Market Overview

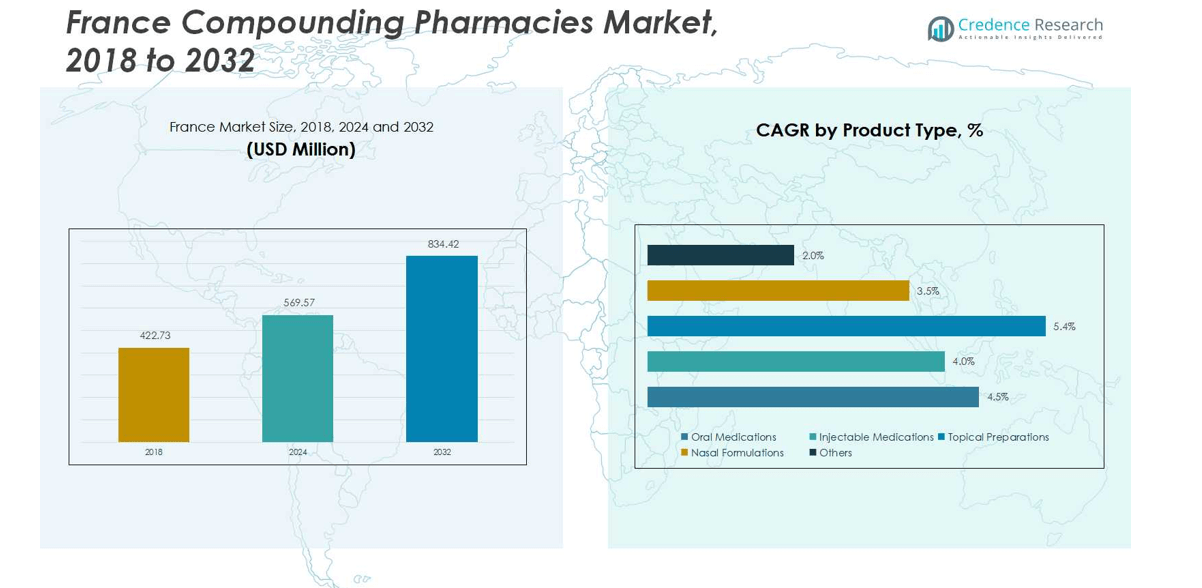

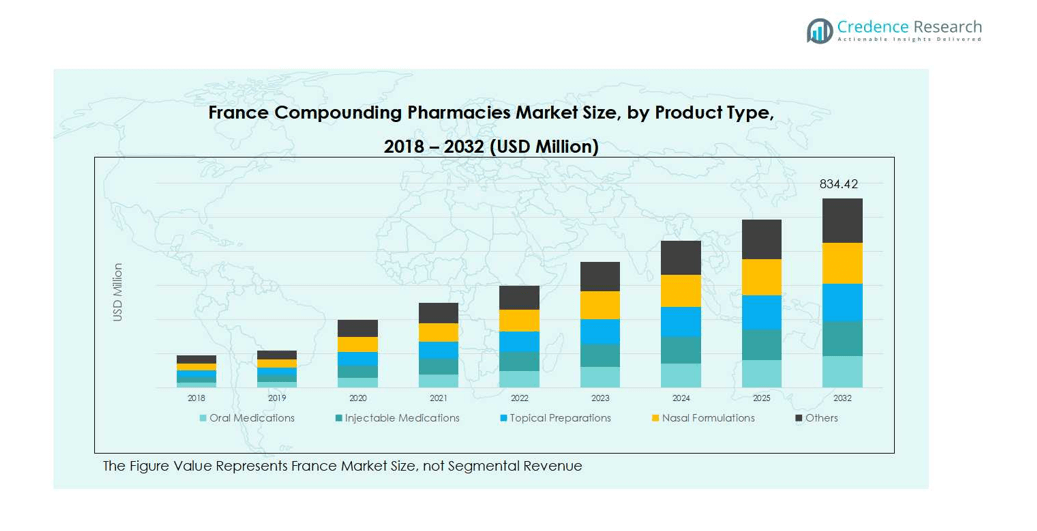

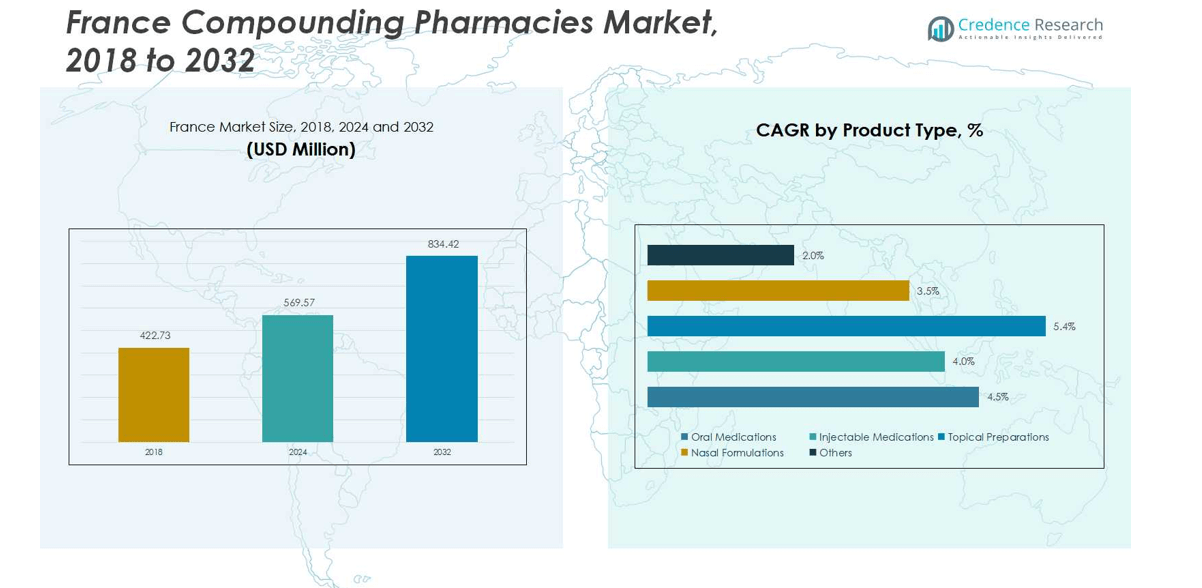

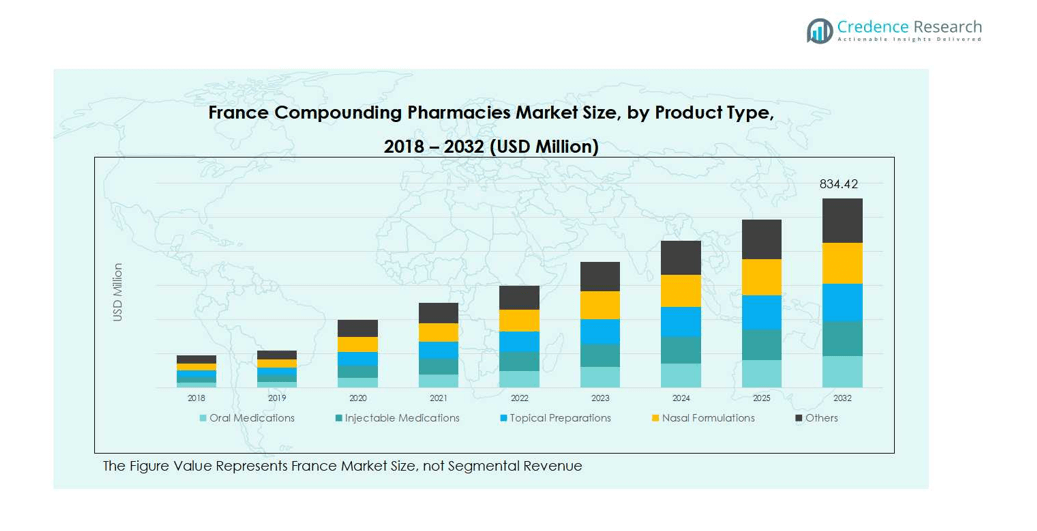

France Compounding Pharmacies Market size was valued at USD 422.73 Million in 2018 to USD 569.57 Million in 2024 and is anticipated to reach USD 834.42 Million by 2032, at a CAGR of 4.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Compounding Pharmacies Market Size 2024 |

USD 569.57 Million |

| France Compounding Pharmacies Market, CAGR |

4.55% |

| France Compounding Pharmacies Market Size 2032 |

USD 834.42 Million |

The France Compounding Pharmacies Market is highly competitive, with key players including Baxter International, Nephron Pharmaceuticals, B. Braun Melsungen AG, Fresenius Kabi AG, Capsa Healthcare, Fagron N.V., Grifols, McKesson, Omnicell, and Athenex driving innovation and market expansion. These companies focus on enhancing patient-specific therapies through oral, injectable, and topical formulations while investing in advanced compounding technologies and regulatory compliance. Strategic collaborations with hospitals, specialty clinics, and home healthcare providers strengthen their market presence and broaden service offerings. Île-de-France emerges as the leading region in the France compounding pharmacies market, commanding 28% of the total share due to its dense population, advanced healthcare infrastructure, and high patient awareness. This combination of strong regional demand and active participation by top players underscores the market’s steady growth trajectory and positions France as a hub for personalized compounding therapies.

Market Insights

- The France Compounding Pharmacies Market was valued at USD 569.57 Million in 2024 and is projected to reach USD 834.42 Million by 2032, growing at a CAGR of 4.55%. Oral medications dominate the product type segment with a 40% share, while sterile compounding leads the sterility segment with 55% share.

- Rising demand for personalized medications, including hormone replacement, pain management, and specialty drugs, is fueling market growth, supported by increasing patient awareness and advanced compounding technologies.

- Key trends include adoption of home healthcare services, outpatient treatments, and innovative automation technologies, which enhance precision, efficiency, and patient convenience.

- The market is competitive, led by top players such as Baxter International, Nephron Pharmaceuticals, B. Braun Melsungen AG, Fresenius Kabi AG, and Fagron N.V., focusing on product innovation, regulatory compliance, and strategic collaborations.

- Île-de-France commands the largest regional share at 28%, followed by Auvergne-Rhône-Alpes with 18%, supported by strong healthcare infrastructure and high patient demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Oral medications dominate the France Compounding Pharmacies Market, accounting for approximately 40% of the segment share. The strong preference for personalized dosing, ease of administration, and patient adherence drives growth in this sub-segment. Injectable medications follow closely, supported by rising demand for specialized therapies requiring intravenous or subcutaneous delivery. Topical preparations and nasal formulations are witnessing steady growth, driven by dermatological and respiratory treatments, while the “Others” category captures niche compounding products, ensuring comprehensive patient-specific formulations across therapeutic applications.

- For instance, Nasal formulations also see advances companies like MedPharm develop optimized nasal sprays for respiratory conditions such as allergic rhinitis, enabling precise drug delivery with enhanced patient compliance.

By Pharmacy Type

503A pharmacies hold the leading share in France, representing around 65% of the market in this segment. These traditional compounding pharmacies serve individual prescriptions and focus on personalized formulations, driven by stringent regulatory compliance and demand for patient-specific medications. Conversely, 503B pharmacies, catering to bulk production for hospitals and clinics, are growing steadily due to increased hospital partnerships and institutional demand. The expansion of healthcare infrastructure and emphasis on quality assurance continues to bolster both sub-segments, with 503A pharmacies maintaining dominance.

By Sterility

Sterile compounding dominates the France market, capturing roughly 55% of the segment share, fueled by demand for injectable, ophthalmic, and intravenous therapies. Stringent hygiene standards and rising applications in oncology, critical care, and specialized therapies drive growth in sterile compounding. Non-sterile compounding accounts for the remaining share, focusing on oral, topical, and nasal formulations. The non-sterile sub-segment benefits from increasing patient-specific treatment needs, but sterile compounding remains the key revenue driver due to its critical role in hospital and clinical applications.

- For instance, the Lille University Hospital in France incorporated advanced sterile compounding devices in its oncology pharmacy unit to enhance the safety and accuracy of chemotherapy preparations.

Key Growth Drivers

Growing Demand for Personalized Medications

The increasing demand for patient-specific therapies is a primary growth driver in the France compounding pharmacies market. Patients with unique dosage requirements or allergies benefit from tailored oral, injectable, and topical formulations. Rising awareness of individualized care and advancements in pharmacy compounding techniques are fueling market adoption. Healthcare providers increasingly prefer customized medications to enhance treatment efficacy, improve patient adherence, and reduce side effects. This focus on personalized therapy underpins the market’s expansion, particularly in hormone replacement, pain management, and specialty drug formulations, strengthening the overall segment growth.

- For instance, collaboration between Institut Pasteur and Stragen in France to develop STR-324, a pain management drug showing promising preclinical efficacy and a better safety profile than traditional opioids.

Expansion of Sterile and Injectable Products

Sterile and injectable compounding products are witnessing substantial growth, driven by increased demand for oncology, critical care, and intravenous therapies. Hospitals and specialty clinics increasingly rely on sterile compounded medications due to stringent quality and safety standards. Injectable formulations provide precise dosing, higher bioavailability, and rapid therapeutic outcomes, enhancing clinical effectiveness. Continuous investments in sterile compounding infrastructure, advanced preparation technologies, and skilled workforce support the expansion of this sub-segment, positioning sterile injectable products as a major revenue contributor in the France compounding pharmacies market.

- For instance, Baxter BioPharma Solutions has expanded its sterile injectable manufacturing capabilities with a $50 million investment in advanced lyophilization and aseptic fill/finish technologies, enabling high-quality production for critical injectable therapies, including COVID-19 vaccines and oncology products.

Supportive Regulatory Environment

France’s regulatory framework supports safe and high-quality compounding practices, fostering market growth. Clear guidelines for 503A and 503B pharmacy operations, sterility standards, and patient-specific formulations ensure compliance and quality assurance. Regulatory oversight encourages pharmacies to adopt advanced compounding technologies while maintaining safety and efficacy, boosting healthcare provider confidence. This environment enables pharmacies to expand product portfolios across oral, injectable, and topical formulations. Consequently, adherence to stringent regulations drives investment in infrastructure and innovation, reinforcing the market’s steady growth trajectory.

Key Trends & Opportunities

Emergence of Innovative Compounding Technologies

Advances in compounding technologies present significant opportunities for the France market. Automation, precision dosing, and formulation optimization reduce preparation errors and enhance consistency, improving patient outcomes. Innovative equipment allows compounding of complex medications, including biologics and specialty drugs, expanding the therapeutic scope. Integration of digital prescription management and quality control systems streamlines operations and enhances pharmacy efficiency. By leveraging technological innovations, compounding pharmacies can meet rising patient-specific demands and differentiate themselves in a competitive landscape, creating a strong growth avenue for the market.

- For instance, Pharmacie Delpech in Paris implemented CurifyLabs’ automation technology, which uses innovative printable Pharma Inks combined with quality control inspired by 3D printing, enabling customized treatments with enhanced speed and quality, significantly increasing production capacity.

Rising Adoption of Home Healthcare and Outpatient Services

The growing trend of home healthcare and outpatient treatments is creating opportunities for compounding pharmacies in France. Patients increasingly prefer personalized medications delivered to their homes, particularly injectable therapies, nutritional supplements, and topical preparations. Pharmacies are responding with tailored dosage forms and convenient packaging solutions, improving patient adherence and convenience. This shift toward decentralized healthcare services not only expands market reach but also enables pharmacies to develop niche products for chronic disease management, creating a robust growth avenue aligned with evolving healthcare consumption patterns.

- For instance, Eli Lilly’s LillyDirect service offers home delivery of personalized injectable medications such as their weight-loss drug Zepbound, simplifying patient access to specialized treatments and combining telehealth consultations with pharmacy services.

Key Challenges

Stringent Regulatory Compliance and High Operational Costs

Despite growth prospects, stringent regulatory requirements pose challenges for compounding pharmacies. Compliance with sterility, quality, and documentation standards requires substantial investment in infrastructure, staff training, and process validation. Smaller pharmacies often struggle to meet these stringent norms, limiting market participation. High operational costs, including specialized equipment and quality control systems, further constrain profitability. Navigating complex regulatory frameworks while ensuring consistent product quality remains a critical challenge, impacting market expansion, particularly for emerging players seeking to establish a foothold in France.

Limited Awareness and Accessibility Among Patients

Limited awareness of compounding pharmacy services among patients presents another challenge. Many individuals remain unaware of personalized therapy options, relying on standard medications instead. Additionally, access to specialized compounding pharmacies may be constrained in rural and semi-urban regions, restricting market penetration. This lack of visibility and availability can slow adoption rates, particularly for non-sterile or niche formulations. Addressing patient education and expanding distribution networks is essential for increasing utilization, but overcoming these barriers continues to challenge market growth and limits broader market expansion.

Regional Analysis

Île-de-France

Île-de-France leads the compounding pharmacies market in France, holding a 28% share due to its dense population and advanced healthcare infrastructure. The region hosts a significant concentration of hospitals, specialty clinics, and research centers, driving demand for personalized medications, including oral, injectable, and sterile formulations. High patient awareness and access to specialized pharmacies support market growth. Additionally, investments in modern compounding technologies and partnerships between pharmacies and healthcare providers reinforce the dominance of Île-de-France. Strong regulatory compliance and emphasis on quality also contribute to its leading position, making it a central hub for compounding pharmacy activities in the country.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes accounts for 18% of the France compounding pharmacies market, driven by expanding healthcare facilities and increasing patient demand for customized therapies. The region’s robust network of hospitals and outpatient clinics encourages adoption of both sterile and non-sterile compounded medications. Rising prevalence of chronic diseases, such as pain management and hormone therapy needs, further stimulates market growth. The focus on precision healthcare, coupled with increasing investments in automated compounding equipment, supports pharmacy efficiency and quality. Continuous healthcare development initiatives in this region are strengthening its position as a key contributor to the national compounding pharmacies market.

Provence-Alpes-Côte d’Azur (PACA)

Provence-Alpes-Côte d’Azur contributes 14% of the France compounding pharmacies market, driven by high patient demand for dermatological, hormonal, and injectable medications. The region’s affluent population and well-established private clinics facilitate adoption of personalized therapies. Compounding pharmacies in PACA are expanding service offerings, including home delivery and outpatient support, enhancing patient convenience. Investments in sterile compounding infrastructure and regulatory compliance further boost market confidence. Additionally, the growing interest in specialty drugs and nutritional supplements strengthens the region’s market presence. This combination of patient-centric services and advanced pharmacy operations positions PACA as a key growth region.

Nouvelle-Aquitaine

Nouvelle-Aquitaine holds 12% market share in the France compounding pharmacies sector, supported by increasing demand for oral medications, topical preparations, and sterile products. The region is witnessing steady growth due to rising patient awareness and improved access to healthcare facilities, particularly in urban centers like Bordeaux and Limoges. Pharmacies are increasingly leveraging automation and advanced compounding technologies to meet local demand efficiently. The expanding prevalence of chronic conditions and preference for personalized therapy also drives growth. Strategic initiatives by regional healthcare authorities to improve medication accessibility reinforce the adoption of compounding services, strengthening Nouvelle-Aquitaine’s market position.

Occitanie

Occitanie represents 11% of the France compounding pharmacies market, with growth fueled by rising demand for injectable and topical formulations. Regional hospitals, clinics, and outpatient centers are adopting sterile compounding services to cater to oncology, pain management, and hormone therapy patients. Pharmacies in Occitanie are enhancing capacity through automation, regulatory compliance, and skilled workforce training. Growing awareness of personalized medications and increased patient visits to specialized pharmacies support consistent growth. Initiatives to expand healthcare infrastructure and improve access to quality compounding services further reinforce Occitanie’s market share, establishing the region as a significant contributor to France’s overall compounding pharmacy market.

Hauts-de-France

Hauts-de-France holds 9% share of the France compounding pharmacies market, driven by rising demand for oral, injectable, and topical medications in both urban and semi-urban areas. Healthcare institutions are increasingly relying on sterile and non-sterile compounding services to meet patient-specific therapeutic needs. The region benefits from a growing network of hospitals and clinics, improved logistics, and access to advanced compounding technologies. Rising patient awareness and adoption of specialized medications for chronic conditions such as dermatology, pain management, and hormone therapy stimulate market expansion. Continuous investments in pharmacy infrastructure maintain Hauts-de-France as a key regional contributor.

Grand Est

Grand Est contributes 8% to the France compounding pharmacies market, driven by increasing demand for customized therapeutic solutions across oral, injectable, and sterile formulations. The region’s hospitals and clinics are adopting advanced compounding services to meet patient-specific needs, particularly in oncology and hormone replacement therapies. Growing healthcare awareness and regulatory support encourage pharmacies to expand service offerings. Investments in training, automation, and quality assurance systems enhance operational efficiency. The focus on personalized patient care and accessibility to compounded medications in urban and semi-urban areas positions Grand Est as a growing market within the national compounding pharmacies landscape.

Brittany

Brittany accounts for 6% of the France compounding pharmacies market, with growth driven by patient demand for oral medications, topical preparations, and injectable therapies. Pharmacies in the region are expanding offerings to include personalized dosages, home delivery, and outpatient services. Rising awareness of customized therapy and increased healthcare accessibility in urban centers like Rennes strengthen market adoption. Investments in regulatory compliance and compounding infrastructure support safe and effective production. The combination of patient-centric services and technological advancement enables Brittany to maintain a steady market presence while gradually increasing its share in the national compounding pharmacies sector.

Other Regions

Other regions in France, including Centre-Val de Loire, Bourgogne-Franche-Comté, Corsica, and Normandy, collectively hold 2% of the compounding pharmacies market. Growth in these regions is driven by localized demand for oral, injectable, and non-sterile medications in hospitals and clinics. While patient awareness is lower compared to major urban areas, pharmacies are gradually adopting automated compounding technologies and personalized treatment services. Government initiatives to improve healthcare access and regulatory guidance for quality assurance contribute to steady adoption. Though smaller in scale, these regions offer potential for niche market expansion and localized service development.

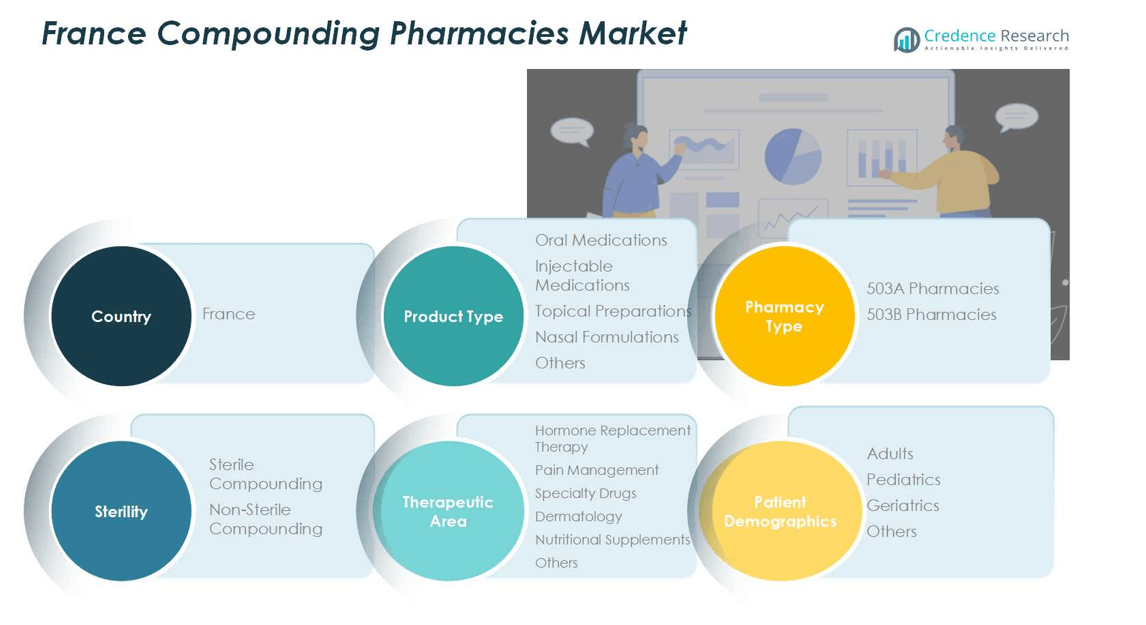

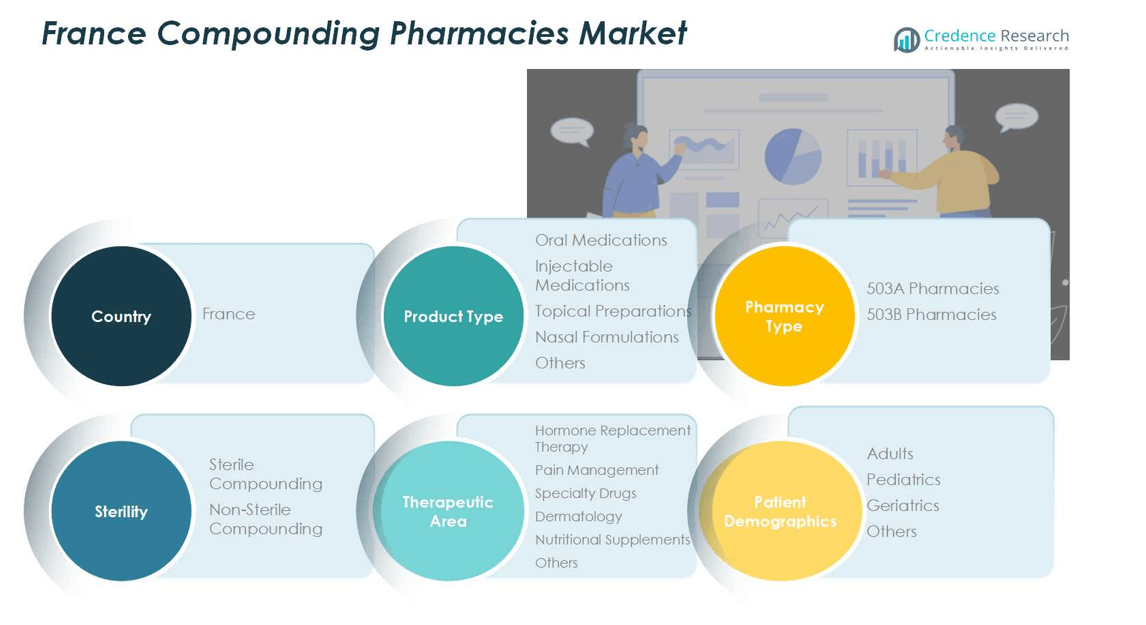

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacie

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- l Île-de-France

- l Auvergne-Rhône-Alpes

- l Provence-Alpes-Côte d’Azur (PACA)

- l Nouvelle-Aquitaine

- l Occitanie

- l Hauts-de-France

- l Grand Est

- l Brittany

- l Others

Competitive Landscape

The competitive landscape of the France Compounding Pharmacies Market is dominated by key players such as Baxter International, Nephron Pharmaceuticals, B. Braun Melsungen AG, Fresenius Kabi AG, Capsa Healthcare, Fagron N.V., Grifols, McKesson, Omnicell, and Athenex. Market competition is driven by product innovation, expansion of sterile and non-sterile compounding capabilities, and strategic collaborations with hospitals and specialty clinics. Leading companies focus on enhancing patient-centric formulations, implementing advanced compounding technologies, and ensuring strict compliance with regulatory standards. Investments in research and development, along with partnerships for home healthcare and outpatient services, allow players to differentiate offerings and strengthen their market presence. The competitive environment encourages continuous improvement in quality, efficiency, and accessibility, enabling pharmacies to cater to growing demand for personalized medications while maintaining high standards across oral, injectable, and topical therapies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Pharmacie Delpech Paris partnered with CurifyLabs to deploy the company’s automated compounding solution, Pharma Kit, enhancing the efficiency and precision of personalized medicine preparation in France.

- In January 2024, Equasens Group acquired a 70% majority stake in Digipharmacie, a SaaS start-up specializing in digital invoicing solutions for pharmacies, strengthening its digital capabilities in the French pharmaceutical sector.

- In January 2025, Alliance Healthcare Group France completed the acquisition of a majority stake in Pharmavance Group, a move aimed at expanding its service offerings and private-label portfolio for pharmacy partners.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising demand for personalized medications.

- Expansion of sterile and injectable compounding services will remain a major revenue contributor.

- Technological advancements in automation and precision dosing will enhance pharmacy efficiency.

- Growing adoption of home healthcare and outpatient treatments will increase market reach.

- Increasing awareness of patient-specific therapies will drive higher prescription volumes.

- Regulatory support and compliance initiatives will encourage investment in infrastructure and quality control.

- Specialty drugs and hormone replacement therapies will continue to emerge as high-demand segments.

- Collaboration between pharmacies and hospitals will strengthen market penetration and service offerings.

- Non-sterile compounding products will see steady growth in oral, topical, and nasal formulations.

- Expansion into underserved regions will create new opportunities for market players.