Market Overview

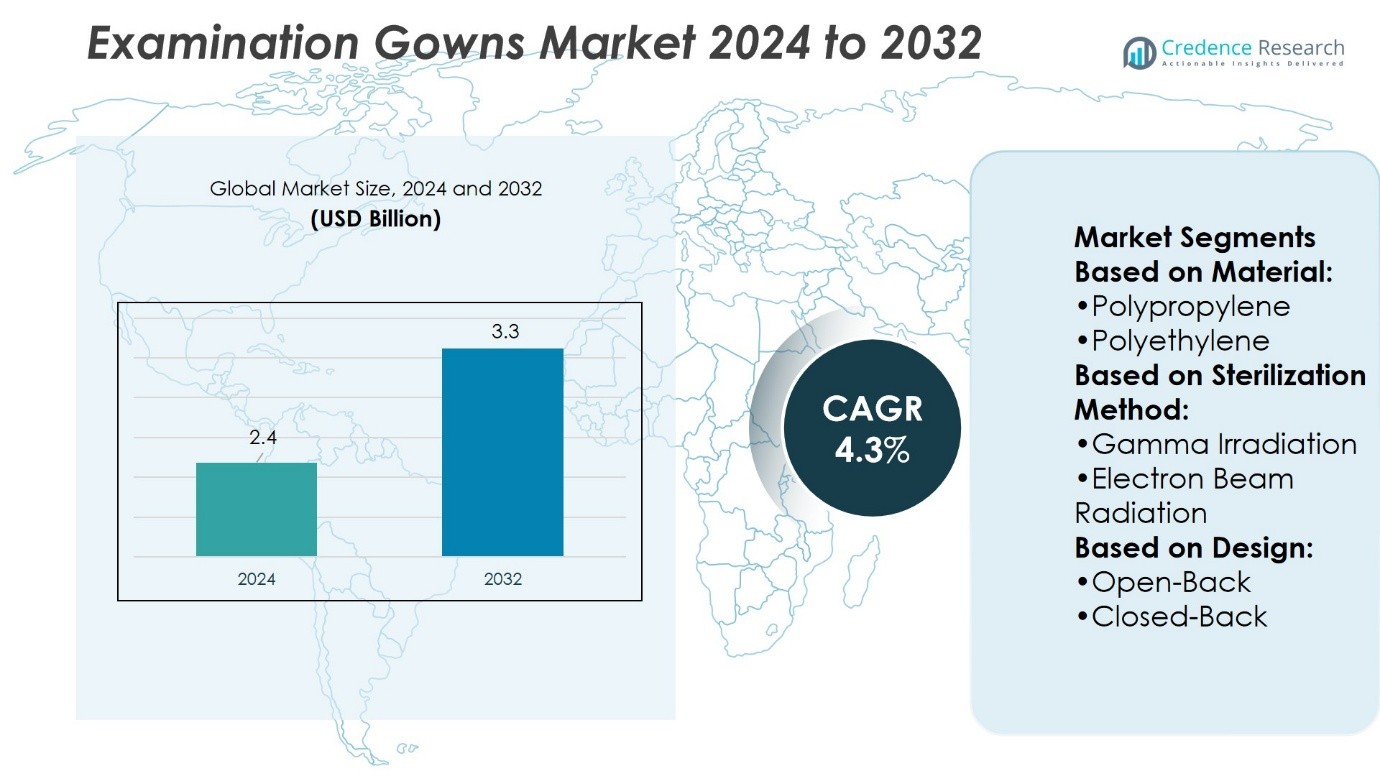

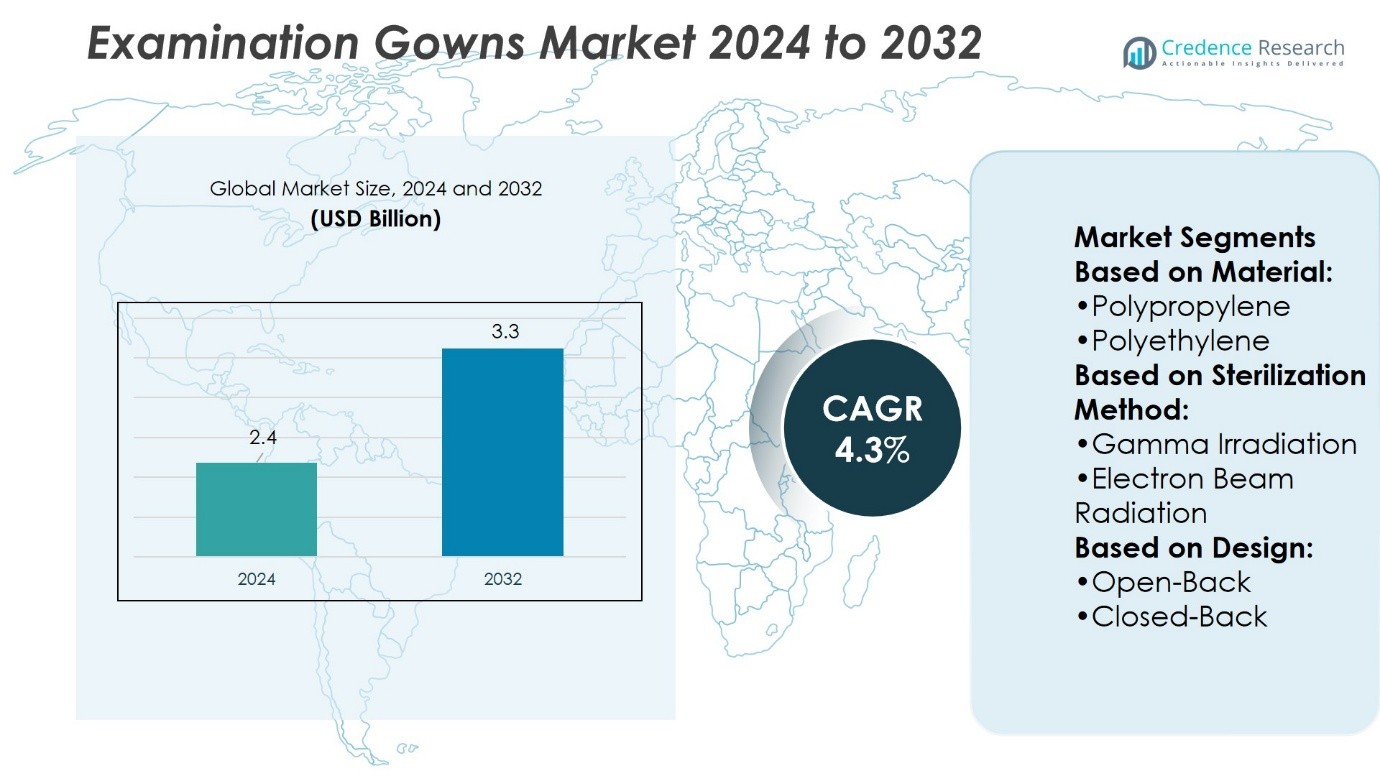

Examination Gowns Market size was valued at USD 2.4 billion in 2024 and is anticipated to reach USD 3.3 billion by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Examination Gowns Market Size 2024 |

USD 2.4 Billion |

| Examination Gowns Market, CAGR |

4.3% |

| Examination Gowns Market Size 2032 |

USD 3.3 Billion |

The Examination Gowns Market grows with rising patient volumes, expanding healthcare infrastructure, and strict infection control protocols. Hospitals, clinics, and diagnostic centers increase gown usage to ensure hygiene and regulatory compliance. Demand for disposable gowns strengthens due to convenience and reduced sterilization costs, while reusable gowns gain traction in high-volume facilities seeking cost efficiency. Technological advancements in nonwoven fabrics improve comfort, durability, and fluid resistance, supporting wider adoption. Growing sustainability initiatives encourage the use of recyclable and eco-friendly materials. Together, these drivers and trends position the market for steady growth across both developed and emerging healthcare economies.

North America leads the Examination Gowns Market with strong healthcare infrastructure and strict safety standards, while Europe follows with emphasis on sustainability and regulatory compliance. Asia-Pacific records the fastest growth, driven by expanding hospitals and medical tourism. Latin America and the Middle East & Africa show gradual adoption supported by rising healthcare investments. Key players such as Kimberly-Clark, Cardinal Health, McKesson Corporation, Stryker, Steris, Baxter International, Owens Minor, Halyard Health, Wallcura, and Asahi Kasei Medical strengthen competition through innovation and global distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Examination Gowns Market size was valued at USD 2.4 billion in 2024 and is anticipated to reach USD 3.3 billion by 2032, at a CAGR of 4.3%.

- Rising patient volumes and expanding healthcare infrastructure drive steady adoption across hospitals and clinics.

- Disposable gowns dominate due to convenience, while reusable gowns gain traction for cost efficiency.

- Key players compete through innovation in materials, distribution efficiency, and sustainability-focused solutions.

- High raw material costs and regulatory compliance pressures act as major restraints.

- North America leads the market, Europe follows with sustainability focus, and Asia-Pacific records fastest growth.

- Latin America and Middle East & Africa show gradual adoption, supported by healthcare investments and rising medical demand.

Market Drivers

Rising Healthcare Infrastructure and Patient Volume

Growing healthcare infrastructure expansion strongly drives the Examination Gowns Market. Rising hospital admissions and outpatient visits require consistent supplies of disposable and reusable gowns. It supports infection control while addressing regulatory compliance for medical facilities. Higher patient inflows in both developed and developing economies amplify demand. It creates a steady market push from hospitals, clinics, and diagnostic centers. With increased health awareness, patients expect safe and hygienic medical apparel, which strengthens gown adoption.

- For instance, Owens & Minor significantly increased its isolation gown production in 2020, achieving a 300% increase in output with new machinery procured through an agreement with the U.S. Department of Defense.

Increasing Focus on Infection Prevention and Control

Stringent infection prevention policies drive the need for high-quality examination gowns. The Examination Gowns Market benefits from government regulations mandating safety standards. Healthcare institutions prioritize gowns to reduce cross-contamination risks and safeguard staff. Rising awareness among healthcare workers about protective apparel enhances compliance. It reinforces product uptake in diverse medical environments. Greater emphasis on hygiene and sterilization across facilities keeps gowns essential in medical procedures.

- For instance, Wallcur offers its Practi-Injecta Pad® injection simulator (7″ × 7″ × 2½″) that delivers realistic injection resistance. The simulator ships 1 unit per order, enabling individual student practice sessions.

Advancements in Fabric Technology and Material Innovation

Continuous advancements in nonwoven and protective fabrics improve gown durability and comfort. The Examination Gowns Market benefits from material innovations that enhance fluid resistance. Manufacturers introduce lightweight, breathable options that increase practitioner efficiency during long procedures. It reduces fatigue and improves overall usability in clinical practice. Enhanced barrier protection also drives broader use in high-risk departments. Product differentiation based on material strength supports long-term adoption.

Rising Demand from Ambulatory and Diagnostic Centers

Ambulatory surgical centers and diagnostic labs represent growing demand hubs. The Examination Gowns Market experiences a boost from facilities focusing on outpatient care. Rising preference for shorter hospital stays shifts procedures toward these centers. It fuels steady orders for disposable gowns that meet quick turnover requirements. Expanding diagnostic testing also adds to daily gown usage. These trends collectively increase procurement frequency and sustain long-term growth in the market.

Market Trends

Growing Preference for Disposable Gowns

Healthcare facilities increasingly prefer disposable gowns for infection control. The Examination Gowns Market benefits from this shift as disposables ensure one-time use and reduce contamination risks. Hospitals and clinics favor them for cost efficiency in large-scale procurement. It supports quicker patient turnover and reduces sterilization expenses. Manufacturers expand production capacities to meet bulk demand. This trend strengthens supply chains focused on single-use medical apparel.

- For instance, Kimberly-Clark’s Kimtech™ A7 Cleanroom Liquid Barrier Gown (2XL) is packaged 100 gowns per case, organized as 10 bags of 10 gowns each, reflecting a design for high-volume clinical use.

Rising Demand for Eco-Friendly and Sustainable Materials

Sustainability drives innovation in medical apparel manufacturing. The Examination Gowns Market witnesses rising use of biodegradable and recyclable fabrics. Healthcare providers seek eco-friendly options to align with green initiatives. It supports reduced environmental impact while ensuring safety standards. Growing investment in plant-based polymers and recycled fibers enhances product portfolios. The trend creates opportunities for suppliers promoting sustainability as a differentiator.

- For instance, McKesson offers its One-Size-Fits-Most disposable patient exam gowns (30 × 42 in.) packaged as 50 gowns per case, neatly organized to support rapid stocking and usage in high-turnover settings.

Technological Integration in Fabric Design

Advances in nonwoven technology improve gown breathability, strength, and resistance. The Examination Gowns Market gains from smart textile applications that offer higher protection levels. Manufacturers focus on lightweight, fluid-resistant designs that enhance comfort. It improves usability for healthcare workers during extended procedures. Antimicrobial coatings and advanced layering techniques further boost adoption. Continuous research on fabric innovation creates long-term product improvement cycles.

Expansion in Outpatient and Home Healthcare Usage

Shifting healthcare delivery models favor gowns beyond hospitals. The Examination Gowns Market expands with rising demand in outpatient clinics, urgent care centers, and home healthcare. Growing adoption supports safer diagnostic and minor surgical procedures in non-hospital settings. It enables providers to meet hygiene standards outside traditional facilities. Home healthcare workers also rely on gowns for patient care safety. This trend broadens the market base and diversifies consumption points.

Market Challenges Analysis

High Cost Pressures and Supply Chain Volatility

Price fluctuations in raw materials create major cost challenges for manufacturers. The Examination Gowns Market faces rising expenses for nonwoven fabrics and protective materials. Hospitals and clinics demand affordable solutions, which reduces margins for suppliers. It forces companies to balance cost efficiency with product quality. Supply chain disruptions, particularly during health emergencies, strain consistent availability. Dependence on imports in several regions heightens the risk of shortages. Managing these pressures remains a constant challenge for industry participants.

Regulatory Compliance and Environmental Concerns

Strict safety regulations demand continuous product testing and certification. The Examination Gowns Market must comply with evolving standards across different regions. Smaller manufacturers face difficulty meeting these requirements, limiting their competitiveness. It increases production costs and slows innovation cycles. Growing environmental concerns over disposable gowns also challenge adoption. Healthcare providers face pressure to reduce medical waste while maintaining patient safety. Balancing compliance and sustainability remains a complex hurdle for the market.

Market Opportunities

Expansion in Emerging Healthcare Markets

Rising healthcare investments in emerging economies create strong opportunities for manufacturers. The Examination Gowns Market benefits from hospital expansions, new diagnostic centers, and growth in outpatient care. Governments across Asia-Pacific, Latin America, and Africa prioritize medical infrastructure development. It creates consistent demand for gowns that meet both safety and affordability requirements. Suppliers focusing on cost-effective products can secure long-term contracts with public and private institutions. Growing medical tourism in these regions further boosts demand for protective medical apparel.

Innovation in Sustainable and Advanced Materials

Rising demand for eco-friendly solutions drives opportunities in product innovation. The Examination Gowns Market experiences growth from biodegradable, recyclable, and antimicrobial fabric adoption. Healthcare providers seek sustainable gowns that reduce waste while meeting infection control standards. It encourages suppliers to invest in research and expand portfolios with advanced material technologies. Lightweight, fluid-resistant, and breathable designs also increase acceptance among healthcare professionals. Companies leveraging sustainability and performance-focused innovations can differentiate themselves and capture higher market share.

Market Segmentation Analysis:

By Material

Material selection plays a critical role in shaping demand within the Examination Gowns Market. Polypropylene dominates due to its lightweight structure, cost efficiency, and fluid resistance. Polyethylene offers enhanced protection in high-risk environments, making it suitable for surgical settings. Laminated materials combine comfort with advanced barrier properties, supporting their use in intensive care units. Nonwoven materials continue to grow in popularity due to breathability and strength, making them ideal for extended use. Other specialty fabrics address niche requirements, ensuring broad adaptability across medical facilities. It demonstrates how material innovation supports functionality and safety in healthcare apparel.

- For instance, Halyard Health (now part of Owens & Minor) offers its disposable patient exam gowns (universal size, blue, 3-layer SMS fabric) in a bulk packaging format that supports compact staging and frequent replenishment in busy patient intake areas.

By Sterilization Method

Sterilization methods define gown usability across diverse healthcare settings. Gamma irradiation provides deep penetration and high effectiveness, supporting gowns used in surgical and emergency care. Electron beam radiation ensures faster sterilization with lower costs, benefiting large-scale production. Ethylene oxide remains popular for its ability to sterilize heat-sensitive gowns without affecting durability. Other methods offer flexibility for smaller manufacturers targeting regional compliance standards. The Examination Gowns Market relies on these approaches to maintain hygiene and meet strict regulatory requirements. It reflects how sterilization ensures gowns align with safety expectations in both reusable and disposable categories.

- For instance, STERIS offers its disposable over-the-head waterproof gowns (Product Number M20289) packaged as 100 gowns per box, enabling easy adoption in high-use environments like surgical suites and emergency departments.

By Design

Design preferences highlight functional requirements in different medical practices. Open-back gowns provide comfort during routine examinations and outpatient procedures. Closed-back gowns enhance protection and are preferred in higher-risk environments. Tie-back gowns balance ease of wear with secure fastening, appealing to both staff and patients. Disposable gowns support infection control with single-use convenience, while reusable gowns address cost savings in high-volume facilities. The Examination Gowns Market adapts designs to align with varied medical needs and institutional policies. It illustrates how functionality, safety, and cost considerations influence design adoption globally.

Segments:

Based on Material:

- Polypropylene

- Polyethylene

Based on Sterilization Method:

- Gamma Irradiation

- Electron Beam Radiation

Based on Design:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 38% of the global Examination Gowns Market, making it the leading region. Strong healthcare infrastructure and high surgical volumes support steady adoption. Hospitals and clinics rely heavily on disposable gowns to ensure safety and infection control. Domestic manufacturers strengthen supply resilience during health crises and maintain high regulatory compliance. It pushes suppliers to prioritize innovations in comfort and durability. The region remains highly competitive, with established players focusing on advanced protective materials.

Europe

Europe holds 27% of the global share, ranking second in the market. Strict regulations across the EU drive consistent demand for certified gowns. Healthcare systems expand outpatient and diagnostic centers, creating continuous consumption. It promotes the adoption of antimicrobial and reusable gowns as part of sustainability initiatives. Increasing focus on eco-friendly solutions supports investments in recyclable fabrics. The region blends compliance with innovation, making it an attractive base for premium product development.

Asia-Pacific

Asia-Pacific captures 23% of the Examination Gowns Market and records the fastest growth. Rapid hospital construction, medical tourism, and large patient bases fuel demand. India and China lead with strong adoption, supported by public healthcare funding. It creates significant opportunities for affordable disposable gowns across rural and urban facilities. Governments emphasize preparedness and infection control, which accelerates gown consumption. Rising investments in local manufacturing reduce dependency on imports and improve supply stability.

Latin America

Latin America accounts for 7% of the total market. Growing healthcare expenditure and modernization of hospitals boost usage. Countries such as Brazil and Mexico strengthen imports of disposable gowns to meet rising needs. It makes cost efficiency a priority for providers managing constrained budgets. Expansion of private hospitals supports broader demand for standardized medical apparel. Opportunities emerge for suppliers offering affordable gowns with reliable delivery channels.

Middle East & Africa

The Middle East & Africa collectively represent 5% of the Examination Gowns Market. Limited access to healthcare and dependence on imports restrict large-scale adoption. It challenges suppliers but also creates entry opportunities for regional production. Gulf nations with advanced healthcare systems show higher gown usage compared to Sub-Saharan countries. Growth in medical tourism in the UAE and Saudi Arabia adds to demand. Strategic partnerships and supply chain improvements can unlock stronger market presence in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Examination Gowns Market players such as Clark, Steris, McKesson Corporation, Stryker, Cardinal Health, Baxter International, Halyard Health, Owens Minor, Wallcura, and Asahi Kasei Medical are the leading players in the Examination Gowns Market. The Examination Gowns Market is marked by strong competition driven by innovation, cost control, and regulatory compliance. Manufacturers focus on developing gowns with improved comfort, fluid resistance, and sustainability to meet evolving healthcare needs. Distribution efficiency plays a critical role in ensuring uninterrupted supply across hospitals, clinics, and outpatient centers. Companies increasingly invest in eco-friendly materials and antimicrobial technologies to align with safety and environmental priorities. Strategic collaborations with healthcare providers and advancements in fabric technology continue to influence market positioning. The competitive environment remains intense, with firms balancing affordability and performance to capture wider customer bases.

Recent Developments

- In January 2025, Mölnlycke initiated a polyethylene back-film recycling program across selected European hospitals, providing take-back logistics that reduce incineration volumes and advance circular material flows.

- In November 2024, Lenzing expanded its LENZING Lyocell Dry fiber series with two grades tailored to medical non-wovens, delivering higher absorbency while retaining full biodegradability, thereby enabling bio-based Level 3 drapes.

- In March 2024, Children’s Minnesota partnered with Henna & Hijabs to launch modest hospital gowns designed specifically for children. The gowns are designed with intentional features to provide appropriate modest coverage while allowing medical care teams to perform necessary procedures.

- In November 2023, Cardinal Health recently introduced its SmartGown EDGE Breathable Surgical Gown with ASSIST Instrument Pockets in the U.S. This innovative gown is specifically designed to offer surgical teams a secure and convenient means of accessing instruments during procedures in the operating room.

Report Coverage

The research report offers an in-depth analysis based on Material, Sterilization Method, Design and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for disposable gowns will continue to grow due to infection control needs.

- Sustainable and eco-friendly fabrics will gain wider adoption across healthcare facilities.

- Reusable gowns will see growth in high-volume hospitals seeking cost efficiency.

- Innovation in antimicrobial and fluid-resistant fabrics will drive product differentiation.

- Regulatory standards will push manufacturers to maintain strict quality compliance.

- Expansion of outpatient and diagnostic centers will increase gown consumption.

- Growth in medical tourism will create new opportunities in emerging economies.

- Local manufacturing will expand to reduce import dependency in key regions.

- Investment in automation will improve production efficiency and supply reliability.

- Partnerships between suppliers and healthcare institutions will shape long-term market stability.