Market Overview

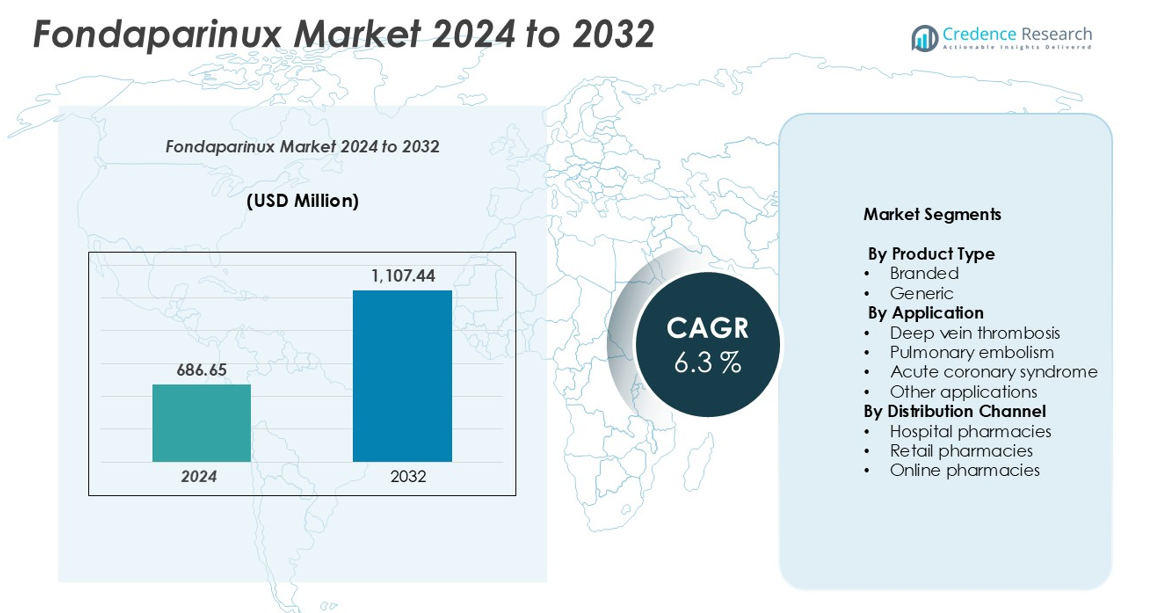

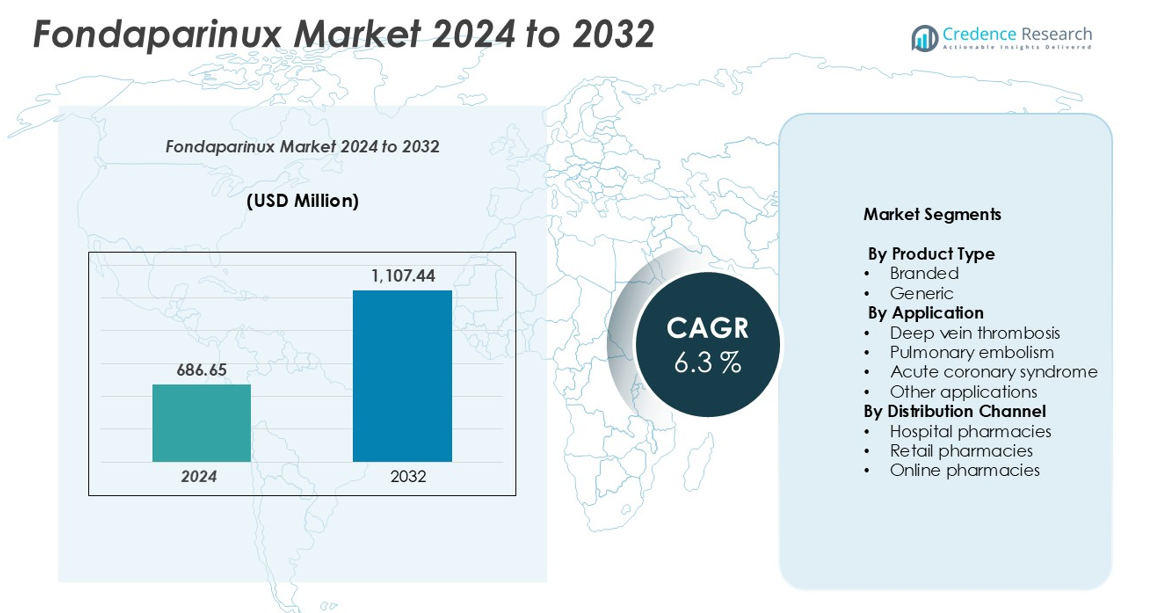

The Fondaparinux market size was valued at USD 686.65 million in 2024 and is anticipated to reach USD 1,107.44 million by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fondaparinux market Size 2024 |

USD 686.65 million |

| Fondaparinux market, CAGR |

6.3% |

| Fondaparinux market Size 2032 |

USD 1,107.44 million |

The Fondaparinux market is led by prominent players such as Abbott Laboratories Inc., GSK plc, Dr. Reddy’s Laboratories Ltd., Bayer Healthcare AG, Boehringer Ingelheim, Sanofi, and Lupin Pharmaceuticals, which collectively drive innovation, brand recognition, and broad distribution networks. Abbott Laboratories and GSK plc hold a strong presence in North America, the leading region with approximately 35% of the global market, supported by advanced healthcare infrastructure and high adoption rates. Europe follows with around 28% share, driven by Germany, France, and the U.K., where structured hospital protocols and patient awareness support demand. Asia Pacific, capturing roughly 22% of the market, is expanding rapidly due to growing surgical procedures, rising thromboembolic disorders, and improved access to generics. Latin America and the Middle East & Africa hold smaller shares, approximately 10% and 5%, respectively, but offer emerging growth opportunities.

Market Insights

- The Fondaparinux market was valued at USD 686.65 million in 2024 and is projected to reach USD 1,107.44 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Market growth is driven by the rising prevalence of thromboembolic disorders, increasing surgical procedures, and the strong clinical efficacy and safety profile of Fondaparinux, particularly in deep vein thrombosis and acute coronary syndrome management.

- Key trends include the growing adoption of generic formulations for cost-effectiveness, integration of digital health and telemedicine for patient monitoring, and increased use in hospital-based thromboprophylaxis protocols.

- The market is competitive, led by Abbott Laboratories, GSK plc, Dr. Reddy’s Laboratories, Bayer Healthcare, Boehringer Ingelheim, Sanofi, and Lupin Pharmaceuticals, with branded products dominating and hospitals serving as the primary distribution channel.

- Regional insights show North America leading with 35% market share, Europe at 28%, Asia Pacific 22%, Latin America 10%, and the Middle East & Africa 5%, reflecting high adoption and infrastructure differences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Fondaparinux market by product type is categorized into branded and generic formulations. The branded segment dominates the market, accounting for a significant share due to strong brand recognition, established clinical efficacy, and trust among healthcare providers. Branded products benefit from extensive marketing support, physician awareness, and patient preference, which drive higher adoption rates. The generic segment is growing steadily, driven by cost-effectiveness and increasing healthcare expenditure control, particularly in emerging markets. Overall, product differentiation and patent-protected innovations continue to sustain the dominance of branded Fondaparinux.

- For instance, Reddy’s Laboratories received final approval from the U.S. Food and Drug Administration (FDA) for its Abbreviated New Drug Application (ANDA) for generic fondaparinux in four strengths—2.5 mg, 5.0 mg, 7.5 mg, and 10.0 mg—on July 11, 2011.

By Application

In terms of application, the Fondaparinux market is segmented into deep vein thrombosis (DVT), pulmonary embolism (PE), acute coronary syndrome (ACS), and other applications. Deep vein thrombosis represents the dominant application segment, capturing the largest market share due to high prevalence and routine prophylactic use in hospitalized patients. Pulmonary embolism and acute coronary syndrome applications are expanding, fueled by rising awareness, improved diagnostic capabilities, and inclusion in clinical guidelines. Drivers for the DVT segment include increasing hospitalizations for orthopedic surgeries, aging populations, and proactive thromboprophylaxis protocols.

- For instance, Alchemia Ltd. initially developed the injectable generic product fondaparinux (Fondared). It was launched by Dr. Reddy’s Laboratories in India in April 2013. Dr. Reddy’s later acquired the worldwide intellectual property rights for the drug in 2015. The product is supplied in 2.5 mg / 0.5 mL strength in pre-filled single-dose syringes, often color-coded, specifically to prevent deep vein thrombosis (DVT) in post-operative patients.

By Distribution Channel

The market by distribution channel includes hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies hold the leading market share, as Fondaparinux is predominantly administered under medical supervision for inpatients and post-surgical thromboprophylaxis. Retail and online pharmacies are witnessing gradual growth, supported by rising patient self-care awareness and ease of access. Key drivers for hospital pharmacy dominance include strong physician prescriptions, integration into hospital formularies, and the requirement of monitoring during treatment. Meanwhile, online pharmacies are emerging due to convenience and growing digital healthcare adoption.

Key Growth Drivers

Increasing Prevalence of Thromboembolic Disorders

The rising incidence of thromboembolic disorders, including deep vein thrombosis (DVT) and pulmonary embolism (PE), is a primary driver for the Fondaparinux market. Aging populations, sedentary lifestyles, and comorbidities such as obesity and cardiovascular diseases are contributing to the growing patient pool requiring anticoagulant therapy. Hospitals and clinics are increasingly adopting Fondaparinux for prophylaxis and treatment due to its predictable pharmacokinetic profile and lower risk of heparin-induced thrombocytopenia. This rising demand for effective anticoagulants ensures steady market expansion. Moreover, enhanced diagnostic capabilities and routine thromboprophylaxis in surgical and high-risk patients further stimulate adoption, reinforcing the market’s growth trajectory.

- For instance, in 2023, Aspen Pharmacare continued to manufacture and supply Fondaparinux formulations and other thrombosis products for commercialization, primarily focusing on emerging markets. The company did not report a global figure for the number of patients treated, as it had divested the commercial rights to its thrombosis business in Europe to Mylan (now Viatris) in 2020.

Strong Clinical Efficacy and Safety Profile

Fondaparinux offers a well-established clinical efficacy and a favorable safety profile, particularly in high-risk patient groups. Its selective factor Xa inhibition reduces complications associated with traditional anticoagulants, making it a preferred choice for clinicians. Evidence-based advantages such as lower bleeding risk, predictable dosing, and no need for routine monitoring enhance physician confidence and patient adherence. Hospitals and specialty clinics actively incorporate Fondaparinux into treatment protocols for acute coronary syndrome and thromboembolic prevention. This combination of efficacy, safety, and convenience is a significant driver for market growth, supporting widespread adoption across both developed and emerging markets.

- For instance, GlaxoSmithKline (GSK), the developer of fondaparinux under the brand Arixtra, conducted a multinational clinical program encompassing over 19,000 patients across dozens of countries.

Expansion of Healthcare Infrastructure and Access

The growth of healthcare infrastructure globally is driving Fondaparinux market expansion. Increasing hospital capacities, modernized surgical facilities, and improved access to specialized care in emerging economies are facilitating wider adoption of anticoagulant therapies. Government initiatives to enhance cardiovascular and thrombosis care, along with rising insurance coverage, have further boosted patient access. Additionally, distribution through hospital, retail, and online pharmacies ensures that Fondaparinux reaches both urban and semi-urban populations. These infrastructure developments, coupled with increasing awareness among healthcare providers and patients, serve as a critical driver of sustained market growth.

Key Trends & Opportunities

Shift Toward Generic and Cost-Effective Options

A notable trend in the Fondaparinux market is the increasing adoption of generic formulations. Rising healthcare costs and government-led initiatives to promote affordable treatment options are driving demand for generics. These cost-effective alternatives expand patient access, particularly in price-sensitive regions, without compromising therapeutic efficacy. Pharmaceutical companies are leveraging patent expirations to introduce competitively priced generic products, creating opportunities for market expansion. Additionally, strategic partnerships and licensing agreements between global and regional manufacturers are accelerating the availability of generics, opening new revenue streams while simultaneously addressing the need for accessible thromboprophylaxis solutions worldwide.

- For instance, Multiple pharmaceutical companies, including Dr. Reddy’s Laboratories (as early as 2011) and Aurobindo Pharma (in 2018), launched FDA-approved generic versions of Fondaparinux Sodium Injection in various strengths following the patent expiration of GlaxoSmithKline’s branded drug, Arixtra.

Integration of Digital Health and Telemedicine

Digital health solutions and telemedicine present significant opportunities for Fondaparinux adoption. Remote patient monitoring, electronic prescription platforms, and online pharmacy services enhance treatment adherence and improve patient outcomes. For instance, elderly or mobility-impaired patients benefit from home delivery and teleconsultations, ensuring timely access to therapy. Furthermore, digital tools allow healthcare providers to track dosing schedules and monitor complications efficiently. This integration of technology not only expands the market reach but also aligns with broader trends in patient-centric care and healthcare digitization, positioning Fondaparinux for continued growth in both developed and emerging markets.

- For instance, in October 2019, Novartis announced a multi-year collaboration with Microsoft and its Azure cloud platform to transform medicine using artificial intelligence (AI) and data science.

Increasing Surgical and Hospital Procedures

The rising number of orthopedic and cardiovascular surgeries globally presents a key market opportunity. Fondaparinux is widely used for thromboprophylaxis in post-surgical patients, particularly in hip and knee replacement procedures. With increasing elective surgeries and aging populations requiring such interventions, the demand for anticoagulants is projected to grow. Hospitals and surgical centers are adopting standardized protocols that include Fondaparinux, ensuring consistent usage. This trend provides manufacturers with opportunities to strengthen hospital partnerships, expand product offerings, and promote awareness among clinicians about its clinical benefits in perioperative care.

Key Challenges

High Cost of Branded Formulations

Despite its clinical benefits, the high cost of branded Fondaparinux remains a significant challenge. Price sensitivity, particularly in emerging markets, can limit patient access and hinder widespread adoption. Insurance coverage gaps and reimbursement issues exacerbate this challenge, compelling hospitals and patients to consider alternative, lower-cost anticoagulants. Additionally, the presence of generics increases competitive pressure, potentially impacting revenue streams for branded products. Manufacturers must balance pricing strategies with market expansion initiatives while maintaining profitability, which remains a persistent hurdle in driving market growth.

Risk of Bleeding and Adverse Events

Although Fondaparinux is generally considered safe, the risk of bleeding and other anticoagulant-related adverse events poses a challenge. Clinicians remain cautious in high-risk populations, such as elderly patients or those with renal impairment, which may restrict prescription. Adverse events necessitate careful monitoring and patient education, adding complexity to therapy management. These safety concerns can affect physician preference and patient adherence, limiting broader utilization. Addressing these challenges requires continuous clinical education, post-marketing surveillance, and clear treatment guidelines to mitigate risks while sustaining market growth.

Regional Analysis

North America

North America leads the Fondaparinux market, accounting for around 35% of the global share, driven by advanced healthcare infrastructure, high prevalence of thromboembolic disorders, and established clinical guidelines. The U.S. and Canada are key contributors, with widespread use of branded formulations in hospitals and surgical centers. Rising orthopedic and cardiovascular procedures, coupled with a growing geriatric population, support consistent demand. The region benefits from strong hospital networks, efficient distribution channels, and high physician awareness, making it the largest and most mature market globally. Continued innovation and patient-centric care are expected to sustain North America’s leadership position.

Europe

Europe holds approximately 28% of the global Fondaparinux market, supported by structured healthcare systems, high cardiovascular disease prevalence, and robust regulatory frameworks. Germany, France, and the U.K. drive adoption through extensive hospital networks and outpatient facilities. The region emphasizes thromboprophylaxis protocols for deep vein thrombosis and acute coronary syndrome, enhancing product penetration. Increasing surgical procedures and rising patient awareness further propel growth. Both branded and generic formulations are widely used, reflecting the region’s focus on quality care and cost-effective solutions. Europe’s consistent demand and mature healthcare infrastructure maintain its position as a key regional market.

Asia Pacific

Asia Pacific represents around 22% of the global Fondaparinux market, experiencing rapid growth due to improving healthcare infrastructure, increasing thromboembolic disorders, and rising surgical procedures. China, Japan, and India are major contributors, with expanding hospital networks, adoption of generic formulations, and growing geriatric populations driving demand. Government initiatives to enhance cardiovascular care, along with increasing patient awareness, further support market expansion. Rapid urbanization, rising insurance coverage, and digital healthcare adoption provide additional growth opportunities. The region is expected to witness the fastest CAGR, gradually increasing its global market share in the coming years.

Latin America

Latin America accounts for about 10% of the global Fondaparinux market, supported by improving healthcare infrastructure, growing awareness of thromboembolic disorders, and increasing surgical interventions. Brazil and Mexico are key markets, where hospitals and clinics are expanding access to anticoagulant therapies. Rising geriatric populations and enhanced insurance coverage are contributing to steady adoption. While the region lags behind North America and Europe, government initiatives and growing patient awareness are creating opportunities for both branded and generic formulations. Latin America’s market is expected to grow steadily, gradually increasing its share in the global Fondaparinux landscape.

Middle East & Africa

The Middle East & Africa (MEA) region holds around 5% of the global Fondaparinux market, with growth driven by investments in modern healthcare infrastructure and rising surgical procedures. Saudi Arabia, UAE, and South Africa are key contributors, where hospitals and specialty clinics are adopting both branded and generic anticoagulants. Increasing awareness of thromboembolic disorders, government healthcare initiatives, and gradual expansion of hospital networks support market development. Despite challenges such as limited patient awareness and healthcare access, the region is poised for steady growth, with improving healthcare facilities and expanding distribution channels expected to gradually enhance MEA’s share in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

By Application

- Deep vein thrombosis

- Pulmonary embolism

- Acute coronary syndrome

- Other applications

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fondaparinux market is highly competitive, with key players striving to strengthen their product portfolios, expand geographic presence, and enhance market share. Leading pharmaceutical companies such as Abbott Laboratories Inc., GSK plc, Dr. Reddy’s Laboratories, Bayer Healthcare AG, Boehringer Ingelheim, Sanofi, and Lupin Pharmaceuticals dominate the market through established branded products and strategic collaborations. Market competition is driven by product innovation, introduction of cost-effective generics, and extensive hospital and pharmacy networks. Companies focus on clinical research, regulatory approvals, and targeted marketing to maintain physician trust and patient preference. Additionally, partnerships, mergers, and acquisitions are common strategies to expand regional footprints and enhance distribution capabilities. The competitive landscape encourages continuous improvements in drug efficacy, safety profiles, and accessibility, ensuring sustainable growth while maintaining high standards of care across global markets.

Key Player Analysis

- Abbott Laboratories Inc.

- Alchemia Limited

- Apotex Inc.

- Bayer Healthcare AG

- Boehringer Ingelheim

- Reddy’s Laboratories Ltd.

- GlaxoSmithKline

- GSK plc

- Kaifeng

- Lupin Pharmaceuticals, Inc.

- Mylan

- Sanofi

- ScinoPharm Taiwan Ltd

- WisMed

Recent Developments

- In December 2024, The FDA approved Mylan’s Arixtra (fondaparinux) for treating) pediatric patients aged one year and older, weighing at least 10 kg with venous thromboembolism (VTE). This approval develops fondaparinux’s existing indications, as it is already authorized for adult use in preventing deep vein thrombosis (DVT) and treating acute DVT and pulmonary embolism. The decision was based on a study involving 366 pediatric patients, demonstrating significant clot resolution with fondaparinux. The recommended pediatric dose is 0.1 mg/kg subcutaneously once daily. Arixtra carries a boxed warning for spinal/epidural hematomas, and healthcare professionals are advised to consult the drug label for comprehensive dosing information.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising prevalence of thromboembolic disorders globally.

- Increasing adoption of branded and generic formulations will expand patient access across regions.

- Hospitals will continue to dominate as the primary distribution channel for Fondaparinux.

- Rising orthopedic and cardiovascular surgical procedures will drive demand for anticoagulant therapy.

- Digital health and telemedicine integration will enhance patient adherence and monitoring.

- Asia Pacific is projected to witness the fastest growth due to expanding healthcare infrastructure.

- Key players will focus on strategic partnerships, collaborations, and regional expansions to strengthen market presence.

- Development of cost-effective generic alternatives will boost market penetration in price-sensitive regions.

- Awareness campaigns and government initiatives will support broader adoption and clinical acceptance.

- Innovation in formulations and safety monitoring will enhance physician confidence and patient outcomes.