Market Overview:

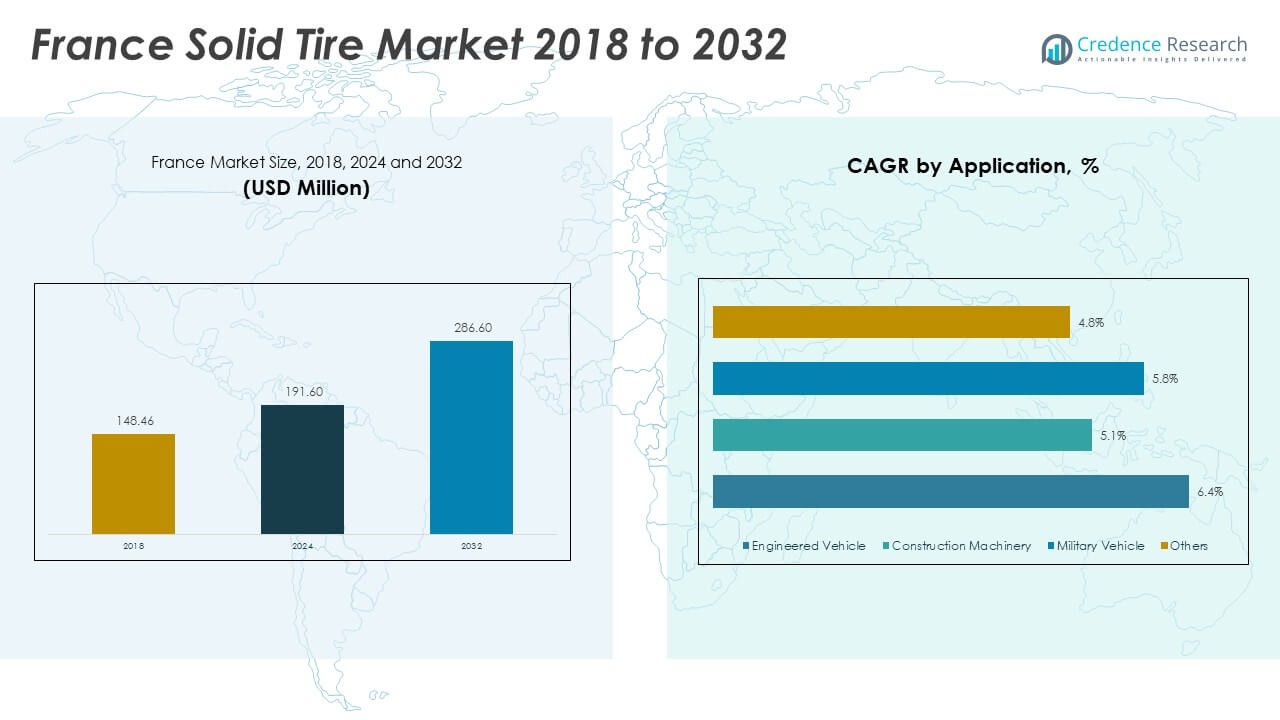

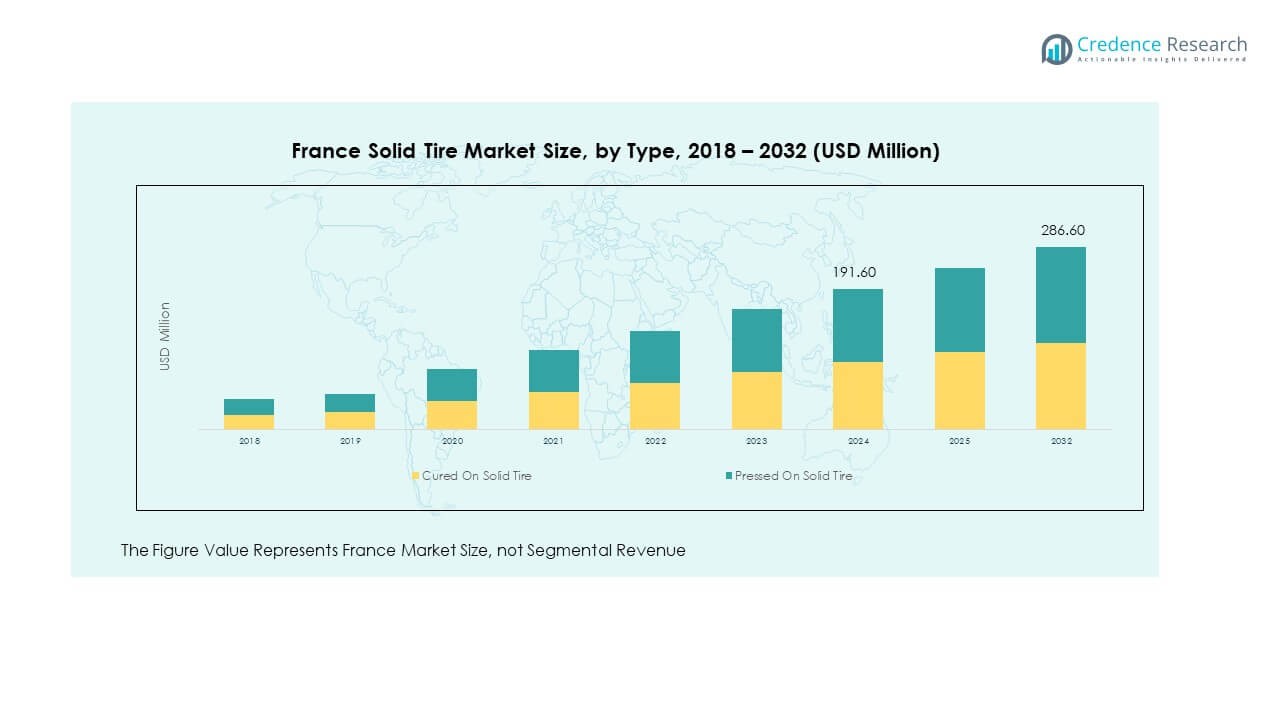

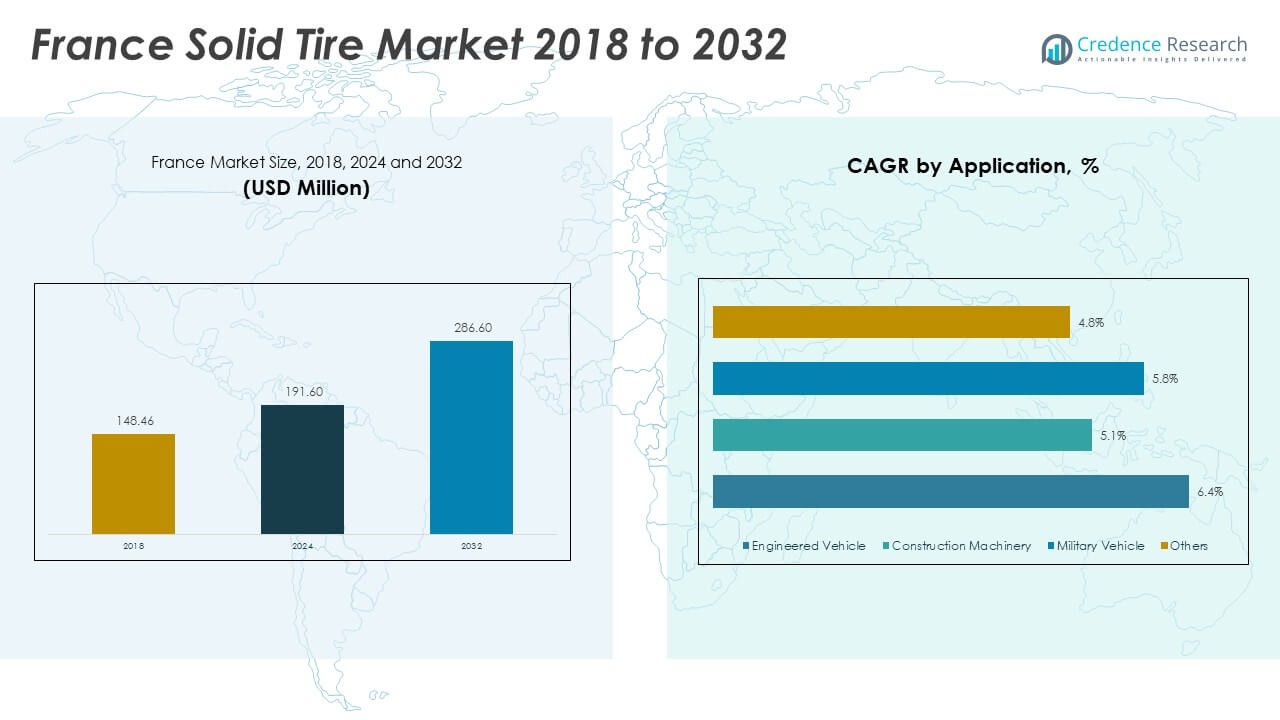

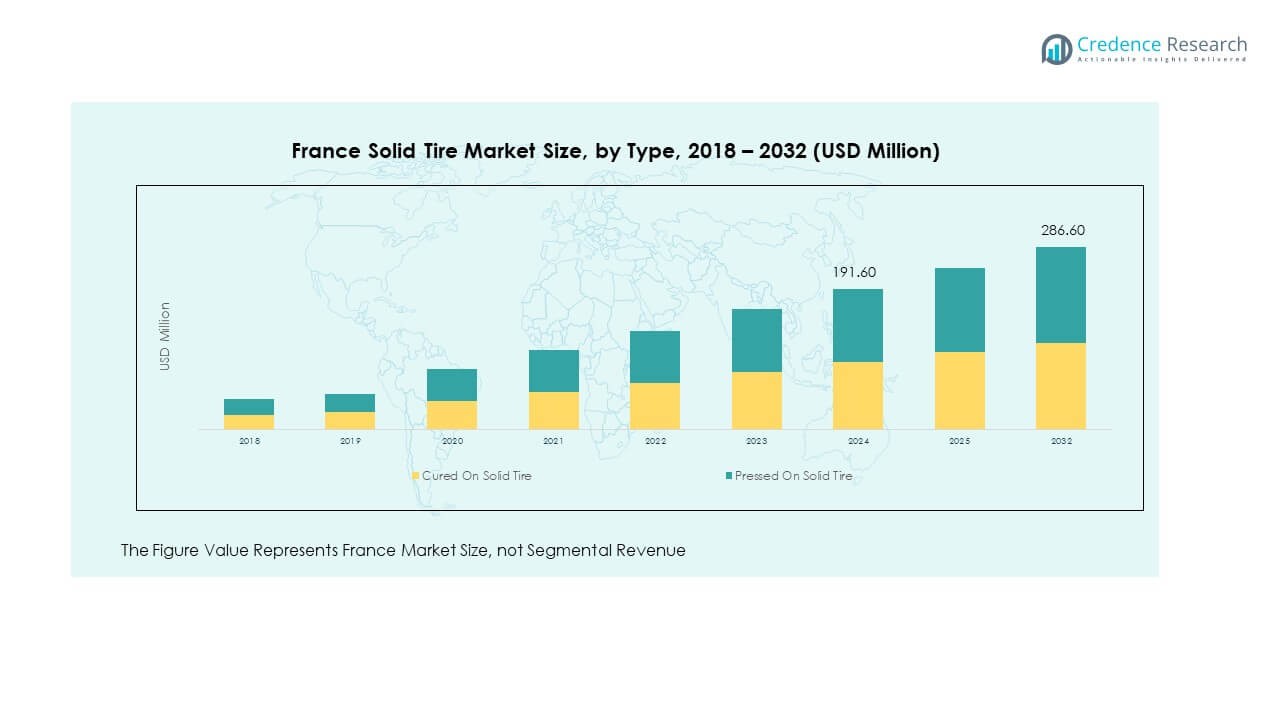

The France Solid Tire Market size was valued at USD 148.46 million in 2018, reached USD 191.60 million in 2024, and is anticipated to reach USD 286.60 million by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Solid Tire Market Size 2024 |

USD 191.60 Million |

| France Solid Tire Market, CAGR |

5.16% |

| France Solid Tire Market Size 2032 |

USD 286.60 Million |

The market in France is expanding due to rising demand from sectors such as construction, warehousing, and industrial logistics. Growing adoption of forklifts and material-handling vehicles supports the demand for durable and maintenance-free tires. Increasing emphasis on safety, reduced downtime, and cost efficiency further strengthens market adoption. Innovation in solid tire designs, offering improved traction and load-bearing capacity, also enhances market appeal. Additionally, the preference for eco-friendly manufacturing processes aligns with sustainability trends, encouraging wider usage across industries.

Geographically, France’s market growth is primarily concentrated in industrialized regions with high logistics and construction activities. Areas with advanced infrastructure and large-scale manufacturing facilities lead the adoption of solid tires. Emerging regions within the country are experiencing gradual demand due to rising urbanization and the expansion of industrial operations. Strong transport and warehouse networks across France further boost solid tire usage. Growth opportunities are also linked to ongoing industrial modernization efforts, positioning France as a key European hub for this market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Solid Tire Market was valued at USD 148.46 million in 2018, reached USD 191.60 million in 2024, and is projected to hit USD 286.60 million by 2032, growing at a CAGR of 5.16%.

- Île-de-France holds 38% share due to concentrated industrial and logistics hubs, Auvergne-Rhône-Alpes follows with 24% driven by automotive and construction industries, and Provence-Alpes-Côte d’Azur accounts for 18% supported by port-related logistics and infrastructure projects.

- The Nouvelle-Aquitaine region is the fastest-growing with 12% share, supported by rapid industrialization, logistics expansion, and increasing warehousing investments.

- Pressed-on solid tires account for 62% share, reflecting higher adoption in forklifts and industrial vehicles.

- Cured-on solid tires represent 38% share, favored for heavy-duty applications requiring strong durability and traction.

Market Drivers:

Expanding Demand Across Industrial and Construction Applications:

The France Solid Tire Market benefits from strong adoption in industries such as logistics, construction, and warehousing. The durability and puncture-resistant nature of solid tires make them suitable for forklifts, loaders, and heavy equipment. It supports businesses by reducing downtime and improving operational safety. Expanding e-commerce activities have created pressure on warehouses and distribution hubs to upgrade material-handling vehicles. Growing construction projects in urban and semi-urban areas also raise the requirement for reliable tire solutions. The market continues to gain momentum from the shift toward high-performance tires with extended service life. It plays an essential role in reducing replacement costs for industrial operators. The combination of these factors provides sustained growth potential.

- For instance, Trelleborg maintains a logistics hub serving over 50 countries with solid tires designed for material handling and construction, holding more than 70,000 tires in stock to support just-in-time delivery and reduce operational delays. Expanding e-commerce activities have created pressure on warehouses and distribution hubs to upgrade material-handling vehicles.

Rising Focus on Efficiency and Cost Management in Enterprises:

Organizations seek tire solutions that minimize maintenance costs and downtime. The France Solid Tire Market addresses this need through tires that withstand rough environments without frequent replacement. It ensures stable vehicle performance across demanding applications, supporting higher productivity. Large enterprises prefer solid tires for their ability to maintain consistent traction under heavy loads. Small and medium-sized enterprises also adopt them due to the long-term cost benefits. Increased emphasis on operational efficiency drives procurement decisions in manufacturing and warehousing facilities. It creates an ecosystem where reliability and cost savings become critical drivers of purchasing behavior. This dynamic directly supports long-term market expansion.

- For instance, Large enterprises favor solid tires for maintaining consistent traction under heavy loads; small and medium enterprises also adopt them due to long-term cost benefits. Increased emphasis on operational efficiency drives procurement decisions in manufacturing and warehousing facilities.

Technological Advancements in Tire Design and Material Innovation:

The France Solid Tire Market evolves through innovation in design, composition, and performance. Manufacturers focus on improving load-bearing capacity, grip, and resistance to wear. It encourages businesses to replace conventional pneumatic tires with advanced solid alternatives. New compounds and eco-friendly materials are gaining attention, enhancing product sustainability. Tire producers also integrate designs that reduce vibration and improve operator comfort. Such advancements increase adoption across construction and logistics equipment fleets. Companies highlight these features to differentiate products in competitive markets. The steady pace of technological progress reinforces trust and accelerates adoption among key sectors.

Alignment with Safety and Environmental Regulations:

Regulatory standards encourage the use of products that improve workplace safety and environmental sustainability. The France Solid Tire Market gains traction from its alignment with such requirements. It offers a safer choice by reducing the risk of blowouts or punctures in demanding environments. Compliance with sustainability frameworks also supports the preference for eco-friendly tire materials. Industrial buyers increasingly prioritize solutions that contribute to lower carbon footprints. The regulatory landscape acts as a catalyst for industry-wide adoption of advanced solid tires. Growing awareness of sustainability goals among enterprises drives consistent demand. It ensures alignment between industry growth and regulatory objectives.

Market Trends:

Integration of Digital Solutions and Smart Monitoring:

The France Solid Tire Market is experiencing a shift toward smart technologies that track performance. Companies are exploring digital sensors to monitor tire wear, pressure substitutes, and operating conditions. It allows businesses to improve predictive maintenance and avoid unexpected downtime. Real-time data enhances decision-making and reduces operational inefficiencies. Integration of digital platforms also supports fleet management by aligning tire usage with performance goals. Tire manufacturers collaborate with technology providers to deliver advanced monitoring features. These solutions create value by extending service life and optimizing replacement cycles. The rise of digital adoption positions solid tires as part of broader industrial modernization.

- For instance, Michelin and Continental have integrated Tire Pressure Monitoring Systems (TPMS) that transmit real-time tire pressure data, significantly reducing accidents caused by underinflated tires and enabling predictive maintenance to avoid unexpected downtime.

Expansion of Customization and Application-Specific Tire Solutions:

The demand for tailored tire designs continues to grow across construction, mining, and logistics sectors. The France Solid Tire Market responds with solutions built for specific equipment and applications. It offers variations in tread design, load capacity, and compound composition. Customization improves safety, comfort, and overall equipment efficiency. Businesses increasingly request tires that adapt to unique surface conditions and heavy-duty requirements. Manufacturers strengthen competitiveness by investing in R&D to deliver differentiated products. This focus on customization encourages long-term partnerships with industrial buyers. It builds loyalty and strengthens market presence.

- For instance, Trelleborg’s solid tires for mining equipment are engineered with reinforced, cut-resistant compounds to endure extreme loads and rough terrains. The company markets these tires as durable solutions that reduce downtime in harsh environments like underground mining.

Growing Sustainability Orientation in Manufacturing Processes:

Sustainability is becoming a defining trend across the tire industry. The France Solid Tire Market emphasizes eco-friendly materials and green production methods. It highlights recycling initiatives and adoption of low-emission processes. Manufacturers explore bio-based compounds to reduce environmental impact. Buyers favor products that align with corporate sustainability goals and regulatory standards. This trend creates a competitive advantage for brands with strong green credentials. Global focus on circular economy practices accelerates eco-innovation in tire manufacturing. It contributes to long-term growth by attracting environmentally conscious customers.

Strategic Collaborations and Expansion of Distribution Channels:

Collaborations between manufacturers, distributors, and industrial users play a critical role in shaping growth. The France Solid Tire Market sees expanded partnerships that enhance product accessibility and service offerings. It involves direct agreements with OEMs and integration with global supply chains. Strong distribution networks support market penetration in both urban and regional markets. Companies explore e-commerce platforms to expand reach and capture smaller industrial buyers. Strategic alliances provide opportunities to co-develop innovative tire solutions. These collaborations also help in addressing supply chain constraints. The expansion of distribution channels drives consistent growth momentum.

Market Challenges Analysis:

Cost Pressures and Competitive Pricing Environment:

The France Solid Tire Market faces challenges from competitive pricing pressures among domestic and international manufacturers. It often leads to cost-sensitive procurement decisions by industrial buyers. Smaller players struggle to compete with larger firms that achieve economies of scale. Rising raw material costs add further strain, limiting profitability for producers. Fluctuations in supply chain expenses also impact pricing stability. Companies must balance affordability with the delivery of durable and high-performance products. The intense price competition narrows margins and challenges innovation investments. Market participants are compelled to optimize operations to maintain sustainability.

Limited Awareness in Smaller Enterprises and Regional Areas:

Awareness about the advantages of solid tires remains limited among smaller businesses and less industrialized regions. The France Solid Tire Market struggles to achieve penetration in these segments. It creates barriers to adoption despite the long-term cost benefits. Traditional reliance on pneumatic tires in small warehouses and workshops slows growth. Resistance to change and lack of technical knowledge further impact expansion. Regional disparities in industrial development also influence market uptake. Companies must invest in awareness campaigns and targeted outreach strategies. Bridging this gap is crucial for unlocking full market potential.

Market Opportunities:

Expanding Demand from E-Commerce Logistics and Warehousing:

The rapid growth of e-commerce and demand for efficient warehousing creates strong opportunities. The France Solid Tire Market stands to benefit from increased forklift and material-handling equipment use. It ensures reliable operations in high-volume distribution centers requiring minimal downtime. Companies view solid tires as a cost-effective solution for heavy-duty logistics. Integration into large-scale e-commerce supply chains drives consistent procurement. The opportunity grows as online retail continues to expand across France. It positions solid tires as an essential enabler of modern logistics.

Rising Investments in Industrial Modernization and Green Solutions:

Ongoing modernization efforts in French industries open doors for wider adoption. The France Solid Tire Market aligns with trends toward safety, sustainability, and operational efficiency. It gains traction from businesses upgrading fleets with durable and eco-friendly solutions. Government support for sustainability initiatives further strengthens this opportunity. Tire manufacturers investing in greener processes capture growing demand. Industrial modernization programs also create space for innovative, high-performance tire designs. It positions the market for long-term growth across diverse industrial applications.

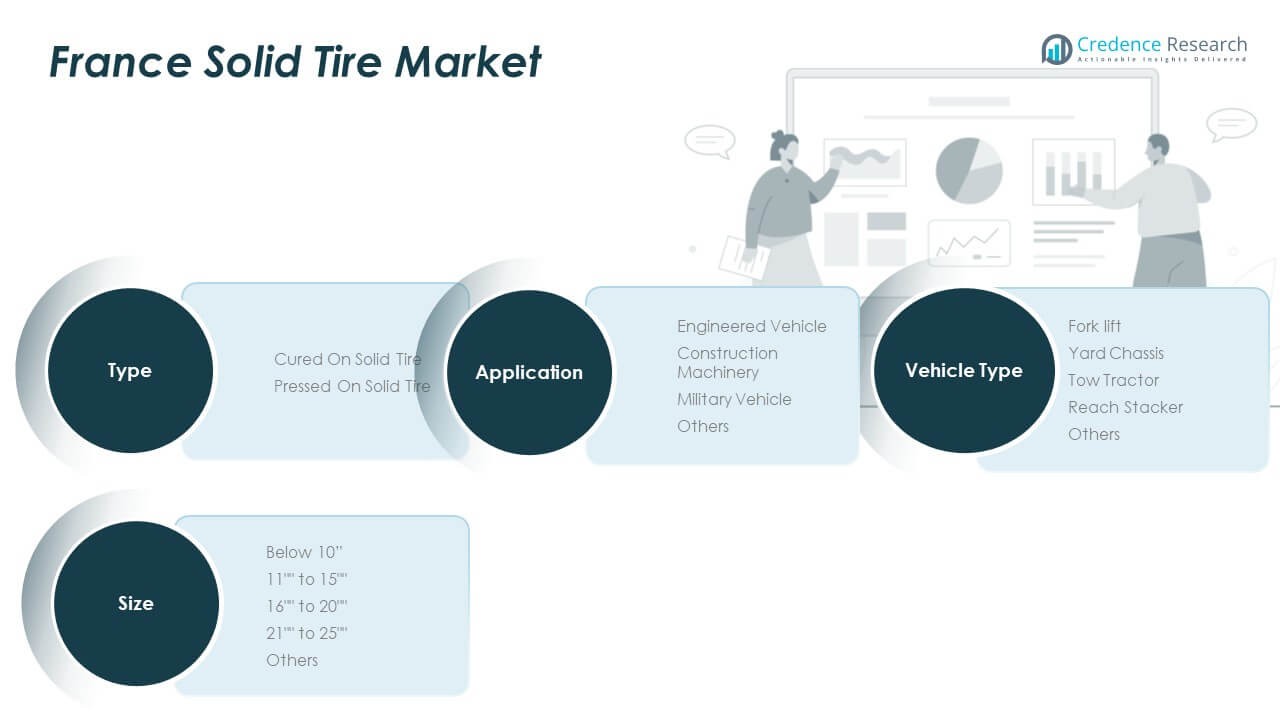

Market Segmentation Analysis:

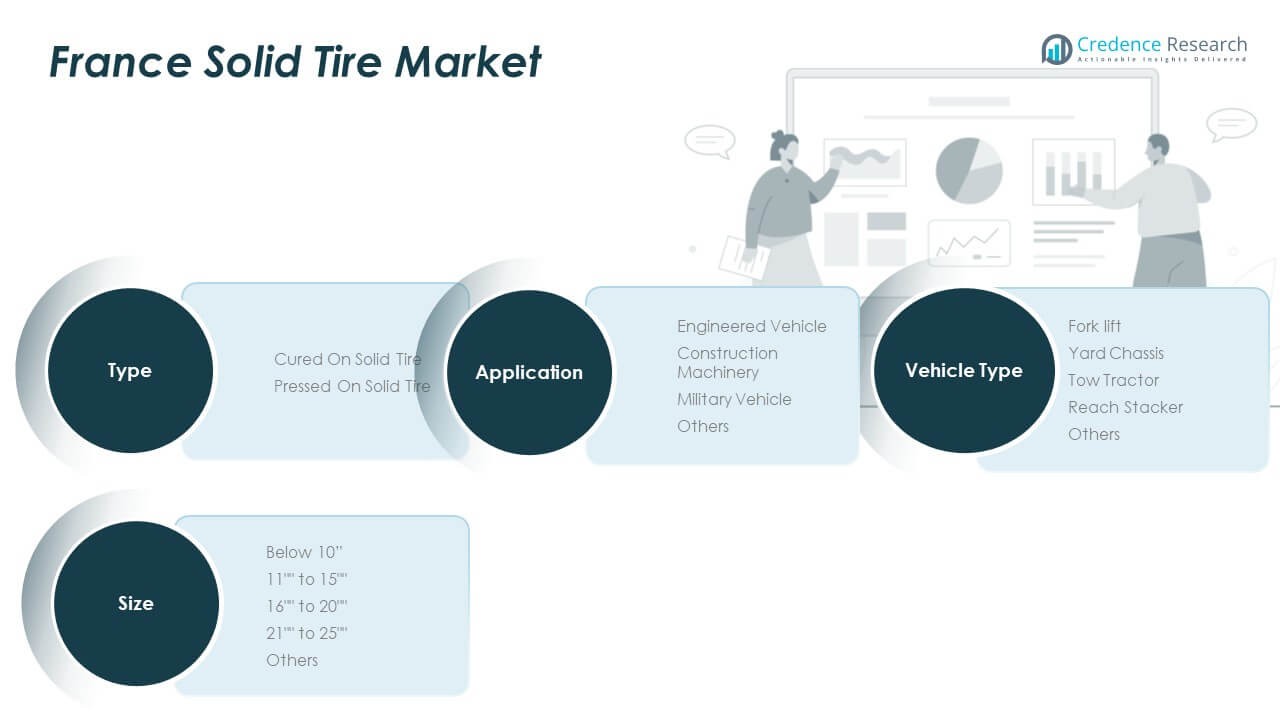

By Type

The France Solid Tire Market is divided into cured on solid tires and pressed on solid tires. Pressed on solid tires dominate due to their strong adoption in forklifts and industrial vehicles, offering durability and easier fitting. Cured on solid tires are favored in heavy-duty environments that demand enhanced traction and longevity. Both types continue to see growth as companies seek reliable and low-maintenance solutions to improve safety and operational efficiency.

- For instance, Trelleborg’s PS1000 solid press-on tires are widely used in warehouse forklifts across France, featuring enhanced wear resistance that extends tire life compared to traditional models, while enabling quick tire changes that reduce downtime.

By Application

Engineered vehicles and construction machinery drive significant demand, supported by expanding industrial activity and infrastructure projects. Military vehicles adopt solid tires for their rugged performance and puncture resistance in challenging terrains. Other applications, such as specialized industrial machinery, contribute to steady adoption. It demonstrates the sector’s diverse end-use scope and alignment with industrial modernization in France.

- For instance, Trelleborg supplies solid tires for heavy construction equipment that operate in urban and semi-urban French projects, with models able to withstand loads upwards of 15,000 kg, reducing operational interruptions caused by tire failures. Military vehicles also adopt solid tires for rugged performance and puncture resistance in challenging terrains.

By Size

The 11” to 15” and 16” to 20” categories dominate the size segment, reflecting their wide use in forklifts and construction machinery. Below 10” tires cater to smaller vehicles requiring lightweight solutions. The 21” to 25” range supports heavy-duty machinery needing greater load-bearing capacity. Other sizes maintain niche demand, ensuring compatibility across diverse industrial requirements.

By Vehicle Type

Forklifts hold the largest share, driven by their critical role in logistics, warehousing, and distribution centers. Yard chassis and tow tractors follow closely, supported by port activities and transportation networks. Reach stackers and other specialized vehicles further expand market adoption. It reinforces the importance of solid tires across multiple industrial applications in France.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Île-de-France – Leading Industrial and Logistics Hub

Île-de-France holds the largest share of the France Solid Tire Market, accounting for 38% of total revenue. The region’s leadership stems from its concentration of logistics, manufacturing, and e-commerce distribution activities. Strong demand from warehouses and construction projects in Paris drives adoption of forklifts and heavy equipment. It benefits from continuous infrastructure investments that support material-handling operations. The presence of multinational corporations further secures consistent procurement. Regional dominance reflects both economic strength and advanced supply chain networks.

Auvergne-Rhône-Alpes – Strong Automotive and Construction Base

Auvergne-Rhône-Alpes represents 24% of the market, ranking second in share. The region benefits from a well-established automotive industry and robust construction activity. Forklifts, tow tractors, and yard chassis see wide use in industrial facilities and logistics operations. It gains momentum from growing investments in industrial modernization and warehouse expansion. Local suppliers and manufacturers strengthen supply consistency across regional markets. The location near major European trade corridors enhances its competitiveness. The combination of infrastructure and industrial demand ensures steady growth.

Provence-Alpes-Côte d’Azur and Emerging Regions

Provence-Alpes-Côte d’Azur accounts for 18% share, supported by port logistics, warehousing, and ongoing infrastructure development. Yard chassis and reach stackers drive tire demand in this region’s shipping-focused economy. It also benefits from urban construction projects that fuel machinery adoption. Nouvelle-Aquitaine follows with 12%, marking the fastest growth rate due to industrial expansion and warehouse investments. Other regions show gradual progress as urbanization and logistics infrastructure expand. It highlights balanced growth across France, ensuring nationwide demand potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Michelin

- Continental AG

- Trelleborg AB

- Maxam Tire

- Global Rubber Industries (GRI)

- Marangoni Industrial Tyres

- NEXEN Tire America

- Tube & Solid Tire

- Superior Tire & Rubber

- Setco Solid Tire & Rim Assembly

Competitive Analysis:

The France Solid Tire Market is characterized by intense competition among global and domestic players. Leading companies such as Michelin, Continental AG, Trelleborg AB, and Maxam Tire dominate through wide product portfolios and established distribution networks. It benefits from innovation in eco-friendly materials, design enhancements, and digital monitoring solutions. Smaller firms and regional players focus on niche applications and competitive pricing to secure market presence. Strategic partnerships, regional expansions, and acquisitions define the competitive landscape. Companies emphasize durability, cost efficiency, and customization to differentiate offerings. Market rivalry encourages continuous product development and efficiency improvements across the sector.

Recent Developments:

- In July 2025, Continental AG supported the Tour de France as the main sponsor and tire supplier for official support vehicles and several race teams, equipping over 70 official vehicles with their UltraContact NXT tires, which focus on sustainability and high performance, thus showcasing their advancements in tire technology on a high-visibility platform across France.

- In 2025, Michelin announced the launch of three new two-wheel tire products, including the Road W GT designed for high-torque motorcycles like Honda Gold Wing, featuring advanced grip and durability technologies such as water sipe lamination and a 3-ply radial casing, enhancing wet and dry surface performance.

- Trelleborg AB reinforced its portfolio through several strategic acquisitions in 2025, including the purchase of sealing and polymer solution companies to strengthen their industrial solutions. Notably, in April 2025, they acquired Aero-Plastics Inc., enhancing their high-performance plastics segment, reflecting their broader expansion rather than direct solid tire launches but reinforcing their related industrial tire ecosystem.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption in logistics and warehousing will sustain consistent demand growth.

- Expansion of e-commerce will strengthen forklift tire usage in distribution centers.

- Construction projects will fuel demand for heavy-duty cured-on solid tires.

- Eco-friendly materials will gain traction as sustainability pressures increase.

- Technological innovations will enhance durability and operator comfort.

- Customization will expand, targeting specific equipment and industrial needs.

- Regional growth will accelerate in emerging industrial hubs across France.

- Strategic partnerships will increase between tire manufacturers and OEMs.

- Digital monitoring solutions will redefine predictive maintenance practices.

- Competitive pricing pressures will push efficiency and innovation among players.