| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Laser Technology Market Size 2024 |

USD 4,717.62 million |

| Europe Laser Technology Market, CAGR |

6.78% |

| Europe Laser Technology Market Size 2032 |

USD 7,973.37 million |

Market Overview

The Europe Laser Technology Market is projected to grow from USD 4,717.62 million in 2023 to an estimated USD 7,973.37 million by 2032, with a compound annual growth rate (CAGR) of 6.78% from 2024 to 2032. This growth reflects the increasing adoption of laser technology across various industries, including manufacturing, healthcare, and telecommunications.

Market drivers include the rising use of lasers in medical treatments, such as dermatology and ophthalmology, and the growing preference for laser-based cutting and welding in the automotive and aerospace sectors. Additionally, the integration of lasers in communication technology, particularly in fiber optics, is boosting market growth. The trend towards miniaturization and the development of compact laser systems are also contributing factors, enhancing the versatility and application range of laser technologies.

Geographically, Germany, France, and the UK are the leading markets in Europe, driven by strong industrial bases and significant investments in research and development. Germany, in particular, is a hub for automotive and industrial manufacturing, where laser technology plays a crucial role. Key players in the market include companies such as Trumpf GmbH + Co. KG, Jenoptik AG, and Coherent, Inc., which are known for their innovation and extensive product portfolios in laser solutions. These companies are at the forefront of developing new applications and expanding the market reach of laser technology in Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Advancements in Medical Applications

The medical field is witnessing significant advancements through the application of laser technology, which is a primary driver of the European market. Lasers offer precision and minimally invasive options for various medical procedures, including surgery, dermatology, ophthalmology, and dental treatments. The ability of lasers to target specific tissues without affecting surrounding areas has revolutionized treatments, improving patient outcomes and reducing recovery times. For instance, laser eye surgeries like LASIK have become commonplace, offering quick and effective vision correction. Similarly, in dermatology, lasers are used for procedures such as tattoo removal, skin resurfacing, and treating vascular lesions. According to recent studies, the European medical laser market has seen substantial growth due to innovations such as femtosecond and picosecond lasers, which are expanding the range of possible medical applications and driving demand in the healthcare sector across Europe.

Rising Demand in Manufacturing and Industrial Sectors

The manufacturing and industrial sectors in Europe are increasingly adopting laser technology due to its efficiency, precision, and versatility. Laser systems are used in cutting, welding, engraving, and marking applications, offering significant advantages over traditional mechanical methods. For instance, laser cutting provides high precision and speed, making it ideal for industries such as automotive, aerospace, and electronics, where intricate designs and clean cuts are essential. Additionally, laser welding is preferred for its ability to create strong, high-quality joints with minimal distortion, particularly in metalworking and fabrication. The demand for lightweight materials and components, driven by the automotive and aerospace industries, is further fueling the adoption of laser technology. This trend is supported by the development of fiber lasers, which offer high power and efficiency, making them suitable for industrial applications. As industries strive for greater automation and precision, the role of laser technology is becoming increasingly prominent in European manufacturing.

Growth in Communication and Information Technology

The communication and information technology sectors are also key drivers of the laser technology market in Europe. Lasers play a crucial role in optical communication systems, which are foundational to modern data transmission networks. The rise of high-speed internet, cloud computing, and the increasing demand for bandwidth have led to the widespread adoption of fiber optic technology, where lasers are essential for signal transmission. In these systems, lasers generate light signals that travel through optical fibers, providing high-speed and long-distance communication capabilities. The development of advanced laser technologies, such as distributed feedback lasers and vertical-cavity surface-emitting lasers (VCSELs), has enhanced the efficiency and reliability of these communication systems. Furthermore, the ongoing expansion of 5G networks and the future deployment of 6G are expected to increase the demand for laser components in telecommunications infrastructure. As Europe continues to invest in digital infrastructure and the Internet of Things (IoT), the role of laser technology in ensuring robust and efficient communication systems is set to grow.

Innovation in Consumer Electronics and Imaging

Consumer electronics and imaging technologies are experiencing a surge in innovation, driven in part by advancements in laser technology. Lasers are increasingly being integrated into a variety of consumer products, including smartphones, televisions, and gaming devices. For example, laser-based displays, such as laser projectors and laser TVs, offer superior image quality, brightness, and color accuracy compared to traditional display technologies. Additionally, lasers are used in the production of optical storage devices, such as Blu-ray discs, and in the development of augmented reality (AR) and virtual reality (VR) systems, where precise laser measurements are crucial for creating immersive experiences. The miniaturization of laser components has enabled their integration into smaller devices, expanding their use in consumer electronics. In the field of imaging, lasers are utilized in applications ranging from barcode scanning to 3D printing, highlighting their versatility and importance in modern technology. As the consumer electronics market continues to evolve with new innovations, the demand for advanced laser technologies is expected to increase, driving growth in the European market.

Market Trends

Increasing Adoption of Fiber Lasers

A significant trend in the Europe laser technology market is the growing adoption of fiber lasers, which are increasingly preferred over traditional CO2 and solid-state lasers. Fiber lasers offer numerous advantages, including higher efficiency, better beam quality, and lower maintenance requirements. These lasers are particularly advantageous in industrial applications such as cutting, welding, and marking, where precision and speed are crucial. For instance, fiber lasers held the largest market share in the Europe ultrafast lasers market in 2020. The automotive and aerospace industries, in particular, benefit from the use of fiber lasers for processing metals and composite materials, supporting the production of lighter and more fuel-efficient vehicles and aircraft. The shift towards automation in manufacturing further accelerates the adoption of fiber lasers, as they can be easily integrated into automated systems, enhancing productivity and consistency. Moreover, fiber lasers’ ability to work with various materials, including metals, polymers, and ceramics, broadens their applicability, making them a versatile choice for different industrial needs. This trend is expected to continue as advancements in fiber laser technology, such as higher power outputs and improved energy efficiency, enhance their appeal to a wider range of industries.

Advancements in Ultrafast Laser Technology

Another notable trend in the Europe laser technology market is the advancements in ultrafast laser technology, which includes femtosecond and picosecond lasers. These lasers emit extremely short pulses of light, measured in femtoseconds (10^-15 seconds) or picoseconds (10^-12 seconds), allowing for high precision and minimal thermal damage during material processing. The unique properties of ultrafast lasers make them ideal for applications in medical device manufacturing, microelectronics, and precision micromachining. For instance, the femtosecond segment held the largest market share in the Europe ultrafast lasers market in 2020. In the medical field, ultrafast lasers are used for eye surgeries, such as LASIK, and for advanced imaging techniques. In microelectronics, they are crucial for processing semiconductor materials and creating intricate patterns on microchips. The demand for smaller, more powerful electronic devices drives the need for ultrafast lasers, as they enable the precise fabrication of tiny components. The European market is witnessing significant investment in research and development to further improve the capabilities of ultrafast lasers, focusing on increasing their efficiency, reducing costs, and expanding their applications. As these technologies continue to evolve, their adoption is likely to increase, reinforcing their role as a key driver of innovation in various industries.

Market Restraints and Challenges

High Initial Investment and Operational Costs

A significant restraint in the Europe laser technology market is the high initial investment and operational costs associated with advanced laser systems. The acquisition of cutting-edge laser technology, particularly fiber and ultrafast lasers, requires substantial capital expenditure, which can be a barrier for small and medium-sized enterprises (SMEs) and startups. Additionally, the operational costs, including maintenance, energy consumption, and the need for specialized personnel to operate and maintain these systems, further add to the financial burden. These costs can deter companies from adopting laser technology, especially in industries with tight budget constraints. Although the long-term benefits, such as increased precision and efficiency, can offset these initial expenses, the upfront costs remain a significant challenge. Companies must weigh the potential return on investment against the immediate financial outlay, which can slow the market adoption rate, particularly in less economically robust regions.

Technical Challenges and Skill Shortages

Another key challenge in the Europe laser technology market is the technical complexity and the associated skill shortages. The operation and maintenance of advanced laser systems require specialized knowledge and expertise, which are not always readily available. This skills gap can lead to operational inefficiencies and increased downtime, as companies may struggle to find or train qualified personnel. Furthermore, the complexity of integrating laser systems into existing manufacturing processes poses additional challenges, requiring significant technical adjustments and potentially leading to disruptions in production. The rapid pace of technological advancements in the field also means that ongoing training and upskilling are necessary to keep up with the latest developments, adding to the operational burden. In addition, technical challenges related to laser safety, system calibration, and beam quality control can impact the overall effectiveness and reliability of laser technologies. Addressing these challenges requires concerted efforts in workforce development, training programs, and industry collaboration to ensure a skilled workforce capable of leveraging laser technology’s full potential.

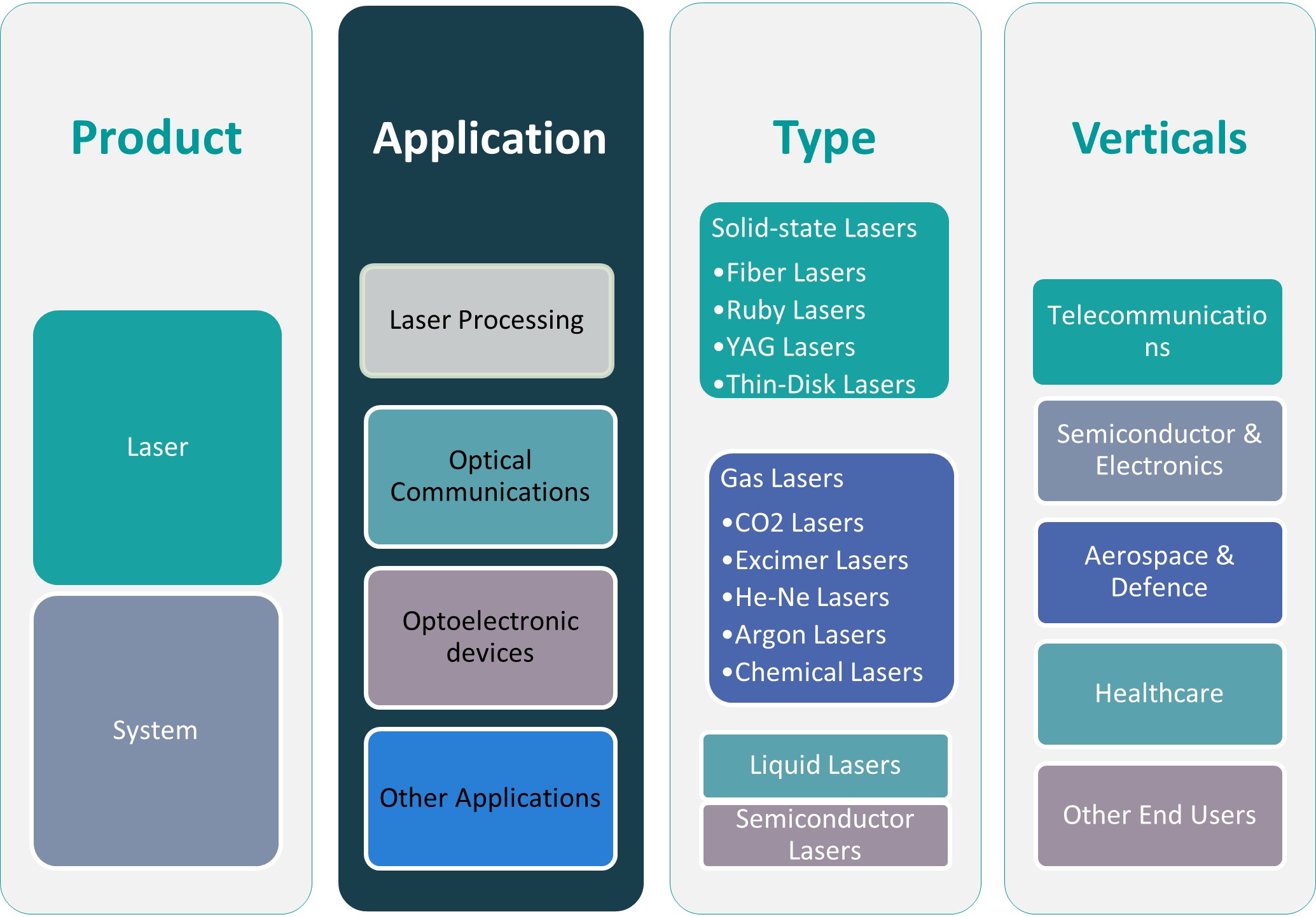

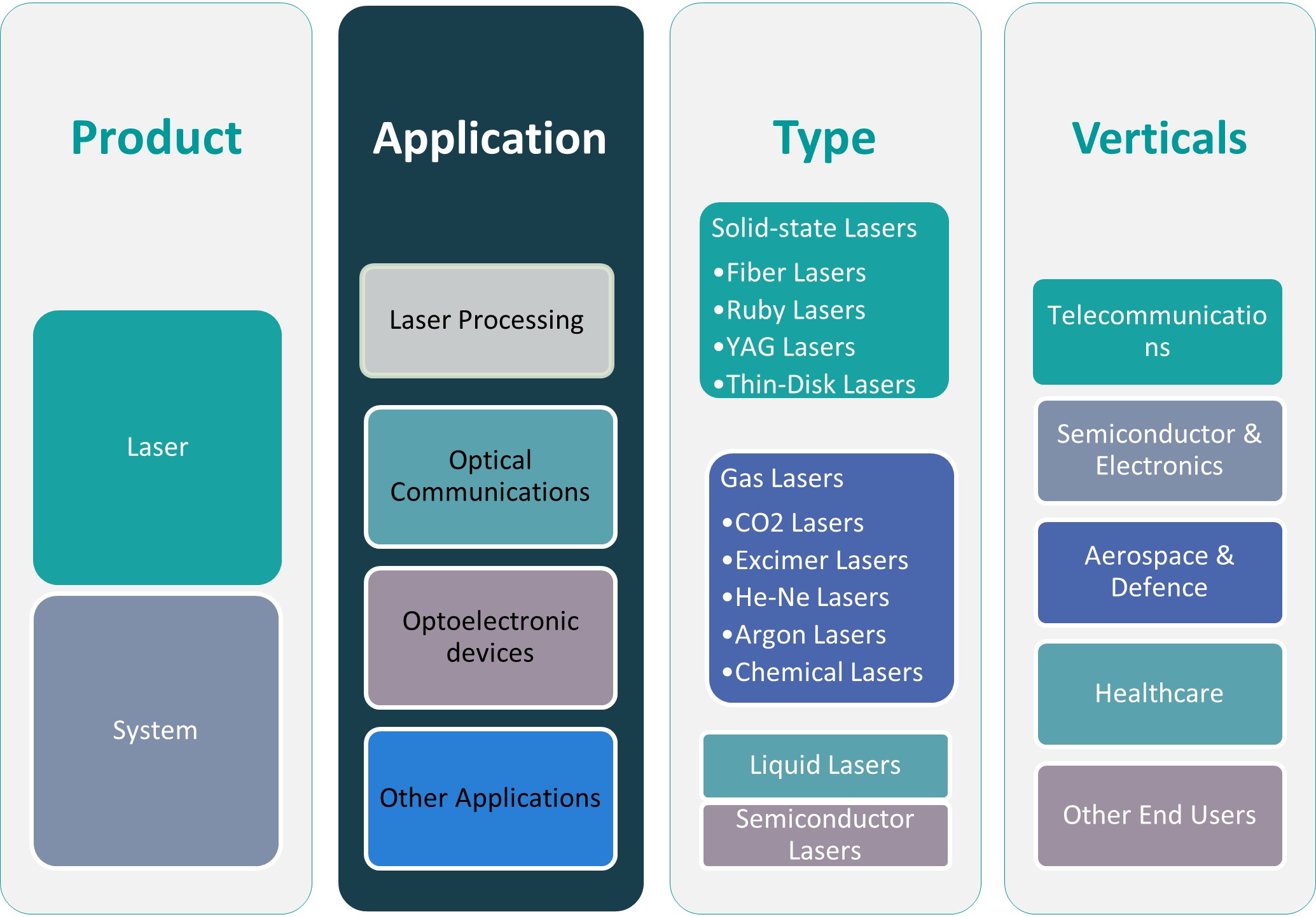

Market Segmentation Analysis

By Type

The Europe laser technology market is segmented by type into several categories, each catering to specific applications. Solid-state lasers, including YAG and ruby lasers, are widely used in medical procedures and industrial applications due to their high efficiency and reliability. Fiber lasers are gaining prominence due to their superior beam quality and efficiency, making them ideal for industrial processing, including cutting and welding. Gas lasers, such as CO2 and excimer lasers, are extensively used in materials processing and medical applications due to their versatility and precision. Semiconductor lasers, including diode lasers, are crucial in telecommunications and optical communication systems. Liquid lasers and chemical lasers, although less common, are used in specialized scientific and military applications. Each type of laser offers unique advantages, catering to a broad range of industrial, medical, and scientific needs.

By Product

The market is also segmented by product into lasers and laser systems. The ‘laser’ category includes the core devices that generate laser beams, which are integral to various applications across industries. The ‘laser system’ segment comprises complete systems that integrate lasers with control units, optics, and other components, providing turnkey solutions for specific applications such as manufacturing and medical procedures. This segmentation highlights the importance of both standalone laser devices and comprehensive systems tailored to end-user requirements.

Segments

Based on Type

- Solid-state Lasers

- Fiber Lasers

- Gas Lasers

- Semiconductor Lasers

- Others

Based on Product

Based on Application

- Processing

- Optical Communications

- Optoelectronic Devices

- Other Applications

Based on Vertical

- Telecommunications

- Semiconductor & Electronics

- Aerospace & Defense

- Healthcare

- Others

Based on Region

Regional Analysis

Germany (35%):

**Germany** holds the largest market share, approximately 35%, driven by its strong manufacturing sector and substantial investments in research and development. The country’s automotive and machinery industries heavily utilize laser technologies for precision manufacturing and automation processes. Moreover, Germany’s leadership in industrial innovation fosters the adoption of advanced laser systems, including fiber and ultrafast lasers, which are crucial for applications in metal processing and automotive manufacturing. The presence of major industry players, such as Trumpf GmbH + Co. KG and Jenoptik AG, further strengthens Germany’s market position.

France (15%):

**France** represents approximately 15% of the market, with a focus on aerospace and defense, as well as consumer electronics. France’s aerospace industry, one of the largest in Europe, utilizes laser technology for materials processing, precision cutting, and welding. In the consumer electronics sector, lasers are integral to the manufacturing of optical devices and components, supporting the production of high-quality consumer goods.

Key players

- Coherent, Inc.

- Han’s Europe Laser Vertical Industry Group Co., Ltd

- Lumentum Holdings Inc.

- JENOPTIK AG

- Novanta Inc.

- LUMIBIRD

- Gravotech Marking

- Corning Incorporated

- Bystronic Laser AG

- Trumpf

- Eurolaser GmbH

Competitive Analysis

The Europe Laser Technology Market is highly competitive, with major players such as Coherent, Inc., and Trumpf leading in innovation and market presence. Coherent, Inc. and Lumentum Holdings Inc. are recognized for their advanced laser solutions across various industrial applications. Trumpf and Bystronic Laser AG are prominent in manufacturing high-performance laser systems for cutting and welding. JENOPTIK AG and Novanta Inc. provide cutting-edge technology in precision lasers, enhancing medical and industrial applications. Han’s Europe Laser Vertical Industry Group Co., Ltd and LUMIBIRD contribute significant advancements in fiber and solid-state lasers. Corning Incorporated and Gravotech Marking offer specialized solutions for optical communications and industrial marking. Eurolaser GmbH is notable for its laser cutting systems, addressing niche market needs. This competitive landscape underscores a focus on technological innovation and application diversification.

Recent Developments

In January 2024, Coherent Corp. unveiled the OBIS 640 XT, a red laser module that complements its existing range of blue and green laser modules. This new addition matches their established portfolio in terms of high output power, low noise, and superior beam quality, all while maintaining a compact size. The OBIS 640 XT is designed to enhance the performance of SRM systems, offering a reliable and high-performance solution for applications requiring precise and powerful laser capabilities. This introduction reflects Coherent’s commitment to expanding its versatile laser offerings and meeting diverse market needs.

In November 2023, IPG Photonics Corporation and Miller Electronics Mfg. LLC formed a strategic partnership to advance laser technology in the handheld welding market. IPG, a leader in fiber laser technology, and Miller, a prominent manufacturer of arc welding products, aim to innovate and improve welding tools. This collaboration focuses on developing high-performance, efficient, and precise welding solutions to meet the evolving demands of modern welding applications. The alliance promises to enhance reliability and effectiveness, offering welders advanced tools for critical tasks and setting new standards in welding technology.

In October 2023, TRUMPF introduced the TruMatic 5000, a laser machine designed for fully automated cutting, punching, and forming operations. This advanced machine facilitates an automated workflow within manufacturing cells, handling tasks from material loading and unloading to the removal of finished parts. The TruMatic 5000 enhances production efficiency and precision, enabling seamless integration into manufacturing processes and improving overall productivity. TRUMPF’s latest innovation represents a significant advancement in automation technology, aimed at streamlining operations and meeting modern manufacturing demands.

In February 2024, BIOLASE, Inc. launched the Waterlase iPlus Premier Edition, a cutting-edge all-tissue laser system. This new system offers clinicians customizable procedural packages, allowing them to select and expand the features according to their practice needs. The Waterlase iPlus Premier Edition is designed to provide flexibility and advanced capabilities, ensuring that practitioners can access the specific functionalities required today while facilitating future upgrades. This innovative approach supports a wide range of dental procedures, enhancing clinical efficiency and patient care.

In January 2024, Iridex Corporation introduced two new next-generation laser platforms, the Iridex 532 nm and Iridex 577 nm, to the U.S. market. These lasers feature Iridex’s patented technology, which enhances control over photothermal effects during laser photocoagulation. The technology allows for cooling of tissue between laser pulses, minimizing potential damage and improving precision. This advancement in laser delivery aims to enhance treatment outcomes and provide clinicians with better tools for managing delicate procedures, reflecting Iridex’s commitment to innovation and patient safety.

In February 2023, Rhein Laser Technologies Ltd. launched the UroFiber 150Q, the first 150W SuperPulsed thulium fiber laser (TFL) system. This innovative technology is designed for treating stone lithotripsy and BPH enucleation. The UroFiber 150Q represents a significant advancement in fiber laser technology, offering enhanced performance and precision for medical applications. By providing a powerful and efficient solution for urological treatments, Rhein Laser Technologies aims to improve patient outcomes and set new standards in laser-based medical interventions.

Market Concentration and Characteristics

The Europe Laser Technology Market exhibits moderate to high concentration, characterized by the presence of several dominant players alongside numerous specialized and emerging companies. Major firms such as Coherent, Inc., TRUMPF, and IPG Photonics hold substantial market shares due to their extensive product portfolios and advanced technological capabilities. These key players invest heavily in research and development to maintain competitive advantages and address diverse industrial needs. The market is marked by significant innovation, particularly in areas such as fiber lasers, solid-state lasers, and laser systems, driving growth across various sectors including manufacturing, healthcare, and telecommunications. While leading companies dominate the market, a dynamic landscape of emerging players and technological advancements continues to shape competitive dynamics, fostering a vibrant and evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Product, Application, Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Continued advancements in laser technologies, such as ultrafast and high-power lasers, are expected to drive innovation and expand applications across multiple industries, including manufacturing and healthcare.

- The increasing need for precision and efficiency in manufacturing processes will boost the adoption of advanced laser systems for cutting, welding, and engraving.

- The adoption of lasers in medical procedures, including surgeries and diagnostics, is anticipated to grow, driven by advancements in laser-assisted therapies and technologies.

- The demand for high-speed data transmission will continue to fuel growth in optical communication systems, with lasers playing a crucial role in improving network capabilities.

- Ongoing investments in research and development by leading companies will enhance laser technology, resulting in more efficient, versatile, and cost-effective solutions.

- Fiber lasers are expected to gain further traction due to their superior beam quality and efficiency, benefiting industries such as automotive, aerospace, and electronics.

- The trend towards automation in manufacturing and industrial processes will drive demand for integrated laser systems that offer high-speed and high-precision capabilities.

- There will be a growing emphasis on developing eco-friendly laser technologies, aimed at reducing energy consumption and minimizing environmental impact in industrial applications.

- Emerging regions within Europe are likely to experience increased adoption of laser technologies as industrialization and technological advancements spread across the continent.

- The competitive dynamics will shift as new entrants and startups introduce innovative solutions, enhancing market diversity and driving further technological progress.