| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Pressure Sensor Market Size 2024 |

USD 5,150.52 Million |

| Europe Pressure Sensor Market, CAGR |

3.59% |

| Europe Pressure Sensor Market Size 2032 |

USD 6,829.58 Million |

Market Overview

The Europe Pressure Sensor Market is projected to grow from USD 5,150.52 million in 2024 to an estimated USD 6,829.58 million by 2032, with a compound annual growth rate (CAGR) of 3.59% from 2025 to 2032. The demand for pressure sensors in the region is driven by their increasing applications across industries such as automotive, healthcare, industrial automation, and oil & gas.

Key drivers of the Europe Pressure Sensor Market include the rising demand for automation in industrial sectors, advancements in sensor technologies, and the growing emphasis on predictive maintenance to minimize downtime. Trends such as the integration of Internet of Things (IoT) technologies with pressure sensors and the increasing adoption of smart sensors for real-time data analytics further contribute to market growth. Additionally, the automotive sector’s transition toward electric vehicles is also fueling the demand for pressure sensors, especially in tire pressure monitoring systems (TPMS) and battery management systems.

Geographically, Western Europe holds a significant share of the Europe Pressure Sensor Market due to the presence of established industrial bases, technological advancements, and a strong automotive sector. Key players in the market include Honeywell International Inc., Siemens AG, Bosch Sensortec GmbH, and Endress+Hauser Group, which are contributing to innovations and the expansion of pressure sensor applications across diverse industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Pressure Sensor Market is projected to grow from USD 5,150.52 million in 2024 to USD 6,829.58 million by 2032, with a CAGR of 3.59% from 2025 to 2032.

- Increasing automation across industries, along with advancements in sensor technologies, is driving the demand for pressure sensors in sectors like automotive, healthcare, and industrial manufacturing.

- The adoption of smart sensors and IoT integration is boosting real-time data analytics and predictive maintenance, contributing to market growth.

- High costs associated with advanced pressure sensor technologies, especially in high-performance applications, may limit their adoption in cost-sensitive industries.

- The lack of standardization in pressure sensor technologies across diverse industries poses integration challenges, slowing market growth in some sectors.

- Western Europe holds the largest market share due to established industrial bases and technological advancements in sectors such as automotive and industrial automation.

- Eastern Europe is witnessing rapid growth, driven by increasing industrialization, particularly in automotive and energy sectors, creating opportunities for pressure sensor adoption.

Market Drivers

Focus on Predictive Maintenance and Operational Efficiency

Another key driver fueling the demand for pressure sensors in Europe is the increasing focus on predictive maintenance and operational efficiency. In various sectors, such as manufacturing, energy, and automotive, the ability to predict equipment failure before it occurs is crucial to maintaining optimal performance and reducing unplanned downtime. Pressure sensors play a pivotal role in predictive maintenance strategies by continuously monitoring pressure levels in machinery, systems, and processes. Any deviation from normal pressure ranges can be detected early, allowing maintenance teams to address potential issues before they lead to costly breakdowns. This ability to prevent equipment failure, extend the lifespan of machinery, and reduce maintenance costs has become a vital part of operational strategies. As more European industries embrace predictive maintenance, the demand for pressure sensors that can provide real-time data and insights will continue to grow.

Growth of Electric Vehicles and Advancements in Automotive Technology

The rapid shift towards electric vehicles (EVs) in Europe is another significant driver for the pressure sensor market. As part of the European Union’s broader environmental goals and efforts to reduce carbon emissions, the automotive industry is undergoing a transformation, with EVs becoming increasingly mainstream. Pressure sensors are critical in several components of electric vehicles, including battery management systems (BMS), tire pressure monitoring systems (TPMS), and fluid management in braking systems. In particular, the accurate measurement of pressure is essential for the safe operation of battery systems, as any deviation in pressure can affect the performance and safety of the vehicle. Additionally, as the automotive sector evolves with increased safety and comfort features, the adoption of pressure sensors in applications such as climate control, power steering, and braking systems is on the rise. The shift towards electric vehicles, coupled with advancements in automotive technology, is driving the demand for high-quality, reliable pressure sensors in Europe.

Increasing Demand for Automation Across Industries

The growing trend of industrial automation is a significant driver for the Europe Pressure Sensor Market. As industries increasingly adopt automated systems for enhanced efficiency, safety, and precision, the need for advanced sensing technologies becomes more critical. Pressure sensors are integral to these systems, providing real-time monitoring and data acquisition in industrial processes. In manufacturing, for instance, pressure sensors help monitor hydraulic systems, control fluid flow, and ensure optimal machine performance, thereby reducing human error and boosting operational efficiency. Automation in sectors like automotive, oil & gas, and manufacturing places a higher demand on these sensors, further expanding their adoption. For instance, in the automotive industry, pressure sensors are being integrated into advanced driver assistance systems (ADAS) to enhance vehicle safety and performance. These sensors monitor tire pressure, engine oil pressure, and brake fluid pressure in real-time, providing critical data for vehicle control systems. In industrial automation, pressure sensors are being deployed in smart factories to monitor and control pneumatic systems, ensuring optimal air pressure for robotic arms and assembly line equipment. As more businesses transition to automation, the pressure sensor market is set to grow substantially in the coming years.

Technological Advancements in Pressure Sensing Technology

Technological advancements in sensor technologies are one of the primary drivers of the Europe Pressure Sensor Market. Innovations such as miniaturization, wireless communication, and the integration of smart features into pressure sensors have revolutionized their applications. Modern pressure sensors are increasingly designed with high accuracy, reliability, and sensitivity, allowing them to be used in more complex environments. The integration of sensors with IoT technologies and data analytics capabilities allows for real-time performance monitoring and predictive maintenance, minimizing downtime and improving operational efficiencies across industries. Additionally, advancements in materials used in sensor production, such as MEMS (Micro-Electro-Mechanical Systems) and piezoelectric technologies, are contributing to the development of sensors that are not only more accurate but also capable of enduring harsh operating environments. For instance, MEMS-based pressure sensors are now being produced with sub-micron precision, allowing for unprecedented accuracy in pressure measurements. Wireless pressure sensors equipped with energy harvesting capabilities are being deployed in remote industrial locations, eliminating the need for complex wiring systems. These continuous improvements in sensor technologies are driving the growing demand for pressure sensors in Europe.

Market Trends

Wireless and Remote Monitoring Capabilities

The trend towards wireless and remote monitoring is becoming increasingly common in the European pressure sensor market. Traditionally, pressure sensors were wired into control systems, requiring additional infrastructure and maintenance. However, advancements in wireless communication technologies, such as Bluetooth, Wi-Fi, and LoRaWAN, have enabled pressure sensors to operate independently of wired connections. This trend is particularly beneficial in environments where wiring may be difficult, costly, or time-consuming to install, such as offshore oil rigs, remote industrial sites, or areas prone to harsh environmental conditions. Wireless pressure sensors provide a high level of flexibility by transmitting data to centralized control units or cloud-based systems, allowing for real-time monitoring and analysis from virtually anywhere. In the context of industrial Internet of Things (IIoT) networks, wireless pressure sensors offer seamless integration with other smart devices and systems, contributing to the development of more intelligent and autonomous industrial processes. This trend is particularly prevalent in industries such as oil & gas, water treatment, and manufacturing, where operational efficiency and safety are critical.

Demand for High-Performance and Specialized Sensors

As industries evolve and adopt more sophisticated technologies, there is an increasing demand for high-performance and specialized pressure sensors tailored to meet the unique needs of specific applications. In sectors such as aerospace, healthcare, and energy, where precision, reliability, and safety are paramount, there is a growing trend toward the use of highly specialized pressure sensors that can perform under extreme conditions. For example, in the aerospace industry, pressure sensors need to operate accurately at high altitudes and withstand varying temperatures, pressures, and other environmental factors. Similarly, in the healthcare sector, specialized pressure sensors are used in devices like blood pressure monitors and ventilators, where accuracy and patient safety are crucial. In energy applications, sensors that can withstand high pressure, temperature, and corrosive environments are essential for monitoring systems in oil & gas pipelines, refineries, and nuclear power plants. The increasing need for high-performance sensors that can perform under challenging conditions is driving innovation in sensor materials, designs, and technologies, resulting in sensors that can offer more accurate, long-lasting, and reliable performance in a wider range of applications.

Integration of Internet of Things (IoT) with Pressure Sensors

One of the most prominent trends shaping the Europe Pressure Sensor Market is the growing integration of the Internet of Things (IoT) with pressure sensing technologies. IoT-enabled pressure sensors are capable of transmitting real-time data to cloud-based systems, providing businesses with continuous, up-to-date monitoring of critical systems and processes. These smart sensors not only offer accurate pressure readings but also provide predictive insights by analyzing historical data, which allows businesses to anticipate potential failures before they occur. This integration enhances the efficiency of maintenance schedules, improves decision-making processes, and helps optimize resource allocation. In industries such as manufacturing, automotive, and energy, where uptime is critical, the ability to monitor pressure remotely and in real time is transforming operational workflows. For instance, a leading oil and gas company leveraged IoT pressure sensors to monitor their pipelines remotely, resulting in significant cost savings by eliminating the need for manual inspections and reducing the risk of leaks and accidents. Additionally, IoT-connected pressure sensors are being deployed in a wide range of applications, including environmental monitoring, energy management, and smart grid systems, providing added value through increased efficiency and automation.

Miniaturization of Pressure Sensors

Another significant trend in the Europe Pressure Sensor Market is the miniaturization of pressure sensors, which allows them to be used in increasingly compact and complex applications. Miniaturized pressure sensors are being designed with advanced MEMS (Micro-Electro-Mechanical Systems) technology, which allows for the production of sensors that are both smaller and more powerful. These compact sensors offer high precision and reliability in tight spaces, enabling their use in portable devices, medical applications, and automotive systems where space constraints are a concern. For example, in medical devices such as respiratory monitors and wearable health trackers, miniaturized pressure sensors provide vital data about fluid pressure, respiration, and other physiological parameters. In the automotive industry, miniaturized pressure sensors are being used in tire pressure monitoring systems (TPMS) and for monitoring critical fluid levels in compact engine compartments. These sensors can measure pressures ranging from 0.5 to 1,000 bar in certain series, with high operating temperature ranges and frequency responses up to 750kHz. In medical applications, miniaturized pressure sensors with thicknesses down to 0.51mm are being used in devices such as blood pressure monitors, respiratory devices, and infusion pumps, providing accurate and real-time data to improve patient care. The growing demand for smaller, more efficient sensors in a variety of applications is pushing the boundaries of pressure sensor technology, driving innovation in the European market.

Market Challenges

Integration and Standardization Challenges Across Multiple Industries

Another key challenge faced by the Europe Pressure Sensor Market is the difficulty in integrating and standardizing pressure sensors across diverse industries with different technical requirements. Various sectors, such as automotive, healthcare, and industrial manufacturing, have specific needs and operating conditions that demand tailored sensor solutions. This lack of standardization can lead to compatibility issues, particularly when pressure sensors need to be integrated into existing industrial systems or IoT networks. Furthermore, different industries often require sensors with varying levels of precision, material durability, and environmental resistance, which complicates the design and development processes. The lack of a universal standard for pressure sensors makes it challenging for manufacturers to offer one-size-fits-all solutions, and the customization process can be time-consuming and costly. This challenge requires manufacturers to invest heavily in research and development to create adaptable and versatile sensors that meet the varying needs of multiple industries while ensuring they remain cost-effective and reliable.

High Cost of Advanced Pressure Sensors

The Europe Pressure Sensor Market faces a significant challenge in the high cost of advanced pressure sensor technologies. As industries demand more sophisticated sensors with features like high accuracy, wireless connectivity, and IoT integration, production and procurement costs rise. These advanced sensors often involve complex designs, specialized materials, and cutting-edge technology, driving up their price compared to traditional sensors.For instance, pressure sensors such as Honeywell’s TruStability™ Board Mount series offer advanced features like internal diagnostic functions, liquid media compatibility, and temperature output, but come with higher costs due to their sophisticated packaging and capabilities. Similarly, in the automotive sector, the integration of high-precision pressure sensors in electric vehicles for applications like battery management and tire pressure monitoring systems significantly increases production expenses.This price barrier can limit widespread adoption, especially for small and medium-sized enterprises (SMEs) or companies in industries with tight margins. The ongoing maintenance and calibration of these advanced systems further add to operational costs, hindering market growth in some sectors. To address this challenge, manufacturers must find ways to reduce production costs, perhaps through mass manufacturing or leveraging emerging technologies, to make these sensors more accessible and cost-effective for a broader range of industries.

Market Opportunities

Expansion of Smart Cities and Infrastructure Projects

A significant opportunity in the Europe Pressure Sensor Market lies in the increasing development of smart cities and large-scale infrastructure projects. As cities across Europe continue to modernize, there is a growing need for advanced technologies to improve urban living, optimize resource management, and ensure sustainability. Pressure sensors play a crucial role in these smart infrastructure systems, including water and waste management, energy distribution, and environmental monitoring. For instance, pressure sensors are used to monitor water pipeline systems, detect leaks, and ensure efficient fluid management in smart grids. Additionally, as urbanization accelerates, there is an increased focus on integrating IoT technologies into city infrastructures. Pressure sensors that can seamlessly integrate into these IoT-based networks present significant growth potential for market players. As governments and private companies invest in smarter, more efficient cities, the demand for high-performance pressure sensors will continue to rise, creating substantial market opportunities.

Growth in the Automotive Sector with Electric Vehicles

Another promising market opportunity stems from the increasing adoption of electric vehicles (EVs) in Europe. With stricter environmental regulations and a shift towards sustainable transportation, the automotive sector is rapidly evolving, particularly with the rise of electric vehicles. Pressure sensors are vital in various EV applications, including battery management systems (BMS), tire pressure monitoring systems (TPMS), and fluid management for braking systems. As the European automotive industry pushes forward with its transition to electric and hybrid vehicles, the demand for pressure sensors designed for these applications is expected to grow. Manufacturers that focus on developing sensors specifically for EVs can capitalize on this growing market trend, positioning themselves at the forefront of the transition to greener transportation solutions.

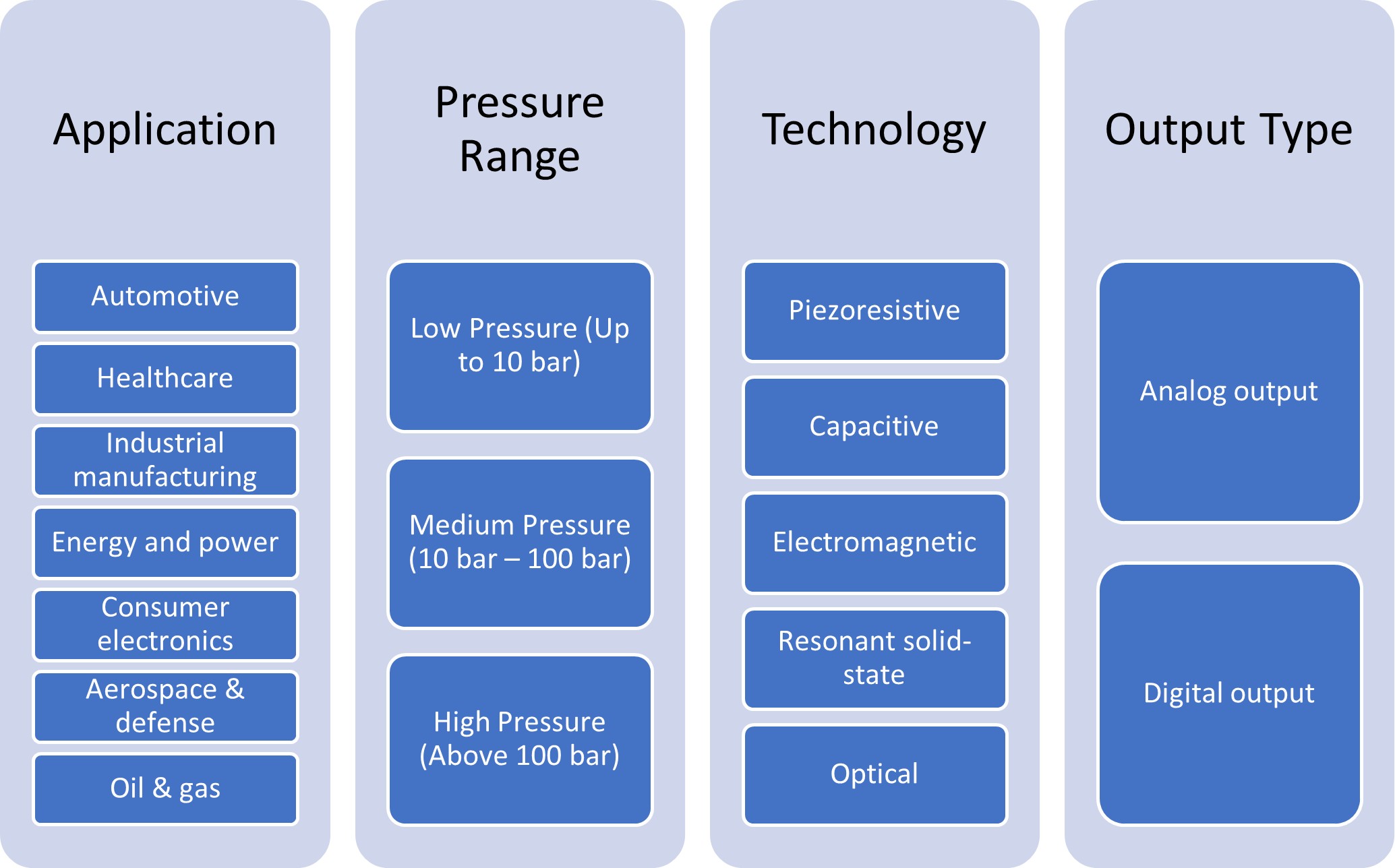

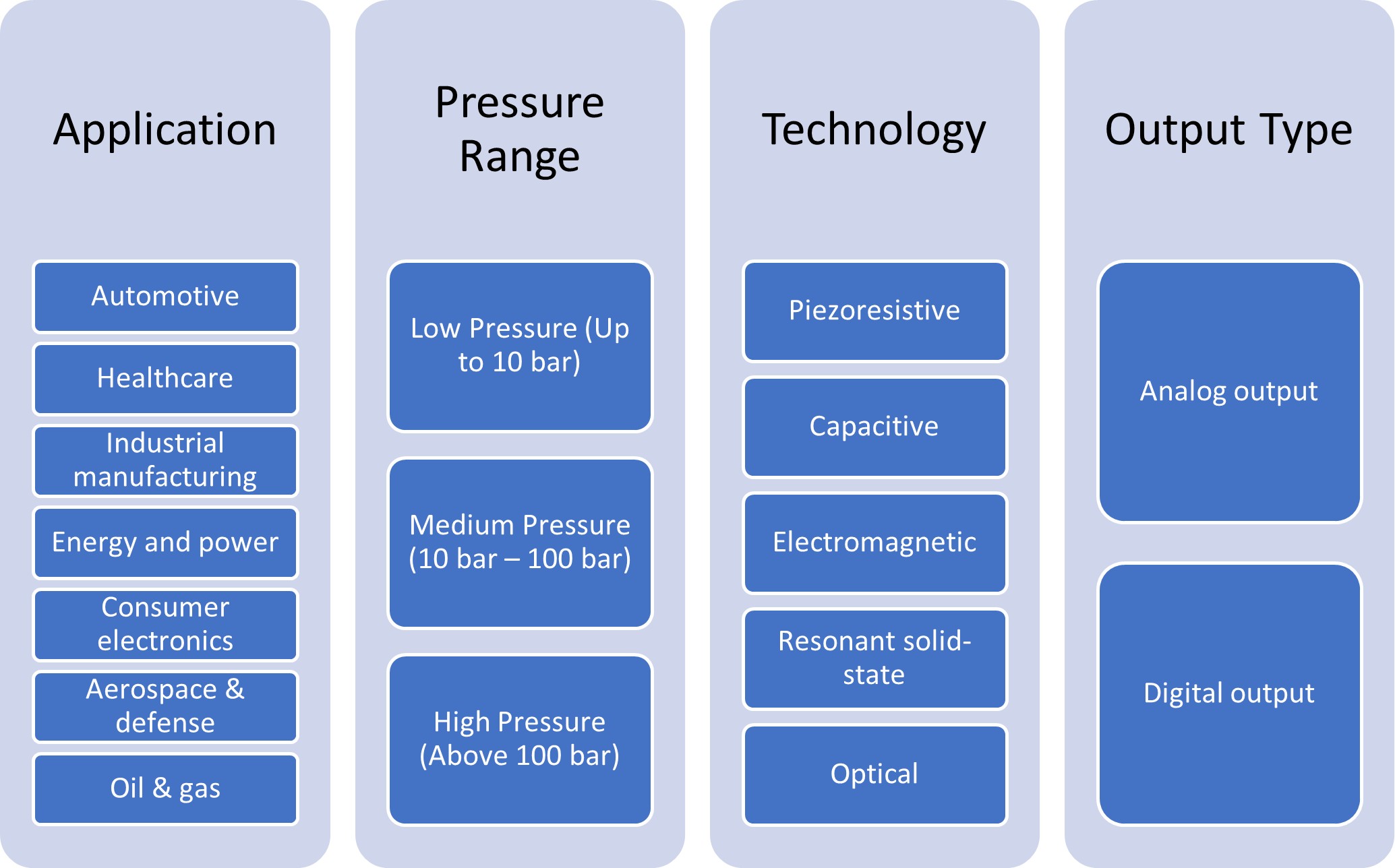

Market Segmentation Analysis

By Application

The automotive sector is one of the largest consumers of pressure sensors, driven by the increasing adoption of advanced vehicle systems, including tire pressure monitoring systems (TPMS), fuel systems, and battery management systems in electric vehicles (EVs). In healthcare, pressure sensors are widely used in medical devices such as ventilators, blood pressure monitors, and infusion pumps, where accuracy and reliability are critical. Industrial manufacturing also accounts for a significant portion of the market, with pressure sensors used in process control, automation, and fluid management systems. The energy and power industry, particularly in oil and gas, relies heavily on pressure sensors for pipeline monitoring, fluid dynamics, and safety systems. Consumer electronics, including smartphones and wearables, incorporate pressure sensors for environmental monitoring and user interactions. In aerospace and defense, pressure sensors are critical in navigation, control systems, and environmental monitoring, operating in high-altitude and extreme conditions.

By Pressure Range

The pressure sensor market is also segmented by pressure range, which includes low pressure (up to 10 bar), medium pressure (10 bar – 100 bar), and high pressure (above 100 bar). Low-pressure sensors are predominantly used in applications such as HVAC systems, medical equipment, and consumer electronics, where precision and small-scale operation are necessary. Medium-pressure sensors find applications in industrial manufacturing, automotive systems, and HVAC, offering a balance of performance and cost-efficiency. High-pressure sensors are essential in industries like oil and gas, aerospace, and heavy-duty manufacturing, where high-performance sensors are required to withstand extreme conditions and measure higher pressure levels with accuracy.

Segments

Based on Application

- Automotive

- Healthcare

- Industrial manufacturing

- Energy and power

- Consumer electronics

- Aerospace & defenseOil & gas

Based on pressure Range

- Low Pressure (Up to 10 bar)

- Medium Pressure (10 bar – 100 bar)

- High Pressure (Above 100 bar)

Based on Technology

- Piezoresistive

- Capacitivem

- Electromagnetic

- Resonant solid-state

- Optical

Based on Output Type

- Analog output

- Digital output

Based on Region

- Western Europe

- Eastern Europe

- Northern Europe

- Southern Europe

Regional Analysis

Western Europe (70%)

Western Europe holds the largest share of the Europe Pressure Sensor Market, accounting for approximately 70% of the total market value. This region is home to some of the world’s most advanced industries, including automotive, aerospace, manufacturing, and healthcare, all of which are major consumers of pressure sensors. Countries such as Germany, the UK, and France are key contributors to the market’s growth. The automotive sector in Germany, known for its innovation in electric vehicles (EVs) and advanced automotive systems, is a primary driver of demand for pressure sensors. Additionally, the increasing adoption of smart manufacturing, automation, and IoT technologies in countries like the UK and France is fueling the demand for high-performance sensors. The presence of global leaders in industrial automation and the energy sector further strengthens Western Europe’s dominant position in the market.

Eastern Europe (18%)

Eastern Europe is witnessing significant growth in the pressure sensor market, contributing approximately 18% to the total market share. Countries like Poland, Hungary, and the Czech Republic are emerging as manufacturing hubs with increasing investments in industrial automation and smart technologies. The automotive sector in Eastern Europe, which benefits from low labor costs and proximity to major European markets, is also a significant driver for pressure sensor adoption. Additionally, the energy and power sector in countries like Russia and Romania is investing in advanced monitoring systems, including pressure sensors, to enhance operational efficiency and safety. As industrialization and modernization continue to expand in Eastern Europe, the pressure sensor market is expected to grow at a faster pace compared to the more mature Western European markets.

Key players

- Sensirion AG

- Kistler Group

- Amphenol Advanced Sensors

- Siemens

- Endress+Hauser

Competitive Analysis

The Europe Pressure Sensor Market is highly competitive, with several well-established players offering innovative products to cater to diverse industry needs. Sensirion AG stands out with its expertise in environmental and industrial sensors, providing high-precision solutions with a strong focus on IoT integration. Kistler Group is known for its advanced pressure measurement technologies, offering robust and reliable sensors that cater to automotive and industrial sectors. Amphenol Advanced Sensors provides a wide range of high-performance sensors, especially focusing on the automotive, healthcare, and industrial sectors, leveraging its vast global presence. Siemens, a leading industrial automation giant, offers pressure sensors that integrate seamlessly into automation and control systems, enhancing operational efficiency. Endress+Hauser, with its strong foothold in the industrial manufacturing sector, offers comprehensive sensor solutions for process control and environmental monitoring. These players maintain a competitive edge through product innovation, technological advancements, and strong market presence across multiple industries.

Recent Developments

In March 2025, Honeywell International Inc launched the TruStability NSC Series pressure sensors, offering uncompensated and unamplified options for customers to perform their own calibration while benefiting from industry-leading stability, accuracy, and repeatability.

In August 2024, Bosch Sensortec introduced the BMP581 barometric pressure sensor, utilizing capacitive technology instead of piezoresistive, resulting in 85% lower current consumption (1.3 µA), 80% reduced noise (0.08 Pa), and 33% improved temperature coefficient offset (± 0.5 Pa/K).

In July 2024, Analog Devices Inc. released the MAX40109 low-power precision sensor interface SoC for pressure sensor applications, featuring a high-precision programmable analog front-end and digital signal processing capabilities.

In November 2023, IFM Electronic released a series of wireless pressure sensors designed specifically for remote monitoring in oil and gas applications.

Market Concentration and Characteristics

The Europe Pressure Sensor Market exhibits moderate market concentration, with a few dominant players holding a significant share while a large number of smaller players contribute to the competitive landscape. Major companies like Sensirion AG, Siemens, Endress+Hauser, Kistler Group, and Amphenol Advanced Sensors lead the market by offering a diverse range of advanced sensor technologies tailored to various industries, including automotive, healthcare, industrial manufacturing, and energy. The market is characterized by continuous innovation, with companies focusing on enhancing sensor performance, miniaturization, and integration with IoT and smart technologies. Additionally, the pressure sensor market is marked by increasing collaboration and strategic partnerships between key players and end-users, which drive the adoption of sensors in emerging applications such as smart cities, electric vehicles, and renewable energy sectors. Despite the dominance of these major players, the market also accommodates niche players offering specialized sensors for specific industrial and technological needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Pressure Range, Technology, Output Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rise of automation in industries such as manufacturing, automotive, and healthcare will continue to drive demand for pressure sensors. These sensors are crucial for enhancing operational efficiency and safety in automated systems.

- The adoption of IoT technologies across various industries will lead to a growing need for connected pressure sensors. Real-time monitoring and data analytics will be key features for future sensor applications.

- As Europe intensifies its efforts toward sustainability, the demand for pressure sensors in renewable energy applications, such as wind and solar power, will rise. These sensors are essential for monitoring and optimizing energy production.

- Ongoing advancements in sensor miniaturization will lead to smaller, more powerful pressure sensors. This will expand their use in consumer electronics, medical devices, and automotive systems.

- The increasing adoption of electric vehicles in Europe will create new opportunities for pressure sensor manufacturers. Sensors will be crucial for tire pressure monitoring, battery management, and fluid systems in EVs.

- As smart cities continue to develop, pressure sensors will play a pivotal role in infrastructure monitoring, including water management systems, environmental monitoring, and waste management.

- The healthcare sector will see a higher demand for pressure sensors in medical devices. Accurate pressure measurements will be essential for devices such as ventilators, blood pressure monitors, and infusion pumps.

- There will be a growing demand for high-performance pressure sensors that can operate under extreme conditions. Industries like aerospace, defense, and oil & gas will continue to rely on these advanced sensors for critical applications.

- Pressure sensor manufacturers will increasingly offer customized solutions tailored to the specific needs of industries such as aerospace, automotive, and industrial manufacturing, addressing unique challenges in each sector.

- The market will likely experience further consolidation, with key players forming partnerships, mergers, and acquisitions to strengthen their market presence and innovate their product offerings.