| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Long Duration Energy Storage Market Size 2023 |

USD 1,129.62 Million |

| Europe Long Duration Energy Storage Market, CAGR |

12.4% |

| Europe Long Duration Energy Storage Market Size 2032 |

USD 3,237.17 Million |

Market Overview:

Europe Long Duration Energy Storage Market size was valued at USD 1,129.62 million in 2023 and is anticipated to reach USD 3,237.17 million by 2032, at a CAGR of 12.4% during the forecast period (2023-2032).

Several factors are driving the adoption of long duration energy storage systems in Europe. The escalating integration of renewable energy sources has led to challenges in grid stability and energy supply consistency. LDES technologies, such as flow batteries, compressed air, and thermal storage, offer solutions to store excess renewable energy during periods of low demand and release it during peak consumption times, thereby enhancing grid reliability. Additionally, declining costs of storage technologies, coupled with supportive government policies and incentives, are making LDES more economically viable. For instance, advancements in battery technologies have led to reduced installation and operating costs, making large-scale storage projects more attractive to investors and utilities. Furthermore, the need for energy security and the ability to mitigate power outages are prompting increased investments in LDES infrastructure across the region.

Europe’s approach to long duration energy storage is characterized by a diverse and region-specific landscape. Germany leads the continent in energy storage capacity, with significant investments in both residential and industrial sectors. The country’s proactive policies, such as subsidies for battery installations and a strong emphasis on renewable energy, have facilitated this growth. In the United Kingdom, the government has introduced mechanisms like the “cap and floor” scheme to support pumped hydro storage projects, aiming to manage supply-demand volatility and integrate more renewable energy into the grid. Other European nations, including France, Spain, and the Netherlands, are also investing in LDES technologies, each tailoring their strategies to local energy needs and infrastructure capabilities. The European Union’s overarching energy policies, such as the Green Deal and Fit for 55 package, provide a cohesive framework that encourages cross-border collaboration and standardization in energy storage solutions. This regional cooperation is essential for creating an integrated and resilient energy storage network across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Europe Long Duration Energy Storage (LDES) market, valued at USD 1,129.62 million in 2023, is projected to reach USD 3,237.17 million by 2032, driven by increasing demand for reliable storage solutions to integrate renewable energy.

- The global Long Duration Energy Storage (LDES) market was valued at USD 4,261.11 million in 2023 and is expected to grow at a CAGR of 13.2%, reaching USD 13,005.91 million by 2032.

- The integration of solar and wind energy into Europe’s power grid is creating a need for LDES systems that store excess energy during high-generation periods and release it during peak consumption or low production.

- Technological advancements, including flow batteries, compressed air, and thermal storage systems, are improving energy efficiency, reducing operational costs, and enhancing the scalability of LDES solutions, making them more viable for large-scale projects.

- European governments are supporting LDES growth through policies like the Green Deal and Fit for 55, providing financial incentives, subsidies, and tax rebates, which lower the cost of installing energy storage systems.

- Long duration energy storage technologies are critical for enhancing grid resilience and ensuring energy security, especially in the face of extreme weather events and during prolonged power outages.

- The high initial capital investment required for deploying LDES technologies, such as flow batteries and pumped hydro storage, remains a significant challenge, hindering adoption by some investors and utilities.

- The integration of LDES into existing grid infrastructure is challenging due to the need for grid upgrades, requiring substantial investments in grid modernization to accommodate new energy storage solutions effectively.

Market Drivers:

Rising Integration of Renewable Energy Sources

One of the key drivers of the Europe Long Duration Energy Storage (LDES) market is the increasing integration of renewable energy sources, such as solar and wind, into the region’s power grid. As European countries commit to ambitious carbon reduction targets and transition to cleaner energy, renewable sources are becoming more prevalent. However, the intermittent nature of these energy sources where solar power is abundant during the day, and wind energy fluctuates based on weather conditions creates challenges in maintaining a stable power supply. Long duration energy storage technologies, such as flow batteries and pumped hydro storage, offer a practical solution to store excess energy generated during periods of high renewable output and release it when demand spikes or generation is low. This capability helps balance the supply and demand on the grid, ensuring reliable energy availability, even when renewable energy generation is insufficient.

Technological Advancements and Cost Reduction

Advancements in energy storage technologies are driving the growth of the LDES market across Europe. In recent years, breakthroughs in battery chemistry, storage efficiency, and system designs have significantly improved the performance of long duration energy storage systems. These advancements have contributed to reduced capital and operational costs, making LDES a more economically viable option for both utility-scale projects and smaller, distributed energy systems. In particular, flow batteries, which offer long discharge durations and can be cycled thousands of times without degradation, are gaining popularity due to their enhanced cost-efficiency and scalability. With continued technological innovation, including the development of solid-state and hydrogen-based storage solutions, the market is expected to see even further cost reductions and performance improvements, making LDES technologies more competitive with traditional energy storage options.

Government Policies and Regulatory Support

Government policies and regulatory frameworks across Europe are playing a crucial role in propelling the LDES market. The European Union has set ambitious targets for renewable energy integration and carbon neutrality by 2050, driving significant investments in energy storage solutions to support the transition to a green economy. For instance, the European Green Deal and the Fit for 55 package, for example, include provisions to encourage energy storage systems and enhance grid flexibility. Many European countries have introduced financial incentives, subsidies, and tax rebates to lower the cost of installing energy storage systems, further accelerating market growth. In addition, programs like the Horizon 2020 initiative are supporting research and development in energy storage technologies, fostering innovation and the widespread adoption of LDES solutions. These supportive policies are crucial in creating a favorable environment for both established players and new entrants in the energy storage market.

Energy Security and Grid Resilience

Energy security and grid resilience are becoming increasingly important in Europe, especially as the region experiences more extreme weather events due to climate change. Prolonged power outages and energy supply disruptions have highlighted the need for robust and resilient energy infrastructure. Long duration energy storage technologies provide an effective means to enhance grid stability and improve energy security by storing energy for extended periods and discharging it when needed to address grid outages or demand peaks. For example, in Norway and Iceland, where RES shares are above 75% due to abundant hydropower, energy storage plays a key role in maintaining grid resilience during periods of low generation. LDES systems, which can discharge energy over longer durations compared to traditional short-duration solutions like lithium-ion batteries, offer a unique advantage in maintaining power availability during extended periods of low renewable generation or high energy consumption. This capability is particularly valuable in ensuring that essential services and industries continue to operate smoothly during emergencies, further driving the demand for long duration energy storage across Europe.

Market Trends:

Expansion of Grid-Scale Storage Capacity

The European long duration energy storage (LDES) market is witnessing a significant shift towards large-scale deployments. In 2024, Europe installed a record 11.9 GW of energy storage capacity across various technologies, bringing the cumulative total to 89 GW. This growth is primarily driven by the increasing need for grid stabilization as renewable energy sources like wind and solar become more prevalent. Countries such as Italy, Germany, and the United Kingdom are leading this expansion, with Italy emerging as the largest energy storage market in Europe through front-of-meter installations. The trend indicates a shift from behind-the-meter to front-of-meter installations, reflecting the growing demand for utility-scale storage solutions.

Technological Advancements and Cost Reductions

Advancements in energy storage technologies are contributing to the growth of the LDES market. Innovations in battery chemistry, such as the development of flow batteries and improvements in lithium-ion technologies, have enhanced the efficiency and longevity of storage systems. For example, in the first half of 2024, renewable electricity generation reached 50% of total EU electricity, underscoring the need for advanced storage solutions to manage this growing share. These technological improvements have led to a reduction in costs, making energy storage solutions more accessible and economically viable. For instance, the cost of lithium-ion batteries has decreased significantly over the past decade, facilitating their integration into large-scale projects. Additionally, the emergence of alternative storage technologies, such as compressed air energy storage and thermal storage systems, is diversifying the options available for long-duration energy storage.

Policy Support and Regulatory Developments

Government policies and regulatory frameworks are playing a pivotal role in shaping the LDES market in Europe. The European Union’s Green Deal and Fit for 55 package aim to reduce greenhouse gas emissions and promote the integration of renewable energy sources, thereby increasing the demand for energy storage solutions. Member states are implementing supportive measures, including financial incentives, subsidies, and streamlined permitting processes, to encourage the deployment of energy storage systems. For example, the United Kingdom is funding hydro energy storage projects using a “cap and floor” mechanism, which guarantees a minimum revenue while limiting excessive charges during high power prices. Such initiatives are expected to accelerate the adoption of long-duration energy storage technologies across the region.

Investment and Market Outlook

Investment in the LDES sector is on the rise, with both public and private entities recognizing the strategic importance of energy storage in achieving energy security and sustainability goals. For instance, according to a report by Goldman Sachs, grid-scale energy storage in Europe is projected to increase to about 375 gigawatts by 2050, up from 15 gigawatts in 2023. This represents a substantial growth trajectory, attracting investments from various stakeholders, including energy companies, financial institutions, and technology providers. The increasing deployment of energy storage systems is expected to create a new multi-billion-dollar asset class, offering opportunities for long-term returns and contributing to the region’s energy transition objectives.

Market Challenges Analysis:

High Initial Capital Investment

One of the primary challenges facing the Europe Long Duration Energy Storage (LDES) market is the high initial capital investment required for large-scale deployment. Technologies such as flow batteries, pumped hydro storage, and compressed air energy storage involve significant upfront costs, which can deter investors and utilities from committing to such projects. While the cost of energy storage has been steadily decreasing due to technological advancements, the substantial capital expenditure required for installation and infrastructure development remains a major barrier, particularly for smaller energy providers or countries with limited financial resources.

Technological Maturity and Efficiency Concerns

Despite significant technological advancements, some LDES technologies are still in the early stages of commercialization and may not yet offer the required efficiency levels to make them fully competitive with established solutions like lithium-ion batteries. In particular, flow batteries and thermal storage systems face challenges related to energy efficiency, scalability, and long-term durability. These issues can limit their widespread adoption in large-scale energy storage applications, as operators prioritize proven technologies that guarantee reliable performance over extended periods.

Regulatory and Permitting Hurdles

The regulatory and permitting processes for deploying LDES systems in Europe can be complex and time-consuming. Navigating through various national and regional regulations, securing necessary permits, and meeting environmental impact assessments often delays project timelines and increases costs. Although the European Union has introduced supportive frameworks to encourage energy storage deployment, regional variations in policy and regulatory standards still pose significant challenges, particularly for projects that span multiple countries.

Grid Integration and Infrastructure Constraints

The integration of LDES technologies into existing grid systems poses another challenge. Many European grids are not yet optimized for long-duration energy storage, requiring upgrades to accommodate new storage solutions. Grid infrastructure constraints, such as limited transmission capacity and insufficient integration capabilities, can hinder the efficient deployment and operation of LDES systems. For instance, in the Netherlands, several provinces-including Flevoland, Friesland, Gelderland, North Holland, and South Holland-are experiencing severe grid bottlenecks, leading to limitations on deploying new solar and wind projects as the grid struggles to accommodate additional renewable input. These limitations require substantial investments in grid modernization to ensure the effective integration of energy storage technologies into Europe’s energy mix.

Market Opportunities:

The Europe Long Duration Energy Storage (LDES) market presents significant opportunities driven by the growing demand for renewable energy integration. As European countries strive to meet their ambitious renewable energy targets under the European Green Deal, the need for robust energy storage solutions has never been more pressing. LDES technologies can effectively store excess renewable energy generated during periods of high production and release it when renewable sources are unavailable. This ability to balance supply and demand, especially with intermittent energy sources like solar and wind, positions LDES as a key enabler of Europe’s clean energy transition. With increasing investments in renewable energy projects, utilities, and energy companies are likely to seek long-duration storage solutions, creating substantial growth opportunities for LDES technologies across the continent.

Another major market opportunity for LDES in Europe stems from strong policy support and technological innovation. European governments have introduced various initiatives, such as subsidies, tax incentives, and green energy bonds, to promote the adoption of clean energy technologies, including energy storage. The EU’s regulatory frameworks, including the Fit for 55 and the Green Deal, aim to drive the development and deployment of advanced energy storage solutions. Additionally, ongoing technological advancements in LDES, such as improvements in flow batteries, thermal storage, and compressed air energy storage, are increasing the efficiency, scalability, and cost-effectiveness of these systems. As these technologies mature, LDES will become a more attractive solution for grid operators and energy providers, creating new business opportunities for technology developers and investors within the European market.

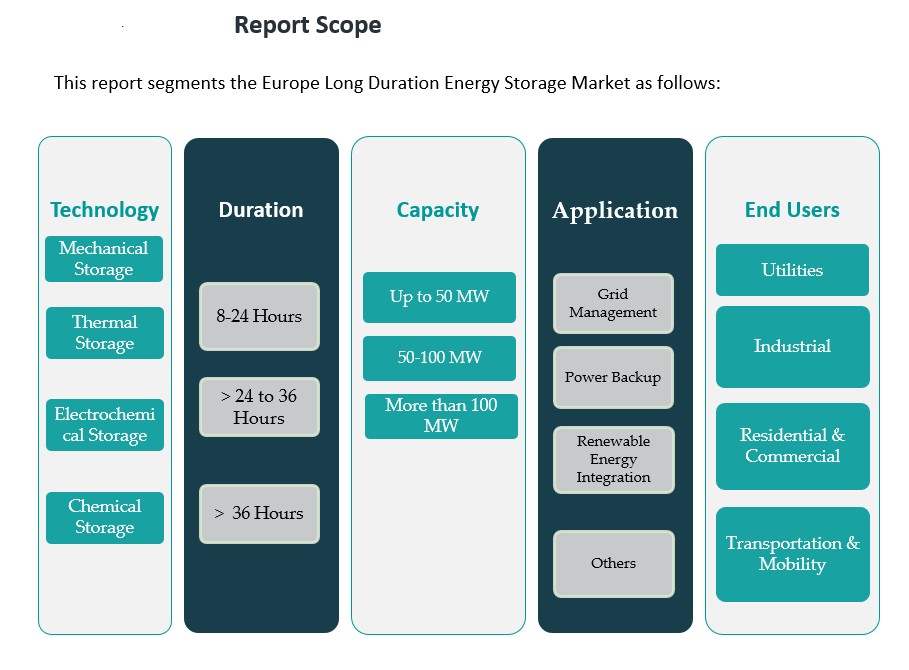

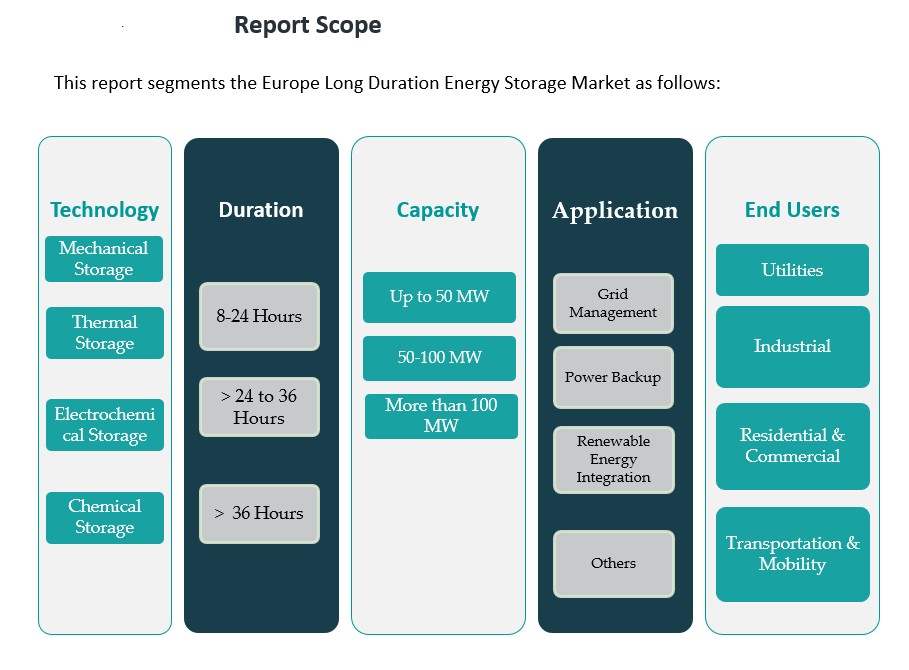

Market Segmentation Analysis:

By Technology

The Europe Long Duration Energy Storage (LDES) market is categorized into four primary technologies: mechanical storage, thermal storage, electrochemical storage, and chemical storage. Mechanical storage, including pumped hydro storage and compressed air energy storage, is a well-established technology known for its ability to store large amounts of energy for extended periods. Thermal storage, which includes molten salt and other heat-based solutions, is gaining traction due to its efficiency in managing large-scale energy storage for power plants. Electrochemical storage, such as flow batteries, provides long-duration storage with high cycle life, offering a solution for both residential and industrial applications. Chemical storage, including hydrogen, is emerging as a promising technology, leveraging the growing focus on hydrogen economies across Europe.

By Duration

The market is further segmented by duration, with storage systems categorized into 8–24 hours, 24–36 hours, and more than 36 hours. Systems with a duration of 8–24 hours are commonly used for daily peak load shifting and renewable energy integration, while those with 24–36 hours offer greater flexibility in grid management. Systems with durations beyond 36 hours are suitable for providing long-term stability and resilience, particularly in emergency backup and large-scale grid applications.

By Capacity

Energy storage capacity segmentation includes systems of up to 50 MW, 50-100 MW, and more than 100 MW. Larger capacities are typically used in utility-scale projects, where vast amounts of energy need to be stored for grid stabilization and renewable energy integration.

By Application

The key applications of LDES include grid management, power backup, renewable energy integration, and other specialized uses. Grid management involves balancing supply and demand, while renewable energy integration focuses on storing intermittent energy generated by renewable sources. Power backup applications are particularly relevant in both residential and industrial settings.

By End User

End users of LDES technologies in Europe include utilities, industrial sectors, residential & commercial sectors, and transportation & mobility. Utilities represent the largest segment, with growing demand for energy storage to stabilize grids, while the industrial sector uses LDES for backup and efficiency. Residential and commercial sectors are increasingly adopting LDES solutions for energy self-sufficiency and cost reduction. Additionally, the transportation sector is exploring LDES technologies for electric vehicle charging infrastructure and sustainable mobility solutions.

Segmentation:

By Technology

- Mechanical Storage

- Thermal Storage

- Electrochemical Storage

- Chemical Storage

By Duration

- 8–24 Hours

- 24–36 Hours

- 36 Hours

By Capacity

- Up to 50 MW

- 50-100 MW

- More than 100 MW

By Application

- Grid Management

- Power Backup

- Renewable Energy Integration

- Others

By End User

- Utilities

- Industrial

- Residential & Commercial

- Transportation & Mobility

Regional Analysis:

The Europe Long Duration Energy Storage (LDES) market is characterized by varied adoption rates and regulatory frameworks across its regions. The market share distribution reflects regional efforts toward renewable energy integration, grid stability, and energy security. Several key countries, including Germany, the United Kingdom, France, and Italy, are leading the way, supported by robust government policies and technological advancements.

Germany remains the largest market for LDES in Europe, holding a significant share of approximately 25%. As Europe’s renewable energy leader, Germany has heavily invested in both renewable energy generation and storage technologies. The country’s Energiewende initiative, which aims to transition to 100% renewable energy by 2050, has fueled significant demand for long-duration energy storage solutions. With a well-established market for mechanical storage technologies, particularly pumped hydro and compressed air systems, Germany is also investing in innovative storage solutions like flow batteries and thermal storage. The combination of government incentives and strong industry support makes Germany a key player in the LDES market.

The United Kingdom follows closely, with a market share of around 20%. The UK’s ambitious net-zero goals and its reliance on renewable energy sources like wind power drive demand for long-duration energy storage solutions. The government’s commitment to enhancing grid resilience and storage capacity is reflected in several large-scale storage projects currently under development. Additionally, the UK is investing in novel technologies such as hydrogen storage and thermal energy storage to address the intermittency of renewable energy.

France holds approximately 15% of the LDES market share in Europe. The French government has prioritized renewable energy growth, coupled with the need for large-scale energy storage to stabilize the grid. The country is focusing on deploying both mechanical and electrochemical storage technologies, with increasing interest in flow batteries and hydrogen storage solutions. France’s strategic location within the EU allows for greater integration with neighboring countries, enhancing cross-border energy storage initiatives.

Italy, with a market share of around 10%, has seen a rapid expansion in renewable energy capacity, particularly solar power. This growth has created an increasing demand for LDES systems to support grid stability and energy integration. Italy is focusing on deploying electrochemical storage and thermal storage technologies to complement its renewable energy goals.

Other regions, including Spain, the Netherlands, and the Nordic countries, also represent emerging markets for LDES. Spain, for instance, is investing heavily in renewable energy integration, making it a rising player in the energy storage sector, while the Nordic countries are exploring pumped hydro and chemical storage solutions.

Key Player Analysis:

- Invinity Energy Systems

- Energy Vault Inc.

- MAN Energy Solutions

- Highview Power

- CMBlu Energy AG

- RheEnergise Limited

- SFW

- GKN Hydrogen

- Ambri Incorporated

- VoltStorage

- Lina Energy Ltd.

- e-Zinc Inc.

- Storelectric LTD

Competitive Analysis:

The Europe Long Duration Energy Storage (LDES) market is highly competitive, with numerous global and regional players vying for market share. Leading companies such as Siemens Energy, GE Renewable Energy, and Vestas dominate the mechanical and electrochemical storage segments, providing large-scale storage solutions, including pumped hydro, flow batteries, and compressed air systems. These players benefit from strong technological expertise, extensive product portfolios, and established market presence. Emerging players, including Energy Vault and Hydrostor, are capitalizing on innovative storage technologies like gravity-based and advanced compressed air systems, respectively. These technologies offer promising alternatives for long-duration storage, attracting investment and partnerships. Additionally, regional companies like Tudor Electric and E3 Group are focusing on niche segments, such as thermal storage and chemical-based storage solutions like hydrogen, to cater to specific regional energy needs. Increased collaboration between technology providers, utilities, and governments is expected to drive future market growth.

Recent Developments:

- In February 2024, Galp, Portugal’s leading integrated energy company, entered into a partnership with Powin LLC, a global energy storage platform provider, to install a utility-scale battery energy storage system (BESS) at one of Galp’s solar power plants near Alcoutim in southern Portugal. This 5 MW/20 MWh battery system marks Galp’s first step in hybridizing its solar power production portfolio, which ranks among the largest in Iberia with nearly 1.5 GW in operation. The batteries will enable Galp to store excess solar energy generated during peak times and deploy it when demand is high, thereby maximizing the value of its renewable energy assets.

- In 2022, Energy Dome, an Italian startup specializing in long-duration energy storage, formed a partnership with Ørsted to explore the deployment of a 20 MW/200 MWh energy storage plant using Energy Dome’s proprietary CO₂ Battery technology at one or more of Ørsted’s sites. This collaboration is focused on providing long-duration storage solutions to enhance grid stability and support baseload renewable energy delivery. Additionally, in the same year, Energy Dome entered into a non-exclusive licensing agreement with Ansaldo Energia to commercialize long-duration energy storage plants across Europe, the Middle East, and Africa, further promoting the integration of renewables into the grid.

- In August 2024, GKN Hydrogen was acquired by Langley Holdings, integrating the Italian hydrogen storage and power-to-power specialist into Langley’s Power Solutions Division. GKN Hydrogen’s technology enables safe, solid-state hydrogen storage at 16 times the density of compressed gas, maintaining efficiency for up to 30 years.

Market Concentration & Characteristics:

The Europe Long Duration Energy Storage (LDES) market is moderately concentrated, with a mix of global players and regional companies competing across various storage technologies. Leading multinational corporations such as Siemens Energy, GE Renewable Energy, and Vestas dominate the market, leveraging their extensive technological expertise, large-scale infrastructure, and established relationships with utilities and grid operators. These companies focus on mechanical and electrochemical storage solutions, driving innovation in flow batteries, pumped hydro storage, and compressed air systems. However, the market also features a growing number of specialized players offering alternative storage technologies, such as Energy Vault and Hydrostor, which provide innovative gravity-based and compressed air systems, respectively. The competitive landscape is also characterized by increasing partnerships, joint ventures, and investments, aimed at enhancing the scalability and efficiency of LDES solutions. As the market continues to mature, the competition is expected to intensify, driving further advancements and cost reductions in energy storage technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Technology, Duration, Capacity, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Long Duration Energy Storage (LDES) market is expected to grow significantly, driven by the increasing integration of renewable energy sources.

- Technological advancements in storage solutions, including flow batteries and thermal storage, will enhance the efficiency and cost-effectiveness of LDES systems.

- Government policies and regulatory support, such as the EU Green Deal and Fit for 55 package, will continue to drive investment in energy storage technologies.

- As renewable energy generation increases, demand for LDES to manage grid stability and ensure energy reliability will rise.

- Market growth will be fueled by the adoption of hydrogen and chemical storage technologies as viable long-duration options.

- Investment in large-scale storage projects is anticipated to increase, with a focus on utility-scale applications.

- The development of hybrid systems combining LDES with traditional energy sources will provide more flexible energy solutions.

- Regional collaboration and cross-border energy storage initiatives will enhance grid integration across Europe.

- Increased adoption of LDES in the transportation and mobility sector will drive innovation and further market expansion.

- Rising focus on sustainability and energy independence will make LDES critical for Europe’s energy transition and carbon neutrality goals.