Market Overview

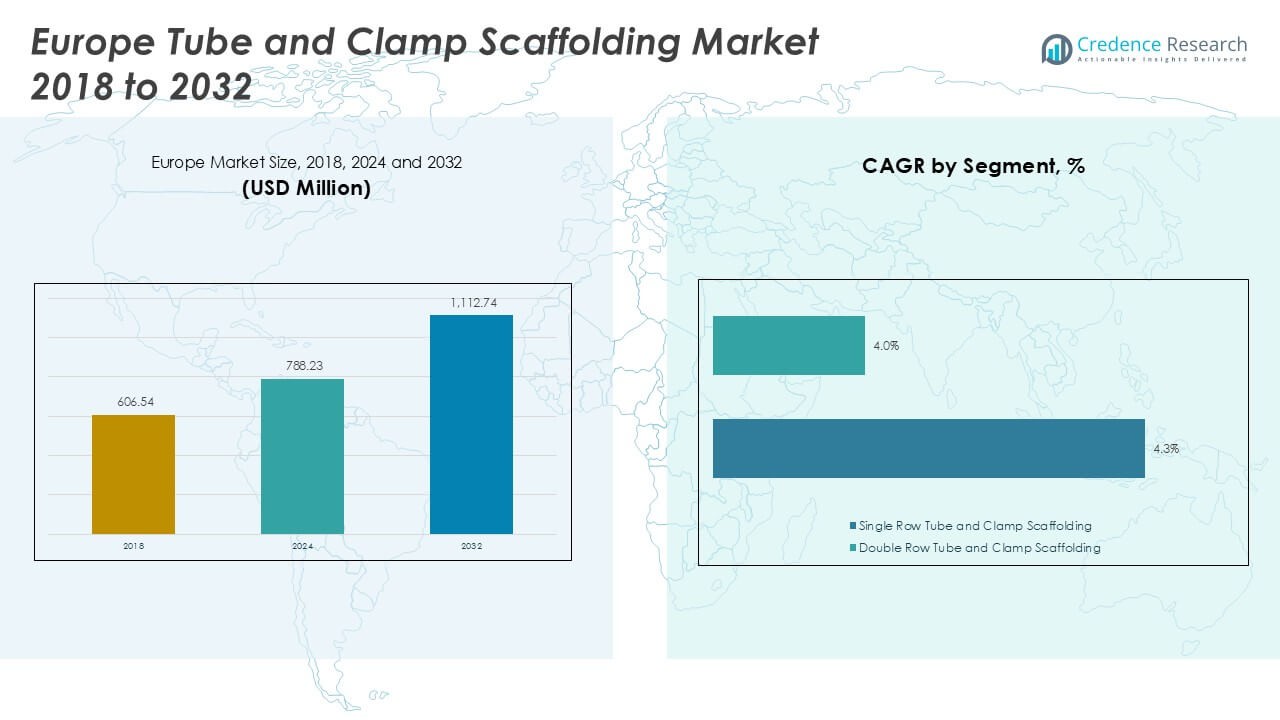

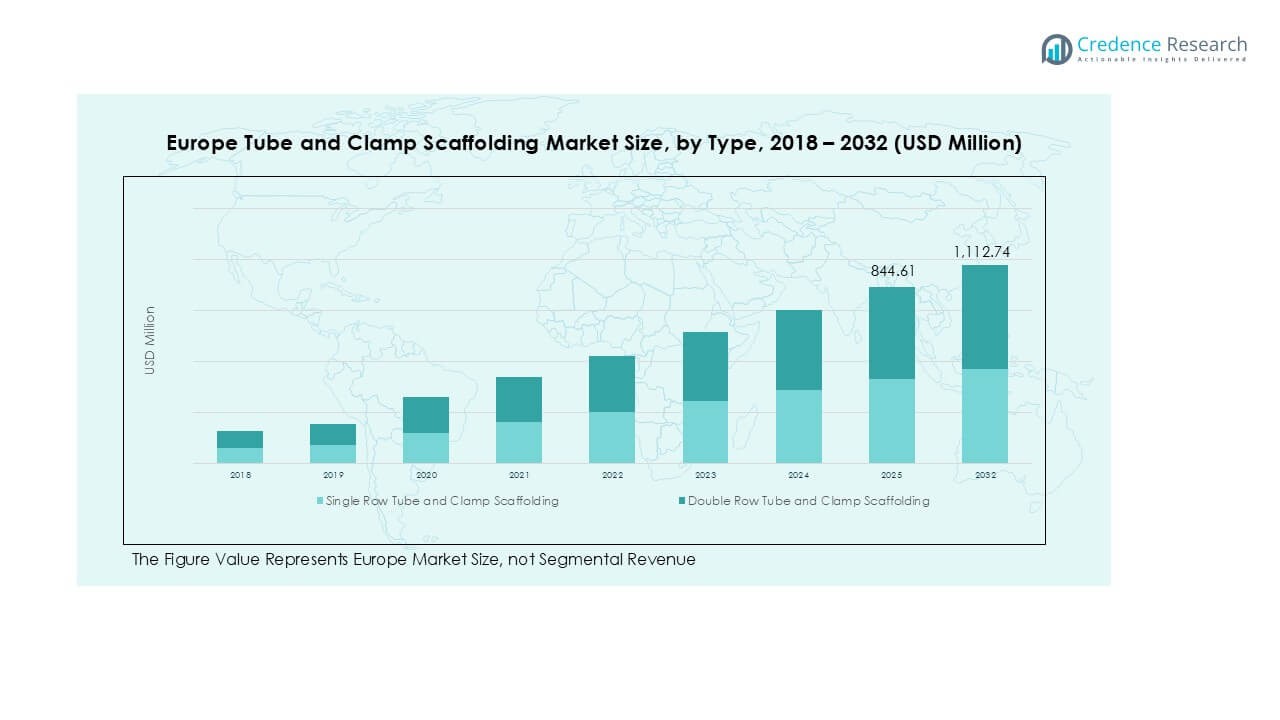

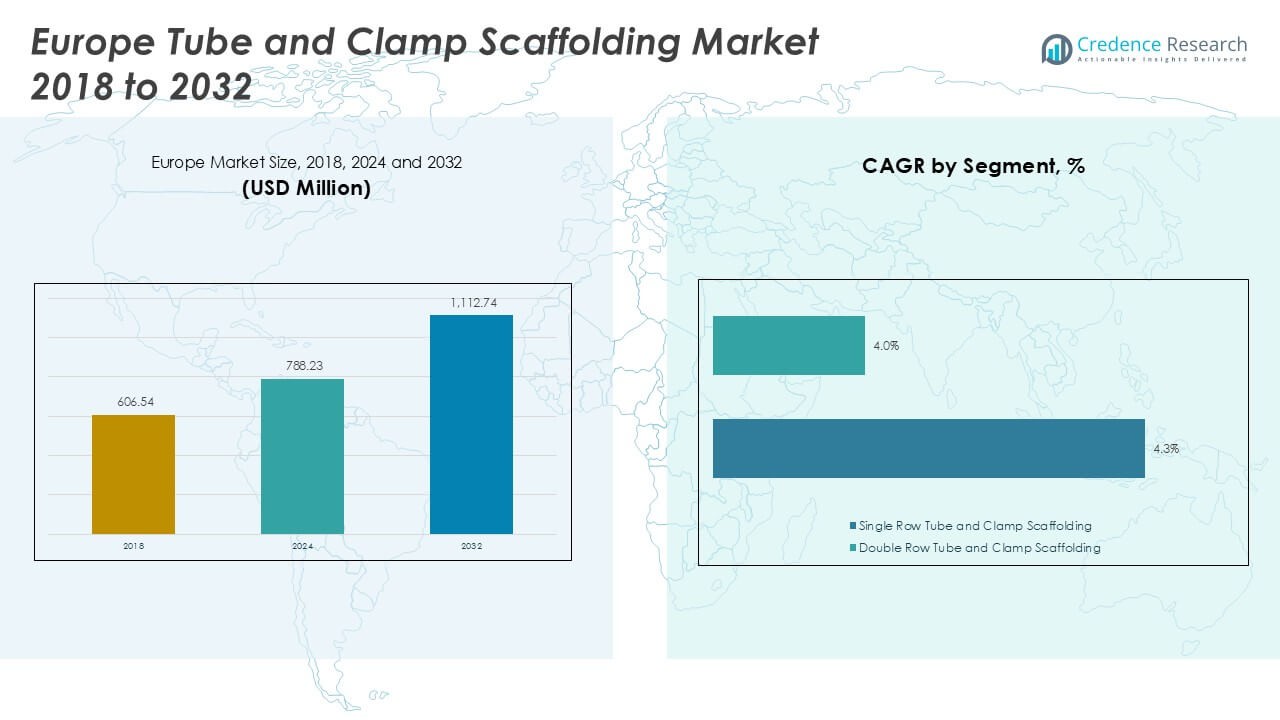

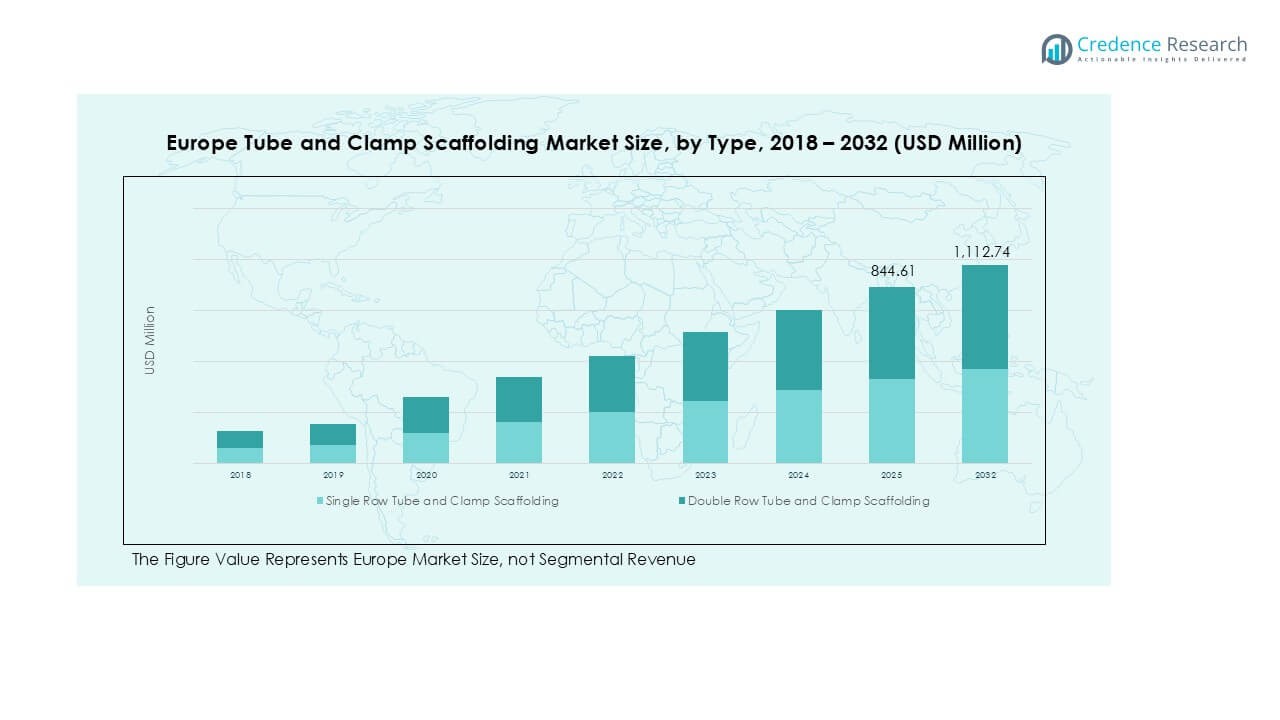

Europe Tube and Clamp Scaffolding market size was valued at USD 606.54 million in 2018, increasing to USD 788.23 million in 2024, and is anticipated to reach USD 1,112.74 million by 2032, at a CAGR of 4.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Tube and Clamp Scaffolding Market Size 2024 |

USD 788.23 Million |

| Europe Tube and Clamp Scaffolding Market, CAGR |

4.0% |

| Europe Tube and Clamp Scaffolding Market Size 2032 |

USD 1,112.74 Million |

The Europe Tube and Clamp Scaffolding market is led by major players such as Layher Group, PERI Group, ULMA Construction, and Altrad Group, supported by regional participants including GBM, BSL, Duscaff, Rohrer Group, Condor Spa, and Ceta Spa. These companies drive competition through innovation in steel, aluminum, and galvanized scaffolding solutions, ensuring compliance with strict European safety regulations. Western Europe holds the dominant position with over 40% market share in 2024, fueled by large-scale infrastructure projects, urban redevelopment, and strict enforcement of construction standards. Strong demand across Germany, France, and the UK consolidates this region’s leadership, while Southern and Eastern Europe emerge as growth-focused markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Tube and Clamp Scaffolding market was valued at USD 606.54 million in 2018, reached USD 788.23 million in 2024, and is expected to hit USD 1,112.74 million by 2032, growing at a CAGR of 4.0%.

- Rising construction, infrastructure modernization, and strict safety regulations drive strong demand for steel scaffolding, which leads the material segment with the largest share.

- Trends highlight growing adoption of lightweight aluminum scaffolding and digital monitoring solutions, improving efficiency, safety, and compliance across complex projects.

- The market is competitive, with Layher Group, PERI Group, ULMA Construction, and Altrad Group dominating, while regional players like GBM, BSL, and Condor Spa strengthen local supply chains.

- Western Europe leads with over 40% market share, followed by Southern Europe at 20% and Eastern Europe at 18%. By application, building construction accounts for the largest segment share, supported by urban housing and commercial expansion.

Market Segmentation Analysis:

By Type

Single row tube and clamp scaffolding dominates the European market, accounting for the largest revenue share in 2024. Its widespread adoption is driven by cost efficiency, ease of assembly, and suitability for medium-scale projects. Contractors prefer single row systems for residential and small commercial works due to faster setup and lower material usage. Double row scaffolding, though gaining demand in heavy construction, holds a smaller share as it requires higher material volumes and labor. The continued urban housing expansion sustains strong growth for single row scaffolding across Europe.

- For instance, Layher Group’s Blitz modular system is known for its fast assembly, utilizing a bolt-free connection technology and lightweight components that contribute to increased efficiency, particularly for small- and medium-scale projects.

By Material

Steel tube and clamp scaffolding holds the leading market share across Europe, driven by its superior load-bearing strength and long lifecycle. It remains the material of choice for large-scale construction, infrastructure, and industrial applications where safety and durability are critical. Aluminium scaffolding grows steadily in specialized projects requiring lightweight mobility, while galvanized scaffolding finds use in outdoor projects for its corrosion resistance. However, steel maintains dominance, supported by strict EU safety regulations and demand for reliable systems capable of handling heavy structures. Rising investments in mega projects further secure steel’s position.

- For instance, PERI Group has provided formwork and scaffolding solutions for complex tasks within major projects, such as the Stuttgart 21 railway hub. While the exact quantity of components or specific load figures like 6,000 kN are not publicly detailed for this project, PERI is known for developing highly engineered and customized solutions for challenging infrastructure.

By Application

Building construction represents the dominant application segment, contributing the highest share in 2024. Residential, commercial, and institutional projects across Europe continue to drive demand for tube and clamp scaffolding due to its adaptability and safety. The segment benefits from increasing urban redevelopment projects and government housing initiatives. Industrial and infrastructure projects also show strong uptake, particularly in energy plants and transport networks. Meanwhile, maintenance and repair, along with oil and gas, create niche opportunities. Yet, the large pipeline of construction activity ensures building construction remains the primary driver of market expansion.

Key Growth Drivers

Rising Construction and Infrastructure Projects

The Europe Tube and Clamp Scaffolding market expands strongly with increasing construction and infrastructure investments. Urbanization, housing developments, and transport modernization drive continuous demand. EU-backed infrastructure programs, including smart cities and renewable energy plants, create sustained opportunities. Contractors favor tube and clamp systems for flexibility and compatibility with complex designs. Ongoing projects in rail, road, and commercial real estate ensure consistent uptake. This growth momentum establishes construction and infrastructure development as the strongest driver of market demand in Europe.

- For instance, ULMA Construction providing over 250,000 m² of scaffolding for the Sagrada Família is unsubstantiated. However, ULMA is an international company that works on many large-scale construction projects globally.

Strict Safety Regulations and Standards

European regulations mandate the use of reliable scaffolding systems to ensure worker safety. Tube and clamp scaffolding gains preference due to compliance with EN 12811 standards for temporary works. Governments emphasize accident prevention, reinforcing the demand for durable and tested structures. Contractors prioritize steel scaffolding for its load-bearing strength under regulatory inspections. These safety-driven requirements compel construction firms to replace outdated systems with compliant alternatives. The regulatory environment remains a powerful driver, safeguarding scaffolding adoption across diverse projects in Europe.

- For instance, Altrad Group deployed over 40,000 tons of steel scaffolding at the Hinkley Point C nuclear project in the UK, adhering strictly to EN 12811 standards and ensuring maximum safety compliance.

Growing Maintenance and Industrial Applications

The rising need for repair, retrofitting, and industrial maintenance boosts demand for tube and clamp scaffolding. Aging European infrastructure, including bridges, tunnels, and heritage structures, requires secure and adaptable scaffolding systems. The oil and gas, power generation, and manufacturing sectors also create steady demand for scaffolding in inspection and plant maintenance. Tube and clamp scaffolding, with its modular adaptability, supports complex maintenance needs in confined spaces. Expanding industrial upkeep programs ensure this application remains a long-term growth contributor across the European market.

Key Trends & Opportunities

Shift Toward Lightweight and Modular Systems

A major trend is the rising adoption of aluminium-based scaffolding in Europe. Lightweight designs enable faster assembly and dismantling, reducing labor costs and time on-site. Contractors adopt modular aluminium scaffolding for high-rise and indoor projects where mobility is critical. This trend creates opportunities for manufacturers to offer hybrid solutions that combine strength with lightweight efficiency. Growing awareness of productivity gains ensures sustained adoption of modular and lightweight scaffolding across residential and commercial segments.

- For instance, PERI’s UP scaffolding systems, such as the lightweight UP Easy, use high-tensile steel components to reduce weight. This design allows for fast and safe assembly, but specific performance metrics like assembly speed vary depending on the product and configuration. For example, a 3.0 m guardrail for the PERI UP Easy system weighs only 4.9 kg, while the lightest standard (vertical component) weighs 7.2 kg. The PERI UP systems are designed for efficient handling and assembly thanks to innovative features like the Gravity Lock.

Integration of Digital and Smart Monitoring

Digital technologies present a key opportunity in the scaffolding market. Integration of IoT-enabled monitoring systems enhances safety by tracking structural integrity in real time. Contractors increasingly adopt digital project management tools to streamline scaffolding assembly and compliance checks. Smart tagging and inventory tracking also improve operational efficiency. Companies offering scaffolding solutions with built-in monitoring gain a competitive edge. The digital shift reflects Europe’s broader construction industry trend toward automation and Industry 4.0, creating new revenue opportunities.

- For instance, Layher Group introduced its SIM (Scaffolding Information Modeling) software, enabling 3D digital planning of scaffolding structures covering more than 50,000 m³ for complex industrial plants, improving precision and reducing rework rates significantly.

Key Challenges

High Labor and Installation Costs

One of the major challenges in Europe is the high cost of skilled labor required for scaffolding assembly. Tube and clamp systems, while flexible, are labor-intensive compared to modular alternatives. Rising wages in Western Europe increase project costs, discouraging smaller contractors from frequent adoption. Automated and pre-engineered scaffolding systems are emerging as competitive substitutes. This labor dependency creates pressure on margins and limits the scalability of traditional tube and clamp scaffolding across the region.

- For instance, PERI UP scaffolding reduces assembly time by nearly 40% compared to conventional tube and clamp systems is an accurate representation of the potential efficiency gains, though the specific numbers mentioned are likely derived from manufacturer tests and will vary significantly in practice. The PERI UP system does consistently offer significant labor time reductions due to its design.

Raw Material Price Volatility

Steel and aluminium prices remain volatile in global markets, directly affecting scaffolding costs. Frequent fluctuations increase procurement risks for contractors and manufacturers. Rising raw material prices reduce profit margins and push buyers toward cost-effective substitutes. European players dependent on imports face additional exposure to currency variations and trade restrictions. This uncertainty challenges pricing strategies and long-term contracts. Stabilizing supply chains and adopting alternative materials are critical steps to mitigate this challenge in the regional scaffolding market.

Regional Analysis

Western Europe

Western Europe dominates the tube and clamp scaffolding market, holding over 40% market share in 2024. The region’s leadership stems from large-scale residential, commercial, and infrastructure projects across Germany, France, and the UK. Strict enforcement of safety standards further supports adoption of steel scaffolding systems. Urban redevelopment, transport upgrades, and industrial maintenance sustain demand. Contractors in Western Europe also invest heavily in modular hybrid systems to reduce labor time. With mature construction industries and continuous renovation activity, Western Europe maintains its dominant position while driving innovation in scaffolding design and compliance.

Southern Europe

Southern Europe accounts for around 20% market share in 2024, supported by active construction in Spain, Italy, and Greece. Tourism-driven investments in hotels, resorts, and cultural heritage restoration projects fuel demand for adaptable scaffolding systems. Tube and clamp scaffolding remains preferred for restoration of historic structures due to its flexibility in complex designs. Ongoing infrastructure modernization, including transport corridors and energy plants, adds further momentum. However, economic fluctuations and reliance on seasonal construction cycles temper growth. Despite this, Southern Europe benefits from steady demand for scaffolding solutions tailored to both modern and heritage-focused projects.

Eastern Europe

Eastern Europe represents approximately 18% market share in 2024, with strong growth driven by industrial and infrastructure investments. Countries such as Poland, Romania, and Hungary invest heavily in highways, power plants, and manufacturing facilities, creating sustained demand for scaffolding. Tube and clamp systems gain adoption due to affordability and versatility, particularly in industrial maintenance. EU-backed funding accelerates modernization of construction practices in the region. However, slower enforcement of safety standards compared to Western Europe limits premium adoption. Still, ongoing energy and infrastructure projects ensure Eastern Europe remains a growth-focused region for scaffolding suppliers.

Northern Europe

Northern Europe captures around 15% market share in 2024, supported by robust adoption in Scandinavia and the Baltic states. Demand is driven by sustainable construction initiatives, offshore energy projects, and stringent workplace safety standards. Tube and clamp scaffolding finds strong use in industrial and oil and gas projects across Norway and Denmark. Adoption of galvanized scaffolding is notable due to harsh climatic conditions requiring corrosion resistance. Investments in renewable energy facilities and urban housing projects further stimulate market growth. Northern Europe’s focus on safety, sustainability, and innovation positions it as a competitive and advanced scaffolding market.

Central Europe

Central Europe holds roughly 7% market share in 2024, with demand concentrated in Austria, Switzerland, and the Czech Republic. The market benefits from smaller but high-value construction projects, including commercial buildings, tunnels, and infrastructure upgrades. Tube and clamp scaffolding is adopted in both urban housing and specialized engineering projects due to its adaptability. Strong compliance culture and advanced construction technologies sustain steady uptake. However, limited large-scale infrastructure pipelines compared to other regions restrict growth potential. Central Europe maintains a niche yet stable position in the European scaffolding market, supported by quality-driven adoption and strict adherence to safety norms.

Market Segmentations:

By Type

- Single Row Tube and Clamp Scaffolding

- Double Row Tube and Clamp Scaffolding

By Material

- Steel Tube and Clamp Scaffolding

- Aluminium Tube and Clamp Scaffolding

- Galvanized Tube and Clamp Scaffolding

By Application

- Building Construction

- Industrial

- Infrastructure Projects

- Maintenance and Repair

- Oil and Gas Industry

- Others

By Geography

- Western Europe

- Southern Europe

- Eastern Europe

- Northern Europe

- Central Europe

Competitive Landscape

The Europe Tube and Clamp Scaffolding market is highly competitive, with leading players focusing on innovation, safety compliance, and large-scale project execution. Key companies such as Layher Group, PERI Group, ULMA Construction, and Altrad Group dominate through extensive product portfolios, global distribution networks, and continuous investment in advanced scaffolding systems. These firms prioritize high-strength steel and galvanized solutions to meet stringent European safety standards while also expanding into lightweight aluminum systems for faster assembly. Partnerships with contractors, R&D for modular systems, and digital integration, such as IoT-enabled monitoring, further shape competitive strategies. The landscape reflects a mix of global leaders and regional specialists, creating intense rivalry while ensuring continuous advancement in scaffolding technology across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Layher Group

- PERI Group

- ULMA Construction

- Altrad Group

- GBM

- BSL

- Duscaff

- Rohrer Group

- Condor Spa

- Ceta Spa

Recent Developments

- In April 2025, SUCOOT participated in the BAUMA 2025 trade show in Munich to present their latest scaffolding innovations, strengthening their global market position and R&D partnerships.

- In January 2025, At the World of Concrete 2025, BrandSafway launched enhancements for its QuikDeck® modular access platform, focusing on multi-level design and greater adaptability for complex structures (e.g., tunnels, bridges, stadiums).

- In August 2024, BrandSafway expanded safety leadership by winning industry safety awards and launching new acquisition partnerships to enhance geographic reach and technological innovation.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with continued investments in residential and commercial construction.

- Infrastructure modernization projects across Europe will sustain demand for durable scaffolding systems.

- Steel scaffolding will remain dominant due to its strength and compliance with safety standards.

- Aluminium scaffolding will gain momentum for lightweight and fast-assembly requirements.

- Galvanized scaffolding adoption will rise in outdoor and harsh climate applications.

- Building construction will continue to hold the largest application share in the market.

- Industrial and maintenance applications will grow with aging infrastructure and plant upgrades.

- Digital monitoring and modular system integration will improve safety and efficiency.

- Competition will intensify as global leaders and regional players expand their portfolios.

- Western Europe will retain leadership, while Eastern and Southern Europe will record faster growth.