Market Overview:

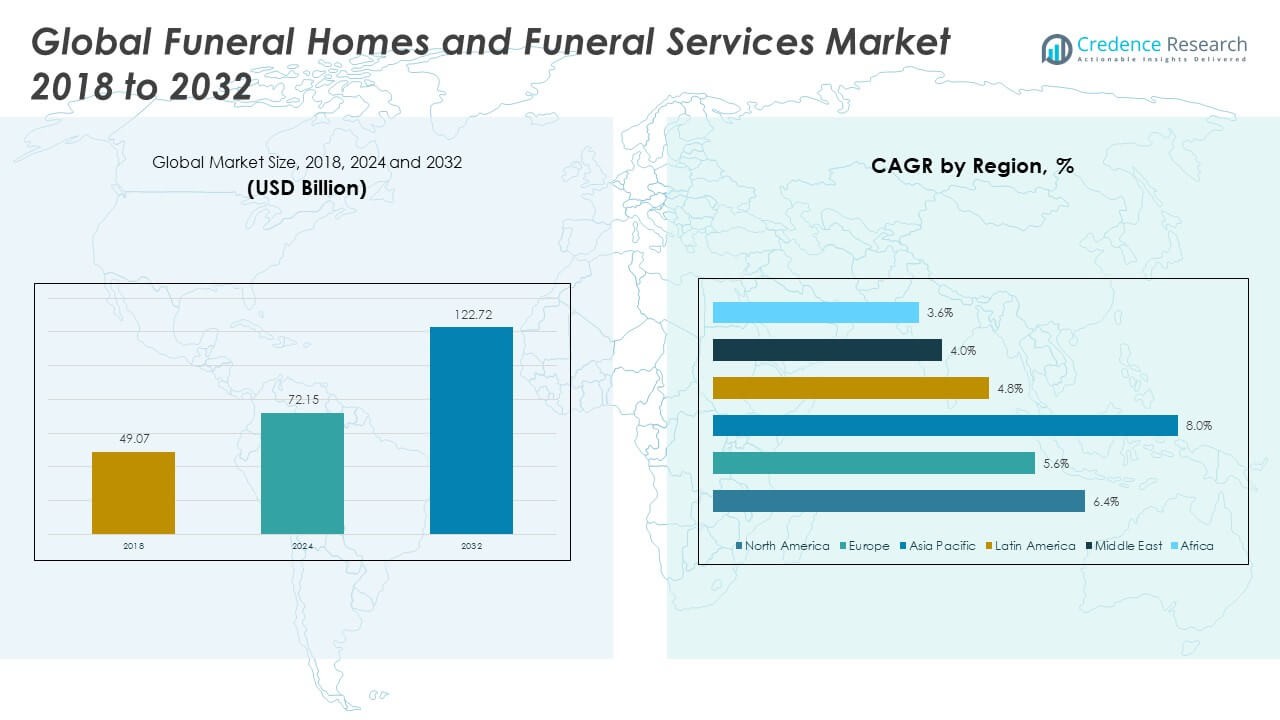

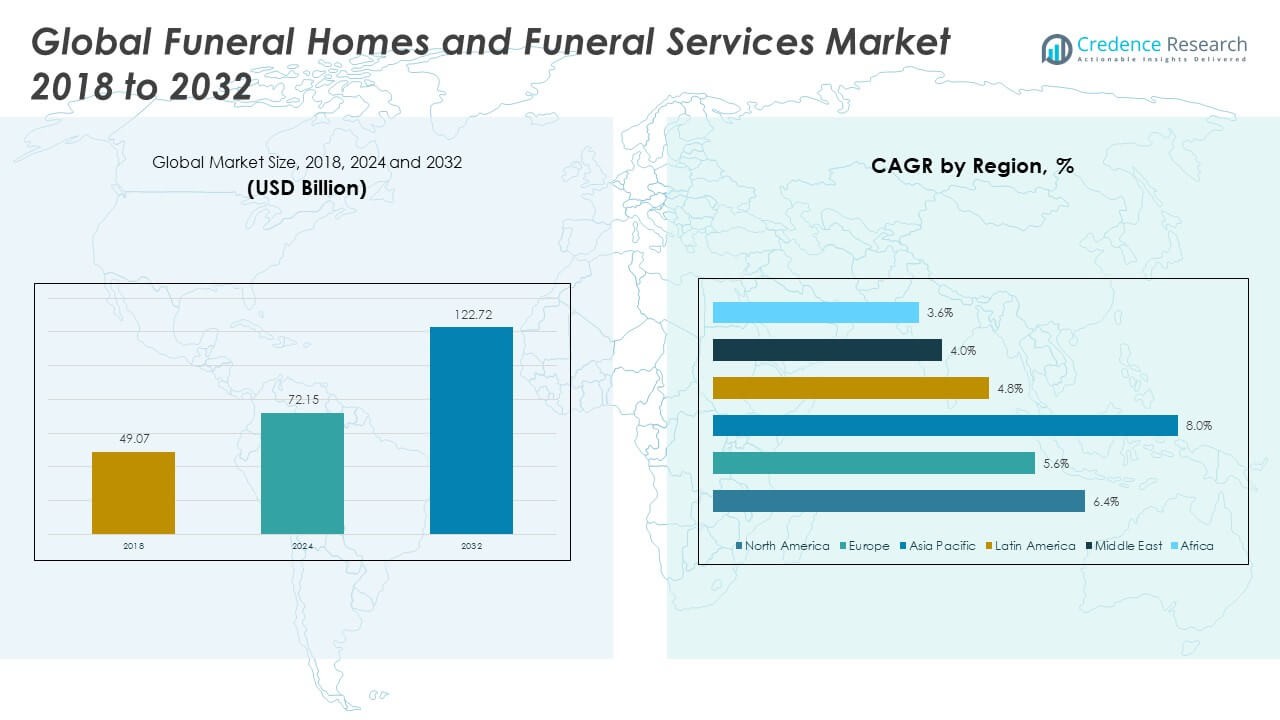

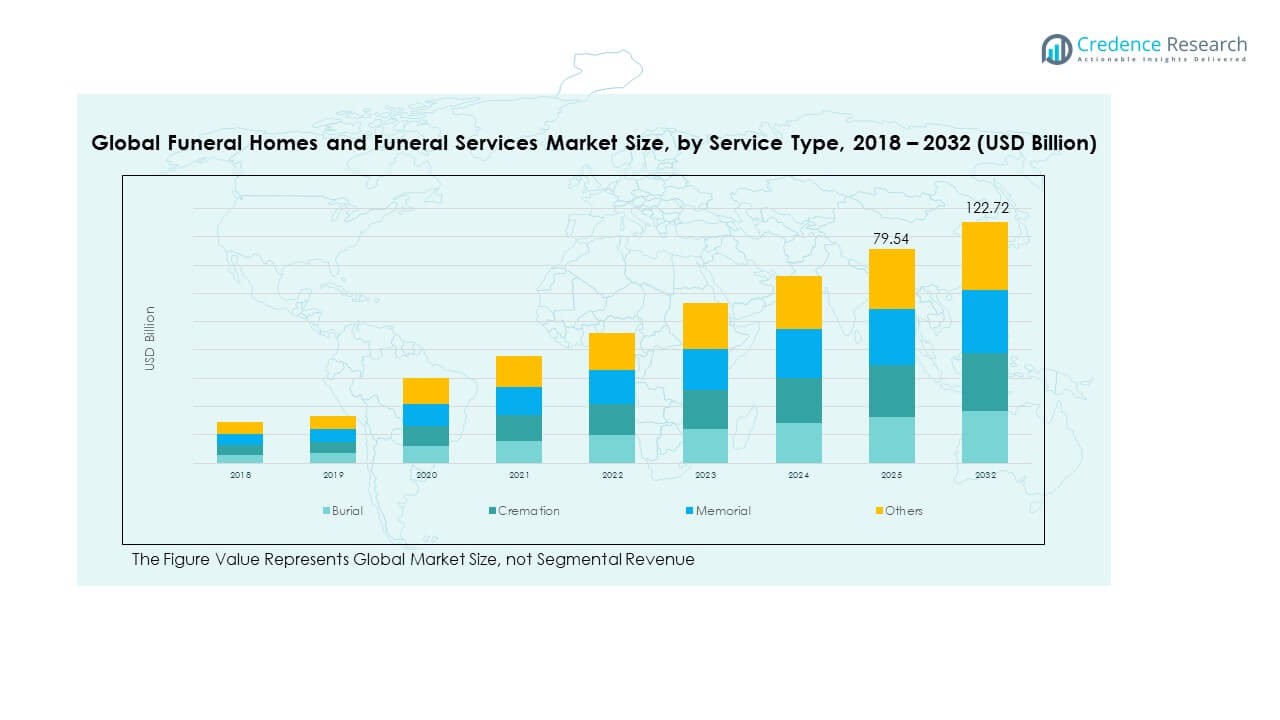

The Global Funeral Homes and Funeral Services Market size was valued at USD 49.07 billion in 2018 to USD 72.15 billion in 2024 and is anticipated to reach USD 122.72 billion by 2032, at a CAGR of 6.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Funeral Homes and Funeral Services Market Size 2024 |

USD 72.15 Billion |

| Funeral Homes and Funeral Services Market, CAGR |

6.39% |

| Funeral Homes and Funeral Services Market Size 2032 |

USD 122.72 Billion |

Growth in the Global Funeral Homes and Funeral Services Market is driven by increasing demand for pre-planned arrangements, reflecting consumer preference for reducing emotional and financial stress on families. Rising adoption of digital platforms enhances service accessibility, while eco-friendly funeral options gain traction as environmental awareness spreads. Personalization of memorial services and insurance-linked funeral plans further contribute to adoption. An aging population across developed economies continues to provide steady demand, while shifting cultural attitudes create opportunities for customized and modern services.

North America leads the market due to its established service networks, high awareness of pre-planned options, and advanced digital adoption. Europe follows closely, supported by strong cultural traditions and increasing acceptance of sustainable practices. Asia Pacific emerges as the fastest-growing region, driven by rapid urbanization, population growth, and changing social norms toward professional services. Latin America and the Middle East show steady growth through modernization of funeral practices, while Africa demonstrates gradual adoption influenced by urban expansion and rising awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Funeral Homes and Funeral Services Market was valued at USD 49.07 billion in 2018, grew to USD 72.15 billion in 2024, and is expected to reach USD 122.72 billion by 2032 at a CAGR of 6.39%.

- North America held 43.78% of the market in 2024, supported by established service networks and strong demand for pre-planned funeral services.

- Europe accounted for 26.66% share in 2024, driven by cultural traditions and growing eco-friendly funeral practices, while Asia Pacific followed with 20.91% due to urbanization and population growth.

- Asia Pacific is the fastest-growing region, supported by changing social norms and expanding awareness of professional funeral services, particularly in China, Japan, and India.

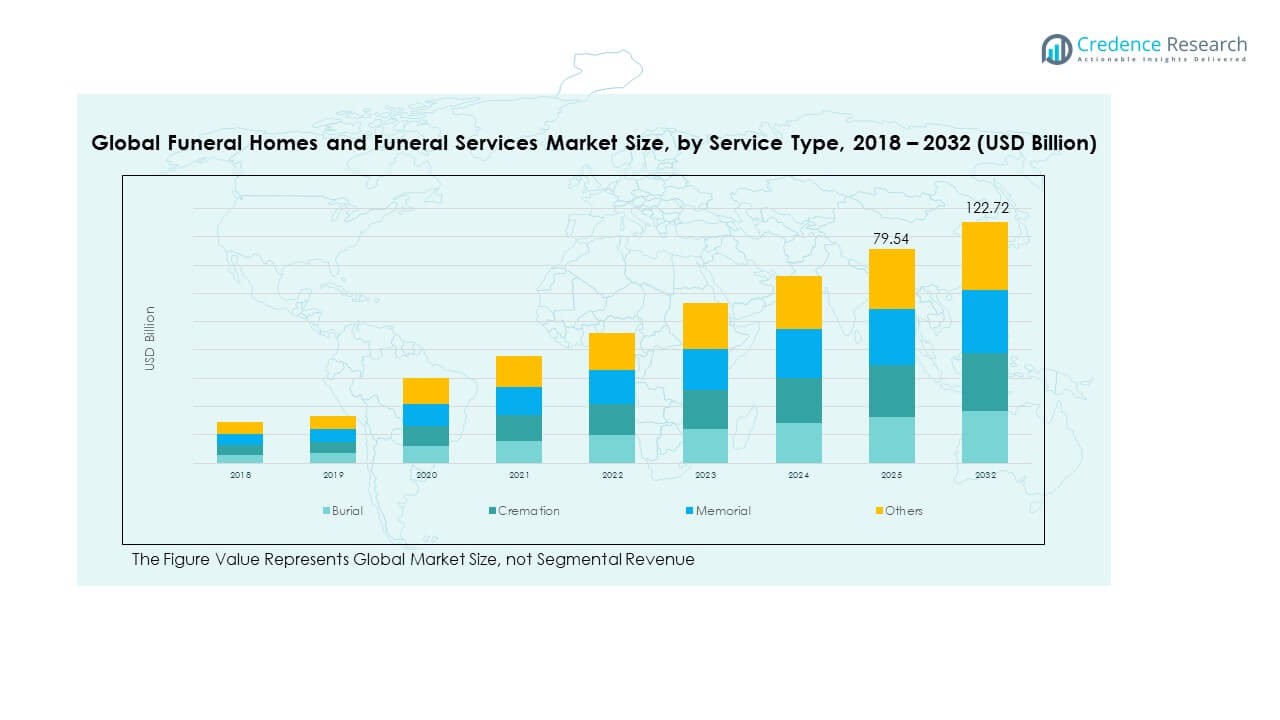

- By service type in 2024, burial accounted for 44%, cremation held 32%, memorial represented 15%, and other services made up 9% of the Global Funeral Homes and Funeral Services Market.

Market Drivers

Growing Demand for Pre-Planned Funeral Services Across Diverse Consumer Groups

The Global Funeral Homes and Funeral Services Market is experiencing strong growth due to rising adoption of pre-planned funeral arrangements. Families increasingly prefer structured options that reduce emotional and financial burdens. It offers assurance to customers that future ceremonies will align with personal preferences and cultural traditions. Service providers respond by offering customized packages with flexible payment models. Aging populations across developed countries are accelerating this trend. Many families choose pre-arranged plans to manage costs and avoid last-minute challenges. These factors continue to boost trust in service providers. The market benefits from a steady rise in awareness about the long-term value of advance planning.

- For example, Dignity plc, one of the UK’s largest funeral service providers, reported in its 2021 preliminary results that it had 581,000 active pre-arranged funeral plans, including both trust-based and insurance-backed arrangements. This highlights the growing trend of consumers securing funeral services in advance through structured plans.

Impact of Aging Population and Rising Mortality on Service Demand

An expanding elderly population remains a critical driver for the Global Funeral Homes and Funeral Services Market. Rising mortality rates are generating consistent demand for professional funeral solutions. It provides structured support for families navigating complex end-of-life arrangements. Urbanization and smaller family units reduce reliance on traditional informal practices. Service providers address these shifts with organized solutions that meet evolving needs. Personalized offerings, such as theme-based memorials, are attracting wider adoption. Growth in insurance-linked funeral plans is also creating new opportunities. This combination of demographic and social factors ensures stable demand across regions.

- For example, InvoCare Limited, a leading funeral services provider in Australia and New Zealand, reported in its 2022 annual results that it served 49,211 client families across its funeral homes and crematoria network. This underscores sustained demand supported by demographic changes and rising mortality in its core regions.

Increased Preference for Eco-Friendly Funeral and Memorial Options

Sustainability is shaping the Global Funeral Homes and Funeral Services Market, with demand for eco-friendly practices rising. Families increasingly seek green burials, biodegradable urns, and reduced carbon cremations. It allows consumers to align end-of-life practices with environmental values. Service providers introduce innovative solutions, including water-based cremation and chemical-free preservation. Urban centers lead in adopting such alternatives due to stronger awareness. These practices reduce environmental impact while creating a premium service category. Rising regulatory pressure on traditional burial methods is further boosting adoption. The trend enhances provider competitiveness while meeting growing consumer expectations.

Growing Digitalization of Funeral Services and Online Arrangements

Digital platforms are driving transformation in the Global Funeral Homes and Funeral Services Market. Families now book services, compare packages, and manage memorial planning online. It streamlines the process, saving time during emotionally difficult moments. Providers adopt digital memorial platforms to support remote participation in ceremonies. Live-streamed funerals are gaining traction, especially after restrictions on gatherings. Virtual pre-planning consultations also reduce barriers for younger demographics. Technology integration strengthens customer engagement and expands provider reach. Growing internet penetration accelerates acceptance of digital solutions in both urban and semi-urban markets.

Market Trends

Shift Toward Personalization and Celebration of Life Ceremonies Worldwide

The Global Funeral Homes and Funeral Services Market is witnessing a major shift toward personalized ceremonies. Families prefer events that celebrate the life of the deceased rather than traditional somber practices. It is reflected in growing demand for tailored rituals, music, and visual displays. Service providers introduce packages that honor individual achievements and lifestyle. Younger generations strongly influence this trend, seeking more inclusive formats. Memorial services often integrate cultural diversity with modern aesthetics. Creative approaches such as storytelling or themed tributes strengthen family connections. This trend highlights a move toward individuality in end-of-life events.

- For example, Co-op Funeralcare’s 2024 study reported 68% of UK adults view funerals more as “celebrations of life” than times of reflection, up from 58% in 2019. The company offers personalised services like custom coffins, music choices, and bespoke orders of service.

Integration of Hybrid Ceremonies Combining Physical and Virtual Participation

The Global Funeral Homes and Funeral Services Market adapts to evolving preferences through hybrid ceremony models. Families across regions seek options that combine in-person gatherings with digital participation. It improves accessibility for relatives who cannot attend physically. Providers offer live-streaming and interactive memorial tools. Remote participation ensures wider inclusion during restricted travel or emergencies. Such integration has moved beyond necessity into mainstream acceptance. Hybrid models also encourage cross-border services for expatriates. This trend continues to reshape the role of digital tools in funeral planning.

Rise of Specialized Funeral Homes Targeting Niche Service Segments

The Global Funeral Homes and Funeral Services Market is evolving through niche specialization. Providers target specific cultural, religious, or lifestyle needs with tailored services. It enables stronger customer loyalty and distinct brand positioning. Pet funeral services, eco-focused memorials, and luxury ceremonies are expanding rapidly. Providers create differentiated offerings to stand out in competitive markets. Families select services that resonate with personal beliefs and values. This trend supports diversification of business models within the sector. Specialized homes are expected to capture rising demand in urban areas.

- For example, Eco-friendly pet cremation is growing in the UK. Resting Pets in Essex offers individual pet cremations under their licences from the Animal and Plant Health Agency and the Environment Agency.

Expansion of International Funeral Service Providers Across Regions

The Global Funeral Homes and Funeral Services Market is expanding through cross-border service providers. Large firms enter emerging economies to meet growing demand. It helps local markets adopt structured and professional practices. International players bring advanced technologies and standardized offerings. Consolidation through mergers and acquisitions strengthens global presence. Service providers expand networks through partnerships with local operators. Families benefit from wider access to consistent quality. This trend drives competition and innovation across developed and emerging regions.

Market Challenges Analysis

High Cost Burden of Funeral Services and Rising Affordability Concerns

The Global Funeral Homes and Funeral Services Market faces challenges due to high costs associated with funeral arrangements. Families often struggle with expenses linked to ceremonies, burials, or cremations. It creates affordability issues, especially in low and middle-income groups. Rising inflation further impacts service pricing and customer willingness. Providers must balance profitability with customer expectations. Price-sensitive markets may limit adoption of premium services. Transparency in pricing becomes a critical factor influencing consumer trust. These cost concerns represent a significant barrier to growth.

Regulatory Restrictions and Cultural Sensitivities Affecting Market Expansion

Cultural diversity and strict regulations limit uniform adoption in the Global Funeral Homes and Funeral Services Market. Each region has distinct burial traditions and legal frameworks. It restricts service providers from standardizing offerings globally. Regulations on land use, cremation emissions, and environmental practices increase compliance costs. Providers face challenges aligning business models with local cultural expectations. Cultural sensitivities often demand highly tailored approaches. Expansion into emerging regions requires navigating complex regulatory systems. These constraints hinder efficiency and slow overall market growth.

Market Opportunities

Emergence of Green Innovations and Growing Awareness of Sustainable Options

The Global Funeral Homes and Funeral Services Market presents opportunities through eco-friendly innovations. Families are showing interest in sustainable memorial choices. It allows providers to diversify offerings with biodegradable coffins, eco urns, and natural burials. Governments also support green initiatives with favorable regulations. Rising awareness of climate impact drives interest in such alternatives. Providers gain a competitive edge by prioritizing eco-conscious services. Growing consumer demand enhances long-term growth potential.

Adoption of Digital Platforms Creating Scalable and Accessible Service Models

Digital adoption opens significant opportunities in the Global Funeral Homes and Funeral Services Market. Families use online platforms for bookings, planning, and memorial participation. It enhances transparency, accessibility, and customer satisfaction. Providers expand reach by offering virtual consultations and memorial tools. Remote accessibility appeals to younger consumers familiar with digital convenience. Scalability improves as providers streamline costs through online solutions. Digital adoption strengthens brand presence while attracting new demographics.

Market Segmentation Analysis:

The Global Funeral Homes and Funeral Services Market is structured across service type, category, and distribution channel, reflecting the diverse needs of consumers.

By service type

Burial services hold the dominant position due to deep cultural traditions and established practices, while cremation is witnessing rising demand driven by lower costs, environmental concerns, and shifting social preferences. Memorial services are gaining traction as families seek personalized ceremonies to celebrate life, while other services, including specialty rituals, complement overall market offerings.

- For instance, in 2024 the National Funeral Directors Association reported the US cremation rate reached 60.5% the first time cremations consistently outpaced burials, due to affordability and evolving attitudes toward end-of-life arrangements.

By category

Immediate-need services account for a significant share, supported by the necessity for urgent arrangements during unexpected deaths. It shows consistent demand across all regions. Pre-planned services are expanding at a faster pace, driven by an aging population, increasing awareness, and consumer preference for structured planning that reduces financial and emotional burdens on families.

By distribution channel

Offline services remain the primary mode due to traditional reliance on direct interactions with funeral directors and service providers. It ensures personalized consultations and stronger family engagement. Online channels are expanding rapidly with the rise of digital platforms offering booking, planning, and live-streaming of ceremonies. This digital transformation improves accessibility, widens consumer choice, and supports market growth, particularly among younger demographics and urban populations.

- For example, ASD (Answering Service for Directors) customizes telephone consultation services for hundreds of small-town funeral homes in the US to ensure personal connection, reflecting the market’s preference for in-person, direct guidance in arranging funerals.

Segmentation:

By Service Type

- Burial

- Cremation

- Memorial

- Others

By Category

- Immediate Need

- Pre-Planned

By Distribution Channel

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Global Funeral Homes and Funeral Services Market size was valued at USD 21.65 billion in 2018 to USD 31.51 billion in 2024 and is anticipated to reach USD 53.74 billion by 2032, at a CAGR of 6.4% during the forecast period. North America holds 43.78% share of the 2024 global market. The region leads due to its established funeral home networks and wide availability of professional services. High awareness of pre-planned funeral arrangements drives consistent adoption. It benefits from advanced digital platforms that simplify booking and memorial planning. Consumers increasingly opt for eco-friendly funeral options, reinforcing provider innovation. Insurance-linked funeral plans are also popular, creating financial security for families. The presence of global leaders strengthens competition while ensuring service quality.

Europe

The Europe Global Funeral Homes and Funeral Services Market size was valued at USD 13.55 billion in 2018 to USD 19.19 billion in 2024 and is anticipated to reach USD 30.68 billion by 2032, at a CAGR of 5.6% during the forecast period. Europe accounts for 26.66% share of the 2024 global market. Strong cultural traditions and regulatory frameworks guide funeral practices across the region. It is supported by high demand for sustainable and eco-conscious funeral solutions. Families increasingly prefer personalized ceremonies, with providers adapting through creative service packages. The aging population ensures stable demand across major economies. Digitalization is gaining ground, offering hybrid memorials with both in-person and virtual participation. Established service providers continue to innovate to meet evolving customer expectations.

Asia Pacific

The Asia Pacific Global Funeral Homes and Funeral Services Market size was valued at USD 9.44 billion in 2018 to USD 15.05 billion in 2024 and is anticipated to reach USD 28.99 billion by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific holds 20.91% share of the 2024 global market. Rapid urbanization and rising disposable incomes are shaping the regional market. It benefits from changing social norms that favor professional funeral services over informal practices. Countries such as China, Japan, and India show growing adoption of structured funeral arrangements. Expanding awareness of pre-planning options supports new opportunities for providers. Eco-friendly funerals are also gaining visibility in urban centers. The region is projected to be the fastest-growing due to its large population base and cultural transitions.

Latin America

The Latin America Global Funeral Homes and Funeral Services Market size was valued at USD 2.32 billion in 2018 to USD 3.37 billion in 2024 and is anticipated to reach USD 5.07 billion by 2032, at a CAGR of 4.8% during the forecast period. Latin America represents 4.68% share of the 2024 global market. The market is expanding steadily with rising demand for professionalized funeral homes. It is supported by increasing urbanization and improved awareness of structured arrangements. Families are adopting flexible payment models, making services more accessible. Local providers focus on affordable offerings to capture middle-income groups. Interest in eco-friendly funeral practices is also emerging across larger cities. Cross-border collaborations with international firms help modernize the sector. The region shows gradual but consistent growth potential.

Middle East

The Middle East Global Funeral Homes and Funeral Services Market size was valued at USD 1.29 billion in 2018 to USD 1.73 billion in 2024 and is anticipated to reach USD 2.45 billion by 2032, at a CAGR of 4.0% during the forecast period. The Middle East holds 2.40% share of the 2024 global market. Cultural traditions and religious frameworks shape funeral practices strongly in this region. It influences service providers to align closely with religious customs. Growth is driven by rising urban populations and modern funeral homes in metropolitan areas. International players enter through partnerships to adapt services to local sensitivities. Eco-friendly funeral options are limited but gaining gradual acceptance. Digital platforms are emerging for booking and memorial support. Market expansion remains steady with opportunities in premium services.

Africa

The Africa Global Funeral Homes and Funeral Services Market size was valued at USD 0.81 billion in 2018 to USD 1.31 billion in 2024 and is anticipated to reach USD 1.80 billion by 2032, at a CAGR of 3.6% during the forecast period. Africa contributes 1.82% share of the 2024 global market. The region is in early stages of adopting professional funeral services. It relies heavily on traditional practices in rural areas. Urbanization is creating demand for structured funeral homes in major cities. Providers face challenges due to affordability constraints among large population groups. Growing middle-class segments drive demand for organized arrangements. Cultural diversity requires service customization across countries. It shows gradual growth potential as awareness improves and infrastructure develops.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AMAR International

- Ritual Funeral Enterprise

- InvoCare Australia Pty Ltd

- Naser Group Inc.

- Nirvana Funeral Services Pvt. Ltd

- Blue Ridge Funeral & Cremation Service

- Funeral Basics

Competitive Analysis:

The Global Funeral Homes and Funeral Services Market is highly fragmented, with regional and international players competing for share. It features established providers offering burial, cremation, and memorial services alongside emerging firms focusing on eco-friendly and digital solutions. Leading companies strengthen their presence through mergers, acquisitions, and partnerships, ensuring broader reach and diversified offerings. It is also shaped by firms investing in online platforms to streamline pre-planning, booking, and remote participation. Competition intensifies as consumer preferences shift toward personalized ceremonies and sustainable options. Regional firms often hold strong cultural ties, giving them an advantage in local markets. International players leverage scale and technology to deliver consistent quality across geographies. It continues to evolve through innovation, service differentiation, and strategic expansion, positioning providers to capture growing demand across developed and emerging economies.

Recent Developments:

- In April 2025, Anthem Partners entered a partnership with Tribute Technology. Anthem migrated its funeral home websites to the Tribute platform to boost digital presence and leverage AI and eCommerce tools.

- In July 2025, Tribute Technology introduced Obit360, a new obituary platform aimed at funeral homes and families to improve engagement and streamline event visibility

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Category and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Funeral Homes and Funeral Services Market will expand steadily, supported by rising demand for pre-planned funeral arrangements.

- Growth will be influenced by demographic shifts, particularly aging populations across developed regions.

- Service diversification will strengthen, with burial, cremation, and memorial services tailored to cultural needs.

- Eco-friendly solutions such as green burials and biodegradable urns will gain higher acceptance.

- Digital platforms for online booking, planning, and virtual memorials will continue to evolve.

- Regional consolidation and acquisitions will drive market competitiveness and global reach.

- Insurance-linked funeral plans will remain a strong factor in consumer adoption.

- Personalization of ceremonies, including themed events and hybrid participation, will increase.

- Emerging markets will witness rising demand as urbanization and awareness expand service adoption.

- Regulatory frameworks and cultural traditions will continue to influence provider strategies worldwide.