| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Water Pump Market Size 2023 |

USD 14,700.86 Million |

| Europe Water Pump Market, CAGR |

3.47% |

| Europe Water Pump Market Size 2032 |

USD 19,987.90 Million |

Market Overview:

Europe Water Pump Market size was valued at USD 14,700.86 million in 2023 and is anticipated to reach USD 19,987.90 million by 2032, at a CAGR of 3.47% during the forecast period (2023-2032).

Several key drivers are propelling the growth of the Europe water pump market. The introduction of intelligent pump systems is a significant factor, as these advanced systems offer improved efficiency and reliability, catering to the evolving needs of industries. Additionally, the reduction in energy consumption requirements across European countries is encouraging the adoption of energy-efficient water pumps. The growing emphasis on sustainable practices and the need to address emerging markets, including chemicals and petrochemicals, further contribute to market expansion. Moreover, the increasing adoption of modern farming practices, such as hydroponics and vertical farming, is driving the demand for water pumps in the agricultural sector. Stringent environmental regulations are pushing industries to replace outdated systems with newer, eco-friendlier technologies. Additionally, rapid industrial automation and the integration of IoT-enabled monitoring solutions in pumping systems are enhancing operational efficiency and lifecycle management.

Germany holds a significant share of the Europe water pump market, driven by strict wastewater treatment laws and a strong focus on energy efficiency. The country’s emphasis on reducing energy consumption in pump operations aligns with the broader European Union directives on sustainability. The United Kingdom is also witnessing growth in the water pump market, supported by government initiatives promoting energy efficiency in residential and commercial sectors. France, Italy, and Spain are other notable contributors, with increasing investments in infrastructure and water management systems. Overall, the regional landscape is characterized by a collective push towards sustainable water management solutions, fostering the adoption of advanced water pump technologies across Europe. In Eastern Europe, countries like Poland and the Czech Republic are modernizing aging water infrastructure, creating new growth opportunities. Meanwhile, Nordic countries are adopting renewable energy-powered pumping solutions, reinforcing the shift toward decarbonized systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Europe Water Pump Market size was valued at USD 14,700.86 million in 2023 and is anticipated to reach USD 19,987.90 million by 2032, at a CAGR of 3.47% during the forecast period (2023-2032).

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Intelligent pump systems with IoT capabilities are gaining traction, enhancing operational efficiency and reducing downtime across industrial applications.

- Energy-efficient pump adoption is accelerating due to the EU’s stringent emission and energy conservation directives, especially in HVAC and water treatment sectors.

- Urbanization and infrastructure modernization, including smart water grids and wastewater systems, are driving consistent demand across Western and Central Europe.

- Agricultural transformation, with the adoption of hydroponics and precision irrigation, is boosting pump deployment in rural and semi-urban areas.

- High initial investment costs and a shortage of skilled professionals in smart technologies are limiting faster adoption in certain segments.

- Germany leads the market share due to strict environmental policies, while Eastern Europe and Nordic regions show growing potential through infrastructure upgrades and renewable-powered pumps.

Market Drivers:

Growing Demand for Energy-Efficient Solutions

The increasing emphasis on energy conservation across Europe is a primary factor driving the growth of the water pump market. Governments and industries are adopting energy-efficient technologies to meet stringent EU regulations aimed at reducing carbon emissions and improving overall system performance. Water pumps, which are integral to applications in water supply, HVAC, agriculture, and industrial processes, are being upgraded with advanced technologies to reduce power consumption and operating costs. As a result, manufacturers are focusing on designing pumps that comply with energy efficiency standards, such as the EU’s Ecodesign Directive, encouraging greater adoption among end-users.

Advancement in Smart Pump Technologies

Technological advancements have led to the emergence of intelligent water pump systems, which is significantly influencing market growth. These smart pumps come equipped with features such as real-time monitoring, automated control, predictive maintenance, and remote diagnostics. For example, smart pumps designed for Industry 4.0 utilize digital twins—virtual replicas of physical pumps—to provide continuous operational data and enhance system reliability. The integration of sensors and IoT-based solutions enhances the operational efficiency and reliability of pumping systems, especially in critical infrastructure. Industries across sectors such as oil and gas, water treatment, and manufacturing are increasingly deploying these systems to reduce downtime and improve process automation. This technological shift aligns with Europe’s broader digital transformation goals and is expected to accelerate the modernization of existing pump systems.

Urbanization and Infrastructure Development

Rapid urbanization and increasing investments in infrastructure development across European nations are further propelling the water pump market. Countries are expanding water supply networks, modernizing wastewater treatment plants, and upgrading urban utilities to accommodate rising population densities and climate resilience strategies. The construction of residential and commercial buildings with integrated water management systems has become a critical priority for local governments. As a result, demand for high-capacity and efficient water pumps is growing, particularly for municipal water supply, irrigation, and drainage applications. The construction sector’s sustained momentum supports continuous demand for a broad range of water pumping solutions.

Agricultural Transformation and Sustainable Water Management

The adoption of advanced agricultural practices is contributing to increased demand for water pumps in the European market. As farmers transition toward precision agriculture, hydroponics, and vertical farming, the need for efficient irrigation systems equipped with modern pump technology is on the rise. For instance, initiatives like the EU’s Water Framework Directive encourage sustainable water resource management by promoting technologies that optimize water use. Water scarcity issues and the need for optimized water usage are also pushing the adoption of automated pump systems that regulate water flow according to crop requirements. Additionally, the European Union’s focus on sustainable water resource management, through initiatives such as the Water Framework Directive, is encouraging the deployment of environmentally friendly pumping solutions across the agricultural and rural water supply sectors. These developments are expected to provide long-term momentum to the regional water pump market.

Market Trends:

Rising Integration of Variable Frequency Drives (VFDs)

The integration of Variable Frequency Drives (VFDs) is transforming the European water pump market by enabling precise control over pump speed and output, which enhances energy efficiency and reduces operational costs. For instance, VFD-enabled pumps are increasingly adopted in industrial and municipal water systems to comply with EU energy efficiency mandates. These systems optimize fluid dynamics, particularly in urban water networks, where fluctuating demand is common. Furthermore, advancements in VFD technology, such as improved power electronics and IoT integration, have made these solutions more accessible and efficient

Shift Toward Renewable Energy-Powered Pumping Systems

The region is witnessing a notable shift toward renewable energy-powered pumping solutions, particularly in remote and agricultural settings. Solar-powered water pumps are gaining traction in countries such as Spain, Italy, and Greece due to their ability to operate independently from the grid. These systems offer a sustainable and cost-effective alternative to traditional pumps, especially in areas with high solar irradiance. Government subsidies and incentives for clean energy adoption are further supporting this transition. The rising deployment of renewable energy-driven pumps underscores Europe’s commitment to achieving its climate goals and reducing reliance on fossil fuels.

Adoption of Modular and Portable Pumping Solutions

Modular and portable water pump systems are becoming increasingly popular in the European market, especially in sectors requiring flexible and mobile water management solutions. Construction, mining, and emergency response sectors are driving the demand for easily deployable pumps that can be quickly assembled, disassembled, and relocated. These systems provide operational convenience and reduce downtime, particularly in temporary setups or disaster recovery situations. Manufacturers are responding by developing lightweight and compact designs that cater to a broad range of applications, enabling faster response and enhanced adaptability across multiple environments. For instance, modular pumps are increasingly used in fire-fighting applications within the oil & gas sector due to their efficiency and reliability.

Increased Focus on Smart Water Infrastructure

The push for smart water infrastructure is fostering the integration of digital technologies within pump systems across Europe. Utilities and municipalities are investing in intelligent water networks that incorporate advanced monitoring and analytics to improve water distribution, detect leaks, and manage assets more efficiently. Smart pumps that communicate in real-time with centralized control systems are essential to this transformation. The trend reflects broader urban modernization initiatives aimed at improving water sustainability, enhancing service reliability, and achieving long-term operational cost savings. As a result, demand for digitally enabled pumping solutions continues to grow, reinforcing the digital evolution of Europe’s water sector.

Market Challenges Analysis:

High Initial Investment and Installation Costs

One of the major restraints impacting the growth of the Europe water pump market is the high upfront cost associated with advanced pump systems. Intelligent and energy-efficient pumps equipped with digital technologies, sensors, and automation features require significant capital investment. These high initial costs can deter small- and medium-sized enterprises and budget-constrained municipalities from adopting modern systems, particularly in regions where return on investment is not immediately evident. Additionally, the installation and integration of such systems often involve complex retrofitting processes, further increasing the total project cost.

Stringent Regulatory and Compliance Requirements

The water pump industry in Europe is subject to a wide range of environmental, safety, and efficiency regulations that vary across countries. For example, adherence to the EU Ecodesign Directive (Commission Regulation No. 547/2012) requires manufacturers to meet minimum efficiency standards for rotodynamic water pumps, necessitating ongoing investments in product innovation and certification. While these regulations aim to ensure sustainable practices, they often impose compliance burdens on manufacturers and end-users. Meeting standards such as the EU Ecodesign Directive or regional water management laws demands ongoing investment in product innovation, documentation, and certification. Smaller manufacturers may struggle to keep pace with these requirements, leading to reduced market participation and limiting product diversity.

Fluctuating Raw Material Prices and Supply Chain Disruptions

The volatility in raw material prices, particularly metals and electronic components, poses a significant challenge for water pump manufacturers. Price fluctuations increase production costs and reduce profit margins, making it difficult for companies to offer competitively priced products. Moreover, recent global supply chain disruptions have delayed the delivery of critical components, causing project slowdowns and hindering market growth. Manufacturers must manage these uncertainties while maintaining quality and delivery timelines, which places additional pressure on operational efficiency.

Lack of Skilled Workforce for Advanced Technologies

As the market shifts toward smart and automated pump systems, the demand for skilled technicians capable of managing installation, programming, and maintenance has increased. However, the shortage of such specialized professionals across Europe creates challenges in scaling advanced solutions efficiently.

Market Opportunities:

The Europe water pump market presents substantial growth opportunities driven by the continent’s strategic investments in sustainable infrastructure and water management systems. As the European Union continues to prioritize environmental sustainability, significant funding is being directed toward upgrading municipal water supply networks, wastewater treatment facilities, and flood management systems. These initiatives open new avenues for manufacturers of advanced and energy-efficient water pumps, particularly in urban redevelopment and smart city projects. The increasing demand for intelligent pumps integrated with IoT and sensor technologies creates further opportunity for suppliers capable of offering connected solutions that align with the EU’s digital and green transformation goals.

In addition, the growing focus on climate-resilient agriculture and rural water access offers promising prospects for water pump deployment. Emerging applications in drip irrigation, precision farming, and sustainable aquaculture are generating demand for reliable and low-energy pumping systems, particularly in Southern and Eastern Europe. Moreover, the expansion of renewable energy infrastructure, such as solar-powered pumping in off-grid areas, provides untapped market potential. As regulatory bodies and end-users seek systems that reduce operational costs and improve water efficiency, companies that invest in innovative product design, remote monitoring capabilities, and decentralized water pumping technologies are well-positioned to capture market share. These evolving needs across urban, industrial, and agricultural sectors collectively reinforce the long-term opportunity for growth and innovation in the European water pump market.

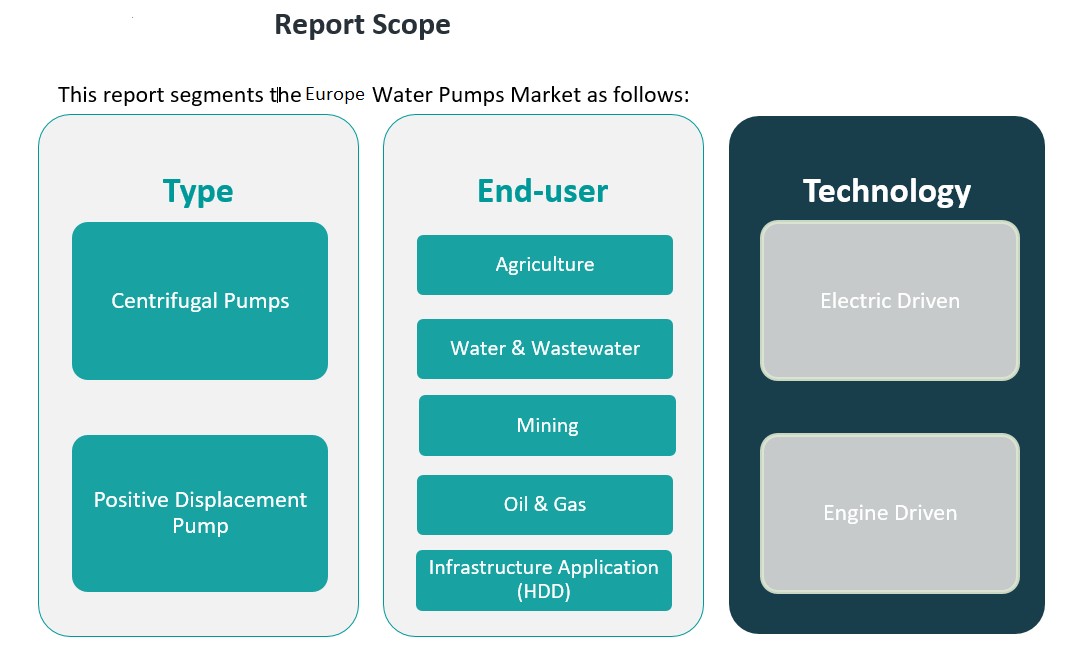

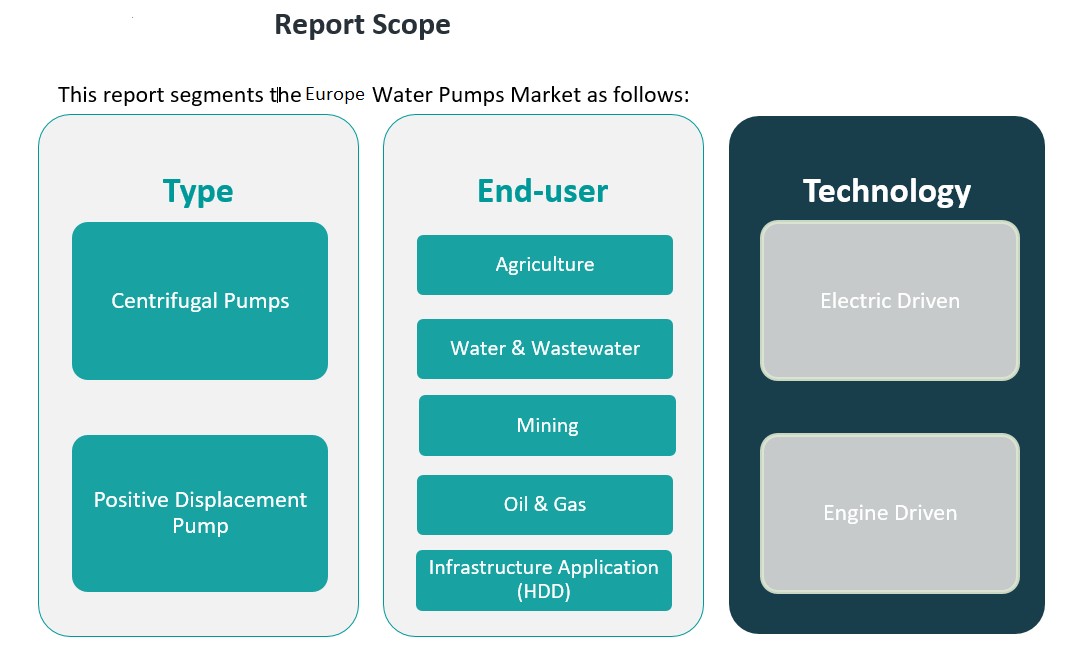

Market Segmentation Analysis:

The Europe water pump market is segmented by type, end-user, and technology, each contributing uniquely to the market’s overall growth trajectory.

By type, centrifugal pumps dominate the market due to their widespread application in water supply, HVAC, and irrigation systems. Their simple design, high efficiency, and cost-effectiveness make them the preferred choice across municipal and industrial sectors. Positive displacement pumps, while occupying a smaller market share, are gaining traction in applications that require precise flow control and handling of viscous or abrasive fluids, particularly in oil & gas and chemical processing industries.

By end-user segmentation, the water and wastewater sector holds a significant share, driven by increased investment in upgrading aging infrastructure and complying with EU water quality regulations. The agriculture sector also contributes notably to demand, with rising adoption of modern irrigation techniques and climate-resilient farming practices. The oil & gas and mining sectors continue to rely on robust pumping solutions for fluid handling in demanding environments. Additionally, the infrastructure segment, particularly horizontal directional drilling (HDD), is emerging as a key area due to its role in modern construction and utility projects.

By technology, electric-driven pumps represent the dominant segment, supported by the region’s focus on energy-efficient and low-emission solutions. Their compatibility with smart grid systems and integration with IoT platforms further boost adoption. Engine-driven pumps, while less common, remain essential in remote or off-grid applications where electric power access is limited, offering flexibility in agriculture, construction, and emergency services.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The Europe water pump market exhibits a diverse regional landscape, with varying degrees of market penetration and growth potential across different countries. Germany leads the market, accounting for approximately 24% of the total European market share in 2023. This dominance is attributed to the country’s rapid industrialization, urbanization, and escalating demand for fluid handling and safe drinking water. Germany’s stringent environmental regulations and emphasis on energy efficiency further bolster the adoption of advanced water pump technologies.

The United Kingdom holds a significant position in the European water pump market, driven by the country’s focus on energy efficiency in both residential and commercial sectors. The UK’s stringent regulations on water use and waste management are encouraging the adoption of high-efficiency water pumps in various applications. Municipal and industrial sectors are particularly adopting energy-efficient pumps to meet sustainability goals and reduce operational costs.

France, Italy, and Spain are also notable contributors to the European water pump market. France’s market is supported by the country’s commitment to environmental sustainability and investments in water infrastructure. Italy is experiencing rapid growth in the water pump market, driven by increasing investments in renewable energy and wastewater treatment facilities. Spain’s market is influenced by the country’s efforts to improve water management systems and infrastructure.

The Rest of Europe, including countries like Switzerland, Austria, and the Netherlands, collectively contributes to the remaining market share. These countries are witnessing increased investments in infrastructure, further fueling the demand for pumps across various applications, from agriculture to oil & gas. Overall, sustainability, efficiency, and digitization are key themes shaping the Europe water pump market landscape.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- EBARA Corporation

Competitive Analysis:

The Europe water pump market features a competitive landscape marked by the presence of both global and regional players. Leading companies such as Grundfos, Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., and Wilo SE dominate the market through a combination of broad product portfolios, technological innovation, and strong distribution networks. These firms invest heavily in research and development to introduce energy-efficient and smart pumping solutions tailored to evolving industrial and municipal needs. Competitive strategies include mergers, strategic partnerships, and geographic expansion to strengthen market presence. Regional players also contribute significantly by offering cost-effective and application-specific solutions, particularly in local infrastructure and agricultural sectors. The ongoing shift toward sustainable water management and digital technologies continues to intensify competition, encouraging companies to enhance operational efficiency, adopt smart technologies, and align their offerings with EU energy regulations to maintain a competitive edge in the evolving European market landscape.

Recent Developments:

- In September 2024, Grundfos expanded its presence in the European water treatment market by acquiring Culligan’s commercial and industrial (C&I) business in Italy, France, and the UK. This acquisition brought a complementary portfolio of solutions and technologies tailored to industrial and commercial water treatment needs.

- In October 2024, Sulzer Ltd launched the ZF-RO end-suction pump, designed to meet the specific technical requirements of energy recovery device (ERD) booster pump services. This product combines a reliable design with high efficiency, making it suitable for hydrocarbon and desalination industries.

- On February 3, 2025, Ingersoll Rand acquired SSI Aeration, Inc., a leader in wastewater treatment equipment manufacturing. This acquisition aims to integrate SSI’s aeration systems with Ingersoll Rand’s low-pressure compressors to offer comprehensive wastewater solutions.

- On February 28, 2025, KSB introduced its MultiTec Plus pump series designed for energy-efficient drinking water transport. These pumps feature advanced hydraulic systems and real-time monitoring capabilities through KSB Guard. Additionally, KSB reported record sales of nearly €3 billion in 2024, driven by strong demand in the energy and water sector.

Market Concentration & Characteristics:

The Europe water pump market exhibits moderate to high market concentration, with a few dominant players holding a significant share of the industry. Companies such as Grundfos, Wilo SE, and KSB SE & Co. KGaA have established strong brand recognition and extensive distribution networks across the region, enabling them to maintain a competitive advantage. The market is characterized by a strong focus on innovation, energy efficiency, and regulatory compliance, reflecting Europe’s broader environmental and sustainability goals. Technological integration, particularly IoT-enabled and variable speed pump systems, is a defining feature of the market, catering to the rising demand for smart infrastructure solutions. Additionally, customer preferences are shifting toward low-maintenance, durable, and cost-effective products, prompting manufacturers to invest in advanced materials and digital monitoring capabilities. The presence of well-regulated industry standards and environmental directives further shapes the competitive dynamics and product development strategies across the European water pump sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing investments in smart water infrastructure will drive demand for IoT-enabled and automated pump systems.

- Expansion of renewable energy projects will support the growth of solar-powered water pumps in off-grid regions.

- Continued urbanization will boost the need for high-efficiency pumps in residential and commercial construction.

- Rising focus on climate-resilient agriculture will enhance adoption of advanced irrigation pump technologies.

- Stricter EU environmental regulations will accelerate the replacement of outdated, inefficient pump systems.

- Technological innovations in variable frequency drives will improve system efficiency and energy savings.

- Growth in wastewater treatment facilities will increase demand for heavy-duty and corrosion-resistant pumps.

- Regional funding for infrastructure modernization will open new opportunities in Central and Eastern Europe.

- Industry collaboration and R&D investments will lead to the development of more compact and durable solutions.

- Digital service models, including predictive maintenance and remote monitoring, will transform aftermarket strategies.