Market Overview:

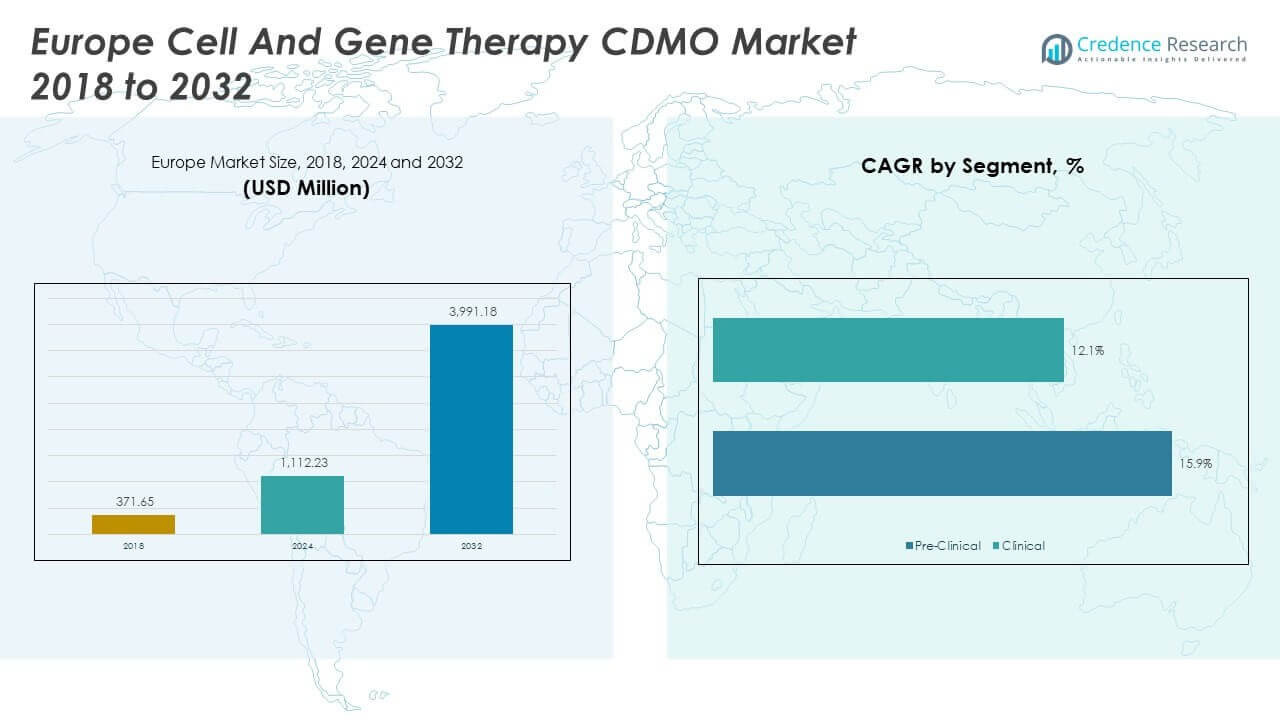

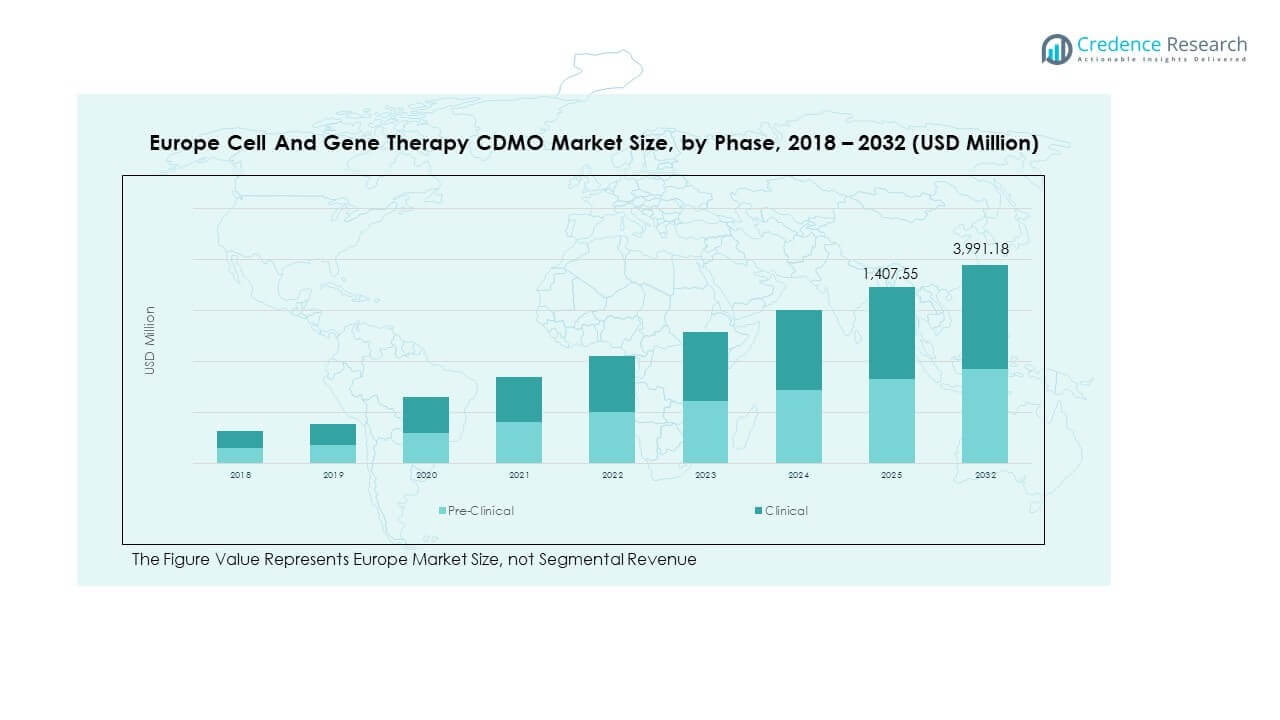

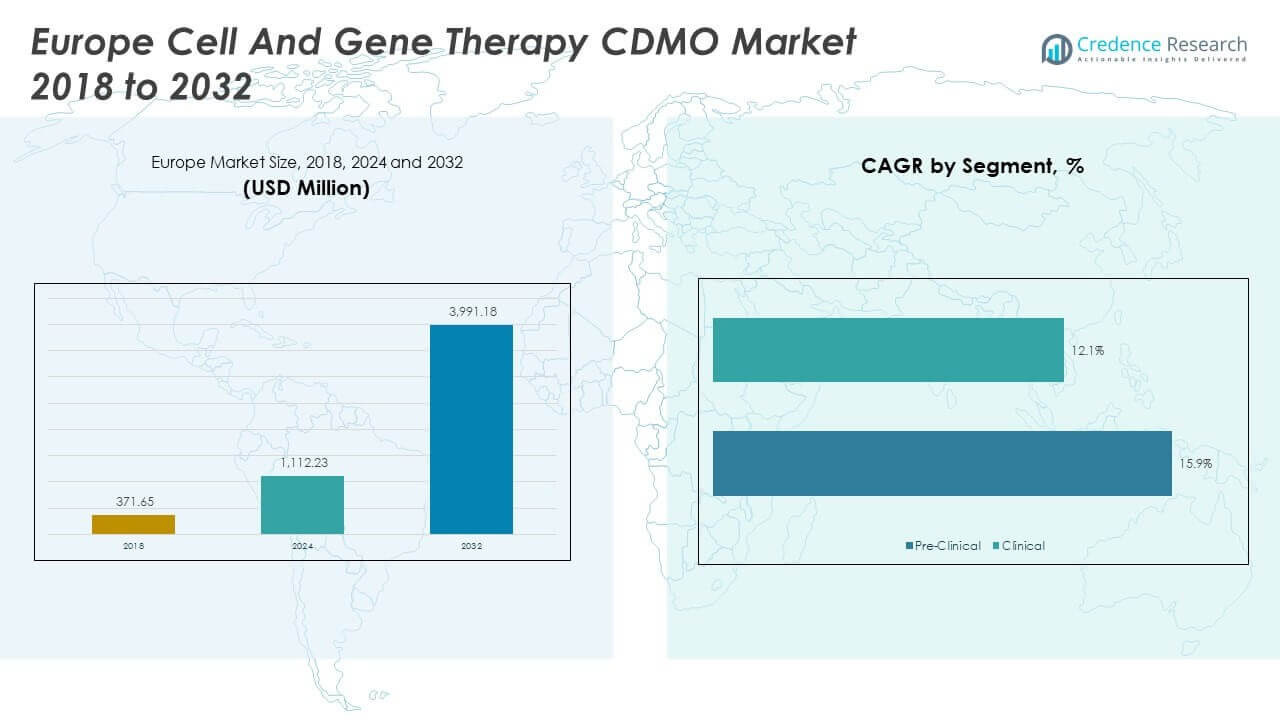

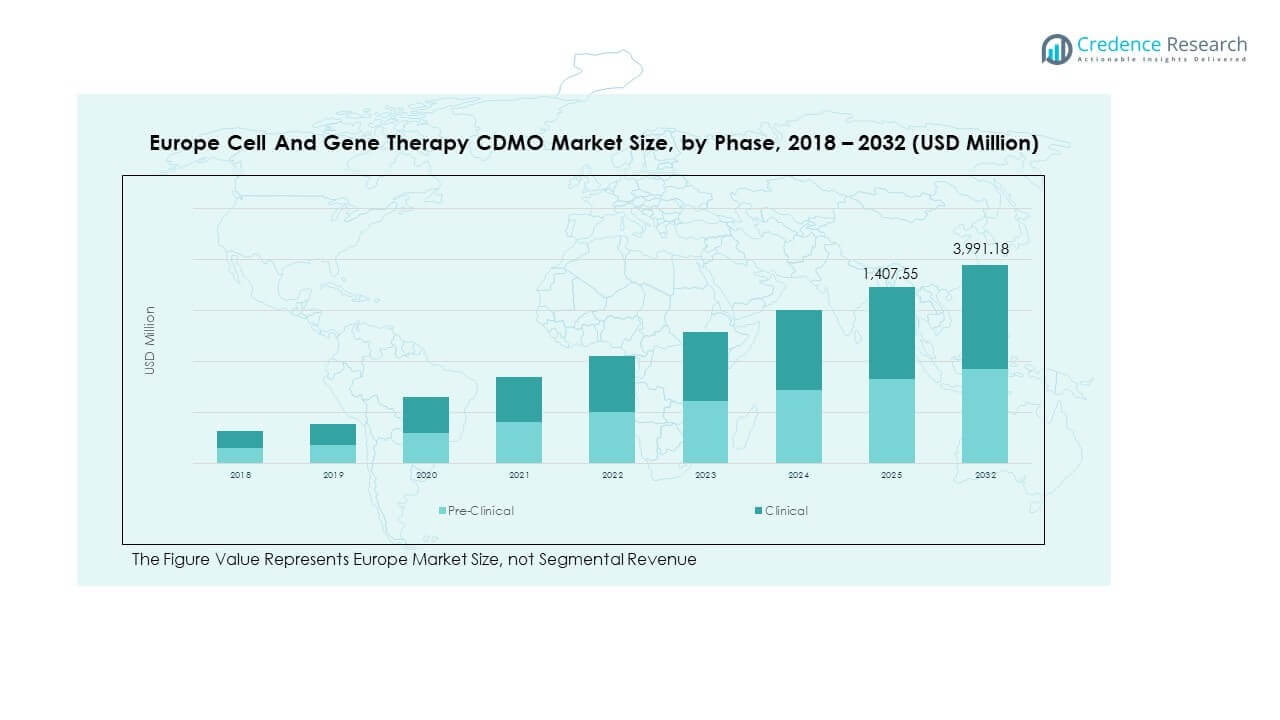

The Europe Cell and Gene Therapy CDMO Market size was valued at USD 371.65 million in 2018, reaching USD 1,112.23 million in 2024, and is anticipated to attain USD 3,991.18 million by 2032, registering a CAGR of 16.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Cell and Gene Therapy CDMO Market Size 2024 |

USD 1,112.23 Million |

| Europe Cell and Gene Therapy CDMO Market, CAGR |

16.05% |

| Europe Cell and Gene Therapy CDMO Market Size 2032 |

USD 3,991.18 Million |

The market is expanding due to rising demand for advanced therapies targeting rare and chronic diseases. Increased investments in R&D, government support, and technological advancements in cell expansion, vector manufacturing, and GMP compliance drive strong growth. Pharmaceutical and biotech companies are increasingly outsourcing to CDMOs for cost efficiency, scalability, and regulatory expertise. The shift toward personalized medicine and the rise of innovative therapies, such as CAR-T and gene-modified cell treatments, are further strengthening the market trajectory.

Geographically, Western Europe, led by Germany, the United Kingdom, and France, dominates the market owing to established biopharmaceutical clusters, advanced infrastructure, and significant clinical trial activity. Emerging markets in Eastern Europe are gaining traction due to growing government funding and lower operational costs, attracting global CDMOs. Southern European countries are also showing rising adoption, driven by increasing collaborations with global pharma and research institutions. This regional landscape highlights both established leaders and emerging hubs that are shaping future growth.

Market Insights:

- The Europe Cell and Gene Therapy CDMO Market was valued at USD 371.65 million in 2018, reached USD 1,112.23 million in 2024, and is projected to attain USD 3,991.18 million by 2032, growing at a CAGR of 16.05%.

- Western Europe led with 52% share in 2024, supported by advanced biotech clusters in Germany, the UK, and France, while Southern Europe held 21% due to cost-efficient outsourcing, and Eastern Europe contributed 15%, leveraging low-cost manufacturing and government incentives.

- Northern Europe, with a 12% share, represents the fastest-growing subregion, driven by strong academic research ecosystems in Sweden and Denmark and innovation in rare disease therapies.

- The clinical phase accounted for 78% share in 2024, highlighting the dominance of late-stage trials and scaling needs across oncology and neurological applications.

- The pre-clinical phase held 22% share, supported by early-stage biotech firms relying on CDMOs for feasibility studies and regulatory preparation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising demand for advanced therapies across multiple therapeutic areas creates momentum for CDMO services

The growth of advanced therapies is creating significant momentum across multiple indications. Increasing prevalence of rare genetic disorders and cancers is expanding the need for specialized treatment options. Governments and healthcare providers are supporting programs that promote early adoption of cell and gene therapies. Pharmaceutical and biotechnology companies are moving towards outsourcing to achieve efficiency and compliance. The Europe Cell And Gene Therapy CDMO Market benefits from a strong regulatory environment that encourages innovation. Rising investment in oncology, neurology, and immunology strengthens the adoption of contract development services. It enables CDMOs to expand capacities, improve scalability, and offer advanced platforms for therapeutic manufacturing. The rising number of clinical trials across Europe also drives consistent demand for specialized expertise.

- For instance, in August 2025 Minaris Advanced Therapies opened a new GMP cell and gene therapy manufacturing facility in Taufkirchen (near Munich), Germany. The site features six Grade B/A cleanrooms, one convertible Grade C cleanroom, dedicated process development and QC labs, cryopreservation and storage facilities, and 224 m² of expansion space, all designed to support streamlined technology transfer and both clinical and commercial production.

Expanding pharmaceutical outsourcing partnerships enhance scalability and reduce operational risks

Pharmaceutical companies are forming partnerships with CDMOs to streamline complex processes. These collaborations enable faster development cycles and minimize financial risks linked to infrastructure investment. Companies are focusing on strengthening product pipelines without diverting resources to in-house facilities. The Europe Cell And Gene Therapy CDMO Market gains momentum as outsourcing offers access to established expertise. It provides flexibility to adjust production capacity in line with shifting demand. CDMOs deliver advanced manufacturing solutions, quality control frameworks, and compliance assurance under strict regulatory guidelines. The trust in CDMOs grows with their ability to deliver consistent performance. Strategic alliances allow both emerging biotech and established pharma to achieve faster commercialization of therapies.

- For instance, Evotec’s J POD biologics manufacturing facility in Toulouse, France, has been customized and dedicated entirely to Sandoz since July 2024, marking a key advancement in their partnership. Under a proposed agreement, Sandoz aims to acquire the Toulouse site leveraging Evotec’s continuous manufacturing platform through a sale valued at around US$ 300 million.

Supportive regulatory frameworks encourage compliance and market expansion across the region

Strong regulations in Europe are guiding the progress of advanced therapy manufacturing. Regulatory authorities encourage innovation while ensuring safety standards are strictly met. Harmonized guidelines across member countries create a favorable environment for CDMOs. The Europe Cell and Gene Therapy CDMO Market benefits from regulatory clarity that reduces delays. It provides confidence to investors and sponsors regarding long-term market sustainability. CDMOs with GMP-certified facilities gain preference from companies seeking compliant production. Regulatory support helps streamline clinical trials and accelerate approvals for advanced therapies. The presence of Pan-European initiatives promotes a unified growth environment for the industry.

Investment in research infrastructure drives technological advancements in therapeutic manufacturing

Strong investments in research centers and biotech hubs support innovation in cell and gene therapies. Public and private funding is enhancing infrastructure for clinical trials and R&D activities. Academic institutions collaborate with CDMOs to accelerate translational research into market-ready therapies. The Europe Cell And Gene Therapy CDMO Market benefits from a dense network of innovation clusters. It creates opportunities for faster adaptation of new manufacturing technologies. CDMOs are investing in automation, process optimization, and AI-enabled monitoring systems. These developments reduce error rates, improve yields, and ensure higher scalability. Investments in infrastructure also strengthen Europe’s global position in advanced therapy manufacturing.

Market Trends

Expansion of viral vector production capacity supports rapid growth of therapeutic pipelines

Viral vectors are essential for the delivery of many gene therapies. Growing demand has pushed CDMOs to expand vector manufacturing capacity across Europe. Large-scale facilities are being developed to meet the surge in clinical programs. The Europe Cell And Gene Therapy CDMO Market reflects this trend as CDMOs invest heavily. It is driving the adoption of scalable vector technologies such as suspension cell cultures. Standardization of vector platforms improves consistency and supports faster approvals. Companies are also deploying modular facilities for greater production flexibility. These expansions secure the supply chain for both clinical and commercial therapies.

- For instance, Oxford Biomedica’s Oxbox facility in Oxford, UK, currently operates four GMP viral vector production suites and two fill–finish suites, while its fully funded Phase Two expansion adds large-scale bioreactor capacity at 500 L, 1,000 L, and up to 2,000 L, strengthening both clinical and commercial manufacturing capability in Europe.

Growing integration of digital technologies enhances efficiency in therapeutic development

Digital transformation is reshaping CDMO operations across Europe. Companies are deploying AI-driven platforms for predictive modeling and process optimization. The Europe Cell And Gene Therapy CDMO Market highlights this trend with adoption of cloud-based monitoring systems. It supports better resource planning and enhances compliance tracking. Digital twins and smart analytics are applied to optimize batch yields. Companies use data insights to reduce downtime and streamline operations. Automation combined with robotics improves consistency in high-complexity manufacturing. These technology integrations help CDMOs deliver reliable and scalable outcomes.

- For instance, Sartorius offers its Umetrics® data analytics solutions, including SIMCA® and SIMCA®-online, which integrate advanced multivariate analysis and real-time process monitoring to optimize bioprocess control and improve consistency across CDMO manufacturing operations.

Rising focus on personalized medicine reshapes manufacturing priorities for CDMOs

The trend toward personalized medicine is influencing how CDMOs manage production. Increasing adoption of CAR-T and autologous therapies requires flexible and adaptive processes. The Europe Cell And Gene Therapy CDMO Market evolves with this demand for individualized solutions. It challenges CDMOs to shift from bulk production models to patient-specific manufacturing. Specialized logistics and rapid turnaround times are becoming critical success factors. The emphasis on small batch sizes pushes development of advanced scheduling systems. Partnerships with healthcare providers and clinics strengthen personalized therapy delivery. The growing focus on tailored treatments continues to reshape industry operations.

Cross-border collaborations create new growth opportunities and knowledge sharing

Collaborations across Europe are fostering knowledge exchange and resource sharing. Academic institutions, biotech firms, and CDMOs are building joint projects to accelerate growth. The Europe Cell and Gene Therapy CDMO Market demonstrates this trend through multiple international partnerships. It is leading to standardized processes and broader access to advanced technologies. Collaborations also reduce the financial burden on smaller biotech companies. Shared infrastructure models improve efficiency and ensure better access to expertise. Cross-border initiatives also support clinical trials that require diverse patient recruitment. These collaborations contribute to the region’s competitive position in global markets.

Market Challenges Analysis

High costs and complex manufacturing requirements create barriers for new entrants and smaller firms

The market faces significant challenges from the high cost of infrastructure and equipment. Manufacturing advanced therapies requires specialized cleanrooms, bioreactors, and analytical systems. Smaller biotech firms often lack the financial resources to invest in such capabilities. The Europe Cell and Gene Therapy CDMO Market addresses this gap, but cost pressures remain high. It leads to increased outsourcing dependency, which can strain CDMO capacity. The complexity of scaling personalized therapies also adds operational hurdles. Companies must maintain strict GMP standards while dealing with variable demand. These challenges create barriers that limit participation from smaller players.

Skilled workforce shortages and supply chain constraints hinder seamless growth across regions

The demand for highly skilled professionals in advanced therapy manufacturing exceeds supply. CDMOs face difficulties recruiting specialists in cell biology, molecular genetics, and process engineering. The Europe Cell and Gene Therapy CDMO Market experiences delays when workforce shortages affect timelines. It also suffers from supply chain bottlenecks for viral vectors and raw materials. Global disruptions increase risks for therapy developers relying on timely delivery. Quality assurance professionals are also in short supply, adding pressure on compliance teams. Training initiatives exist, but they require time to create an impact. These workforce and supply challenges limit efficiency and scalability across Europe.

Market Opportunities

Expanding partnerships with global biopharma companies create growth prospects for CDMOs in Europe

Collaborations with global biopharma leaders are creating new opportunities for CDMOs. Multinational firms prefer European partners for access to advanced facilities and regulatory compliance. The Europe Cell and Gene Therapy CDMO Market gains momentum from these partnerships. It positions CDMOs to expand service portfolios and secure long-term contracts. Demand for scalable manufacturing and rapid development cycles drives sustained collaborations. Strategic alliances with North American and Asian firms enhance market penetration. These opportunities strengthen Europe’s role in global therapy development.

Increasing focus on emerging therapeutic areas boosts demand for specialized CDMO services

Emerging therapeutic areas such as regenerative medicine and rare disease treatment are expanding. CDMOs with expertise in novel platforms are well positioned to capture demand. The Europe Cell and Gene Therapy CDMO Market benefits from its strong innovation ecosystem. It encourages new service models that address evolving therapeutic needs. CDMOs are adopting flexible manufacturing to support smaller, specialized pipelines. Growing funding for early-stage biotech ventures boosts outsourcing opportunities. These conditions create an attractive environment for market expansion across Europe.

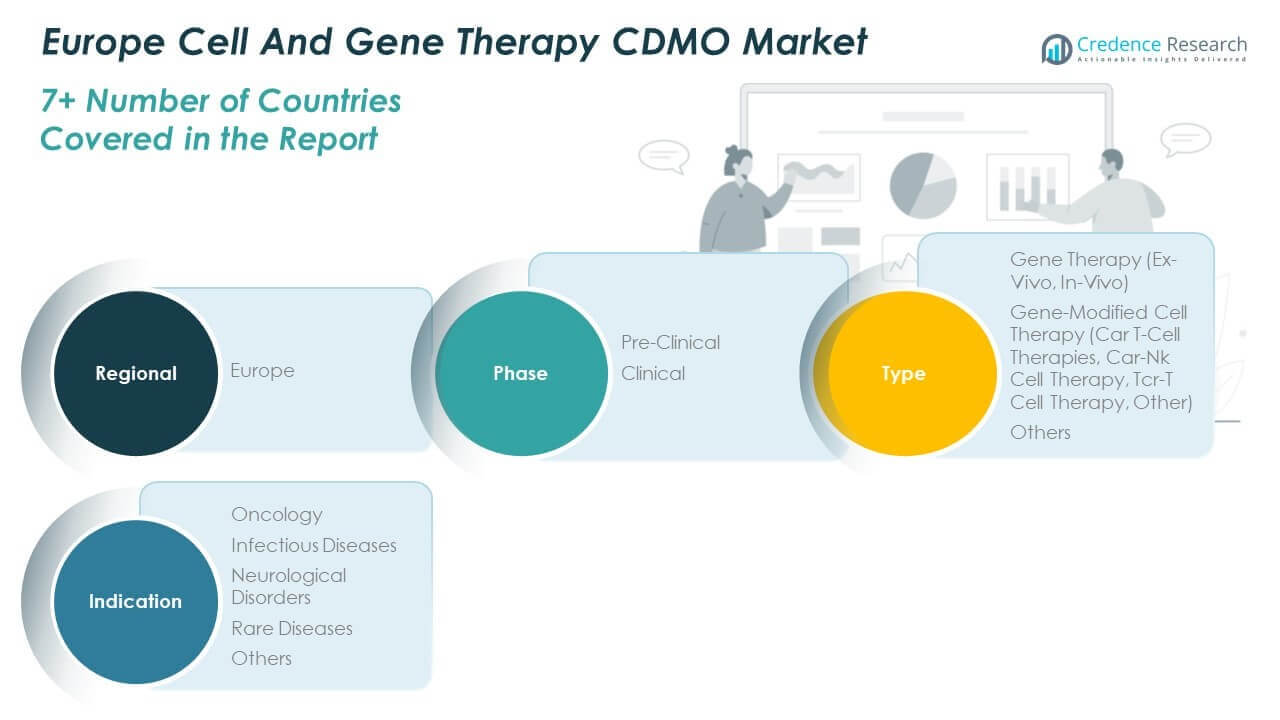

Market Segmentation Analysis:

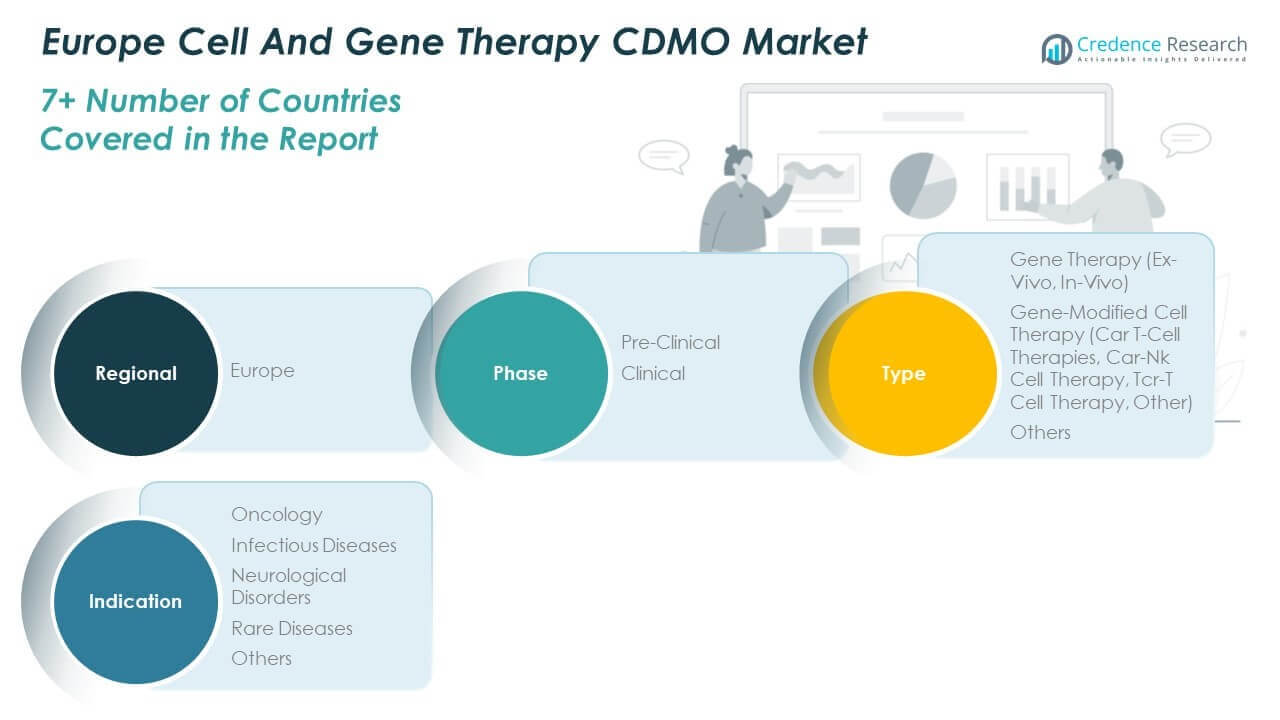

The Europe Cell and Gene Therapy CDMO Market demonstrates strong segmentation by phase, type, and indication, reflecting diverse demand drivers.

By phase, pre-clinical services hold steady importance due to early research requirements, while the clinical segment dominates revenue share with rising trial activity and regulatory submissions. It highlights the growing reliance of biotech firms on CDMOs for complex, large-scale clinical production.

- For instance, Amatsigroup, part of Eurofins CDMO, in France provides contract development and manufacturing services that support biotech and pharmaceutical companies from preclinical stages through Phase III clinical trials, strengthening early-stage research and clinical manufacturing in Europe.

By type, gene therapy is segmented into ex-vivo and in-vivo approaches. Ex-vivo therapies lead due to their precision and established clinical success, particularly in hematological disorders, while in-vivo approaches are gaining traction with advancements in vector delivery. Gene-modified cell therapies form a significant segment, with CAR T-cell therapies at the forefront due to their commercialized adoption in oncology. Emerging modalities like CAR-NK and TCR-T therapies are gaining visibility through early-stage clinical trials. Other categories remain niche but present opportunities for diversification.

By indication, oncology accounts for the largest share, driven by the widespread adoption of CAR T-cell therapies and pipeline investments. Infectious diseases follow with renewed interest in viral vector-based therapies for unmet needs. Neurological disorders represent a growing segment with promising advances in gene replacement therapies targeting conditions such as Parkinson’s and rare neuromuscular diseases. Rare diseases collectively form a strong opportunity area due to orphan drug incentives and high unmet clinical demand, while other indications sustain moderate growth across therapeutic niches. This segmentation underscores the market’s broad applicability and dynamic growth potential across Europe.

- For example, EUROAPI’s collaboration with Priothera targets manufacturing of mocravimod for blood cancers representing both oncology focus and CDMO reliance for clinical supply in Europe.

Segmentation:

By Phase

By Type

- Gene Therapy

- Gene-Modified Cell Therapy

- CAR T-Cell Therapies

- CAR-NK Cell Therapy

- TCR-T Cell Therapy

- Others

- Others

By Indication

- Oncology

- Infectious Diseases

- Neurological Disorders

- Rare Diseases

- Others

Regional Analysis:

Western Europe holds the dominant position in the Europe Cell and Gene Therapy CDMO Market, accounting for nearly 52% market share in 2024. Countries such as Germany, the United Kingdom, and France drive this leadership due to advanced biopharmaceutical infrastructure and a strong base of clinical trials. Germany benefits from its established biotech clusters and government-backed R&D programs, while the UK leverages its innovation hubs like the Cell and Gene Therapy Catapult. France contributes with increasing investments in manufacturing capacity and international collaborations. It remains the region with the highest concentration of CDMOs offering both pre-clinical and commercial services. Western Europe’s leadership is reinforced by regulatory clarity and strong academic-industry partnerships.

Southern Europe secures close to 21% market share, with Italy and Spain emerging as important contributors. The region benefits from rising investments in biopharma infrastructure and expanding clinical research networks. Italy demonstrates strong activity in regenerative medicine and cell therapy development, while Spain shows growth through collaborations between hospitals and biotech firms. Southern Europe continues to attract outsourcing contracts due to cost advantages compared to Western Europe. It plays a growing role in bridging local innovation with global biopharma demand. The region shows potential for becoming a secondary hub as CDMOs expand into newer geographies to reduce capacity pressure in established markets.

Eastern Europe and Northern Europe collectively account for 27% market share, split into 15% and 12%, respectively. Eastern Europe is emerging as a cost-effective outsourcing destination, with countries such as Poland and Hungary offering attractive incentives for biotech manufacturing. It provides opportunities for small and mid-sized biotech firms seeking affordable CDMO partnerships. Northern Europe, led by countries like Sweden and Denmark, benefits from strong academic research ecosystems and government-backed innovation clusters. It supports niche therapeutic development, particularly in rare diseases and advanced clinical programs. The region shows a growing preference for sustainable manufacturing practices and digitalized operations. It is strengthening its position by aligning with global CDMOs for cross-border collaborations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AGC Biologics

- WuXi Advanced Therapies

- Oxford Biomedica

- Novasep

- Recipharm

- CEVEC Pharmaceuticals

- Bayer AG

- Cell and Gene Therapy Catapult

- BioElpida

- Cell Medica

Competitive Analysis:

The Europe Cell And Gene Therapy CDMO Market is shaped by a diverse set of global and regional players competing across innovation, capacity, and service specialization. Leading companies such as AGC Biologics, WuXi Advanced Therapies, and Oxford Biomedica dominate through extensive manufacturing capabilities and integrated service portfolios. These players invest heavily in viral vector production, cell expansion technologies, and GMP-certified facilities to secure long-term contracts with biopharma firms. It demonstrates strong competition among established CDMOs, where technological advancement and regulatory expertise provide a clear advantage. Regional players such as Novasep, Recipharm, and BioElpida enhance competition by offering flexible and niche services tailored for small and mid-sized biotech firms. Strategic initiatives, including facility expansions, partnerships with academic institutes, and acquisitions, strengthen their positions in the market. It reflects a trend where both global giants and regional specialists are targeting oncology and rare disease pipelines, creating intense rivalry. CDMOs differentiate themselves through scalability, turnaround times, and ability to support personalized medicine development. Competitive intensity is further fueled by increasing demand for cost-effective solutions, encouraging players to adopt digital platforms and automation to boost efficiency.

Recent Developments:

- In May 2025, eXmoor Pharma, a leading CDMO in cell and gene therapy, entered into a strategic partnership with KU Leuven, one of Europe’s top academic institutions. The collaboration aims to develop a proprietary AAV producer cell line for scalable vector production as part of a newly established cell and gene therapy hub in Leuven, Belgium.

- In May 2025, Minaris Advanced Therapies was launched following a major merger between Minaris Regenerative Medicine and WuXi Advanced Therapies, establishing itself as a prominent global partner for cell therapy development, manufacturing, and contract testing dedicated to advanced therapies.

- In April 2025, AGC Biologics announced the official launch of its new Cell and Gene Technologies Division. This expansion is intended to focus on and elevate the company’s cell and gene therapy manufacturing capabilities, supporting the increasing demand and innovation within the sector.

- In February 2025, PHC Corporation partnered with CCRM to jointly develop advanced T-cell expansion culture processes, furthering cell and gene therapy manufacturing innovation and capabilities in Europe.

Report Coverage:

The research report offers an in-depth analysis based on Phase, Type and Indication. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Cell and Gene Therapy CDMO Market will expand as demand for advanced therapies rises across oncology, neurology, and rare diseases.

- Outsourcing partnerships will strengthen, with biopharma companies relying on CDMOs for clinical trial support and commercial manufacturing.

- Viral vector production will remain a strategic focus, with CDMOs investing in scalable and modular platforms.

- Digital technologies, including AI-driven analytics and process automation, will enhance efficiency and reduce production risks.

- Personalized medicine will drive small-batch, patient-specific manufacturing, increasing the need for adaptive CDMO capabilities.

- Regulatory clarity and harmonized frameworks across Europe will encourage investment and accelerate therapy approvals.

- Regional hubs in Western Europe will consolidate leadership, while Eastern Europe emerges as a cost-effective outsourcing base.

- Strategic collaborations between CDMOs, academic institutions, and biotech firms will accelerate innovation and clinical success.

- Sustainability and eco-friendly manufacturing practices will gain traction as environmental compliance becomes a priority.

- Competitive intensity will increase through mergers, acquisitions, and facility expansions, shaping a consolidated yet dynamic market landscape.