| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

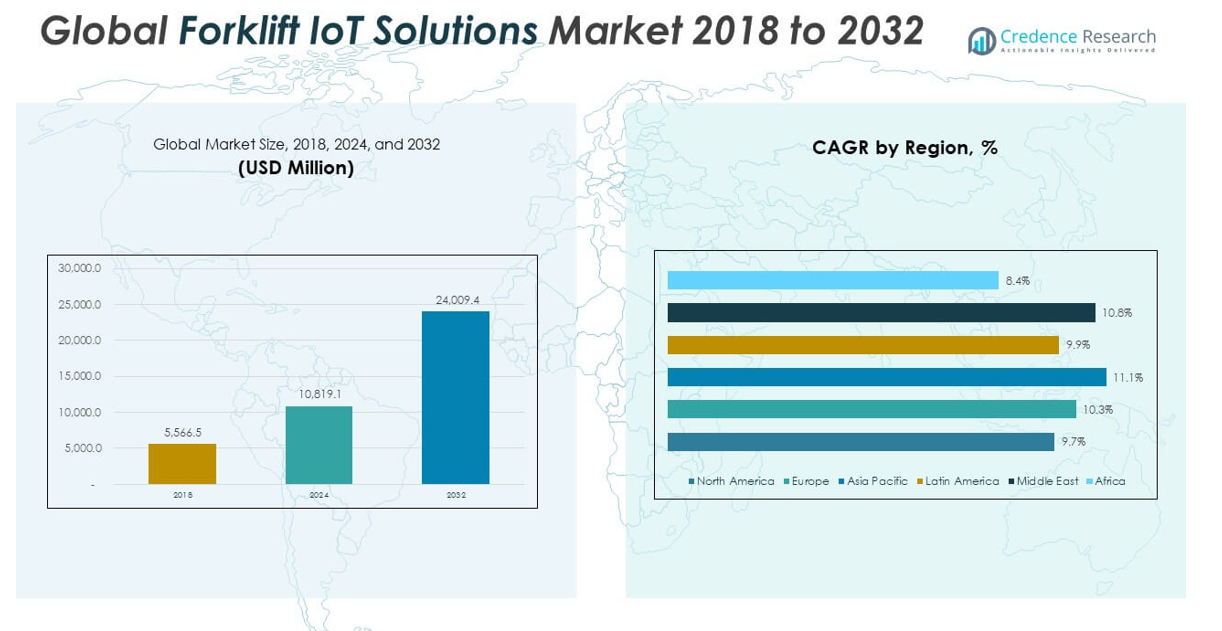

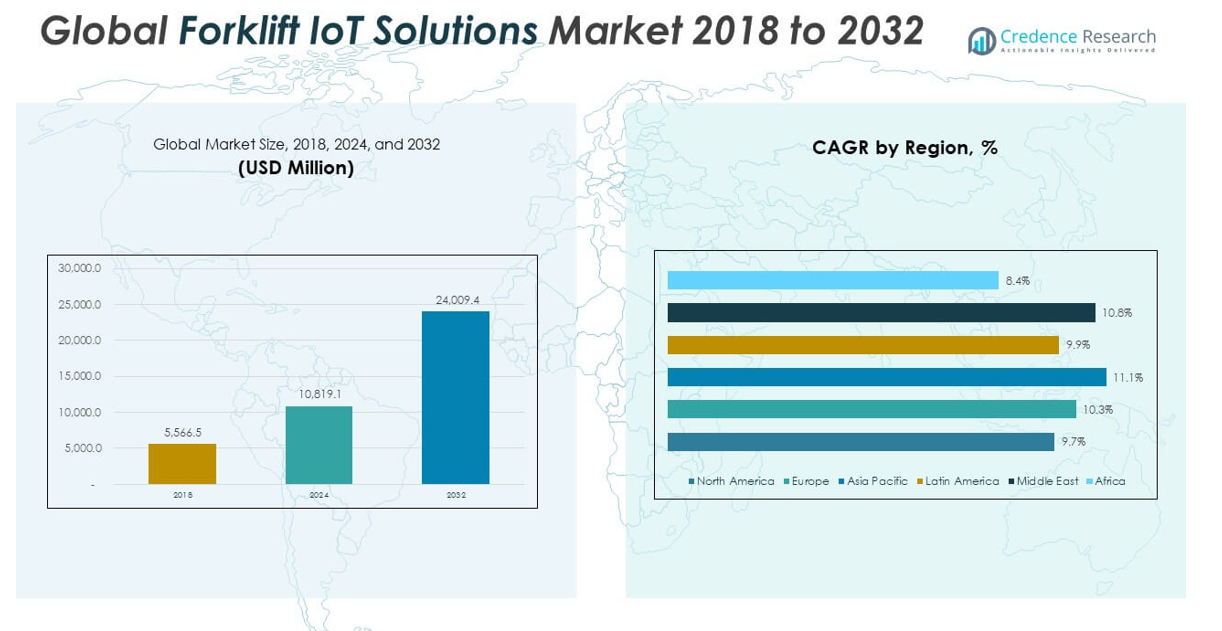

| Forklift IoT Solutions Market Size 2024 |

USD 10,819.1 million |

| Forklift IoT Solutions Market, CAGR |

10.47% |

| Forklift IoT Solutions Market Size 2032 |

USD 24,009.4 million |

Market Overview:

The Forklift IoT Solutions Market size was valued at USD 5,566.5 million in 2018 to USD 10,819.1 million in 2024 and is anticipated to reach USD 24,009.4 million by 2032, at a CAGR of 10.47% during the forecast period.

The Forklift IoT Solutions Market is expanding rapidly due to several pivotal drivers that are reshaping the industrial and logistics landscape. The rise of Industry 4.0 and Industrial Internet of Things (IIoT) adoption across warehouses and manufacturing facilities has significantly increased the demand for intelligent forklift systems. Companies seek real-time visibility into asset utilization, productivity, and safety, prompting the integration of IoT sensors, GPS tracking, and telematics into forklift fleets. Additionally, growing regulatory pressure to improve workplace safety has pushed organizations to invest in solutions that enable collision avoidance, driver behavior monitoring, and compliance reporting. Another key factor is the cost-saving potential of predictive maintenance powered by IoT analytics. By preventing unplanned downtime and extending equipment life, businesses can reduce maintenance costs and enhance operational efficiency.

Regionally, North America holds a dominant position in the Forklift IoT Solutions Market, supported by early technology adoption, strict safety regulations, and a well-established logistics infrastructure. The United States contributes a significant share of revenue, driven by its emphasis on automation and compliance with workplace safety norms. Europe follows closely, with Germany, the United Kingdom, and France leading adoption through strong industrial bases and government-backed digitalization initiatives. The Asia-Pacific region is witnessing the fastest growth, fueled by large-scale industrial expansion, rising e-commerce penetration, and government investments in smart logistics systems. China is a major contributor to regional demand, while countries like Japan, India, and South Korea are rapidly catching up through increased focus on manufacturing automation. In contrast, Latin America and the Middle East & Africa are in the early stages of adoption, with gradual progress driven by improvements in industrial infrastructure and growing awareness of the benefits of IoT-enabled fleet management.

Market Insights:

- The Forklift IoT Solutions Market was valued at USD 10,819.1 million in 2024 and is projected to reach USD 24,009.4 million by 2032, growing at a CAGR of 10.47%.

- Industry 4.0 initiatives and increased automation in manufacturing and logistics are accelerating the integration of IoT-enabled forklift systems.

- Regulatory mandates around workplace safety are driving the demand for telematics, driver behavior monitoring, and collision avoidance systems.

- Predictive maintenance powered by real-time diagnostics is helping reduce unplanned downtime and lowering total ownership costs.

- Technological innovations such as AI, edge computing, and 5G connectivity are enhancing the functionality, scalability, and responsiveness of IoT solutions.

- High initial costs, integration challenges with legacy systems, and cybersecurity risks are key barriers limiting widespread adoption.

- North America leads the market due to strong logistics infrastructure and early tech adoption, while Asia Pacific is the fastest-growing region driven by industrial expansion and smart logistics investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Industrial Automation and Industry 4.0 Integration Fuel Market Momentum

The growing emphasis on industrial automation has significantly accelerated the adoption of smart technologies in warehousing and logistics. Industry 4.0 initiatives have led organizations to implement intelligent forklift systems that integrate IoT sensors, telematics, and real-time data monitoring. Businesses now demand visibility into forklift operations to streamline material handling and improve asset utilization. These connected systems offer continuous tracking of vehicle location, usage patterns, and idle time, enabling companies to optimize workflows and increase operational efficiency. The Forklift IoT Solutions Market benefits from this digital shift, as enterprises increasingly prioritize data-driven decision-making. Integration of IoT with warehouse management systems has become a strategic imperative, supporting predictive analytics and adaptive fleet coordination. The demand for scalable and automated material handling solutions continues to strengthen market growth.

- For instance, Toyota Material Handling reports that IoT-driven fleet management systems have enabled 25% faster turnaround times in warehouse operations by providing continuous tracking of forklift location, load weight, energy consumption, and driver behavior.

Rising Workplace Safety Regulations Accelerate Adoption

Governments and regulatory agencies are implementing stricter safety standards across industrial sectors, prompting companies to invest in forklift telematics and driver monitoring systems. Collision detection, speed control, geofencing, and fatigue monitoring features are now essential for reducing accidents and ensuring compliance. These features help fleet operators identify unsafe behavior, enforce safety protocols, and mitigate risks in high-traffic warehouse environments. Businesses are also adopting solutions that document operator performance and enable automated incident reporting, reducing insurance costs and legal exposure. It responds to this demand by offering advanced safety integration that aligns with evolving regulatory frameworks. Organizations view safety-focused IoT implementations as a necessary step to safeguard their workforce and protect assets.

Operational Cost Reduction through Predictive Maintenance

Cost efficiency remains a central concern for companies managing forklift fleets across large-scale operations. Traditional maintenance models often lead to unexpected breakdowns, downtime, and unnecessary servicing. IoT-based predictive maintenance leverages real-time diagnostics and performance data to anticipate component failures and schedule repairs proactively. This approach minimizes disruptions and extends the lifespan of forklift equipment, resulting in lower total cost of ownership. The Forklift IoT Solutions Market is gaining traction as companies seek smarter maintenance strategies that reduce costs and improve productivity. Predictive tools also allow asset managers to optimize parts inventory and schedule repairs during off-peak hours, further enhancing operational planning.

Technological Advancements Strengthen Competitive Differentiation

Rapid innovation in IoT hardware and software is driving the development of sophisticated forklift monitoring solutions. The use of 5G connectivity, edge computing, and artificial intelligence enables real-time data processing and decentralized decision-making. These advancements support faster responses to safety events, enhanced route optimization, and seamless system integration across supply chain platforms. It continues to evolve by incorporating machine learning algorithms that refine recommendations over time based on historical data. Vendors offering modular and cloud-based platforms are gaining competitive advantages through improved scalability and customization. Businesses recognize the value of these solutions in building resilient, agile, and future-ready operations.

- Sumitomo Electric’s edge AI system, for example, utilizes a compact edge computer (115 mm × 63 mm, Arm+FPGA architecture, Linux OS) installed on each forklift to process camera data locally, achieving real-time worker detection and response times well below 100 milliseconds.

Market Trends:

Integration of AI and Machine Learning Enhances Fleet Intelligence

Artificial intelligence (AI) and machine learning (ML) are becoming key components in forklift IoT ecosystems. These technologies enable advanced data analytics, pattern recognition, and real-time decision-making within material handling operations. AI-driven platforms now analyze vast datasets to detect anomalies, predict maintenance needs, and optimize operator performance. Fleet managers gain deeper insights into operational efficiency and equipment health through continuous learning models. The Forklift IoT Solutions Market is increasingly incorporating AI to support autonomous decision-making and precision control in high-volume logistics environments. It enables predictive insights that reduce downtime, improve safety, and support proactive management strategies. These advancements are reshaping expectations around how forklift fleets are monitored and optimized.

- For example, Sumitomo Electric’s Edge AI-based Forklift Safety Support System utilizes deep neural networks (DNNs) running on a compact Arm+FPGA edge computer (measuring 115 mm × 63 mm), achieving real-time detection of workers within a 10-meter range using front and rear cameras.

Rising Demand for Cloud-Based and Edge IoT Architectures

Organizations are shifting toward cloud and edge computing models to streamline their forklift IoT deployments. Cloud-based platforms offer centralized visibility, remote access, and scalable integration with enterprise resource planning (ERP) and warehouse management systems (WMS). Edge computing complements this by enabling low-latency data processing directly on the forklift or near the source. The Forklift IoT Solutions Market is evolving to support hybrid architectures that balance cloud scalability with edge responsiveness. It allows real-time decision-making, even in environments with limited connectivity. Companies favor this flexibility, which improves system resilience and operational continuity in dynamic industrial settings. The trend reflects a growing need for agility and control in digital transformation initiatives.

Expansion of Telematics Features for Operational Transparency

Forklift IoT platforms now offer an expanded suite of telematics features designed to provide granular operational visibility. These include real-time GPS tracking, engine diagnostics, fuel monitoring, and load analysis. Operators and supervisors gain accurate, up-to-date information on fleet activity, improving accountability and workflow management. The Forklift IoT Solutions Market is responding to demand for transparency by integrating more advanced reporting and alert systems. It equips businesses with tools to assess productivity, reduce fuel consumption, and enforce best practices. Real-time alerts and customizable dashboards help address issues promptly and align performance with strategic objectives. The growing scope of telematics reflects a broader industry push for data-enabled operational control.

- Technoton’s telematics solutions, for example, monitor over 10,800 operational parameters 24/7, integrating data from standard CAN j1939 and j1708 buses and supporting edge/fog computing for scalable, reliable performance.

Increased Focus on Sustainability and Energy Efficiency

Sustainability goals are influencing procurement and technology strategies in the logistics sector. Companies are adopting IoT-enabled electric forklifts and energy monitoring systems to reduce emissions and improve resource efficiency. The Forklift IoT Solutions Market supports these initiatives by offering insights into battery health, energy usage, and charging patterns. It helps operators identify inefficiencies and extend battery life through optimized charging cycles. Integration with energy management platforms further enhances a company’s ability to meet environmental targets. This trend aligns with corporate sustainability mandates and industry pressure to reduce environmental impact. Data-driven efficiency is now viewed as both a competitive advantage and a regulatory imperative.

Market Challenges Analysis:

High Initial Investment and Integration Complexity Limit Adoption

One of the primary challenges in the Forklift IoT Solutions Market is the high upfront investment required for deployment. Implementing IoT-enabled forklift systems involves costs related to hardware installation, software licensing, network infrastructure, and workforce training. Small and mid-sized enterprises often hesitate to invest in these solutions due to budget constraints and uncertainty around return on investment. The Forklift IoT Solutions Market faces resistance in cost-sensitive environments where traditional forklift operations still prevail. It also encounters integration barriers when attempting to connect with legacy warehouse management or enterprise systems. The complexity of aligning various data streams and ensuring interoperability can delay adoption and increase implementation costs.

Data Security Risks and Connectivity Constraints Impact Reliability

Ensuring data security and maintaining continuous connectivity are significant concerns for companies investing in forklift IoT systems. Real-time tracking and remote monitoring require robust cybersecurity frameworks to prevent data breaches and unauthorized access. The Forklift IoT Solutions Market must address these vulnerabilities, especially in industries that handle sensitive operational information. It also faces reliability challenges in environments with poor network infrastructure, such as large warehouses with signal interference or outdoor storage yards. Unstable connectivity can disrupt data flow, reduce visibility, and compromise system performance. Vendors must develop resilient architectures and offline functionalities to maintain system uptime and user trust in varied deployment scenarios.

Market Opportunities:

Expansion in Emerging Markets Drives Future Revenue Potential

Rapid industrialization and e-commerce growth in emerging economies present significant opportunities for the Forklift IoT Solutions Market. Countries in Asia Pacific, Latin America, and the Middle East are investing heavily in smart logistics infrastructure and automated warehousing. Businesses in these regions are adopting connected forklift systems to improve supply chain visibility and reduce operational inefficiencies. The Forklift IoT Solutions Market stands to benefit from government initiatives that promote digital transformation and smart manufacturing. It can achieve wider penetration by offering scalable, cost-effective solutions tailored to developing market needs. Vendors that localize products and provide flexible deployment models will gain competitive advantages in these regions.

Integration with Autonomous and Electric Forklift Systems Creates New Demand

The rise of autonomous and electric forklifts is opening new avenues for IoT solution providers. These next-generation vehicles require continuous monitoring and intelligent control systems to function safely and efficiently. The Forklift IoT Solutions Market can leverage this trend by delivering platforms that support real-time navigation, battery optimization, and autonomous decision-making. It enables seamless coordination across automated fleets and enhances energy efficiency through smart charging systems. Demand for integrated, sustainable solutions is creating a pathway for long-term market expansion. Companies investing in these capabilities position themselves at the forefront of industrial innovation.

Market Segmentation Analysis:

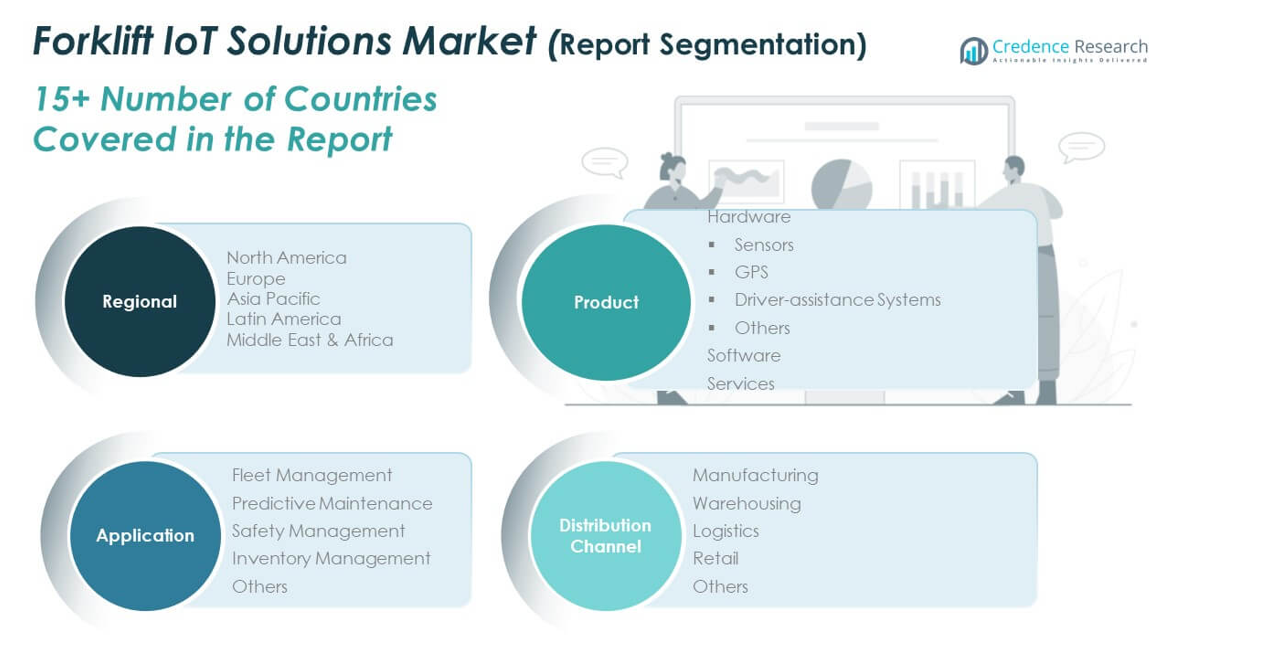

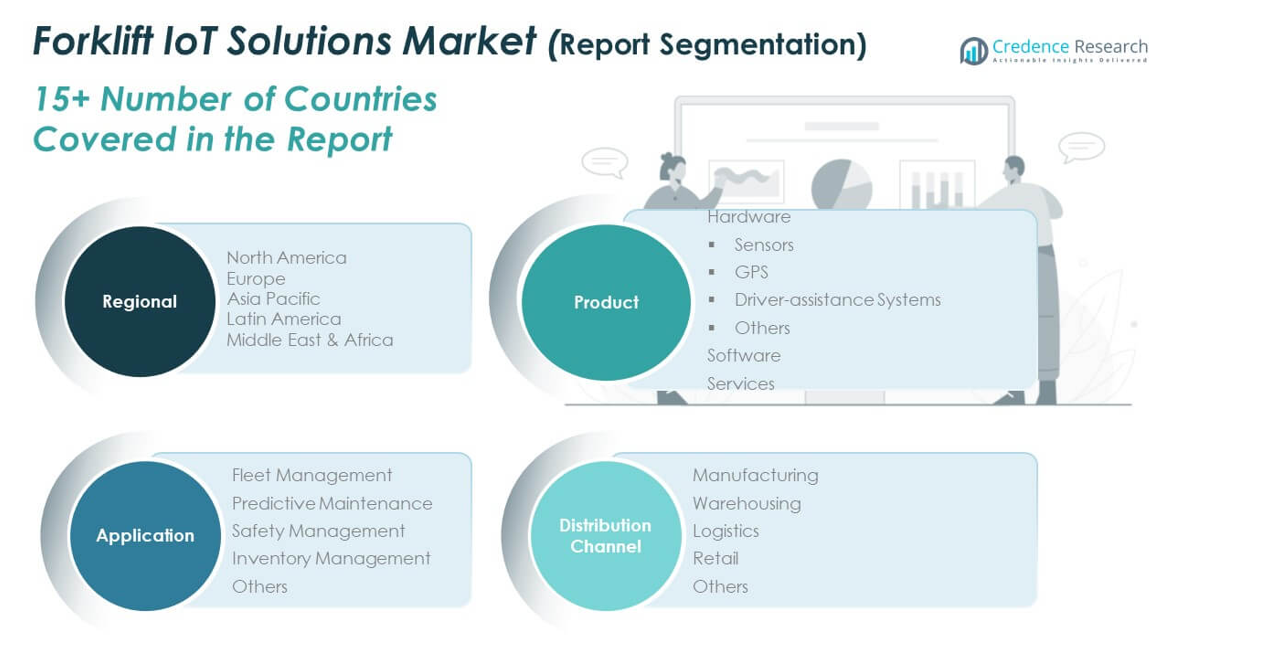

The Forklift IoT Solutions Market is segmented by product type, application, and end user, reflecting its diverse use cases across industrial sectors.

By product type, hardware leads in market share, with sensors, GPS, and driver assistance systems forming the core components that enable real-time tracking, safety automation, and location accuracy. It also includes growing demand for software platforms that provide analytics, fleet insights, and remote monitoring capabilities. Services, including integration, support, and maintenance, play a critical role in ensuring system performance and scalability.

- For instance, Linde Material Handling’s Safety Guard system uses ultra-wideband (UWB) technology to define dynamic safety zones up to 20 meters around forklifts, improving operator awareness and preventing collisions.

By application, fleet management accounts for the largest share due to rising demand for asset tracking, route optimization, and real-time monitoring. Predictive maintenance is gaining traction for its ability to reduce downtime and extend equipment lifespan. Safety management is also expanding rapidly, driven by regulatory requirements and workplace safety mandates. Inventory management solutions are being integrated to streamline warehouse operations and reduce manual handling errors.

By end user, manufacturing and warehousing are the dominant segments, driven by automation and Industry 4.0 initiatives. Logistics providers adopt IoT to optimize throughput and delivery performance, while the retail sector deploys connected forklift systems to enhance back-end supply chain efficiency. Other users include distribution centers and ports that require advanced visibility and operational control.

- For instance, Sumitomo Electric’s AI-based forklift safety system has been deployed to enhance safety protocols in industrial environments with immediate visual and audio alerts

Segmentation:

By Product Type

- Hardware

- Sensors

- GPS

- Driver Assistance Systems

- Others

- Software

- Services

By Application

- Fleet Management

- Predictive Maintenance

- Safety Management

- Inventory Management

By End User

- Manufacturing

- Warehousing

- Logistics

- Retail

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Forklift IoT Solutions Market size was valued at USD 1,156.71 million in 2018 to USD 2,165.68 million in 2024 and is anticipated to reach USD 4,561.78 million by 2032, at a CAGR of 9.70% during the forecast period. North America holds a substantial share of the Forklift IoT Solutions Market, supported by a mature logistics infrastructure and strong emphasis on safety compliance. The United States is the primary driver in the region, with high adoption of telematics, predictive maintenance, and real-time fleet monitoring systems. Businesses in North America prioritize efficiency and operational control, which drives consistent investment in advanced IoT solutions. It benefits from widespread digital transformation initiatives across warehousing, retail, and manufacturing sectors. Integration with enterprise systems such as WMS and ERP further supports market penetration. Strategic partnerships among technology providers and logistics operators are also fueling innovation and implementation.

The Europe Forklift IoT Solutions Market size was valued at USD 1,564.73 million in 2018 to USD 3,015.76 million in 2024 and is anticipated to reach USD 6,616.99 million by 2032, at a CAGR of 10.30% during the forecast period. Europe represents one of the fastest-evolving regions for the Forklift IoT Solutions Market, driven by strong industrial automation efforts and regulatory backing. Countries such as Germany, France, and the UK are leading the way in integrating IoT-enabled forklifts into their smart manufacturing frameworks. The market benefits from the region’s strict workplace safety standards, which encourage adoption of tracking, analytics, and driver-behavior monitoring. It also gains traction through innovation in green logistics, aligning with the EU’s broader sustainability goals. European companies are increasingly favoring electric forklifts integrated with IoT for efficient energy use and maintenance. The push for digital warehouses and automated inventory systems further enhances regional growth.

The Asia Pacific Forklift IoT Solutions Market size was valued at USD 2,082.97 million in 2018 to USD 4,189.01 million in 2024 and is anticipated to reach USD 9,711.80 million by 2032, at a CAGR of 11.10% during the forecast period. Asia Pacific dominates the Forklift IoT Solutions Market in terms of growth rate and future potential, driven by expansive industrial development and digitalization. China, Japan, South Korea, and India are key contributors, supported by smart city initiatives and e-commerce growth. The region’s logistics and manufacturing sectors are undergoing rapid transformation, encouraging large-scale deployment of IoT-powered forklifts. It is seeing increased investment in warehouse automation and infrastructure modernization, especially in urban hubs. Government policies that incentivize digital supply chains and smart factories are further fueling demand. Regional vendors are also emerging with cost-effective IoT solutions suited for varied industrial needs.

The Latin America Forklift IoT Solutions Market size was valued at USD 352.91 million in 2018 to USD 664.60 million in 2024 and is anticipated to reach USD 1,411.75 million by 2032, at a CAGR of 9.90% during the forecast period. Latin America presents growing opportunities for the Forklift IoT Solutions Market, particularly in countries such as Brazil, Mexico, and Chile. The expansion of retail and logistics sectors is creating demand for digital tools that enhance fleet visibility and performance. While overall adoption lags behind more developed regions, companies are recognizing the benefits of real-time monitoring and preventive maintenance. It is gradually gaining ground due to increased investment in warehousing infrastructure and interest in automation. Challenges related to cost and network coverage still exist, but localized solutions are helping bridge these gaps. International partnerships and pilot projects are expected to accelerate regional uptake.

The Middle East Forklift IoT Solutions Market size was valued at USD 295.02 million in 2018 to USD 583.61 million in 2024 and is anticipated to reach USD 1,325.32 million by 2032, at a CAGR of 10.80% during the forecast period. The Middle East is experiencing steady growth in the Forklift IoT Solutions Market, fueled by smart infrastructure development and economic diversification efforts. Countries such as the UAE and Saudi Arabia are leading adopters, supported by their national visions for digital transformation. Logistics hubs, free trade zones, and industrial parks are integrating forklift telematics to improve operational efficiency. It benefits from regional interest in predictive maintenance, safety compliance, and remote fleet tracking. Demand for intelligent systems is also growing in oil and gas, construction, and retail sectors. Expanding 5G and IoT connectivity infrastructure strengthens the market foundation for future scalability.

The Africa Forklift IoT Solutions Market size was valued at USD 114.11 million in 2018 to USD 200.46 million in 2024 and is anticipated to reach USD 381.75 million by 2032, at a CAGR of 8.40% during the forecast period. Africa holds a smaller but emerging position in the Forklift IoT Solutions Market, with steady adoption driven by gradual industrialization and improvements in supply chain operations. South Africa and Nigeria are key markets where logistics and warehousing demand is growing. The region faces challenges in connectivity and infrastructure, which can hinder widespread deployment of IoT technologies. It is gradually expanding as companies begin to recognize the cost-saving and safety benefits of connected forklift systems. International vendors and development agencies are collaborating to pilot digital transformation projects. Long-term growth depends on infrastructure investments and skills development to support smart logistics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Toyota Industries Corporation

- Mitsubishi Logisnext Co., Ltd.

- Crown Equipment Corporation

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- Komatsu Ltd.

- Anhui Heli Co., Ltd.

- Doosan Corporation Industrial Vehicle

- Clark Material Handling Company

- Hangcha Group Co., Ltd.

- UniCarriers Americas Corporation

- Hyundai Heavy Industries Co., Ltd.

- Other Key Players

Competitive Analysis:

The Forklift IoT Solutions Market is characterized by strong competition among established industrial automation providers and emerging IoT technology firms. Key players such as Toyota Industries, KION Group, Jungheinrich AG, Mitsubishi Logisnext, and Hyster-Yale Materials Handling lead the market with integrated telematics, fleet management platforms, and advanced safety features. It is witnessing rapid innovation driven by real-time analytics, predictive maintenance, and AI-enabled operational optimization. Companies are expanding their portfolios through strategic partnerships, acquisitions, and cloud-based service offerings. Startups and regional players are entering the space with modular, cost-effective solutions targeting mid-sized warehouses and emerging markets. The market rewards vendors that offer scalable architectures, seamless ERP integration, and customizable interfaces. With rising demand for electric and autonomous forklifts, solution providers are also focusing on energy monitoring and automation capabilities. Competitive advantage depends on product adaptability, data security, and ongoing support for continuous operational improvement.

Recent Developments:

- In March 2025, Powerfleet entered into a strategic partnership with TELUS, launching its AI-driven Unity in‑warehouse solution across North America. The collaboration combines TELUS’s robust connectivity infrastructure with Powerfleet’s AIoT SaaS platform to enhance safety, compliance, and operational monitoring specifically targeting warehouse and forklift operations in Canada and the United States.

- In July 2024, Toyota Material Handling Japan, a division of Toyota Industries Corporation, launched Japan’s first AI Forklift Driving Analysis service in partnership with Fujitsu. This cloud-based solution evaluates forklift driving safety by leveraging Toyota’s logistics expertise and Fujitsu’s AI platform, and is available through Toyota’s FORKLORE IoT subscription suite for logistics sites.

- In July 2024, Toyota Material Handling Japan partnered with Fujitsu to launch Japan’s first AI-based forklift safety evaluation cloud service. This new solution leverages Fujitsu’s Kozuchi AI on the Data Intelligence PaaS and integrates with TMHJ’s FORKLORE IoT suite. It automatically analyzes dashcam footage to detect unsafe maneuvers and generate safety scorecards for operators. The service supports proactive safety training and operational insights by replacing manual video reviews with AI-driven intelligence

Market Concentration & Characteristics:

The Forklift IoT Solutions Market exhibits moderate to high market concentration, with a few global players dominating key segments through advanced technological capabilities and established customer networks. It features a blend of traditional forklift manufacturers integrating IoT technologies and specialized IoT solution providers offering fleet analytics and remote monitoring tools. The market is characterized by strong demand for interoperability, real-time data processing, and scalable deployment across industrial settings. Buyers prioritize system reliability, cybersecurity, and integration with warehouse management systems. It continues to evolve with the adoption of AI, 5G, and cloud-based platforms, pushing vendors to innovate and offer tailored solutions. Competitive dynamics are shaped by technological differentiation, customer service quality, and the ability to deliver measurable operational improvements.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will see robust growth driven by increased automation across logistics and warehousing sectors.

- Rising adoption of electric and autonomous forklifts will accelerate demand for integrated IoT platforms.

- Predictive maintenance and real-time analytics will become standard features in fleet management systems.

- AI and machine learning will enhance decision-making and safety in material handling operations.

- Cloud and edge computing integration will support faster data processing and remote fleet control.

- Emerging markets will offer new revenue streams due to industrialization and smart infrastructure investments.

- Sustainability goals will boost deployment of energy-efficient IoT-enabled forklift systems.

- Vendors will focus on modular, scalable solutions to meet the diverse needs of small and large enterprises.

- Regulatory compliance will drive the inclusion of safety and monitoring tools across regions.

- Strategic partnerships between OEMs and tech firms will shape the competitive landscape.