Market Overview

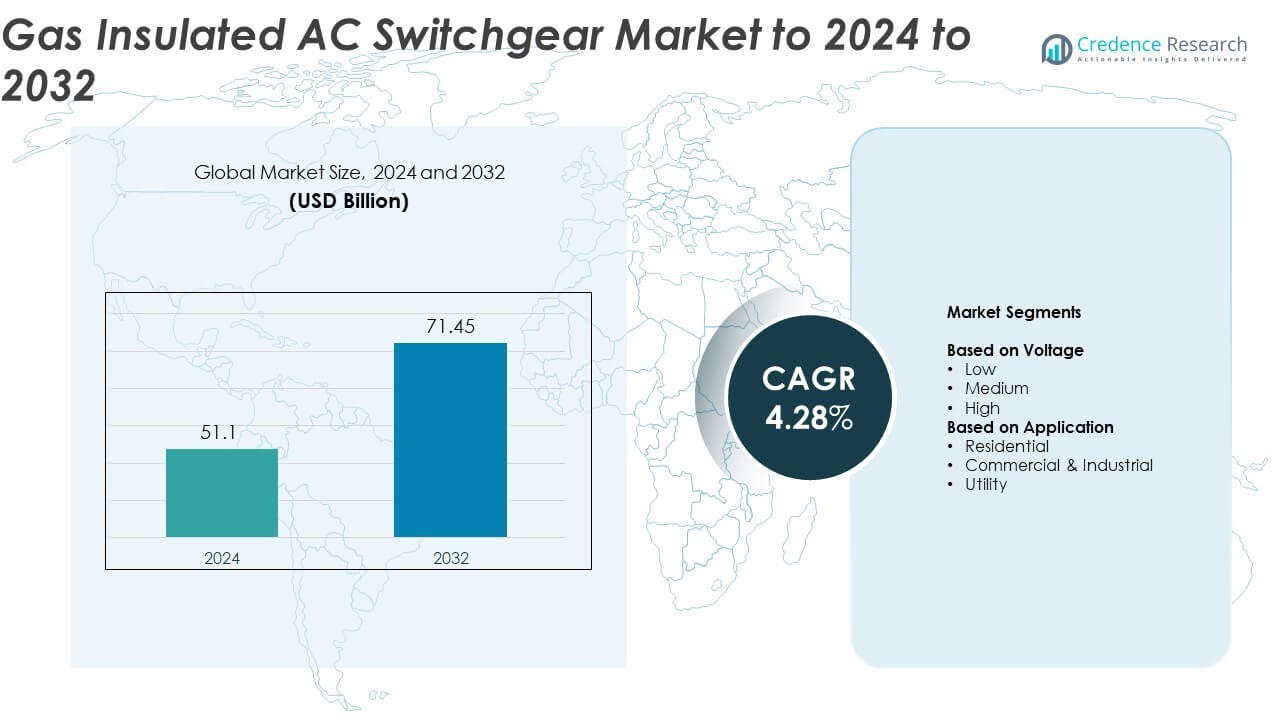

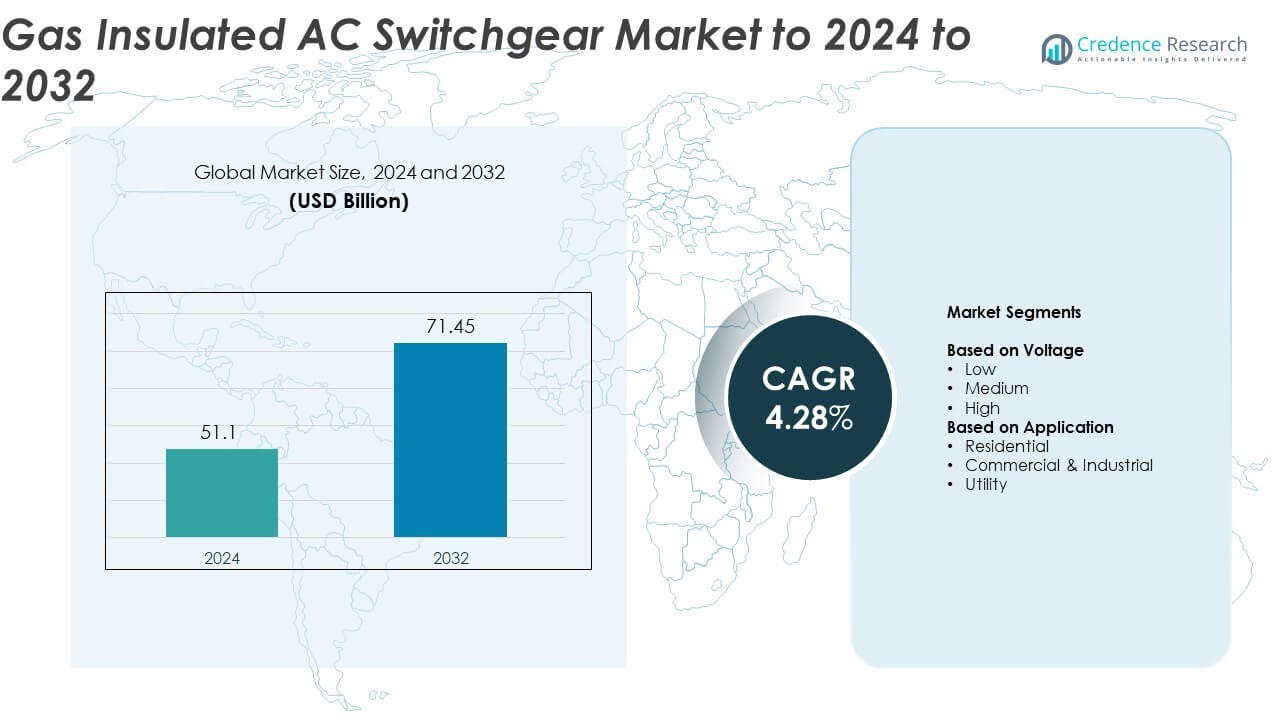

Gas Insulated AC Switchgear Market size was valued at USD 51.1 Billion in 2024 and is anticipated to reach USD 71.45 Billion by 2032, at a CAGR of 4.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Insulated AC Switchgear Market Size 2024 |

USD 51.1 Billion |

| Gas Insulated AC Switchgear Market, CAGR |

4.28% |

| Gas Insulated AC Switchgear Market Size 2032 |

USD 71.45 Billion |

The gas insulated AC switchgear market is dominated by major players such as Siemens Energy, ABB, Hitachi Energy, Mitsubishi Electric Corporation, Schneider Electric, and General Electric. These companies lead through technological innovation, extensive product portfolios, and strong global distribution networks. Asia Pacific remains the largest regional market, holding about 36.7% share in 2024, driven by rapid urbanization, industrial expansion, and grid modernization projects in China, India, and Japan. Europe follows with nearly 28.6% share, supported by renewable energy integration and environmental regulations, while North America captures around 23.4%, benefiting from smart grid development and substation upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The gas insulated AC switchgear market was valued at USD 51.1 Billion in 2024 and is projected to reach USD 71.45 Billion by 2032, growing at a CAGR of 4.28%.

• Growing demand for reliable, space-efficient, and low-maintenance power distribution systems drives market growth, supported by rising renewable energy integration and smart grid expansion.

• The market is witnessing trends such as the adoption of SF6-free technologies, digital monitoring systems, and modular switchgear designs aimed at improving efficiency and sustainability.

• Competition is strong among global manufacturers focusing on innovation, eco-friendly solutions, and strategic collaborations with utilities to expand market presence across key economies.

• Asia Pacific leads the market with 36.7% share, followed by Europe at 28.6% and North America at 23.4%, while the high-voltage segment dominates globally with 48.6% share, driven by expanding transmission and substation infrastructure projects.

Market Segmentation Analysis:

By Voltage

The high voltage segment dominates the gas insulated AC switchgear market, accounting for around 48.6% share in 2024. This dominance is driven by its extensive use in large-scale transmission networks and substations where compactness and reliability are essential. High voltage GIS systems offer superior performance in harsh environments and require minimal maintenance compared to conventional air-insulated setups. Growing investments in smart grid infrastructure and renewable energy integration across Asia-Pacific and Europe further boost the adoption of high voltage switchgear for efficient and space-saving power distribution.

- For instance, GE Vernova’s T210 GIS operates up to 800 kV and cuts substation footprint by 65% versus market average.

By Application

The utility segment leads the gas insulated AC switchgear market with nearly 52.4% share in 2024. Utilities prefer GIS systems due to their high reliability, low footprint, and ability to handle high load capacities in urban and high-demand regions. The expansion of transmission and distribution networks to support renewable energy integration drives steady demand. Ongoing upgrades to replace aging substations with modern GIS solutions in countries like China, India, and Germany further strengthen this segment’s dominance in global market growth.

- For instance, Siemens Energy is delivering 197 units of 8VM1 Blue GIS for the Hornsea 3 offshore project, with first deliveries in January 2025.

Key Growth Drivers

Expansion of Smart Grid Infrastructure

The increasing development of smart grids is a major growth driver for the gas insulated AC switchgear market. Governments and utilities are investing in advanced grid systems to enhance energy efficiency and reduce transmission losses. GIS systems support automation, digital monitoring, and compact installation, making them ideal for smart substations. Growing urbanization and rising electricity consumption further accelerate deployments, especially in densely populated regions where space constraints make GIS a preferred solution for modern power networks.

- For instance, Eaton’s SF₆-free Xiria portfolio had an installed base exceeding 150,000 panels for 12–24 kV.

Rising Renewable Energy Integration

The shift toward renewable energy sources significantly boosts demand for gas insulated AC switchgear. Wind, solar, and hydroelectric projects require reliable, compact, and low-maintenance switchgear for power transmission and distribution. GIS units ensure stable performance under varying load conditions, supporting grid stability. Countries emphasizing clean energy transitions are adopting GIS systems to manage decentralized power generation efficiently, ensuring safe and continuous electricity flow in renewable-heavy grids.

- For instance, Hitachi Energy’s EconiQ program reports 1,200+ eco-efficient high-voltage units deployed across 26 countries, including the first SF₆-free 420 kV GIS for TenneT.

Urbanization and Space Optimization Needs

Rapid urbanization and the need for compact power systems drive GIS adoption across cities and industrial areas. Unlike air-insulated systems, GIS requires minimal installation space, making it ideal for underground or high-density environments. Urban infrastructure projects, metro networks, and industrial complexes rely on GIS for uninterrupted operations. Its modular design, high safety, and reduced maintenance needs make it an efficient choice for sustainable power distribution in growing metropolitan regions.

Key Trends & Opportunities

Adoption of Digital and Eco-Friendly Switchgear

The market is witnessing a clear shift toward digital and eco-friendly gas insulated switchgear. Manufacturers are adopting sensors, IoT, and cloud-based monitoring to improve predictive maintenance and system efficiency. The use of SF6-free gases, such as dry air and fluoronitrile blends, is gaining traction to lower greenhouse gas emissions. These innovations align with global sustainability goals and open opportunities for manufacturers to expand portfolios with environmentally responsible GIS solutions.

- For instance, Schneider Electric’s RM AirSeT is an SF₆-free ring-main GIS rated up to 24 kV for secondary distribution with integrated digital features.

Rising Investments in Transmission Network Modernization

Modernization of existing transmission networks presents significant opportunities for the GIS market. Governments across Asia-Pacific, Europe, and the Middle East are upgrading old substations with advanced switchgear to handle increasing power demand. GIS offers improved reliability, reduced outages, and enhanced safety in densely populated or environmentally sensitive zones. Such modernization projects will continue to create strong business prospects for GIS suppliers worldwide.

- For instance, Mitsubishi Electric developed and tested 1,000 kV GIS equipment at TEPCO’s Shin-Haruna UHV station, advancing ultra-high-voltage upgrade programs.

Key Challenges

High Installation and Maintenance Costs

The high cost of installation and maintenance remains a major challenge in the gas insulated AC switchgear market. GIS systems involve complex engineering and expensive materials, making them costlier than conventional air-insulated options. The initial investment limits adoption in developing countries with budget constraints. Additionally, specialized maintenance and limited availability of skilled technicians increase operational expenses, affecting deployment in smaller or low-voltage applications.

Environmental Concerns Over SF6 Gas Usage

Environmental concerns linked to sulfur hexafluoride (SF6) usage pose a serious challenge. SF6 is a potent greenhouse gas with high global warming potential, leading to regulatory pressure on manufacturers to find alternatives. While research into eco-friendly substitutes is ongoing, the transition adds cost and complexity. Compliance with environmental norms and the need for leak detection systems further increase operational challenges for utilities and manufacturers relying on SF6-based GIS systems.

Regional Analysis

North America

North America holds around 23.4% share of the global gas insulated AC switchgear market in 2024. The region benefits from extensive investments in smart grid infrastructure and modernization of aging transmission networks. The United States and Canada are accelerating GIS adoption to enhance grid reliability and reduce transmission losses. Increasing integration of renewable energy sources and the replacement of outdated substations support steady demand. The presence of advanced utility frameworks and supportive energy policies further strengthen the regional market, especially across industrial and commercial sectors.

Europe

Europe accounts for approximately 28.6% share of the gas insulated AC switchgear market in 2024. The region’s growth is fueled by rapid expansion of renewable energy capacity and strong environmental regulations favoring compact and low-emission systems. Countries such as Germany, France, and the United Kingdom are leading in upgrading transmission infrastructure with SF6-free GIS technology. Growing urbanization and the need for efficient underground substations drive installations across major cities. Additionally, the European Union’s focus on carbon neutrality by 2050 is promoting significant investments in sustainable grid systems.

Asia Pacific

Asia Pacific dominates the global gas insulated AC switchgear market, holding nearly 36.7% share in 2024. The region’s leadership is attributed to large-scale power distribution projects in China, India, Japan, and South Korea. Rising electricity demand, industrial expansion, and urban development drive continuous deployment of GIS systems. Government initiatives to enhance renewable power integration and grid reliability are accelerating infrastructure investments. The adoption of high voltage GIS systems is particularly strong due to their compact design, making them suitable for space-limited urban and industrial areas.

Latin America

Latin America captures around 6.8% share of the global gas insulated AC switchgear market in 2024. The market is expanding due to ongoing grid modernization and increasing urban electrification efforts in Brazil, Mexico, and Chile. Investments in renewable energy projects, especially in wind and solar, are enhancing the demand for GIS systems. Growing industrialization and the need for reliable power transmission in dense urban centers are further supporting market growth. However, high installation costs and limited technical expertise slightly constrain broader adoption across the region.

Middle East & Africa

The Middle East & Africa region holds about 4.5% share of the global gas insulated AC switchgear market in 2024. Demand is driven by large-scale infrastructure development, oil and gas projects, and growing urbanization. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are investing in advanced power systems to improve reliability and efficiency. Expansion of renewable energy initiatives, particularly solar and wind projects, also contributes to market growth. The focus on grid stability and compact substations further strengthens the regional adoption of GIS technology.

Market Segmentations:

By Voltage

By Application

- Residential

- Commercial & Industrial

- Utility

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the gas insulated AC switchgear market includes leading companies such as Siemens Energy, Hitachi Energy, ABB, Mitsubishi Electric Corporation, Schneider Electric, General Electric, Eaton Corporation, Toshiba International Corporation, Fuji Electric, HD Hyundai Electric, Hyosung Heavy Industries, CG Power & Industrial Solutions, Chint Group, Lucy Group, and Powell Industries. The market is characterized by technological innovation, with manufacturers focusing on digital monitoring, automation, and SF6-free switchgear solutions to meet global sustainability goals. Companies are investing in expanding production capabilities and strategic partnerships with utilities to strengthen their regional presence. Growing emphasis on eco-friendly insulation materials, modular switchgear systems, and predictive maintenance technologies continues to define competition. Players are also enhancing after-sales service networks and developing localized manufacturing facilities to reduce costs and improve lead times. Continuous innovation in compact designs and integration of smart grid compatibility remains central to gaining a competitive edge globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens Energy

- Hitachi Energy

- ABB

- Mitsubishi Electric Corporation

- Schneider Electric

- General Electric

- Eaton Corporation

- Toshiba International Corporation

- Fuji Electric

- HD Hyundai Electric

- Hyosung Heavy Industries

- CG Power & Industrial Solutions

- Chint Group

- Lucy Group

- Powell Industries

Recent Developments

- In 2025, ABB commercially launched a new SF6-free gas insulated switchgear portfolio including SafeRing, SafePlus Air, and UniSec Air systems up to 24 kV, fulfilling emerging EU F-gas regulations while maintaining reliability.

- In 2025, Hitachi Energy introduced a new generation of its EconiQ gas-insulated switchgear (GIS) portfolio, featuring a lower carbon footprint and utilizing alternative gas mixtures to SF₆ for enhanced environmental sustainability without compromising performance.

- In 2025, GE Vernova announced plans to invest significantly in manufacturing facilities across the US to expand production capacity for its switchgear and other energy solutions over the next two years.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing adoption of SF6-free technologies will reshape the market toward sustainable switchgear solutions.

- Growing renewable energy integration will continue driving demand for compact and reliable GIS systems.

- Expansion of smart grid infrastructure will boost deployment of digital and automated switchgear networks.

- Urbanization and industrialization in emerging economies will create strong growth opportunities.

- Advancements in sensor and IoT integration will enhance real-time monitoring and predictive maintenance.

- Ongoing replacement of aging substations will support consistent market expansion across developed regions.

- Investments in transmission and distribution modernization will strengthen utility adoption of GIS.

- Manufacturers will focus on modular and space-efficient designs for dense urban installations.

- Stricter environmental regulations will accelerate innovation in eco-friendly insulation materials.

- Strategic partnerships among utilities and technology providers will drive global market competitiveness.