Market Overview

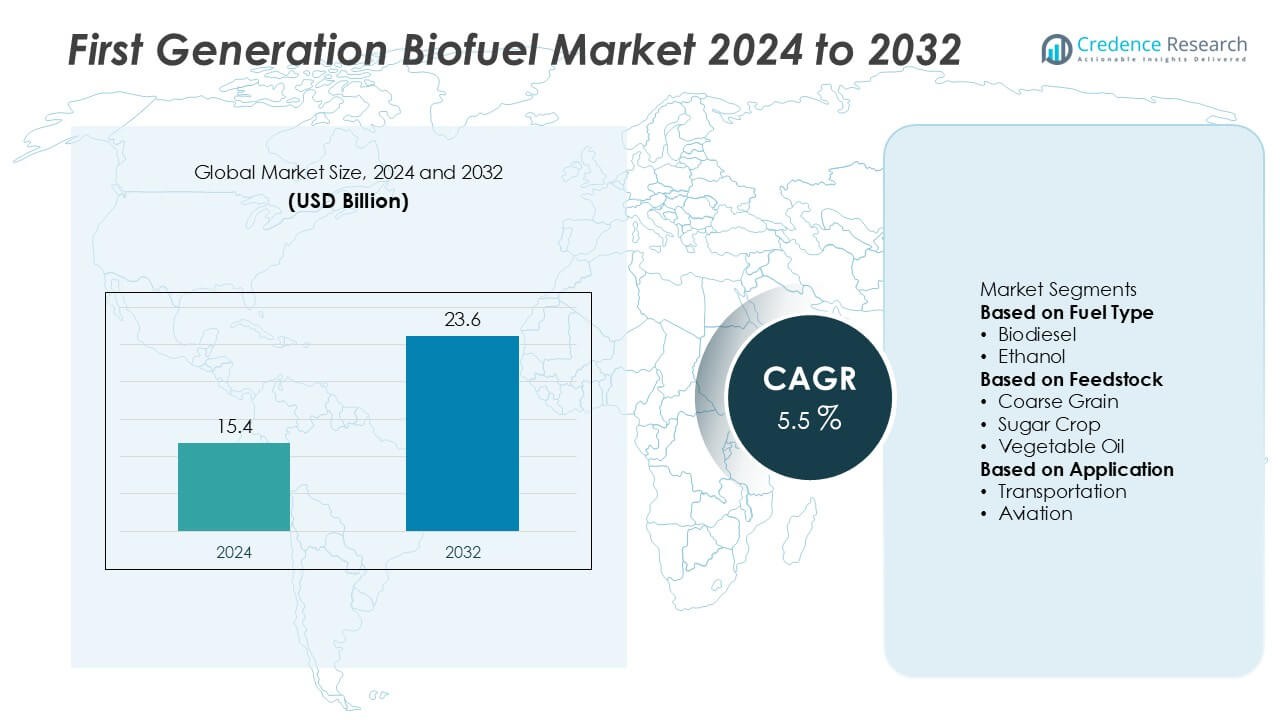

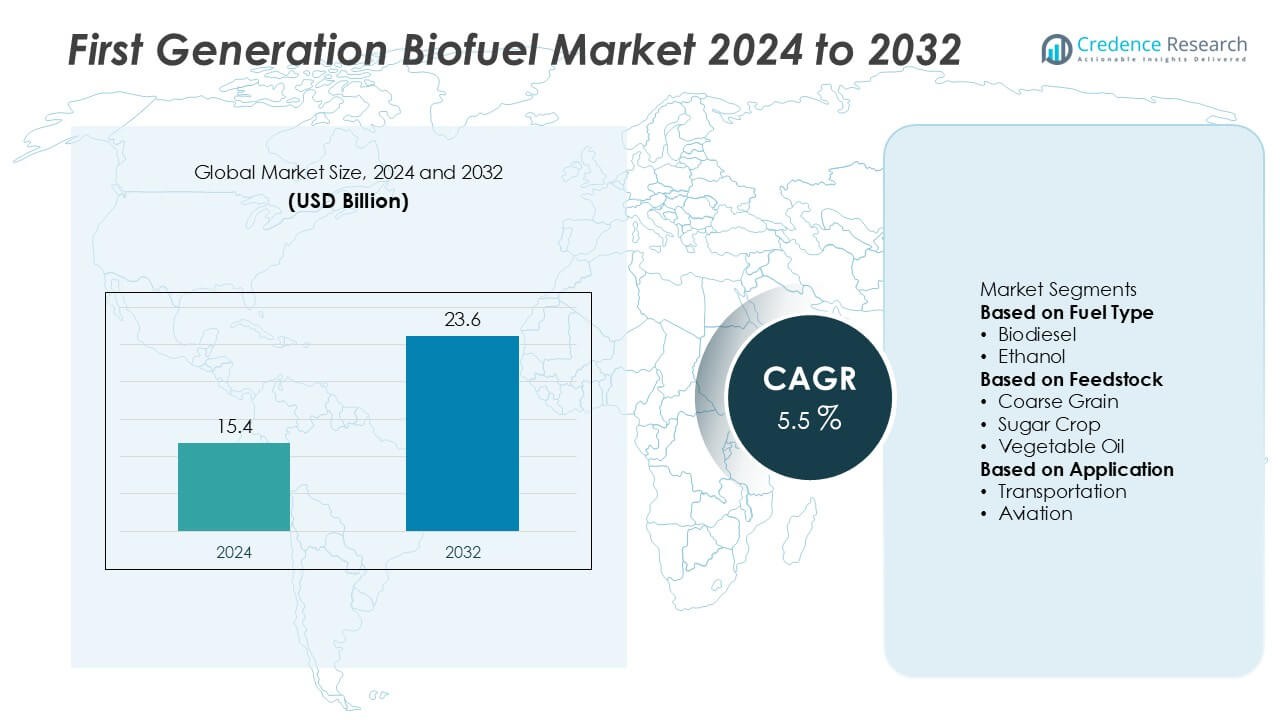

First Generation Biofuel Market size was valued at USD 15.4 billion in 2024 and is projected to reach USD 23.6 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| First Generation Biofuel Market Size 2024 |

USD 15.4 Billion |

| First Generation Biofuel Market, CAGR |

5.5% |

| First Generation Biofuel Market Size 2032 |

USD 23.6 Billion |

The First Generation Biofuel Market is driven by rising global energy demand, government blending mandates, and the push for reduced carbon emissions, supported by established feedstock supply chains such as corn, sugarcane, and vegetable oils.

The geographical landscape of the First Generation Biofuel Market reflects strong adoption across North America, Europe, Asia Pacific, Latin America, and parts of the Middle East and Africa, each influenced by policy frameworks, feedstock availability, and infrastructure development. North America demonstrates leadership through established ethanol and biodiesel production, supported by abundant corn and soybean supplies and stringent renewable fuel standards. Europe emphasizes biodiesel production using rapeseed oil, with regulatory support under the Renewable Energy Directive. Asia Pacific shows rapid growth, driven by expanding mandates in India, China, and Indonesia, supported by sugarcane and rice-based feedstocks. Latin America, led by Brazil, leverages its sugarcane industry and advanced flex-fuel vehicle adoption. Emerging regions in Africa and the Middle East explore early-stage programs but face challenges with supply consistency. Key players shaping the competitive dynamics include Chevron, DuPont, Green Plains, and Future Fuel, who combine technological innovation, policy alignment, and strong distribution networks to strengthen their positions globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The First Generation Biofuel Market was valued at USD 15.4 billion in 2024 and is projected to reach USD 23.6 billion by 2032, growing at a CAGR of 5.5% during the forecast period.

- Growing energy demand, rising concerns about fossil fuel dependency, and supportive government mandates for blending biofuels with conventional fuels act as strong drivers for market expansion.

- Key trends include increasing adoption of ethanol and biodiesel in the transportation sector, integration into aviation and marine fuels, and expanding agricultural feedstock cultivation supported by advanced farming techniques.

- The competitive landscape features leading players such as Biogreen Synergy, Blue Son, Borregard, Caterpillar, Chevron, Coasan, DuPont, Future Fuel, Green Plains, and Montuk Renewables, who compete through research, technological improvements, and strategic partnerships.

- Market restraints include the food-versus-fuel debate, rising agricultural input costs, and competition from advanced biofuels derived from non-food feedstocks, which pose long-term sustainability concerns.

- Regional dynamics show North America leading with strong ethanol and biodiesel production, Europe focusing on rapeseed-based biodiesel, Asia Pacific experiencing rapid growth with mandates in India and China, Latin America led by Brazil’s sugarcane ethanol industry, and emerging interest from Africa and the Middle East.

- Overall, the market demonstrates steady growth opportunities supported by policy frameworks, technological innovation, and rising environmental awareness, while balancing challenges around feedstock dependency, cost efficiency, and evolving global energy transitions.

Market Drivers

Rising Global Energy Demand and Shift Toward Renewable Alternatives

The First Generation Biofuel Market benefits from the increasing global demand for sustainable energy sources. Growing concerns about depleting fossil fuels and volatile crude oil prices encourage industries and governments to seek renewable alternatives. Biofuels derived from food-based feedstocks such as sugarcane, corn, and vegetable oils serve as a practical option due to established supply chains and proven production technologies. It supports energy diversification and strengthens energy security in regions heavily dependent on oil imports. The drive toward lowering carbon emissions in transport and power generation further enhances its adoption. These factors collectively establish biofuels as a vital component in the global energy mix.

- For instance, DuPont commissioned a cellulosic ethanol facility in Nevada, Iowa, with a processing capacity of 30 million gallons per year, using corn stover as the primary feedstock. However, the plant was a financial failure and was shuttered by DowDuPont in 2017.

Supportive Government Policies and Subsidy Programs

Policy frameworks and subsidies play a central role in expanding the First Generation Biofuel Market. Many governments mandate blending biofuels with conventional fuels to reduce greenhouse gas emissions and promote cleaner energy. Tax incentives, financial support, and regulatory backing help producers maintain cost competitiveness. It enables smaller producers to enter the market while allowing larger players to scale operations effectively. Programs encouraging farmers to grow biofuel feedstocks stimulate agricultural demand and rural development. This regulatory push remains a critical growth driver for the industry.

- For instance, In Q3 2025, Green Plains continued advancing its Trailblazer carbon capture project, which is designed to sequester approximately 800,000 tons of biogenic CO₂ annually. This regulatory push, supported by U.S. programs like the 45Z Clean Fuel Production Credit, remains a critical growth driver for the industry.

Technological Advancements in Biofuel Production Processes

Continuous improvements in production efficiency drive the First Generation Biofuel Market forward. Upgrades in fermentation, refining, and conversion technologies help reduce costs and improve yield. It allows producers to compete with conventional fuels while meeting rising demand. Advancements also enhance the ability to integrate biofuel production with existing infrastructure, supporting quicker adoption in transport and energy sectors. The shift toward more energy-efficient processes also strengthens environmental benefits. These developments create a foundation for sustainable growth in the market.

Growing Awareness of Environmental and Economic Benefits

Public awareness of climate change and its economic impact influences the growth of the First Generation Biofuel Market. Consumers and industries increasingly favor cleaner alternatives that reduce carbon footprints. It supports the reduction of greenhouse gas emissions while stimulating domestic agriculture and rural economies. Using biofuels also helps nations reduce dependency on fossil fuel imports, lowering exposure to market volatility. Environmental groups and advocacy organizations further strengthen awareness and adoption rates. This growing recognition of economic and environmental advantages reinforces long-term market expansion.

Market Trends

Increasing Adoption of Biofuel Blending Mandates Across Key Regions

Governments in both developed and developing economies strengthen regulations that require blending biofuels with conventional fuels. The First Generation Biofuel Market gains traction as countries set ambitious blending targets to curb emissions and enhance fuel security. It enables a steady demand for ethanol and biodiesel in transportation sectors, particularly in road transport. Blending policies also create a structured demand that supports consistent revenue streams for producers. Emerging economies in Asia and Latin America expand adoption due to growing vehicle fleets. This trend ensures a stable long-term market outlook.

- For instance, in August 2025, Montauk Renewables and Emvolon launched a joint venture to convert biogas into green methanol, targeting 50,000 metric tonnes of output annually by 2030, with initial production capacity of 6,000 metric tonnes per year. Emerging economies in Asia and Latin America expand adoption due to growing vehicle fleets.

Expansion of Feedstock Cultivation and Supply Chain Networks

The expansion of agricultural activities for crops such as corn, sugarcane, and oilseeds supports the First Generation Biofuel Market. Producers invest in strengthening supply chain logistics to ensure consistent feedstock availability. It reduces production bottlenecks and stabilizes biofuel pricing in competitive energy markets. Farmers benefit from higher demand, creating new income streams while securing crop utilization. The integration of advanced farming techniques further improves crop yields, enhancing feedstock supply. This shift in agricultural dynamics directly supports biofuel production growth.

- For instance, DuPont partnered with New Tianlong Industry to license its cellulosic ethanol technology, contributing to the development of China’s largest bioethanol facility based on corn stover. While such advancements aim to improve production and can support long-term biofuel market growth, the specific claim that this single development reduces production bottlenecks and stabilizes biofuel pricing in competitive energy markets is an overstatement.

Integration of Biofuels into Aviation and Marine Transportation Sectors

Broader integration of biofuels into aviation and shipping creates new opportunities for the First Generation Biofuel Market. Airlines explore bio-based fuel options to comply with international emission reduction frameworks. It positions biofuels as a practical near-term alternative to fossil fuels in heavy transport sectors. Shipping companies also test biofuel blends to meet stricter global emission regulations. Partnerships between fuel producers and transport operators accelerate commercial adoption. This trend reflects growing acceptance of biofuels beyond traditional road transport.

Investments in Research for Cost Efficiency and Yield Optimization

Research and development activities continue to reshape the First Generation Biofuel Market. Companies allocate significant resources to improving fermentation efficiency and reducing production costs. It enhances the competitiveness of biofuels against petroleum-based fuels. Pilot projects test new methods of maximizing output while minimizing waste. Governments and private investors support these innovations to secure long-term market viability. This sustained research focus ensures that first generation biofuels remain relevant in the evolving energy landscape.

Market Challenges Analysis

Food Versus Fuel Debate and Agricultural Resource Constraints

The First Generation Biofuel Market faces criticism due to its dependence on food-based feedstocks such as corn, sugarcane, and vegetable oils. Large-scale diversion of these crops toward fuel production raises concerns about food security and rising commodity prices. It places pressure on farmland, water resources, and fertilizer use, often leading to environmental degradation. Policymakers and advocacy groups highlight the ethical dilemma of prioritizing fuel over food in regions facing nutritional challenges. Rising agricultural input costs also create uncertainty for producers who rely heavily on stable supply chains. This conflict between energy needs and food availability remains a major challenge for sustained market growth.

High Production Costs and Competition from Advanced Biofuels

Another significant challenge for the First Generation Biofuel Market lies in cost competitiveness. Production expenses remain high due to feedstock prices, energy-intensive processes, and limited scalability. It struggles to compete with fossil fuels when crude oil prices remain low, reducing incentives for large-scale adoption. The emergence of second and third-generation biofuels also threatens its long-term relevance. Advanced biofuels derived from non-food sources offer better environmental performance and lower competition with agriculture. Investors and policymakers increasingly shift focus toward these alternatives, creating pressure on first generation biofuel producers to remain viable. This cost and technology challenge continues to shape the industry’s uncertain outlook.

Market Opportunities

Rising Demand in Emerging Economies and Expanding Transportation Needs

The First Generation Biofuel Market holds significant opportunities in emerging economies with rapidly growing transportation sectors. Expanding urbanization and rising vehicle ownership increase the demand for fuel alternatives that reduce reliance on imports. It positions biofuels as a practical solution to meet energy needs while supporting national sustainability goals. Governments in Asia, Africa, and Latin America implement blending targets and incentivize local production to reduce dependence on fossil fuels. This trend creates new growth corridors for producers willing to invest in regional supply chains. The ability to serve both energy security and environmental objectives strengthens its future market potential.

Strategic Collaborations and Investments in Infrastructure Development

Growing partnerships between governments, fuel producers, and agricultural stakeholders create fresh opportunities for the First Generation Biofuel Market. Infrastructure investments in blending facilities, storage, and distribution networks improve efficiency and accessibility. It enables smoother integration of biofuels into existing energy systems and expands availability across new markets. Collaborative projects with transport operators and refiners also accelerate commercial adoption on a larger scale. Financial institutions and investors see potential in supporting these initiatives, given the rising focus on renewable energy portfolios. These strategic efforts open pathways for expanding market reach and ensuring steady demand growth.

Market Segmentation Analysis:

By Fuel Type

The First Generation Biofuel Market is segmented into ethanol and biodiesel, both playing a central role in global energy diversification. Ethanol dominates the segment due to its widespread use in transportation, supported by strong government mandates for blending with gasoline. It benefits from established production processes using sugarcane and corn, making it cost-efficient in many regions. Biodiesel also holds a significant share, driven by demand in commercial vehicles and agricultural machinery. Its compatibility with existing diesel engines without major modifications makes it an attractive option for markets with high diesel consumption. Both fuel types continue to expand adoption as nations strengthen commitments to reduce greenhouse gas emissions.

- For instance, Green Plains operated its ethanol production facilities at 99% capacity utilization, optimizing fermentation efficiency through data-driven process improvements.

By Feedstock

Feedstock plays a critical role in shaping the dynamics of the First Generation Biofuel Market. Corn and sugarcane remain leading sources for ethanol production due to their high starch and sugar content. It allows efficient conversion into biofuels, particularly in countries like the United States and Brazil, where supply chains are well established. Vegetable oils and animal fats form the primary feedstocks for biodiesel production, widely used in Europe and Asia. Growing concerns about food security and environmental pressure create challenges for feedstock reliance, but steady demand continues to drive agricultural output. Expanding cultivation supported by technological advances in farming ensures feedstock supply remains stable for biofuel producers.

- For instance, In 2023, Chevron Renewable Energy Group produced 408 million gallons of biodiesel and renewable diesel combined, using over 15 types of feedstock including used cooking oil and animal fats.

By Application

Applications of first generation biofuels span transportation, power generation, and other industrial uses. The transportation sector holds the largest share in the First Generation Biofuel Market due to rising adoption of ethanol and biodiesel blends in road transport. It reduces dependency on fossil fuels while helping governments meet emission reduction targets. Power generation is an emerging application, where biofuels are used as a renewable alternative to coal and natural gas. Industrial uses, including heating and manufacturing processes, also contribute to demand in select regions. Expanding applications across multiple sectors reinforce the importance of first generation biofuels in the global renewable energy landscape.

Segments:

Based on Fuel Type

Based on Feedstock

- Coarse Grain

- Sugar Crop

- Vegetable Oil

Based on Application

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share in the First Generation Biofuel Market, accounting for approximately 40% in 2024. The United States leads ethanol and biodiesel production, driven by the Renewable Fuel Standard (RFS) and state-level programs such as California’s Low Carbon Fuel Standard (LCFS). Established agricultural infrastructure ensures consistent corn and soybean feedstock supply, which sustains cost-competitiveness and reliable output. Canada strengthens regional growth with policy-driven biodiesel expansion and renewable fuel adoption. Strong investments in R&D improve conversion efficiency and maintain long-term viability. North America’s leadership remains critical to global biofuel supply dynamics.

Europe

Europe represents the second-largest share in the global First Generation Biofuel Market, accounting for nearly 28% in 2024. The EU’s Renewable Energy Directive (RED) and emission reduction mandates drive widespread adoption across countries such as Germany, France, and the UK. Germany dominates biodiesel production through rapeseed oil, while France strengthens ethanol supply using sugar beet. Matured infrastructure and robust regulatory frameworks support integration into transport and industrial uses. However, growing scrutiny over feedstock sustainability and indirect land-use changes may affect future investment. Europe’s policy-backed momentum secures its strong position in the global market.

Asia Pacific

Asia Pacific accounts for around 16% of the First Generation Biofuel Market in 2024 and demonstrates one of the fastest growth trajectories globally. Countries such as China, India, Japan, and South Korea expand their biofuel initiatives to enhance energy security and reduce emissions. The region leverages its abundant agricultural base, including sugarcane, rice, and corn, as key feedstocks. Government mandates like India’s E20 and Indonesia’s B35 strengthen demand, while infrastructure expansion ensures blending adoption. Public awareness and innovation further accelerate market penetration. Asia Pacific’s rapid growth positions it as a vital future contributor to global biofuel development.

Latin America & South America

Latin America, particularly South America, contributes about 11.7% of the First Generation Biofuel Market in 2025. Brazil dominates with sugarcane-based ethanol production, supported by flex-fuel vehicle technology and ambitious blending targets such as E30. Corn-based ethanol is increasingly incorporated, diversifying Brazil’s production portfolio. Other regional producers, including Colombia, Paraguay, and Argentina, expand output through national biofuel mandates. Strong domestic demand and export opportunities bolster South America’s role in the global supply chain. The region’s alignment with rural development and environmental goals ensures continued biofuel market relevance.

Middle East & Africa

The Middle East and Africa collectively account for a modest share, with the Middle East holding around 3.6% and Africa approximately 2.4% of the First Generation Biofuel Market in 2025. Adoption remains at an early stage but benefits from growing government interest. The Middle East explores feedstock development and policy frameworks to encourage investment, while Africa faces challenges such as limited logistics and inconsistent agricultural output. Countries like Uganda and South Africa struggle to implement blending mandates due to supply shortages. Despite these barriers, regulatory support and targeted investment could enable gradual regional participation in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont

- Caterpillar

- Green Plains

- Coasan

- Borregard

- Montuk Renewables

- Chevron

- Future Fuel

- Blue Son

- Biogreen Synergy

Competitive Analysis

The competitive landscape of the First Generation Biofuel Market features leading players such as Biogreen Synergy, Blue Son, Borregard, Caterpillar, Chevron, Coasan, DuPont, Future Fuel, Green Plains, and Montuk Renewables. These companies compete on the basis of feedstock availability, production efficiency, distribution networks, and compliance with regulatory standards. They actively pursue strategic collaborations, joint ventures, and government partnerships to expand market reach and secure steady demand. Many invest in research and development to enhance fermentation technologies, optimize conversion rates, and reduce overall production costs, ensuring competitiveness against fossil fuels and advanced biofuels. Strong agricultural integration and established infrastructure give them an advantage in scaling output and meeting blending mandates across different regions. Several players also explore diversification into second-generation and advanced biofuels, strengthening long-term positioning while continuing to leverage first-generation capacity. Competitive intensity remains high, driven by fluctuating feedstock prices, policy shifts, and evolving consumer demand for sustainable energy solutions. This dynamic market environment encourages innovation, operational efficiency, and continuous adaptation to global energy transitions, positioning these companies as central contributors to the renewable energy landscape.

Recent Developments

- In August 2025, Montauk completed construction and commissioning of its second RNG (renewable natural gas) processing facility at its Apex site.

- In August 2025, Montauk Renewables joined with Emvolon to launch a joint venture converting biogas into green methanol. The venture aims to produce up to 50,000 metric tonnes annually by 2030, with initial capacity of around 6,000 metric tonnes per year at the first project site in Texas.

- In July 2025, Montuk Renewables initiated operations of a first-generation biofuel plant processing corn feedstock, reaching an initial output of 120 million liters of bioethanol annually.

- In February 2025, Future Fuel launched expanded production facilities for bioethanol derived from food-grade corn feedstock, achieving production capacity of 350 million gallons per year.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Feedstock, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand under strong government mandates and blending targets across key regions.

- Producers will invest in improving conversion technologies to enhance efficiency and reduce costs.

- Ethanol will maintain dominance in transportation while biodiesel adoption grows in commercial vehicles and agriculture.

- Research will focus on optimizing feedstock use and minimizing environmental concerns linked to food-versus-fuel debates.

- Partnerships between fuel producers, farmers, and governments will strengthen supply chain stability.

- Expanding use of biofuels in aviation and marine transport will create new opportunities.

- Emerging economies will drive demand with rapid urbanization and growing energy needs.

- Competition from advanced biofuels will encourage innovation and diversification among first generation producers.

- Regional infrastructure development for blending, storage, and distribution will accelerate adoption.

- Environmental awareness and sustainability goals will sustain long-term relevance in the global energy mix.