| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Water Pump Market Size 2024 |

USD 2,051.62 Million |

| France Water Pump Market, CAGR |

3.94% |

| France Water Pump Market Size 2032 |

USD 2,906.39 Million |

Market Overview:

France Water Pump Market size was valued at USD 2,051.62 million in 2023 and is anticipated to reach USD 2,906.39 million by 2032, at a CAGR of 3.94% during the forecast period (2023-2032).

Several factors are propelling the growth of France’s water pump market. The country’s strong emphasis on infrastructure development and water management has led to steady demand for pumps across sectors such as water supply, wastewater treatment, agriculture, and industrial processes. In agriculture, the expansion of irrigation systems, particularly in regions known for wine production and other crops, has significantly increased the need for water pumps. Additionally, the government’s investment in industrial water management, totaling around €2.3 billion in 2022, underscores the importance of efficient water delivery technologies in promoting industrial growth. The integration of energy-efficient and smart water management solutions is also enhancing operational efficiency across various industries, further stimulating market demand.

Regionally, the demand for water pumps in France is influenced by specific agricultural and industrial activities. In the western regions, such as the Poitou-Charentes area, the construction of “megabasins” or large water reservoirs has been a focal point to support agricultural irrigation needs. These projects aim to store water during wetter periods for use during droughts, thereby ensuring a stable water supply for farming activities. However, these initiatives have also sparked environmental debates concerning sustainable water management practices. In industrial sectors, regions with significant manufacturing activities are investing in advanced pump technologies to meet stringent environmental regulations and efficiency standards. Overall, the regional dynamics of France’s water pump market are shaped by a combination of agricultural demands, industrial growth, and environmental considerations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- France Water Pump Market size was valued at USD 2,051.62 million in 2023 and is anticipated to reach USD 2,906.39 million by 2032, at a CAGR of 3.94% during the forecast period (2023-2032).

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Infrastructure modernization efforts, particularly in water treatment and sewage systems, are driving the adoption of advanced pump technologies.

- Agricultural demand is rising due to climate variability and expansion of irrigation systems, especially in wine-producing regions.

- Industrial sectors such as food processing, chemicals, and pharmaceuticals are adopting smart pumps to improve efficiency and meet environmental standards.

- Regulatory push for energy efficiency and sustainability is accelerating the shift toward eco-friendly and solar-powered water pumps.

- Economic challenges, including inflation and a slowdown in the construction sector, are hindering short-term growth potential.

- Regional initiatives like “megabasins” in western France are influencing pump demand, though they also raise environmental sustainability concerns.

Market Drivers:

Rising Demand for Water Infrastructure Modernization

The modernization of water infrastructure stands as a major catalyst for the growth of the France water pump market. France’s existing water supply and wastewater management systems, many of which were constructed decades ago, are undergoing significant upgrades to improve operational efficiency and meet evolving environmental standards. The government and municipal authorities are investing heavily in modernizing water treatment plants, sewage systems, and distribution networks. These initiatives necessitate the installation of advanced and energy-efficient water pumps, thereby driving demand across public and private infrastructure projects. Furthermore, the push for digitalization and automation in water infrastructure is accelerating the adoption of intelligent pump systems equipped with real-time monitoring capabilities and automated controls.

Increased Agricultural Irrigation Needs

Agriculture remains a vital contributor to France’s economy, particularly in regions known for viticulture and high-value crop production. As climate variability continues to affect traditional rainfall patterns, farmers are increasingly turning to efficient irrigation systems to ensure consistent crop yields. For instance, in the Bordeaux region, precision irrigation systems have been introduced to support viticulture, ensuring optimal water use for high-quality grape production. Water pumps play a central role in these irrigation networks, facilitating the effective distribution of water across fields. Government support for agricultural modernization, including subsidies for water-efficient technologies, has further incentivized farmers to invest in high-performance pumps. In particular, regions implementing large-scale water storage projects, such as “megabasins,” are creating new avenues for pump installations to support both conventional and precision farming practices.

Industrial Expansion and Process Automation

France’s industrial sectors—ranging from chemicals and pharmaceuticals to food and beverage processing—require robust and reliable fluid handling systems, with water pumps being integral components. The demand for specialized pumps in these industries is being driven by the need for high flow rates, pressure control, and energy efficiency. As industrial players increasingly adopt automated and closed-loop systems, the requirement for advanced pumping technologies with smart controls has surged. Environmental regulations surrounding water usage and wastewater discharge have also pushed industries to upgrade their existing pump infrastructure. For example, centrifugal pumps embedded with IoT-enabled sensors are widely used in wastewater treatment plants to comply with EU environmental standards while minimizing energy use. This trend is reinforced by France’s commitment to reducing industrial emissions and promoting sustainable resource management, further encouraging the integration of energy-efficient and low-maintenance pump solutions.

Sustainability Goals and Energy Efficiency Regulations

Sustainability is at the forefront of France’s environmental policy, directly influencing the technological direction of the water pump market. Regulatory frameworks aimed at reducing energy consumption and carbon emissions have prompted end-users across municipal, industrial, and agricultural segments to adopt eco-friendly water pumping systems. Manufacturers are responding by developing pumps that comply with EU energy efficiency standards and offer lower operational costs over their lifecycle. Additionally, the integration of renewable energy sources, such as solar-powered water pumps, is gaining traction in remote and off-grid applications. The convergence of energy efficiency mandates and environmental consciousness among end-users is steadily reshaping the market, encouraging innovation and investment in green pumping technologies.

Market Trends:

Growth in Centrifugal Pump Applications

The adoption of centrifugal pumps in France has been rising steadily due to their wide applicability across municipal, agricultural, and industrial sectors. Their simple design, ease of maintenance, and adaptability to various fluid handling processes have made them a preferred choice among end-users. These pumps are particularly suited for applications involving water transfer, circulation, and irrigation. As industries strive to improve fluid transport systems, centrifugal pumps continue to see growing preference. Additionally, the increasing integration of automation and monitoring systems has enhanced the operational reliability of centrifugal pumps, enabling real-time performance tracking and preventive maintenance.

Emphasis on Sustainable Water Management

France’s commitment to sustainable water management is shaping market dynamics by encouraging the adoption of environmentally responsible technologies. For example, Veolia’s modernization of the Saint Fons wastewater treatment plant in Greater Lyon includes digitized management systems that reduce electricity consumption by 15% and water usage by 10%. Industrial sectors and municipalities are increasingly prioritizing energy-efficient pumping systems to reduce water wastage and improve process sustainability. Ongoing renovation of wastewater treatment plants and the expansion of water recycling projects are boosting the demand for pumps that support low-energy consumption and high durability. This trend reflects broader national and EU-level objectives to reduce environmental impact through improved water conservation and waste management practices.

Integration of Smart Technologies

The integration of smart technologies into water pumping systems is gaining momentum across France. Manufacturers are introducing intelligent pumps embedded with sensors, software, and IoT capabilities that enable automated operation, remote monitoring, and data-driven decision-making. These systems help optimize energy usage and enhance maintenance scheduling, minimizing downtime and increasing overall efficiency. For instance, predictive maintenance solutions powered by real-time data analytics are being adopted widely across industries to enhance operational efficiency. End-users, particularly in building services and industrial applications, are increasingly adopting such solutions to align with their digital transformation goals. This growing preference for smart pumping systems signals a shift toward more advanced and sustainable infrastructure.

Impact of Economic and Regulatory Factors

While sustainability and innovation continue to drive the water pump market, economic and regulatory factors are also influencing its trajectory. A slowdown in the residential construction sector has led to a temporary decline in demand for water pumps in building applications. However, this impact is being balanced by regulatory pressure for improved energy performance and stricter environmental compliance across sectors. Pump manufacturers and users are responding by prioritizing technologies that meet energy efficiency standards and support long-term cost savings. Despite short-term fluctuations, the market remains resilient, supported by policy-driven demand for modern, compliant water management systems.

Market Challenges Analysis:

Economic Uncertainty and Construction Sector Slowdown

The French water pump market is currently facing challenges stemming from economic instability. For instance, the HCOB France Construction PMI Total Activity Index dropped to 39.7 in July 2024, marking the sharpest decline since January of the same year. High inflation rates, reduced purchasing power, and increasing interest rates have led to a notable decline in the construction sector. This downturn has resulted in decreased demand for new thermodynamically

systems, including water pumps, particularly in new building projects.The slowdown in construction activity has directly impacted the market, as the installation of water pumps is closely tied to new construction and infrastructure development.

Intensifying Competition from International Manufacturers

The French water pump market is experiencing heightened competition due to the entry of foreign manufacturers offering a broad range of products at competitive prices.This influx has put pressure on domestic manufacturers to innovate and reduce costs to maintain market share.The increased competition has led to price wars, affecting profit margins and making it challenging for local companies to invest in research and development for advanced, energy-efficient pump technologies

Fluctuating Raw Material Prices and Supply Chain Disruptions

The market is also grappling with the volatility of raw material prices, such as metals and plastics, which are essential components in pump manufacturing.Fluctuations in these prices have led to increased production costs, affecting the overall profitability of manufacturers.Additionally, global supply chain disruptions have caused delays in the procurement of raw materials and components, leading to extended lead times and potential project delays.

Regulatory Compliance and Environmental Standards

Compliance with stringent environmental regulations presents another significant challenge for the French water pump market.Manufacturers are required to invest in research and development to produce pumps that meet evolving energy efficiency and environmental standards.These investments increase production costs and can be particularly burdensome for small and medium-sized enterprises (SMEs).Failure to comply with these regulations can result in penalties and loss of market access, making regulatory compliance a critical concern for industry players.

Market Opportunities:

The France water pump market presents significant opportunities driven by the country’s accelerating transition toward energy-efficient infrastructure and sustainable water management practices. The government’s commitment to reducing carbon emissions and promoting the adoption of green technologies has created a favorable environment for the development and deployment of next-generation water pumps. Increasing demand for smart, sensor-integrated pumps across municipal water supply systems, industrial processes, and agricultural irrigation networks opens avenues for manufacturers to innovate. Furthermore, the refurbishment of aging water infrastructure in urban and rural areas creates a sustained need for high-performance and low-maintenance pump systems.

In addition, the integration of digital technologies and the Internet of Things (IoT) within water pump systems presents a key growth area. French industries are increasingly adopting predictive maintenance and remote monitoring solutions to enhance operational efficiency and reduce downtime. These trends align with the broader goals of Industry 4.0 and smart city initiatives, where intelligent fluid management plays a central role. Moreover, the growing interest in decentralized water treatment and localized water reuse systems across France supports the expansion of compact and energy-efficient pumps. Companies that can deliver tailored, technology-driven solutions catering to both public utilities and private sector applications are well-positioned to capitalize on the emerging demand across various sectors in the French market.

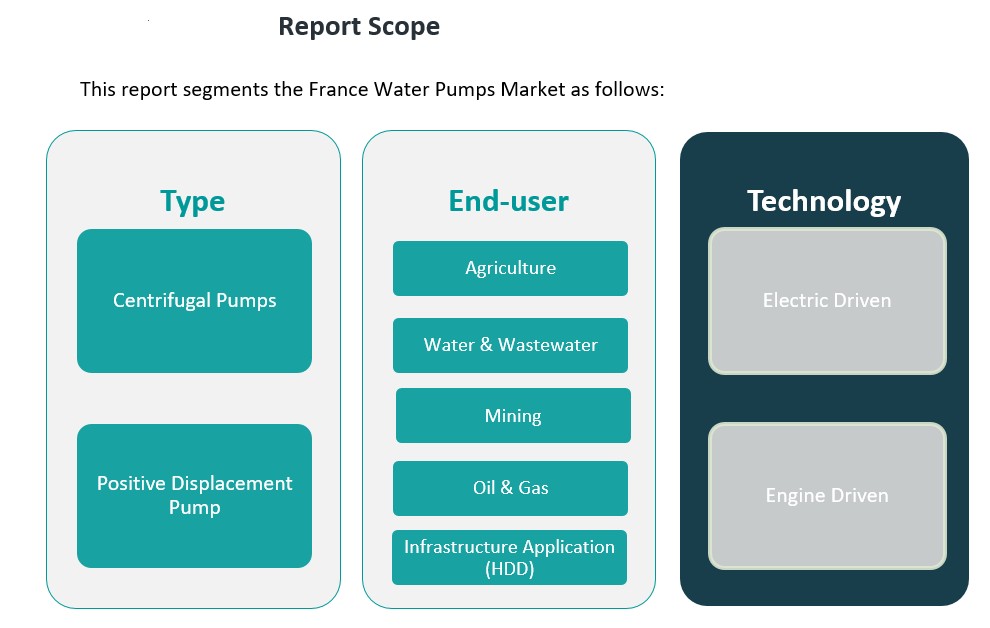

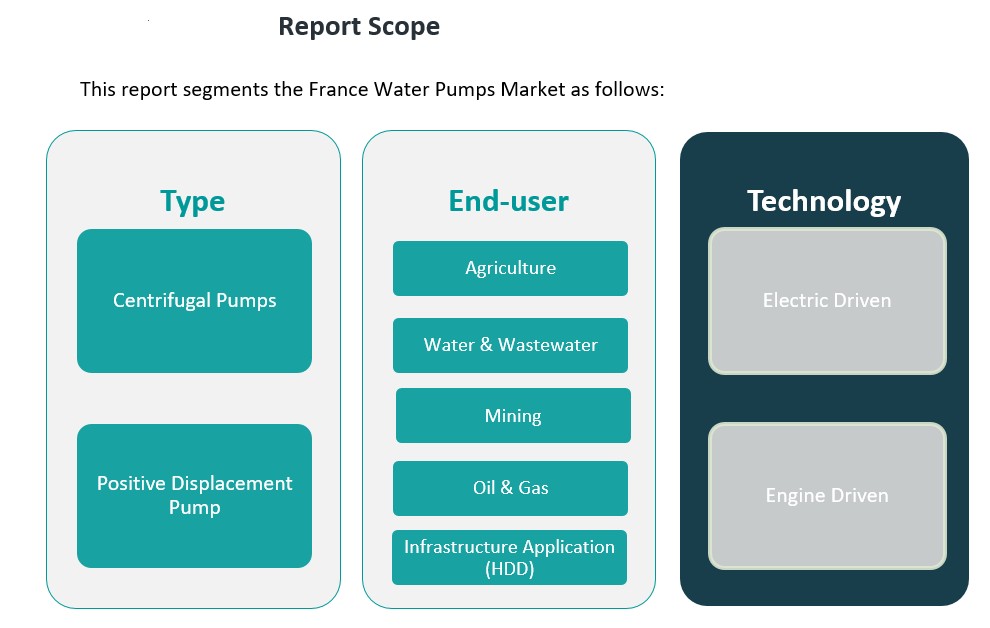

Market Segmentation Analysis:

The France water pump market is segmented by type, end-user, and technology, each contributing uniquely to the market’s dynamics.

By type, centrifugal pumps dominate the market due to their versatile applications in water transfer, irrigation, and industrial operations. Their simple design and high efficiency in continuous flow systems have made them the preferred choice in both public utilities and industrial facilities. Positive displacement pumps, on the other hand, are gaining traction in applications requiring precise fluid control, particularly in the oil and gas, mining, and chemical industries where managing viscous or abrasive fluids is essential.

By end-user segmentation, the water and wastewater segment represents a significant share, driven by investments in infrastructure modernization and environmental compliance. The agriculture sector also holds a substantial position, supported by the adoption of efficient irrigation systems to mitigate water scarcity and optimize crop yields. The oil and gas and mining sectors utilize pumps for fluid handling under demanding operational conditions, while infrastructure applications such as horizontal directional drilling (HDD) are expanding with urban development projects.

By technology perspective, electric-driven pumps lead the market due to their lower operating costs, reduced emissions, and alignment with sustainability goals. Engine-driven pumps remain relevant in remote or off-grid locations where electric access is limited. As France continues to modernize its infrastructure and enhance energy efficiency, the demand for advanced, durable, and application-specific water pump solutions across these segments is expected to remain strong.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

The France water pump market exhibits regional variations influenced by industrial activity, agricultural practices, and infrastructure development. While specific market share data by region is limited, insights into regional dynamics provide a comprehensive understanding of the market landscape.

Northern France

Northern France, encompassing regions such as Hauts-de-France and Normandy, is characterized by a strong industrial base, including chemical processing and oil refining sectors. The presence of major port cities like Le Havre and Dunkirk further amplifies the demand for water pumps in fuel handling and wastewater management applications. The region’s focus on modernizing water infrastructure to meet environmental standards contributes to the steady demand for advanced pumping solutions.

Central France

Central France, including regions like Centre-Val de Loire, is predominantly agricultural, with extensive farmlands requiring efficient irrigation systems. The adoption of high-efficiency centrifugal pumps supports sustainable water use in agriculture. Additionally, the presence of food processing and pharmaceutical industries necessitates hygienic and corrosion-resistant pumps for fluid handling. Urban wastewater treatment initiatives in this region also drive the demand for advanced pumping systems.

Southern France

Southern France, encompassing regions such as Provence-Alpes-Côte d’Azur and Occitanie, experiences significant demand for water pumps due to urban development, tourism, and renewable energy projects. The Mediterranean coastline’s focus on wastewater treatment and desalination requires high-performance pumps. Smart city initiatives in metropolitan areas like Marseille and Nice promote the adoption of energy-efficient pumping solutions. The region’s wine and food industries further contribute to the demand for specialized pumps.

Eastern France

Eastern France, including the Auvergne-Rhône-Alpes region, is a hub for chemical, pharmaceutical, and power generation industries. The region’s reliance on hydropower projects necessitates efficient pump systems for energy production. Investments in modernizing industrial facilities and water treatment plants support the adoption of smart, energy-efficient pumping technologies. The region’s innovation centers contribute to the development of advanced pump solutions.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT Inc.

- EBARA Corporation

- Coreau S.A.

- ENTROPIE SAS

Competitive Analysis:

The France water pump market is characterized by a competitive landscape driven by both domestic manufacturers and international players. Leading companies focus on technological innovation, energy efficiency, and integration of smart features to meet growing demand across industrial, municipal, and agricultural sectors. Established brands maintain a strong presence through extensive distribution networks and after-sales services, while newer entrants compete by offering cost-effective and customized solutions. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their product portfolios and strengthen market positioning. Additionally, manufacturers are investing in research and development to comply with stringent environmental regulations and improve pump performance. The market remains dynamic, with companies adapting to economic fluctuations, shifting customer preferences, and regulatory changes. Overall, success in this market hinges on innovation, reliability, and the ability to address diverse application needs across France’s evolving water management landscape.

Recent Developments:

- In January 2024, Atlas Copco completed the acquisition of Kracht GmbH, a global manufacturer specializing in external gear pumps, fluid measurement systems, valves, hydraulic drives, and dosing systems. This strategic move strengthens Atlas Copco’s position in the water pump market by expanding its product portfolio and enhancing its operational capabilities.

- On February 3, 2025, Ingersoll Rand acquired SSI Aeration Inc., a global leader in wastewater treatment equipment. This acquisition strengthens the company’s capabilities in sustainable wastewater solutions by integrating SSI’s innovative aeration systems into its portfolio.

- In 2023, Andritz introduced corrosion-resistant pumps specifically designed for offshore wind farms, aligning with Germany’s renewable energy goals and increasing offshore infrastructure needs.

- In September 2024, Grundfos expanded its European water treatment market presence by acquiring Culligan’s commercial and industrial business in Italy, France, and the UK.

- In October 2024, Sulzer Ltd launched the ZF-RO end-suction pump to meet the technical requirements of energy recovery device booster pump services in hydrocarbon and desalination industries.

Market Concentration & Characteristics:

The France water pump market exhibits a moderate level of concentration, characterized by the presence of both established international manufacturers and a multitude of domestic players. Major global companies such as Grundfos, KSB, and Sulzer have a significant footprint in the market, offering a wide range of advanced and energy-efficient pumping solutions. These industry leaders leverage their extensive distribution networks and technological expertise to cater to diverse sectors, including water treatment, industrial processes, and infrastructure development. Concurrently, numerous small and medium-sized French enterprises contribute to the market by providing specialized and customized pumping solutions, particularly for niche applications in agriculture and municipal services. This blend of global and local participants fosters a competitive environment that encourages innovation and responsiveness to evolving customer needs. The market is characterized by a strong emphasis on energy efficiency and sustainability, driven by stringent environmental regulations and the country’s commitment to reducing carbon emissions. There is a growing demand for smart pumps equipped with IoT capabilities, enabling real-time monitoring and predictive maintenance, which enhances operational efficiency and reduces downtime. Additionally, the market benefits from the ongoing modernization of water infrastructure and the increasing adoption of renewable energy sources, which necessitate the deployment of advanced pumping technologies. As a result, manufacturers are focusing on developing innovative solutions that align with these trends, ensuring compliance with regulatory standards and meeting the evolving demands of end-users across various sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased investments in water infrastructure modernization will drive sustained demand for advanced pump systems.

- Adoption of smart and IoT-enabled water pumps will accelerate across industrial and municipal applications.

- Regulatory emphasis on energy efficiency will encourage the transition to eco-friendly pump technologies.

- Rising agricultural automation will expand the market for high-efficiency irrigation pumps.

- Technological advancements will improve pump durability, reducing operational costs for end-users.

- Growth in wastewater treatment and recycling initiatives will boost demand in urban regions.

- Engine-driven pump adoption will persist in off-grid and emergency response sectors.

- Strategic mergers and partnerships will reshape the competitive landscape and broaden product offerings.

- Market penetration will increase through digital sales platforms and localized service support.

- Economic recovery and infrastructure stimulus programs will positively influence market expansion.