Market Overview

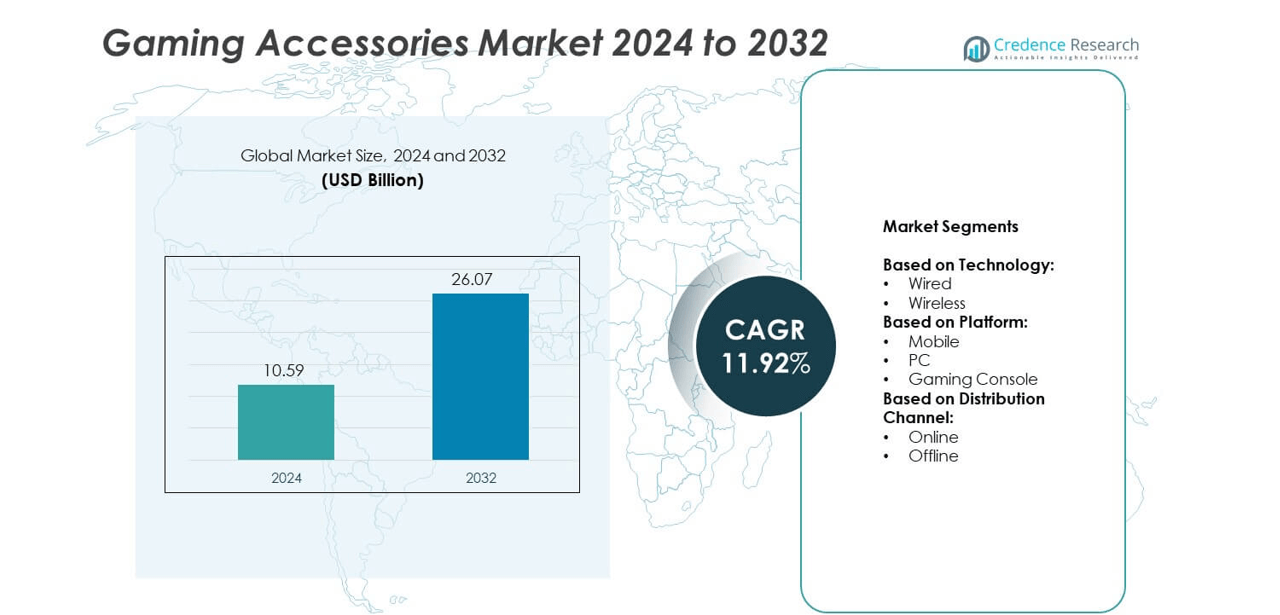

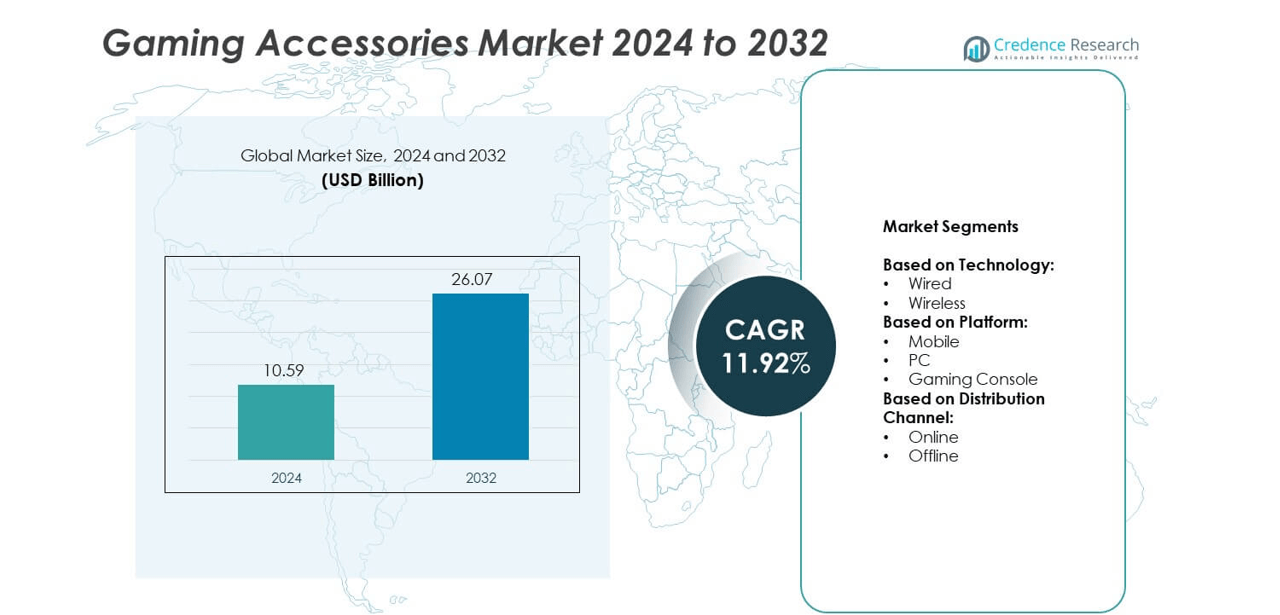

The Gaming Accessories Market size was valued at USD 10.59 Billion in 2024 and is projected to reach USD 26.07 Billion by 2032. The market is expected to grow at a CAGR of 11.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gaming Accessories Market Size 2024 |

USD 10.59 Billion |

| Gaming Accessories Market, CAGR |

11.92% |

| Gaming Accessories Market Size 2032 |

USD 26.07 Billion |

The Gaming Accessories market is driven by rising esports popularity, growing online gaming platforms, and increasing demand for immersive experiences. Wireless technology adoption, cross-platform compatibility, and innovations in VR and AR accessories fuel strong growth. It benefits from expanding gaming communities, influencer-driven promotions, and higher disposable incomes supporting premium product purchases. Manufacturers focus on personalization, eco-friendly designs, and advanced performance features to meet evolving consumer expectations. These drivers and trends collectively strengthen the market’s global expansion and long-term growth potential.

North America leads the Gaming Accessories market, supported by strong esports culture and high consumer spending on premium products. Europe follows with steady demand across console and PC gaming, while Asia Pacific shows the fastest growth with expanding mobile and online gaming communities. Latin America and the Middle East & Africa present emerging opportunities driven by rising internet access and gaming adoption. Key players shaping the market include Logitech G, Razer Inc., Corsair, and ASUS, focusing on innovation and global reach.

Market Insights

- The Gaming Accessories market was valued at USD 10.59 Billion in 2024 and is projected to reach USD 26.07 Billion by 2032, growing at a CAGR of 11.92%.

- Rising esports popularity and expansion of online gaming platforms drive consistent demand for advanced peripherals.

- Wireless technology, cross-platform compatibility, and adoption of VR and AR accessories shape current trends in product development.

- The market is highly competitive with leading players such as Logitech G, Razer Inc., Corsair, SteelSeries, and ASUS focusing on innovation and brand influence.

- High cost of premium accessories and short product life cycles act as restraints, limiting adoption among price-sensitive and casual gamers.

- North America leads the market with strong consumer spending and esports infrastructure, while Europe maintains steady growth with diverse gaming cultures.

- Asia Pacific emerges as the fastest-growing region, supported by mobile gaming adoption and a young demographic, whereas Latin America and the Middle East & Africa provide untapped opportunities through e-commerce expansion and increasing internet access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Popularity of Esports and Online Gaming Platforms

The Gaming Accessories market benefits from the growing popularity of esports and online platforms. Competitive gaming attracts millions of viewers globally and drives investment in advanced peripherals. Players demand high-performance accessories that deliver precision, speed, and comfort during extended sessions. Headsets, controllers, and gaming mice become essential for achieving competitive advantages. It also encourages continuous upgrades, as gamers seek the latest innovations. The rise of global esports tournaments further expands accessory adoption across diverse demographics.

- For instance, The Logitech G PRO X SUPERLIGHT 2 DEX mouse features the advanced HERO 2 sensor and LIGHTSPEED wireless technology. It supports a wireless polling rate of up to 8,000 Hz (0.125 ms) for responsive and reliable performance in competitive gaming. The mouse is capable of tracking at speeds of over 888 IPS (inches per second) and a maximum acceleration of 88G, with a maximum DPI of 44,000. The mouse is also incredibly lightweight at 60 grams.

Technological Advancements in Gaming Hardware and Peripherals

Innovations in hardware and peripheral design fuel consistent growth within the Gaming Accessories market. Manufacturers integrate features such as haptic feedback, adaptive triggers, and customizable lighting. These improvements enhance user experience and support immersive gameplay across multiple devices. It creates demand for premium accessories that align with next-generation consoles and PCs. Wireless technology adoption also improves convenience and performance reliability. Integration with virtual reality and augmented reality further broadens product demand among tech-savvy consumers.

- For instance, Razer released the BlackShark V3 Pro wireless headset featuring Gen-2 HyperSpeed Wireless tech achieving latency as low as 10 milliseconds, with a detachable 12 mm mic sampling voice at 48 kHz.

Expanding Gaming Communities and Consumer Engagement

The Gaming Accessories market gains momentum through expanding gaming communities and interactive platforms. Social media, streaming services, and community forums drive awareness and influence purchase decisions. Gamers often look for accessories endorsed by influencers and professionals. It encourages companies to collaborate with gaming personalities to boost product visibility. The growing culture of live streaming also elevates demand for high-quality microphones and headsets. Wider community interaction ensures constant interest in product innovation and upgrades.

Increasing Availability of Affordable and Premium Product Lines

The Gaming Accessories market is shaped by availability across both affordable and premium segments. Entry-level devices attract casual players seeking reliable performance at lower costs. Premium products cater to enthusiasts who value superior build quality and advanced features. It provides opportunities for brands to diversify offerings across multiple price tiers. Expanding retail presence and e-commerce platforms make these products accessible globally. The balance between affordability and innovation supports sustained market penetration and customer loyalty.

Market Trends

Growing Integration of Wireless and Cloud-Based Technologies

The Gaming Accessories market is witnessing rapid adoption of wireless and cloud-based solutions. Gamers prefer accessories with reduced latency and greater mobility for seamless experiences. Companies design controllers, keyboards, and headsets with advanced wireless connectivity to meet these needs. It also aligns with cloud gaming services, which require reliable peripherals for smooth operation. The shift improves flexibility for players across consoles, PCs, and mobile devices. This trend continues to influence both product design and consumer expectations.

- For instance, The Logitech G305 LIGHTSPEED wireless gaming mouse offers up to 250 hours of continuous gameplay on a single AA battery. It is powered by the highly energy-efficient HERO sensor, which provides precise and accurate tracking with sensitivity ranging from 200 to 12,000 DPI. Using LIGHTSPEED wireless technology, the mouse delivers a super-fast 1 ms report rate for a responsive connection. The mouse is also lightweight, weighing only 99 grams.

Rising Influence of Personalization and Customization Features

The Gaming Accessories market highlights personalization as a core purchasing factor. Consumers demand customizable designs, lighting options, and adjustable ergonomics for individual preferences. Companies introduce software-driven personalization tools to allow unique setups. It enhances engagement by giving players more control over performance and style. Customization also helps accessories stand out in a highly competitive environment. Growing consumer focus on unique gaming identities strengthens this trend across global markets.

- For instance, Corsair’s HS80 Max headset offers up to 65 hours of wireless battery life with low-latency 2.4 GHz Slipstream wireless, giving competitive players long sessions without interruptions.

Expansion of Eco-Friendly and Sustainable Product Designs

The Gaming Accessories market is moving toward sustainable designs driven by environmental awareness. Manufacturers explore recycled materials, reduced packaging waste, and energy-efficient production methods. This aligns with consumer interest in eco-conscious brands and long-lasting products. It helps companies gain trust among environmentally aware buyers. Premium accessories with sustainable credentials attract younger demographics seeking responsible consumption. Eco-friendly innovation continues to influence strategies for long-term competitiveness.

Increasing Adoption of Multi-Platform Compatibility and Cross-Play Support

The Gaming Accessories market benefits from the rise of multi-platform gaming and cross-play features. Players seek accessories compatible across PCs, consoles, and mobile devices. Companies introduce universal controllers, adaptable headsets, and software integrations to address this demand. It ensures seamless transitions for users playing on multiple systems. Multi-platform support also encourages higher adoption among casual and professional gamers alike. Growing cross-play acceptance continues to shape the direction of product innovation.

Market Challenges Analysis

High Cost of Advanced Accessories and Price Sensitivity Among Consumers

The Gaming Accessories market faces challenges due to the high cost of advanced peripherals. Premium accessories with features such as haptic feedback, adaptive triggers, and wireless technology remain expensive. It limits adoption among casual gamers and price-sensitive buyers in emerging economies. Companies must balance innovation with affordability to maintain market reach. Growing competition intensifies pricing pressure, as low-cost alternatives attract budget-conscious consumers. Fluctuations in raw material costs and supply chain expenses further complicate pricing strategies for manufacturers.

Rapid Technological Changes and Short Product Life Cycles

The Gaming Accessories market is challenged by fast-paced innovation and shorter product cycles. New console launches and hardware updates quickly make older accessories less relevant. It forces manufacturers to accelerate product development and invest heavily in research. Frequent upgrades create difficulties for consumers who hesitate to replace devices too often. Compatibility issues across different platforms also impact long-term product adoption. Intense pressure to innovate while maintaining durability and performance standards remains a key challenge for industry players.

Market Opportunities

Expanding Demand from Emerging Markets and Untapped Demographics

The Gaming Accessories market holds significant opportunities in emerging regions with growing digital adoption. Rising internet penetration and smartphone availability increase interest in both mobile and console gaming. It creates strong demand for affordable yet reliable peripherals suited for new players. Younger demographics in Asia, Latin America, and Africa represent a large untapped customer base. Manufacturers targeting localized designs and pricing can capture substantial growth. Strategic distribution through online platforms further supports accessibility across diverse regions.

Growing Role of Immersive Technologies and Next-Generation Gaming Platforms

The Gaming Accessories market is positioned to benefit from the rise of immersive technologies. Virtual reality and augmented reality integration requires specialized peripherals that enhance user engagement. It drives opportunities for headsets, controllers, and motion-sensing devices tailored for advanced platforms. Expanding popularity of cloud gaming also fuels demand for versatile and high-performance accessories. Cross-platform compatibility strengthens adoption among both casual and competitive gamers. Continuous innovation in immersive experiences ensures new revenue streams for manufacturers in the coming years.

Market Segmentation Analysis:

By Technology:

The Gaming Accessories market divides into wired and wireless products. Wired accessories maintain relevance due to consistent performance, low latency, and affordability, making them popular among budget-conscious gamers. Wireless accessories gain momentum with advances in connectivity, offering greater flexibility and convenience. It supports immersive experiences with reduced cable clutter, appealing strongly to premium users. Manufacturers continue to expand wireless portfolios, driven by demand from competitive gamers and integration with modern gaming platforms.

- For instance, SteelSeries, in collaboration with top esports professionals and influencers, designed the Arctis Nova Pro Wireless gaming headset to provide a high-end audio experience with the Nova Pro Acoustic System. The headset is engineered with a multi-system connect featuring dual-wireless capabilities, including simultaneous 2.4G wireless for lossless gaming audio and Bluetooth 5.0 for mobile devices. It is equipped with an Infinity Power System, which includes two hot-swappable batteries. Each battery provides up to 22 hours of usage, for a total of 44 hours of continuous playtime, as one battery charges in the base station while the other is in use.

By Platform:

The Gaming Accessories market includes mobile, PC, and gaming console segments. Mobile gaming shows strong growth with rising smartphone penetration and adoption of casual and competitive titles. It boosts demand for compact controllers, gaming earphones, and mobile-compatible headsets. PC gaming remains a stronghold due to high adoption of performance-driven accessories like mechanical keyboards, gaming mice, and VR-enabled devices. Console gaming maintains dominance, supported by launches of advanced platforms from Sony, Microsoft, and Nintendo. Cross-platform accessories further enhance demand across all categories.

- For instance, HyperX launched the Cloud Alpha Wireless with 300 hours of battery life on a single charge, meeting wireless cloud-gaming needs

By Distribution Channel:

The Gaming Accessories market splits into online and offline channels. Online platforms dominate with wide product availability, competitive pricing, and global reach. It supports market penetration by offering access to both budget and premium products. Offline channels retain importance due to consumer preference for hands-on testing before purchase. Specialty gaming stores and retail outlets play a role in brand promotion and customer engagement. Hybrid strategies combining online efficiency with offline presence continue to strengthen overall distribution.

Segments:

Based on Technology:

Based on Platform:

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Gaming Accessories market, accounting for 36% in 2024. The region benefits from a strong presence of console manufacturers, advanced PC gaming culture, and a well-established esports ecosystem. High consumer spending power enables widespread adoption of premium accessories such as wireless controllers, VR headsets, and advanced gaming keyboards. It also benefits from robust infrastructure for online gaming, supported by leading platforms and high-speed internet penetration. The United States drives the majority of demand, fueled by the growing popularity of competitive esports tournaments and extensive live-streaming culture. Canada contributes with a steady rise in mobile gaming adoption and growing preference for accessories compatible with cross-platform gaming. The strong base of accessory manufacturers and continuous product launches ensures North America remains a dominant market throughout the forecast period.

Europe

Europe represents the second-largest regional market, holding 28% of the Gaming Accessories market in 2024. The region is shaped by diverse gaming cultures across countries such as Germany, the United Kingdom, France, and Nordic nations. Strong console adoption and steady PC gaming demand continue to fuel accessory sales. It is supported by a growing esports audience and increasing adoption of VR and AR-enabled peripherals. Western Europe demonstrates high demand for premium devices, while Eastern Europe shows growing adoption of affordable accessories. Cross-border e-commerce platforms expand accessibility and product variety across the region. Europe’s regulatory focus on sustainable electronics also influences manufacturers to adopt eco-friendly materials in product design, which enhances brand positioning among environmentally conscious consumers.

Asia Pacific

Asia Pacific accounts for 24% of the Gaming Accessories market in 2024 and is the fastest-growing region. Rising internet penetration and affordable smartphone availability accelerate mobile gaming adoption across China, India, Japan, and Southeast Asia. It supports strong demand for mobile-compatible controllers, gaming headsets, and accessories tailored for compact devices. Japan and South Korea continue to lead in console and PC gaming, with gamers seeking high-performance accessories for competitive play. China remains a critical market with its growing esports industry, large gaming population, and increasing focus on premium accessories. Expanding e-commerce platforms and local manufacturing capacity also make products widely accessible at competitive prices. Asia Pacific’s young demographic profile and rising disposable incomes create opportunities for both global brands and domestic players.

Latin America

Latin America holds 7% of the Gaming Accessories market in 2024, showing steady expansion. Brazil and Mexico are the leading contributors, driven by rising interest in esports and console gaming. It benefits from increased smartphone penetration, which expands the mobile gaming segment. Price sensitivity remains a challenge, but affordable accessory ranges gain traction among casual gamers. Regional demand for headsets, controllers, and wireless peripherals continues to grow through online platforms. Local distributors and retail networks help bridge gaps in offline sales channels, enhancing market penetration. The region’s gaming culture is also boosted by community-driven platforms and rising engagement on streaming services.

Middle East and Africa

The Middle East and Africa represent 5% of the Gaming Accessories market in 2024, reflecting the smallest share among regions but offering long-term potential. Gulf countries such as the UAE and Saudi Arabia drive regional demand with rising investments in esports infrastructure and gaming hubs. It is supported by a young population with increasing interest in competitive gaming. Africa, particularly South Africa and Nigeria, shows growth in mobile gaming accessories due to smartphone adoption. Limited affordability challenges wider adoption of premium accessories, but mid-range and entry-level products gain traction. E-commerce growth in urban centers improves access to international brands, supporting regional expansion. Global manufacturers view the region as an emerging growth hub with untapped opportunities for localized product strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Turtle Beach

- Razer Inc.

- Xbox

- Corsair

- Logitech G

- SteelSeries

- Micro-Star INT’L CO., LTD

- HyperX

- ASUS

- Thrustmaster

Competitive Analysis

The leading players in the Gaming Accessories market include Turtle Beach, Razer Inc., Xbox, Corsair, Logitech G, SteelSeries, Micro-Star INT’L CO., LTD, HyperX, ASUS, and Thrustmaster. These companies compete strongly by focusing on product innovation, brand positioning, and expanding their distribution networks across global markets. Each player emphasizes delivering accessories that enhance user experience, whether through advanced audio, precision controls, or compatibility with multiple platforms. The market is highly competitive, with companies targeting both premium and affordable segments to capture diverse consumer bases. Competition is further shaped by rapid technological advancement, where wireless connectivity, cross-platform support, and immersive technologies define differentiation. Companies invest heavily in research and development to align with the evolving demands of esports, professional gaming, and casual users. It places pressure on players to consistently launch updated models that match next-generation consoles and gaming PCs. Strategic collaborations with game developers, esports organizations, and streaming platforms also strengthen brand influence and consumer reach. The market’s future competitiveness will rely on balancing affordability with innovation, as well as meeting sustainability expectations. This environment ensures continuous rivalry among global leaders while creating opportunities for new entrants with disruptive technologies.

Recent Developments

- In 2025, Razer introduced the Pro Click V2 and Pro Click V2 Vertical Edition mice, moving toward more ergonomic designs and productivity-focused features.

- In 2024, Logitech G launched its new PRO Series gear at the Logi PLAY event, introducing the PRO X SUPERLIGHT 2 DEX mouse, PRO 2 LIGHTSPEED mice.

- In 2023, Corsair launched the NIGHTSABRE WIRELESS gaming mouse and K65 PRO MINI Optical-Mechanical Gaming Keyboard, delivering high responsiveness and multiple programmable buttons.

Report Coverage

The research report offers an in-depth analysis based on Technology, Platform, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with strong demand from esports and online gaming.

- Wireless accessories will dominate due to better connectivity and convenience for players.

- Mobile gaming will drive demand for compact and versatile peripherals.

- Virtual reality and augmented reality will boost sales of immersive accessories.

- Cross-platform compatibility will become a standard feature in most products.

- Sustainable designs will gain importance with eco-friendly materials in manufacturing.

- Online sales channels will lead growth, supported by global e-commerce expansion.

- Premium accessories will attract professional gamers seeking advanced performance.

- Emerging markets will provide opportunities with rising smartphone and internet adoption.

- Innovation in AI-enabled and smart accessories will shape future product development.