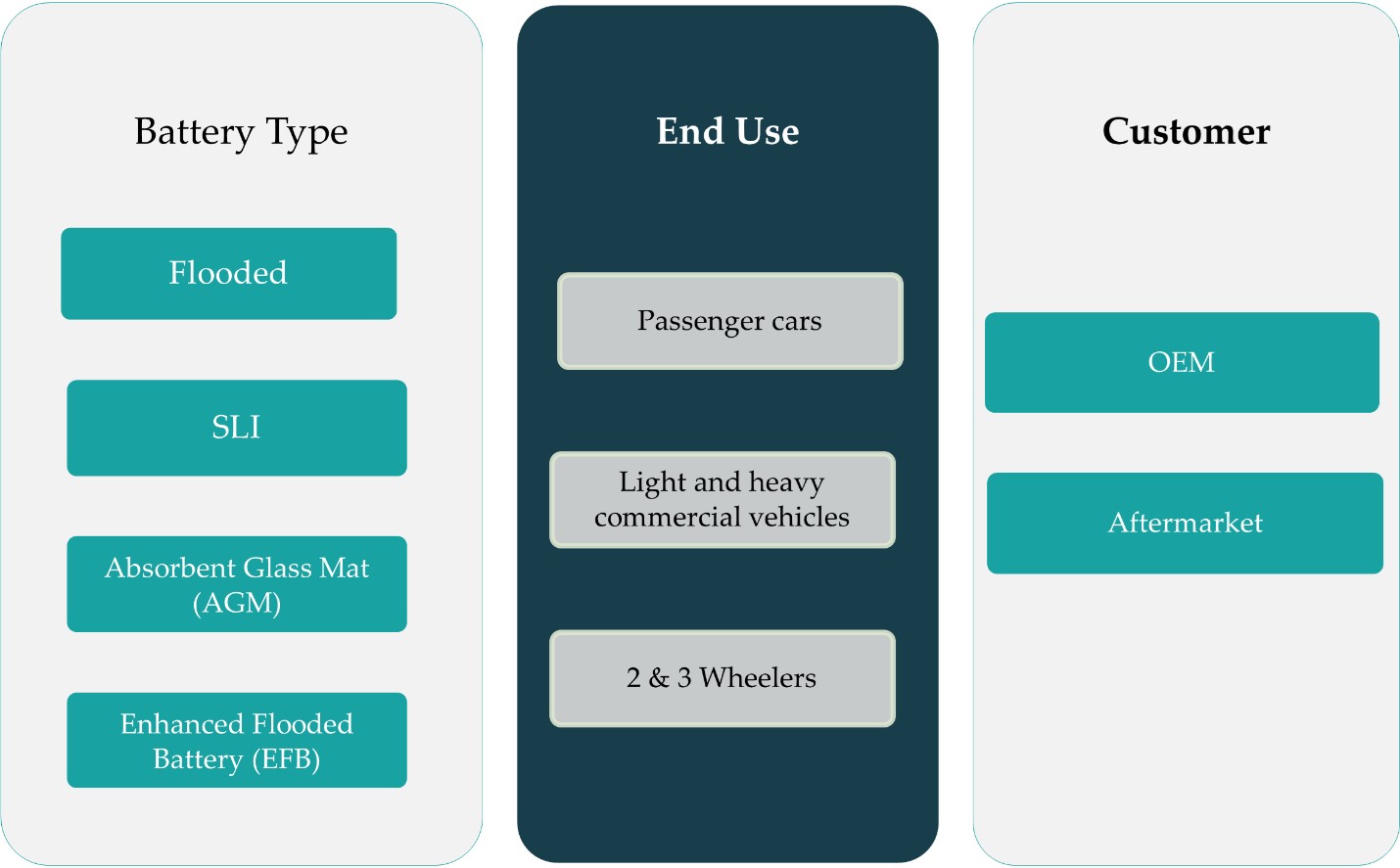

Market Segmentation Analysis:

By Battery Type:

The Europe Automotive Lead Acid Battery market can be segmented based on battery type into flooded, SLI (Starting, Lighting, and Ignition), Absorbent Glass Mat (AGM), and Enhanced Flooded Battery (EFB). Flooded batteries are the most traditional and cost-effective option, widely used in conventional internal combustion engine (ICE) vehicles. They are characterized by a simple design and are typically found in older vehicles and entry-level models. SLI batteries are primarily used in starting the vehicle’s engine, as well as powering the vehicle’s lights and electrical systems. They dominate the automotive sector due to their reliable performance and affordability. Absorbent Glass Mat (AGM) batteries are used in premium vehicles and those equipped with start-stop technology, as they provide higher energy output, improved cycle life, and better performance in extreme temperatures. Enhanced Flooded Batteries (EFBs), which offer higher energy efficiency and durability than flooded batteries, are increasingly utilized in vehicles with advanced start-stop systems. This trend is expected to drive the growth of AGM and EFB segments, particularly as demand for energy-efficient automotive solutions rises.

By End Use:

The market can also be segmented based on end use into passenger cars, light and heavy commercial vehicles, and 2 & 3-wheelers. Passenger cars hold the largest share in the market, as they are the primary consumers of lead-acid batteries for starting, lighting, and ignition functions. With the increasing adoption of electric and hybrid electric vehicles, the demand for lead-acid batteries remains significant in entry-level and hybrid passenger vehicles. Light and heavy commercial vehicles also represent a major segment, particularly for use in auxiliary power systems, lighting, and ignition functions. With Europe’s strong logistics sector, the demand for durable, high-performance lead-acid batteries in commercial vehicles is expected to grow. Finally, 2 & 3-wheelers are emerging as an important segment, especially in countries with high urban mobility needs. Lead-acid batteries are widely used in these vehicles due to their affordability, compact design, and reliable performance in smaller vehicles. The increasing urbanization and demand for affordable transportation options are expected to drive the growth of this segment in the European market.

Segments:

Based on Battery Type:

- Flooded

- SLI

- Absorbent Glass Mat

- Enhanced Flooded Battery

Based on End Use:

- Passenger cars

- Light and heavy commercial vehicles

- 2 & 3 Wheelers

Based on Customer:

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

United Kingdom

The United Kingdom holds a significant share of the Europe Automotive Lead Acid Battery market, contributing approximately 15% of the total market in 2023. The UK automotive market is driven by strong demand for both conventional vehicles and hybrids, where lead-acid batteries are still widely used due to their affordability and reliability. The country’s robust regulatory framework supporting emissions reductions and vehicle efficiency standards further stimulates the adoption of lead-acid batteries, particularly in vehicles with start-stop systems. Additionally, the growing focus on sustainability and the rise of electric vehicle (EV) adoption in the UK continue to influence the automotive battery market. Despite the shift towards EVs, lead-acid batteries remain an essential power source in lower-cost hybrid vehicles and conventional models, ensuring their steady market share.

Germany

Germany is the largest automotive market in Europe and holds the highest market share of around 25% in the Europe Automotive Lead Acid Battery market. Known for its strong automotive industry, Germany has a high demand for automotive batteries driven by both internal combustion engine (ICE) vehicles and hybrid models. The adoption of advanced start-stop systems in German vehicles, particularly in premium brands like BMW, Mercedes-Benz, and Audi, has significantly increased the demand for lead-acid batteries, especially AGM and EFB types. Moreover, Germany’s push towards sustainability and its ongoing efforts to transition to electric mobility further impact the automotive battery market, providing growth opportunities for lead-acid batteries in hybrid and entry-level EVs. As the country balances both innovation and traditional automotive technologies, lead-acid batteries continue to play a crucial role in the market.

France and Italy

France and Italy, contributing a combined market share of approximately 18%, are also key players in the European automotive lead-acid battery market. France, with its emphasis on low-emission vehicles and green technology, sees a rising demand for lead-acid batteries in both conventional and hybrid vehicles. The French market is particularly influenced by government incentives promoting environmentally friendly vehicles, including tax breaks for hybrid models, which often rely on lead-acid batteries for auxiliary functions. Similarly, Italy, with its strong automotive heritage and focus on fuel-efficient vehicles, also maintains a steady demand for lead-acid batteries, particularly in smaller vehicles and hybrids. Both countries are expected to continue contributing to the growth of the market, driven by the ongoing shift toward hybrid technologies and stringent fuel efficiency regulations.

Rest of Europe

The remaining European regions, including Spain, Sweden, Poland, and other countries in the rest of Europe, contribute approximately 42% to the overall Europe Automotive Lead Acid Battery market. Spain, with its growing automotive manufacturing sector, and Sweden, with its emphasis on electric and hybrid vehicles, reflect regional shifts in battery technology and demand. Poland is emerging as an important automotive hub in Eastern Europe, where cost-effective solutions like lead-acid batteries continue to dominate in both commercial and passenger vehicle applications. The overall market share of the rest of Europe is large due to diverse automotive markets in these regions, with varying degrees of adoption of hybrid technologies and fuel-efficient systems, ensuring a balanced demand for lead-acid batteries across the continent. This broad regional presence continues to offer significant growth opportunities for manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Camel Group Co., Ltd.

- C&D Technologies, Inc.

- Clarios

- CSB Energy Technology Co., Ltd.

- East Penn Manufacturing Company

- EnerSys

- Exide Industries Ltd.

- GS Yuasa Corporation

- Crown Battery

- Leoch International Technology Limited

- Johnson Controls

- Robert Bosch LLC

- Yuasa Battery Europe

Competitive Analysis

The Europe Automotive Lead Acid Battery market is highly competitive, with several key players dominating the industry. Clarios, EnerSys, Exide Industries, Johnson Controls, Camel Group, C&D Technologies, CSB Energy Technology, GS Yuasa, Crown Battery, Leoch International Technology, and Robert Bosch are among the major players shaping the market landscape. Additionally, the growing demand for hybrid and electric vehicles (EVs) in Europe continues to support the market, as lead-acid batteries are commonly used in these vehicles for auxiliary power and energy storage. Technological advancements in lead-acid battery efficiency and recycling processes are also boosting market growth by improving battery performance and sustainability. The affordability of lead-acid batteries compared to alternatives like lithium-ion makes them a popular choice in mass-market and budget vehicles, while stricter environmental regulations and the push for more eco-friendly solutions are contributing to the demand for more efficient and sustainable battery technologies. Despite competition from lithium-ion batteries, the market remains robust due to the cost-effectiveness and reliability of lead-acid batteries in automotive applications.

Recent Developments

- In November 2024, EnerSys showcased the iQ Mini™ battery monitoring device and maintenance-free NexSys® Thin Plate Pure Lead (TPPL) batteries, which offer longer service life and faster recharge rates.

- In July 2024, Exide Industries Ltd. introduced an advanced Absorbent Glass Mat (AGM) battery for Starting, Lighting, and Ignition (SLI) applications in the automotive market. This new battery is designed to deliver enhanced performance, including improved starting power, and potentially longer lifespan compared to traditional lead-acid batteries.

- In August 2023, Clarios, a global leader in advanced low-voltage battery manufacturing and recycling, is acquiring Paragon GmbH & Co. KGaA’s power business, which specializes in batteries and battery management systems for the automotive industry. This acquisition enhances Clarios’ engineering capabilities and supports its low-voltage and lithium-ion projects, significantly expanding the team dedicated to developing new low-voltage architectures.

- In May 2023, C&D Technologies, Inc. introduced the Pure Lead Max (PLM) VRLA battery, designed for long lifespan and improved performance in UPS and data center applications.

- In April 2023, the acquisition of IBCS by EnerSys is a strategic move to expand its motive power services and strengthen its presence in the UK market. This addition will enhance EnerSys’s range of battery-related services, including installation, maintenance, repair, and replacement.

Market Concentration & Characteristics

The Europe Automotive Lead Acid Battery market is moderately concentrated, with a few key players dominating the industry. Leading companies such as Clarios, EnerSys, Exide Industries, and Johnson Controls hold significant market shares due to their extensive product portfolios and strong technological capabilities. These companies have established robust manufacturing and distribution networks, enabling them to meet the increasing demand for lead-acid batteries in both conventional and hybrid vehicles. The market is characterized by high competition among these major players, which focus on product innovation, cost-efficiency, and sustainability to maintain their market positions. Smaller players like Camel Group and Leoch International also contribute to market diversity by offering cost-effective solutions, particularly in emerging markets. The market’s characteristics include a growing demand for advanced lead-acid batteries with improved energy efficiency, longer lifespan, and enhanced recyclability. The shift toward eco-friendly solutions and evolving regulatory standards further influences the competitive dynamics of the market.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, End Use, Customer and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Automotive Lead Acid Battery market is expected to continue growing at a steady pace due to the increasing demand for fuel-efficient and eco-friendly automotive solutions.

- Technological advancements in lead-acid battery performance, such as improved charge retention and longer cycle life, will drive market growth.

- The rising adoption of start-stop systems in vehicles will further fuel the demand for lead-acid batteries across Europe.

- Hybrid and electric vehicle adoption will continue to support the need for lead-acid batteries, especially in auxiliary power systems and energy storage applications.

- The expansion of battery recycling programs and improvements in sustainability will enhance the environmental appeal of lead-acid batteries.

- Competition from lithium-ion and other advanced battery technologies will challenge the lead-acid battery market, but cost advantages will maintain its relevance in budget and entry-level vehicles.

- The increasing focus on reducing carbon emissions and meeting stringent European Union regulations will push manufacturers to innovate and enhance battery efficiency.

- The rise of urban mobility solutions like electric scooters and e-bikes will contribute to the growth of lead-acid battery applications in smaller vehicles.

- The development of new applications for lead-acid batteries in energy storage systems for vehicles will diversify their role in the automotive market.

- Ongoing investments in the European automotive sector will continue to drive demand for reliable and cost-effective battery solutions, ensuring lead-acid batteries remain an essential power source.