| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Green Data Center Market Size 2024 |

USD 12,597.03 Million |

| Europe Green Data Center Market, CAGR |

17.93% |

| Europe Green Data Center Market Size 2032 |

USD 47,127.71 Million |

Market Overview

The Europe Green Data Center Market is projected to grow from USD 12,597.03 million in 2024 to an estimated USD 47,127.71 million by 2032, with a compound annual growth rate (CAGR) of 17.93% from 2025 to 2032. This robust expansion is driven by growing environmental concerns, regulatory mandates, and the increasing demand for sustainable IT infrastructure.

Key drivers fueling market growth include stringent EU regulations promoting environmental sustainability, rising electricity costs, and growing pressure to meet carbon neutrality goals. Companies are prioritizing green certifications such as LEED and BREEAM to enhance their brand value and ensure compliance. Trends indicate a strong shift toward modular data center architectures and the integration of AI-based energy optimization tools, which further drive operational efficiency. Additionally, hyperscale operators are playing a significant role in pushing the adoption of renewable-powered data centers across the region.

Geographically, Northern and Western Europe dominate the market due to strong government incentives, advanced digital infrastructure, and the early adoption of green technologies. Countries such as Germany, the United Kingdom, the Netherlands, and the Nordic nations are leading in green data center development. Key players operating in the region include Equinix, Digital Realty, Interxion (Digital Realty), Schneider Electric, IBM Corporation, and Vertiv Group Corp, all of whom continue to invest in sustainable innovation and expansion initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Green Data Center Market is projected to grow significantly, reaching USD 47,127.71 million by 2032, driven by the increasing demand for sustainable IT infrastructure.

- The global Green Data Center Market is expected to grow from USD 59,645.02 million in 2024 to USD 239,470.06 million by 2032, at a CAGR of 18.98% from 2025 to 2032.

- Rising environmental concerns and stricter regulations are pushing organizations to adopt energy-efficient and sustainable data center solutions to reduce their carbon footprint.

- The surge in digital transformation and cloud-based applications is fueling the need for scalable, efficient, and eco-friendly data centers across Europe.

- The significant upfront capital investment required to implement green technologies and retrofitting existing facilities remains a major challenge for some businesses in the market.

- Navigating the fragmented regulatory environment in Europe can be cumbersome for companies, with varying standards and compliance requirements across different regions.

- Northern and Western Europe dominate the market due to favorable renewable energy availability, strong government incentives, and early adoption of green technologies.

- Southern and Eastern Europe are emerging as key markets, with growing investments in green data center infrastructure driven by EU sustainability policies and digital transformation needs.

Report Scope

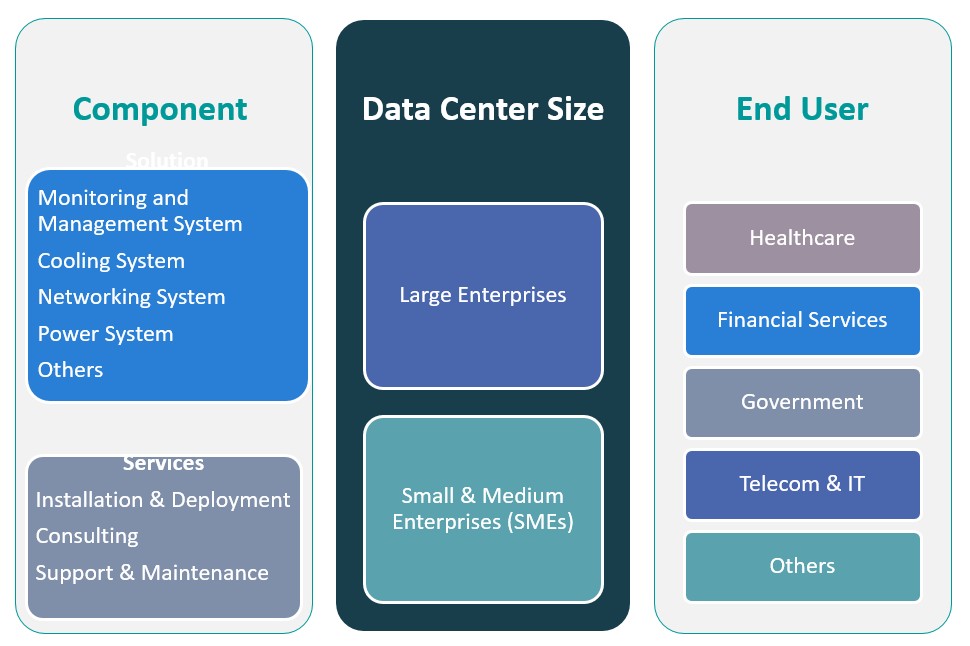

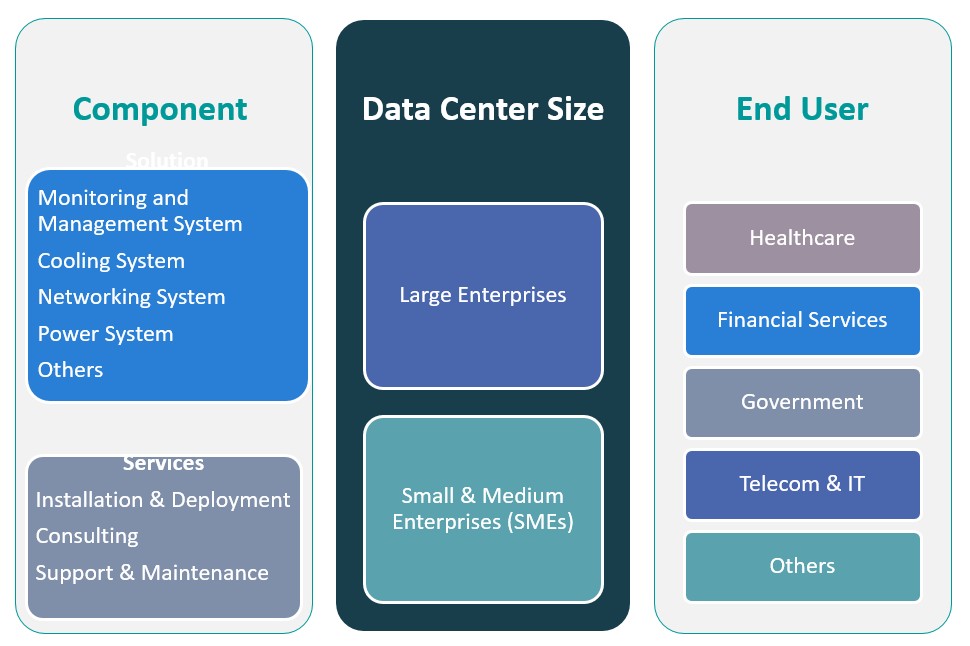

This report segments the Europe Green Data Center Market as follows:

Market Drivers

Proliferation of Data and the Expansion of Cloud Services

The exponential growth in data generated by enterprises, driven by the rapid adoption of cloud computing, IoT, artificial intelligence, and edge computing, is increasing the demand for robust, scalable, and environmentally sustainable data center infrastructure. Cloud service providers, hyperscale companies, and colocation facilities are responding by building and upgrading facilities that prioritize sustainability without compromising performance. Europe has emerged as a strategic location for data center expansion due to its high internet penetration rates, digitally advanced economies, and strong commitment to climate policies. The demand for low-latency digital services is further pushing organizations to localize data processing, thereby accelerating regional data center development. Many cloud providers, such as Amazon Web Services, Google Cloud, and Microsoft Azure, have made public commitments to power their European operations entirely with renewable energy. These initiatives are setting industry benchmarks and encouraging other market participants to follow suit, creating a ripple effect across the supply chain that supports the green data center market’s momentum.

Technological Innovation and Vendor-Led Sustainability Initiatives

Continuous innovation in energy-efficient hardware and software is another critical driver supporting the expansion of the Europe Green Data Center Market. Vendors are introducing server and storage equipment optimized for lower energy consumption, using low-power processors, solid-state drives (SSDs), and advanced cooling enclosures. At the same time, software-defined power systems and AI-based energy analytics are enabling predictive maintenance and demand-side management, ensuring that facilities operate at peak efficiency while minimizing environmental impact. Key market players such as Schneider Electric, Vertiv, and Siemens are leading the way by offering integrated energy solutions and sustainability-as-a-service platforms tailored for data centers. Furthermore, the circular economy model is gaining traction, with vendors and operators emphasizing the reuse and recycling of hardware components to reduce e-waste and carbon emissions. Collaborations between technology providers, real estate developers, and utility companies are also paving the way for innovative designs, such as subterranean and offshore data centers, which use natural cooling mechanisms to enhance sustainability. These developments reinforce Europe’s position as a leader in green data center technologies and support long-term market growth.

Regulatory Mandates and Sustainability Goals Across the European Union

One of the primary drivers of the Europe Green Data Center Market is the regulatory environment shaped by the European Union’s ambitious climate objectives. The European Green Deal, which targets climate neutrality by 2050, mandates aggressive reductions in greenhouse gas emissions, directly influencing energy-intensive industries such as data centers. Initiatives such as the Climate-Neutral Data Centre Pact, signed by leading European cloud infrastructure providers, highlight the industry’s commitment to aligning with EU sustainability targets. These policies require data centers to adhere to strict energy efficiency guidelines, adopt renewable power sources, and reduce water usage for cooling. For instance, Equinix has committed to achieving 100% renewable energy usage across its European data centers, showcasing alignment with EU climate goals. Consequently, operators across Europe are investing in infrastructure retrofits and greenfield projects to comply with these mandates, accelerating the market’s growth. Additionally, tax incentives and subsidies offered by regional governments for deploying energy-efficient systems are making green data centers a more viable and attractive investment for enterprises of all sizes.

Rising Energy Costs and Demand for Operational Efficiency

Europe has witnessed significant volatility in energy prices, particularly in the aftermath of the global energy crisis and geopolitical tensions that have affected supply chains. As a result, data center operators are prioritizing energy efficiency to reduce operational costs and ensure business continuity. Green data centers offer a viable solution by leveraging technologies such as free cooling, direct-to-chip liquid cooling, and AI-driven thermal optimization to minimize energy consumption. For instance, Google’s European data centers have implemented AI-driven cooling systems, reducing energy usage by up to 30%. The integration of advanced power management systems, such as DCIM (Data Center Infrastructure Management) tools, enables real-time monitoring and control of power usage effectiveness (PUE). This shift toward intelligent energy management not only reduces electricity bills but also improves the lifecycle management of hardware components, further lowering total cost of ownership (TCO). The focus on energy optimization is prompting widespread investment in renewable energy sources, such as wind and solar power, thereby contributing to the growth of the green data center ecosystem across Europe.

Market Trends

Modular and Edge Data Center Deployment

The increasing demand for low-latency digital services, coupled with the need for scalability and energy efficiency, is driving the adoption of modular and edge data centers across Europe. Modular data centers, which are pre-engineered and factory-built, allow for rapid deployment, energy efficiency, and optimized use of resources. These systems are designed with sustainability in mind, incorporating energy-saving equipment, integrated power and cooling systems, and recyclable materials. Edge data centers, often located closer to end-users in urban areas, reduce the need for long-distance data transmission, thereby decreasing energy consumption associated with network infrastructure. In Europe, the rise of smart cities, 5G deployment, and industrial IoT applications is fueling this trend, with edge facilities playing a key role in processing and storing data locally. The modular and edge models also enable easier compliance with regional energy and environmental regulations. By decentralizing data processing and reducing reliance on large-scale centralized facilities, these solutions support the continent’s broader digital sustainability goals.

Increased Focus on Circular Economy and Lifecycle Sustainability

The concept of circular economy is gaining substantial traction in the Europe Green Data Center Market, with a growing emphasis on the sustainable lifecycle management of infrastructure components. Operators are increasingly adopting practices that reduce electronic waste, such as refurbishing, repurposing, and recycling IT hardware. Manufacturers and vendors are also supporting this trend by designing equipment that is modular, upgradeable, and easier to disassemble for material recovery. Additionally, the reuse of waste heat from data centers is being explored and implemented, particularly in Scandinavian countries, where heat is redirected to warm nearby residential and commercial buildings. This practice not only improves energy efficiency but also contributes to broader urban sustainability initiatives. Data centers are also incorporating sustainable construction materials and aiming for environmental certifications such as BREEAM and LEED during design and build phases. Through these efforts, the industry is transitioning from a linear, consumption-heavy model to one that emphasizes resource optimization, long-term value creation, and minimal ecological impact.

Surge in Renewable Energy Integration for Data Center Operations

A prominent trend shaping the Europe Green Data Center Market is the widespread integration of renewable energy sources into facility operations. With governments enforcing stringent emission regulations and incentivizing sustainable practices, data center operators are increasingly turning to solar, wind, and hydroelectric power to meet energy demands. For instance, a data center in Sweden has secured a long-term power purchase agreement (PPA) with a hydroelectric provider, sourcing 95% of its energy needs from renewable sources and reducing its carbon emissions by approximately 70,000 metric tons annually. Additionally, on-site renewable installations, such as rooftop solar panels generating 2 megawatts of clean energy, are becoming more prevalent in both new builds and retrofitted facilities. This trend not only reduces environmental impact but also hedges operators against future electricity price fluctuations, enhancing long-term sustainability and cost-efficiency.

Adoption of Advanced Cooling Technologies

The transition from traditional air-based cooling systems to innovative, energy-efficient cooling technologies is another significant trend in the European market. With rising rack densities and increasing power consumption per server, data centers are seeking high-performance cooling methods that align with environmental objectives. For instance, a data center in Denmark has implemented liquid immersion cooling systems, reducing energy consumption by 30% compared to traditional methods and achieving a Power Usage Effectiveness (PUE) ratio of 1.2. Free cooling solutions that utilize ambient air and natural resources are widely adopted in temperate regions like the Nordics, where facilities leverage cold outside air to maintain optimal thermal conditions. These technologies are not only essential for maintaining server performance and hardware longevity but also play a crucial role in lowering PUE scores—an important metric for green data centers. This shift toward sustainable cooling reflects the broader industry focus on reducing operational carbon footprints.

Market Challenges

High Capital Investment and Long ROI Cycles

The Europe Green Data Center Market faces significant challenges, particularly the substantial upfront capital required to establish environmentally sustainable infrastructure. Transitioning from conventional to green data centers involves considerable investments in energy-efficient hardware, renewable energy integration, advanced cooling systems, and smart energy management technologies. For instance, these solutions, while offering long-term operational savings and environmental benefits, often come with prohibitive initial costs, especially for small and mid-sized enterprises. Retrofitting existing legacy facilities to meet green standards often demands complex modifications that can disrupt operations and escalate expenses. The return on investment (ROI) for green data centers is not immediate and may take several years to materialize, deterring some investors and organizations with shorter financial planning horizons. While governments across Europe offer subsidies, tax incentives, and funding programs, navigating these mechanisms can be cumbersome. New entrants or smaller players often face challenges in accessing these benefits. Additionally, economic uncertainty and inflationary pressures increase the financial risk associated with large-scale infrastructure development. As a result, the market experiences an uneven adoption curve, where only well-capitalized organizations with long-term strategic goals can fully embrace the green transformation. Addressing these financial and structural barriers is essential for accelerating widespread market penetration and ensuring that sustainability is accessible to all tiers of the industry.

Complex Regulatory Landscape and Compliance Burdens

The evolving and fragmented regulatory landscape in Europe poses another significant challenge to the green data center market. While the European Union promotes sustainability through directives such as the Green Deal and the Energy Efficiency Directive, each member state interprets and enforces these rules differently, resulting in inconsistencies across regions. Data center operators must navigate varying energy performance standards, building codes, carbon reporting requirements, and renewable energy mandates. These discrepancies complicate project planning and increase compliance costs, particularly for companies operating across multiple jurisdictions. In addition, the lack of unified metrics and standard benchmarks for green certification further complicates procurement decisions and performance assessments. Certifications such as BREEAM, LEED, and ISO 50001 differ in scope and applicability, leading to confusion among stakeholders regarding which standards to prioritize. Moreover, the regulatory focus is intensifying, with upcoming policies expected to enforce stricter environmental audits, power usage transparency, and circular economy obligations. While these initiatives support long-term sustainability, they also add layers of administrative burden and require constant adaptation to remain compliant. This environment necessitates dedicated compliance teams and legal counsel, increasing operational complexity and cost. To mitigate these challenges, the industry needs greater harmonization of green standards across Europe and collaborative frameworks that streamline regulatory compliance without compromising environmental objectives.

Market Opportunities

Expansion of Renewable Energy Integration

The growing focus on sustainability presents a significant opportunity for the Europe Green Data Center Market, particularly in the integration of renewable energy sources. As governments across Europe push for carbon neutrality, data centers are increasingly adopting solar, wind, and hydroelectric power to meet their energy demands. Countries in Northern and Western Europe, with their abundant renewable resources, are particularly well-positioned to leverage this trend. Data center operators can capitalize on long-term power purchase agreements (PPAs) and on-site renewable energy installations to secure a stable, cost-effective, and sustainable energy supply. This transition not only aligns with environmental goals but also helps companies reduce dependency on fluctuating energy prices, making renewable energy adoption a highly attractive investment opportunity in the region.

Rise of Edge Computing and Modular Data Centers

Another key opportunity in the Europe Green Data Center Market lies in the rapid adoption of edge computing and modular data center solutions. As industries like IoT, 5G, and AI continue to expand, there is increasing demand for localized data processing to reduce latency and improve operational efficiency. Edge data centers, often smaller and more energy-efficient than traditional facilities, are ideally suited to meet these demands. Additionally, modular data centers, which offer scalability, flexibility, and reduced deployment time, are becoming increasingly popular. These solutions allow businesses to implement sustainable infrastructure at a lower initial cost while maintaining the flexibility to expand as their needs grow. With the growing need for real-time data processing, edge and modular data centers present a promising market opportunity for operators to develop green, energy-efficient solutions tailored to the needs of modern industries.

Market Segmentation Analysis

By Component

The Europe Green Data Center Market is divided into two main segments: solutions and services. The solutions segment includes components like monitoring and management systems, cooling systems, networking systems, and power systems. Monitoring and management systems are essential for maintaining energy efficiency and optimal operational performance in green data centers, enabling real-time tracking of energy usage and performance metrics. Cooling systems, particularly liquid cooling and free cooling, are a crucial part of green data centers as they reduce energy consumption, especially in high-density environments. Networking systems facilitate communication and data transfer within the data center while ensuring scalability and reliability. Power systems, including renewable energy sources such as solar and wind, are integral to achieving the sustainability goals of green data centers, reducing reliance on traditional grid power. Other components may include backup power, lighting systems, and security infrastructure, all of which are designed with energy efficiency in mind. The services segment encompasses installation & deployment, consulting, and support & maintenance. Installation and deployment services are critical for setting up energy-efficient systems in new or existing data centers, ensuring that green technologies are integrated effectively. Consulting services help businesses design and implement sustainable infrastructure, while support & maintenance services ensure that systems continue to operate efficiently over their lifespan.

By Data Center Type

Data centers in Europe are primarily segmented into large enterprises and small & medium enterprises (SMEs). Large enterprises, which typically include major cloud service providers, hyperscale companies, and large-scale enterprises, are driving the demand for green data centers due to their substantial energy consumption and need for scalable, energy-efficient solutions. These companies are focused on building large, highly efficient facilities that can support high computing workloads while adhering to sustainability targets. On the other hand, SMEs are increasingly adopting green data center solutions as they seek to reduce operational costs and improve energy efficiency. While SMEs may not have the same scale as large enterprises, they are leveraging modular and edge data centers, which provide flexible, cost-effective, and energy-efficient solutions suited to their needs.

Segments

Based on Component

- Solution

- Monitoring and Management System

- Cooling System

- Networking System

- Power System

- Others

- Services

- Installation & Deployment

- Consulting

- Support & Maintenance

Based on Data Center Type

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Based on End User

- Healthcare

- Financial Services

- Government

- Telecom & IT

- Others

Based on Region

- Northern Europe

- Western Europe

- Southern Europe

- Eastern Europe

Regional Analysis

Northern Europe (35%)

Northern Europe is the leading region in the Europe Green Data Center Market, holding the largest market share of approximately 35%. Countries like Sweden, Norway, Denmark, and Finland benefit from abundant renewable energy sources, especially hydro and wind power, which make them ideal locations for green data centers. The cooler climate in these regions also enables the widespread adoption of free cooling technologies, reducing the need for energy-intensive air conditioning systems. Furthermore, the strong commitment to sustainability from governments and businesses in Northern Europe, coupled with tax incentives and subsidies, has created a favorable environment for the establishment of green data centers. Sweden, in particular, stands out for its aggressive renewable energy targets and environmental policies that support green infrastructure development.

Western Europe (30%)

Western Europe follows closely, accounting for about 30% of the market share. Key players in the region include the United Kingdom, Germany, the Netherlands, and France. These countries are leading the way in implementing energy-efficient data center solutions due to their advanced digital infrastructure, high demand for cloud services, and the EU’s strict environmental regulations. The adoption of renewable energy and smart grid technologies is widespread, and major data center operators are increasingly committing to 100% renewable energy goals. Additionally, Western European nations are focusing on reducing carbon emissions, with green data centers playing a crucial role in helping businesses meet sustainability targets.

Key players

- Interxion

- Global Switch

- Verne Global

- KDDI

- EdgeConneX

Competitive Analysis

The Europe Green Data Center Market is highly competitive, with several key players leading the charge in energy-efficient infrastructure and renewable energy adoption. Interxion stands out for its extensive network of data centers across Europe and its commitment to sustainability, leveraging renewable energy and advanced cooling solutions to meet environmental goals. Global Switch operates large-scale data centers across key European cities, offering flexible, scalable, and energy-efficient solutions. Verne Global focuses on using Iceland’s natural geothermal and hydroelectric power, positioning itself as a leader in green energy-powered data centers. KDDI, a major player from Japan, is expanding its footprint in Europe by offering highly secure and sustainable data center services. Lastly, EdgeConneX emphasizes edge data centers that bring computing closer to end-users, reducing latency and energy consumption. These companies are strategically aligned with EU sustainability objectives, ensuring they remain competitive in a rapidly growing green data center market.

Recent Developments

- In December 2023, Vertiv acquired CoolTera Ltd., a provider of liquid cooling infrastructure solutions. This acquisition strengthens Vertiv’s capabilities in high-density compute cooling, aligning with the industry’s shift towards energy-efficient data center technologies.

- In July 2024, Huawei unveiled three green data center facility solutions at the Global Smart Data Center Summit. These include the AeroTurbo fans, IceCube polymer heat exchangers, and iCooling AI energy efficiency cooling solutions, designed to optimize cooling efficiency and reduce energy consumption.

- In May 2024, Microsoft launched its first hyperscale cloud data center region in Mexico, located in Querétaro. This facility aims to provide scalable, highly available, and resilient cloud services, supporting digital transformation and sustainable innovation in the region.

- In June 2024, HPE partnered with Danfoss to introduce the HPE IT Sustainability Services – Data Center Heat Recovery. This turnkey heat recovery module helps organizations manage and repurpose excess heat, contributing to more sustainable IT infrastructures.

- In November 2024, Google announced a partnership with SB Energy Global to supply 942 MW of renewable energy to power its data center operations in Texas. This initiative supports Google’s commitment to operate on carbon-free energy and aligns with its sustainability goals.

- In January 2025, AWS announced plans to invest approximately $11 billion in Georgia to expand its infrastructure, supporting cloud computing and AI technologies. This investment is expected to create at least 550 new high-skilled jobs and enhance the state’s digital innovation capabilities.

- In May 2024, IBM announced a partnership with Schneider Electric to develop and deploy energy-efficient data center solutions, focusing on reducing carbon emissions and improving operational efficiency.

Market Concentration and Characteristics

The Europe Green Data Center Market exhibits moderate to high concentration, with several large players dominating the landscape, including Interxion, Global Switch, Verne Global, KDDI, and EdgeConneX. These companies, alongside numerous regional players, are driving the adoption of energy-efficient technologies and renewable energy solutions across the continent. The market is characterized by significant investment in sustainability initiatives, with leading operators focusing on reducing carbon footprints through renewable power sources, advanced cooling technologies, and energy management systems. Although large enterprises dominate the space, smaller companies and regional players are also emerging by offering modular and edge data center solutions that cater to the growing demand for localized data processing. The competitive environment is shaped by regulatory pressures, technological innovation, and the increasing need for data center scalability, making it a dynamic and rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Data Center Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Green Data Center Market will see continued growth in the integration of renewable energy sources, with more data centers transitioning to 100% renewable power to meet sustainability targets.

- Edge data centers will experience rapid expansion to reduce latency, improve efficiency, and support the growing demand for real-time data processing across industries like IoT, AI, and 5G.

- Data center operators will increasingly adopt energy-efficient cooling technologies such as liquid cooling, immersion cooling, and free cooling, which will lower power consumption and improve environmental performance.

- AI and machine learning will play a key role in optimizing energy efficiency, managing power usage, and reducing operational costs through intelligent automation and predictive maintenance.

- Modular and prefabricated data center solutions will gain traction, providing a flexible and scalable way to build energy-efficient facilities with lower initial capital investment and quicker deployment.

- Stricter EU regulations and transparency requirements will push data centers to adopt greener practices, while regular sustainability reporting will become a critical component of operations for compliance.

- Southern and Eastern Europe will see increased investments in green data center infrastructure, driven by EU sustainability policies and the growing need for localized cloud services and digital transformation.

- A shift toward circular economy practices will increase as data centers focus on reusing components, recycling e-waste, and repurposing waste heat to enhance sustainability and reduce environmental impact.

- The industry will see increased collaboration between technology providers, utility companies, and governments to create cost-effective, sustainable solutions for green data centers.

- As sustainability becomes a priority, data centers will increasingly pursue green certifications such as BREEAM and LEED, signaling their commitment to reducing environmental impact and attracting eco-conscious clients.