Market Overview

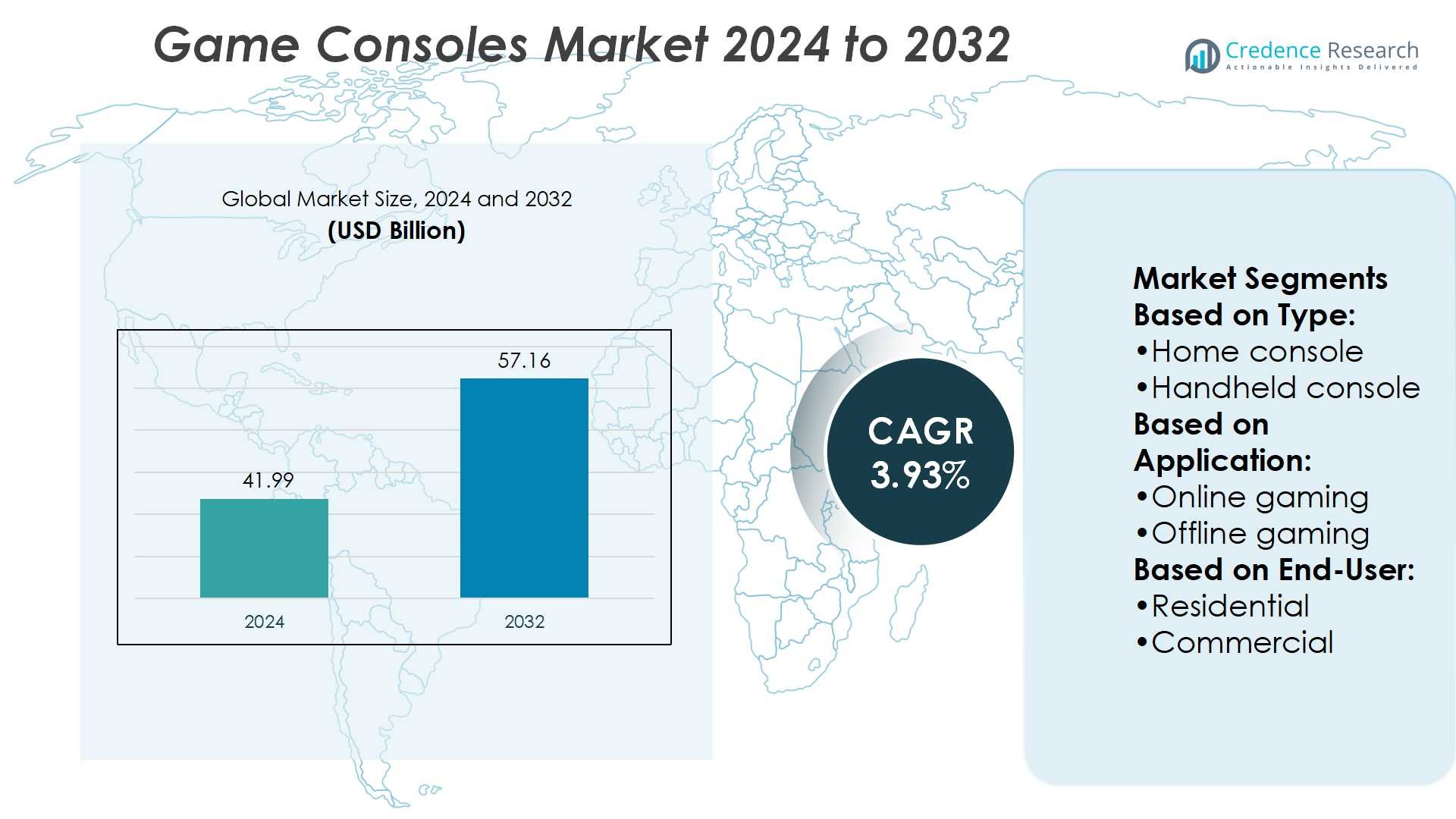

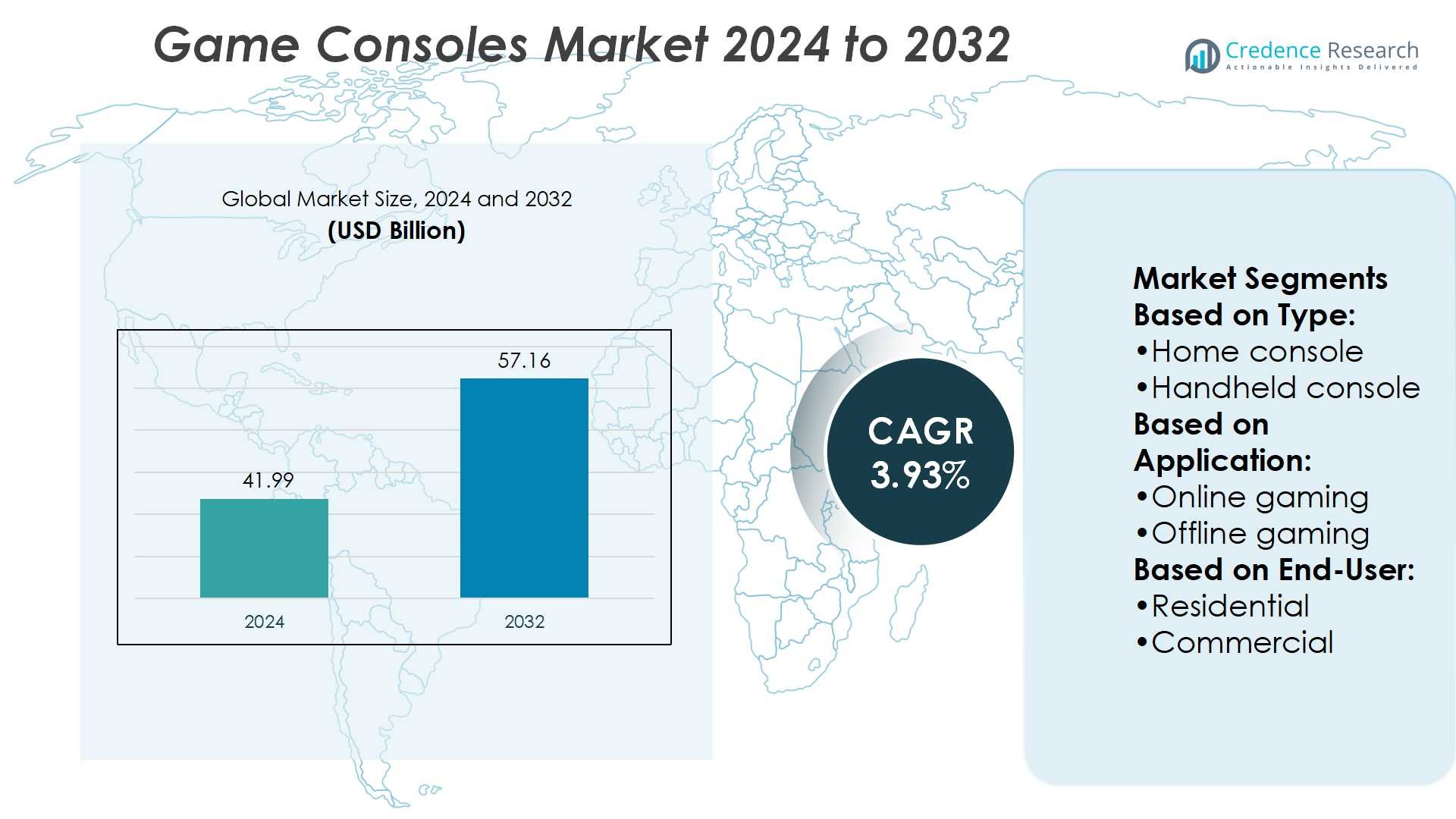

Game Consoles Market size was valued at USD 41.99 billion in 2024 and is anticipated to reach USD 57.16 billion by 2032, at a CAGR of 3.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Game Consoles Market Size 2024 |

USD 41.99 Billion |

| Game Consoles Market, CAGR |

3.93% |

| Game Consoles Market Size 2032 |

USD 57.16 Billion |

The Game Consoles Market grows through strong drivers and evolving trends that reshape global gaming. Rising demand for immersive experiences, high-performance hardware, and exclusive content strengthens adoption. Subscription models and digital ecosystems create recurring revenue streams while expanding player engagement. Esports popularity and online multiplayer services boost visibility and community-driven growth. Trends such as cloud gaming, cross-platform compatibility, and hybrid console demand reflect shifting consumer preferences. Integration of VR, AR, and AI enhances gaming realism and personalization. Sustainability and energy-efficient designs further influence development. The market continues to advance as companies invest in innovation, accessibility, and long-term user loyalty.

The Game Consoles Market shows strong geographical diversity, with Asia-Pacific leading through high adoption and esports growth, North America maintaining dominance with advanced infrastructure and premium console demand, and Europe recording steady expansion supported by established gaming communities. Latin America and the Middle East & Africa display emerging potential driven by rising internet access and younger populations. Key players shaping the market include Sony, Microsoft, Nintendo, Sega, Valve Corporation, ASUS, Razer, Logitech, Ayaneo, and SNK Corporation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Game Consoles Market size was USD 41.99 billion in 2024 and will reach USD 57.16 billion by 2032, growing at a CAGR of 3.93%.

- Rising demand for immersive experiences, high-performance hardware, and exclusive content drives steady adoption.

- Cloud gaming, hybrid console demand, and cross-platform compatibility reflect major consumer-driven trends.

- Strong competition exists, with companies focusing on digital ecosystems, subscription services, and innovation to capture share.

- High development costs, semiconductor shortages, and pricing pressures act as restraints to wider growth.

- Asia-Pacific leads with esports-driven adoption, North America dominates with premium demand, and Europe records stable growth.

- Latin America and the Middle East & Africa present emerging opportunities supported by rising internet penetration and young populations.

Market Drivers

Growing Demand for Immersive Gaming Experiences Drives Hardware Advancements

The Game Consoles Market grows through rising consumer interest in immersive experiences. High-resolution graphics, faster frame rates, and real-time rendering drive demand for advanced consoles. Companies integrate powerful GPUs and CPUs to deliver seamless performance. Expanding libraries of visually rich titles reinforce this momentum. Competitive differentiation often relies on exclusive content and hardware superiority. It creates consistent pressure for innovation across the industry.

- For instance, Valve’s Steam Deck integrates a custom AMD APU featuring a quad-core/8-thread Zen 2 CPU clocked at 2.4–3.5 GHz and an RDNA 2 GPU delivering 1.6 TFLOPS of FP32 performance, enabling smooth AAA gaming experiences on a handheld device.

Expanding Online Gaming Ecosystems Enhance Market Growth

The integration of online services significantly strengthens the Game Consoles Market. Platforms offer multiplayer options, digital downloads, and subscription-based access to games. These services build recurring revenue streams for manufacturers and enhance user engagement. Cloud connectivity allows players to access titles across devices. Growing social interaction within gaming networks supports community-driven adoption. It reinforces customer loyalty and encourages longer console lifecycles.

- For instance, Sega’s original Phantasy Star Online on the Dreamcast launched with an initial deployment of 20 servers, scaled up to support 36,000 concurrent players at peak usage.

Rising Popularity of Esports and Competitive Gaming Creates New Opportunities

Esports expansion strongly influences the Game Consoles Market. Competitive gaming demands advanced hardware with minimal latency and high-speed processing. Leading brands sponsor tournaments and form partnerships with esports organizations. These initiatives increase brand visibility and drive console adoption among younger audiences. High-profile events showcase console capabilities to global audiences. It positions consoles as essential tools for aspiring professionals and dedicated fans.

Strong Influence of Technological Convergence and Cross-Platform Play

Technological convergence plays a central role in shaping the Game Consoles Market. Cross-platform compatibility enables users to engage with friends regardless of hardware choice. This flexibility supports broader adoption and reduces fragmentation in gaming communities. Integration of VR, AR, and AI elevates user experiences. Streaming services and backward compatibility further extend console value. It allows consumers to view consoles as multi-functional entertainment hubs.

Market Trends

Growing Adoption of Cloud Gaming and Digital Distribution Models

The Game Consoles Market reflects a steady transition toward cloud gaming and digital distribution. Consumers increasingly prefer downloading or streaming titles instead of purchasing physical discs. Subscription services provide access to large libraries at affordable costs. Major console makers invest heavily in cloud infrastructure to deliver seamless gameplay. Digital-first strategies also reduce reliance on retail channels. It reshapes how developers and publishers design and distribute content.

- For instance, ASUS provides server infrastructure for Boosteroid’s cloud gaming platform, which operates across 27 data center points of presence and supports over 6 million users in Europe, North and South America.

Expanding Role of Cross-Platform Compatibility and Shared Gaming Communities

Cross-platform play continues to shape the Game Consoles Market by unifying gaming experiences. Players demand the ability to interact with friends across devices without restrictions. Leading companies support this by forming partnerships with developers and online platforms. Cross-play reduces community fragmentation and increases engagement in multiplayer titles. Strong integration across ecosystems enhances customer loyalty. It establishes consoles as central gateways to broader gaming networks.

- For instance, Helldivers 2 published by Sony Interactive Entertainment achieved a peak concurrent player count of over 450,000 on Steam.The game surpassed 15 million units sold globally.

Increasing Integration of Virtual Reality, Augmented Reality, and AI Features

The Game Consoles Market experiences growth through rising integration of VR, AR, and AI. VR headsets provide immersive environments that redefine entertainment standards. AR capabilities add interactive layers to gameplay and encourage new applications. AI-driven personalization improves in-game experiences by adapting content to individual preferences. Hardware makers collaborate with technology providers to expand these advanced features. It creates differentiation in a competitive environment and strengthens consumer appeal.

Rising Influence of Esports and Streaming Culture on Console Adoption

Esports and live-streaming culture exert strong influence over the Game Consoles Market. Competitive gaming elevates hardware demand with emphasis on speed and reliability. Social platforms like Twitch and YouTube amplify visibility of console-based titles. Gamers showcase performance capabilities to large global audiences. The combination of esports and streaming fuels adoption among younger demographics. It positions consoles as cultural hubs where competition and entertainment converge.

Market Challenges Analysis

High Development Costs and Supply Chain Constraints Impact Market Stability

The Game Consoles Market faces challenges from high production costs and global supply chain issues. Advanced components such as GPUs, processors, and memory modules require significant investment. Semiconductor shortages disrupt manufacturing cycles and delay product launches. Rising raw material costs increase retail prices, reducing affordability in price-sensitive regions. Companies must balance innovation with profitability while managing volatile supply conditions. It creates uncertainty for both manufacturers and consumers who expect timely product availability.

Intense Competition and Shifts Toward Alternative Gaming Platforms

The Game Consoles Market also struggles with fierce competition and shifting consumer preferences. Mobile gaming, cloud-based platforms, and PC gaming attract a growing share of users. Strong demand for flexible and low-cost alternatives challenges traditional console sales. Competitive pressure forces companies to invest in exclusive titles and advanced features. Market saturation in developed economies further limits growth opportunities. It drives manufacturers to explore new services and subscription models to maintain relevance.

Market Opportunities

Expansion of Subscription Services and Cloud Gaming Platforms

The Game Consoles Market benefits from strong opportunities in subscription-based and cloud gaming models. Growing demand for affordable access to large content libraries supports this shift. Major brands invest in services that combine digital downloads with cloud access. These platforms extend console lifecycles while attracting diverse user groups. Emerging markets with rising internet penetration create new revenue streams. It allows console makers to strengthen recurring income and broaden their customer base.

Integration of Advanced Technologies and Emerging Regional Markets

The Game Consoles Market gains opportunities through adoption of VR, AR, and AI-driven experiences. Advanced features enhance gameplay and differentiate consoles from alternative platforms. Partnerships with developers expand innovation and generate exclusive content. Emerging markets in Asia-Pacific, Latin America, and Africa show rising demand for interactive entertainment. Growing disposable incomes and urbanization support adoption in these regions. It positions console makers to capture untapped audiences and accelerate long-term growth.

Market Segmentation Analysis:

By Type

The Game Consoles Market divides into home consoles, handheld consoles, and hybrid consoles. Home consoles dominate due to their powerful hardware, large storage, and immersive gaming experiences. These devices remain popular among core gamers who prioritize high-quality graphics and exclusive titles. Handheld consoles attract users seeking portability and accessibility, especially in regions with high mobile gaming adoption. Hybrid consoles combine the strengths of both, offering flexibility for users to switch between handheld and docked modes. It creates strong appeal for households that prefer versatile entertainment options, strengthening adoption across diverse demographics.

- For instance, The AYANEO 2 features an AMD Ryzen 7 6800U APU, 16 GB or 32 GB of LPDDR5-6400 memory, an RX 680M GPU delivering approximately 3.379 TFLOPS, powered by a 50.25 Whr battery in a 680 g chassis.

By Application

The Game Consoles Market segments by online and offline gaming applications. Online gaming records strong growth with increasing demand for multiplayer titles, esports, and streaming platforms. Players value access to live services, downloadable content, and subscription-based ecosystems. This segment benefits from cloud integration and rising social interaction in gaming networks. Offline gaming retains importance, appealing to users in areas with limited connectivity or those who prefer single-player experiences. It ensures consoles maintain relevance among traditional gamers while adapting to evolving digital trends.

- For instance, Microsoft’s Xbox Game Pass has grown to over 35 million subscribers with cloud gaming enabling access to hundreds of titles across Xbox, PC, and mobile devices.

By End User

The Game Consoles Market also classifies by residential and commercial users. Residential usage dominates, driven by rising consumer demand for interactive entertainment at home. Families and individual gamers invest in consoles that deliver immersive experiences and extensive content libraries. Commercial usage emerges in gaming cafés, esports arenas, and entertainment centers. These environments rely on consoles to attract competitive players and provide high-quality gaming setups. It highlights opportunities for manufacturers to target institutional buyers and expand market reach beyond households.

Segments:

Based on Type:

- Home console

- Handheld console

Based on Application:

- Online gaming

- Offline gaming

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds nearly 24–25% of the Game Consoles Market in 2024. The region benefits from strong consumer spending, advanced broadband networks, and early adoption of next-generation consoles. Leading manufacturers focus on this region by releasing exclusive titles and promoting subscription services such as online passes and game libraries. Esports and streaming culture also strengthen demand, making consoles a household essential. Consumers in the United States and Canada prefer home consoles with powerful hardware and large storage, ensuring continued dominance of premium models. It highlights the region’s role as a major driver of revenue and innovation in the global landscape.

Europe

Europe accounts for around 20–25% of the Game Consoles Market. The region shows steady growth supported by established gaming communities and widespread broadband penetration. Countries like the United Kingdom, Germany, and France lead adoption due to strong demand for high-quality gaming systems. Governments support local developers through tax incentives, adding to content diversity. Esports tournaments and cross-platform play expand user engagement across the region. Players value a balance of online and offline gaming options, making Europe an attractive but competitive space for manufacturers. It secures Europe’s position as a stable and mature market with consistent demand.

Asia-Pacific

Asia-Pacific dominates the Game Consoles Market with nearly 46–47% share. Rising disposable incomes, rapid urbanization, and increasing internet access fuel adoption across key countries such as China, Japan, and South Korea. Esports popularity drives high sales of both home and handheld consoles, while hybrid models attract younger players. Companies form partnerships with local developers to create region-specific content that appeals to cultural preferences. Affordable broadband and mobile penetration support cloud gaming growth, expanding console utility. It positions Asia-Pacific as the largest and fastest-growing regional market with significant long-term potential.

Latin America

Latin America represents roughly 5–6% of the Game Consoles Market. Growth is supported by rising internet usage and increased demand for affordable entertainment. Brazil and Mexico lead in console adoption, driven by a growing youth population. However, high import tariffs and pricing challenges limit broader accessibility. Consumers often favor handheld and hybrid consoles due to cost efficiency and portability. Esports events and gaming cafés help expand awareness across urban areas. It reflects a promising yet cost-sensitive region with steady growth potential.

Middle East & Africa

The Middle East & Africa account for nearly 3–4% of the Game Consoles Market. Rising internet penetration, a growing young population, and expanding retail infrastructure support console sales. Countries like the UAE, Saudi Arabia, and South Africa drive demand through increasing interest in esports and online gaming. Pricing sensitivity and limited broadband coverage remain key challenges in rural areas. Manufacturers focus on localized pricing strategies and promotional campaigns to attract consumers. Handheld and hybrid consoles gain traction due to affordability and mobility. It shows that MEA is an emerging region with gradual but promising opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Game Consoles Market players including Sony, Microsoft, Nintendo, Sega, Valve Corporation, ASUS, Razer, Logitech, Ayaneo, and SNK Corporation. The Game Consoles Market remains highly competitive, driven by constant innovation, exclusive content, and ecosystem development. Companies focus on enhancing hardware performance, building strong digital service platforms, and expanding subscription-based models to attract and retain users. Hybrid and handheld devices gain traction as consumers demand flexibility and portability alongside traditional home consoles. Advancements in VR, AR, and cloud gaming create new opportunities for differentiation and customer engagement. Firms also prioritize cross-platform compatibility and community-driven features to strengthen loyalty. The competition highlights a clear emphasis on delivering immersive experiences while balancing affordability, accessibility, and long-term growth strategies.

Recent Developments

- In June 2025, Microsoft announced a strategic multi-year partnership with AMD to co-engineer custom silicon for its next-generation Xbox consoles. The new platform will support a broader ecosystem by offering an Xbox experience that is not locked to a single store or limited to one device.

- In June 2025, Microsoft and ASUS announced the launch of the ROG Xbox Ally and ROG Xbox Ally X, two new handheld gaming console developed in collaboration to bring the power of Xbox to portable devices. Designed to support Xbox Play Anywhere, Game Pass, Xbox Cloud Gaming (Beta), and Remote Play, these handhelds allows gamers to enjoy high-performance console experiences on the go.

- In June 2025, Nintendo launched the Nintendo Switch 2. The new console features enhanced hardware performance and a broader content library. The launch of Nintendo rolled out a firmware update, introducing system stability improvements and expanding the Nintendo Classics catalog with legacy GameCube titles.

- In May 2024, Gcore declared its strategic association with Xsolla, through which Gcore provides global solutions for edge AI cloud networking security to Xsolla as a video game commerce company.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand through stronger adoption of subscription-based gaming services.

- Cloud gaming will gain wider traction and extend console lifecycles.

- Hybrid and handheld consoles will record higher demand in emerging economies.

- Cross-platform compatibility will remain central to player engagement strategies.

- VR and AR integration will shape the next phase of immersive gaming.

- Esports and streaming platforms will drive visibility and hardware adoption.

- AI-driven personalization will improve gaming experiences and retention.

- Emerging regions will provide new growth opportunities with rising internet access.

- Digital distribution will reduce reliance on physical game sales.

- Sustainability and energy-efficient designs will influence console development.