Market Overview

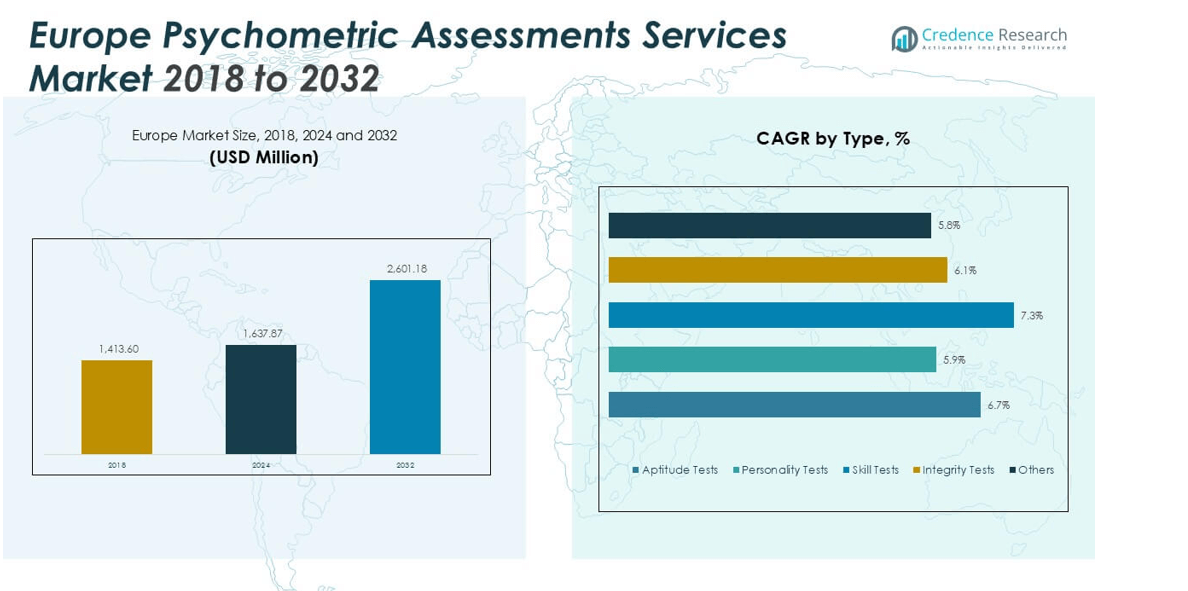

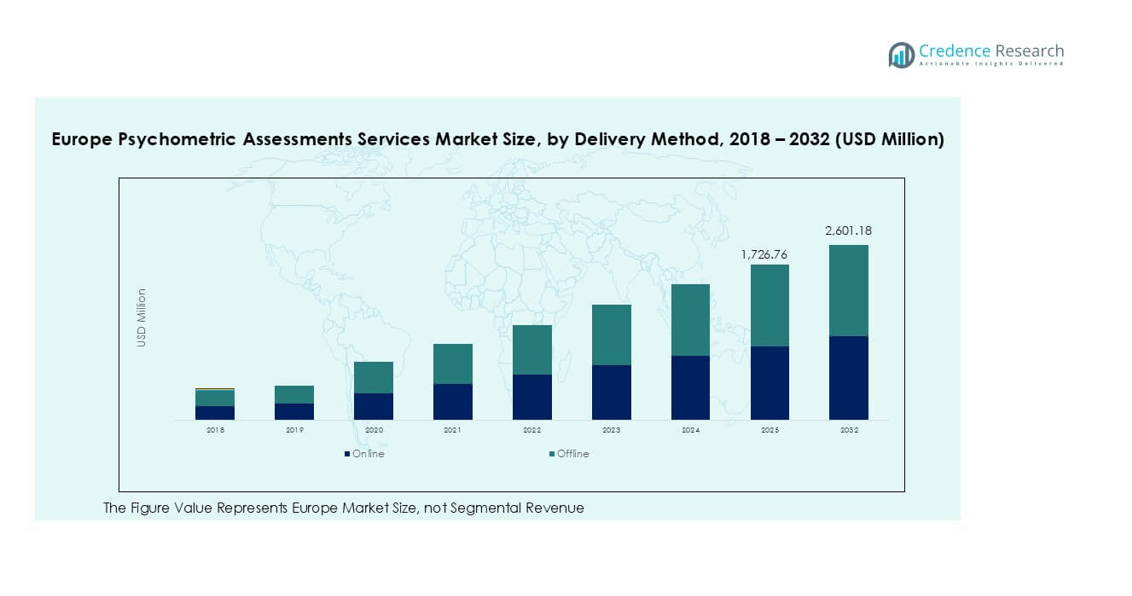

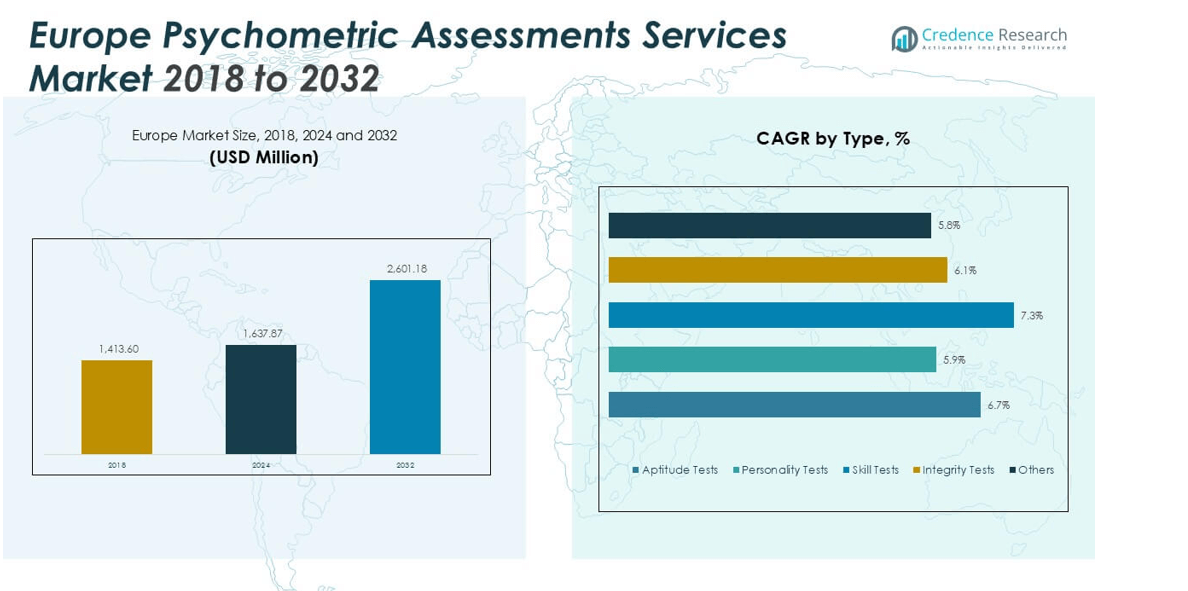

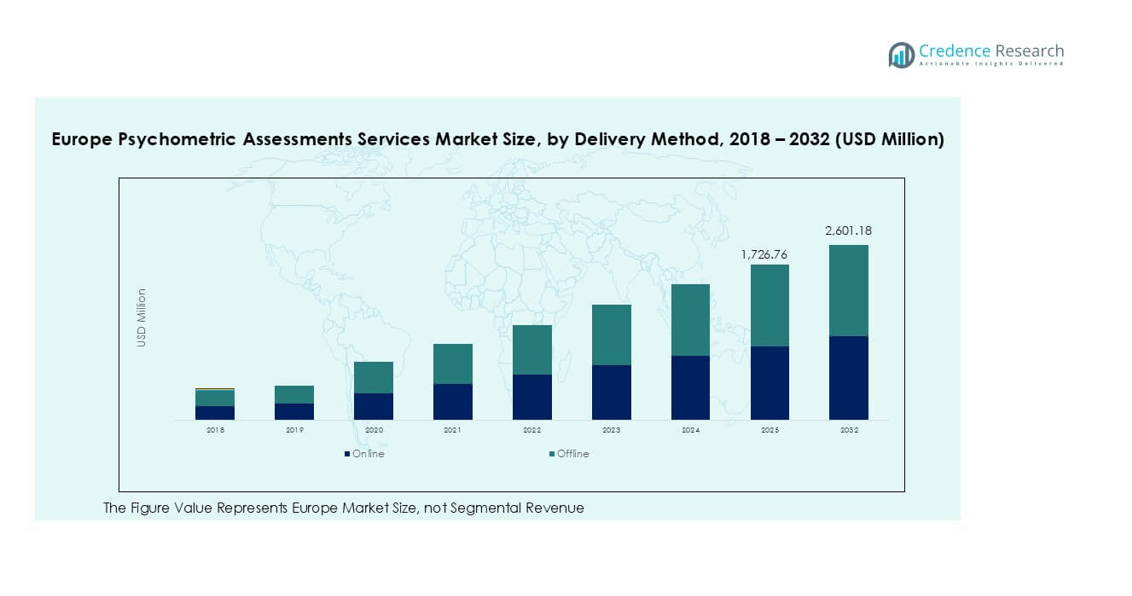

Europe Psychometric Assessments Services market size was valued at USD 1,413.60 million in 2018 and increased to USD 1,637.87 million in 2024. The market is anticipated to reach USD 2,601.18 million by 2032, registering a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Psychometric Assessments Services Market Size 2024 |

USD 1,637.87 million |

| Europe Psychometric Assessments Services Market , CAGR |

5.9% |

| Europe Psychometric Assessments Services Market Size 2032 |

USD 2,601.18 million |

Leading players in the Europe Psychometric Assessments Services market include SHL, Hogan Assessments, Aon Assessment Solutions, Thomas International, and Korn Ferry. These companies dominate through advanced digital platforms, AI-based analytics, and diversified assessment tools covering aptitude, personality, and leadership evaluations. SHL and Aon lead in corporate and government recruitment, while Hogan and Thomas International specialize in personality and behavioral profiling. Among regions, the UK holds the largest market share at 28%, driven by strong corporate adoption and digital hiring initiatives. Germany and France follow as key contributors, supported by rising demand for data-driven workforce evaluation solutions.

Market Insights

- The Europe Psychometric Assessments Services market was valued at USD 1,637.87 million in 2024 and is projected to reach USD 2,601.18 million by 2032, growing at a CAGR of 5.9%.

- Growth is driven by rising demand for data-based hiring, employee development, and leadership assessment across corporate and government sectors.

- Key trends include AI-enabled testing platforms, remote assessments, and growing use of emotional intelligence and soft-skill evaluations in recruitment.

- The market is moderately consolidated, with leading players such as SHL, Aon, Hogan Assessments, and Thomas International expanding through cloud-based solutions and predictive analytics.

- The UK holds 28% share, followed by Germany at 19% and France at 17%, while the aptitude test segment leads with 36% share, driven by corporate adoption of digital assessment tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Aptitude tests dominated the Europe psychometric assessments services market in 2024, accounting for nearly 36% share. Their dominance stems from widespread use in corporate hiring to evaluate logical reasoning, numerical skills, and problem-solving ability. Organizations increasingly rely on data-driven hiring tools to reduce bias and improve talent quality. Rising adoption of AI-enhanced test platforms and adaptive assessments further boosts demand. Vendors like SHL and Mercer are integrating predictive analytics to improve accuracy and streamline candidate evaluation, strengthening the segment’s leadership in pre-employment screening and workforce planning.

- For instance, SHL’s Verify G+ cognitive test has up to 30 questions with an average administration time of 32-36 minutes.

By Application

The recruitment and selection segment held the largest share of 42% in 2024. Companies across Europe are increasingly using psychometric tools to identify high-potential candidates and align skills with organizational roles. The growing need for efficient remote hiring solutions and digital recruitment platforms supports segment growth. Automated psychometric tests help reduce hiring time while enhancing objectivity. Firms such as Thomas International and Talogy are expanding AI-based assessment tools to offer real-time analytics, enabling recruiters to make faster and more accurate talent decisions across large applicant pools.

- For instance, Thomas International’s PPA (Personal Profile Analysis) comprises 24 questions in 8–12 minutes.

By End-User

The corporate sector dominated the market with a 54% share in 2024, driven by growing emphasis on performance benchmarking and leadership development. Enterprises use psychometric assessments to enhance talent retention, succession planning, and workplace productivity. Increased demand for customized evaluation frameworks tailored to organizational culture has strengthened adoption. Educational institutions and government agencies are also integrating assessment tools for admissions and career guidance. Leading providers like Aon and Cubiks are offering scalable SaaS-based platforms, supporting corporate clients in conducting continuous skill evaluation and personality profiling across European workforces.

Key Growth Driver

Growing Focus on Data-Driven Recruitment

European organizations are increasingly adopting psychometric assessments to enhance objectivity in hiring. Businesses rely on aptitude and personality tests to predict job performance, reduce turnover, and ensure cultural alignment. The rising demand for evidence-based recruitment supports widespread adoption in corporate and government sectors. Automated and AI-enabled testing platforms also reduce hiring bias and streamline candidate evaluation. Companies like SHL and Aon provide advanced data analytics tools that integrate psychometrics with HR systems, improving decision accuracy. This shift toward scientific hiring methods remains a major driver of market expansion across industries.

- For instance, Aon’s Global Assessment Solutions platform delivers over 30 million assessments annually across 90 countries.

Expansion of Digital and Remote Testing Platforms

The rapid digitization of HR processes has transformed the psychometric assessment landscape across Europe. Remote and cloud-based testing platforms allow organizations to conduct large-scale evaluations with higher efficiency. Growing adoption of hybrid work models increases reliance on virtual testing systems. Providers such as Talogy and Thomas International offer mobile-compatible, multilingual platforms supporting cross-border assessments. These digital innovations improve accessibility, scalability, and cost-effectiveness. The continued integration of AI and adaptive algorithms in testing tools strengthens the market by enabling real-time performance tracking and individualized evaluation insights.

- For instance, Talogy delivers over 30 million assessments each year across its global client base.

Increasing Emphasis on Employee Development and Retention

Organizations across Europe are using psychometric assessments not only for recruitment but also for employee growth. Skill, personality, and integrity tests support leadership training, succession planning, and performance optimization. With the growing importance of emotional intelligence and behavioral skills, psychometrics helps align individual potential with organizational goals. Companies like Mercer and Cubiks are expanding offerings that link personality profiles with learning outcomes. This proactive use of assessments enhances workplace engagement and retention, driving long-term demand for psychometric services in both corporate and educational environments.

Key Trends and Opportunities

Integration of AI and Predictive Analytics

Artificial intelligence and machine learning are reshaping psychometric assessments by enabling deeper behavioral insights. AI-driven analytics help interpret complex data patterns, allowing recruiters to forecast employee performance more accurately. Predictive models identify traits linked to high productivity, leadership, and job fit. Companies like Aon and Criteria Corp are embedding AI modules to automate scoring and eliminate human bias. This trend opens opportunities for developing next-generation assessment platforms with adaptive question sequencing, continuous learning, and emotion recognition, enhancing test precision and decision-making accuracy across industries.

- For instance, Aon has administered over 48 million talent assessments to date, many enhanced with AI modules.

Rising Demand for Soft Skills and Emotional Intelligence Testing

Employers are increasingly focusing on soft skills, empathy, and emotional intelligence as critical factors for workforce success. Psychometric tools designed to assess interpersonal behavior, stress management, and collaboration are gaining traction across Europe. The growing shift toward remote work amplifies the need to evaluate communication and adaptability. Organizations in finance, education, and healthcare are integrating emotional intelligence assessments to support leadership and teamwork development. This focus on behavioral and cognitive profiling creates strong opportunities for providers offering specialized, research-backed assessment frameworks tailored to evolving workplace needs.

- For instance, Criteria’s Emotional Intelligence assessments are part of its portfolio alongside cognitive and personality tests.

Key Challenges

Data Privacy and Regulatory Compliance

Strict data protection laws, such as GDPR, present significant challenges for psychometric service providers. Handling sensitive psychological and behavioral data requires high security standards and transparent consent mechanisms. Non-compliance risks legal penalties and reputational harm. Providers must ensure encrypted data storage, anonymized reporting, and compliant AI use. Balancing innovation with ethical and regulatory requirements remains a major concern. Companies are investing heavily in secure cloud infrastructures and localized data centers to maintain compliance, but ongoing regulatory evolution continues to add operational complexity across European markets.

Cultural and Language Adaptability Issues

Europe’s diverse cultural and linguistic landscape complicates the standardization of psychometric assessments. Tests designed for one region may not translate effectively across countries due to differences in work culture, communication norms, and interpretation. This limits the accuracy and fairness of assessments. Providers must localize test content, scoring methods, and behavioral models to suit national contexts. Developing valid and reliable multilingual tests requires extensive research and psychometric validation. Despite progress by firms like Talogy and Central Test, ensuring cultural neutrality remains a persistent challenge to market scalability.

Regional Analysis

UK

The UK led the Europe psychometric assessments services market in 2024, holding a 28% share. The dominance is supported by strong corporate adoption across banking, IT, and public sectors. Organizations use psychometric tools to enhance recruitment efficiency and ensure cultural fit. The rising use of AI-driven and gamified testing platforms also supports market growth. Leading providers like SHL and Talogy have expanded digital solutions to support hybrid hiring. Government initiatives promoting fair and skill-based recruitment further strengthen the UK’s leadership in psychometric evaluations across both private and public employment segments.

France

France accounted for a 17% market share in 2024, driven by the integration of psychological testing in recruitment and leadership training. French companies emphasize emotional intelligence and behavioral profiling for workforce development. Increased demand from public administration and healthcare sectors also supports adoption. Providers such as Central Test and PerformanSe lead the market with customized personality and aptitude tools tailored to European standards. The country’s focus on regulatory compliance and ethical testing practices enhances trust in psychometric evaluations, solidifying France as a key contributor to the region’s overall market expansion.

Germany

Germany captured a 19% market share in 2024, supported by strong adoption across manufacturing, engineering, and technology sectors. Companies use psychometric tools to identify technical aptitude and leadership potential within structured hiring frameworks. The demand for digital assessment platforms aligned with GDPR compliance continues to rise. Firms such as Aon and Cubiks have strengthened presence through cloud-based assessment suites. The growing focus on employee retention and professional development, particularly in Industry 4.0-related roles, fuels steady market expansion, making Germany a central hub for psychometric innovation in continental Europe.

Italy

Italy held a 10% share of the Europe psychometric assessments services market in 2024. The market is expanding as enterprises adopt behavioral and personality testing to improve workforce alignment and training effectiveness. Growing awareness among SMEs and universities is increasing the use of assessments in recruitment and academic counseling. Local HR technology firms are collaborating with global providers to deliver multilingual, culturally adapted tools. The Italian government’s push for digital transformation in hiring practices and career guidance further encourages broader adoption of psychometric solutions across both public and private sectors.

Spain

Spain accounted for a 9% share of the market in 2024, driven by increased adoption across corporate and educational sectors. Companies are integrating online psychometric tools to streamline recruitment and performance management. Universities and vocational training centers use these assessments to support career planning. Providers like Meta4 and Psytech International are expanding localized platforms in Spanish to improve accessibility. The country’s focus on talent development, remote assessment tools, and AI-driven evaluation systems supports sustained market growth, positioning Spain as a fast-growing contributor within Europe’s psychometric services landscape.

Russia

Russia represented an 8% share in the 2024 Europe market, driven by rising demand from IT, manufacturing, and defense industries. Local enterprises use psychometric evaluations to enhance employee selection and psychological resilience testing. The increasing adoption of digital testing platforms, often integrated with HR analytics, supports market penetration. Companies like Talent Q and local HR tech firms offer region-specific personality and cognitive assessments. Despite data protection and localization challenges, the growing focus on workforce optimization and leadership development continues to drive psychometric testing adoption in Russia’s evolving corporate landscape.

Rest of Europe

The Rest of Europe region, comprising Nordic and Eastern European countries, accounted for a 9% market share in 2024. Demand is growing across education, government, and small enterprise sectors, supported by digital transformation initiatives. Countries such as the Netherlands, Sweden, and Poland are adopting cloud-based platforms for multilingual and remote testing. Vendors are introducing adaptive and mobile-first assessments to meet regional skill development goals. Increasing emphasis on inclusive recruitment and competency-based evaluation frameworks continues to support steady adoption, strengthening the region’s contribution to Europe’s overall psychometric assessment ecosystem.

Market Segmentations:

By Type

- Aptitude Tests

- Personality Tests

- Skill Tests

- Integrity Tests

- Others

By Application

- Recruitment & Selection

- Training & Development

- Clinical & Counselling

- Others

By End-User

- Corporate

- Educational Institutions

- Government

- Others

By Delivery Mode

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe psychometric assessments services market is moderately consolidated, with key players such as SHL, Hogan Assessments, Aon Assessment Solutions, and Thomas International leading the landscape. These companies compete through digital innovation, extensive test portfolios, and AI-based evaluation tools. Partnerships and product expansions are common strategies to strengthen regional presence and client engagement. Firms like Pearson TalentLens and Korn Ferry focus on leadership and personality assessments, while Mettl and Criteria Corp emphasize online and customizable testing solutions. Continuous integration of predictive analytics, cloud platforms, and adaptive testing technologies enhances competitiveness, as vendors aim to provide scalable, compliant, and data-secure assessment solutions aligned with Europe’s evolving HR and organizational development needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SHL

- Hogan Assessments

- TalentSmart

- Criteria Corp

- Thomas International

- Cubiks

- PSI Services LLC

- Aon Assessment Solutions

- Pearson TalentLens

- Korn Ferry

- The Myers-Briggs Company

- Mettl

- Berke

- AssessFirst

Recent Developments

- In October 2025, SHL introduced a new Personality and Ability Assessment Training Program in Czechia, focusing on professional development for HR teams to increase self-sufficiency in test interpretation and talent evaluation. This initiative forms part of SHL’s updated global training calendar for advanced psychometric assessment methodologies.

- In April 2025, TalentSmartEQ launched its 2025 State of EQ Report, analyzing data from over 37,000 Emotional Intelligence Appraisal participants. The report highlighted a shift toward people-first leadership and the growing use of emotional intelligence training to support employee well-being and adaptability in dynamic workplaces.

- In 2025, Hogan Assessments focused on leveraging AI for deeper behavioral insights in its predictive personality assessments, as presented at the IPAC 2025 conference. This aligns with Hogan’s emphasis on ethical AI and enhanced cross-cultural validity, a priority highlighted in their April 2025 Top Trends in Personality Assessment report. Hogan was also a platinum sponsor of the IPAC conference, which was held from July 27–30 in Atlanta.

- In March 2023, Talent Select AI, a Milwaukee-based company, announced the official launch of its ground-breaking, self-titled psychometric assessment tool.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Delivery Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven and adaptive psychometric tools will continue to rise across Europe.

- Remote and mobile-compatible testing platforms will dominate corporate recruitment processes.

- Emotional intelligence and behavioral skill assessments will gain stronger importance in leadership development.

- Integration of psychometric data with HR analytics systems will improve workforce planning.

- Cloud-based and multilingual platforms will expand accessibility across diverse European regions.

- Growing focus on employee retention will increase the use of personality and integrity testing.

- Data privacy compliance and ethical AI frameworks will shape product design and delivery.

- Educational institutions will adopt psychometric tools for academic counseling and career mapping.

- Mergers and partnerships among major vendors will strengthen regional market consolidation.

- Continuous innovation in gamified and immersive testing formats will enhance user engagement and accuracy.