Market Overview:

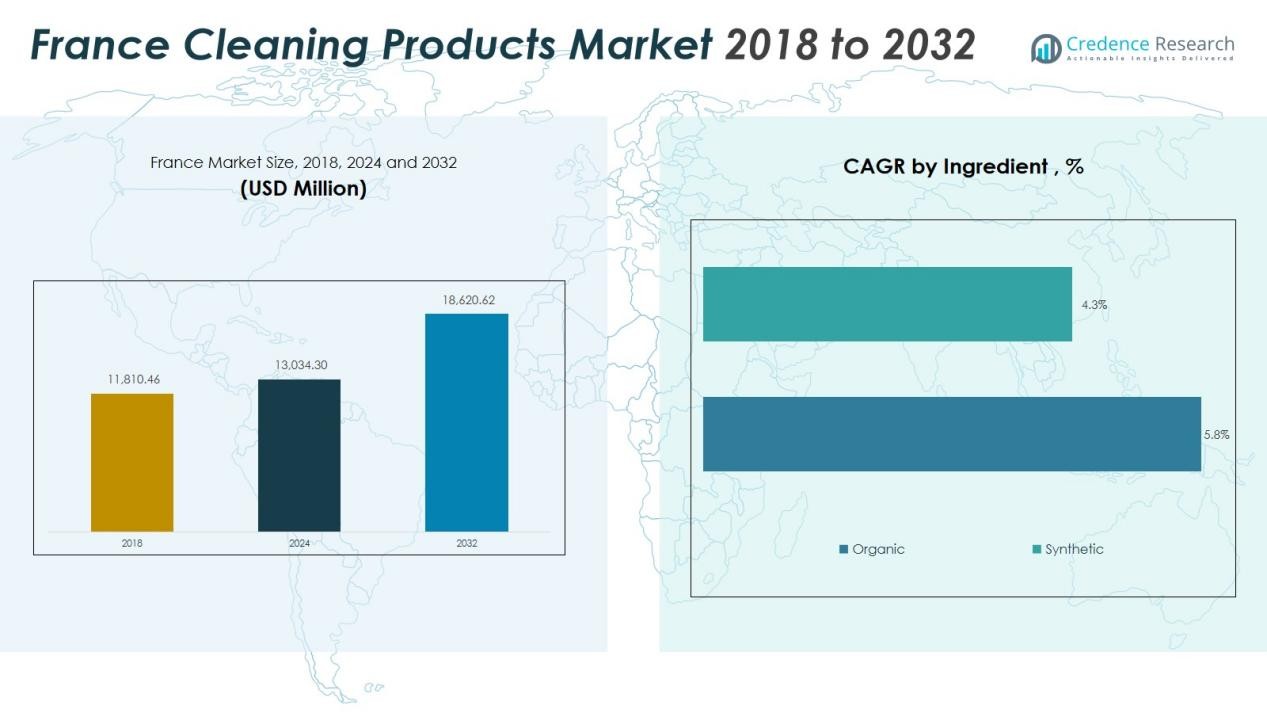

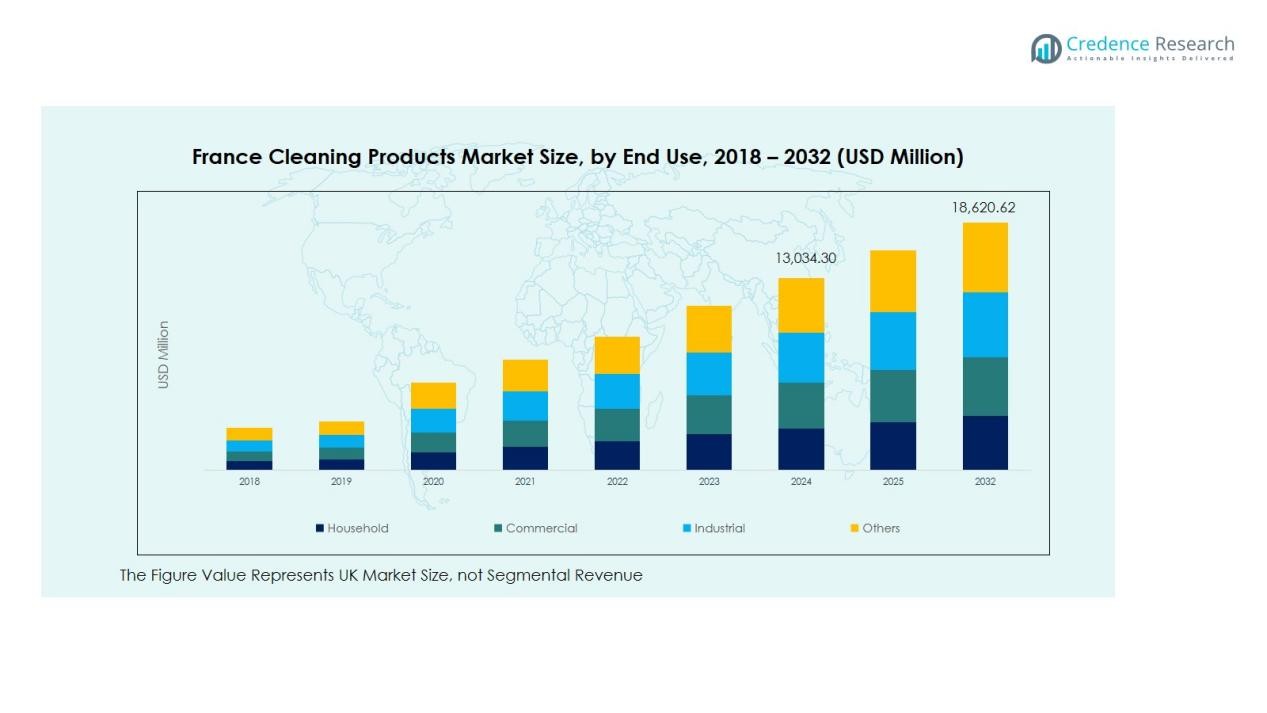

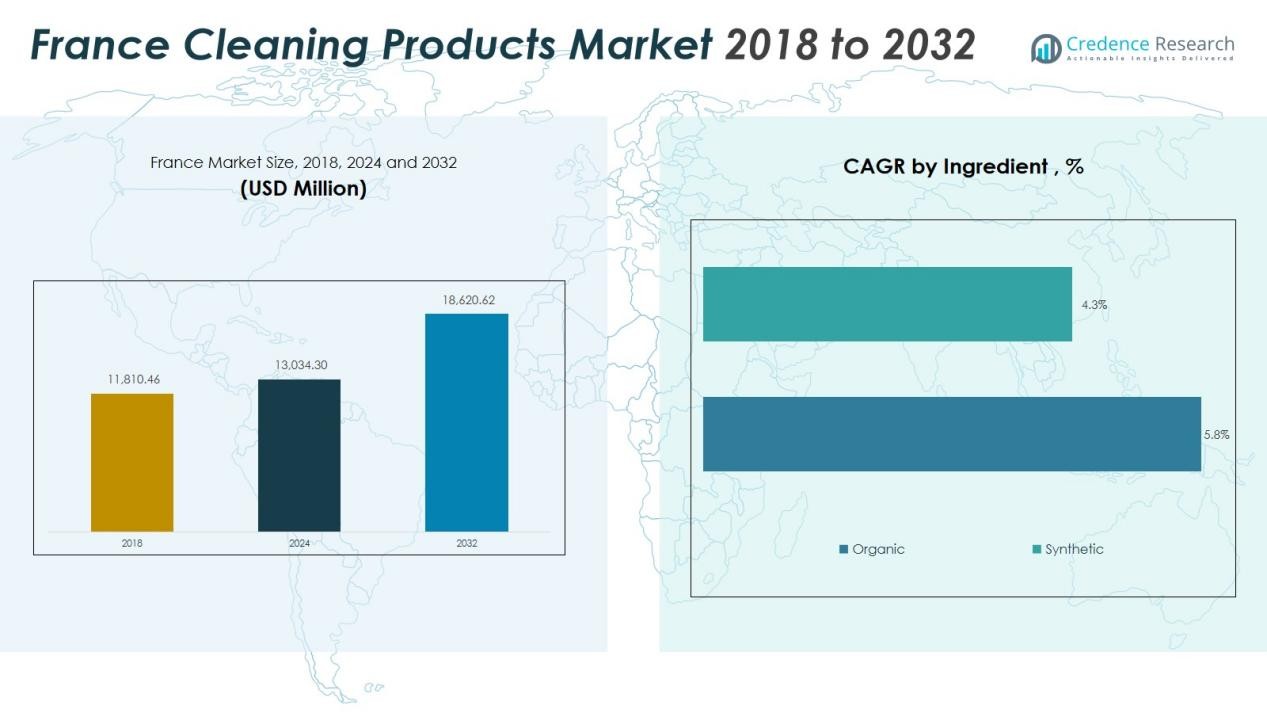

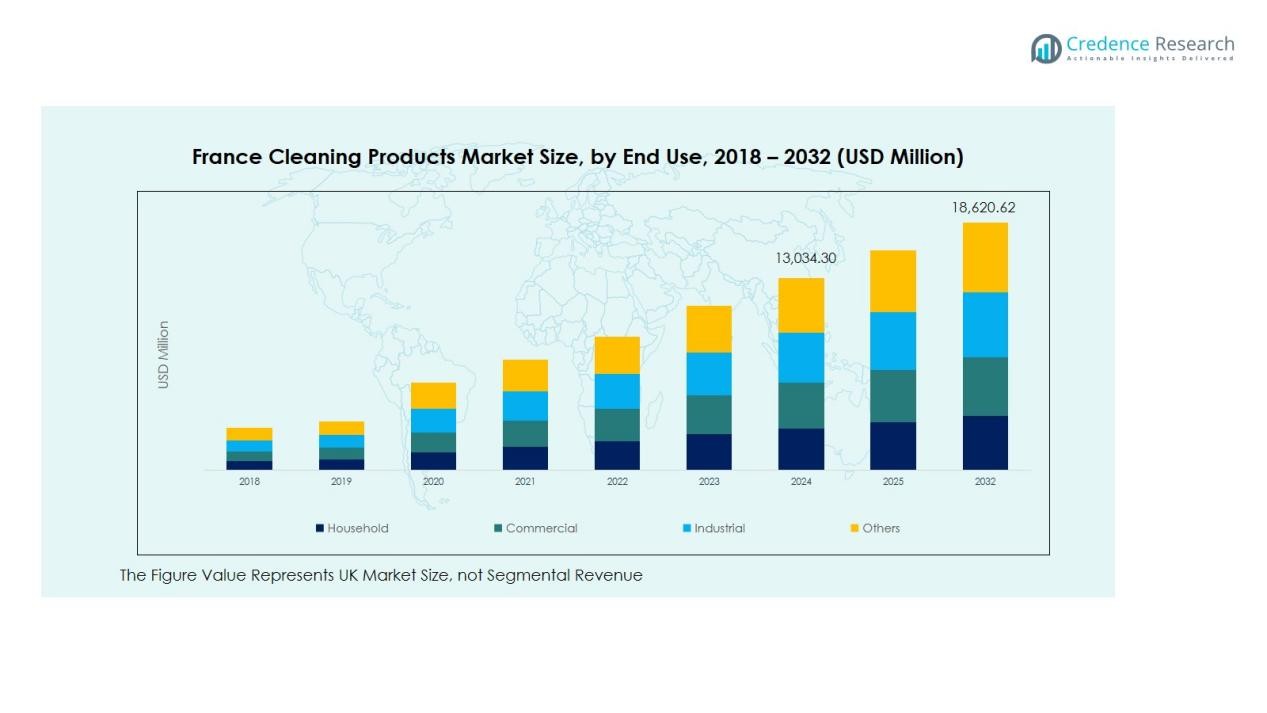

The France Cleaning Products Market size was valued at USD 11,810.46 million in 2018 to USD 13,034.30 million in 2024 and is anticipated to reach USD 18,620.62 million by 2032, at a CAGR of 4.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Cleaning Products Market Size 2024 |

USD 13,034.30 Billion |

| France Cleaning Products Market, CAGR |

4.56% |

| France Cleaning Products Market Size 2032 |

USD 18,620.62 Billion |

Key growth drivers include rising consumer awareness of hygiene and cleanliness, particularly following global health events, which spurred demand for effective household cleaning solutions. The shift toward sustainable and eco-friendly formulations is also a major driver, with French consumers showing elevated interest in “natural” or biodegradable cleaning products. In addition, the strong chemical manufacturing base in France supports innovation and availability of premium cleaning agents, further stimulating market expansion.

Within France, household demand accounts for the majority of consumption, with imports covering roughly 35% of total market size in 2024. The market is mature and concentrated in urban and suburban regions where retail infrastructure and e-commerce are well developed. Growth potential is higher in segments such as eco-friendly cleaning and premium products, compared with standard mainstream lines. Outside Paris and major metropolitan areas, growth may be more moderate due to slower disposable-income expansion and consumer adoption.

Market Insights:

- The France Cleaning Products Market was valued at USD 11,810.46 million in 2018 and is expected to reach USD 18,620.62 million by 2032, growing at a CAGR of 4.56% from 2024 to 2032.

- The metropolitan regions of Île-de-France, Rhône-Alpes, and Provence-Alpes-Côte d’Azur dominate the market with high household incomes, retail infrastructure, and premium product demand.

- Secondary cities and suburban regions show strong growth potential as they benefit from expanding retail formats and rising disposable incomes, though eco-friendly adoption lags urban areas.

- The household segment holds the largest share in the France Cleaning Products Market, accounting for the majority of consumption, while the commercial segment is showing significant demand for premium solutions.

- The eco-friendly product segment continues to gain traction, representing a substantial share of the market as French consumers prioritize sustainability in their purchasing decisions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Consumer Awareness and Hygiene Standards

The France Cleaning Products Market has witnessed a surge in demand driven by heightened consumer awareness about hygiene and sanitation. The COVID-19 pandemic significantly increased the focus on cleanliness, influencing both residential and commercial sectors. Consumers now prioritize hygiene and cleanliness in everyday life, especially in high-touch areas. This trend pushes the market towards stronger demand for disinfectants, sanitizers, and specialized cleaning agents for home and office use. As public health concerns continue, cleaning products remain essential for maintaining cleanliness and preventing the spread of infections.

- For instance, INEOS established hand sanitizer production facilities at its Lavéra plant in France, delivering 1 million bottles per month to hospitals across Southern France starting in April 2020.

Shift Towards Eco-friendly and Sustainable Products

A significant driver of growth in the France Cleaning Products Market is the rising preference for eco-friendly and sustainable cleaning solutions. Consumers are increasingly seeking products with natural ingredients, biodegradable formulations, and minimal environmental impact. This trend is reflected in the growing demand for green cleaning products, with French consumers prioritizing sustainability in their purchasing decisions. Companies in the market are responding by innovating in this space, offering eco-certified products that align with the country’s sustainability goals. The trend is expected to accelerate as consumer preference shifts toward greener alternatives.

- For Instance, Ecover has produced an ‘Essential’ line of laundry detergents that are Ecocert certified, with the ingredients typically being 98% of natural origin, as confirmed by product details available as of November 2025

Technological Advancements and Product Innovation

Technological advancements have become a crucial factor in shaping the France Cleaning Products Market. Innovations in cleaning formulations and packaging continue to meet the evolving needs of both consumers and businesses. Smart dispensers and automated systems are being integrated into the market, enhancing user convenience and optimizing product usage. As cleaning product manufacturers focus on improving efficiency, performance, and sustainability, new products and technologies are expected to drive market growth. The adoption of such innovations is boosting the appeal of advanced cleaning solutions across various segments.

Government Regulations and Safety Standards

Government regulations and safety standards are playing a pivotal role in shaping the France Cleaning Products Market. The government’s focus on hygiene regulations and public health safety ensures that cleaning products meet strict quality and safety benchmarks. This regulatory framework encourages the development of high-quality, effective cleaning agents that meet the demands of both consumers and commercial establishments. The ongoing enforcement of hygiene standards across sectors, such as healthcare, education, and hospitality, supports the continued growth of cleaning product consumption in France.

Market Trends:

Evolution of Retail Channels and Omni‑Channel Engagement

Online platforms have secured a progressively larger share in the France Cleaning Products Market. Manufacturers and retailers deploy direct‑to‑consumer web stores, social commerce channels and subscription models to reach urban households. Retail chains expand click‑and‑collect services and integrate mobile apps with loyalty programs in response to changing buyer habits. Smaller independent stores shift inventory strategies to meet fast‑moving green cleaning ranges and promote exclusive local brands. The distribution shift drives agile supply‑chain adjustments and opens new pricing strategies for premium and niche product lines.

- For instance, E.Leclerc Chez Moi managed over 400,000 home deliveries since January 2021 using a logistics software solution, which included electric bikes as a last-mile delivery option in Paris, reducing emissions while expanding its last-mile delivery capabilities in the region.

Increase in Premiumisation and Customised Formulations

Consumers in the France Cleaning Products Market show rising demand for premium and specialist formats. They choose concentrated formulas, multi‑surface sprays, scent‑free variants and allergen‑friendly cleaning agents. Brands introduce tailored lines for pet owners, urban apartments and eco‑conscious buyers, leveraging local chemical‑industry capacity. Packaging upgrades—such as recyclable materials and reuse‑friendly systems—gain traction among quality‑seeking shoppers. The push toward differentiation supports higher average selling prices and encourages segmentation beyond conventional mass‑market cleaning solutions.

- For instance, Unilever launched Cif Infinite Clean in April 2025, a probiotic multi-purpose spray formulated with 100% natural probiotics that continues cleaning for up to 3 days on various surfaces. Packaging upgrades—such as recyclable materials and reusefriendly systems—gain traction among qualityseeking shoppers.

Market Challenges Analysis:

Escalating Production Costs and Margin Pressure

Manufacturers in the France Cleaning Products Market face pressure from rising raw‑material expenses, higher labour rates and increasing logistics costs. It has become harder to maintain product quality while keeping retail prices competitive. Companies must invest in more efficient manufacturing technology and streamlined operations to protect margins. Any delay in adapting production systems can reduce profitability and hamper growth potential. Some firms may defer investments which could compromise innovation or product differentiation. This cost‑pressure environment challenges many established and new players alike.

Regulatory Complexity and Ingredient Restrictions

The France Cleaning Products Market must comply with strict regulations around chemical use, labelling and environmental impact, which adds complexity and cost. It also faces consumer demand for safer, cleaner‑label ingredients, forcing reformulation of many cleaning agents. The requirement to adapt packaging for recyclability and fulfil chemical disclosure rules complicates supply‑chain management. Non‑compliance risk includes fines and damage to brand reputation, prompting cautious rollout of new products. These regulatory burdens slow new product introduction and may limit small‑scale players from scaling efficiently.

Market Opportunities:

Growth Opportunity through Eco‑Certifications and Sustainable Formulations

The France Cleaning Products Market faces a strong opportunity in the eco‑certified and sustainable segment. It can tap consumer demand for biodegradable ingredients, refill‑friendly formats and reduced‑plastic packaging. Brands that highlight transparency, recyclability and local production stand to gain trust and market share. French legislation promotes waste reduction and transparency, further encouraging producers to innovate in sustainable solutions. Manufacturers who upgrade supply chains for circular‑economy compliance can establish leadership early. This opens pathways for premium pricing and improved margin structure.

Expansion Potential in Professional and Institutional Cleaning Applications

The France Cleaning Products Market also finds opportunity beyond the household segment in professional and institutional cleaning. It can serve facilities such as healthcare, hospitality, education and offices that demand higher‑performance and compliant solutions. Innovations in automated dispensing, touch‑free systems and high‑efficiency formulations drive value in those segments. Market penetration in smaller towns and suburban regions remains under‑exploited, providing additional reach. Partnerships between chemical manufacturers and professional service providers can accelerate uptake. Firms that tailor offerings for niche use‑cases gain differentiation and growth potential.

Market Segmentation Analysis:

By Product Type

The market divides into surface cleaners, toilet cleaners, glass & metal cleaners, floor cleaners, fabric cleaners, dish‑washing products and other specialty cleaners. Surface and floor cleaners hold large shares thanks to high usage in homes and commercial spaces. Dish‑washing products and toilet cleaners show steadier growth due to hygiene concerns and frequent replacement cycles. Specialty products—such as personal‑care cleaners and building cleaners—gain traction in niche segments. Manufacturers increasingly tailor product design and packaging to each type, driving differentiation.

- For Instance, Procter & Gamble’s Swiffer brand is a significant commercial success, with the product line generating over $500 million in annual global revenue.

By Ingredient

The market categorises ingredients into organic and synthetic formulations. Organic‑based or “natural” cleaning agents appeal to eco‑aware French consumers seeking biodegradable and plant‑derived options. Synthetic formulas remain dominant due to cost‑efficiency and proven cleaning power across broad categories. Brands that invest in reformulation to combine efficacy with environmental compliance help reshape ingredient mix in the market. The shift in ingredient preference opens room for premium‑priced formulations and reformulated legacy offerings.

- For instance, Henkel was the first company to launch a phosphate-free detergent in France in 1986 with Le Chat, demonstrating early commitment to reformulating products for environmental compliance.

By End‑use

End‑use segmentation splits the market into household, commercial, industrial and other applications. The household segment holds the majority share in the France Cleaning Products Market, driven by consumer spending in urban areas and strong retail penetration. Commercial users—such as offices, hospitality and education facilities—show rising demand for professional‑grade solutions and specialist formats. Industrial end‑users require bulk formats, compliance with safety standards and supply‑chain reliability. Targeting each end‑use category with customised offerings supports growth and diversification.

Segmentations:

By Product Type:

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaner, etc.)

By Ingredient:

By End-use:

- Household

- Commercial

- Industrial

- Others

By Price Range:

Regional Analysis:

Metropolitan & Urban Zones Drive Demand Concentration

The France Cleaning Products Market records strong consumption in metropolitan areas like Île‑de‑France, Rhône‑Alpes and Provence‑Alpes‑Côte d’Azur where retail infrastructure remains dense. These zones feature high household incomes and elevated standards of living, which fuel premium product uptake. Urban dwellers favour multi‑function and convenience‑oriented cleaning formats, thus influencing product portfolios. Manufacturers and retailers prioritise urban roll‑out for new launches and premium ranges. Logistics networks within and between major cities support rapid distribution of innovations and niche SKUs.

Growth Potential in Secondary Cities and Suburban Regions

Beyond major urban centres, secondary cities and suburban districts present emerging opportunity for the France Cleaning Products Market. These regions benefit from expanding retail formats, growing disposable incomes and increased household formation. The adoption rate of eco‑friendly formulations and higher‑end cleaning solutions often lags urban zones, offering room for awareness campaigns and targeted marketing. Supply chains have recently extended deeper into regional France, reducing cost to serve and enabling finer segmentation. Brands that customise offerings for regional sensibilities and price elasticity stand to increase market share.

Rural Zones and Import Reliance with Cost Sensitivity

Rural and remote regions in France remain characterised by lower modern trade penetration and higher reliance on traditional outlets. The France Cleaning Products Market in these zones shows cost sensitivity and a preference for economy‑priced products or regional brands. Imports account for about 35 % of total market size, reflecting supply from outside sources especially in less‑accessible areas. Localised promotional strategies, small‑pack formats and distribution through neighbourhood networks offer competitive pathways. Manufacturers that tailor packaging, pricing and channel strategy for these areas can unlock under‑served demand.

Key Player Analysis:

Competitive Analysis:

In the France Cleaning Products Market, competition remains intense among major global players operating strong brand portfolios and diversified distribution models. Henkel AG & Co. KGaA leverages established home‑care brands and focuses on sustainability and innovation in cleaning formulations to hold a significant share. Reckitt Benckiser Group plc builds strength through premium hygiene and cleaning brands and emphasises product efficacy and health‑oriented positioning. The Procter & Gamble Company competes primarily through scale, broad distribution and strong retailer partnerships in France. Unilever plc drives growth via innovation, eco‑friendly formats and targeted launches (such as its recent shorter‑cycle detergent release) to enhance its competitive standing. Each of these players invests heavily in brand engagement, formulation upgrades and channel expansion to secure leadership. They frequently adjust pricing strategies and promotional mechanics to respond to consumer shifts and regulatory changes.

Recent Developments:

- In March 2025, Procter & Gamble launched the Always Pocket Flexfoam and became the first-ever period care partner at Coachella.

- In October 2025, Henkel announced an expansion of its strategic partnership with Dow to decarbonize its adhesives portfolio by integrating low-carbon feedstocks and renewable electricity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Cleaning Products Market will witness stronger demand for eco‑certified and biodegradable solutions driven by consumer sustainability priorities.

- It will benefit from expanding online and omnichannel distribution, enabling brands to reach smaller cities and rural regions more efficiently.

- Growth in commercial and institutional end‑use segments will accelerate, fueled by cleanliness standards in hospitality, healthcare and education sectors.

- Higher‑performance formats designed for quick use—such as spray concentrates, multi‑surface wipes and automated dispensers—will become more prevalent.

- Reformulation to exclude restricted chemicals such as PFAS will reshape product portfolios and offer competitive differentiation.

- Regional penetration in secondary urban and suburban zones will increase, encouraging tailored pack sizes and localized marketing.

- Refillable packaging and circular‑economy models will gain share and support premium pricing strategies.

- Collaboration between chemical manufacturers and cleaning‑service providers will drive bundled offerings and professional‑grade product adoption.

- Domestic manufacturing that emphasises sustainable feedstocks and local production will support resilience and brand reputation.

- Smaller niche brands focusing on allergen‑free, pet‑safe and fragrance‑free cleaning agents will capture specific consumer segments and challenge mainstream players.