Market Overview

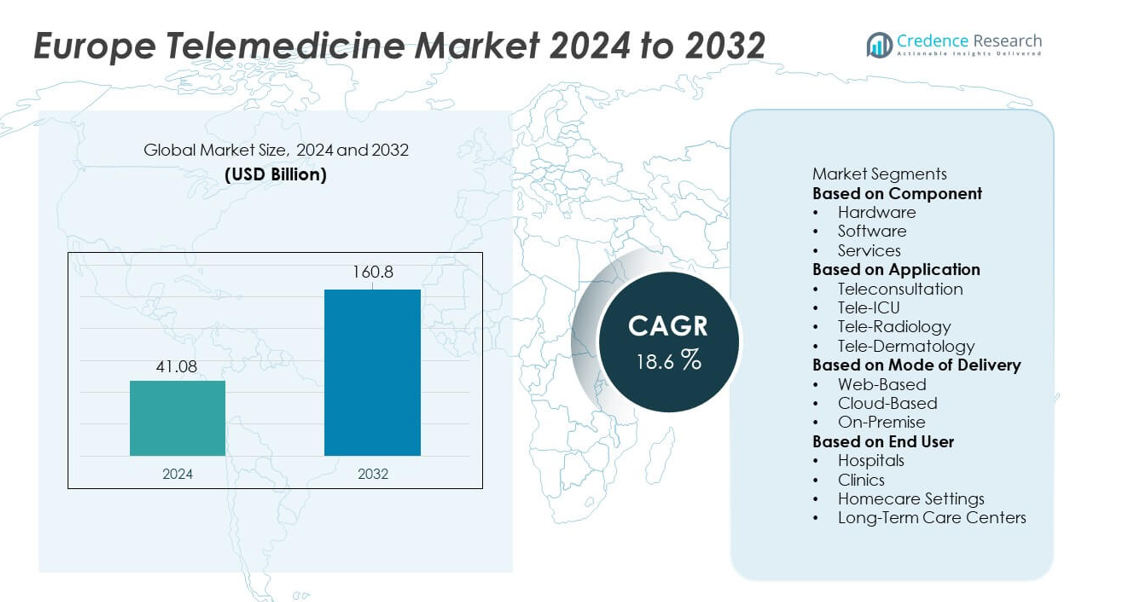

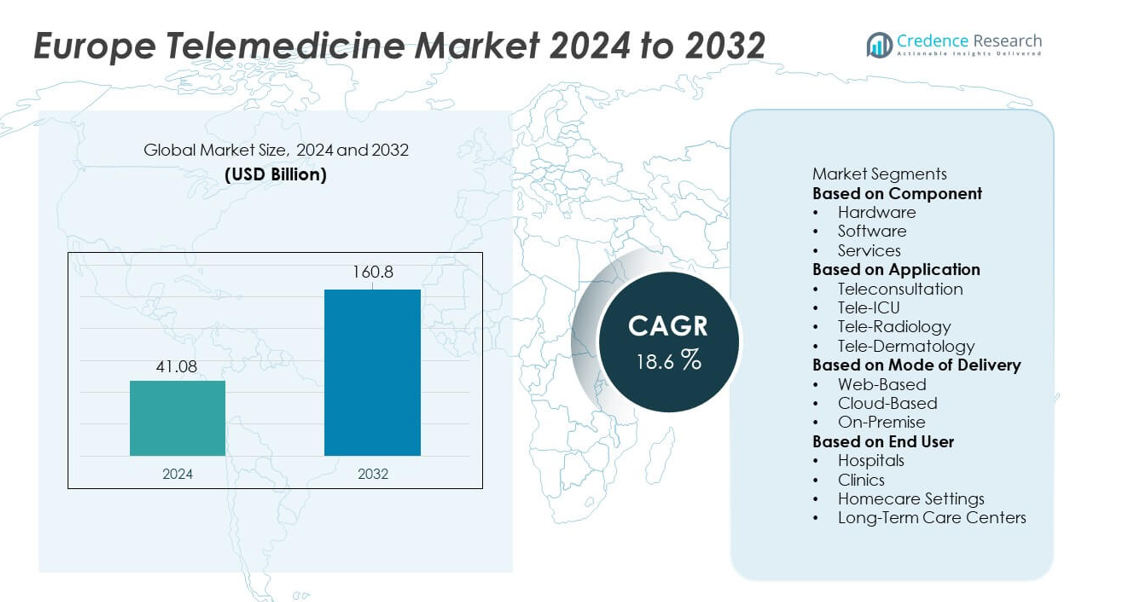

The Europe Telemedicine market reached USD 41.08 billion in 2024. The market is projected to grow to USD 160.8 billion by 2032, supported by an 18.6% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Telemedicine Market Size 2024 |

USD 41.08 billion |

| Europe Telemedicine Market, CAGR |

18.6% |

| Europe Telemedicine Market Size 2032 |

USD 160.8 billion |

The Europe Telemedicine market is shaped by leading companies such as Philips Healthcare, Siemens Healthineers, GE HealthCare, Teladoc Health, Cerner Corporation, Medtronic plc, Cisco Systems, AMD Global Telemedicine, Babylon Health, and ResMed. These players strengthen their presence through advanced virtual care platforms, remote monitoring systems, and AI-enabled diagnostics tailored for European healthcare needs. Western Europe stands as the leading region with a 42% share, supported by strong digital health policies, mature hospital networks, and high patient adoption of virtual consultations. Northern Europe, Southern Europe, and Eastern Europe continue to expand adoption, driven by modernization efforts and growing demand for accessible virtual care.

Market Insights

- The Europe Telemedicine market reached USD 41.08 billion in 2024 and will grow at an 18.6% CAGR through 2032, driven by rising virtual care adoption.

- Strong market expansion is supported by demand for remote monitoring, digital consultations, and AI-enabled diagnostic tools, strengthening adoption across hospitals and homecare settings.

- Key trends include rapid cloud migration, rising use of teleconsultation—which leads with a 58% share—and wider deployment of integrated EHR-based platforms that improve care coordination.

- Competitive activity intensifies as major players expand virtual care solutions, enhance interoperability, and invest in secure, scalable telehealth ecosystems while addressing data privacy requirements.

- Regional growth remains led by Western Europe with a 42% share, followed by Northern Europe at 23%, Southern Europe at 19%, and Eastern Europe at 16%, while services dominate the component segment with a 52% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

remote monitoring support, and technical maintenance. Hospitals and clinics prefer service-driven models due to easier deployment and lower upfront costs. Software adoption rises as providers use AI-based triage, e-prescription, and interoperable EHR tools. Hardware maintains steady demand with connected devices and cameras used for diagnostics and remote assessments. Higher digital literacy, strong reimbursement frameworks, and EU-backed digital health initiatives continue to support rapid expansion across the component landscape.

- For instance, Philips Healthcare expanded its HealthSuite digital platform with open APIs, which are based on industry standards like FHIR and HL7, enabling large hospitals to connect remote monitoring devices and other third-party systems.

By Application

Telemedicine adoption accelerates across various clinical areas as patient expectations move toward convenient virtual care. Teleconsultation dominates with a 58% share, driven by its wide use in primary care, mental health, chronic illness follow-ups, and remote expert access. Health systems in Germany, France, and the U.K. promote virtual visits to reduce outpatient pressure and improve access across rural regions. Tele-radiology grows due to strong imaging demand and cross-border expert collaboration. Tele-ICU use increases with specialist shortages, while tele-dermatology expands through AI-assisted skin analysis. Supportive reimbursement rules enhance application growth across Europe.

- For instance, Teladoc Health has facilitated tens of millions of virtual visits globally through its unified care platform and delivers care in a large number of countries each year.

By Mode of Delivery

Delivery models evolve quickly as European healthcare invests in scalable digital platforms. Cloud-based solutions lead with a 55% share, supported by secure storage, real-time data access, and strong EHR integration. Hospitals prefer cloud-based platforms for managing high consultation volumes and enabling remote monitoring. Web-based platforms remain popular among smaller providers seeking low-cost deployment and simple interfaces. On-premise systems maintain relevance in institutions with strict data control requirements. Rising data protection standards, enhanced cybersecurity needs, and growing digital transformation programs across national health systems drive steady growth in delivery mode adoption.

Key Growth Driver

Expansion of Remote Patient Monitoring

Remote patient monitoring accelerates market growth as Europe focuses on chronic disease management and early intervention. Health systems adopt connected devices and wearable technologies to track vital signs, medication adherence, and patient symptoms in real time. This approach reduces hospital readmissions and supports continuous care for aging populations. Providers use telemedicine platforms to identify early deterioration and deliver timely interventions. Governments in Germany, France, and the Nordics promote RPM adoption through supportive reimbursement, which boosts patient engagement and clinical efficiency. Strong demand for home-based monitoring strengthens the role of telemedicine within integrated care pathways.

- For instance, Medtronic expanded its CareLink network, which now monitors millions of connected cardiac device patients worldwide, supporting early detection of arrhythmias.

Rising Digital Health Investments Across Europe

European countries increase investment in digital health infrastructure to enhance access, efficiency, and care coordination. National health systems prioritize telemedicine platforms to manage high outpatient volumes and improve specialist availability. Funding improves interoperability between telemedicine tools and electronic health records, enabling seamless data exchange. Governments also expand national telehealth programs to strengthen rural and underserved area coverage. Strategic partnerships between telecom operators, technology firms, and healthcare providers accelerate innovation. These investments support rapid scaling of virtual care ecosystems and strengthen telemedicine adoption among hospitals, clinics, and long-term care centers across the region.

- For instance, Teladoc Health processed well over its initial reported visits, with global virtual encounters reaching above that number and growing, while serving members across many countries.

Growing Acceptance of Virtual Consultations

Virtual consultations gain strong acceptance as patients and clinicians prioritize convenience, shorter wait times, and flexible access. Teleconsultation adoption rises in primary care, mental health, pediatrics, and chronic disease follow-ups. Providers integrate video visits, e-prescriptions, and digital triage tools to streamline workflows. Rising digital literacy and improved broadband coverage support broader adoption across Europe. Hospitals use virtual visits to reduce outpatient congestion, while insurers promote telehealth as a cost-effective alternative. The growing preference for accessible care strengthens telemedicine’s role in routine clinical practice and drives sustained demand across diverse patient groups.

Key Trend & Opportunity

AI Integration for Smarter Clinical Workflows

AI-enabled telemedicine platforms create major opportunities by supporting advanced triage, predictive insights, and decision-support tools. Providers use AI to analyze symptoms, imaging, and patient histories, enabling faster and more accurate clinical assessments. Automated scheduling, chatbot-based guidance, and workflow optimization enhance efficiency for hospitals and clinics. AI-driven analytics help identify high-risk patients and personalize care plans for chronic conditions. As demand grows for efficient virtual care, AI becomes a key differentiator for telehealth vendors. Ongoing innovation positions Europe as a strong market for intelligent telemedicine platforms that support data-driven clinical operations.

- For instance, Babylon Health’s AI system performed numerous symptom assessments using structured clinical models.

Expansion of Cross-Border Virtual Care

Cross-border telemedicine offers a strong opportunity as Europe increases focus on interoperable digital health standards. Patients benefit from virtual access to specialists across neighboring countries, improving care quality and reducing wait times. Tele-radiology and tele-ICU services especially benefit from remote expert collaboration. EU initiatives that promote digital patient records, shared clinical guidelines, and secure data exchange strengthen this growth. Healthcare providers use cross-border networks to manage specialist shortages and expand service portfolios. This trend supports a more connected European health ecosystem and enhances the scalability of telehealth solutions across regions.

- For instance, Teleradiology Solutions handled a significant volume of radiology scans across international networks, enabling hospitals to access expertise beyond national borders.

Key Challenge

Data Privacy and Cybersecurity Compliance

Strict data protection rules create operational challenges for telemedicine providers. Compliance with GDPR, national privacy laws, and cybersecurity standards requires significant investment in secure platforms, encrypted data transfer, and access-control systems. Providers must manage complex consent procedures and ensure safe handling of sensitive health information across digital channels. Cyberattacks on healthcare systems intensify concerns, pushing organizations to strengthen security frameworks. Small clinics often face challenges meeting regulatory expectations due to limited IT resources. Achieving full compliance remains demanding, which slows implementation for some telehealth services across Europe.

Uneven Digital Infrastructure Across Regions

Digital infrastructure varies widely across Europe, creating adoption gaps between urban and rural areas. Regions with limited broadband quality face difficulty supporting high-quality video consultations and remote monitoring programs. Healthcare providers in underserved areas struggle to deploy advanced telemedicine platforms and achieve stable connectivity. This disparity limits equal access to virtual care and slows market penetration in parts of Eastern and Southern Europe. Governments continue to invest in connectivity upgrades, but progress remains uneven. Closing the digital divide is essential for achieving consistent telemedicine adoption and maximizing regional healthcare efficiency.

Regional Analysis

Western Europe

Western Europe holds the largest share of the Europe Telemedicine market with a 42% share, driven by strong digital health policies, advanced hospital networks, and high patient adoption of virtual care. The U.K., Germany, and France lead deployment as governments expand reimbursement for video consultations and remote monitoring. Hospitals integrate AI-based triage, chronic disease platforms, and interoperable EHR-linked telemedicine tools to reduce outpatient loads. High broadband penetration and strong investments from health insurers support more scalable virtual care models. Western Europe’s mature healthcare infrastructure continues to strengthen the region’s leadership in telemedicine adoption.

Northern Europe

Northern Europe accounts for a 23% share of the regional market, supported by strong digital literacy and advanced national e-health systems. Countries such as Sweden, Denmark, and Finland lead virtual care integration through unified health records, widespread remote monitoring programs, and efficient digital appointment systems. Governments promote telemedicine to improve access in remote and rural areas and address workforce shortages. Hospitals rely on virtual consultations and tele-radiology for faster clinical decision-making. High trust in digital services, robust cybersecurity frameworks, and strong investment in health technology accelerate the region’s telemedicine expansion.

Southern Europe

Southern Europe holds a 19% share of the Europe Telemedicine market, driven by rising demand for remote care and modernization of public health systems. Italy, Spain, and Portugal expand teleconsultation services to manage chronic diseases, reduce hospital crowding, and support aging populations. COVID-19 accelerated digital adoption across regional providers, leading to greater use of e-prescriptions and mobile health platforms. Growing investment in cloud-based telehealth systems and EU-funded digital infrastructure upgrades improve accessibility. Despite regional disparities in connectivity, Southern Europe continues to scale virtual care adoption across primary care and specialty services.

Eastern Europe

Eastern Europe captures a 16% share, supported by ongoing digital transformation and growing acceptance of virtual care services. Countries such as Poland, Romania, and Hungary increasingly adopt teleconsultation and remote diagnostics to address physician shortages and improve rural healthcare access. Governments invest in national e-health portals, digital prescriptions, and cloud-based telemedicine platforms to strengthen care delivery. Hospitals use virtual tools to reduce patient wait times and manage high outpatient volumes. Although infrastructure gaps persist in rural regions, investment in broadband expansion and health IT modernization drives steady telemedicine growth across Eastern Europe.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Application

- Teleconsultation

- Tele-ICU

- Tele-Radiology

- Tele-Dermatology

By Mode of Delivery

- Web-Based

- Cloud-Based

- On-Premise

By End User

- Hospitals

- Clinics

- Homecare Settings

- Long-Term Care Centers

By Geography

- Western Europe

- Eastern Europe

- Northern Europe

- Southern Europe

Competitive Landscape

The Europe Telemedicine market features strong participation from major players such as Philips Healthcare, Siemens Healthineers, GE HealthCare, Teladoc Health, Cerner Corporation, Medtronic plc, Cisco Systems, AMD Global Telemedicine, Babylon Health, and ResMed. These companies compete by expanding virtual consultation platforms, enhancing remote monitoring technologies, and integrating AI-driven diagnostics into care pathways. Leading vendors invest heavily in cloud-based telehealth systems, interoperability upgrades, and secure data exchange frameworks tailored to European regulations. Many players form strategic partnerships with hospitals, insurers, and telecom operators to scale virtual care delivery. Product innovation focuses on real-time analytics, wearable connectivity, and integrated digital workflows that improve clinical efficiency. Companies also strengthen market presence through acquisitions, localized service models, and country-specific digital health collaborations. As demand grows for chronic disease management, home-based care, and cross-border virtual services, competitive activity intensifies across both established medical-device firms and emerging digital health innovators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, GE HealthCare announced a multi-year partnership with the large health system Ascension to improve patient access and care quality through digital health collaboration.

- In 2025, Philips Healthcare advanced AI-based image analysis and telehealth-enabled remote care offerings.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Mode of Delivery, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Virtual consultations will become a routine part of primary and specialty care across Europe.

- Remote patient monitoring will expand as chronic disease management programs scale.

- AI-driven decision support will improve diagnostic accuracy and streamline clinical workflows.

- Cross-border telemedicine services will grow as digital health interoperability strengthens.

- Cloud-based platforms will replace older systems due to better scalability and security.

- Home-based care models will rise as aging populations require continuous support.

- Tele-ICU and tele-radiology adoption will increase to address specialist shortages.

- Digital health investments will accelerate modernization across hospitals and clinics.

- Data security enhancements will shape platform development and vendor strategies.

- Partnerships between technology firms and healthcare providers will expand digital care integration.