| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Feminine Hygiene Products Market Size 2023 |

USD 869.05 Million |

| France Feminine Hygiene Products Market, CAGR |

6.93% |

| France Feminine Hygiene Products Market Size 2032 |

USD 1,589.45 Million |

Market Overview:

France Feminine Hygiene Products Market size was valued at USD 869.05 million in 2023 and is anticipated to reach USD 1,589.45 million by 2032, at a CAGR of 6.93% during the forecast period (2023-2032).

Key drivers propelling the growth of the feminine hygiene products market in France include rising awareness of menstrual health, increased disposable income, and a shift towards eco-friendly alternatives. Educational initiatives and government campaigns have significantly improved menstrual hygiene literacy, leading to greater adoption of hygiene products. Additionally, consumers are increasingly opting for products made from natural fibers like organic cotton, bamboo, and banana fibers, driven by environmental concerns and a desire for safer, biodegradable options. The growing influence of social media influencers and advocacy groups has also played a pivotal role in spreading awareness about the importance of using sustainable and chemical-free products. These factors collectively contribute to a dynamic market landscape with a growing emphasis on sustainability and health-conscious choices, propelling the market toward long-term expansion.

France, as part of Western Europe, exhibits high per capita consumption of feminine hygiene products, with women aged 11 to 55 using over 390 units annually. This region’s mature market is characterized by well-established retail channels, including pharmacies, supermarkets, and an increasing presence of online platforms. The French market is also witnessing a shift towards premium and eco-friendly products, aligning with broader European trends towards sustainability and health-conscious consumer behavior. Urban areas in France, particularly Paris and Lyon, account for a significant share of the market due to the concentration of working women and a high level of disposable income. This regional dynamic positions France as a significant player in the European feminine hygiene products market, with continued growth anticipated in the coming years, as the demand for both traditional and innovative hygiene solutions continues to rise.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The French Feminine Hygiene Products market, valued at USD 869.05 million in 2023, is projected to reach USD 1,589.45 million by 2032, growing at a CAGR of 6.93%.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Rising awareness of menstrual health, supported by educational campaigns and government initiatives, is driving the adoption of feminine hygiene products.

- Increased disposable income among women allows for greater spending on both traditional and premium hygiene products, boosting market growth.

- A growing preference for eco-friendly and sustainable options, such as organic cotton pads and menstrual cups, reflects consumer demand for environmentally conscious products.

- Social media influencers and advocacy groups are normalizing menstrual health discussions, further encouraging the use of sustainable and chemical-free products.

- The high cost of premium, eco-friendly products remains a barrier, particularly for price-sensitive consumers, hindering widespread adoption.

- Market saturation, especially in urban areas like Île-de-France, poses challenges for new entrants, with competition increasing among established brands.

Market Drivers:

Rising Awareness of Menstrual Health

One of the primary drivers of growth in the France feminine hygiene products market is the rising awareness of menstrual health. Over the past decade, there has been a significant shift in how menstrual hygiene is perceived, with increased focus on health education and menstrual hygiene management. Government initiatives, educational campaigns, and widespread media attention have all contributed to raising awareness about the importance of maintaining proper hygiene during menstruation. For example, Règles Élémentaires, France’s first organization dedicated to tackling period poverty, has donated over 21 million menstrual products since 2015 and covered more than 1.2 million menstrual cycles for people experiencing period poverty. As a result, women are more informed about the variety of products available, such as sanitary pads, tampons, menstrual cups, and organic alternatives. This awareness has led to a more informed consumer base that demands higher-quality, effective, and safe feminine hygiene solutions.

Increase in Disposable Income

Another key factor fueling the growth of the feminine hygiene products market in France is the increase in disposable income, particularly among women. As France’s economy continues to recover and grow, consumers, particularly middle and upper-middle-class households, have more financial resources to spend on personal care and hygiene products. This increase in disposable income has made it easier for women to purchase a broader range of feminine hygiene products, including premium options. Women are no longer limited to basic sanitary products but are increasingly opting for high-end, eco-friendly, and organic alternatives that are often more expensive but offer additional benefits like improved comfort and environmental sustainability. This trend is also a reflection of the growing importance of personal well-being and self-care among French consumers.

Demand for Eco-Friendly and Sustainable Products

The growing demand for eco-friendly and sustainable feminine hygiene products is another significant driver in the French market. As concerns about environmental impact continue to rise globally, French consumers are increasingly looking for products that align with their environmental values. This includes opting for organic cotton sanitary pads, biodegradable tampons, and reusable menstrual cups. For instance, companies such as Silvercare and Plim have responded by offering ranges made from organic cotton and reusable materials, including panty liners, menstrual cups, and period underwear, which are manufactured with reduced environmental impact. Major brands have responded by expanding their product lines to include environmentally friendly options. The rise of eco-conscious consumerism has also spurred new entrants into the market, offering innovative products such as period panties and bamboo-based sanitary pads. The shift towards sustainability is expected to continue, with eco-friendly products becoming a standard expectation rather than a niche market.

Growing Influence of Social Media and Advocacy Groups

The influence of social media platforms and advocacy groups is another important factor driving the growth of the feminine hygiene products market in France. Social media has become an essential tool for disseminating information on menstrual health and hygiene products, with influencers and advocates leading conversations on the importance of menstrual care. This has helped to normalize discussions around menstruation, breaking down long-standing taboos and fostering an open dialogue about feminine hygiene. Additionally, feminist movements and health advocates have played a role in pushing for better access to hygienic products and creating awareness about their availability. Social media platforms have made it easier for women to share their experiences and connect with brands, further driving the demand for high-quality, ethical, and innovative feminine hygiene products in France.

Market Trends:

Shift Towards Organic and Natural Products

A key trend in the French feminine hygiene products market is the increasing demand for organic and natural alternatives. With growing concerns over the use of chemicals in personal care products, consumers are seeking hygiene solutions made from organic cotton, natural fibers, and sustainable materials. For example, Kimberly-Clark Corporation has expanded its offerings to include sanitary pads and tampons made from organic cotton, specifically designed to be free from synthetic chemicals, fragrances, and dyes. A 2023 study revealed that over 30% of French women now prefer organic sanitary products, reflecting a significant rise in demand for products free from synthetic chemicals, fragrances, and dyes. This shift is not only driven by health concerns but also by the growing awareness of the environmental impact of conventional hygiene products. The trend towards organic feminine hygiene solutions is expected to continue, with an increasing number of brands entering the market to cater to the demand for more natural, biodegradable options.

Rise in Subscription and Direct-to-Consumer Models

The French feminine hygiene products market is also witnessing the rise of subscription and direct-to-consumer (DTC) models. As convenience becomes a critical factor for many consumers, subscription services that deliver feminine hygiene products on a regular basis are gaining popularity. For instance, Ontex has piloted delivery and collection services for its hygiene products, allowing customers to receive and return products directly from their homes, which streamlines the purchasing process and supports product recycling initiatives. This model eliminates the need for consumers to make frequent purchases in-store, offering them a hassle-free experience. Companies like Yoni and Looni, which specialize in organic and eco-friendly feminine hygiene products, have leveraged the DTC model to reach their customers directly, fostering brand loyalty and improving customer retention. Subscription services also align with the growing preference for personalized, tailored experiences, where consumers can choose the products that suit their specific needs.

Technological Innovations and Smart Products

Technological innovation is another significant trend in the French feminine hygiene products market. The development of smart products, such as period tracking apps integrated with menstrual cups and pads, is becoming more prominent. These innovations offer a more personalized approach to menstrual health by providing insights into the menstrual cycle, flow patterns, and product usage. Additionally, there is a growing interest in menstrual cups and other reusable products, which are seen as more sustainable and cost-effective options compared to traditional products. As technology continues to evolve, it is expected that more companies will invest in creating smarter, more efficient, and user-friendly feminine hygiene products that meet the needs of modern consumers.

Growth of Eco-Friendly Packaging

The trend toward sustainability in the feminine hygiene sector extends beyond the products themselves to packaging. Increasingly, brands in France are opting for eco-friendly packaging solutions, aligning with the broader consumer push for sustainable practices. A report from 2022 found that 42% of French consumers are willing to pay a premium for products that use recyclable or biodegradable packaging. In response to this demand, several feminine hygiene brands have shifted away from plastic packaging and are now using paper, bamboo, or other sustainable materials. This shift not only meets consumer expectations but also contributes to reducing the environmental footprint of the feminine hygiene industry. The continued growth of eco-friendly packaging is expected to be a significant trend as consumers become more environmentally conscious.

Market Challenges Analysis:

High Cost of Premium Products

One of the key restraints in the French feminine hygiene products market is the high cost of premium and eco-friendly products. While demand for organic, biodegradable, and reusable products is on the rise, these alternatives are often more expensive than conventional options. This price gap can be a significant barrier for price-sensitive consumers, especially in a market where traditional hygiene products remain widely accessible and affordable. For instance, a 2023 study by Règles Elementaires found that 30% of women aged 18-24 in France were regularly unable to buy sanitary products due to financial difficulties, often forcing them to opt for the most basic and cheapest options rather than higher-quality or eco-friendly alternatives. The cost of sourcing organic materials, manufacturing eco-friendly products, and sustainable packaging often results in a higher retail price, limiting their adoption among a broader consumer base. This challenge may slow the widespread shift toward premium products, particularly in lower-income households.

Cultural Taboos and Stigma

Despite increasing awareness, cultural taboos and stigma surrounding menstruation continue to pose challenges in the French feminine hygiene market. Though France has made progress in normalizing conversations about menstruation, some segments of the population still view it as a sensitive or private subject. This can impact the willingness of consumers to openly discuss their menstrual health, affecting purchasing behavior and limiting the expansion of certain products. Additionally, the hesitancy to engage in open dialogue may hinder the uptake of new products and innovative solutions, particularly those involving smart technology or reusable options.

Environmental and Regulatory Constraints

Another challenge in the French feminine hygiene products market is the increasing pressure to comply with stringent environmental regulations. As sustainability becomes more of a priority, manufacturers must navigate complex regulatory requirements related to product composition, packaging, and waste management. This not only increases operational costs but also poses challenges in meeting consumer expectations for both product efficacy and environmental impact. Balancing eco-friendly production with affordability and performance remains a complex challenge for manufacturers looking to satisfy the growing demand for sustainable products while adhering to regulatory standards.

Market Saturation

The French feminine hygiene market is nearing saturation, with many major brands already established and widely distributed. This saturation can make it difficult for new entrants to gain a foothold or for existing brands to achieve significant market share growth. Increased competition leads to price wars, which further limits profitability and innovation, making it harder for companies to differentiate themselves in a crowded market.

Market Opportunities:

A significant market opportunity in the French feminine hygiene products market lies in the growing demand for sustainable and eco-friendly solutions. With increasing consumer awareness around environmental concerns, French consumers are seeking products that are biodegradable, organic, and made from natural materials like organic cotton and bamboo. The shift towards reusable menstrual products, such as menstrual cups and period underwear, presents a prime opportunity for companies to innovate and cater to the eco-conscious demographic. As regulations around plastic waste and environmental impact tighten, brands that can develop sustainable packaging and produce high-quality, environmentally friendly products stand to gain significant market share. This trend aligns with France’s broader environmental goals, making it a prime area for growth.

Another promising opportunity in the market is the integration of technology into feminine hygiene products. The increasing popularity of digital tools, such as period tracking apps, presents an opportunity to develop smart products that offer personalized solutions for menstrual health. For example, integrating sensors in menstrual cups or pads to track menstrual cycles and offer data-driven insights is an emerging trend. Additionally, innovation in product designs, such as enhancing the comfort and effectiveness of sanitary products, represents a growing opportunity in the market. As French consumers continue to seek products that blend convenience, comfort, and health benefits, the integration of technology in feminine hygiene products can provide brands with a competitive edge and help drive consumer loyalty.

Market Segmentation Analysis:

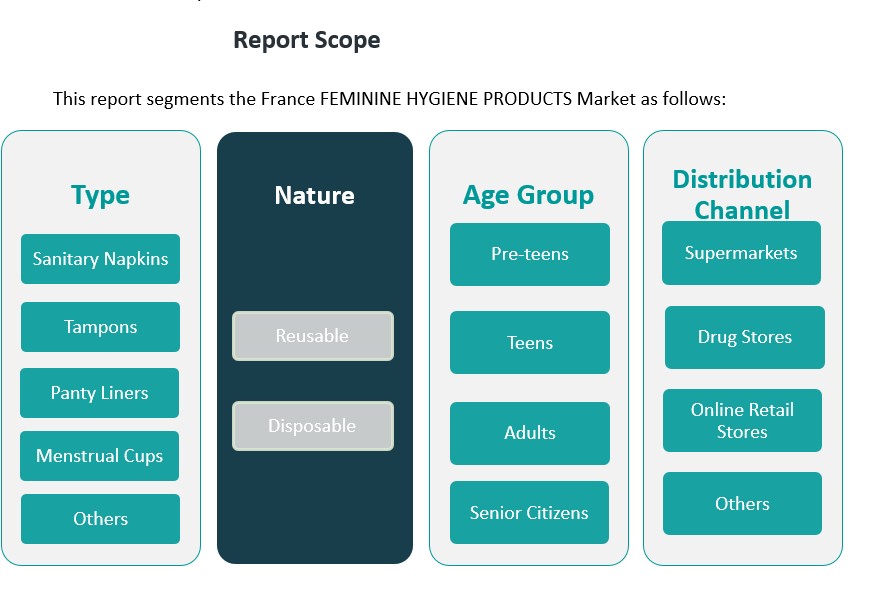

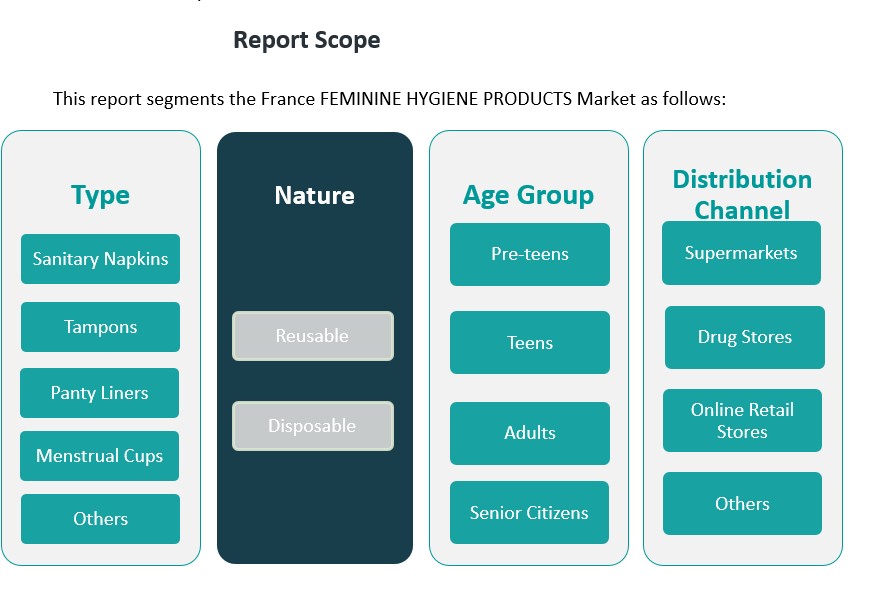

The French feminine hygiene products market is segmented by type, nature, age group, and distribution channel, offering a comprehensive view of consumer preferences and market dynamics.

By Type: The market is dominated by sanitary napkins, which account for a significant share due to their widespread usage and convenience. Tampons follow, driven by their popularity for active lifestyles. Panty liners have seen growing adoption for daily use and hygiene maintenance. Menstrual cups, a more sustainable option, are experiencing steady growth as eco-conscious consumers shift towards reusable products. The “Others” category includes items such as organic feminine hygiene products and period underwear, which are gaining traction among environmentally conscious consumers.

By Nature: The market is divided into reusable and disposable products. Disposable products, including sanitary napkins and tampons, remain the dominant choice due to their convenience. However, the demand for reusable products like menstrual cups and period underwear is on the rise as consumers prioritize sustainability and cost-effectiveness over time.

By Age Group: The market is also segmented by age group, with products for pre-teens and teens focusing on education and ease of use. Adults, particularly those aged 18-45, form the largest consumer base, driven by a mix of convenience and premium product adoption. The senior citizens’ segment is growing, with specialized products catering to post-menopausal women or those with specific health concerns.

By Distribution Channel: Supermarkets remain the leading distribution channel for feminine hygiene products, followed by drug stores and online retail platforms. The rise in e-commerce has made online shopping increasingly popular, offering convenience and a wide range of products. Other channels include pharmacies and specialty stores.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

The France feminine hygiene products market is characterized by regional variations influenced by demographic factors, economic conditions, and consumer preferences. While comprehensive regional market share data specific to France is limited, general insights can be drawn from broader European trends and available statistics.

Île-de-France Region

Île-de-France, encompassing Paris and its surrounding areas, is the most populous and economically developed region in France. This region exhibits the highest per capita consumption of feminine hygiene products, with women aged 11 to 55 using over 390 units annually. The concentration of urban populations, higher disposable incomes, and greater awareness of menstrual health contribute to the elevated demand for both traditional and eco-friendly feminine hygiene products.

Provence-Alpes-Côte d’Azur and Rhône-Alpes

Provence-Alpes-Côte d’Azur and Rhône-Alpes regions, known for their urban centers like Marseille and Lyon, also demonstrate significant consumption patterns. These areas benefit from a combination of urbanization, higher income levels, and increased awareness of sustainable hygiene solutions. Consequently, there is a growing preference for organic and reusable feminine hygiene products among consumers in these regions.

Other Regions

In contrast, regions such as Normandy, Brittany, and the French Overseas Territories exhibit lower per capita consumption rates. Factors such as lower population density, varying income levels, and less emphasis on menstrual health education contribute to these disparities. However, even in these areas, there is a gradual shift towards sustainable and eco-friendly feminine hygiene products, driven by increasing environmental awareness and the availability of such products through various distribution channels.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Biocodex

Competitive Analysis:

The French feminine hygiene products market is highly competitive, with both established global brands and emerging local players competing for market share. Major international brands such as Procter & Gamble (Tampax, Always), Kimberly-Clark (Kotex), and Johnson & Johnson dominate the market, leveraging their extensive distribution networks, brand recognition, and diverse product offerings. These companies offer a wide range of sanitary napkins, tampons, panty liners, and menstrual cups, catering to various consumer preferences. Local companies, particularly those focused on eco-friendly and organic products, are increasingly gaining traction. Brands like Yoni and Looni are positioning themselves as alternatives to conventional products, capitalizing on the growing demand for sustainable and reusable options. The competition is intensifying as consumer preferences shift towards organic, biodegradable, and reusable products, compelling established brands to innovate and incorporate eco-friendly materials into their product lines. This dynamic landscape presents opportunities for both new entrants and established players to innovate and meet evolving consumer demands.

Recent Developments:

- In February 2022, Kimberly-Clark Corporation took a significant step in the feminine hygiene sector by acquiring a majority stake in Thinx Inc., a company known for its innovative period underwear. This acquisition aims to drive category growth with retail partners and expand Kimberly-Clark’s presence in direct-to-consumer channels, further strengthening its position in the global feminine hygiene market.

- On the policy front, the French government announced in March 2023 that, starting in 2024, reusable sanitary products such as menstrual cups and pads would be available free of charge for individuals under 25. This initiative is part of France’s effort to combat period poverty and promote the adoption of sustainable menstrual products. Under the plan, the French healthcare system reimburses eligible purchases made in pharmacies, marking a significant step toward menstrual equity in the country.

Market Concentration & Characteristics:

The French feminine hygiene products market is moderately concentrated, with a few dominant multinational corporations holding substantial market shares. Procter & Gamble, Kimberly-Clark, and Essity are the leading players, commanding a significant portion of the market through their well-established brands such as Always, Kotex, and Nana. These companies benefit from extensive distribution networks, strong brand recognition, and substantial marketing budgets, enabling them to maintain a competitive edge. Despite the dominance of these major players, the market exhibits characteristics of a competitive landscape. The increasing consumer demand for sustainable and eco-friendly products has led to the emergence of niche brands offering organic cotton pads, menstrual cups, and reusable period underwear. This shift reflects a growing consumer preference for products that align with environmental and health-conscious values. Additionally, the rise of e-commerce platforms has facilitated greater market access for both established and emerging brands, further intensifying competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for eco-friendly and organic feminine hygiene products is expected to increase as consumers prioritize sustainability.

- Menstrual cups and reusable period products will see significant growth due to environmental awareness and cost-effectiveness.

- Consumer preference will shift towards products with natural ingredients and biodegradable materials, impacting product formulations.

- The expansion of e-commerce platforms will continue to enhance accessibility and convenience for consumers.

- Regulatory pressure for sustainable packaging will drive innovation in eco-friendly packaging solutions.

- Personalized menstrual health products integrated with technology, such as smart tracking apps, will grow in popularity.

- Increased government and public health initiatives will raise awareness of menstrual health, further boosting market demand.

- Demand for premium and high-performance products will rise as consumers seek better comfort and quality.

- Urbanization will contribute to higher consumption rates, particularly in regions like Île-de-France and Rhône-Alpes.

- Local and niche brands focused on sustainability will increase market competition, offering alternatives to traditional products.