Market Overview

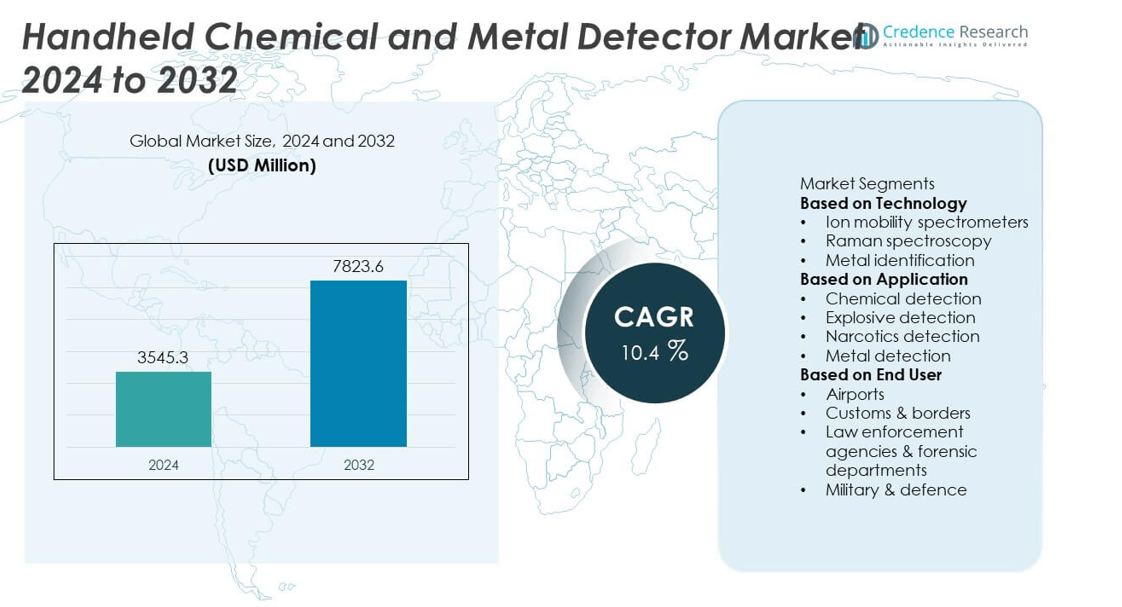

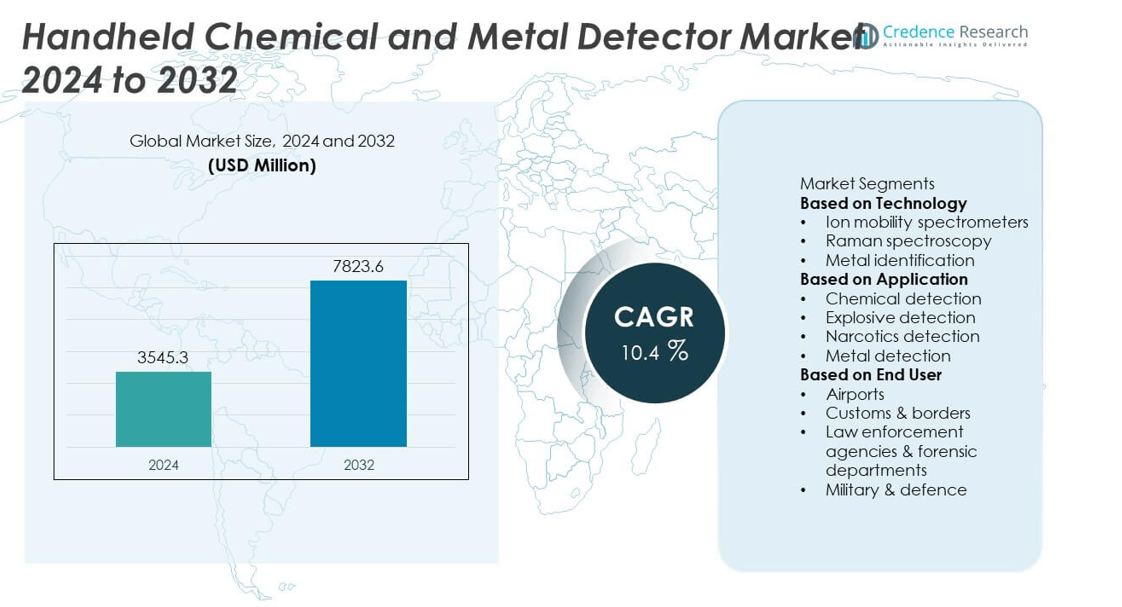

Handheld Chemical and Metal Detector Market size stood at USD 3,545.3 million in 2024 and is projected to reach USD 7,823.6 million by 2032, registering a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Handheld Chemical and Metal Detector Market Size 2024 |

USD 3,545.3 million |

| Handheld Chemical and Metal Detector Market, CAGR |

10.4% |

| Handheld Chemical and Metal Detector Market Size 2032 |

USD 7,823.6 million |

The Handheld Chemical and Metal Detector Market grows through rising global security concerns, stricter industrial safety regulations, and increasing demand from defense, law enforcement, and emergency response sectors. It benefits from advancements in sensor technology, miniaturization, and AI integration, which enhance detection speed, accuracy, and portability.

The Handheld Chemical and Metal Detector Market has a strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each region driven by distinct security, industrial, and regulatory priorities. North America leads with extensive adoption in defense, homeland security, and industrial safety, supported by advanced technology infrastructure. Europe maintains consistent demand through stringent safety regulations and modernization of border control systems, while Asia Pacific experiences rapid growth fueled by government security initiatives and expanding industrial applications. Latin America and the Middle East & Africa show increasing adoption in public safety, customs inspections, and critical infrastructure protection. Key players shaping the competitive landscape include Leidos, Bruker Corporation, Garrett Metal Detectors, and Agilent Technologies, Inc., all leveraging technological innovation, global distribution, and strategic partnerships to strengthen their market position and address evolving detection needs in security and safety operations.

Market Insights

- The Handheld Chemical and Metal Detector Market was valued at USD 3,545.3 million in 2024 and is projected to reach USD 7,823.6 million by 2032, growing at a CAGR of 10.4% during the forecast period.

- It grows through rising global security threats, stricter industrial safety regulations, and increasing adoption by defense, law enforcement, and emergency response agencies.

- Emerging trends include the integration of multi-detection capabilities in a single device, adoption of AI-driven analysis for faster and more accurate threat identification, and use of wireless connectivity for real-time data sharing.

- The competitive landscape features global and regional companies such as Leidos, Bruker Corporation, Garrett Metal Detectors, and Agilent Technologies, Inc., each focusing on technological innovation, product durability, and market expansion strategies.

- The market faces restraints from high equipment costs, budget limitations in developing regions, and technical challenges such as false readings in certain environmental conditions.

- North America leads with advanced deployment in defense and security operations, Europe sustains growth through regulatory compliance and modernization programs, and Asia Pacific shows the fastest growth driven by industrial expansion and security modernization.

- Latin America and the Middle East & Africa are expanding markets supported by government investments in border control, public safety, and infrastructure protection, creating opportunities for technology providers targeting these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Security Threats Driving Adoption of Advanced Detection Devices

The growing threat of terrorism, cross-border smuggling, and organized crime significantly increases the need for advanced portable detection systems. The Handheld Chemical and Metal Detector Market benefits from law enforcement agencies, border control units, and security forces deploying these devices for rapid and accurate identification of hazardous substances and concealed weapons. It plays a vital role in enhancing public safety during large-scale events and in high-risk areas. Governments worldwide are investing heavily in detection technologies to strengthen national security measures. The increased frequency of security breaches reinforces the demand for portable solutions that offer flexibility and quick deployment in the field.

- For instance, Bruker’s RoadRunner handheld explosives detector weighs just 3.5 kg, includes hot‑swappable batteries with around 4 hours of runtime, and delivers bench‑top level sensitivity via CHIRP‑IMS technology in both swab and vapor modes.

Stringent Safety Regulations in Industrial and Hazardous Work Environments

Industries handling chemicals, explosives, and metals must comply with strict workplace safety regulations. The adoption of handheld detectors helps organizations ensure compliance by detecting dangerous compounds or metal contamination before incidents occur. The Handheld Chemical and Metal Detector Market serves critical applications in mining, manufacturing, and oil and gas sectors. It supports safety officers in conducting on-site inspections without disrupting operations. The availability of rugged, weather-resistant devices enables their use in challenging industrial environments. This trend is fueled by both regulatory enforcement and corporate safety initiatives aimed at reducing workplace hazards.

- For instance, Agilent Technologies’ Resolve handheld Raman spectrometer demonstrated the ability to positively identify over 10,000 hazardous substances, including industrial chemicals and explosives, through opaque containers within 30 seconds, allowing safety teams to conduct rapid, non-invasive inspections while meeting stringent compliance standards.

Advancements in Sensor Technology Enhancing Detection Capabilities

Innovations in chemical sensors, metal detection coils, and integrated analytics improve the speed, accuracy, and reliability of handheld detection devices. The Handheld Chemical and Metal Detector Market benefits from miniaturized components, allowing lighter designs without sacrificing sensitivity. It leverages real-time data processing, wireless connectivity, and AI-driven pattern recognition for better decision-making in the field. Integration of multi-sensor platforms expands the range of detectable substances within a single device. Continuous R&D investments drive the development of detectors capable of operating in extreme conditions while maintaining performance standards.

Growing Demand from Emergency Response and Public Safety Sectors

Emergency responders require fast, portable detection systems to identify chemical leaks, toxic spills, and explosive threats. The Handheld Chemical and Metal Detector Market supports firefighting units, hazardous materials teams, and disaster relief agencies in ensuring public safety. It enables rapid incident assessment, reducing risks for both responders and civilians. The compact design and battery-powered operation allow use in remote or resource-limited settings. Increasing natural and industrial disasters elevate the demand for reliable detection equipment. This growth is supported by government funding programs dedicated to strengthening emergency response infrastructure.

Market Trends

Integration of Multi-Detection Capabilities in a Single Device

The Handheld Chemical and Metal Detector Market is experiencing a shift toward devices that combine chemical, explosive, and metal detection in one compact unit. This trend allows operators to carry fewer devices while expanding detection coverage. It improves operational efficiency for security forces, customs agencies, and industrial safety teams. The integration reduces training requirements and maintenance costs by standardizing equipment. Manufacturers are focusing on sensor fusion technologies to enable simultaneous analysis of multiple threat types. This approach addresses the growing need for versatile, field-ready detection solutions.

- For instance, Chemring’s PGR-1064 handheld Raman system can identify over 5,000 hazardous materials in less than 10 seconds and operates with a 1064 nm laser that minimizes fluorescence interference, while integrating GPS tagging and data transfer for unified reporting.

Adoption of Artificial Intelligence for Real-Time Threat Analysis

AI and machine learning are increasingly embedded into handheld detection systems to enhance recognition accuracy and speed. The Handheld Chemical and Metal Detector Market leverages AI algorithms to differentiate between benign and hazardous substances more effectively. It enables faster decision-making in critical environments such as airports, seaports, and industrial plants. AI-driven predictive analytics help in identifying potential threats before they escalate. Real-time threat data can be shared instantly with central command systems, improving situational awareness. This technological trend is reshaping the capabilities of modern portable detectors.

- For instance, Leidos’ H150E handheld narcotics and explosives detector uses proprietary real-time algorithms capable of analyzing samples in under 15 seconds, storing up to 2,000 detection records onboard, and automatically recalibrating via its patented inCal system to maintain consistent accuracy without manual intervention.

Miniaturization and Ergonomic Design Enhancing Field Usability

Advancements in component miniaturization have led to lighter, more compact devices without compromising performance. The Handheld Chemical and Metal Detector Market benefits from ergonomic designs that reduce operator fatigue during extended use. It supports single-hand operation and integrates intuitive user interfaces for quicker deployment in urgent scenarios. Improved battery efficiency allows longer operational hours in the field. Ruggedized casings and weatherproofing enable usage in challenging environments. These design enhancements align with the growing demand for mobility and ease of use in detection equipment.

Wireless Connectivity and Cloud Integration for Data Management

Modern handheld detectors are incorporating wireless communication protocols for instant data transfer and remote diagnostics. The Handheld Chemical and Metal Detector Market is adopting cloud-based platforms to store, analyze, and share detection results securely. It allows supervisors to monitor field operations in real time and provide immediate guidance. Historical data storage supports compliance reporting and forensic analysis. This connectivity trend improves collaboration between agencies and strengthens coordinated response efforts. The move toward connected detection ecosystems is expanding operational capabilities across sectors.

Market Challenges Analysis

High Equipment Costs and Budget Constraints Limiting Adoption

The Handheld Chemical and Metal Detector Market faces a significant challenge in balancing advanced technology with affordability. High costs associated with integrating multi-sensor platforms, AI capabilities, and ruggedized designs often limit procurement, especially for small agencies and organizations in developing regions. It encounters resistance from buyers with constrained budgets who must prioritize essential operational equipment over advanced detection tools. Maintenance expenses, periodic calibration, and software updates further add to the total cost of ownership. Government tenders and security contracts may favor lower-cost alternatives, reducing the uptake of high-end models. This cost barrier can slow market penetration, particularly in sectors with narrow funding allocations.

Technical Limitations and Risk of Operational Errors

Despite advancements, handheld detectors can face performance challenges in detecting certain low-concentration chemicals or deeply concealed metals. The Handheld Chemical and Metal Detector Market must address false positives and negatives that can lead to operational delays or security breaches. It relies heavily on skilled operators to interpret readings accurately, creating a dependency on specialized training programs. Harsh environmental conditions such as high humidity, dust, or extreme temperatures can impair device performance. The need for regular calibration and adherence to strict maintenance schedules increases operational complexity. These technical and operational hurdles highlight the importance of continuous R&D to enhance device reliability and precision in diverse field conditions.

Market Opportunities

Expansion Potential in Emerging Security and Industrial Markets

The Handheld Chemical and Metal Detector Market can grow by targeting emerging economies where investments in public safety, border control, and industrial hazard prevention are increasing. Governments in these regions are prioritizing modernization of security infrastructure, creating demand for advanced portable detection tools. It can benefit from establishing partnerships with local distributors and agencies to accelerate market entry. Industrial sectors such as mining, oil and gas, and manufacturing are also adopting handheld detectors to meet evolving safety regulations. Offering rugged, cost-effective models tailored to regional needs can open significant new revenue streams. This expansion is further supported by rising awareness of chemical and explosive threat prevention in high-risk industries.

Technological Integration Driving New Application Areas

Advances in miniaturization, sensor fusion, and AI integration create opportunities to introduce multifunctional handheld detectors across broader applications. The Handheld Chemical and Metal Detector Market can leverage these innovations to penetrate niche markets such as environmental monitoring, customs inspections, and emergency disaster response. It can also expand into critical infrastructure protection, including ports, airports, and energy facilities, where rapid threat detection is vital. Enhanced wireless connectivity and cloud-based analytics allow for real-time data sharing, improving coordinated response capabilities. Incorporating modular designs enables device customization for specific operational requirements. These technological advancements position handheld detectors as essential tools for both security and industrial safety applications.

Market Segmentation Analysis:

By Technology

The Handheld Chemical and Metal Detector Market is segmented into spectroscopy-based, ion mobility spectrometry, electrochemical sensing, electromagnetic induction, and others. Spectroscopy-based devices dominate in chemical detection due to their ability to identify hazardous substances with high specificity in real time. Ion mobility spectrometry is preferred in security and defense applications for its rapid detection of explosives and narcotics. Electromagnetic induction remains the core technology for handheld metal detectors, offering reliable performance in locating concealed metallic objects in diverse environments. Electrochemical sensing is gaining traction for detecting industrial toxins and hazardous gases. It benefits from ongoing innovations that integrate multiple detection methods into a single device, enhancing versatility and operational efficiency.

- For instance, Garrett’s Super Scanner V operates for 100+ hours on a single charge and detects small metallic threats such as a 3-inch weapon blade at up to 9 inches distance. Electrochemical sensing is gaining traction for detecting industrial toxins and hazardous gases

By Application

Applications span security screening, industrial safety, environmental monitoring, and emergency response. Security screening accounts for the largest share, driven by growing demand at airports, border checkpoints, and public event venues. Industrial safety applications focus on preventing accidents in hazardous environments such as oil refineries, mining operations, and manufacturing plants. Environmental monitoring involves detecting chemical leaks, soil contamination, and air quality hazards, supporting regulatory compliance. Emergency response teams deploy handheld detectors to assess chemical spill sites, explosive threats, and disaster zones. It serves as a critical asset in each of these applications by enabling rapid, on-site decision-making.

- For instance, Bruker’s handheld FTIR analyzers can identify over 5,000 environmental pollutants directly in the field. Emergency response teams deploy handheld detectors to assess chemical spill sites, explosive threats, and disaster zones

By End-User

End-users include defense and law enforcement agencies, industrial enterprises, customs and border protection, and emergency services. Defense and law enforcement rely on handheld detectors for threat identification, crime scene investigations, and anti-smuggling operations. Industrial enterprises use them to maintain workplace safety and protect infrastructure. Customs and border agencies deploy these tools for contraband detection and hazardous goods screening. Emergency services leverage them to ensure responder safety during hazardous incidents. It meets the varied operational needs of these end-users through tailored features such as ruggedized construction, extended battery life, and advanced connectivity for remote data analysis.

Segments:

Based on Technology

- Ion mobility spectrometers

- Raman spectroscopy

- Metal identification

Based on Application

- Chemical detection

- Explosive detection

- Narcotics detection

- Metal detection

Based on End User

- Airports

- Customs & borders

- Law enforcement agencies & forensic departments

- Military & defence

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Handheld Chemical and Metal Detector Market, representing approximately 38% of global demand in 2024. The region benefits from strong investments in security infrastructure, driven by high awareness of terrorism, smuggling, and hazardous material risks. The United States leads the market due to extensive deployment by homeland security agencies, defense forces, and airport authorities. Canada and Mexico also contribute significantly through industrial safety programs and customs inspection upgrades. It gains momentum from the presence of leading manufacturers and steady funding for technological innovation. The region’s well-established regulatory framework further supports consistent adoption across defense, law enforcement, and industrial sectors.

Europe

Europe holds around 27% of the global market share, with steady demand supported by stringent safety and security regulations. Countries such as Germany, the United Kingdom, and France are major contributors due to their advanced border control systems and industrial hazard prevention measures. The European Union’s focus on harmonized safety standards drives procurement of certified detection devices across member states. Eastern Europe shows rising adoption rates, fueled by modernization programs in customs and defense agencies. It benefits from Europe’s strong R&D ecosystem, which fosters innovation in multi-threat detection technologies. The region’s emphasis on public safety during large events and transport security further sustains market growth.

Asia Pacific

Asia Pacific accounts for approximately 22% of the global market and is the fastest-growing regional segment. The region’s expansion is driven by increasing government investments in security modernization, especially in China, India, and Japan. Rising incidents of cross-border smuggling and industrial safety concerns accelerate adoption of advanced handheld detectors. Local manufacturers contribute to growth by offering cost-effective models tailored for regional conditions. It leverages the region’s large-scale infrastructure development projects, where safety compliance drives demand for chemical and metal detection tools. Countries like Australia and South Korea also demonstrate strong uptake due to advanced industrial safety protocols and defense initiatives.

Latin America

Latin America represents about 7% of the global market, with Brazil and Mexico leading regional demand. Growth is supported by initiatives to strengthen border control, public safety, and environmental hazard detection. Industrial safety in sectors such as mining, oil and gas, and manufacturing further drives adoption. It finds opportunities in government-led modernization projects aimed at combating smuggling and improving emergency response capabilities. While economic constraints affect procurement in some countries, international partnerships and donor-funded programs help boost adoption.

Middle East & Africa

The Middle East & Africa holds roughly 6% of the global market, with demand concentrated in the Gulf Cooperation Council (GCC) countries and South Africa. Saudi Arabia and the UAE invest heavily in detection technologies to protect critical infrastructure and enhance border security. In Africa, South Africa leads adoption due to developed industrial and security infrastructure. It faces slower uptake in some Sub-Saharan regions due to budgetary constraints, though growth is supported by international aid and training programs. The region’s focus on securing high-profile events and infrastructure projects continues to drive interest in advanced handheld detection systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leidos

- Chemring Group PLC

- Garrett Metal Detectors

- Agilent Technologies, Inc.

- Nuctech Company Limited

- Hitachi High-Technologies Corporation

- Amphenol Corporation

- Bruker Corporation

- L-3 Security & Detection Systems

- Advanced Detection Technology, Inc.

Competitive Analysis

The competitive landscape of the Handheld Chemical and Metal Detector Market is defined by the presence of established global players and specialized technology providers competing on innovation, product reliability, and market reach. Key players include Leidos, Bruker Corporation, Garrett Metal Detectors, Agilent Technologies, Inc., Chemring Group PLC, Nuctech Company Limited, Hitachi High-Technologies Corporation, Amphenol Corporation, L-3 Security & Detection Systems, and Advanced Detection Technology, Inc. These companies focus on enhancing detection sensitivity, reducing false alarms, and integrating multi-sensor platforms to address chemical, explosive, and metal detection needs in a single device. Leidos and Bruker Corporation maintain a strong foothold in defense and homeland security sectors through advanced spectroscopy and ion mobility spectrometry solutions. Garrett Metal Detectors is a leader in portable metal detection for security screening, supported by durable and ergonomic designs. Agilent Technologies leverages its expertise in chemical analysis instruments to deliver precise handheld chemical detection devices. Nuctech and Chemring focus on emerging markets with cost-effective, rugged solutions tailored for border security and industrial applications. Competitive strategies include expanding product portfolios, securing government contracts, forming technology partnerships, and investing in R&D to comply with evolving safety and performance standards. This competitive positioning ensures sustained relevance in both security and industrial safety markets.

Recent Developments

- In July 2025, Garrett Electronics introduced the SecureFlow Kiosk tablet interface for its Paragon walk-through metal detectors. This tablet provides real-time alarm visualizations and checkpoint analytics through a wired Ethernet connection, enhancing the efficiency of secondary screening processes.

- In June 2024, Bruker Corporation introduced its RoadRunner high-sensitivity, handheld explosives and narcotics trace detector. The device offers bench-top detection sensitivity, hot-swappable batteries, approximately 4-hour battery life, and uses CHIRP-IMS technology for enhanced selectivity and reduced false alarms, all in a lightweight handheld format featuring a pistol grip design.

- In December of 2023, the Agilent Resolve handheld Raman spectrometer received the UK National CBRN Centre Certificate of Merit and the highest overall score in the US DHS SAVER evaluation for its ability to identify hazardous materials through opaque barriers using SORS technology

Market Concentration & Characteristics

The Handheld Chemical and Metal Detector Market displays moderate concentration, with a mix of global defense technology leaders, specialized detection equipment manufacturers, and emerging regional players competing for market share. It is characterized by high product differentiation driven by sensor technology, multi-threat detection capabilities, and ruggedized designs tailored for diverse field conditions. The market favors companies with strong R&D capabilities, proven reliability in mission-critical operations, and compliance with strict international safety and performance standards. Procurement often comes through government contracts, security tenders, and industrial safety programs, creating high entry barriers for new entrants. It benefits from steady demand across security, defense, industrial, and emergency response sectors, where accuracy, portability, and real-time data capabilities are critical. Competition focuses on enhancing detection sensitivity, reducing false positives, and integrating wireless and AI-enabled analytics to improve decision-making in the field. The requirement for durable, long-life, and low-maintenance devices further shapes product development and market positioning.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with increasing global security concerns and stricter safety regulations.

- Multi-threat detection devices will gain wider adoption across industries.

- AI and machine learning integration will improve detection accuracy and speed.

- Rugged and weather-resistant designs will expand usability in harsh environments.

- Wireless connectivity and cloud-based analytics will become standard features.

- Emerging economies will drive new procurement opportunities in security and industrial sectors.

- Lighter and more ergonomic devices will improve operator efficiency in the field.

- Cross-agency data sharing will enhance coordinated security responses.

- Energy-efficient designs will extend operational life and reduce downtime.

- Continuous R&D will lead to advanced sensor technologies with broader detection capabilities.