Market Overview:

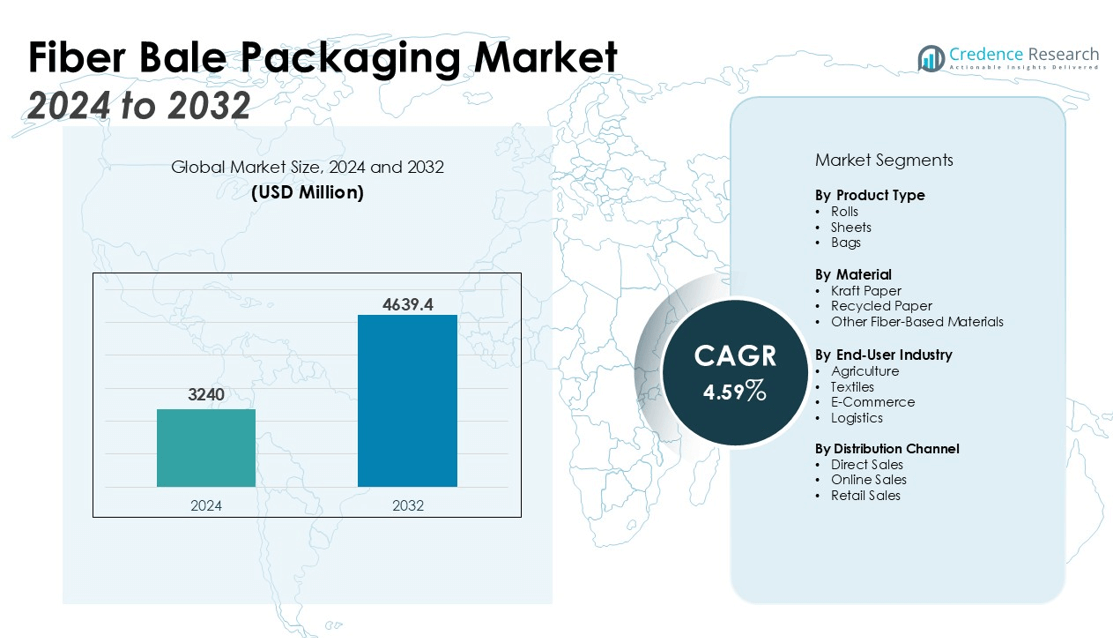

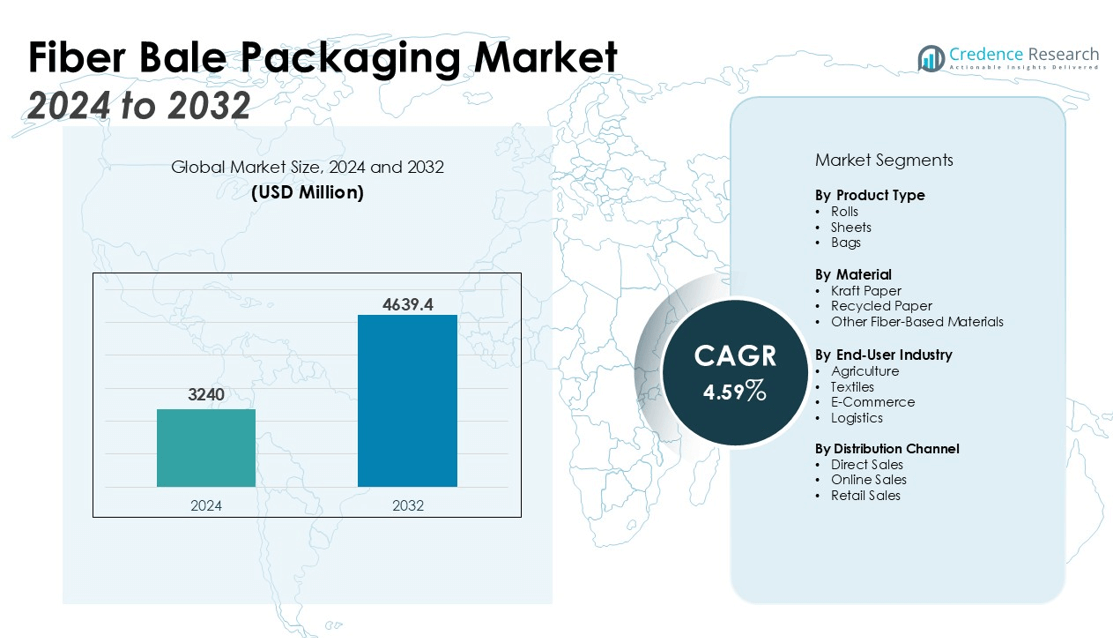

The Fiber Bale Packaging Market size was valued at USD 3240 million in 2024 and is anticipated to reach USD 4639.4 million by 2032, at a CAGR of 4.59% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Bale Packaging Market Size 2024 |

USD 3240 million |

| Fiber Bale Packaging Market, CAGR |

4.59% |

| Fiber Bale Packaging Market Size 2032 |

USD 4639.4 million |

Key drivers of market growth include the growing need for sustainable packaging solutions, especially in industries focused on reducing plastic usage. Fiber bale packaging, being recyclable and eco-friendly, aligns with the rising environmental awareness among consumers and businesses alike. Additionally, advancements in packaging technology, which enhance the strength and durability of fiber bale packaging, are expected to further fuel market demand. The increasing demand for fiber bale packaging in the textile and agricultural sectors is another significant factor, driven by its ability to preserve the quality of goods and reduce transportation costs. Furthermore, the shift towards circular economy models is further bolstering the adoption of fiber bale packaging as a preferred solution.

Regionally, North America holds a prominent share of the fiber bale packaging market, driven by stringent regulations on plastic waste and a strong focus on sustainability. Europe follows closely, supported by robust demand in the textile and agriculture industries. The Asia Pacific region is expected to exhibit the highest growth rate during the forecast period, primarily due to the expanding manufacturing and agricultural sectors in countries like China and India, along with increasing investments in sustainable packaging solutions.

Market Insights:

- The Fiber Bale Packaging Market was valued at USD 3,240 million in 2024 and is expected to reach USD 4,639.4 million by 2032, growing at a CAGR of 4.59% during the forecast period.

- Rising demand for sustainable packaging solutions is driving the growth of the fiber bale packaging market, particularly in industries focused on reducing plastic usage.

- Technological advancements in fiber bale packaging have improved its strength, durability, and flexibility, making it a reliable solution for large-scale logistics and transportation.

- The agricultural and textile sectors are major drivers of market demand, with fiber bale packaging offering a cost-effective solution for packaging raw materials and finished goods.

- The shift towards a circular economy and waste reduction has increased the adoption of recyclable fiber bale packaging in various industries.

- Higher initial costs compared to traditional packaging materials remain a challenge for wider adoption, especially in price-sensitive industries.

- North America holds a 35% share of the market, Europe commands 30%, and the Asia Pacific region is expected to show the highest growth, driven by industrial expansion and sustainability investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable Packaging Solutions

The increasing demand for sustainable packaging solutions is a primary driver of the fiber bale packaging market. Industries are under growing pressure to reduce their environmental footprint, particularly in sectors like agriculture, textiles, and logistics. Fiber bale packaging, known for its eco-friendly attributes, offers a recyclable alternative to traditional plastic packaging. Companies are shifting towards more sustainable solutions to meet regulatory requirements and consumer demand for environmentally responsible products. This trend aligns with global initiatives to reduce plastic waste, further pushing the adoption of fiber bale packaging in multiple industries.

Technological Advancements in Packaging Materials

Advancements in packaging technology have significantly improved the performance of fiber bale packaging, contributing to its market growth. Manufacturers are constantly innovating to enhance the strength, durability, and flexibility of fiber-based materials. These improvements ensure that fiber bale packaging meets the demands of industries that require robust and long-lasting packaging solutions. By enhancing the material properties, it is increasingly able to protect goods during transit while reducing the risk of damage. These technological developments make fiber bale packaging a more viable option for large-scale logistics operations, boosting its adoption in the market.

- For instance, the new Lenzing bale wrap material is certified for up to 350 loading cycles without degradation, as recorded in recent factory qualification tests.

Growing Agricultural and Textile Industry Demands

The fiber bale packaging market benefits from the growing demand for packaging solutions in the agricultural and textile sectors. These industries rely heavily on efficient and protective packaging to preserve the quality of their products during storage and transportation. Fiber bale packaging offers a lightweight yet durable solution that reduces transportation costs while safeguarding goods. The increasing demand for packaging in these sectors further accelerates the adoption of fiber bale packaging, positioning it as a go-to choice for packaging raw materials and finished goods.

Shift Toward Circular Economy and Waste Reduction

The shift towards a circular economy model has played a pivotal role in driving the growth of the fiber bale packaging market. As companies and industries focus more on waste reduction and recycling, fiber bale packaging provides a solution that supports sustainability. It can be recycled and reused, contributing to less waste and environmental impact. This aspect of fiber bale packaging aligns with evolving waste management regulations and consumer preferences for products that can be recycled or repurposed, helping to boost its demand across various markets.

- For instance, International Paper conserved and restored 1 million acres of forestland as documented in its 2024 Sustainability Report.

Market Trends:

Adoption of Fiber Bale Packaging in Eco-Conscious Industries

The fiber bale packaging market is witnessing a growing trend toward adoption across industries that prioritize sustainability. Companies in sectors such as agriculture, textiles, and e-commerce are increasingly adopting fiber bale packaging as part of their green initiatives. These industries require durable, cost-effective, and sustainable packaging solutions to meet both operational and environmental goals. Fiber bale packaging offers a recyclable, biodegradable alternative to traditional materials, making it an attractive option for businesses seeking to reduce their carbon footprint. Furthermore, rising consumer awareness about environmental impact drives demand for eco-friendly packaging. The increasing focus on corporate social responsibility (CSR) in these sectors accelerates the shift towards fiber bale packaging, making it a preferred choice in sustainable packaging strategies.

- For instance, Berry Global’s agricultural innovations allowed their clients to cut film weight by up to 25 units per roll compared to conventional products, directly reducing material usage and overall emissions in daily farm operations.

Technological Developments Enhancing Fiber Bale Packaging Capabilities

Technological advancements in fiber bale packaging are enhancing its versatility and efficiency, aligning with market trends favoring more durable and cost-effective solutions. Innovations in materials and manufacturing processes are allowing fiber bale packaging to meet stricter industry standards for strength, durability, and protection. These improvements enable it to handle a wider variety of products, including those with more complex storage and transportation needs. Enhanced production techniques have also made fiber bale packaging more affordable, further fueling its growth in competitive industries. As industries demand increasingly efficient solutions, these technological developments ensure that fiber bale packaging remains a top contender in meeting both sustainability and functional requirements.

- For instance, Sonoco Products’ automated lines now wrap up to 1,500 bales per 24-hour period.

Market Challenges Analysis:

Cost-Related Challenges in Fiber Bale Packaging Adoption

One of the key challenges facing the fiber bale packaging market is the higher initial cost compared to traditional packaging materials. While it offers long-term sustainability benefits, the production cost of fiber bale packaging remains relatively high, which can deter businesses, especially smaller enterprises, from adopting it. These costs are primarily driven by the raw materials and advanced manufacturing processes required for production. Although the market for eco-friendly solutions continues to grow, price-sensitive industries may find it challenging to justify the expense, particularly when competing against cheaper plastic alternatives. This cost barrier may slow down the widespread adoption of fiber bale packaging in certain sectors.

Logistical and Performance Constraints

Another challenge for the fiber bale packaging market lies in its performance under certain logistical conditions. While it offers excellent protection for many goods, it may not always provide the same level of durability or moisture resistance as plastic packaging in extreme conditions. Fiber bale packaging may face limitations when handling high humidity or heavy-duty transport, affecting its suitability for certain applications. These constraints can restrict its use in some industries, especially those requiring packaging solutions that guarantee high-performance standards. Ensuring that fiber bale packaging meets the diverse needs of global supply chains remains a significant hurdle for further market growth.

Market Opportunities:

Expansion in Sustainable Packaging Regulations

The fiber bale packaging market is well-positioned to capitalize on the increasing global push for sustainable packaging regulations. Governments and regulatory bodies worldwide are implementing stricter policies to curb plastic waste, creating significant opportunities for eco-friendly alternatives. Fiber bale packaging, with its recyclable and biodegradable properties, aligns perfectly with these regulations. As industries strive to meet compliance standards and enhance their sustainability efforts, the adoption of fiber bale packaging is expected to increase. This shift presents a growing opportunity for manufacturers to expand their product offerings and cater to industries looking to reduce their environmental impact while adhering to new regulations.

Growth in E-Commerce and Textile Industries

The fiber bale packaging market can further benefit from the rapid expansion of e-commerce and the textile industries. E-commerce businesses are increasingly seeking packaging solutions that not only protect products but also reflect consumer demand for sustainability. Fiber bale packaging, with its cost-effectiveness and eco-friendly attributes, is an ideal solution for the growing volume of goods in transit. Similarly, the textile industry’s need for durable and sustainable packaging for raw materials and finished products provides a significant growth opportunity. The continued demand for fiber bale packaging in these sectors will drive its market expansion, positioning it as a key player in global supply chains.

Market Segmentation Analysis:

By Product Type

The Fiber Bale Packaging Market is segmented into rolls, sheets, and bags, with rolls dominating the market share due to their versatility in handling various goods. Rolls are ideal for industries that require bulk packaging and high-efficiency handling, particularly in agriculture and textiles. Sheets and bags, while growing in demand, cater to smaller-scale packaging needs and specific product requirements, such as in consumer goods and pharmaceuticals.

- For instance, Andritz AG supplied more than 40 complete fiber bale press and packaging lines to global pulp producers such as Suzano S.A., ensuring efficient automatic bale handling and packaging for industrial-scale facilities.

By Material

The market is primarily divided into kraft paper, recycled paper, and other fiber-based materials. Kraft paper holds the largest market share due to its strength, durability, and recyclability, making it a preferred choice for industries focusing on eco-friendly packaging solutions. Recycled paper is gaining traction as businesses seek cost-effective and environmentally responsible alternatives, especially in regions with stringent recycling regulations.

By End-User Industry

The fiber bale packaging market sees substantial demand from the agriculture, textiles, e-commerce, and logistics industries. The agricultural sector remains the largest consumer, as fiber bale packaging efficiently protects crops and raw materials during transportation. The textile industry contributes significantly to growth, offering durable packaging for fabric and garment transport. E-commerce and logistics sectors are adopting fiber bale packaging due to increasing sustainability efforts and the need for efficient, environmentally friendly solutions in global supply chains.

- For instance, Sealed Air’s Mail Lite® recyclable mailers are engineered using a minimum of 60 percent post-consumer recycled content in the AirCap® bubble liner, substantially increasing recyclability and reducing waste for each item shipped.

Segmentations:

By Product Type

By Material

- Kraft Paper

- Recycled Paper

- Other Fiber-Based Materials

By End-User Industry

- Agriculture

- Textiles

- E-Commerce

- Logistics

By Distribution Channel

- Direct Sales

- Online Sales

- Retail Sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading in Sustainability and Regulations

North America holds a 35% share of the fiber bale packaging market, driven by strong sustainability initiatives and regulatory pressures. The region has implemented stringent regulations aimed at reducing plastic waste, making the demand for eco-friendly packaging solutions, such as fiber bale packaging, more prominent. Major industries, including agriculture, textiles, and e-commerce, are adopting sustainable packaging solutions to comply with environmental regulations and align with consumer preferences. The growing trend of corporate social responsibility (CSR) and increasing consumer awareness regarding sustainability further boosts market growth. The presence of key manufacturers and suppliers in the region strengthens its position as a leader in fiber bale packaging adoption.

Europe: Driving Innovation in Packaging Technology and Sustainability

Europe commands a 30% share of the fiber bale packaging market, with an equally strong focus on sustainability and technological advancements. The region’s proactive approach to environmental regulations and sustainable packaging has led to high demand for recyclable solutions like fiber bale packaging. Governments across Europe have introduced policies that promote circular economy models, further encouraging businesses to adopt eco-friendly alternatives. Additionally, Europe’s established agricultural and textile industries are major contributors to the demand for durable, cost-effective packaging solutions, making fiber bale packaging a preferred choice. The continuous push for innovative packaging solutions helps drive growth in the European market.

Asia Pacific: Rapid Growth from Expanding Industries

The Asia Pacific region holds a 25% share of the fiber bale packaging market, expected to experience the highest growth rate due to the rapid expansion of manufacturing, agricultural, and e-commerce sectors. Emerging economies such as China and India are witnessing significant industrial growth, increasing the need for efficient packaging solutions. As these regions focus more on sustainability, fiber bale packaging offers a suitable alternative to plastic, aligning with the shift toward eco-friendly practices. With growing awareness of environmental issues and the implementation of green packaging solutions, the Asia Pacific market is poised for substantial expansion. The region’s developing infrastructure and supply chains further support the adoption of fiber bale packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Lenzing Plastics

- Sonoco Products

- ITW Signode India

- Stein Fibers

- Proag Products

- Bischof + Klein

Competitive Analysis:

The Fiber Bale Packaging Market is highly competitive, with several key players driving innovation and sustainability. Major manufacturers in the market include International Paper Company, WestRock Company, and Smurfit Kappa Group. These companies focus on producing eco-friendly packaging solutions, leveraging advanced technologies to enhance the strength, durability, and recyclability of fiber bale packaging. They maintain a strong market presence through strategic partnerships, extensive distribution networks, and a commitment to sustainability. Regional players also play a vital role, particularly in markets such as Asia Pacific, where emerging economies are increasing their adoption of eco-friendly packaging solutions. The competitive landscape is further shaped by the rising demand for sustainable packaging solutions across industries like agriculture, textiles, and logistics. Companies are focusing on expanding their product offerings, improving production capabilities, and enhancing customer engagement to maintain market leadership in the evolving fiber bale packaging sector.

Recent Developments:

- In July 2025, Lenzing launched VEOCEL™ Lyocell fibers for Enhanced Cleaning at the World of Wipes® (WOW) 2025 event in Columbus, Ohio.

- In June 2024, Sonoco announced its agreement to acquire Eviosys, a European leader in metal food can packaging, for approximately $3.9 billion.

- In February 2025, Stein Fibers officially rebranded as Everra to signify its evolving focus on sustainable PET materials and innovation in global markets.

Market Concentration & Characteristics:

The Fiber Bale Packaging Market exhibits moderate concentration, with a few key players dominating the industry, such as International Paper Company, WestRock Company, and Smurfit Kappa Group. These companies hold significant market shares, driven by their large-scale production capabilities, extensive distribution networks, and commitment to sustainable packaging solutions. The market also features a growing number of regional players, particularly in emerging economies, which contribute to increased competition. Characteristics of the market include a strong emphasis on eco-friendly materials, technological advancements to improve packaging strength and durability, and an increasing focus on recycling. Companies are also investing in product innovation to meet the growing demand from industries like agriculture, textiles, and logistics. With sustainability becoming a key priority across sectors, the market is witnessing increased collaboration and partnerships to enhance product offerings and expand regional reach.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material, End-User Industry, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Fiber Bale Packaging Market is poised for sustained growth, driven by increasing demand for sustainable and efficient packaging solutions across various industries.

- Advancements in material science are enhancing the strength, durability, and moisture resistance of fiber bale packaging, making it a viable alternative to traditional plastic packaging.

- Automation in packaging processes is improving efficiency and reducing labor costs, contributing to the market’s expansion.

- The agricultural sector remains a significant end-user, with fiber bale packaging providing effective solutions for transporting and storing bulk goods like cotton and hay.

- The textile industry is adopting fiber bale packaging to meet sustainability goals and improve the efficiency of its supply chain operations.

- E-commerce growth is driving the need for protective and eco-friendly packaging solutions, further boosting market demand.

- Regulatory pressures and consumer preference for eco-friendly products are encouraging industries to shift towards recyclable and biodegradable packaging options.

- Emerging markets, particularly in Asia-Pacific, are experiencing rapid industrialization and urbanization, increasing the demand for fiber bale packaging solutions.

- Companies are investing in research and development to innovate and create packaging solutions that align with circular economy principles.

- The market’s future outlook is positive, with continued growth expected as industries prioritize sustainability and efficiency in their packaging practices.