Market Overview

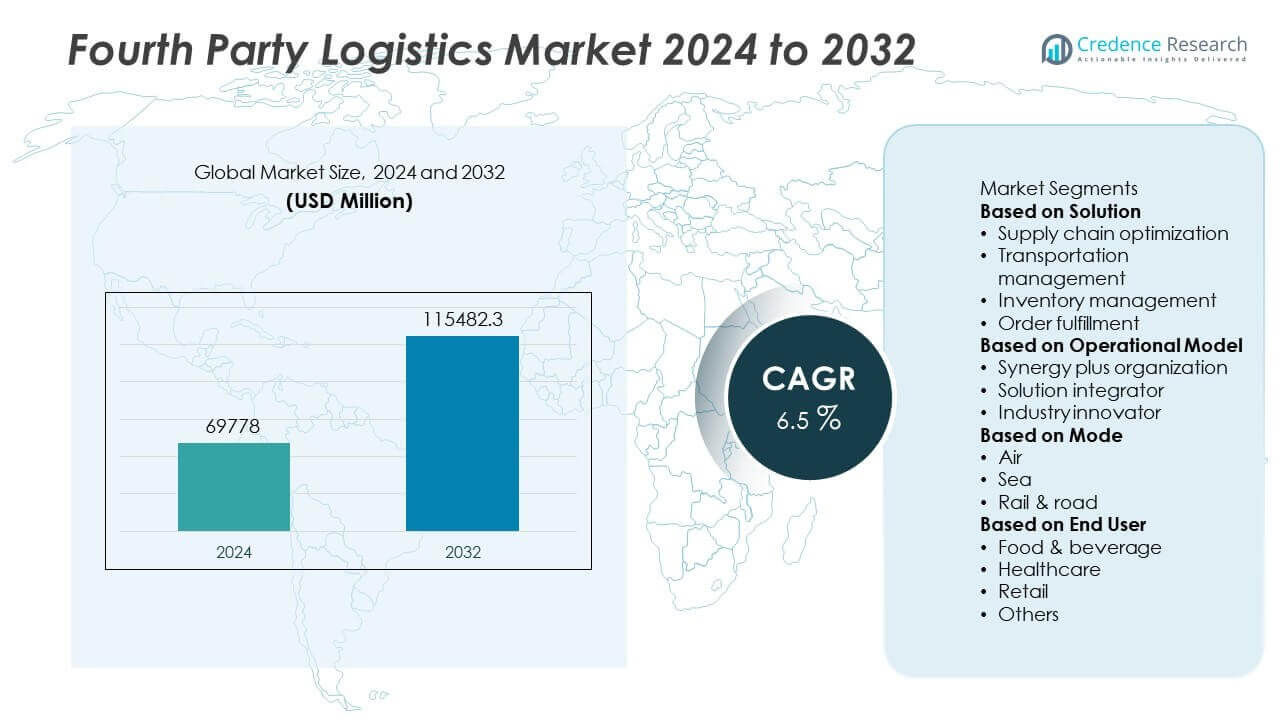

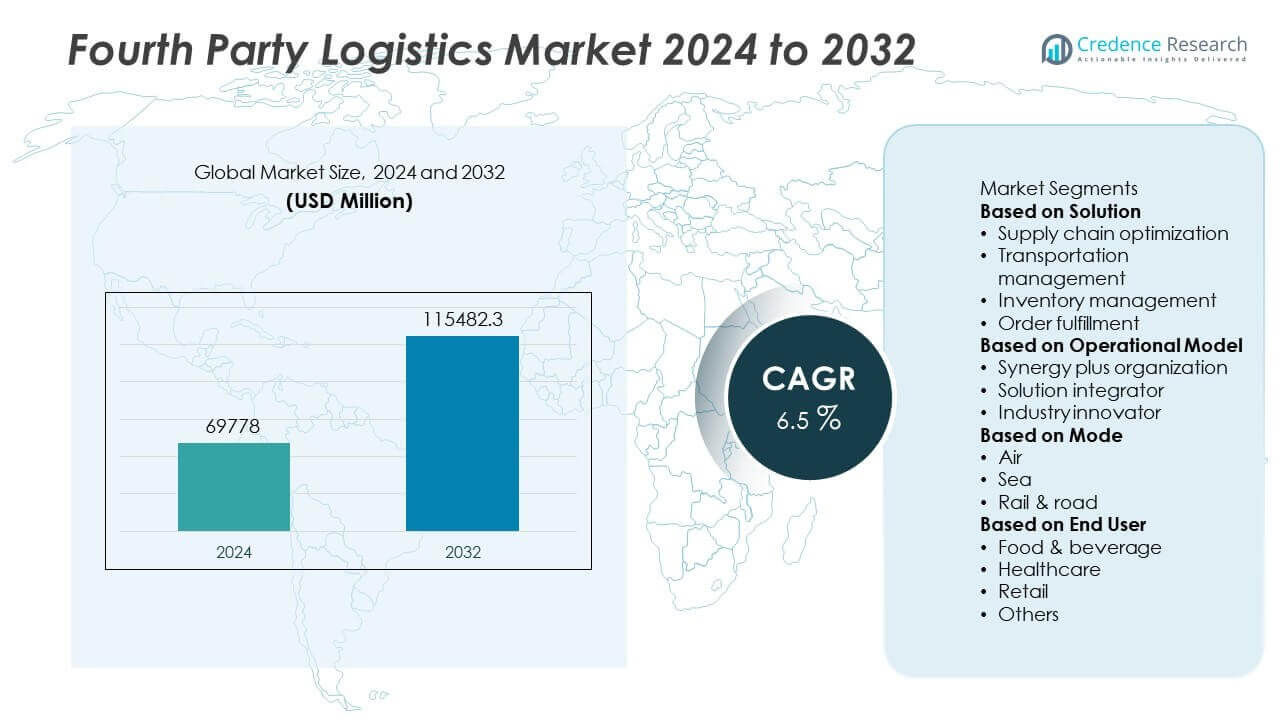

The global Fourth Party Logistics (4PL) Market was valued at USD 69,778 million in 2024 and is projected to reach USD 115,482.3 million by 2032, expanding at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fourth Party Logistics Market Size 2024 |

USD 69,778 Million |

| Fourth Party Logistics Market, CAGR |

6.5% |

| Fourth Party Logistics Market Size 2032 |

USD 115,482.3 Million |

Fourth Party Logistics Market grows with rising demand for fully integrated supply chain solutions and outsourcing of complex logistics operations. Businesses adopt 4PL models to reduce costs, streamline processes, and gain end-to-end visibility. It benefits from expansion of e-commerce, global trade, and the need for faster delivery networks.

North America leads the Fourth Party Logistics Market with strong adoption of digital supply chain solutions, driven by mature logistics infrastructure and high demand from e-commerce and manufacturing sectors. Europe follows with a focus on sustainability, regulatory compliance, and cross-border trade efficiency, supported by advanced transportation networks. Asia-Pacific is the fastest-growing region, fueled by industrialization, global trade integration, and rapid retail expansion in China, India, and Southeast Asia. Latin America and Middle East & Africa show growing interest as businesses seek cost-effective and technology-enabled logistics services to overcome infrastructure challenges. Key players such as Geodis, UPS Supply Chain Solutions, Maersk (A.P. Moller – Maersk), and DHL Supply Chain focus on building control tower platforms, expanding multimodal capabilities, and enhancing visibility across global networks. These companies invest in automation, data analytics, and partnerships with technology providers to deliver scalable and efficient 4PL solutions for diverse industries.

Market Insights

- Fourth Party Logistics Market was valued at USD 69,778 million in 2024 and is projected to reach USD 115,482.3 million by 2032, growing at a CAGR of 6.5% during the forecast period.

- Rising demand for integrated supply chain management and outsourcing of complex logistics operations drives the adoption of 4PL solutions across industries.

- Key trends include digitalization of supply chains, deployment of AI-driven analytics, sustainability-focused logistics planning, and increased use of control tower platforms for real-time visibility.

- The market is competitive with players such as Geodis, UPS Supply Chain Solutions, Maersk (A.P. Moller – Maersk), DHL Supply Chain, and Kuehne+Nagel focusing on automation, multimodal transport optimization, and strategic partnerships.

- High implementation costs, integration complexity, and concerns over loss of operational control act as restraints, slowing adoption among smaller businesses.

- North America leads with advanced logistics infrastructure and strong technology adoption, Europe focuses on green logistics and regulatory compliance, while Asia-Pacific records the fastest growth driven by manufacturing and e-commerce expansion.

- Emerging opportunities lie in Latin America and Middle East & Africa where growing trade volumes, infrastructure development, and demand for cost-efficient logistics networks encourage adoption of 4PL models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Integrated Supply Chain Management

Fourth Party Logistics Market grows with the increasing need for fully integrated supply chain solutions. Businesses seek 4PL providers to streamline procurement, warehousing, transportation, and distribution through a single point of contact. It helps reduce complexity and enhances operational efficiency for global companies. Outsourcing to 4PL providers allows businesses to focus on core activities while improving logistics performance. Rising competition pushes companies to adopt advanced supply chain models that deliver cost savings and faster turnaround times. Integration of services strengthens resilience and reduces risk during demand fluctuations.

- For instance, Geodis is a major global logistics provider with a strong presence in the automotive sector, offering 4PL control tower services. The company works with European automotive manufacturers, and achieving high on-time delivery rates, often exceeding 95% or 98%, is a standard industry goal. Geodis has reported general increases in customer satisfaction and investments in operational excellence in 2024.

Growth of Global Trade and E-Commerce Expansion

Fourth Party Logistics Market benefits from the rise in cross-border trade and booming e-commerce sector. Global supply chains require expert coordination to manage multiple suppliers, carriers, and distribution centers efficiently. It enables real-time visibility and optimized route planning for faster delivery times. The growth of e-commerce pushes demand for 4PL solutions that manage reverse logistics and last-mile delivery challenges. Companies depend on 4PL partners to consolidate shipments and reduce transportation costs. This growth supports adoption across retail, consumer goods, and manufacturing sectors.

- For instance, Maersk’s NeoNav is a 4PL platform that offers customers predictive insights, inventory visibility, and optimized route planning for their supply chains. Maersk’s total loaded volume across its global ocean operations in 2024 was over 12.3 million FFE (equivalent to approximately 24.6 million TEU), and its APM Terminals segment achieved a record revenue of $4.5 billion for port handling in 2024, representing strong volume growth.

Focus on Cost Optimization and Asset-Light Strategies

Fourth Party Logistics Market is driven by growing emphasis on reducing logistics costs while maintaining service quality. Businesses adopt 4PL models to eliminate capital investments in warehouses, fleets, and IT systems. It allows flexible scaling of operations without significant fixed costs. Advanced analytics and data-driven decision-making reduce waste and improve inventory management. Cost optimization through 4PL solutions improves competitiveness and profitability. This driver is especially important for industries facing volatile demand and tight margins.

Adoption of Digitalization and Real-Time Visibility Platforms

Fourth Party Logistics Market experiences growth through digital transformation and use of smart logistics platforms. 4PL providers deploy advanced software, IoT, and AI tools to provide end-to-end supply chain visibility. It enables predictive analytics, demand forecasting, and proactive risk management. Real-time data sharing improves collaboration between shippers, carriers, and suppliers. Automation of order management and shipment tracking enhances customer satisfaction. These innovations drive faster decision-making and optimize supply chain performance globally.

Market Trends

Market Trends

Rising Adoption of Digital Supply Chain Platforms

Fourth Party Logistics Market shows a strong trend toward using cloud-based platforms and advanced analytics. Companies implement digital control towers to monitor shipments and optimize routes in real time. It improves collaboration between suppliers, carriers, and distributors across global networks. Artificial intelligence and machine learning support predictive demand planning and inventory optimization. Blockchain solutions are being tested to enhance transparency and security in transactions. This trend drives efficiency and supports data-driven decision-making for complex supply chains.

- For instance, C.H. Robinson’s Managed Solutions helps manage complex supply chains for clients using its Navisphere® platform and network of Control Towers, which manages 37 million shipments annually for the broader C.H. Robinson business, improving collaboration among suppliers, carriers, and distributors across global networks.

Growing Focus on Sustainability and Green Logistics

Fourth Party Logistics Market benefits from the shift toward eco-friendly logistics practices. Companies adopt carbon tracking tools and route optimization to cut emissions. It encourages use of alternative fuel vehicles and energy-efficient warehousing solutions. 4PL providers design supply chain strategies that align with ESG targets. Partnerships with carriers offering electric or hybrid fleets are increasing. This trend positions 4PL as a key enabler of sustainable supply chain transformation.

- For instance, Kuehne+Nagel’s myKN platform tracks the environmental impact of shipments, with the company reporting a total of 16.74 million tonnes of Greenhouse Gas (GHG) emissions in 2024. This platform and others like seaexplorer provide visibility to help shippers choose lower-carbon options. It encourages the use of alternative fuels, such as the 1.2 million liters of Hydrotreated Vegetable Oil (HVO) used in road logistics during 2024, and leverages energy-efficient warehousing, with 98% of electricity at its sites sourced from renewable sources in the same year.

Expansion of E-Commerce and Omnichannel Logistics

Fourth Party Logistics Market is experiencing growth from rising e-commerce and omnichannel retail models. Businesses require 4PL solutions to manage fulfillment, returns, and last-mile delivery efficiently. It supports dynamic inventory allocation across distribution centers to reduce delivery times. Micro-fulfillment centers and urban warehouses gain traction to meet same-day delivery expectations. Reverse logistics management becomes a priority for handling product returns. This trend enhances the role of 4PL in connecting multiple retail channels seamlessly.

Increased Collaboration and Strategic Partnerships

Fourth Party Logistics Market is witnessing growing collaboration between 4PL providers, technology firms, and carriers. Joint ventures help expand service portfolios and geographical reach. It allows integration of innovative solutions such as autonomous vehicles and drone delivery. Strategic partnerships also improve capacity management during seasonal peaks. Industry players invest in building long-term relationships with shippers to create tailored solutions. This collaborative approach strengthens market competitiveness and drives innovation.

Market Challenges Analysis

High Implementation Costs and Complex Integration Requirements

Fourth Party Logistics Market faces challenges due to high upfront investment in technology and process integration. Many businesses hesitate to adopt 4PL solutions because of the cost of digital platforms, system upgrades, and training. It requires significant coordination between multiple stakeholders, which can delay implementation. Legacy IT infrastructure in some organizations creates integration hurdles and data compatibility issues. Smaller companies find it difficult to justify the investment without clear ROI. These factors slow adoption and limit market penetration among cost-sensitive sectors.

Risk of Dependency and Limited Control Over Operations

Fourth Party Logistics Market is impacted by concerns over losing direct control of logistics operations. Businesses rely heavily on 4PL providers for strategic decision-making and execution. It increases risk if service providers fail to meet performance expectations or face capacity shortages. Data security and confidentiality remain critical issues when sharing sensitive supply chain information. Disruption at the 4PL provider level can affect the entire value chain. This dependency creates hesitation among companies considering a full outsourcing model.

Market Opportunities

Growing Demand for End-to-End Supply Chain Visibility

Fourth Party Logistics Market holds strong opportunities with the rising need for transparent and connected supply chains. Businesses seek real-time data on inventory, shipments, and supplier performance to make faster decisions. It allows 4PL providers to offer control tower solutions and predictive analytics that enhance efficiency. Demand for risk management tools and proactive disruption alerts is increasing across industries. Companies adopting digital dashboards gain a competitive edge through better responsiveness. This creates growth potential for technology-driven 4PL solutions worldwide.

Expansion into Emerging Markets and Sector-Specific Solutions

Fourth Party Logistics Market can expand through entry into developing economies with growing manufacturing and retail sectors. Rising globalization and foreign investment increase the need for managed logistics networks. It gives providers opportunities to design sector-specific solutions for automotive, healthcare, and e-commerce industries. Customized services such as temperature-controlled logistics or reverse supply chain management attract specialized demand. Building local partnerships and infrastructure improves service delivery in cost-sensitive regions. This expansion strategy strengthens market presence and supports long-term growth.

Market Segmentation Analysis:

By Solution

Fourth Party Logistics Market is segmented by solution into supply chain consulting, logistics management, technology, and transportation services. Supply chain consulting leads the segment as businesses seek expert guidance to redesign and optimize global supply chains. Logistics management solutions are in high demand for coordinating procurement, warehousing, and distribution through a single platform. It enables end-to-end control and helps companies achieve better cost efficiency. Technology solutions such as control tower systems, AI-driven analytics, and real-time tracking tools are gaining popularity. Transportation services continue to grow with rising cross-border trade and e-commerce deliveries.

- For instance, CEVA Logistics announced it handled a pro forma 1.9 million TEU in ocean freight and 800,000 tons in air freight for 2023, following its acquisition of Bolloré Logistics in early 2024. To help manage its expanding operations, the company is completing its long-term rollout of the CargoWise digital platform, which enables end-to-end control and improves cost efficiency.

By Operational Model

Fourth Party Logistics Market by operational model includes solution integrator model and synergy plus operating model. Solution integrator model dominates because it provides a single point of contact to manage multiple 3PL providers and vendors. It offers strategic planning, technology integration, and continuous improvement for complex supply chains. Synergy plus model is growing steadily as it allows shared resources and collaborative execution across multiple clients. It appeals to businesses looking for cost-sharing benefits and operational flexibility. These models provide scalability and help companies align logistics with long-term business objectives.

- For instance, UPS Supply Chain Solutions uses its AI-powered ORION route optimization system, which has been credited with reducing drivers’ total mileage by an estimated 100 million miles annually, leading to significant savings and faster deliveries.

By Mode

Fourth Party Logistics Market is segmented by mode into roadways, railways, airways, and waterways. Roadways account for the largest share due to their flexibility, extensive reach, and importance in last-mile delivery. Railways are preferred for bulk cargo and cost-efficient long-haul transportation, especially in manufacturing and mining sectors. Airways serve time-sensitive and high-value shipments where speed is critical. Waterways support large-scale international trade, particularly for heavy commodities. It ensures a balanced approach where 4PL providers design multimodal solutions to optimize transit times and costs.

Segments:

Based on Solution

- Supply chain optimization

- Transportation management

- Inventory management

- Order fulfillment

Based on Operational Model

- Synergy plus organization

- Solution integrator

- Industry innovator

Based on Mode

Based on End User

- Food & beverage

- Healthcare

- Retail

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 35% of the Fourth Party Logistics Market, driven by strong adoption of integrated supply chain management across manufacturing, retail, and e-commerce sectors. The United States leads with advanced technology platforms and widespread use of digital control towers that enhance visibility and optimize logistics operations. It benefits from mature 3PL and 4PL ecosystems, enabling businesses to outsource end-to-end supply chain management efficiently. Growth in cross-border trade with Canada and Mexico under USMCA further fuels demand for 4PL solutions. Companies in the region focus on data-driven decision-making, sustainability, and automation to stay competitive. The presence of leading logistics technology providers supports rapid innovation and high customer adoption rates.

Europe

Europe accounts for 28% of the Fourth Party Logistics Market and is characterized by strong regulatory frameworks and demand for sustainable logistics practices. Germany, France, and the UK lead in deploying 4PL models to optimize complex supply chains serving automotive, pharmaceutical, and FMCG sectors. It benefits from the region’s advanced transportation networks and focus on green logistics, including carbon reduction and route optimization strategies. The growth of e-commerce and pan-European distribution networks increases the need for centralized control towers. Companies prioritize digitalization and compliance with EU regulations such as emissions tracking and customs management. Collaboration between logistics service providers and technology firms drives innovation in service offerings.

Asia-Pacific

Asia-Pacific represents 25% of the Fourth Party Logistics Market and is the fastest-growing regional segment. China, India, and Southeast Asia drive growth through rising manufacturing activity, global trade participation, and rapid e-commerce expansion. It benefits from government investments in logistics infrastructure such as industrial corridors, ports, and multimodal transport systems. Businesses adopt 4PL solutions to manage complex supplier networks and reduce inefficiencies in large-scale distribution. Demand for advanced logistics management is also growing in electronics, automotive, and healthcare industries. The region shows strong potential for technology-driven solutions, including AI-enabled forecasting and blockchain for supply chain transparency.

Latin America

Latin America holds 7% of the Fourth Party Logistics Market, led by Brazil and Mexico where industrial growth and export activity are increasing. Regional companies seek 4PL partners to streamline operations, improve customs compliance, and lower transportation costs. It supports development of multimodal solutions combining road, rail, and port logistics for greater efficiency. Adoption is rising in sectors like agriculture, consumer goods, and automotive manufacturing. Investment in logistics technology and warehouse automation helps overcome infrastructure gaps and improve service quality.

Middle East & Africa

Middle East & Africa capture 5% of the Fourth Party Logistics Market with steady demand growth supported by expanding trade and infrastructure development. Gulf countries invest in logistics hubs and free trade zones to strengthen their role as global supply chain gateways. It benefits from diversification efforts that increase non-oil trade and manufacturing activities. Africa’s demand for 4PL is growing with urbanization and rising imports of consumer goods. Providers offering cost-efficient and scalable logistics solutions are well positioned to capitalize on this emerging opportunity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Geodis

- UPS Supply Chain Solutions

- Maersk (A.P. Moller – Maersk)

- XPO Logistics

- CEVA Logistics

- DSV Panalpina

- TMC, a division of C.H. Robinson

- DB Schenker

- DHL Supply Chain

- Kuehne+Nagel

Competitive Analysis

Competitive landscape of the Fourth Party Logistics Market is shaped by leading players such as Geodis, UPS Supply Chain Solutions, Maersk (A.P. Moller – Maersk), DHL Supply Chain, Kuehne+Nagel, CEVA Logistics, DSV Panalpina, TMC (a division of C.H. Robinson), DB Schenker, and XPO Logistics. These companies compete by offering end-to-end supply chain management, advanced control tower platforms, and integrated technology solutions that provide real-time visibility. They focus on expanding global multimodal transport capabilities and optimizing warehouse networks to improve service levels. Strategic partnerships with technology providers strengthen their ability to deliver predictive analytics, automation, and AI-enabled decision-making tools. Investment in sustainability initiatives, including route optimization and carbon tracking, positions them as partners of choice for businesses pursuing ESG goals. These players also expand their presence in emerging markets, targeting growing demand from e-commerce, automotive, and healthcare sectors. Continuous innovation and digital transformation ensure strong competition and sustained market growth.

Recent Developments

- In August 2025, Maersk published “Redefine European air freight with digital transformation and e-commerce,” highlighting its 4PL supply chain management role.

- In August 2025, Maersk released “Strategies for supply chain resilience and reliable customs handling,” which touches on its 4PL capabilities in Europe.

- In June 2025, CEVA Logistics and bol signed an early contract renewal (June 30, 2025) to extend their partnership through 2029, with option to 2032. The agreement includes operations across five highly automated facilities in the Netherlands.

- In 2025, Geodis signed a long-term 4PL agreement with Ecopetrol. Geodis will manage Ecopetrol’s entire logistics supply chain via a smart platform offering real-time, end-to-end visibility, tracking delivery milestones and CO₂ emissions.

Report Coverage

The research report offers an in-depth analysis based on Solution, Operational Model, Mode, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of 4PL models will grow as businesses seek end-to-end supply chain control.

- Digital control tower platforms will become standard for real-time visibility and analytics.

- AI and machine learning will play a larger role in demand forecasting and risk management.

- Sustainability initiatives will drive route optimization and low-emission transportation solutions.

- E-commerce growth will increase demand for last-mile delivery and reverse logistics management.

- Strategic partnerships between 4PL providers and tech firms will accelerate innovation.

- Emerging markets will see rising adoption as infrastructure and manufacturing sectors expand.

- Automation in warehousing and transport planning will reduce costs and improve speed.

- Industry-specific 4PL solutions will grow in sectors like healthcare, automotive, and consumer goods.

- Competition will intensify as global players expand services and enter new regional markets.

Market Trends

Market Trends